TIDMLIO

RNS Number : 8789G

Liontrust Asset Management PLC

24 July 2023

THIS ANNOUNCEMENT, INCLUDING THE APPENDICES AND THE INFORMATION

CONTAINED IN THEM, IS RESTRICTED AND IS NOT FOR RELEASE,

PUBLICATION, DISTRIBUTION OR FORWARDING, IN WHOLE OR IN PART,

DIRECTLY OR INDIRECTLY, IN OR INTO JAPAN OR ANY OTHER JURISDICTION

IN WHICH SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE

UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

LEI: 549300XVXU6S7PLCL855

For immediate release

24 July 2023

Stock Exchange Announcement

LIONTRUST ASSET MANAGEMENT PLC

Update on Proposed Acquisition of GAM Holding AG

Liontrust Asset Management Plc ("Liontrust", or the "Company"),

the specialist independent fund management group, today issues an

update in relation to its recommended public exchange offer for all

publicly held registered shares of GAM Holding AG ("GAM") (the

"Proposed Acquisition") which was announced on 4 May 2023.

Liontrust announces that the Board has agreed to waive the FMS

Exit condition(1) . This follows the announcement by GAM on 29 June

2023 that it had entered into agreements for the sale of its

third-party Fund Management Services businesses in Luxembourg and

Switzerland to Carne Group ("FMS Sale"), in the light of feedback

from GAM shareholders and the fact that the FMS Sale remains on

target to complete in the final calendar quarter of 2023.

Liontrust also announces that the Main Offer Period(2) , during

which Liontrust's offer for GAM is open for acceptance, has been

extended by three days so that it will now end on 28 July 2023 at

16:00 CEST. The purpose of the extension of the Main Offer

Period(2) is to give GAM shareholders further time to consider the

waiver of the FMS Exit condition(1) , Liontrust's offer and the

implications of the pre-announcement of a partial and conditional

offer for 17.5% of the issued share capital of GAM by NewGAMe SA,

which was published on 18 June 2023.

The start of the Additional Acceptance Period(2) will therefore

also change as a consequence of the extension of the Main Offer

Period(1) . Should the offer be declared a success, the Additional

Acceptance Period(2) will now commence on 7 August 2023 and end on

18 August 2023 at 16:00 CEST.

The Proposed Acquisition is the best way to ensure a future for

GAM and a positive outcome for its shareholders and clients. During

the extension to the deadline we are announcing today, GAM

shareholders will have time to consider further the Proposed

Acquisition and Liontrust's latest announcements. It is in the best

interests of GAM shareholders and clients that there is immediate

corporate and financial stability, which we believe Liontrust's

offer delivers.

Liontrust thanks those GAM shareholders who have already

tendered their shares for their support. Liontrust also notes that

GAM's senior investment managers have written a second letter to

its Board stressing their strong support for the Liontrust

offer.

As we announced on 21 July 2023, the Proposed Acquisition is

Liontrust's full and final offer. For the avoidance of any doubt,

the public exchange offer by Liontrust is the only offer for the

entire issued share capital of GAM.

Liontrust has today issued a second update to its Swiss offer

prospectus in relation to the Proposed Acquisition formally

confirming the matters described above, a copy of which has been

published on the website of Liontrust (

https://www.liontrust.co.uk/gam-acquisition/documents ).

(1) As set out in paragraph 3 of Part 5 of the circular in

relation to the proposed acquisition of GAM dated 13 June 2023.

(2) As set out in the Swiss Offer Prospectus that was published

on 13 June 2023.

For further information please contact:

Teneo (Tel: 020 7353 4200, Email: liontrust@teneo.com)

Tom Murray

Liontrust Asset Management Plc (Tel: 020 7412 1700, Website:

liontrust.co.uk)

John Ions: Chief Executive

Vinay Abrol: Chief Financial Officer & Chief Operating

Officer

Simon Hildrey: Chief Marketing Officer

David Boyle: Head of Corporate Development

Singer Capital Markets (Tel: 020 7496 3000)

Corporate Broking: Tom Salvesen

Corporate Finance: Justin McKeegan

Panmure Gordon (Tel: 020 7886 2500)

Corporate Broking: David Watkins

Corporate Advisory: Atholl Tweedie

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEAEXDAFEDEAA

(END) Dow Jones Newswires

July 24, 2023 02:00 ET (06:00 GMT)

Liontrust Asset Management (LSE:LIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

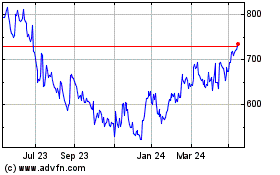

Liontrust Asset Management (LSE:LIO)

Historical Stock Chart

From Nov 2023 to Nov 2024