TIDMKEN

RNS Number : 6602L

Kenetics Group Limited

11 May 2010

11 May 2010

Kenetics Group Limited

("Kenetics", the "Group" or the "Company")

Preliminary Unaudited Results for the year ended 31 December 2009

Kenetics Group Limited (AIM:KEN), the Radio Frequency Identification ("RFID")

group focussed on security and RFID systems and products, announces its

Preliminary Unaudited Results for the year ended 31 December 2009.

Highlights

· Consolidated revenue increased by 156% to GBP1,42 million (2008:

GBP556,397)

· Operating expenses increased by 49% to GBP1.71 million (2008: GBP1.15

million)

· Pre-tax loss for the year decreased by 65% to GBP204,594 (2008:

GBP590,741)

· The Singapore Land Transport Authority (LTA) Contactless Smart Card

Readers ("CSC Readers") have been successfully commissioned in the Mass Rapid

Transit subway rail system.

· The CSC Readers are already in commercial operation across 16 stations

with mass roll-out to begin in the second half of 2010.

· The CSC Readers are certified by FCC and CE bodies for sale in the US and

European markets respectively

· Development of the LTA On board Bus Equipment and wireless local area

network has been completed. Trials are on-going and production units are

targeted to go on commercial trials from the second half of 2010 and are

expected to be completed by the 3rd quarter of 2010.

Commenting on the results, Ken Wong, Chairman of Kenetics said:

"The Singapore LTA contracts have provided Kenetics with the opportunity to

enter the Automated Fare Collection Systems market. Development work for the

rail and bus systems has been successfully completed and these systems are

undergoing commercial trials. The Contactless Smart Card Readers have been

installed in 16 stations of the new Circle Line and are now in commercial

operation. We are expecting the mass roll-out of these readers for the whole

subway system to begin in the second half of the year. The On Board Bus

Equipment (OBE) is now ready for commercial trials, which are expected to begin

in the second half of the year. Similarly, upon successful completion of these

trials by the 3rd quarter of 2010, commercial roll-out is expected to begin on

the rest of the public bus system in Singapore."

Ken added: "The board feels that with the significant development work completed

in 2009, we are ready to realise the significant opportunity offered by the

roll-out of the LTA contracts. With the expectation that the current global

markets will continue to improve, Kenetics is in a good position to leverage

upon the momentum and growth built in 2009."

For more information, please contact:

+--------------------------------+----------------------------+

| Ken Wong, Chairman and CEO | David Galan |

| Kenetics Group Limited | ZAI Corporate Finance Ltd |

+--------------------------------+----------------------------+

| Tel: +65 6749 0083 | (Nominated Advisor) |

+--------------------------------+----------------------------+

| Website: | Tel: +44 207 060 1760 |

| www.kenetics-group.com | Website: www.zaicf.com |

+--------------------------------+----------------------------+

| | |

+--------------------------------+----------------------------+

| Peter Ward / Ian CallawaySVS | Jeremy CareyTavistock |

| Securities (Ltd) | Communications Ltd |

+--------------------------------+----------------------------+

| (Broker) | Tel: +44 207 920 3150 |

+--------------------------------+----------------------------+

| Tel: +44 207 638 5600 | |

+--------------------------------+----------------------------+

Chairman's Statement

Despite the challenging and volatile market in 2009, the Group has seen its

sales revenue increase by one and a half fold, putting it in the right path to

further exploit and grow its business.

Last year, we secured a significant contract with the Singapore Land Transport

Authority ("LTA"), for the development and production of On Board Bus Equipment.

The Board believes that this contract will be significant for the growth of the

Group.

Coupled with an earlier contract win in 2008 for the supply of Contactless Smart

Card Readers for both the public rail and bus systems, we have made good

progress and are now poised to take advantage of the opportunities in the

Automated Fare Collection Systems market.

The Group has also maintained steady revenue from its industrial RFID product

sales despite challenging market conditions. This has contributed a steady

source of sales revenue for the Group in 2009.

Financial results

Consolidated revenue for the period increased by 156% to GBP1,422,156 (2008:

GBP556,397) reflecting the good progress made in the two LTA contracts.

Operating expenses were GBP1.71 million (2008: GBP1.15 million), an increase of

only 49%, compared to the 156% increase in sales revenue.

The pre tax loss for the year was decreased by 65% to GBP204,594 (2008:

GBP590,741). In the half-year interim results announced in September 2009, a

consolidated pre-tax loss of GBP202,400 was reported, which indicates that the

company was close to break-even for the second half of the year. A foreign

exchange loss of GBP66K (2008: gain of GBP45K) was incurred due mainly to the

weakening of Sterling against the Singapore Dollar. Financing costs rose to

GBP57K (2008: GBP14K) predominantly due to an increase in bank interest rates

and interest rates charged on the convertible loan. The aggregate of the foreign

exchange loss and the increase in financing cost accounted for more than half of

the pre tax loss for the year.

Working Capital

Owing to the growth in its business activities, the Group needed additional

working capital to fund the increase in sales revenue. In November 2009, the

Group successfully raised a total of GBP192,500 before expenses. The money

raised was used to fund the development and supply of equipment mainly for the

two LTA contracts.

In 2009, the Group secured an extension of the S$1 million (GBP458,716)

convertible loan, which will be due on 30 June 2010. We are pleased to mention

that the lender has further agreed to extend the loan for another twelve months

based on the current interest being payable at 6% per annum.

In March 2009 the Group received a S$500,000 (GBP223,354) bridging loan from

United Overseas Bank to provide additional working capital in respect of our

contracts. The loan is repayable over two years and carries a fixed interest

rate of 5% per annum.

The Group will be seeking additional funds in the form of equity financing in

two phases during 2010. The first phase will take place during the early part of

the year to provide continued working capital to fulfil the LTA contracts

whereas the latter phase will focus in raising GBP2.5 million to provide the

company with the necessary financial resources for the subsequent commercial

roll-out contracts for both the rail and bus systems.

Dividend policy

Because of the Board's continuing commitment to invest in growing the business

further and establishing Kenetics at the forefront of RFID technology and

services, the Company does not have distributable reserves at this time.

Consequently the Board is not recommending a dividend.

Product Development

For 2009, Kenetics focussed mainly in developing the CSC Readers and the On

Board Bus Equipment, which will form the backbone of its entry into the

Automated Fare Collection

Systems used widely in public transport such as

the subway and bus systems.

Improvements were made to its existing industrial product range including the

Ultra High Frequency (UHF) USB RFID Reader that are currently being sold in USA,

Europe and Japan.

Sales and Marketing

During the year, Kenetics conserved its resources and cut back on its marketing

efforts in Europe and the US. For 2009, the RFID market conditions in Europe and

US were challenging, resulting in shift in directional focus by the Group to

preliminary marketing efforts of the On Board Bus Equipment system mainly in

South East Asia.

Despite the reduced marketing efforts, we are happy to note that our

distribution partners in Japan, Europe and US continued to service their

respective customers with the longer term view of riding the recovery and

exploiting market opportunities when the global economy improves.

We are aware that global economic recovery will take time, but with the ongoing

efforts of our distribution partners, we are beginning to see more sales

enquiries from these partners, in line with our expectations.

Research and Development

Since Kenetics began investing into the development of advanced Automated Fare

Collection (AFC) technologies in early 2008, it has made significant progress in

its R&D efforts in developing what we believe to be technologically advanced

innovations for the rail and bus systems. To cater for global requirements, the

short-range reader that is capable of reading most of the world's fare cards

including the Oyster card used by London Transport, has been successfully

developed and certified by FCC and CE bodies for sale in US and European markets

respectively.

Singapore Land Transport Authority Contracts

In March 2010, Kenetics reported on the progress of the LTA contracts. Under the

first contract with the LTA, its Contactless Smart Card Reader, installed in the

mass rapid transit ('MRT') stations of the new MRT Circle Line, are now running

as part of the operational phase of trials in 16 stations with the opening of a

new section of the MRT Circle Line on 17 April 2010. Upon successful completion

of these operational trials in the first half of 2010, Kenetics is expecting the

commercial roll-out phase to begin which will include not only the remaining MRT

Circle line stations but also more significantly, the rest of the subway rail

system. Kenetics expects that the roll-out will begin from the 3rd quarter of

2010 and will extend to 2011. We are expecting the total requirement to exceed

20,000 readers for both the rail and bus systems.

Under its second LTA contract, Kenetics reported that it has built the

prototypes of its On-board Bus Equipment and initial testing and trials of these

prototypes has commenced. Pre-production units are currently being built and

installed progressively on more than 150 buses for field trials on various bus

routes.Commercial trials on these buses will be conducted beginning July 2010

and are expected to complete by September this year. The current contract allows

the LTA to exercise an option to purchase additional sets of OBE for commercial

roll-out on the 4,000-bus fleet. Kenetics expect the roll-out phase to begin in

the 3rd quarter of 2010 with about 500 buses and full rollout of 3,500 buses in

2011. To finance the rollout, the Company will require additional capital, which

the Board believes will be approximately GBP2.5million. The Company plans to

raise this working capital from investors before the roll out phase begins.

In November 2009, the Group projected that the revenues from the smart card

readers and the OBE were expected to be GBP4.0 million and GBP5.36 million for

2010 and 2011 respectively. Owing to the testing and trials being extended from

the 4th quarter of 2009 to the 2nd and 3rd quarters of 2010 for both the readers

and the OBE, the projected revenue for 2010 is expected to be lower at GBP3.0

million. With the completion of trials in 2010, installations of the readers and

OBE are expected to speed up with the Group projecting revenue of GBP8.96

million for 2011.

Directors and Employees

The developmental work for the two contracts discussed above, which required

substantial technical manpower resources, has been completed. Technical

specialists, including network engineers and RF hardware engineers were

recruited to complement the Kenetics R&D team. Kenetics are currently in the

production phase as we commence the trials for the two contracts in 2010. During

the commercial roll-out stages in the second half of 2010, manufacturing of the

products will be contracted out, as Kenetics does not have mass production

facilities and equipment. As such, we are expecting to see a reduction in

manpower costs.

We thank our dedicated staff across the Group, whose hard work and enthusiasm

has helped us progress this year and express our appreciation to our

Non-Executive Directors, Mr Lynton Jones and Mr Terry Fuller for their

invaluable guidance.

Outlook

The Board feels that significant progress has been achieved and the Group is

moving ahead in accordance with its strategic plans put in place during 2009.

We believe that the progress made will stand us in good stead to follow through

and develop the significant opportunities in the Automated Fare Collection

System business during the coming year.

Ken Wong

Chairman

Kenetics Group Limited

11 May 2010

KENETICS GROUP LIMITED

(Incorporated in Jersey)

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 2009

+---------------------------+------+------------+----------+-----------+

| |Note | 2009 | | 2008 |

+---------------------------+------+------------+----------+-----------+

| | | GBP | | GBP |

+---------------------------+------+------------+----------+-----------+

| Continuing operations | | | | |

+---------------------------+------+------------+----------+-----------+

| Revenue | | 1,422,156 | | 556,397 |

+---------------------------+------+------------+----------+-----------+

| Other operating income | | 79,920 | | 1,870 |

+---------------------------+------+------------+----------+-----------+

| Other losses - net | | (20,239) | | - |

+---------------------------+------+------------+----------+-----------+

| Changes in inventories of | | | | |

| finished goods | | | | |

+---------------------------+------+------------+----------+-----------+

| and work-in-progress | | (46,978) | | (3,515) |

+---------------------------+------+------------+----------+-----------+

| Raw materials and | | (429,546) | | (292,738) |

| consumables used | | | | |

+---------------------------+------+------------+----------+-----------+

| Employee benefits | | (723,181) | | (463,182) |

| expenses | | | | |

+---------------------------+------+------------+----------+-----------+

| Depreciation of plant and | | (51,254) | | (90,938) |

| equipments | | | | |

+---------------------------+------+------------+----------+-----------+

| Other operating expenses | | (377,815) | | (283,418) |

+---------------------------+------+------------+----------+-----------+

| Finance costs | | (57,657) | | (15,217) |

+---------------------------+------+------------+----------+-----------+

| Loss before tax | | (204,594) | | (590,741) |

+---------------------------+------+------------+----------+-----------+

| Income tax | 5 | 17,013 | | (315) |

+---------------------------+------+------------+----------+-----------+

| Loss for the year | | (187,581) | | (591,056) |

+---------------------------+------+------------+----------+-----------+

| Other comprehensive | | | | |

| (loss)/income: | | | | |

+---------------------------+------+------------+----------+-----------+

| Currency translation | | (1,086) | | 47,857 |

| differences | | | | |

+---------------------------+------+------------+----------+-----------+

| Other comprehensive | | | | |

| (loss)/income | | | | |

+---------------------------+------+------------+----------+-----------+

| for the year, net of tax | | (1,086) | | 47,857 |

+---------------------------+------+------------+----------+-----------+

| Total comprehensive loss | | | | |

+---------------------------+------+------------+----------+-----------+

| for the year, net of tax | | (188,667) | | (543,199) |

+---------------------------+------+------------+----------+-----------+

| | | | | |

+---------------------------+------+------------+----------+-----------+

| Loss for the year | | | | |

| attributable to: | | | | |

+---------------------------+------+------------+----------+-----------+

| Equity holders of the | | (187,581) | | (580,254) |

| company | | | | |

+---------------------------+------+------------+----------+-----------+

| Minority interests | | - | | (10,802) |

+---------------------------+------+------------+----------+-----------+

| | | (187,581) | | (591,056) |

+---------------------------+------+------------+----------+-----------+

| Total comprehensive loss | | | | |

| for the year attributable | | | | |

| to: | | | | |

+---------------------------+------+------------+----------+-----------+

| Equity holders of the | | (188,667) | | (532,397) |

| company | | | | |

+---------------------------+------+------------+----------+-----------+

| Minority interests | | - | | (10,802) |

+---------------------------+------+------------+----------+-----------+

| | | (188,667) | | (543,199) |

+---------------------------+------+------------+----------+-----------+

| Loss per share (pence) | | | | |

+---------------------------+------+------------+----------+-----------+

| - Basic and diluted | 4 | (0.68) | | (2.24) |

+---------------------------+------+------------+----------+-----------+

KENETICS GROUP LIMITED

(Incorporated in Jersey)

STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2009

+--------------------------------+-------------+-+-------------+

| | 2009 | | 2008 |

+--------------------------------+-------------+-+-------------+

| | GBP | | GBP |

+--------------------------------+-------------+-+-------------+

| Non-current assets | | | |

+--------------------------------+-------------+-+-------------+

| Plant and equipments | 207,686 | | 120,749 |

+--------------------------------+-------------+-+-------------+

| Available for sale financial | - | | - |

| asset | | | |

+--------------------------------+-------------+-+-------------+

| Total non-current assets | 207,686 | | 120,749 |

+--------------------------------+-------------+-+-------------+

| | | | |

+--------------------------------+-------------+-+-------------+

| Current assets | | | |

+--------------------------------+-------------+-+-------------+

| Contract work-in-progress | 525,521 | | 23,969 |

+--------------------------------+-------------+-+-------------+

| Inventories | 504,135 | | 308,345 |

+--------------------------------+-------------+-+-------------+

| Trade receivables | 204,838 | | 68,253 |

+--------------------------------+-------------+-+-------------+

| Other receivables | 207,921 | | 71,421 |

+--------------------------------+-------------+-+-------------+

| Cash and cash equivalents | 136,978 | | 168,952 |

+--------------------------------+-------------+-+-------------+

| Total current assets | 1,579,393 | | 640,940 |

+--------------------------------+-------------+-+-------------+

| Total assets | 1,787,079 | | 761,689 |

+--------------------------------+-------------+-+-------------+

| | | | |

+--------------------------------+-------------+-+-------------+

| Equity | | | |

+--------------------------------+-------------+-+-------------+

| Share capital | 333,495 | | 263,495 |

+--------------------------------+-------------+-+-------------+

| Share premium | 402,704 | | 280,204 |

+--------------------------------+-------------+-+-------------+

| Share option reserve | 4,343 | | 3,415 |

+--------------------------------+-------------+-+-------------+

| Equity component of | - | | 16,260 |

| convertible loan | | | |

+--------------------------------+-------------+-+-------------+

| Merger reserve | 369,579 | | 369,579 |

+--------------------------------+-------------+-+-------------+

| Foreign currency translation | 20,257 | | 21,343 |

| reserve | | | |

+--------------------------------+-------------+-+-------------+

| Accumulated losses | (1,373,777) | | (1,186,196) |

+--------------------------------+-------------+-+-------------+

| Total equity | (243,399) | | (231,900) |

+--------------------------------+-------------+-+-------------+

| | | | |

+--------------------------------+-------------+-+-------------+

| Non-current liabilities | | | |

+--------------------------------+-------------+-+-------------+

| Amounts owing to directors | 762,633 | | 272,007 |

+--------------------------------+-------------+-+-------------+

| Term loans - secured | 29,195 | | - |

+--------------------------------+-------------+-+-------------+

| Total non-current liabilities | 791,828 | | 272,007 |

+--------------------------------+-------------+-+-------------+

| | | | |

+--------------------------------+-------------+-+-------------+

| Current liabilities | | | |

+--------------------------------+-------------+-+-------------+

| Excess of progress billings | | | |

| over contract work-in-progress | 7,744 | | - |

+--------------------------------+-------------+-+-------------+

| Trade payables | 265,389 | | 49,989 |

+--------------------------------+-------------+-+-------------+

| Other payables | 164,240 | | 115,205 |

+--------------------------------+-------------+-+-------------+

| Amounts owing to directors | 28,866 | | 20,489 |

+--------------------------------+-------------+-+-------------+

| Obligations under finance | - | | 632 |

| leases | | | |

+--------------------------------+-------------+-+-------------+

| Convertible loan | 462,968 | | 362,938 |

+--------------------------------+-------------+-+-------------+

| Derivative financial | 20,239 | | - |

| instrument | | | |

+--------------------------------+-------------+-+-------------+

| Term loans - secured | 202,386 | | - |

+--------------------------------+-------------+-+-------------+

| Bank overdraft - secured | 86,818 | | 172,329 |

+--------------------------------+-------------+-+-------------+

| Total current liabilities | 1,238,650 | | 721,582 |

+--------------------------------+-------------+-+-------------+

| Total liabilities | 2,030,478 | | 993,589 |

+--------------------------------+-------------+-+-------------+

| Total equity and liabilities | 1,787,079 | | 761,689 |

+--------------------------------+-------------+-+-------------+

KENETICS GROUP LIMITED

(Incorporated in Jersey)

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2009

+-------------------------------------------+-----------+----------+-----------+

| | 2009 | | 2008 |

+-------------------------------------------+-----------+----------+-----------+

| | GBP | | GBP |

+-------------------------------------------+-----------+----------+-----------+

| Cash Flows From Operating Activities | | | |

+-------------------------------------------+-----------+----------+-----------+

| Loss before tax | (204,594) | | (590,741) |

+-------------------------------------------+-----------+----------+-----------+

| Adjustments for: | | | |

+-------------------------------------------+-----------+----------+-----------+

| Depreciation of plant and equipments | 51,254 | | 90,938 |

+-------------------------------------------+-----------+----------+-----------+

| Impairment loss | - | | 30,884 |

+-------------------------------------------+-----------+----------+-----------+

| Loss arising from derivative financial | 20,239 | | - |

| instrument | | | |

+-------------------------------------------+-----------+----------+-----------+

| Loss on disposal of plant and equipments | 62 | | - |

+-------------------------------------------+-----------+----------+-----------+

| Provision for inventory obsolescence | - | | 39,774 |

+-------------------------------------------+-----------+----------+-----------+

| Share options | 928 | | 2,485 |

+-------------------------------------------+-----------+----------+-----------+

| Unrealized exchange losses on convertible | 60,872 | | - |

| loan | | | |

+-------------------------------------------+-----------+----------+-----------+

| Interest income | (789) | | (1,358) |

+-------------------------------------------+-----------+----------+-----------+

| Interest expense | 57,657 | | 15,217 |

+-------------------------------------------+-----------+----------+-----------+

| Operating loss before working capital | (14,371) | | (412,801) |

| changes | | | |

+-------------------------------------------+-----------+----------+-----------+

| Increase in contract work-in-progress | (495,433) | | (23,969) |

+-------------------------------------------+-----------+----------+-----------+

| Increase/(decrease) in trade and other | (282,800) | | 94,220 |

| receivables | | | |

+-------------------------------------------+-----------+----------+-----------+

| Increase in inventories | (217,083) | | (19,752) |

+-------------------------------------------+-----------+----------+-----------+

| Increase/(decrease) in trade and other | 271,671 | | (362,997) |

| payables | | | |

+-------------------------------------------+-----------+----------+-----------+

| Cash used in operations | (738,016) | | (725,299) |

+-------------------------------------------+-----------+----------+-----------+

| Interest paid | (13,340) | | (7,766) |

+-------------------------------------------+-----------+----------+-----------+

| Income tax refunded/(paid) | 17,013 | | (315) |

+-------------------------------------------+-----------+----------+-----------+

| Net cash flows used in operating | (734,343) | | (733,380) |

| activities | | | |

+-------------------------------------------+-----------+----------+-----------+

| | | | |

+-------------------------------------------+-----------+----------+-----------+

| Cash Flows from Investing Activities | | | |

+-------------------------------------------+-----------+----------+-----------+

| Purchase of plant and equipments | (146,614) | | (12,851) |

+-------------------------------------------+-----------+----------+-----------+

| Proceeds from disposal of plant and | 46 | | - |

| equipment | | | |

+-------------------------------------------+-----------+----------+-----------+

| Capital contribution from minority | - | | 10,802 |

| interests | | | |

+-------------------------------------------+-----------+----------+-----------+

| Interest received | 789 | | 1,358 |

+-------------------------------------------+-----------+----------+-----------+

| Net cash flows used in investing | (145,779) | | (691) |

| activities | | | |

+-------------------------------------------+-----------+----------+-----------+

| | | | |

+-------------------------------------------+-----------+----------+-----------+

| Cash Flows from Financing Activities | | | |

+-------------------------------------------+-----------+----------+-----------+

| Loans from directors | 513,255 | | 221,346 |

+-------------------------------------------+-----------+----------+-----------+

| Issue of ordinary shares | 192,500 | | - |

+-------------------------------------------+-----------+----------+-----------+

| Proceeds from convertible loan | - | | 371,747 |

+-------------------------------------------+-----------+----------+-----------+

| Proceeds from term loans | 312,697 | | - |

+-------------------------------------------+-----------+----------+-----------+

| Repayment of term loans | (81,117) | | - |

+-------------------------------------------+-----------+----------+-----------+

| Difference of fixed deposit balance due | (1,097) | | (2,250) |

| to accumulation of interest | | | |

+-------------------------------------------+-----------+----------+-----------+

| Repayment of hire purchase creditor | (590) | | (7,654) |

+-------------------------------------------+-----------+----------+-----------+

| Net cash flows generated from financing | 935,648 | | 583,189 |

| activities | | | |

+-------------------------------------------+-----------+----------+-----------+

| | | | |

+-------------------------------------------+-----------+----------+-----------+

| Net increase / (decrease) in cash and | 55,526 | | (150,882) |

| cash equivalents | | | |

+-------------------------------------------+-----------+----------+-----------+

| Effects of exchange rate changes | 5,545 | | 60,077 |

+-------------------------------------------+-----------+----------+-----------+

| Cash and cash equivalents at beginning of | (130,643) | | (39,838) |

| year | | | |

+-------------------------------------------+-----------+----------+-----------+

| Cash and cash equivalents at end of year | (69,572) | | (130,643) |

+-------------------------------------------+-----------+----------+-----------+

KENETICS GROUP LIMITED

(Incorporated in Jersey)

NOTES TO THE FINANCIAL INFORMATION

1. Financial information

The financial information set out in this preliminary results announcement does

not constitute the Group's financial statements for the year ended 31 December

2009.

The financial statements have been prepared in accordance with International

Financial Reporting Standards (IFRS and IFRIC preparations) ("IFRS") which are

effective, or issued and early adopted as at the date of the statement.

Whilst the financial information included in this preliminary announcement has

been prepared in accordance with the recognition and measurement criteria of

IFRS, it does not include sufficient information to comply with IFRS.

The auditors have yet to sign their report on the 2009 financial statements. The

financial statements for the year ended 31 December 2009 will be finalised on

the basis of the financial information presented by the Directors in this

preliminary announcement, and will be delivered to the Companies Registry

following the Company's Annual General Meeting. Whilst the auditors have not yet

reported on the financial statements for the year ended 2009, they anticipate

issuing an unqualified report.

The financial information for the year ended 31 December 2008 is derived from

the financial statements for that year. The auditors have reported on the 2008

financial statements; their report was unqualified.

The financial information set out in this announcement was approved by the board

on 7 May 2010.

2. Exchange rates

The financial statements of the Group are presented in Pound Sterling ('GBP'),

which is the Company's functional currency. The functional currencies of

Kenetics Innovations Pte Ltd and Kenetics Innovations (Beijing) Co Ltd are

Singapore Dollars ('S$') and Renminbi ('RMB') respectively. The following

exchange rates have been used in preparing the financial statements as at 31

December 2009:

+----------------------------+----------+---------+

| | S$1 = | RMB1 = |

| | GBP | GBP |

+----------------------------+----------+---------+

| 31 December 2009 | 0.44671 |0.09211 |

| | | |

+----------------------------+----------+---------+

| Average rates | 0.44052 |0.09402 |

| | | |

+----------------------------+----------+---------+

3. Basis of preparation

These preliminary results have been prepared in accordance with the accounting

policies adopted by the Company which are consistent with those adopted in the

annual report and accounts for the year ended 31 December 2008.

4. Loss per share

Basic loss per share has been calculated by dividing the net loss attributable

to equity holders of the Company of GBP187,581 (2008: GBP591,056) by the

weighted average number of ordinary shares outstanding during the financial year

of 27,480,973 (2008: 26,349,466).

The number of ordinary shares used for the calculation of basic loss per share

in 2009 and 2008 where merger accounting is applied, is based on the contributed

capital of Kenetics Innovations Pte Ltd, adjusted to equivalent shares of the

Company whose shares are outstanding after the combination.

5. Income tax

The income tax credit attributable to the loss of GBP17,013 (2008: Charge of

GBP315) is made up of over-provision of income tax expense in the prior year.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR GMGMKVGFGGZM

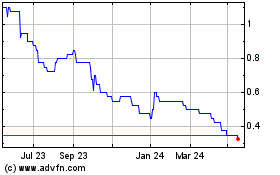

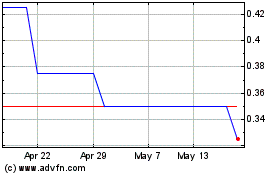

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Sep 2023 to Sep 2024