Lon.Fin.&Inv.Grp. Result of AGM

November 28 2013 - 9:00AM

UK Regulatory

TIDMLFI

Date: 28th November 2013

On behalf of: London Finance & Investment Group P.L.C ("Lonfin" or "Company")

London Finance & Investment Group P.L.C.

Annual General Meeting results

AGM Results

London Finance & Investment Group P.L.C. (LSE: LFI, JSE: LNF), the investment

company whose assets primarily consist of two Strategic Investments and a

General Portfolio, held its Annual General Meeting today and is pleased to

report that all resolutions were passed by the required majority.

The proxy votes that would have been cast for each resolution, had a poll been

held, were as follows:

Resolution For Against Abstain

1 17,761,113 Nil 200

2 17,741,113 200 20,000

3 17,761,113 200 Nil

4 17,761,113 200 Nil

5 17,761,113 Nil 200

6 17,761,113 200 Nil

7 17,761,113 200 Nil

The Chairman presented a summary of investments showing net assets per share,

including investments at market value, and separately the net assets per share

including the underlying investments of Western Selection P.L.C. at market

value:

Summary of Investments

25 November 30 June

2013 2013

GBP000 GBP000

Investment in associate at market value:

Western Selection P.L.C. 4,323 3,930

Strategic Investment at market value:

Finsbury Food Group plc 6,030 5,490

---------- ----------

10,353 9,420

General Equity Portfolio at market value 5,800 5,601

Tangible non-current assets 2 3

Cash, bank balances and deposits 185 116

Bank loans (800) (650)

Other net (liabilities)/assets (170) 53

Non-controlling interests (79) (81)

Deferred Tax (421) (204)

---------- ----------

Net assets, including investments at market value 14,870 14,258

====== ======

Net assets per share 47.7p 45.7p

Net assets per share, including the underlying

investments of

Western Selection P.L.C. at market value. 58.0p 53.8p

Since our year ended 30th June 2013 our net assets per share, including

investments at market value have increased by 4.4% from 45.7p to 47.7p at 25th

November 2013.

We currently hold 29 blue chip stocks in the UK, Europe and the USA and our

strategic investments have performed well in the turbulent economic period with

the value of Western Selection P.L.C. rising by 10% and Finsbury Food Group Plc

rising by 10%.

The Board remains positive for the coming months.

Enquiries to:

London Finance & Investment Group P.L.C.

Lloyd Marshall 020 7448 8950

Notes to Editors:

? Lonfin is an investment company whose assets primarily consist of two

Strategic Investments and a General Portfolio. Strategic Investments are

significant investments in smaller UK quoted companies and these are balanced

by a General Portfolio, which consists mainly of investments in major U.K.

and European equities.

? Its strategic investments comprise: Western Selection P.L.C. and Finsbury

Food Group plc. Western Selection P.L.C. has strategic investments in

Creston plc, Swallowfield plc, Northbridge Industrial Services plc and Hartim

Limited. The General Portfolio has material interests in Oil, Natural

Resources, Pharmaceuticals & Healthcare and Food & Beverages.

END

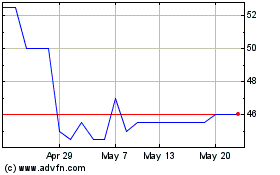

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jun 2024 to Jul 2024

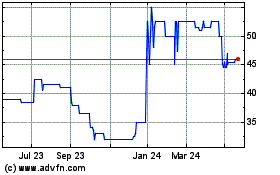

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jul 2023 to Jul 2024