Interim Management Statement

August 04 2009 - 2:00AM

UK Regulatory

TIDMMARS

RNS Number : 8004W

Marston's PLC

04 August 2009

4 August 2009

MARSTON'S PLC ("MARSTON'S")

INTERIM MANAGEMENT STATEMENT

43 weeks to 1 August 2009

Trading

Our performance continues to be resilient with sales trends showing some further

improvement since the end of the first half-year on 4 April 2009, despite the

recent wet weather. We have achieved encouraging sales growth in Marston's Inns

and Taverns; there has been no material change to previously reported trends in

Marston's Pub Company; and in Marston's Beer Company our premium ale brands have

maintained strong sales momentum in the on-trade and the off-trade.

Group turnover was 1.9% below last year for the 43 week period compared to the

2.8% decline previously reported for the 26 weeks ended 4 April 2009.

In Marston's Inns and Taverns, our managed pub division, like-for-like sales in

the 43 week period were 1.2% below last year. This reflects improved trading

since March including like-for-like sales growth of 2.3% in the last 6 weeks to

1 August. Food like-for-like sales continue to be strong, up by 2.2% in the 43

weeks and by 6.0% in the 6 weeks to 1 August. Food sales now represent

approximately 38% of total retail sales. Operating margin trends continue to be

in line with those reported for the first half-year largely driven by tight cost

controls; an easing of food input cost inflation; and the careful management of

promotional offers.

In Marston's Pub Company, around 80% of our estate is on substantive agreements

which demonstrate the long term commitment of the licensee to the pub, and

profits in these pubs continue to be in line with last year. We are committed to

developing long term solutions for the remainder of the estate. The "Tracker"

variable rent agreement launched earlier this year has been well received, with

around 100 tenants now having signed up. In addition, we have recently launched

an innovative franchise-style retail agreement that further reduces risk for the

licensee whilst improving flexibility and the commercial offer to pub customers.

In this agreement Marston's Pub Company defines and controls the pub's retail

offer and is responsible for all operating costs with the exception of labour.

The licensee is paid a turnover related sum to cover licensee remuneration and

staff costs. Results from the 10 pubs currently operating under this agreement

have been encouraging, and we plan to extend it to around 80 more pubs in the

next financial year.

In Marston's Beer Company our aim is to market a wide

range of high quality beer brands with strong local provenance, together with

national marketing investment in Marston's Pedigree. This differentiated

strategy is achieving good results. In the 43 weeks to 1 August own brewed ale

volumes increased by around 13%. Premium ale volumes increased by 31% and now

represent 53% of the ale portfolio. On a like-for-like basis we estimate that

our market shares in premium cask ale and premium bottled ale have both

increased by around 1% in the current financial year. Of particular note is

the performance of Marston's Pedigree 'The Official Beer of England Cricket'

which has seen off-trade bottle volumes more than double since the end of the

first half-year on 4 April 2009.

Financing and cash flow

Net debt and cash flow are in line with our expectations. We remain on target to

realise around GBP20m from the disposals of smaller pubs and other properties in

the current financial year, and have achieved book values overall on sales to

date. Capital expenditure continues to be controlled carefully.

Following the extension of our bank facility announced earlier in the year we

have no further refinancing requirements until August 2013.

On 22 July 2009 we announced that the rights issue had been completed

successfully, raising net funds of GBP165 million. As announced previously, we

anticipate that approximately GBP140 million will be invested in

developing around 60 new managed pubs over the next 3 years. Marston's is a

market leader in new-build pub development having opened over 50 new pubs and

bars in the last five years.

We also intend to repurchase securitised bonds at an appropriate level of

discount and to make selective pub acquisitions as and when good opportunities

arise.

Progress made on new-build programme

As a consequence of the rights issue we are able to take advantage of current

market conditions to acquire excellent sites at attractive prices and to build

new, high quality managed pubs which target the growing part of the

pub-restaurant market. We are making good progress with development already

underway on sites in Caterham, Surrey; Ashbourne, Derbyshire; Aylesbury,

Buckinghamshire; and shortly to commence on a site in Sittingbourne, Kent. By

the end of the current financial year we expect development to have started on 9

sites and plan to open 15 new pubs in the next financial year.

Legislation - BEC enquiry

There have been no further legislative developments since the Interim Results

announcement on 22 May 2009, although decisions are awaited in respect of

possible reviews relating to tenanted and leased pubs by both the Office of Fair

Trading (OFT) and the Competition Commission. Marston's Pub Company continues

to develop its relationship with tenants and lessees, and to operate in a

transparent manner with the objective of a fair division of risk and reward

between the Company and the licensee. We are adapting the model where

appropriate to assist licensees as a consequence of current economic conditions

and market trends, but we are clear that the principles underlying existing

agreements, including the tie and fair, sustainable rents, confer real benefits

to tenants.

Outlook

Although we remain cautious because of the current challenging economic and

trading environment, we are confident of meeting our expectations for the year.

We are encouraged by the robust performance of the business which reflects the

high quality of our pubs; our value for money offers; the popularity of our ale

brands; and the continued implementation of our stated approach. We have a

differentiated strategy and, in our accelerated new build programme, a

significant development opportunity from which we aim to deliver good and

sustainable returns.

Enquiries

Marston's, PLC Hudson Sandler

Ralph Findlay, Chief Executive Andrew Hayes

Andrew Andrea, Finance Director James White

Tel: 01902 329516 Tel: 020 7796 4133

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSUOANRKKRWRAR

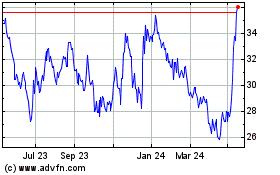

Marston's (LSE:MARS)

Historical Stock Chart

From Dec 2024 to Jan 2025

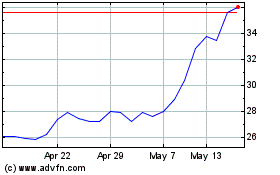

Marston's (LSE:MARS)

Historical Stock Chart

From Jan 2024 to Jan 2025