Intnl Greetings PLC - Interim Results

January 28 1999 - 2:32AM

UK Regulatory

RNS No 7597c

INTERNATIONAL GREETINGS PLC

28th January 1999

EPS UP 19%

INTERIM DIVIDEND UP 15%

CHRISTMAS TRADING IN LINE WITH EXPECTATIONS

International Greetings PLC (IG) today announces interim

results for the six months ended 30 September 1998, showing

pre-tax profit up 16% to #2.07 million, (1997: pre-tax profit

#1.79 million) and interim dividend up 15% at 3.0 pence (1997:

2.6 pence).

IG is one of the world's leading designers and manufacturers

of gift wrapping paper, gift accessories, greeting cards and

crackers and is the UK's leading supplier of private label

greetings products to major multiples including Woolworths,

Tesco and Boots. Through the July acquisition of Copywrite, it

is now also one of the main suppliers of children's character

stationery products in Europe.

Highlights for the period include:

* Pre-tax profit up 16% to #2.07m (1997: #1.79m)

* EPS up 19% to 10.6 pence (1997: 8.9 pence)

* 1998 Christmas retail sales in line with expectations

* Early indicators for Christmas 1999 are positive

* Confident for full year to 31 March 1999 results

Commenting on today's results, the Chairman, John Elfed Jones,

said:

"I am pleased to report that your Company has again achieved

an impressive set of results for the six months to 30

September 1998. Total turnover was up 29%, with turnover

excluding acquisitions up 18%. Profit before taxation was up

16% at #2.1m, with earnings per share increasing by 19% to

10.6p.

"Both acquisitions completed during the period have now been

integrated into the group's operations and have performed in

line with our expectations. The Cracker Company, purchased in

May 1998, has been fully merged within the group's existing

Christmas cracker operations. The Copywrite business,

purchased in July 1998, has been established as a new

operating division within the group, under a newly appointed

managing director who has had extensive experience in all

areas of the gift stationery business. Additionally, steps

have been taken to utilise the existing Copywrite overseas

distribution network as a means of developing export markets

for other group products.

"Following the trend of recent years, the peak pre-Christmas

trading period of our retail customers occurred later than

previously. Notwithstanding the mixed views coming from the

retail sector, I am pleased to report that sales of our

products, which are primarily low ticket items, were generally

in accordance with expectations. As a result we look forward

to the results for the full year to 31 March 1999 with

confidence.

"Our strategy of developing partnerships with key retailers

continues to be successful and early indications from

discussions with our customers in relation to the 1999

Christmas season are positive. Reflecting the good

performance for the past six months of the year and our

confidence in the outlook for the full year and for 1999, your

Board recommends an increased interim dividend up 15% to 3p

net per share."

The dividend will be paid on 26 February 1999, to all

shareholders on the register on 12 February 1999.

For further information, please contact:

International Greetings PLC

Nick Fisher, Joint Chief Executive 01727 844 888

Mark Collini, Finance Director

Grandfield

Clare Abbot 0171 417 4170

Christian Judge

Group Profit & Loss Account

Unaudited 6 Unaudited 6 Audited year

months to 30 months to 30 ended 31

September September March 1998

1998 1997

#000 #000 #000

Turnover

Continuing 24,819 21,116 53,496

Acquisitions 2,400 - -

------ ------ ------

27,219 21,116 53,496

------ ------ ------

Operating profit

Continuing 2,768 2,282 7,636

Acquisitions 68 - -

2,836 2,282 7,636

------ ------ ------

Net interest payable (768) (491) (1,014)

------ ------ ------

Profit before taxation 2,068 1,791 6,622

Taxation (658) (582) (2,149)

------ ------ ------

Profit after taxation 1,410 1,209 4,473

Minority interests - (36) (27)

Dividend (405) (343) (1,135)

------ ------ ------

Retained profit 1,005 830 3,311

------ ------ ------

Earnings per share 10.6p 8.9p 33.7p

Fully diluted

earnings per share 10.4p 8.7p 32.8p*

Dividend per ordinary share 3.0p 2.6p 8.6p

------ ------ ------

Notes:

1. The figures for the year ended 31 March 1998 are an

abridged version of the published accounts, which have been

reported on without qualification by the auditors and have

been delivered to the Registrar of Companies.

2. The calculation of earnings per share is based on

13,310,695 (6 months to 30 September 1997:13,198,500, 12

months to 31 March 1998: 13,198,969) ordinary shares being the

average number of shares in issue during the period. The

calculation of fully diluted earnings per share is based on

13,621,230 (6 months to 30 September 1997: 13,559,275, 12

months to 31 March 1998: 13,575,562*) ordinary shares

calculated in accordance with FRS 14.

3. The taxation charge for the six months ended 30 September

1998 is based on the estimated tax rate for the full year.

* The fully diluted earnings per share and weighted average

number of shares for the year ended 31 March 1998 have

been recalculated in accordance with FRS 14.

END

IR ALLVDLFIDFAA

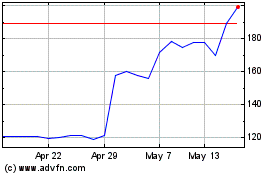

Ig Design (LSE:IGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

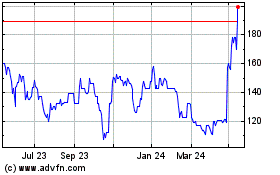

Ig Design (LSE:IGR)

Historical Stock Chart

From Jul 2023 to Jul 2024