RNS Number:3707P

London Finance & Investment Grp.PLC

14 August 2000

London Finance & Investment Group P.L.C.

Preliminary announcement of unaudited results for the year ended 30th June 2000

Introduction

I am pleased to announce very good results for the year. The Company drew down

the balance of the #1.5 million loan facility during the year and increased the

amount of its holdings in Strategic Investments, which have produced strong

performances.

We hold three strategic investments, in which we have board representation.

Detailed comments on these companies, Western Selection P.L.C., our associated

company, Marylebone Warwick Balfour Group Plc and Megalomedia plc, are given

below.

Results

The profit before tax for the year ended 30th June 2000 was #638,000, an

improvement of 287% compared to #165,000 (restated) last year. Earnings per

share for the year improved by 46% to 2.43p, compared to 1.67p last year, which

included a tax credit of #220,000 (0.86p per share) arising from the release of

a prior year provision.

The 1999 comparative figures for dividend income and the taxation charge have

been restated to comply with FRS 16. The restatement has no impact on the

profit after tax. FRS 16 "Current Taxation" requires that UK dividends are

now accounted for net of any tax credit, whereas previously they were grossed up

to include the appropriate tax credit.

Your directors propose to raise the dividend this year to 1.1p per share, an

increase of 10% from 1.0p last year.

At 30th June 2000 the Company's net assets, including investments at market

value before providing for any tax that might arise on realisation of

investments, were #12,774,000, an increase of 39%, 14.25p per share, over last

year. The FTSE-100 index has been volatile but was virtually unchanged at

6312.7 at 30th June 2000 compared to 6318.5 at 30th June 1999.

Strategic Investments

Western Selection P.L.C. ("Western")

The Company owns 17,611,745 shares, being 40.48% of the issued share capital,

and 3,238,255 warrants, of Western. On 24th July 2000 Western announced a

profit after tax and exceptional items of #851,100 for its year to 30th June

2000, an increase in earnings to 1.96p from 0.79p, and a 14% increase in

dividend to 0.40p (1999 - 0.35p). Western's net assets at market value were

#12.9 million, equivalent to 29.59p per share, an increase of 67% over the

17.75p recorded at 30th June 1999.

The market value of the Company's investment in Western at 30th June 2000 was

#2.6 million and the book value was #3.3 million. At market value this

represents 20% of the net assets of the Company. The underlying value of the

Company's investment in Western, valuing Western's own investments at market

value, was #5.2 million (1999 - #3.1 million).

Western has strategic investments in The Sanctuary Group PLC and Creston plc and

has recently reported on them as follows:

The Sanctuary Group PLC ("Sanctuary")

Western owns 6,725,000 shares and 3,131,801 warrants in Sanctuary, being 2.6%

of the issued share capital and 14.6% of the warrants of Sanctuary. The market

value of Western's holding in shares and warrants of Sanctuary on 30th

June 2000 was #4.8 million and the cost was #1 million. At market value this

represents 38% of the net assets of Western.

Sanctuary now operates in four divisions - screen, music, facilities and new

media, which supply content both on the Internet and through more traditional

channels. These divisions produce and distribute television programmes,

provide creative and business management to music artists, own and license

rights to recorded music, publish books, operate film and television studios,

operate music recording facilities, and develop lifestyle websites. These

lifestyle websites are being designed to exploit Sanctuary's niche positions

in music and film, and the first, a heavy metal site, Metal-is.com, went live

in April 2000. I am the non-executive chairman of Sanctuary.

On 31st January 2000 Sanctuary announced its results for the year to 30th

September 1999. Earnings per share were 1.65p for the year compared to 1.27p

for the 9 months to 30th September 1998 and a dividend of 0.20p per share was

declared, increased from 0.15p last year.

Sanctuary continues to expand its intellectual property rights. In November

1999, it issued 43.7 million shares at 24.5p each to fund acquisitions, repay

borrowings and provide for the development of a heavy metal virtual portal.

In March this year, Sanctuary acquired CMC International Records Inc. which

has a catalogue of over 1,200 tracks for #4.4million. In April, Sanctuary

issued 68.5 million shares at 73p each to fund the acquisition of Castle.

Castle is a leading independent music company with a large catalogue of over

45,000 valuable tracks.

On 5th June 2000 Sanctuary announced its results for the half-year to 31st

March 2000. Turnover increased by 30% over the equivalent period in 1999;

operating profits before interest, taxation, depreciation and amortisation

increased by 58%. Profit before tax, including amortisation of the catalogues

rose 33%. Basic earnings per share were 0.81p for the half-year compared with

0.77p for the same period a year earlier.

Creston plc ("Creston")

Western owns 1,334,322 shares in Creston, being 13.9% of the issued share

capital of Creston. The market value of the Western's holding in Creston on

30th June 2000 was #1.5 million and the book value was #1.3 million. At market

value this represents 12% of the net assets of Western.

Creston was a property investment, development, and trading company, with

property assets throughout the United Kingdom. Substantially all of Creston's

property assets were sold in the year and a substantial part of the sales

proceeds after repayment of debt is being returned to Creston's shareholders.

On 5th May 2000 Western received a special dividend of 36p per share, #480,400,

which Western has accounted for as an exceptional item. It is Western's

intention to account for any future special dividends as exceptional items in

the accounts for the year ending 30th June 2001. A year ago the share price of

Creston was 105.5p and at 30th June 2000 it was 115p, after the payment of the

special dividend.

I have been a non-executive director of Creston for many years and was elected

non-executive chairman of Creston on 26th November 1999. Mr. Robotham was

appointed non-executive director of Creston on 3rd September 1999.

Lonfin owns an additional 207,000 shares in Creston being 2.3% of the issued

share capital of Creston. The market value of Lonfin's holding in Creston on

30th June 2000 was #238,000 and the book value was #156,000. Lonfin received

#74,000 in respect of the special dividend paid on 5th May 2000.

Marylebone Warwick Balfour Group Plc ("MWB")

The Company owns 3,000,000 shares in MWB, being 3.5% of the issued share capital

of MWB. The market value of the Company's holding in shares of MWB on 30th June

2000 was #4.8 million and the book value was #2.5 million. At market value this

represents 38% of the net assets of the Company. We have invested a further

#507,000 in the group during the year, taking scrip in lieu of

dividends, exercising 299,439 warrants and taking up 74,074 shares under a

placing and open offer.

MWB has six main operating divisions: business centres, hotels, fund management,

asset management, project management and retails. The first four of these are

structured as long term businesses producing recurring income and cash flow, the

project management division produces profits and fees over fixed timetables and

the retail division encompasses the Liberty retail store operations in London.

During its most recent year ended 30th June 2000, MWB has announced:

- An increase in proforma net asset value by nearly 100% to #162 million.

- The #40.2 million sale of the first phase of its development at Kensington

Village in January 2000 followed by the #60 million sale of the second phase

in July 2000. These two sales produced net cash receipts of some #25

million to MWB and substantial realised profits.

- #25 million investment by DLJ Real Estate for a 20% interest in MWB's

subsidiary MWB Business Exchange.

- #300 million of property acquisitions and disposals during the year.

- #165 million of long term debt raisings.

- The #72 million acquisition of Liberty plc.

Since DLJ's investment last November, MWB's serviced office business continues

to produce substantial growth, more than tripling turnover in the year to June

2000 compared with the previous year. MWB now has 29 operating business centres

in the UK and three further centres under development in Paris and Amsterdam.

Further centres are due to be opened in Frankfurt, Berlin and Amsterdam later

this year.

The other area of operations that witnessed dramatic growth during the year to

June 2000 was MWB's hotel division. Today, MWB owns or is developing hotel

properties with a combined end value in excess of #300 million. This includes

the Howard Hotel on London's Embankment, a major five star development on Park

Lane and a luxury hotel development in Glasgow.

In May 2000, MWB acquired a 70% interest in the proposed #300 million mixed-use

development adjacent to the new ExCel Exhibition Centre in London's Docklands.

A substantial development comprising 900 hotel rooms, up to 800 apartments,

offices and car parking is currently being created.

Also in May 2000, MWB announced a #72 million recommended offer for the retail

group Liberty plc. This offer was completed in July 2000. The Board of MWB

considers Liberty to be a seriously under-developed brand with tremendous global

potential that can be unlocked through a focused and dynamic investment

strategy. Its aim is also to create a more focused retail business operation

from Liberty's refurbished retail buildings in Great Marlborough Street, London.

MWB announced earnings of 4.8p per share for its half-year ended 31st December

1999, up from 2.2p for the half-year ended 31st December 1998, and an interim

dividend of 1.4p per share (1.3p last year). The increase in profits from last

year was due to the positive cash flow and earnings produced from the Group's

core operations. At 31st December 1999 MWB had net assets #118 million which

represent net assets per share of 143p (unchanged from 30th June

1999) with substantial surpluses forecast by the market for the full year to

June 2000 when the annual property valuation is included in its accounts.

Megalomedia plc ("Megalomedia")

At 30th June 2000 the Company owned 3,855,000 shares in Megalomedia, and on 6th

July purchased a further 145,000 shares at a cost of #34,000. Our current

holding represents 5.41% of Megalomedia's issued share capital. The market

value of our holding was #867,000 on 30th June 2000 compared to a cost of

#508,000.

Megalomedia achieved profits before tax of #3.2 million for its year to 31st

March 2000. This included an exceptional profit of #1.8 million from the sale

of practically all of its investment in The Multimedia Corporation PLC.

Earnings per share, including exceptionals, were 4.33p compared to a loss, also

including exceptionals, of 7.82p per share. The dividend for 2000 was 0.25p per

share the same as the year before. Shortly after the year end, Megalomedia sold

its investment in Forward Publishing Limited, realising approximately #8.25

million in cash and loan notes.

Megalomedia's principal business is now the provision of post production

services to the film and television industry. This is a capital intensive and

occasionally volatile business, as is evidenced by the results over the last two

years. It is a business which uses some of the most advanced special effects

technology available and employs some of the most creative animators in the

world.

The sale of the investment in contract publishing opens up a range of

possibilities for Megalomedia's future strategy, which we expect to focus on the

creation of lasting shareholder value.

The year ahead

In looking to the future, we see a world economy which we believe will remain

largely dominated by the United States of America. Developments there, such as

the forth-coming presidential election and possible changes of emphasis in

political and economic policy, will be important. Perhaps the major debate for

investors over the next few years will be deciding what is an appropriate value

for information technology businesses using electronic delivery systems. Recent

swings in these markets throughout the world have created and in some cases

shortly thereafter, eliminated apparent shareholder value on an unprecedented

scale.

Our long standing strategy is to achieve a balance of shareholder value from a

number of strategic investments which we must expect to be volatile, and a

general portfolio of leading shares which operate on a global basis. We intend

to maintain this strategy so as to take advantage where appropriate of new

opportunities and to continue to focus on year by year growth of capital and

dividends for our shareholders.

D.C. MARSHALL

Chairman

14th August 2000

Unaudited Consolidated Profit & Loss Account

Year ended 30th June 2000 1999

Restated

#000 #000

Operating income 1,093 729

Operating profit on ordinary activities before

taxation 392 92

Share of result of associated undertaking 350 147

Interest payable (104) (74)

Profit on ordinary activities before taxation 638 165

Taxation (16) 252

Profit after taxation 622 417

Minority interests (1) 10

Profit attributable to members of holding

company 621 427

Dividend (Note 1) (281) (255)

Retained profit for the financial year 340 172

Earnings per share (Note 2) 2.43p 1.67p

Dividend per share (net) 1.10p 1.00p

There is no difference in either period between the above profit and the profit

on an historical cost basis.

The Group had no discontinued operations in either period.

There were no other recognised gains or losses in the year.

Unaudited abridged Consolidated Balance Sheet

at 30th June 2000 1999

#000 #000

Fixed Assets

Tangible assets 517 505

Investments 6,499 5,812

7,016 6,317

Current Assets

Listed investments 3,710 3,724

Unlisted investments 55 54

Debtors 146 222

Bank balances and deposits 53 95

3,964 4,095

Creditors: falling due within one year (1,962 (1,736)

Net current assets 2,002 2,359

Total Assets less Current Liabilities 9,018 8,676

Capital and Reserves

Called up share capital 1,276 1,276

Share premium account 957 956

Reserves 361 361

Profit and loss account 6,371 6,031

Equity shareholders' funds 8,965 8,624

Minority equity interests 53 52

9,018 8,676

Analysis of Net Assets (Note 3)

30th June 2000 1999

#000 #000

Tangible fixed assets 517 505

Principal fixed asset investments at

market value

Western Selection P.L.C. 2,604 1,502

Megalomedia plc 867 810

Marylebone Warwick Balfour Group Plc 4,830 1,924

Creston plc 238 218

Current assets

General equity portfolio 5,497 5,480

Cash, bank balances and deposits 53 95

Total assets 14,606 10,534

Bank loan (1,500 (1,150)

Other, net liabilities (261) (195)

Minority interests (53) (52)

Net assets attributable to shareholders

(Note 3) 12,792 9,137

Net assets per share (including net

assets at market value) 50.05p 35.80p

Consolidated Cash Flow Statement

For the year ended 30th June 2000 1999

#000 #000

Cash outflow on operating activities (18) (616)

Returns on investments and servicing of

finance

Dividends received 369 326

Interest paid (104) (71)

Net cash inflow from returns on investments

and servicing of finance 265 255

Taxation (10) (25)

Investing activities

Tangible fixed assets - purchased (31) (17)

- proceeds on disposal - 6

Fixed asset investments - purchased (511) (176)

- proceeds on disposal 167 716

Net cash (outflow)/inflow from investment

activities (375) 529

Equity dividend paid - Company (255) (128)

Financing

Share capital issued 1 -

Net drawdown of loan facility 350 50

Net cash inflow from financing 351 50

(Decrease)/Increase in cash (42) 65

Notes

1 The dividend for the year of 1.10p per share (1999 - 1.00p) will be paid on

27th October 2000 to shareholders on the register on 29th September 2000.

2 Earnings per share are based on the result of ordinary activities after

taxation and minority interests and on 25,523,710 (1999 - 25,520,274) being

the weighted average of the number of shares in issue during the year.

3 The net assets attributable to shareholders, taking investments at market

value, are before providing for any tax that may arise on realisation

4 The financial information in this preliminary announcement of unaudited

group results, which has been reviewed and agreed by the auditors, does not

constitute statutory accounts within the meaning of section 240(5) of the

Companies Act 1985. The audited accounts of the group for the year ended

30th June 1999 have been reported on with an unqualified audit report in

accordance with section 235 of the Companies Act 1985 and have been

delivered to the Registrar of Companies.

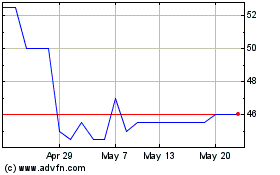

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jul 2024 to Aug 2024

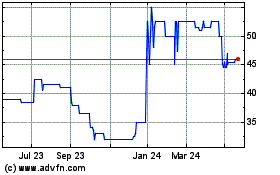

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Aug 2023 to Aug 2024