TIDMLPA

RNS Number : 8012O

LPA Group PLC

03 February 2023

LPA GROUP PLC

LPA Group plc ("LPA", the "Company" or the "Group"), the high

reliability LED lighting, electronic and electro-mechanical system

designer and manufacture, announces its Preliminary Results for the

year to 30(th) September 2022.

Preliminary Results key points:

Financial

-- Order Entry at GBP19.7m (2021: GBP23.2m)

-- Order Book at GBP27.8m (2021: GBP27.4m)

-- Revenue GBP19.3m (2021: GBP18.3m)

-- Underlying Operating Loss* GBP0.23m (2021: (Loss) 0.27m)

-- Profit before Tax amounted to GBP1.07m (2021: (Loss) 0.39m)

-- Basic Earnings/(Loss) per share amounted to 8.99p (2021: (Loss) 0.17p)

-- No dividends declared or paid in 2022 or 2021

-- Gearing** reduced to 3.5% (2021: 11.9%)

*Operating Profit/(Loss) before Share Based Payments and

Exceptional Costs

** Net Debt as a percentage of Total Equity

The year to 30(th) September 2022, included the following

highlights and operational developments.

-- Record year for our new LED tube product with significant

orders from UK and worldwide customers. This is an important step

as we approach the September 2023 ban across the EU on the sale of

old technology fluorescent tubes.

-- Excellent year for new Plane Power range of products with

customers now including - Heathrow, Shanghai, Beijing, Copenhagen,

Melbourne, Auckland, Stockholm and Schiphol airports.

-- Appointment of first employee outside of the UK in support of

growth plans for the DACH region. This is an essential resource in

support of some of the biggest rolling stock customers in the

world.

-- Continued growth of distribution network to support growth

plans for both our electronic / lighting, and electro-mechanical

business divisions.

-- Successful delivery of the Viaggio Nightjet / ÖBB project,

which is the most technically advanced intelligent lighting system

ever undertaken by the Group. This is a flagship platform for the

customer with further follow-on orders expected.

Robert B Horvath - Chairman commented:

"The year to September 2022 was challenging however, we are

reporting a profit before tax of GBP1.1m; albeit heavily influenced

by exceptional items and a slower than expected first half.

Encouragingly the second half was much stronger than the first half

at the operating level although the business traditionally has a

stronger second half performance, not least because December is a

shorter trading month. Our order entry during the year was robust

and I am pleased to report that our order book remains resilient

with good opportunities for further growth currently in

negotiation.

During the year there was a strong emphasis on rebuilding

executive capability across the Group and specifically in the

operating companies. We have recruited well for our

electro-mechanical subsidiary and strengthened the senior

leadership team. We have more to do to ensure that we can deliver

our workload efficiently, but good progress has been made.

As I reported last year, we aimed to build up cash reserves

recognising that as we start to grow again following the last two

years of reduced turnover there will be pressure on working

capital. The vacant land that we had inherited and had no plans to

use was sold and realised GBP1.7m of cash which we are retaining in

the business to create capacity and give us the agility to respond

quickly to new business opportunities to enhance the product

range.

We are very alive to global supply chain issues that we and our

customers are experiencing which could delay our own ability to

deliver finished product. Additionally, where we supply to new

build projects, we are only a small part of our customer's overall

project, and it is this that often causes re-scheduling. In the

face of these headwinds we are concentrating on being more agile

and to keep higher stock levels as 'just in time' is not a viable

solution to our customers' often irregular demands and call offs.

The rebalancing of the business by working closer with our

customers in the aftercare market will support a more even

production flow and we continue to actively chase down these

revenue opportunities.

Our gearing fell to a modest 3.5% from 11.9% because of our

strong cash position, and our net asset value grew even after a

small reduction in the actuarial valuation of our (closed) defined

benefit pension scheme. The trustees of the defined benefit scheme

(of which I remain Chairman) sought to de-risk the scheme last year

and we have been fortunate with the resultant impact and resilience

of the Trust's investments given all that has happened in the

financial markets in 2022. The pension remains in a healthy

surplus.

We anticipate an overall return to operating profitability in FY

2023, with stronger recovery thereafter, and accordingly we expect

to resume dividend payments for this financial year. The Board has

confidence in the prospects for the Group, supported by our high

quality customers, growing order book, visibility of new business

and our overall strategy."

3(rd) February 2023

Enquires: www.lpa-group.com Tel:

------------------------------------ ------------------- --------------

LPA Group plc

Robert B Horvath Chairman 01799 512844

Paul Curtis CEO 01799 512858

finnCap NOMAD and Broker 020 7220 0500

Ed Frisby / Abigail Kelly

(Corporate Finance)

Tim Redfern / Charlotte Sutcliffe

(ECM)

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

Chairman's Statement

Overview

It has been a busy year for us as we rebuild the individual

business plans for the members of the Group that result directly

from our strategic planning exercise. These plans cover markets,

people, operations and facilities and will naturally morph as

opportunity and markets dictate.

We have long recognised the need to broaden our offering as some

of our operations have become too reliant on a few large customers.

A lot of our future project work whilst still robust continues to

suffer from re-scheduling by our customers and this was reflected

in our ability to cover our overhead in the first part of the year.

We managed the second half of the year in a more conservative way

and are actively pursuing projects that have more immediate

delivery times. In the second half we began to see the impact that

the aftercare markets for our customers could have on building

resilience into our overhead recovery and as a result, we returned

to profitability. We are set up well going forward and have ended

the year with a strong order book replacing most of what has been

delivered this year and at the time of writing it has grown still

further.

We have had a very good response to our customer and

relationship management programmes and we have signed up a number

of new distributor partners across the globe this year as well as

seeing Channel expand its distribution products here in the UK. It

was also very encouraging to see the end of pandemic restrictions

and to attend Innotrans in Berlin this year. We had a successful

event and it was heartening to gain the opportunity once again to

be face to face and enjoy open conversations with so many customers

that have been unable to travel.

The planning highlighted our need to recruit into a number of

key posts and some high calibre people have been appointed to take

the Group forward. The new Managing director for our

electro-mechanical systems operations commenced in August 2022 and

is now well in post. He and the team have recruited a new Technical

Engineering director and already we are seeing the impact on their

business plans. We have struggled to recruit an MD for our Channel

business and must go back and re-think the scope of how this

operation functions. Our new Group CFO, Stuart Stanyard, will join

the Board in March 2023 and will in place before the AGM. We have

recruited heavily into our Sales teams and into engineering

competency generally and this should impact the second half of the

current year and beyond. We have also been conscious that to

recruit this talent pool we need to rebase our reward mechanisms to

retain more moderate salaries and to increase the performance

related element of our remuneration packages.

As a market leading designer and manufacturer of high

reliability electronic, electro-mechanical components and systems,

we pride ourselves on our capabilities. Operationally, the

manufacturing facilities remain first class. We have upgraded some

of our machinery and tooling and we will look to broaden our

offering with a limited amount of Capex in the new year. We have

investment to make in our enterprise resource planning ("ERP")

which will only enhance our ability to manage productivity going

forward. The incidence of turnover in our staff who operate our

facilities has been manageable and throughout the last two years we

have sought to bring in apprentices and young engineers.

To ensure that we had plenty of working capital to carry us

through what is a difficult trading environment both in the UK and

in our export markets we sold some vacant land realising a

substantial GBP1.5m profit; the profit and cash are reflected in

these accounts. We are continuing to look to buy and re-invent

Chairman's statement (continued)

products from ours and other businesses that will enhance our

offering particularly in the aftercare market and having a strong

cash position will make us that much more agile to move

quickly.

Shareholders and Investors

We want to communicate our long-term plans to deliver

shareholder value in line with our vision and mission and our

continuing commitment to our reputation. Therefore, the Chairman

and the CEO will continue to meet key shareholders where possible

in person and work closely with its Brokers and Advisers to ensure

regular and open dialogue.

Importantly, we have stakeholders, in the wider sense, all over

the world and we have struggled in the last two years to see them.

The Group is in the business of long-term contracts and projects

that we export widely and this needs to be reflected in our

stakeholder relationships which must be proactive, long term,

visible and embedded into our corporate culture. Our staff need to

be able to travel and meet our customers first hand, as much of

what we do is solutions based and flows from these interactions. We

have now recruited our first senior employee who resides in our

DACH (Germany, Austria and Switzerland) market and we believe this

investment will only strengthen our relationships further.

Dividends and Pension Fund

No dividends were declared in 2021 and no interim or final

dividends have been declared in 2022. The Board believes in a

progressive dividend policy and so will keep the policy under

review, however, given the ongoing economic and market challenges,

we believe it continues to remain appropriate in the shorter term

to defer any resumption of the policy.

The LPA Industries Limited Defined Benefit Scheme was part of

the Deloitte Pensions Master Plan throughout the entire year under

review. This arrangement had included the transfer of the advisory

functions, administration and the pensioner payroll to Deloitte.

The total costs of this transition have been substantial as the

Scheme has necessarily been subject to a level of scrutiny and

audit to ensure that it can be prepared for an eventual exit to an

insurance provider. The costs of running the scheme have been borne

by the Company and this year amounted to GBP174,800 (2021:

GBP283,128 including GBP100,000 of Company contribution). The

rectification work is largely complete and subject to GMP

equalisation ongoing discussion we anticipate substantially reduced

costs going forward.

A full Actuarial valuation of the Scheme was carried out in

March 2021 which indicated the Scheme was at a healthy 121% funding

level. At 31 March 2022 an actuarial report indicated that this had

risen to 127% of the actuarial funding level. The benefit of the

change in investment strategy in January 2022, when the Trustees

having undertaken a review in 2021 agreed to lock in the gains and

de risk the scheme, has been beneficial. The key driver for the

then improved funding position has been the higher than assumed

returns on the Scheme's assets and the changes in financial

conditions which have reduced the liabilities. It is natural for

the Scheme's funding level to fluctuate over time reflecting

changes in the financial markets and this was apparent during the

last six months of the year under review especially sparked by the

mini- budget on 23 September 2022. Over the year to 30 September

2022 the Scheme's assets, which are with Legal & General

Investment Managers in LGIM funds, marginally outperformed the

benchmark return at -24.8% versus -25%.

Chairman's statement (continued)

The IAS19 actuarial surplus recognised at 30 September 2022 was

GBP2.5m (2021 restated: GBP2.6m). The Trustees, under advice, did

not seek any voluntary employer contributions during the year from

the Company (2021: GBP100,000). The IAS19 position shown in the

accounts reflects the impact of rising interest rates on the

present value of the Assets and the liability to pay pensions in

the future.

Employees

Our people and our investment in them is key to our future

success. Their skills alone are not enough without a commitment to

the style and corporate values that the Board are committed to

promoting. Our recently appointed subsidiary directors are fully

committed to these values and we will see the impact of this in the

coming years.

The general health, and well-being of our employees personally,

cannot be underestimated. We have had a number of retirements of

long-standing staff during the pandemic; but we are not alone in

this. Senior management time on people issues, managing our

employee numbers and the cost base is now part of daily routine.

Communication with our staff and progressive investment in their

well-being will distinguish us and we hope to persuade more

youngsters and apprentices to join an engineering group.

We pride ourselves on our engineering skills and our factory

operations and we are committed to keeping them intact to fulfil

our record order book. We do maintain flexibility through use of

agency and temporary contracts, but we have no zero-hour contracts

.

I should like to thank all our employees, past and present, for

their hard work and diligence during yet another challenging

year.

Board and Management

Board members' biographies and relevant experience are published

on the Group's website www.lpa-group.com .

Paul Curtis (CEO) heads up the Executive Team and we have

retained some interim support following the departure of Chris

Buckenham. We have secured a contract with our new Group Finance

Director who will join before the AGM. Andrew Jenner, as Senior

Independent Director, and Chair of the Audit Committee has been in

post throughout the year under review as has Gordon Wakeford who is

chairman of our Remuneration Committee.

We have started a broader communication programme including a

comprehensive newsletter to our Employees, this was published

shortly after the year end and will be updated every 6 months. The

Board's belief in instilling our corporate values, including

through induction and regular communication, remains a

priority.

Chairman's statement (continued)

Outlook

The Executive team have a strong order book to work with, a

solid balance sheet, positive cash flow and importantly a good

plan. It will take a little longer to see the impact of such a

significant change in the group's leadership and given the

gestation period for our engineers to turn opportunity into quality

engineered products we anticipate a strong second half to the

current financial year and thereafter. The Company has a bright

future built on our capabilities and great customer

relationships.

Robert B Horvath

Chairman

2(nd) February 2023

Business Model and Strategy

The Group is a quoted Small and Medium-sized Enterprise (SME)

listed in the Electronic and Electrical section of the Alternative

Investment Market (AIM) of the London Stock Exchange.

LPA is a market leading designer, manufacturer and supplier of

high reliability, LED based lighting, electronic systems,

electro-mechanical systems and a distributor of engineered

components supplying markets operating within high dependency,

hostile and benign environments which focuses on the market

segments of rail, rail infrastructure, aviation, airport

infrastructure and defence. These are viewed as stable / growth

markets both in the UK and globally. All Group activities serve the

same markets (to a greater or lesser extent), have a mutual

dependence on transportation (which accounts for more than two

thirds of Group turnover), share resource and frequently work on

the same projects.

The Group has a reputation for innovation, providing cost

effective solutions to customers' problems which aim to improve

reliability and reduce maintenance and life cycle costs. Three

distinct sites across the UK are operated, namely:

LPA operations Market segment Products, solutions, and

technologies

LPA Connection Electro-mechanical

Systems systems * Hybrid / battery control boxes and systems

Light & Power

House A designer and manufacturer

Shire Hill of electro-mechanical * Control panels & boxes

Saffron Walden systems and components

CB11 3AQ, UK to the rail, aircraft

Tel: +44 (0)1799 ground support and niche * Enclosures, fabrications, laser cut, form & weld

512800 industrial markets.

* Rail, aircraft, ship & industrial connectors

* Shore supply systems

* Transport turnkey engineering and manufacturing

services

--------------------------------- -------------------------------------------------------------

Email: enquiries@lpa-connect.com

LPA Channel Engineered component

Electric distribution * Circuit breakers

Bath Road High value, high level

Thatcham service distributor * Connectors

Berkshire and added value solutions

RG18 3ST, UK provider to the rail

Tel: +44 (0)1635 and aerospace & defence * Fans & motors

864866 markets.

* Relays & contactors

* Switches

* USB charging units

--------------------------------- -------------------------------------------------------------

Email: enquiries@lpa-channel.com

LPA Lighting LED lighting and electronic

Systems systems * Electronic control systems

LPA House

Ripley Drive A designer and manufacturer

Normanton of LED lighting and * Electronic monitoring systems

West Yorkshire electronic systems which

WF6 1QT, UK serve the rail, infrastructure,

Tel: +44 (0)1924 and other high reliability * Fluorescent lamp Inverters

224100 markets

* Complete rolling stock interior lighting systems

* Rolling stock interior and exterior door status

indication systems

* Rolling stock seat electronics solutions

--------------------------------- -------------------------------------------------------------

Email: enquiries@lpa-light.com

Business Model and Strategy (continued)

Group revenues are derived from both large value projects and

smaller value routine orders with the route to market a combination

of direct and indirect for most products. Agents and distributors

may be used, particularly in overseas markets, although larger

projects continue to require direct contact in most cases.

A wide range of leading organisations form our customer base,

including: Alstom, Avanti, BAA, BAe Systems, CAF, Compin, CRRC,

Downer EDI, First Group, Grammer, Heathrow Airport, Hitachi, ITW

GSE, Kinki Sharyo, Knorr Bremse, Leonardo, Omer, Shanghai Pudong

Airport, Siemens, SNCF, Stadler, Spirit Aerospace, Taiwan Rolling

Stock Company, Transport for London, Unipart Rail and Wabtec .

It is our intention to strengthen the Group's position within

the global marketplace by growing our customer base, alongside the

addition of new products and the undertaking of selected strategic

acquisitions. This is underpinned by our Vision, Mission and

Objectives as detailed below and the business planning that we do

each year.

Vision, Mission & Objectives (VMO)

V ision

-- To be a market leading electronic / electro-mechanical

engineering Group, supplying high quality components and systems to

customers in safety critical and challenging markets.

M ission

-- Provide sustainable growth and returns to shareholders.

-- Grow organically and by acquisition.

-- Be our customers' first choice for products and services.

-- Be an ethical and responsible employer.

O bjectives

-- Promote and build on the history and brand of LPA.

-- Ensure all companies within the Group deliver 'best in class' products and services.

-- Focus on reducing dependency on the transportation market.

-- Continuous innovation and product development.

-- Improved sales channels for export.

-- Targeted acquisitions to bring growth, technology, or access to markets.

-- Work together across the Group and maximise opportunities.

-- Exploit Group capability and technology to create new products and service new markets.

-- Be an employer of choice.

Values and Culture

Investment in our people is paramount to our success and we have

created clear communication and development strategies to enhance

skills and ensure that we all understand and align to Group values,

culture and best practice. This is supported by the Board and

Executive teams and demonstrated by their visibility and

accessibility across the Group.

Our core values are promoted throughout the Group. These are set

out below and published on our website www.lpa-group.com .

Business Model and Strategy (continued)

LPA Core Values

-- L eadership - you do not need to be in a position of power to

lead in what you do.

-- P assion - love what you do, use it to drive both yourself

and the business forward.

-- A ccountability -whatever you do, own it and do it well.

-- Continuous Product Improvement - staying ahead of the

competition.

-- Personal Growth - always seek to learn and improve.

-- Diversity - everyone deserves a chance and a voice.

-- Fun - yes, it is work, but it does not mean we cannot enjoy

it!

-- Innovation - technology is everything to us, look forward and

push the boundaries.

-- Integrity - honesty and respect are key to who we are.

-- Teamwork - work with your colleagues not against them.

Chief Executive Officer's Review

Trading Results

An increase in activity during H2 ensured a positive trading

period but fell short of full recovery from the difficult trading

experienced during H1, resulting in an underlying operating loss

for the full year slightly ahead of prior year at GBP0.23m (2021:

Loss GBP0.27m). During the period, the successful sale of a piece

of unused land held by the Group, realised levels exceeding

expectations and raised a net profit of GBP1.51m, resulting in a

final PBT for the year of GBP1.07m (2021: Loss of GBP0.39m).

Even though there were several delayed project awards within the

period, orders slightly edged revenues, resulting in the orderbook

increasing marginally during the year and remaining at a solid

GBP27.7m (2021: GBP27.3m).

Added Value (AV) for the year remained broadly in line with

expectation at 49.1% (2021: 50.5%) but suffered from general

inflationary pressure and increasing material costs across all

sectors. This is an area being actively managed to ensure that

future revenues continue to remain at AV expectations.

2022 Summary

-- Order book increased to GBP27.7m (2021: GBP27.3m)

-- Order entry at GBP19.7m (2021: GBP23.2m)

-- Revenue at GBP19.3m (2021: GBP18.3m)

-- Underlying Operating Loss of GBP0.23m (2021: Loss GBP0.27m)

-- Profit before tax (including sale of land) at GBP1.07m (2021: Loss of GBP0.39m)

-- Net cash inflow from operating activities GBP0.1m (2021: GBP1.2m).

Markets

Aviation (aircraft) build programmes have remained steady for

the year with revenues resulting at expected levels. The Group

involvement is predominantly on the A350 and A220 aircraft and,

with both these aircraft programs intending to increase production

rates, it is forecast that the business in this area will increase

as we move through 2023 and beyond. Both these platforms enjoy

strong orderbooks, covering multiple customers, and are scheduled

to remain in production for many years.

With the rapid development of electric and other powertrain

technology there are several opportunities developing for a new

generation of flight vehicles. This is an area of much interest to

the Group and one where we have been subsequently focusing our

efforts. This is an industry in its infancy but is one where we are

looking to be successful over the coming years as it comes of

age.

Aviation (infrastructure) performed well in the year, with

revenues increasing 96% and orders increasing 68%, when compared to

2021 levels. Export at 81% was a strong feature within the revenue

number and demonstrates the importance of the improved sales

channels that are now in place for this segment. The key objective

of appointing distribution partners within all 1(st) tier targeted

countries is nearly complete and efforts are now ongoing in

expanding this further to include 2(nd) tier countries and beyond.

This expansion and management of our distribution network is an

essential strategic program and crucial to our vision of building a

robust worldwide sales network of which further developed products

can be promoted through.

Chief Executive Officer's Review (continued)

During the year the Group also launched the new Plane Power

cable carrying system. As with the Plane Power connectors, the

product was received well by our customer base and initial orders

for airports in the UK and Australia were received within the

period.

Rail has seen some recovery during the period but is still

experiencing some frustrations and delays with project new build

schedules. This is however somewhat being offset by the expansion

of our sales network and the drive towards an increased product

offering. The aftercare market remains a key area for the Group and

is one where we are now starting to see some of the previously

stalled spending being released.

The expansion of our global sales network and the addition of a

dedicated LPA sales resource in the DACH market is progressing well

for our Lighting and Electronics business. This increased support

brings better market intelligence and offers a greater level of

service and support, which is being appreciated by both existing

and potential customers. This expanded coverage is essential for

our LED tube product which is receiving much interest as we

approach the September 2023 ban across the EU on the sale of old

technology fluorescent tubes. It is envisaged that this change in

legislation will create several opportunities for this product over

the current and coming years.

Work is also underway in the standardisation of our Rail

connector range with a view of targeting the Rail aftermarket

sector within countries other than the UK. As with our Lighting and

Electronics business, this will again rely on the development and

expansion of our sales channels in these regions. This is however

fast becoming a core skill and competence within the Group and is a

key development area receiving much focus.

Industrial market expansion is a somewhat new area for the Group

and will look to target niches such as infrastructure, marine and

energy. In support of this we have taken on new products at our

distribution business and strengthened our sales team within our

electro-mechanical business. These are the first steps into these

markets but are steps that we believe to be essential for growth

and the development of a diverse sales profile.

Operational Review

The transition of the business from a predominantly project

driven model to one that has a balance of projects and standard

products, serving multiple markets and countries, is firmly

underway. This is however a medium-term strategy and, as such, it

will take time before the benefits of this are truly realised.

In support of this vision, there has been much change within the

business units in relation to both process and people. The complete

refresh of our sales teams, in both our distribution business and

electro-mechanical business, is now complete, and coming up to

speed. Several other senior appointments across the Group have also

been concluded, which although impacting overhead costs, they are

essential in achieving the goals of growth that the business

has.

Our electro-mechanical business is well on its way to achieving

the aviation approval standard AS9100 and is now also targeting the

IS14001 certification in support of our environmental credentials.

Our distribution business will also start the journey to achieve

IS14001 in the coming year, which will result in all Group

companies being compliant of this important standard.

Chief Executive Officer's Review (continued)

O utlook

The Group has endured difficult trading over the last few years

due to dependence on a marketplace that was severely disrupted by

several global situations. During this period however much work has

been undertaken throughout the Group to ensure the foundations for

growth and the de-risking of our customer dependence are in place.

We expect to see progression as we move through the coming year and

look forward to a more stable and robust business for the

future.

Paul Curtis

Chief Executive Officer

2(nd) February 2023

Financial Review

Set out are the key drivers related to the business performance

in the year and position at 30 September 2022, together with

explanation of the financial Key Performance Indicators.

Trading Performance

Macro-economic factors

Although some improvement has been seen across our markets in

relation to clarity of customer requirements, the 2022 year

continued to see some frustration and delays to both order

placement and delivery schedules. Whilst H1 was heavily impacted by

these delays, H2 saw some improvement and an uplift in activity,

resulting in a profitable period, highlighting that once over a

certain level, a good level of return can be expected from the

business.

Inflation was and continues to be a battle, with cost of energy,

people and materials, all moving up beyond levels experienced

prior. Efforts to mitigate these increases have been ongoing and

where possible fed through to the market. Added Value remains

broadly inline with expectations and is expected to remain at this

level as we move forward.

Supply of material and components has also been problematic

within the period. Electronic components, in particular, have seen

the biggest disruption, with deliveries moving out to a 52 week

lead-time in some cases. The result of this causing delays to

shipments, considerable engineering time looking for alternatives

and, in some cases, cost increases as premiums paid for stock

availability from alternate suppliers.

As the business shapes itself for the future, employment has

been a key feature of the year. Uncertainty in the market, coupled

with a low unemployment rate, has made this somewhat difficult at

times. However, the year has seen good progress on this, and with a

few exceptions, the Group moves into the new year with a high

percentage of this change completed and plans for others in

place.

Headlines

-- Order entry slightly exceeded sales at GBP19.7m (2021:

GBP23.2m) resulting in a strong order book of GBP27.7m (2021:

GBP27.3m), an increase of 1.8%;

-- Revenue of GBP19.3m up 5.8% (2021: GBP18.3m) with

electro-mechanical systems revenues down GBP1.2m and engineered

component distribution down GBP0.1m, lighting and electronic

systems up GBP2.4m;

-- Added Value reduced by 1.4% at 49.1% (2021: 50.5%) through

cost pressures and the need to source alternative suppliers;

and

-- Gross margins 22.8% (2021: 20.3%), was up 2.5% primarily

because of product mix and some reduction in production overhead

costs.

By comparison to 2021, H1 2022 revenues decreased by 7.2% at

GBP8.6m (2021: GBP9.3m), delivering an underlying operating loss of

GBP568,000 (2021: profit of GBP154,000). H2 revenues were

anticipated to accelerate as customer production recovered from

delayed projects. H2 delivered revenues of GBP10.7m (2021:

GBP9.0m), representing an increase of 19.3% against H2 2021 sales.

This resulted in an H2 underlying profit of GBP342,000 (2021: loss

of GBP428,000).

Financial Review (continued)

Distribution costs and administrative expenses increased by 9.9%

to GBP4.6m (2021: GBP4.3m). The main contributors to this were the

wider economic cost pressures seen across the industry. Also, the

UK Government Covid support was withdrawn during 2021 leading to a

reduction in other operating income.

Group employment costs reduced by GBP100,000 to GBP6.21m (2021:

GBP6.32m) inclusive of exceptional costs, as outlined below.

Included are share based payments of GBP13,000 (2021: GBP28,000)

relating to the award of share options through the Group's Long

Term Incentive Plan, these calculated using the Black-Scholes

model.

Other operating income of GBP7,000 (2021: GBP217,000) reduced

due to support from CJRS grant receipts during 2021.

Exceptional Costs and Non-Underlying Items

Exceptional costs in the year totalled a gain of GBP1,323,000,

(2021: loss of GBP46,000). K ey items comprised:

(i) Sale of surplus land raising a net profit of GBP1,506,000 in 2022 (2021: GBPnil)

(ii) GBP10,000 dual running management costs (2021: GBP46,000).

These costs reflect extended crossover periods for appointments and

retirements for the Group's directors, a transition process which

commenced in 2017 and completed on 31 December 2021.

(iii) reorganisation costs in 2022 of GBP173,000 (2021: GBPnil)

- associated with cost base reductions.

Finance Costs and Income

Within finance costs, the interest on borrowings increased to

GBP88,000 (2021: GBP86,000). The weighted average interest rate

increased by 0.5% from 2.7% to 3.2%. There was no utilisation of

the Group's overdraft facility in the year. The UK base rate

increased 7 times throughout the year, increasing through the year

from 0.10% to 2.25%.

Profit before Tax, Taxation and Earnings Per Share

After net finance costs of GBP10,000 (2021: GBP39,000) a profit

before tax of GBP1,074,000 was recorded (2021: loss GBP387,000). A

tax credit of GBP111,000 (2021: GBP365,000) is recognised,

reporting a profit after tax of GBP1,185,000 (2021: loss of

GBP22,000). This resulted in a basic earnings per share of 8.99p

(2021: loss per share 0.17p).

Tax reflects the UK corporation tax rate of 19.0% (2021: 19.0%).

The tax credit recognised is largely the consequence of recognition

of tax losses and tax credits on qualifying R&D

expenditure.

Treasury

The Group's treasury policy remained unchanged in the year.

Financial Review (continued)

Balance Sheet

Shareholders' funds increased by GBP1.0m (7.0%) in the year to

GBP14.8m (2021: GBP13.7m), including:

-- profit for the year of GBP1.2m;

-- a decrease in the defined benefit pension asset recognised of

GBP0.1m (2021: increase of GBP1.3m); and

-- an increase in ordinary share capital of GBP3,000 following

exercise of share options and issue of 35,000 new shares with a

share premium recognised of GBP14,000 (2021: share capital

GBP79,000, share premium GBP221,000).

This has resulted in an increase to the net asset value per

ordinary share to 109.4p (2021: 102.0p). Adjusted net asset value

per share (calculated excluding goodwill and the pension asset) was

82.6p (2021: 74.4p).

-- Gearing (net debt as a % of total equity) reduced to 3.5%

(2021: 11.9%) assisted by the cash proceeds from the sale of

land;

-- net debt decreasing by 68% to GBP0.52m (2021: GBP1.63m);

-- working capital, as defined as inventory, trade & other

receivables less trade & other payables, increasing 9.6% to

GBP5.08m (2021: GBP4.63m); and

-- pension asset surplus recognised reducing by 3.6% to GBP2.47m (2021: GBP2.56m).

Shareholders' funds include Investment in Own Shares (Treasury

Shares), unchanged at GBP0.32m, representing ordinary shares held

in the Company by the LPA Group Plc Employee Benefit Trust

("EBT").

I ntangible assets, which comprise goodwill related to the

Group's investment in Excil Electronics Ltd, capitalised

development costs and software purchases were GBP1,473,000 (2021:

GBP1,405,000). After assessment for impairment the goodwill remains

unchanged at GBP1,149,000. Development costs capitalised in the

year, representing the continued development of the Group's

technologies and new product development ("NPD"), were GBP163,000

(2021: GBP167,000). There were no Capitalised development assets

written off in the year (2021: loss of GBP53,000).

The net book value of property, plant and equipment as at 30

September 2022, including Right of Use Assets, totalled

GBP5,985,000 (2021: GBP6,433,000), of which property represented

GBP3,913,000 (2021: GBP4,115,000), plant, equipment and motor

vehicles GBP2,072,000 (2021: GBP2,318,000). Additions in the year

increased following the low level in the previous year of capital

investment, at GBP419,000 (2021: GBP215,000). Disposals in the year

totalled GBP1,666,000 with a net book value of GBP170,000 including

sale of surplus land and Right of Use lease terminations (2021:

GBP368,000 with a net book value of GBP9,000). The depreciation

charge reduced 7.7%. reflecting prior levels of investment at

GBP699,000 (2021: GBP757,000) .

Net trading assets (defined as inventories plus trade and other

receivables, plus current tax and less trade and other payables)

were 9.3% higher at GBP5,119,000 (2021: GBP4,688,000),

predominantly through higher activity at the end of the year

increasing the level of debtors.

Financial Review (continued)

Net Debt and Financing

The Group's main bank finance is a bank loan drawn down in 2019

at GBP2.6m and repayable over 5 years. Repayments are quarterly

over the term with a bullet repayment in March 2024 of GBP1.8m

(quarterly repayments calculated at draw down on a 15 year

repayment term). As at 30(th) September 2022 the amount outstanding

was GBP2.1m (2021: GBP2.3m). Interest is payable at base rate plus

2.25%.

Cash Flow

Net cash inflow from operating activities was GBP77,000 (2021:

GBP1,189,000) made up of a trading cash inflow of GBP395,000 (2021:

GBP601,000); an increase in working capital of GBP612,000 (2021

decrease: GBP594,000); tax refunds of GBP159,000 (2021: GBP77,000)

and voluntary defined benefit pension contributions of GBPNil

(2021: GBP83,000). Overall, there was a net increase in the Group's

cash position of GBP841,000 (2021: GBP513,000), which included

GBP17,000 receipts from the exercise of share options (2021:

GBP300,000).

Capital expenditure outflows on property, plant and equipment

reduced to GBP88,000 (2021: GBP100,000), excluding assets financed

through lease arrangements. Capitalised development expenditure

amounted to GBP163,000 (2021: GBP167,000), including expenditure to

develop a new range of aircraft ground power support products and

further product developments focused on smart lighting and

electronic systems, including rail seat electronics. The Group also

benefitted from the sale of surplus land raising GBP1,666,000.

In the year new leasing arrangements led to right of use

additions of GBP331,000 (2021: GBP115,000). Interest at 3.7% was

charged on fixed rate borrowings (2021: 3.6%). Interest on the

Group's overdraft facility is payable at base rate plus 2.0%. The

facility was unutilised as at 30 September 2022 and 2021. The

composite interest rate across both borrowings and lease

liabilities was 3.1% (2021: 2.7%).

Capital loan repayments of GBP190,000 were made in the year

(2021: GBP187,000). Outflows repaying the principal elements of

lease liabilities were GBP390,000 (2021: GBP420,000). Interest

payments on borrowings amounted to GBP88,000 (2021: GBP86,000).

The Group's dividend policy was paused in 2020 as a safeguard to

secure cash reserves through the economic downturn and supply

issues, this continuing through 2022 with no distributions.

Defined Benefit Pension Asset

The LPA Industries Limited Defined Benefit Scheme was part of

the Deloitte Pensions Master Plan throughout the entire year under

review. This arrangement had included the transfer of the advisory

functions, administration and the pensioner payroll to Deloitte.

The total costs of this transition have been substantial as the

Scheme has necessarily been subject to a level of scrutiny and

audit to ensure that it can be prepared for an eventual exit to an

insurance provider. The costs of running the scheme have been borne

by the Group and this year amounted to GBP174,800 (2021: GBP283,128

including GBP100,000 of Group contribution). The rectification work

is largely complete and subject to GMP equalisation ongoing

discussion, we anticipate substantially reduced costs going

forward.

A full Actuarial valuation of the Scheme was carried out in

March 2021 which indicated the Scheme was at a healthy 121% funding

level. At 31 March 2022 an actuarial report indicated that this had

risen to 127% of the actuarial funding level. The result of the

change in investment strategy in January 2022, when the

Financial Review (continued)

Trustees having undertaken a review in 2021 agreed to lock in

the gains and de risk the scheme, has been beneficial. The key

driver for the then improved funding position has been the higher

than assumed returns on the Scheme's assets and the changes in

financial conditions which have reduced the liabilities. It is

natural for the Scheme's funding level to fluctuate over time

reflecting changes in the financial markets and this was apparent

during the last six months of the year under review especially

sparked by the mini-budget on 23 September 2022. Over the year to

30 September 2022 the Scheme's assets, which are with Legal &

General Investment Managers in LGIM funds marginally outperformed

the benchmark return at -24.8% versus -25%.

The IAS19 actuarial surplus recognised at 30 September 2022 was

GBP2.5m (2021 restated: GBP2.6m). This is after restricting the

asset recognised by a tax deduction of 35% which is applied to any

refund from a UK pension scheme. This change in accounting for the

surplus in the year has been recognised as a prior year

adjustment.

The Trustees, under advice, did not seek any voluntary employer

contributions during the year from the Group (2021: GBP100,000).

The IAS 19 position reflects the impact of rising interest rates on

the present value of the Assets and the liability to pay pensions

in the future.

Paul Curtis

Chief Executive Officer

2(nd) February 2023

Key Performance Indicators

The Group uses the following key performance indicators to

assess the progression in its business: factors affecting them are

discussed in the Chairman's Statement, the Chief Executive

Officers' Review and the Financial Review.

KPI Basis of measurement 2022 2021

---------------------------------------------------------------

Health

& Safety

Riddors None None

* reportable incidents of disease or danger occurrences

* events that cause impact, damage or injury involving

Accidents a person or infrastructure, which are not a Riddor 25 13

* events that occurred which have not caused an

Near misses Accident 21 15

Financial

Orders to * orders for the year expressed as a multiple of

revenue revenue as a measure of prospective growth 1.02 1.27

Order entry GBP19.7m GBP23.2m

* order intake confirmed

Order book GBP27.7m GBP27.3m

* the measure of opening order book, plus order entry,

less revenue

Revenue * increase/(decrease) year-on-year as a percentage of

growth prior year 5.8% (11.8%)

* the margin generated on revenue after deduction of

material costs but before other costs of sale and

Added value conversion 49.1% 50.5%

Gross margin * as a percentage of revenue 22.8% 20.3%

* underlying operating (loss) as a return on trading

Profitability activities to revenue (1.2%) (1.5%)

Cash generation GBP1.5m GBP0.9m

* net increase in cash and cash equivalents before

financing activities

* the measure of net debt being borrowings and lease

Gearing liabilities less cash balances, to net assets 3.5% 11.9%

This year's comparative of accidents reflects increased level of

activities at the end of covid restrictions and a greater emphasis

on the reporting within the factories.

Consolidated Income Statement

For the year ended 30 September 2022

Restated

2022 2021

Note GBP000 GBP000

Continuing operations

Revenue 2 19,325 18,265

Cost of Sales (14,925) (14,558)

Gross Profit 4,400 3,707

Distribution Costs (1,781) (1,562)

Administrative Expenses (2,865) (2,664)

Administrative Expenses-Exceptional Items 3 1,323 (46)

Other Operating Income 3 7 217

Underlying Operating (Loss) (226) (274)

Share Based Payments 3 (13) (28)

Exceptional Items 3 1,323 (46)

Operating Profit/(Loss) 3 1,084 (348)

Finance Income 78 47

Finance Costs (88) (86)

Profit/(Loss)Before Tax 1,074 (387)

Taxation 4 111 365

Profit/(Loss)for the Year 1,185 (22)

========= =========

Attributable to:

- Equity Holders of the Parent 1,185 (22)

Earnings/(Loss) per Share

Basic 8.99p (0.17)p

Diluted 8.99p (0.17)p

Consolidated Statement of Comprehensive Income

For the year ended 30 September 2022

Restated

2022 2021

GBP000 GBP000

Profit/(Loss) for the Year 1,185 (22)

------- ---------

Other Comprehensive Income

Items that will not be reclassified

to profit or loss:

Actuarial (loss)/gain on pension scheme (219) 1,849

Restriction of pension assets 49 (693)

Other Comprehensive Income (170) 1,156

------- ---------

Total Comprehensive Income for the

Year 1,015 1,134

======= =========

Attributable to:

- Equity Holders of the Parent 1,015 1,134

Consolidated Balance Sheet

At 30 September 2022

Restated Restated

Co No: 00686429 2022 2021 2020

GBP000 GBP000 GBP000

Non-Current Assets

Intangible Assets 1,473 1,405 1,386

Tangible Assets 4,774 5,188 5,546

Right of Use Assets 1,211 1,245 1,438

Retirement Benefits 2,471 2,563 1,277

Deferred Tax Assets 229 263 -

10,158 10,664 9,647

-------- --------- ---------

Current Assets

Inventories 4,567 4,702 3,968

Trade and Other Receivables 5,095 4,111 5,447

Current Tax Receivable 41 55 30

Cash and Cash Equivalents 2,199 1,358 845

-------- --------- ---------

11,902 10,226 10,290

-------- --------- ---------

Total Assets 22,060 20,890 19,937

-------- --------- ---------

Current Liabilities

Bank Loan (190) (191) (188)

Lease Liabilities (356) (323) (406)

Trade and Other Payables (4,584) (4,180) (4,193)

(5,130) (4,694) (4,787)

-------- --------- ---------

Non-Current Liabilities

Bank Loan (1,934) (2,123) (2,313)

Lease Liabilities (240) (354) (584)

Deferred Tax Liabilities - - (16)

-------- --------- ---------

(2,174) (2,477) (2,913)

-------- --------- ---------

Total Liabilities (7,304) (7,171) (7,700)

-------- --------- ---------

Net Assets 14,756 13,719 12,237

======== ========= =========

Equity

Share Capital 1,348 1,345 1,266

Investment in Own Shares (324) (324) (324)

Share Premium Account 943 929 708

Share Based Payment Reserve 49 60 118

Merger Reserve 230 230 230

Retained Earnings 12,510 11,479 10,239

-------- --------- ---------

Equity Attributable to Shareholders

of The Parent 14,756 13,719 12,237

======== ========= =========

Consolidated Statement of Changes in Equity

For the year ended 30 September 2022

Investment Share Share

Share in Own Premium Based Payment Merger Retained

Capital Shares Account Reserve Reserve Earnings Total

2022 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 October 2021* 1,345 (324) 929 60 230 11,479 13,719

--------- ----------- --------- ------------------ --------- ---------- -------

Profit for the Year - - - - - 1,185 1,185

Other Comprehensive

Income - - - - - (170) (170)

Total Comprehensive

Income - - - - - 1,015 1,015

--------- ----------- --------- ------------------ --------- ---------- -------

Proceeds from issue

of shares 3 - 14 - - - 17

Share based payments - - - 13 - - 13

Tax on share-based payments - - - - - (8) (8)

Transfer on exercise

of

share options - - - (24) - 24 -

--------- ----------- --------- ------------------ --------- ---------- -------

Transactions with Owners 3 - 14 (11) - 16 22

--------- ----------- --------- ------------------ --------- ---------- -------

At 30 September 2022 1,348 (324) 943 49 230 12,510 14,756

========= =========== ========= ================== ========= ========== =======

* restated - see note

1

Investment Share Share

Share in Own Premium Based Payment Merger Retained

Capital Shares Account Reserve Reserve Earnings Total

2021 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 October 2020* 1,266 (324) 708 118 230 10,239 12,237

--------- ----------- --------- ------------------ --------- ---------- -------

(Loss) for the Year* - - - - - (22) (22)

Other Comprehensive

Income* - - - - - 1,156 1,156

Total Comprehensive

Income* - - - - - 1,134 1,134

--------- ----------- --------- ------------------ --------- ---------- -------

Proceeds from issue

of shares 79 - 221 - - - 300

Share based payments - - - 28 - - 28

Tax on share-based payments - - - - - 20 20

Transfer on exercise

of

share options - - - (86) - 86 -

--------- ----------- --------- ------------------ --------- ---------- -------

Transactions with owners 79 - 221 (58) - 106 348

--------- ----------- --------- ------------------ --------- ---------- -------

At 30 September 2021 1,345 (324) 929 60 230 11,479 13,719

========= =========== ========= ================== ========= ========== =======

Consolidated Cash Flow Statement

For the year ended 30 September 2022

2022 2021

GBP000 GBP000

Profit/(Loss) Before Tax 1,074 (387)

Finance Costs 88 86

Finance Income (78) (47)

Operating Profit/(Loss) 1,084 (348)

Adjustments for:

Amortisation of Intangible Assets 95 111

Depreciation of Tangible Assets 497 484

Depreciation of Right of Use Assets 202 273

Profit on sale of Land/Plant and Equipment (1,496) -

Loss on disposal of Intangible Assets - 53

Equity Settled Share Based Payments 13 28

Operating cash flow before movements

in working capital 395 601

Movements in Working Capital:

Decrease/(Increase) in Inventories 135 (734)

(Increase)/Decrease in Trade and Other

Receivables (984) 1,336

Increase/(Decrease) in Trade and Other

Payables 372 (8)

Cash generated from operations (82) 1,195

Income Taxes Received 159 77

Defined Benefit Pension Contributions

less settlements - (83)

Net cash inflow from operating activities 77 1,189

-------- -------

Purchase of Software - (16)

Purchase of Property, Plant & Equipment (88) (100)

Proceeds from Sale of Property, Plant 1,666 -

and Equipment

Expenditure on Capitalised Development

Costs (163) (167)

Net cash inflow/(outflow) from investing

activities 1,415 (283)

-------- -------

Repayment of Bank Loan (190) (187)

Principal elements of Lease Liabilities (390) (420)

Interest Paid (88) (86)

Proceeds from Issue of Share Capital 17 300

Net cash outflow from financing activities (651) (393)

-------- -------

Net increase in Cash and Cash Equivalents 841 513

Cash and Cash Equivalents at start

of the year 1,358 845

-------- -------

Cash and Cash Equivalents at end

of the year 2,199 1,358

======== =======

Reconciliation of cash and cash equivalents

Cash and Cash Equivalents in Current

Assets 2,199 1,358

======== =======

Consolidated Cash Flow Statement (continued)

For the year ended 30 September 2022

Net Debt

An analysis of the change in net debt is shown below:

Cash and

Bank Loan Lease Liabilities Cash Equivalents Net Debt

GBP000 GBP000 GBP000 GBP000

At 1 October 2021 2,314 677 (1,358) 1,633

New Lease Obligations - 309 - 309

Interest Costs 64 24 - 88

Repayment of Borrowings/Lease

Liabilities (254) (414) 668 -

Other Cash (Generated) - - (1,509) (1,509)

At 30 September 2022 2,124 596 (2,199) 521

========== ================== ================== =========

Cash and

Bank Loan Lease Liabilities Cash Equivalents Net Debt

GBP000 GBP000 GBP000 GBP000

At 1 October 2020 2,501 990 (845) 2,646

New Lease Obligations - 107 - 107

Interest Costs 57 30 (1) 86

Repayment of Borrowings/Lease

Liabilities (244) (450) 694 -

Other Cash (Generated) - - (1,206) (1,206)

At 30 September 2021 2,314 677 (1,358) 1,633

========== ================== ================== =========

Notes

1 Information

In accordance with Section 435 of the Companies Act 2006, the

Group confirms that the financial information for the years ended

30 September 2022 and 2021 are derived from the Group's audited

financial statements and that these are not statutory accounts and,

as such, do not contain all information required to be disclosed in

the financial statements prepared in accordance with UK-adopted

International Accounting Standards. The statutory accounts for the

year ended 30 September 2021 have been delivered to the Registrar

of Companies. The statutory accounts for the year ended 30

September 2022 have been audited and approved but have not yet been

filed. The Group's audited financial statements for the year ended

30 September 2022 received an unqualified audit opinion and the

auditor's report contained no statement under section 498(2) or

498(3) of the Companies Act 2006. The financial information

contained within this full year results statement was approved and

authorised for issue by the Board on 2 February 2023.

The 2022 accounts, together with notice of the Annual General

Meeting, are expected to be posted to shareholders on 27 February

2023 and will be available from the LPA website ( www.lpa-group.com

) from 15(th) February 2023. They will also be available from the

Group Finance Director, LPA Group Plc, Light & Power House,

Shire Hill, Saffron Walden, CB11 3AQ.

The Group financial statements have been prepared under the

historical cost convention and under the basis of going concern.

The principal accounting policies adopted are consistent with those

disclosed in the financial statements for the year ended 30

September 2021.

The prior year accounts have been restated to restrict the

pension scheme asset by 35% tax which is netted off the amounts

that would be refunded. Given no further taxes will be payable by

the Group, the deferred tax provision held in relation to the

pension scheme has also been reversed. There is no change in the

profit before tax reported for the year ended 30 September 2022 as

a result of this change however the net assets have reduced by

GBP380,000.

2 Operating Segments

All of the Group's operations and activities are based in, and

its assets located in, the United Kingdom. The CODM does not review

segmental assets and liabilities by segment and therefore no

reconciliations are disclosed. For management purposes the Group

comprises three product groups (in accordance with IFRS 8) -

electro-mechanical, lighting & electronics and engineered

component distribution (which collectively design, manufacture and

market industrial electrical and electronic products) - less

corporate costs, which operate across three market segments - Rail;

Aerospace & Defence and Other. It is on this basis that the

board of directors assess Group performance. The split is as

follows:

2022 2021

GBP000 GBP000

Electro-mechanical systems 6,533 7,761

Engineered component distribution 3,342 3,410

Lighting & Electronics systems 9,450 7,094

Operational Revenue 19,325 18,265

======= =======

2022 2021

GBP000 GBP000

Revenue recognised over time 97 788

Revenue recognised at a point in time 19,228 17,477

19,325 18,265

======= =======

All revenue originates in the UK. An analysis by geographical

markets and market segments is given below:

2022 2021

Rail 72% 77%

Aerospace and Defence 13% 10%

Other 15% 13%

100% 100%

======= =======

2022 2021

GBP000 GBP000

United Kingdom 12,649 12,618

Rest of Europe 4,607 3,500

Rest of World 2,069 2,147

19,325 18,265

======= =======

One individual customer (2021: three) represented more than 10%

of Group revenue, combined totalling 23% (2021: 38%).

2 Operating segments (continued)

2022 2021

GBP000 GBP000

Operational Profit 768 652

Corporate Costs (994) (926)

Underlying Operating (Loss) (226) (274)

======= =======

Corporate costs and operational profit are shown excluding

charges levied to subsidiary entities by LPA Group Plc relating to

management charges and where the property is held by LPA Group Plc,

property rent which combined totalled GBP594,000 (2021:

GBP426,000).

3 Operating Profit/(Loss)

The following items have been charged in arriving at Operating

profit/(loss)/profit.

2022 2021

A. Component costs in arriving at Operating GBP000 GBP000

Profit/(Loss)

Materials (to Added Value) 9,831 9,036

Production Overhead & Direct Labour 5,094 5,522

Cost of Sales 14,925 14,558

Selling & Distribution Costs 1,781 1,562

Administrative Expenses 2,865 2,664

Administration Expenses - Exceptional Items (1,323) (46)

Other Operating Income (7) (217)

======== =======

2022 2021

B. Expenses/(credits) by nature within Underlying GBP000 GBP000

Operating Loss

Amortisation of Intangible Assets 95 111

Depreciation of Tangible Assets 497 484

Depreciation of Right of Use Assets 202 273

Loss on Disposal of Assets 10 53

Lease Rentals / Short Term Hire Charges

- Plant, Equipment & Motor Vehicles 22 16

Foreign Exchange (Gain)/Loss

Other Operating Income: (62) 96

- Covid-19 Job Retention Scheme grants (CJRS) (7) (217)

Fees Payable to The Company's Auditor:

- For the Audit of The Company's Annual Accounts 49 22

- The Audit of The Company's Subsidiaries

Pursuant to Legislation 84 71

======== =======

2022 2021

C. Within Exceptional Costs GBP000 GBP000

Sale of land (1,506) -

Reorganisation costs / staff changes 173 -

Dual running management costs 10 46

-------- -------

(1,323) 46

======== =======

Sale of land relates to the disposal of a piece of surplus land

that was valued on the books at GBP160,000 and realised a net gain

of GBP1,506,000 during the year (2021: GBPnil).

Reorganisation costs / staff changes of GBP173,000 in 2022

relate to a Group wide cost base review and loss of office payment.

(2021: GBPnil).

Dual running costs of GBP10,000 (2021: GBP46,000) relate to an

extended crossover between the appointment and retirement of Board

Directors related to the board rejuvenation process commenced in

2018, and concluded on 31 December 2021.

4 Taxation

Restated

2022 2021

A. Recognised in The Income Statement GBP000 GBP000

Current Tax Expense

UK Corporation Tax (65) (4)

Adjustment in Respect of Prior Years (80) (46)

------- ---------

(145) (50)

Deferred Taxation

Net Origination and (Recognition) / Reversal

of

Temporary Differences 34 (244)

Net Change as a Result of Rate Increase - (71)

Total Corporation Tax (Credit) (111) (365)

======= =========

2022 2021

B. Reconciliation of Effective Tax Rate GBP000 GBP000

Profit/(loss) Before Tax 1,074 (387)

======= =========

Tax at The UK Corporation Tax Rate of

19% (2021: 19%) 204 (74)

Effects of:

- Tax Rate Change - (71)

- Enhanced Deduction for Qualifying

R&D Expenditure (102) (80)

- Prior Period Adjustments (80) (46)

- Prior Period Losses Recognised (71) (55)

- Other Differences (62) (39)

Total Income Tax Credit (111) (365)

======= =========

2022 2021

C. Current and Deferred Tax Recognised GBP000 GBP000

Directly in Equity

Tax Charge/(Credit) Arising on Share

Options 8 (20)

======= =========

5 Earnings/(Loss) Per Share

The calculation of earnings per share is based upon the profit

for the year of GBP1,185,000 (2021 restated: loss GBP22,000) and

the weighted average number of ordinary shares in issue during the

year of 13.472m (2021: 12.89m) less investment in own shares of

0.3m (2021: 0.3m), of 13.172m (2021: 12.59m).

2022 2021

--------------------------------------------------------- -------------------------------------

Weighted Weighted Loss

Average Earnings Average Per

No of Per (Loss) No of Share

Earnings Shares Share - restated Shares - restated

--------- --------- --------- ------------ --------- ------------

GBP000 Million Pence GBP000 Million Pence

--------- --------- --------- ------------ --------- ------------

Basic Earnings/(Loss)

Per Share 1,185 13.172 8.99 (22) 12.590 (0.17)

Effect of Share Options - 0.007 - - - -

Diluted Earnings/(Loss)

Per Share 1,185 13.179 8.99 (22) 12.590 (0.17)

========= ========= ========= ============ ========= ============

Diluted earnings per share has been calculated for the year

ended 30 September 2022 as the Group reported a profit (2021: the

loss was considered anti-dilutive and was ignored for the

calculation). Basic earnings per share for the year ended 30

September 2021 has been restated (see note 1). The impact of the

restatement has reduced loss per share by 0.10 pence.

6 Going Concern

In assessing going concern, including impacts of supply chain

shortages and inflationary pressures seen latterly, the directors

note that current economic conditions are continuing to create

uncertainty. Such uncertainties have and continue to make

forecasting extremely challenging, with these multiple factors

causing delivery schedule delays.

In assessing the Group's going concern the directors also note

that (i) despite reporting an underlying operating loss in the

current year and anticipating a challenging start to the 2023 year,

the Group is expected to return to profitability in the near term;

(ii) has in place adequate working capital facilities for its

forecast needs and was cash generative through the 2022 financial

year, with a positive EBITDA and strong cash management, benefiting

from the sale of the surplus land; (iii) has a strong order book

with significant further opportunities in its market place; and

(iv) has proven adaptable in past periods of adversity, as again

proven through the 2022 challenges. Therefore, the directors

believe that it is well placed to manage its business risks

successfully.

Supply chain delays now widely seen, aligned with price

pressures in the supply chain, covering commodities, utilities and

wage inflation all pose risks to UK manufacturing businesses.

Offsetting these, on-shoring opportunities and the supply chain

delays and shortages themselves offer new opportunities to the

Group to assist offset some of the project delays.

The directors recognise that the ongoing support of its bank is

a key feature to the Group's success which provides for the funding

and working capital facilities. We maintain good relationships with

our bank and our current facility is in place until March 2024

before which discussions should lead to renewal as the bank remains

supportive of our business model.

After making enquiries including but not limited to compiling

updated forecasts; sensitivities; and expectations, reviewing

liabilities and risks and following confirmation of ongoing support

from the Group's bank, the directors have a reasonable expectation

that the Company and the Group have adequate resources to continue

in operational existence for the foreseeable future. Accordingly,

they continue to adopt the going concern basis in preparing the

annual report and accounts.

7 Annual General Meeting

The annual general meeting is to be held at 12:00 noon on

Thursday 23 March 2023 at the offices of finnCap, 1 Bartholomew

Close, London, EC1A 7BL. Special business includes four resolutions

which relate to share capital:

1. an ordinary resolution to renew the authority of the directors to allot shares generally.

2. is a special resolution to give power to the directors to

allot equity securities for cash without first offering them to

existing shareholders.

3. is a special resolution to permit the Company to make market purchases of its own shares.

4. is an ordinary resolution to increase the Company's

authorised share capital to GBP2,500,000 divided into 25,000,000

ordinary shares of 10 pence each.

Of the four resolutions, the first three are part of the

portfolio of powers commonly granted to directors to ensure

flexibility, should appropriate circumstances arise, to either

allot shares, or make purchases of the Company's own shares in the

best interests of shareholders. Each authority will run through

until the next annual general meeting.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BRGDDUUGDGXD

(END) Dow Jones Newswires

February 03, 2023 02:00 ET (07:00 GMT)

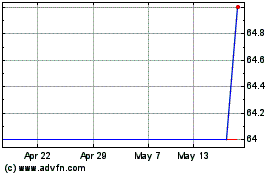

Lpa (LSE:LPA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Lpa (LSE:LPA)

Historical Stock Chart

From Dec 2023 to Dec 2024