Mercia Asset Management PLC Investment into Locate Bio (6114K)

September 03 2021 - 2:00AM

UK Regulatory

TIDMMERC

RNS Number : 6114K

Mercia Asset Management PLC

03 September 2021

RNS 3 September 2021

Mercia Asset Management PLC

("Mercia", the "Group" or the "Company")

Mercia invests GBP1.6million as part of a GBP10.0million

syndicated round into Locate Bio

Mercia Asset Management PLC (AIM: MERC), the proactive,

regionally focused specialist asset manager with c.GBP940million of

assets under management, is pleased to announce a significant

syndicated investment into existing direct investment portfolio

company Locate Bio Limited ("Locate Bio"), a Nottingham-based

business developing a range of orthobiologics.

This investment into Locate Bio consists of a syndicated

GBP10.0million Series A round in which Mercia has made a direct

investment of GBP1.6million, alongside GBP4.0million from Mercia's

third party managed funds, which included EIS and VCT capital,

together with GBP3.0million from BGF and GBP1.4million from other

syndicate partners. This funding round has increased Mercia's fully

diluted direct investment stake to 18.1%, with Mercia's combined

managed funds' fully diluted stakes now totalling 24.6%. Locate Bio

was initially backed in April 2018 by Mercia's EIS funds.

Locate Bio's products will be used by orthopaedic surgeons to

accelerate the natural repair of bone and cartilage. Addressing a

multi-billion pound global market, Locate Bio currently has four

products going through trials, the first targeting formal market

approval by 2022. This GBP10.0million round will support the next

stages of these trials including its lead bone graft solution

("LDGraft") as part of the FDA approval process, as well as the

development of additional products acquired last year.

Peter Dines, COO of Mercia Asset Management , said: " This

significant investment round, alongside our continuing active

approach to supporting the business and its management team, is

another example of how our Complete Connected Capital can help

accelerate growth, with investment not only by our balance sheet

but also by our managed funds and syndicate partners. As Mercia's

representative on the Locate Bio board, this latest investment is

testament to the significant potential market value and global

reach of the products Locate Bio is currently developing."

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 which is

part of UK law by virtue of the European Union (Withdrawal) Act

2018. Upon publication of this announcement, this inside

information is now considered to be in the public domain.

--Ends--

For further information, please contact:

Mercia Asset Management PLC

Mark Payton, Chief Executive Officer

Martin Glanfield, Chief Financial Officer +44 (0)330 223

www.mercia.co.uk 1430

Canaccord Genuity Limited (NOMAD and Joint +44 (0)20 7523

Broker) 8000

Simon Bridges, Andrew Potts

+44 (0)20 7496

Singer Capital Markets (Joint Broker) 3000

Harry Gooden, James Moat

+44 (0)20 3727

FTI Consulting 1051

Tom Blackwell, Louisa Feltes, Shiv Talwar

mercia@fticonsulting.com

About Mercia Asset Management PLC

Mercia is a proactive, specialist asset manager focused on

supporting regional SMEs to achieve their growth aspirations.

Mercia provides capital across its four asset classes of balance

sheet, venture, private equity and debt capital: the Group's

'Complete Connected Capital'. The Group initially nurtures

businesses via its third-party funds under management, then over

time Mercia can provide further funding to the most promising

companies, by deploying direct investment follow-on capital from

its own balance sheet.

The Group has a strong UK footprint through its regional

offices, 19 university partnerships and extensive personal

networks, providing it with access to high-quality deal flow.

Mercia currently has c.GBP940million of assets under management

and, since its IPO in December 2014, has invested c.GBP111million

gross into its direct investment portfolio.

Mercia Asset Management PLC is quoted on AIM with the EPIC

"MERC".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBIGDCSGGDGBD

(END) Dow Jones Newswires

September 03, 2021 02:00 ET (06:00 GMT)

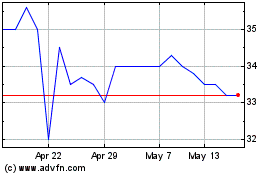

Mercia Asset Management (LSE:MERC)

Historical Stock Chart

From Apr 2024 to May 2024

Mercia Asset Management (LSE:MERC)

Historical Stock Chart

From May 2023 to May 2024