TIDMKLR

RNS Number : 1295Y

Keller Group PLC

27 February 2012

For immediate release Monday, 27 February 2012

Keller Group plc

Full Year Results for the year ended 31 December 2011

Keller Group plc ("Keller" or "the Group"), the international

ground engineering specialist, is pleased to announce its full year

results for the year ended 31 December 2011.

Results summary:

-------------------------------- ------------ ------------

2011 2010

-------------------------------- ------------ ------------

Revenue GBP1,154.3m GBP1,068.9m

-------------------------------- ------------ ------------

EBITDA GBP71.4m GBP85.0m

-------------------------------- ------------ ------------

Operating profit* GBP28.9m GBP43.3m

-------------------------------- ------------ ------------

Profit before tax* GBP21.9m GBP39.6m

-------------------------------- ------------ ------------

Earnings per share* 24.8p 44.0p

-------------------------------- ------------ ------------

Cash generated from operations GBP54.8m GBP70.3m

-------------------------------- ------------ ------------

Total dividend per share 22.8p 22.8p

-------------------------------- ------------ ------------

* 2010 figures stated before a GBP21.8m goodwill impairment

charge

Highlights include:

-- 2011 results in line with previous guidance, in a challenging year

-- Year-end net debt better than expected at GBP102.5m (1.4x EBITDA)

-- Recent major project awards, including:

-- GBP120m Wheatstone contract awarded in Australia, starting late 2012

-- GBP30m Vale contract awarded in Malaysia, starting March 2012

-- All-time high order book up 40% on last year

-- up 10% excluding 2013/14 work

-- Business improvement initiatives in progress

Justin Atkinson, Keller Chief Executive said:

"These results reflect tough market conditions which remained

very challenging throughout 2011, with the uncertain macro-economic

outlook impeding any significant recovery in our mature

construction markets - principally the US and Western Europe - and

overcapacity maintaining pressure on margins.

"Overall, whilst the business is expected to show steady

improvement in 2012, the year will not be without further

challenges, particularly given the economic uncertainty and a slow

start to the year in Europe.

"However, with signs of strengthening demand in certain of our

key markets, an increased number of larger projects in the order

book and with the benefits of our Group-wide business improvement

initiatives starting to come through, we are confident that 2012

will be a year of progress."

For further information, please contact:

Keller Group plc www.keller.co.uk

Justin Atkinson, Chief Executive 020 7616 7575

James Hind, Finance Director

Finsbury

James Leviton, Rowley Hudson 020 7251 3801

A presentation for analysts will be held at 9.30am at The London

Stock Exchange,

10 Paternoster Square, London, EC4M 7LS

A live audio webcast will be available from 9.30 am and, on

demand, from 2.00 pm at

http://www.keller.co.uk/keller/investor/result-centre/latest-results/

Print resolution images are available for the media to download

from www.vismedia.co.uk

Notes to Editors:

Keller is the world's largest independent ground engineering

specialist, providing technically advanced and cost-effective

foundation solutions to the construction industry. With 2011

revenue of nearly GBP1.2 billion, Keller has around 6,000 staff

world-wide.

Keller is the market leader in the North America and Australia;

it has prime positions in most established European markets; and a

strong and growing profile in many developing markets.

Chairman's Statement

Results[1]

Group revenue increased by 8% to GBP1,154.3m (2010: GBP1,068.9m)

and the operating profit was GBP28.9m (2010: GBP43.3m), resulting

in an operating margin of 2.5%, compared with the previous year's

4.1%. Profit before tax was GBP21.9m (2010: GBP39.6m) and earnings

per share were 24.8p (2010: 44.0p).

These results reflect tough market conditions which remained

very challenging throughout 2011, with the uncertain macro-economic

outlook impeding any significant recovery in our mature

construction markets - principally the US and Western Europe - and

overcapacity maintaining pressure on margins.

Against this backdrop, the Group has continued to take steps to

reduce its fixed cost base. Actions taken in 2011 will deliver a

further GBP5m of savings in 2012, bringing the total fixed overhead

reduction in North America and Western Europe since 2009 to over

GBP20m, a reduction of around 20%. Going forward, we will continue

to keep costs under close scrutiny.

Cash flow and net debt[2]

The Group continues to focus hard on maximising cash flow in

these difficult times. Cash generated from operations was GBP54.8m

(2010: GBP70.3m), which represented 77% of EBITDA (2010: 83%).

Whilst emphasising cash generation, we continue to make

investments where they are necessary to develop the business and to

secure future growth, which in 2011 included strategic capital

expenditure for Asia and Australia. After net capital expenditure

of GBP37.4m (2010: GBP28.6m), net debt at the end of the year stood

at GBP102.5m (2010: GBP94.0m), which represents 1.4x EBITDA.

The financial position of the Group remains strong. There is

comfortable headroom in the Group's main financing facilities,

which run to 2015, and we continue to operate well within all of

our financial covenants.

Dividends

The Board has recommended a final dividend of 15.2p per share

(2010: 15.2p per share), to be paid on 31 May 2012 to shareholders

on the register at 4 May 2012. Together with the interim dividend

paid of 7.6p, this brings the total dividend for the year to 22.8p

(2010: 22.8p). This unchanged dividend reflects the Board's

confidence in the Group's prospects. Dividend cover for the full

year is 1.1x (2010: 1.9x).

Strategy

During the year we undertook a review of the Group's business

and strategy, facilitated by an independent third party and

involving many of the Group's senior managers. This process, which

was undertaken over a period of six months culminating in the

fourth quarter, reaffirmed our overall strategy: to extend further

our global leadership in specialist ground engineering through both

organic growth and targeted acquisitions.

The review also highlighted certain areas where a concerted

programme of initiatives, together with some internal changes,

could deliver significant improvements to the Group's business and

profitability. This programme focuses principally on: increasing

our revenue and profit from large projects; further improvement of

the Group's risk management; and accelerating our global transfer

of technologies. The review also reinforced local or regional

initiatives which were already in progress and on which we are

redoubling our efforts.

To help maximise the benefits of Keller's global reach and

technical capability, Dr Wolfgang Sondermann (formerly Managing

Director, CEMEA) has been appointed to the new role of Director,

Group Technology & Best Practice. A large part of this new role

will be to drive the Group-wide initiatives to improve further our

risk management and transfer of technology.

Employees

2011 was another challenging year for many of our employees; and

yet, from my visits to our operations around the Group I have seen

first-hand their continued resolve and pride in the business,

together with a willingness to explore new ways of working together

more effectively. I would like to thank them for their contribution

and wish all of them personal success in 2012.

Board

In May 2011, Mr Richard Scholes stepped down as a Non-executive

Director, having served for more than nine years on the Board. Mr

Chris Girling joined the Board in February and took over as Audit

Committee Chairman in May. His considerable experience of the

construction sector and strategic strengths make him an excellent

addition to the Keller Board. In August, Mr David Savage was

appointed to the Board, bringing strong entrepreneurial skills and

a track record in building contracting businesses in Asia and the

Middle East.

Outlook

After a period of stabilisation in 2011, certain recent data

indicate that US construction markets may be turning the corner.

However, the European debt crisis continues to weigh heavily and is

expected to impede recovery in construction markets across Europe.

Looking to Australia and our other developing markets, recent major

contract awards indicate that our businesses in these regions will

have a busy year.

For the Group as a whole, contract awards in recent months have

been strong and, as a result, at the end of January 2012 our order

book was at an all-time high level and 40% ahead of the previous

year. This includes the GBP120m Wheatstone contract announced in

January, most of which will be undertaken in 2013. Excluding work

to be undertaken in 2013/14, the Group order book at the end of

January was 10% ahead of the previous year.

Overall, whilst the business is expected to show steady

improvement in 2012, the year will not be without further

challenges, particularly given the economic uncertainty and a slow

start to the year in Europe. However, with signs of strengthening

demand in certain of our key markets, an increased number of larger

contracts in the order book and with the benefits of our group-wide

business improvement initiatives starting to come through, we are

confident that 2012 will be a year of progress.

Operating Review

Conditions in our major markets

In 2011, many of our major global construction markets saw

further decline and the debt crisis in Europe had a damaging effect

on financial markets around the world. Generally, across our mature

markets, investment in public infrastructure continued to reduce,

as government austerity programmes gained traction. Continued

weakness in privately-financed construction meant that the private

sector was unable to take up the slack.

Although conditions in the US construction market overall

remained difficult, there were signs that the market had

stabilised. Overall, US construction expenditure reduced in the

year by a further 2%. This compares with a fall of 10% in the

corresponding period last year, indicating that, although

expenditure continues to fall, the rate of reduction has slowed

significantly. Private non-residential construction expenditure was

up by 2% year-on-year[3] following two years of significant

reduction, whereas residential construction was reasonably steady,

picking up towards the end of the year. For the second consecutive

year, however, US public infrastructure spending declined, with a

6% year-on-year reduction.

Within our principal European markets, Poland and Germany saw

growth across most sectors. However, France continued to stagnate;

the UK - particularly the housing and commercial sectors of the

market - declined; and Spain contracted still further.

Elsewhere, in Australia the "two-speed" construction market

continued to mirror the underlying economy, offering strong

prospects for projects related to the resources sector, but weaker

demand across the other sectors in the underlying market. Our Asian

markets remained strong, but we saw little change in our Middle

Eastern markets.

Changes to the Group's reporting structure

From January 2012, we have changed the reporting structure of

the Group, with the UK business joining Europe, Middle East and

Africa to form a new EMEA division and the Asian business forming a

separate division. The resultant four reporting divisions of North

America, EMEA, Asia and Australia are better aligned geographically

and represent more closely the expected future revenue and profit

contributions to the Group. The four divisional heads now sit on a

new Group Executive Committee.

This Operating Review has been structured to reflect our new

reporting structure; however, segmental analyses on both the new

and old bases are shown in note 3 to the financial statements.

Operations

North America

Results summary: *

-------------------- ---------- ----------

2011 2010

-------------------- ---------- ----------

Revenue GBP471.1m GBP425.2m

-------------------- ---------- ----------

Operating profit GBP12.0m GBP6.9m

-------------------- ---------- ----------

Operating margin 2.5% 1.6%

-------------------- ---------- ----------

*2010 results are stated before goodwill impairment

Despite the further contraction in US construction markets, our

total revenue from North America was up by 14% in local currency.

However, the trading environment remains extremely competitive,

keeping margins under pressure. At 2.5%, the operating margin was

up on the previous year's 1.6%, but well below the long-term

average for our North American operations.

The full-year operating profit of GBP12.0m (2010: GBP6.9m)

reflects an improving trend as the year progressed, with the

second-half result up significantly on the same period in 2010. A

large part of this improvement was at Suncoast, which continued to

reduce its losses in the second half of the year.

Hayward Baker

Hayward Baker fared best amongst our North American companies,

reflecting the fact that, as a national player with the potential

to work across 50 states, it is less susceptible to regional

differences in market conditions.

Management is continuing to adapt Hayward Baker's operations to

the challenging trading environment, following a change of company

President in early 2011. Hayward Baker's under-performing western

region was subsequently put under the management of Anderson,

before the two were formally merged at the start of 2012. In the

particularly tough market conditions that persist in the Western

States, this should make the two businesses more competitive

through a lower cost base and better utilisation of people and

equipment. The integration is progressing well and will start to

deliver tangible benefits as the year progresses.

One of Hayward Baker's longest-running contracts last year was

in Southern California, where it undertook extensive soil mixing

and jet grouting works for settlement control, liquefaction

mitigation and slope stabilisation, in preparation for the

construction of five new fuel storage tanks.[4] The involvement of

Anderson, who provided pre-drilling services in advance of the

soil-mixing, contributed to a successful outcome and illustrates

the synergies between these two businesses.

North American Piling Companies

The North American piling companies had mixed fortunes, with

certain regions served by Anderson and Case suffering from their

exposure to the particularly difficult California and Florida

markets. HJ Foundation, which has made significant strides over

recent years in winning work outside of its South Florida home

market, continued to demonstrate its excellent job execution,

working both on its own and in several joint projects with Case and

Hayward Baker.

Two of the main contributors to our second-half result were the

large jobs for the extension to the Vogtle nuclear power plant at

Augusta, in Georgia(4) , where Case provided bored piling ;and the

second phase of CFA piling works at the BP oil refinery at Whiting,

Indiana(4) , executed jointly by Case and HJ Foundation.

We are encouraged by the progress made in McKinney in the second

half of the year. Following actions taken to improve its results

and prospects, including a management change in the southern

region, the results have stabilised. With a good order intake in

recent months, McKinney entered 2012 with a healthy order book,

including several jobs for transmission lines - a growing sector

which we have been targeting.

Since the year end, Case has implemented a new enterprise

resource planning (ERP) system which will be progressively

rolled-out across our other North American foundation companies

throughout 2012. The new ERP system requires the standardisation of

certain procedures and will facilitate further co-operation

between, and optimisation of, our North American foundation

companies.

Suncoast

The US residential market, having stabilised in the first half,

ended 2011 on a fairly upbeat note, with housing starts at a level

not seen since 2010 and a significant strengthening of the

homebuilder housing market index.

As we expected, further cost-reduction measures taken in 2010

helped to produce a much improved 2011 result at Suncoast, which

broke even, after a substantial loss in 2010. Since its peak in

2006, Suncoast has reduced its overheads by more than 50%, in line

with the fall in its revenue. The 2011 improvement in performance

was also helped by price increases introduced in late summer, which

held up well despite competitive pressure.

Europe, Middle East & Africa (EMEA)

Results summary: *

-------------------- ---------- ----------

2011 2010

-------------------- ---------- ----------

Revenue GBP384.8m GBP357.8m

-------------------- ---------- ----------

Operating profit GBP8.4m GBP8.1m

-------------------- ---------- ----------

Operating margin 2.2% 2.3%

-------------------- ---------- ----------

*2010 results are stated before goodwill impairment

In local currency, revenue was up by 8% whilst operating profit

was 4% above the previous year.

Europe

In general, our businesses within the more mature European

markets faced very challenging conditions. The exception was

Germany, where the construction market remained reasonably good

across most sectors. Against this backdrop, our German company

performed well, with a continued focus on productivity improvements

and good contract selection. During the year, it extended its

product offering with the addition of complete excavation pits.

Having developed and acquired specific skills and expertise in this

area, the business secured an excellent reference contract for an

excavation at the German State Opera House in Berlin(4) .

France and Spain both implemented further downsizing, with

management doing an excellent job of maintaining the alignment

between overheads and revenues. Both subsidiaries also looked for

selective opportunities outside of their domestic markets.

Elsewhere, in Italy, one of our smaller European markets, we used

our extensive experience of large-scale tunnel stabilisation

projects on the Rome Metro extension(4) .

The UK business also further reduced its costs, with the closure

of one office and the downsizing of another. Despite these actions,

the business reported a loss, which was exacerbated by the impact

of two legacy contracts. During the year the UK business was

awarded contracts valued at GBP37m for the Victoria Station Upgrade

project and GBP31m for the Crossrail project, which started as

anticipated towards the end of 2011. Another Crossrail contract was

for the largest-ever restricted access piling project awarded in

the UK, at Lord Hill's Bridge(4) . With the first phase of the

contract - installing vertical piles - now complete, the more

challenging second phase, which involves installing minipiles at up

to 38-degree angles, is progressing well.

In Eastern Europe, our Polish subsidiary had a strong year,

benefiting from an extremely buoyant civil engineering sector.

However, the business started to slow somewhat towards the end of

the year, as a number of its large projects drew to a close.

Middle East

The impact of the geopolitical issues in the Middle East and

North Africa, which curbed our first-half profitability in these

regions, continued to be felt through the second half. Whilst our

business in Saudi Arabia fared well, the results for the region

overall were disappointing. Since the year end, a new Managing

Director has been appointed to manage our businesses in the region,

as part of a planned management succession.

Brazil

Further progress was made in Brazil, where we have now almost

completed a major contract at Porto do Sudeste, installing vibro

stone columns for the foundations of a new iron ore storage

facility(4) . We also undertook a related contract for ground

improvement works for a new railway link, to connect the facility

to the main rail network.

Having created a new market in vibro stone columns, we are now

extending the range of technologies we can offer in Brazil. Last

year we undertook our first off-shore sand compaction job in the

region and in 2012 our range is being further expanded with the

addition of driven piles.

Asia

Results summary:

------------------ --------- ---------

2011 2010

------------------ --------- ---------

Revenue GBP76.7m GBP92.1m

------------------ --------- ---------

Operating profit GBP6.0m GBP11.8m

------------------ --------- ---------

Operating margin 7.8% 12.8%

------------------ --------- ---------

Overall, our key markets in Asia remained strong throughout the

year and our companies there continued to perform well although,

following an exceptional year in 2010, the results were held back

by contract delays in India and a very competitive piling market in

Singapore.

Asean Region

In Singapore, our ground improvement business demonstrated good

project management and innovative solutions which fed through into

strong results. A contract to create foundations for the Cogen

Power Plant(4) , using sand compaction rather than a traditional

piled solution, illustrates well these success factors.

Our Resource Piling business in Singapore struggled, with tight

pricing in this highly competitive market impacting on margins.

However, market activity picked up in the latter part of the year

and accordingly, Resource Piling now has a much stronger order

book.

The Group's emerging business in Vietnam was profitable and

demonstrated high levels of safety, quality and project

management.

In Malaysia, we had another busy year. Since the year end,

Keller Malaysia has secured a circa GBP30m project to build the

foundations for a major iron ore distribution facility in Lumut for

Vale, for whom we have recently performed work in Brazil. Our scope

involves treating an area of 200,000 m(2) with a system of vibro

stone columns and bored piles, based on our re-design. Work is

expected to commence in March and to be completed in the second

quarter of next year.

India

In India, we experienced significant project delays on two large

projects, which are indicative of the difficulties associated with

working in this market. These delays, combined with severe floods

in the third quarter, resulted in lower than expected sales

volume.

Nonetheless, we are encouraged by the significant improvement in

the piling and ground anchor capabilities of our Indian business,

as it consistently achieves good results in this increasing

component of their work.

Although market forecasts for India have been tempered somewhat

to reflect reduced direct foreign investment and high inflation,

our tender rates and the current order book remain good.

Australia

Results summary:

------------------ ---------- ----------

2011 2010

------------------ ---------- ----------

Revenue GBP221.7m GBP193.8m

------------------ ---------- ----------

Operating profit GBP6.7m GBP19.1m

------------------ ---------- ----------

Operating margin 3.0% 9.9%

------------------ ---------- ----------

In Australia, the 'two-speed' construction market is ever more

apparent, mirroring the underlying economy. Prospects for projects

related to the resources sector continue to be very strong, whereas

commercial construction and expenditure on infrastructure remain

much weaker.

The end of the infrastructure boom in Queensland meant that 2011

was a challenging year for Piling Contractors, our Brisbane-based

business which is largely reliant on the infrastructure market.

This was compounded by some difficult jobs as well as by costs

incurred in connection with possible work in New Zealand. As a

result, Piling Contractors made a loss in the year. Actions were

taken both to refocus the business and management and to reduce its

cost base by A$4m (GBP2.6m), with an associated one-off cost of

about A$2m (GBP1.3m). Encouragingly, Piling Contractors' results

have since improved, as the benefits of the actions taken are now

showing through in their results.

Our other Australian businesses all performed well, with notable

contract successes including minefill works for the new Hunter

Expressway(4) undertaken jointly by KGE and Piling Contractors and

the second stage of ground improvement works for Newcastle Coal

Infrastructure Group's latest Newcastle coal terminal(4) ,

undertaken by KGE. In addition, Vibro-Pile performed well on a

number of smaller contracts in the Melbourne area.

Following its successful completion of remedial works at

Milson's Point wharf, Waterway Constructions was recently awarded a

further Sydney wharf upgrade programme. This is in addition to an

A$86m (GBP57m) design and construct contract for a materials

offloading facility at a liquid natural gas project, being

undertaken as a 50:50 joint venture with a local civil construction

company, which got underway at the start of 2012. Together, these

major contracts mean that Waterway Constructions is well placed for

2012.

Since the year end, Keller Australia has secured a project worth

in excess of A$180m (GBP120m) to install the foundations for the

Wheatstone LNG Plant to be located at Onslow, Western Australia.

The scope of work includes the procurement, installation and

testing of approximately 20,000 piles for the onshore main plant

facilities. Undertaking a project of this scale will require the

collective resources of the Group's Australian businesses, which

have a strong track record of successful collaboration on large and

complex projects. Preparatory work is now underway, with full

production beginning in late 2012 and running through to

mid-2014.

Financial review

Income Statement

Trading results

The Group's total revenue in 2011 was GBP1,154.3m, an increase

of 8% on 2010. Stripping out the effects of acquisitions and

foreign exchange movements, 2011 revenue was 7% up on 2010, almost

wholly due to a 13% increase in like-for-like revenue in North

America.

EBITDA was GBP71.4m, compared to GBP85.0m in 2010 and operating

profit was GBP28.9m, down from GBP43.3m in 2010. The Group

operating margin fell from 4.1% to 2.5%, largely as a result of the

depressed state of the Group's more established markets.

In North America, which represented 41% of Group revenue, the US

dollar-denominated operating profit was up over 80% year-on-year,

albeit from a low base. This was largely due to a substantial

improvement in the result at Suncoast, which broke even in 2011

after recording a significant loss in 2010, although there was also

an increase in the profit earned by the Group's North American

foundation contracting businesses. EMEA's result was similar to the

previous year, while the Asian and Australian results were behind

2010. The Asian result was impacted by a keenly competitive piling

market in Singapore and significant project delays in India. In

Australia, an expected reduction in profitability as a result of

there being fewer large projects in the year was exacerbated by a

very disappointing result at Piling Contractors, which recorded a

loss for the year. Actions taken in the second half of 2011 have

now restored Piling Contractors to profitability.

The Group's trading results are discussed more fully in the

Chairman's Statement and the Operating Review.

Net finance costs

Net finance costs increased to GBP7.0m in 2011 from GBP3.7m in

2010. This increase mainly reflects the increased cost of borrowing

under the Group's GBP170m revolving credit facility agreed in

December 2010 and higher non-cash items required to be included in

net finance costs under IFRS.

Tax

The Group's underlying effective tax rate was 25%, down from 28%

in 2010, as a higher proportion of the Group's profit was derived

from lower tax countries.

Earnings and dividends

Earnings per share (EPS) before goodwill impairment decreased to

24.8p (2010: 44.0p). The Board has recommended a final dividend of

15.2p per share, which brings the total dividend to be paid out of

2011 profits to 22.8p, the same as last year. The 2011 dividend is

covered 1.1 times by earnings.

Cash flow

The Group has always placed a high priority on cash generation.

The current economic environment is inevitably putting pressure on

working capital in certain locations and we continue to focus on

maximising cash generation and minimising the Group's investment in

working capital.

Net cash inflow from operations was GBP54.8m, representing 77%

of EBITDA. Year-end working capital was GBP119.8m, GBP13.1m or 12%

more than at the end of 2010. Stripping out the impact of currency

movements, year-end working capital increased by 8%, consistent

with the 8% increase in revenue. Capital expenditure, net of

disposals, was GBP37.4m, which compares to depreciation of

GBP41.0m.

Financing

As at 31 December 2011, net debt amounted to GBP102.5m (2010:

GBP94.0m). Based on net assets of GBP326.8m, year-end gearing was

31%, up slightly from 28% at the beginning of the year.

The Group's term debt and committed facilities mainly comprise a

US$70.0m private placement, repayable in October 2014, and a

GBP170.0m syndicated revolving credit facility expiring in April

2015. At the year end, the Group also had other committed and

uncommitted borrowing facilities totalling GBP92.6m. The Group

therefore has sufficient available financing to support its

long-term strategy of growth, both through organic means and

targeted, bolt-on acquisitions.

The most significant covenants in respect of our main borrowing

facilities relate to the ratio of net debt to EBITDA, EBITDA

interest cover and the Group's net worth. The Group is operating

well within its covenant limits, as is illustrated in the table

below:

Test Covenant limit Current position*

Net debt: EBITDA < 3x 1.8x

EBITDA interest cover > 4x 15x

Net worth > GBP200m GBP326.8m

----------------------- ---------------- ------------------

*Calculated in accordance with the covenant, with letters of

credit included as net debt and certain adjustments to net

interest

Capital structure

The Group's capital structure is kept under constant review,

taking account of the need for, availability and cost of various

sources of finance.

Pensions

The Group has defined benefit pension arrangements in the UK,

Germany and Austria. The Group closed its UK defined benefit scheme

for future benefit accrual with effect from 31 March 2006 and

existing active members transferred to a new defined contribution

arrangement. The last actuarial valuation of the UK scheme was as

at 5 April 2008, when the market value of the scheme's assets was

GBP26.9m and the scheme was 77% funded on an ongoing basis. The

level of contributions, currently set at GBP1.5m a year, will be

reviewed at the finalisation of the next actuarial valuation, which

is as at April 2011. This valuation is largely complete and, based

on work to date, there are not expected to be any material changes

to either the absolute deficit or the level of contributions going

forward.

The 2011 year-end IAS 19 valuation of the UK scheme showed

assets of GBP32.2m, liabilities of GBP38.0m and a pre-tax deficit

of GBP5.8m.

In Germany and Austria, the defined benefit arrangements only

apply to certain employees who joined the Group prior to 1998.

There are no segregated funds to cover these defined benefit

obligations and the respective liabilities are included on the

Group balance sheet. These totalled GBP11.9m at 31 December 2011.

All other pension arrangements in the Group are of a defined

contribution nature.

Management of financial risks

Currency risk

The Group faces currency risk principally on its net assets,

most of which are in currencies other than sterling. The Group aims

to reduce the impact that retranslation of these assets might have

on the balance sheet by matching the currency of its borrowings,

where possible, with the currency of its assets. The majority of

the Group's borrowings are held in US dollars, euros and Australian

dollars, in order to provide a hedge against these currency net

assets.

The Group manages its currency flows to minimise currency

transaction exchange risk. Forward contracts and other derivative

financial instruments are used to hedge significant individual

transactions. The majority of such currency flows within the Group

relate to repatriation of profits and intra-Group loan repayments.

The Group's foreign exchange cover is executed primarily in the

UK.

The Group does not trade in financial instruments, nor does it

engage in speculative derivative transactions.

Interest rate risk

Interest rate risk is managed by mixing fixed and floating rate

borrowings depending upon the purpose and term of the financing. As

at 31 December 2011, virtually all the Group's third-party

borrowings bore interest at floating rates.

Credit risk

The Group's principal financial assets are trade and other

receivables, bank and cash balances and a limited number of

investments and derivatives held to hedge certain of the Group's

liabilities. These represent the Group's maximum exposure to credit

risk in relation to financial assets.

The Group has stringent procedures to manage counterparty risk

and the assessment of customer credit risk is embedded in the

contract tendering processes. Customer credit risk is mitigated by

the Group's relatively small average contract size, its diversity,

both geographically and in terms of end markets, and by taking out

credit insurance in many of the countries in which the Group

operates. No individual customer represented more than 5% of

revenue in 2011.

The counterparty risk on bank and cash balances is managed by

limiting the aggregate amount of exposure to any one institution by

reference to their credit rating and by regular reviews of these

ratings.

Consolidated income statement

For the year ended 31 December 2011

2011 2010 2010 2010

Before

goodwill Goodwill

Note impairment impairment Total

GBPm GBPm GBPm GBPm

------------------------------------ ------ ---------- ------------ ------------ ----------

Revenue 3 1,154.3 1,068.9 - 1,068.9

Operating costs (1,125.4) (1,025.6) (21.8) (1,047.4)

------------------------------------ ------ ---------- ------------ ------------ ----------

Operating profit 3 28.9 43.3 (21.8) 21.5

Finance income 2.1 3.3 - 3.3

Finance costs (9.1) (7.0) - (7.0)

------------------------------------ ------ ---------- ------------ ------------ ----------

Profit before taxation 21.9 39.6 (21.8) 17.8

Taxation (5.5) (11.0) 4.7 (6.3)

------------------------------------ ----------

Profit for the period 16.4 28.6 (17.1) 11.5

------------------------------------ ------ ---------- ------------ ------------ ----------

Attributable to:

Equity holders of the parent 15.9 28.3 (17.1) 11.2

Minority interests 0.5 0.3 - 0.3

------------------------------------ ------ ---------- ------------ ------------ ----------

16.4 28.6 (17.1) 11.5

------------------------------------ ------ ---------- ------------ ------------ ----------

Earnings per share before goodwill

impairment

Basic earnings per share 5 24.8p 44.0p

Diluted earnings per share 5 24.4p 43.2p

Earnings per share

Basic earnings per share 5 24.8p 17.3p

Diluted earnings per share 5 24.4p 17.0p

Consolidated statement of comprehensive income

For the year ended 31 December 2011

2011 2010 2010 2010

Before

goodwill Goodwill

Note impairment impairment Total

GBPm GBPm GBPm GBPm

--------------------------------------------- ------- ------ ------------ ------------ -------

Profit for the period 16.4 28.6 (17.1) 11.5

------------------------------------------------------ ------ ------------ ------------ -------

Other comprehensive income

Exchange differences on translation

of foreign operations (6.3) 12.0 - 12.0

Net investment hedge gains/(losses) 0.3 (0.3) - (0.3)

Cash flow hedge losses taken to equity - (3.0) - (3.0)

Cash flow hedge transfers to income

statement - 3.0 - 3.0

Actuarial gains/(losses) on defined

benefit pension schemes 1.1 (1.3) - (1.3)

Tax on actuarial (gains)/losses on

defined benefit pension schemes (0.3) 0.3 - 0.3

------------------------------------------------------ ------ ------------ ------------ -------

Other comprehensive income for the

period, net of tax (5.2) 10.7 - 10.7

------------------------------------------------------ ------ ------------ ------------ -------

Total comprehensive income for the

period 11.2 39.3 (17.1) 22.2

------------------------------------------------------ ------ ------------ ------------ -------

Attributable to:

Equity holders of the parent 10.9 39.3 (17.1) 22.2

Minority interests 0.3 - - -

--------------------------------------------- ------- ------ ------------ ------------ -------

11.2 39.3 (17.1) 22.2

----------------------------------------------------- ------ ------------ ------------ -------

Consolidated balance sheet

As at 31 December 2011

2011 2010

Note GBPm GBPm

------------------------------------------ ----- -------- --------

Assets

Non-current assets

Intangible assets 100.6 106.8

Property, plant and equipment 266.1 275.0

Deferred tax assets 6.7 10.0

Other assets 15.8 16.1

------------------------------------------ ----- -------- --------

389.2 407.9

------------------------------------------ ----- -------- --------

Current assets

Inventories 37.3 32.9

Trade and other receivables 334.7 334.6

Current tax assets 10.5 6.2

Cash and cash equivalents 50.0 41.4

------------------------------------------ ----- -------- --------

432.5 415.1

------------------------------------------ ----- -------- --------

Total assets 3 821.7 823.0

------------------------------------------ ----- -------- --------

Liabilities

Current liabilities

Loans and borrowings (8.4) (25.9)

Current tax liabilities (6.8) (7.1)

Trade and other payables (252.2) (260.8)

Provisions (9.7) (9.1)

------------------------------------------ ----- -------- --------

(277.1) (302.9)

------------------------------------------ ----- -------- --------

Non-current liabilities

Loans and borrowings (144.1) (109.5)

Retirement benefit liabilities (17.7) (20.1)

Deferred tax liabilities (22.5) (18.4)

Provisions (4.0) (4.5)

Other liabilities (29.5) (36.8)

------------------------------------------ ----- -------- --------

(217.8) (189.3)

------------------------------------------ ----- -------- --------

Total liabilities 3 (494.9) (492.2)

------------------------------------------ ----- -------- --------

Net Assets 326.8 330.8

------------------------------------------ ----- -------- --------

Equity

Share capital 6.6 6.6

Share premium account 38.1 38.0

Capital redemption reserve 7.6 7.6

Translation reserve 42.6 48.4

Retained earnings 222.7 220.1

------------------------------------------ ----- -------- --------

Equity attributable to equity holders of

the parent 317.6 320.7

Minority interests 9.2 10.1

------------------------------------------ ----- -------- --------

Total equity 326.8 330.8

------------------------------------------ ----- -------- --------

Consolidated statement of changes in equity

For the year ended 31 December 2011

Share Share Capital Translation Hedging Retained Attributable Minority Total

capital premium redemption reserve reserve earnings to interests equity

account reserve equity

holders

of

parent

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------- -------- -------- ----------- ------------ -------- --------- ------------- ---------- -------

At 1 January

2010 6.6 38.0 7.6 36.4 - 224.1 312.7 10.6 323.3

Profit for the

period - - - - - 11.2 11.2 0.3 11.5

--------------- -------- -------- ----------- ------------ -------- --------- ------------- ---------- -------

Other

comprehensive

income

Exchange

differences

on

translation

of foreign

operations - - - 12.3 - - 12.3 (0.3) 12.0

Net investment

hedge

losses - - - (0.3) - - (0.3) - (0.3)

Cash flow

hedge losses

taken to

equity - - - - (3.0) - (3.0) - (3.0)

Cash flow

hedge

transfers

to income

statement - - - - 3.0 - 3.0 - 3.0

Actuarial

losses on

defined

benefit

pension

schemes - - - - - (1.3) (1.3) - (1.3)

Tax on

actuarial

losses

on defined

benefit

pension

schemes - - - - - 0.3 0.3 - 0.3

--------------- -------- -------- ----------- ------------ -------- --------- ------------- ---------- -------

Other

comprehensive

income for

the period,

net of tax - - - 12.0 - (1.0) 11.0 (0.3) 10.7

--------------- -------- -------- ----------- ------------ -------- --------- ------------- ---------- -------

Total

comprehensive

income for

the period - - - 12.0 - 10.2 22.2 - 22.2

Dividends - - - - - (14.2) (14.2) (0.7) (14.9)

Share capital

issued - - - - - - - 0.2 0.2

At 31 December

2010

and 1 January

2011 6.6 38.0 7.6 48.4 - 220.1 320.7 10.1 330.8

--------------- -------- -------- ----------- ------------ -------- --------- ------------- ---------- -------

Profit for the

period - - - - - 15.9 15.9 0.5 16.4

--------------- -------- -------- ----------- ------------ -------- --------- ------------- ---------- -------

Other

comprehensive

income

Exchange

differences

on

translation

of foreign

operations - - - (6.1) - - (6.1) (0.2) (6.3)

Net investment

hedge

gains - - - 0.3 - - 0.3 - 0.3

Actuarial

gains on

defined

benefit

pension

schemes - - - - - 1.1 1.1 - 1.1

Tax on

actuarial

gains

on defined

benefit

pension

schemes - - - - - (0.3) (0.3) - (0.3)

--------------- -------- -------- ----------- ------------ -------- --------- ------------- ---------- -------

Other

comprehensive

income for

the period,

net of tax - - - (5.8) - 0.8 (5.0) (0.2) (5.2)

--------------- -------- -------- ----------- ------------ -------- --------- ------------- ---------- -------

Total

comprehensive

income for

the period - - - (5.8) - 16.7 10.9 0.3 11.2

Dividends - - - - - (14.7) (14.7) (1.1) (15.8)

Share-based

payments - - - - - 0.6 0.6 - 0.6

Share capital

issued - 0.1 - - - - 0.1 - 0.1

Acquisition of

minority

interest - - - - - - - (0.1) (0.1)

At 31 December

2011 6.6 38.1 7.6 42.6 - 222.7 317.6 9.2 326.8

--------------- -------- -------- ----------- ------------ -------- --------- ------------- ---------- -------

Consolidated cash flow statement

For the year ended 31 December 2011

2011 2010

GBPm GBPm

----------------------------------------------------- ------- -------

Cash flows from operating activities

Operating profit 28.9 21.5

Goodwill impairment - 21.8

----------------------------------------------------- ------- -------

Operating profit before goodwill impairment 28.9 43.3

Depreciation of property, plant and equipment 41.0 40.0

Amortisation of intangible assets 1.5 1.7

Profit on sale of property, plant and equipment (0.3) (0.5)

Other non-cash movements 3.2 5.8

Foreign exchange losses - 0.2

----------------------------------------------------- ------- -------

Operating cash flows before movements in working

capital 74.3 90.5

(Increase)/decrease in inventories (5.0) 5.2

Increase in trade and other receivables (5.2) (23.8)

(Decrease)/increase in trade and other payables (5.1) 2.2

Change in provisions, retirement benefit and

other non-current liabilities (4.2) (3.8)

----------------------------------------------------- ------- -------

Cash generated from operations 54.8 70.3

Interest paid (5.7) (4.5)

Income tax paid (3.8) (10.2)

----------------------------------------------------- ------- -------

Net cash inflow from operating activities 45.3 55.6

----------------------------------------------------- ------- -------

Cash flows from investing activities

Interest received 0.6 0.5

Proceeds from sale of property, plant and equipment 1.9 1.0

Acquisition of subsidiaries, net of cash acquired (0.2) (23.4)

Acquisition of property, plant and equipment (37.7) (28.2)

Acquisition of intangible assets (1.6) (1.4)

Acquisition of other non-current assets (0.1) (0.3)

----------------------------------------------------- ------- -------

Net cash outflow from investing activities (37.1) (51.8)

----------------------------------------------------- ------- -------

Cash flows from financing activities

Proceeds from the issue of share capital 0.1 0.2

New borrowings 54.1 99.5

Repayment of borrowings (40.3) (76.8)

Payment of finance lease liabilities (0.7) (1.3)

Dividends paid (15.8) (14.9)

----------------------------------------------------- ------- -------

Net cash (outflow)/inflow from financing activities (2.6) 6.7

----------------------------------------------------- ------- -------

Net increase in cash and cash equivalents 5.6 10.5

Cash and cash equivalents at beginning of period 39.1 29.3

Effect of exchange rate fluctuations (1.4) (0.7)

----------------------------------------------------- ------- -------

Cash and cash equivalents at end of period 43.3 39.1

----------------------------------------------------- ------- -------

1. Basis of preparation

The Group's 2011 results have been prepared in accordance with

International Financial Reporting Standards ('IFRS') as adopted by

the EU.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 31 December 2011

or 2010 but is derived from the 2011 accounts. Statutory accounts

for 2010 have been delivered to the Registrar of Companies. Those

for 2011, prepared under IFRS as adopted by the EU, will be

delivered to the Registrar of Companies and made available on the

Company's website at www.keller.co.uk in April 2012. The auditors

have reported on those accounts; their reports were (i)

unqualified, (ii) did not include references to any matters to

which the auditors drew attention by way of emphasis without

qualifying their reports and (iii) did not contain statements under

section 498(2) or (3) of the Companies Act 2006.

2. Foreign currencies

The exchange rates used in respect of principal currencies

are:

Average for Period end

period

------------------- -------------- -------------

2011 2010 2011 2010

------------------- ------ ------ ------ -----

US dollar 1.60 1.55 1.55 1.55

Euro 1.15 1.17 1.19 1.17

Australian dollar 1.55 1.68 1.52 1.52

------------------- ------ ------ ------ -----

3. Segmental analysis

The Group is managed as four geographical divisions and has only

one major product or service: specialist ground engineering

services. This is reflected in the Group's management structure and

in the segment information reviewed by the Chief Operating Decision

Maker.

2010

2011 2011 Operating 2010

profit

before 2010 Operating

Operating 2010 goodwill Goodwill profit

Revenue profit Revenue impairment impairment Total

GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------------- --------- ----------- --------- ------------ ------------ -----------

UK 53.6 (3.7) 49.6 (2.5) - (2.5)

North America 471.1 12.0 425.2 6.9 (13.5) (6.6)

CEMEA(1) 407.9 18.1 400.3 22.4 (8.3) 14.1

Australia 221.7 6.7 193.8 19.1 - 19.1

-------------------------------- --------- ----------- --------- ------------ ------------ -----------

1,154.3 33.1 1,068.9 45.9 (21.8) 24.1

Central items and eliminations - (4.2) - (2.6) - (2.6)

-------------------------------- --------- ----------- --------- ------------ ------------ -----------

1,154.3 28.9 1,068.9 43.3 (21.8) 21.5

-------------------------------- --------- ----------- --------- ------------ ------------ -----------

2011

2011 2011 2011 2011 2011 Tangible

Segment Segment Capital Capital Depreciation and intangible

assets liabilities employed additions and amortisation assets

GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------- --------- ------------- ---------- ----------- ------------------ ----------------

UK 39.2 (16.2) 23.0 2.3 1.7 22.2

North America 306.0 (101.5) 204.5 8.9 12.5 133.7

CEMEA(1) 280.4 (111.1) 169.3 18.5 19.9 139.4

Australia 124.5 (41.0) 83.5 9.9 8.2 71.1

----------------------------- --------- ------------- ---------- ----------- ------------------ ----------------

750.1 (269.8) 480.3 39.6 42.3 366.4

Central items and

eliminations(2) 71.6 (225.1) (153.5) (0.3) 0.2 0.3

----------------------------- --------- ------------- ---------- ----------- ------------------ ----------------

821.7 (494.9) 326.8 39.3 42.5 366.7

----------------------------- --------- ------------- ---------- ----------- ------------------ ----------------

2010

2010 2010 2010 2010 2010 Tangible

Segment Segment Capital Capital Depreciation and intangible

assets liabilities employed additions and amortisation assets

GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------- --------- ------------- ---------- ----------- ------------------ ----------------

UK 37.0 (14.1) 22.9 0.3 1.9 21.8

North America 291.8 (98.2) 193.6 6.0 13.1 137.9

CEMEA(1) 309.1 (130.7) 178.4 15.9 20.1 151.6

Australia 122.3 (45.2) 77.1 24.5 6.6 70.0

----------------------------- --------- ------------- ---------- ----------- ------------------ ----------------

760.2 (288.2) 472.0 46.7 41.7 381.3

Central items and

eliminations(2) 62.8 (204.0) (141.2) 0.3 - 0.5

----------------------------- --------- ------------- ---------- ----------- ------------------ ----------------

823.0 (492.2) 330.8 47.0 41.7 381.8

----------------------------- --------- ------------- ---------- ----------- ------------------ ----------------

(1 Continental Europe, Middle East and Asia.)

(2 Central items includes net debt and tax balances.)

The impact of acquisitions is detailed in note 4.

The Group changed its divisional management structure with

effect from 1 January 2012. This has resulted in identifying a new

reportable segment, Asia. This was previously reported within the

CEMEA segment. In addition the UK segment has been merged with the

CEMEA segment, which has now been renamed as Europe, Middle East

and Africa ('EMEA'). Although this change is effective 1 January

2012, additional disclosures have been set out in these Financial

Statements below which reflect this structure, with the comparative

information being restated.

2011 2011 2010 2010 2010 2010

Restated Restated Restated Restated

Operating

profit

before Operating

Operating goodwill Goodwill profit

Revenue profit Revenue impairment impairment Total

GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------------- --------- ----------- ---------- ------------ ------------ -----------

North America 471.1 12.0 425.2 6.9 (13.5) (6.6)

EMEA (3) 384.8 8.4 357.8 8.1 (8.3) (0.2)

Asia 76.7 6.0 92.1 11.8 - 11.8

Australia 221.7 6.7 193.8 19.1 - 19.1

-------------------------------- --------- ----------- ---------- ------------ ------------ -----------

1,154.3 33.1 1,068.9 45.9 (21.8) 24.1

Central items and eliminations - (4.2) - (2.6) - (2.6)

-------------------------------- --------- ----------- ---------- ------------ ------------ -----------

1,154.3 28.9 1,068.9 43.3 (21.8) 21.5

-------------------------------- --------- ----------- ---------- ------------ ------------ -----------

2011

2011 2011 2011 2011 2011 Tangible

Segment Segment Capital Capital Depreciation and intangible

assets liabilities employed additions and amortisation assets

GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------- --------- ------------- ---------- ----------- ------------------ ----------------

North America 306.0 (101.5) 204.5 8.9 12.5 133.7

EMEA (3) 252.9 (113.3) 139.6 13.6 17.3 122.0

Asia 66.7 (14.0) 52.7 7.2 4.3 39.6

Australia 124.5 (41.0) 83.5 9.9 8.2 71.1

----------------------------- --------- ------------- ---------- ----------- ------------------ ----------------

750.1 (269.8) 480.3 39.6 42.3 366.4

Central items and

eliminations

(4) 71.6 (225.1) (153.5) (0.3) 0.2 0.3

----------------------------- --------- ------------- ---------- ----------- ------------------ ----------------

821.7 (494.9) 326.8 39.3 42.5 366.7

----------------------------- --------- ------------- ---------- ----------- ------------------ ----------------

2010 2010 2010 2010 2010

Restated Restated Restated Restated 2010 Restated

Restated Tangible

Segment Segment Capital Capital Depreciation and intangible

assets liabilities employed additions and amortisation assets

GBPm GBPm GBPm GBPm GBPm GBPm

---------------------------- ---------- ------------- ---------- ----------- ------------------ ----------------

North America 291.8 (98.2) 193.6 6.0 13.1 137.9

EMEA (3) 264.0 (118.4) 145.6 10.0 16.8 128.1

Asia 82.1 (26.4) 55.7 6.2 5.2 45.3

Australia 122.3 (45.2) 77.1 24.5 6.6 70.0

---------------------------- ---------- ------------- ---------- ----------- ------------------ ----------------

760.2 (288.2) 472.0 46.7 41.7 381.3

Central items and

eliminations

(4) 62.8 (204.0) (141.2) 0.3 - 0.5

---------------------------- ---------- ------------- ---------- ----------- ------------------ ----------------

823.0 (492.2) 330.8 47.0 41.7 381.8

---------------------------- ---------- ------------- ---------- ----------- ------------------ ----------------

(3 Europe, Middle East and Africa.)

(4 Central items includes net debt and tax balances.)

4. Acquisitions

There were no acquisitions in the year. Acquisitions in 2010

were as follows:

Waterway Nilex Total

Fair Fair Fair

Acquisitions in Carrying value Fair Carrying value Fair Carrying value Fair

2010 amount adjustment value amount adjustment value amount adjustment value

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------- -------- ----------- ------ -------- ----------- ------ -------- ----------- ------

Net assets acquired

Intangible assets - 0.5 0.5 - 0.2 0.2 - 0.7 0.7

Property, plant

and equipment 7.9 2.8 10.7 1.3 - 1.3 9.2 2.8 12.0

Cash and cash

equivalents 9.1 - 9.1 - - - 9.1 - 9.1

Receivables 2.3 - 2.3 3.6 - 3.6 5.9 - 5.9

Other assets 0.5 - 0.5 0.6 - 0.6 1.1 - 1.1

Loans and borrowings (4.8) - (4.8) - - - (4.8) - (4.8)

Other liabilities (4.5) - (4.5) (1.1) - (1.1) (5.6) - (5.6)

------------------------- -------- ----------- ------ -------- ----------- ------ -------- ----------- ------

10.5 3.3 13.8 4.4 0.2 4.6 14.9 3.5 18.4

------------------------- -------- ----------- ------ -------- ----------- ------ -------- ----------- ------

Goodwill 7.9 - 7.9

------------------------- -------- ----------- ------ -------- ----------- ------ -------- ----------- ------

Total consideration 21.7 4.6 26.3

------------------------- -------- ----------- ------ -------- ----------- ------ -------- ----------- ------

Satisfied by:

Initial cash

consideration 21.1 4.6 25.7

Contingent consideration 0.6 - 0.6

------------------------- -------- ----------- ------ -------- ----------- ------ -------- ----------- ------

21.7 4.6 26.3

------------------------- -------- ----------- ------ -------- ----------- ------ -------- ----------- ------

On 10 June 2010 the Group acquired 100% of the share capital of

Waterfront Services Pty Limited, Australia, with subsidiaries,

trading as Waterway Constructions ('Waterway'). The provisional

fair value of the intangible assets acquired represents the fair

value of customer contracts at the date of acquisition. The

goodwill arising on acquisition is attributable to the knowledge

and expertise of the assembled workforce and the operating

synergies that arise from the Group's strengthened market position.

Contingent consideration of up to GBP10.9m (A$16.5m) is payable

based on total earnings before interest and tax in the three

year-period to 30 June 2013. Acquisition costs of GBP0.4m (A$0.7m)

were charged to other operating charges.

On 14 June 2010 the Group acquired selected assets and

businesses of Nilex Construction LLC and other entities

(collectively 'Nilex'), the leading wick drain contractor in the

United States. Contingent consideration of up to GBP0.6m ($1.0m) is

payable based on total earnings before interest and tax in the two

year-period to 30 June 2012.

The fair value of the total receivables in both acquisitions is

not materially different from the gross contractual amounts

receivable and is expected to be recovered in full. In the period

to 31 December 2010 Waterway and Nilex contributed GBP24.1m to

turnover and GBP1.0m to the net profit of the Group. Had both

acquisitions taken place on 1 January 2010, total Group revenue in

2010 would have been GBP1,090.1m and total net profit in 2010 would

have been GBP13.1m.

5. Earnings per share

Basic and diluted earnings per share are calculated as

follows:

2011 2011 2010 2010

Basic Diluted Basic Diluted

GBPm GBPm GBPm GBPm

--------------------------------------------------- ----------- ----------- ----------- -----------

Earnings (after tax and minority interests),

being net profits attributable to equity holders

of the parent 15.9 15.9 11.2 11.2

No. No. No. No.

of shares of shares of shares of shares

Million Million Million Million

Weighted average of ordinary shares in issue

during the year 64.3 64.3 64.2 64.2

Add: weighted average of shares under option

during the year - 1.0 - 1.0

Adjusted weighted average of ordinary shares

in issue 64.3 65.3 64.2 65.2

--------------------------------------------------- ----------- ----------- ----------- -----------

2011 2010

--------------------------------------------------- ------------------------ ------------------------

Pence Pence Pence Pence

--------------------------------------------------- ----------- ----------- ----------- -----------

Earnings per share 24.8p 24.4p 17.3p 17.0p

--------------------------------------------------- ----------- ----------- ----------- -----------

Earnings per share of 24.8p (2010: 17.3p) was calculated based

on earnings of GBP15.9m (2010: GBP11.2m) and the weighted average

number of ordinary shares in issue during the year of 64.3 million

(2010: 64.2 million).

Diluted earnings per share of 24.4p (2010: 17.0p) was calculated

based on earnings of GBP15.9m (2010: GBP11.2m) and the adjusted

weighted average number of ordinary shares in issue during the year

of 65.3 million (2010: 65.2 million).

Earnings per share before goodwill impairment of 24.8p (2010:

44.0p) was calculated based on earnings of GBP15.9m (2010:

GBP28.3m) and the weighted average number of ordinary shares in

issue during the year of 64.3 million (2010: 64.2 million).

Diluted earnings per share before goodwill impairment of 24.4p

(2010: 43.2p) was calculated based on earnings of GBP15.9m (2010:

GBP28.3m) and the adjusted weighted average number of ordinary

shares in issue during the year of 65.3 million (2010: 65.2

million).

6. Dividends payable to equity holders of the parent

Ordinary dividends on equity shares:

2011 2010

GBPm GBPm

---------------------------------------------------------------- ----- -----

Amounts recognised as distributions to equity holders in

the period:

Final dividend for the year ended 31 December 2010 of 15.2p 9.8 -

per share (2009: nil)

Second interim dividend for the year ended 31 December 2009

of 14.5p per share in lieu of a final dividend - 9.3

Interim dividend for the year ended 31 December 2011 of

7.6p (2010: 7.6p) per share 4.9 4.9

14.7 14.2

---------------------------------------------------------------- ----- -----

The Board have recommended a final dividend for the year ended

31 December 2011 of GBP9.8m, representing 15.2p (2010: 15.2p) per

share. The proposed dividend is subject to approval by shareholders

at the AGM on 18 May 2012 and has not been included as a liability

in these financial statements.

7. Capital and reserves

The capital redemption reserve is a non-distributable reserve

created when the Company's shares were redeemed or purchased other

than from the proceeds of a fresh issue of shares.

The total number of shares held in Treasury was 2.2m (2010:

2.2m). All shares issued related to share options exercised.

8. Related party transactions

Transactions between the parent, jointly controlled operations

and its subsidiaries, which are related parties, have been

eliminated on consolidation and are not disclosed in this note.

During the year the Group undertook various contracts with a

total value of GBP2.3m (2010: GBP3.3m) for GTCEISU Construccion,

S.A., a connected person of Mr Lopez Jimenez, a Director of the

Company. An amount of GBP1.8m (2010: GBP2.3m) is included in trade

and other receivables in respect of amounts outstanding as at 31

December 2011.

During the year the Group made purchases from GTCEISU

Construccion, S.A. with a total value of GBP3.5m (2010: GBP3.6m).

An amount of GBP1.0m (2010: GBP2.8m) is included in trade and other

payables in respect of amounts outstanding as at 31 December

2011.

Related party transactions were made on an arms-length basis.

All amounts outstanding from related parties are unsecured and will

be settled in cash. No guarantees have been given or received. No

provisions have been made for doubtful debts in respect of the

amounts owed by related parties.

The remuneration of the Directors, who are the key management

personnel and related parties of the Group, is set out below in

aggregate for each of the relevant categories specified in IAS 24 -

Related Party Disclosures.

2011 2010

GBPm GBPm

------------------------------ ----- -----

Short-term employee benefits 2.1 1.9

Post-employment benefits 0.2 0.2

------------------------------ ----- -----

2.3 2.1

------------------------------ ----- -----

[1] 2010 results are stated before a GBP21.8m goodwill

impairment charge.

[2] Net debt represents total loans and borrowings less cash and

short-term deposits.

[3] The North America Census Bureau of the Department of

Commerce, 1 February 2012.

[4] Case Studies can be found on our website at

http://www.keller.co.uk/services.aspx

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SEEFALFESEDE

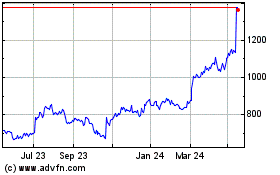

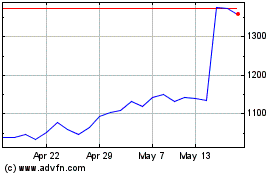

Keller (LSE:KLR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Keller (LSE:KLR)

Historical Stock Chart

From Jul 2023 to Jul 2024