RNS No 2556r

INTERNATIONAL GREETINGS PLC

14th July 1998

Earnings and dividend up 30% for International Greetings

Acquisition of Copywrite for #2.1 million

International Greetings PLC (IG) today announces preliminary

results for the year ended March 31 1998 showing pre-tax

profits of #6.6 million, 29% ahead of last year's comparable

pre-exceptional #5.1 million. Earnings per share were up 30%

at 33.7p and the Board is recommending a final dividend of

6.0p payable on 1 September 1998 to shareholders on the

register on 14 August 1998.

The company also announces that it has acquired the UK

business of Copywrite Limited (in Administrative

Receivership), a children's character stationery business from

the receivers for a cash consideration, payable at completion,

equal to the net assets acquired of #2.1 million. In the year

to 31 December 1997 unaudited management accounts for that

company which consists primarily of the acquired business had

turnover of approximately #23.5m.

In order to secure the future development of this business,

International Greetings has entered into long term licence

agreements with Disney Consumer Products and representatives

of Mattel and Hasbro, the principal former product licensors

of the acquired business.

Commenting on the results for the year, Anders Hedlund, Joint

Chief Executive, said: "These are excellent results. We have

continued to improve both gross and net margins and with an

increase in sales this has brought a very strong performance

at the earnings level. We are expecting a good Christmas in

1998 and are confident that this growth and the acquisitions

of The Cracker Company and Copywrite will show significant

benefits during the next financial year".

Commenting on the acquisition Nick Fisher, Joint Chief

Executive, said: "This is a great acquisition for

International Greetings. It adds a new and exciting product

range to our activities and the synergy benefits with our

existing customers and licence partners are highly attractive.

We will refocus the business and we are confident that it will

achieve our required levels of profitability in due course."

"Both this acquisition and of The Cracker Company in May fit

our strategy of acquiring businesses closely related to our

current operations, particularly where our design and

management strengths can be best applied."

Copies of this announcement will be available to the public at

the Company's offices at Belgrave House, The Merlin Centre,

Acrewood Way, St Albans, Herts, AL4 0JY until 27 July 1998.

For further information, contact:

International Greetings PLC

Nick Fisher, Joint Chief Executive 01727-844 888

Grandfield

Michael Henman/ Christian Judge 0171-417 4170

Chairman's Statement

I am once again delighted to report another set of excellent

results for the Group, highlighted as follows:

Profit before taxation* - #6.6m up 29%

Earnings per share* - 33.7p up 30%

Dividend for the year - 8.6p up 29%

*figures exclude exceptional items

Acquisitions

In addition to the continuing strong performance of our

existing businesses, I am pleased to report to you that the

Group has recently completed two acquisitions.

Both fit in with our strategy of identifying opportunities

that are closely related to our current operations, but

particularly where the Group's design and management strengths

can be utilised to develop them to their fullest potential.

Copywrite Limited

On 13 July 1998 the UK business of Copywrite Limited (in

Administrative Receivership), a children's character

stationery business, was acquired from the receivers for a

cash consideration, payable in full at completion, equal to

net assets acquired of #2.1m. In the year to 31 December 1997

unaudited management accounts for that company which consists

primarily of the acquired business had turnover of

approximately #23.5m. It has not been possible to separately

identify the profit or loss atttributable to the net assets

acquired. However, unaudited management accounts for Copywrite

Limited, its subsidiaries and associates for the year ended 31

December 1997 show turnover of approximately #34m and an

operating loss of #1.5m.

In order to secure the future development of this business,

International Greetings has entered into long term licence

agreements with Disney Consumer Products and representatives

of Mattel and Hasbro, the principal former product licensors

of the acquired business. It is our intention to retain

certain key members of the management team of this business

and negotiations to this effect are continuing.

This acquisition adds a new range of products to the group's

activities. We believe that the application of our management

strengths to Copywrite's strong market position will, in due

course, restore the business to our required levels of

profitability.

The Cracker Company Limited

The Cracker Company, purchased in May 1998 for a maximum cash

consideration of #0.2m, is the market leader in confectionery

and games Christmas crackers. The company had turnover of

approximately #2m in the year to 31 December 1997.

Employees

Your Board continues its recognition of the importance our

employees make to the continued success of the business, and

here I pay tribute to the commitment and professionalism of

all of them. Our operating divisions based in South Wales are well into the

process of incorporating the working practices of the

"Investors in People" standards, and initial assessments have

now commenced at the St Albans location.

An Employee Share Purchase Scheme has been approved by the

Board, and all employees are being actively encouraged to

become shareholders in the Company.

Board Responsibilities

Due to the continued expansion of the business it has been

decided to clearly identify the roles and responsibilities of

the Joint Chief Executives.

Anders Hedlund will have sole responsibility for all day to

day operational activities, and for the strategic development

of each product area.

Nick Fisher will concentrate on corporate affair matters -

particularly the identification and integration of

acquisitions and investor relations.

Achievements

We all felt a great sense of pride when International

Greetings was awarded the AIM Company of the Year accolade

last October. We received further professional recognition

when our Joint Chief Executive, Anders Hedlund, was voted

Welsh Business Achiever of the Year at the Welsh Business

Awards in May. Although this was a personal award, Anders

accepted it on behalf of all International Greetings

employees, particularly those with whom he has worked during

his 20 years in South Wales. He commented that, "The success

of our business activities in Wales has been as a direct

result of the commitment and dedication our workforce has

demonstrated.".

Outlook

The trading year to date, together with the seasonal order

book, is in line with our expectations and I am confident that

this year's organic growth, together with the acquisitions

made, will show significant benefits during the next financial

year. This confidence is reflected in your Board's

recommendation of a final dividend of 6p, making a total for

the year of 8.6p, a 29% increase over last year. The final

dividend will be paid on 1 September 1998 to shareholders on

the register at the close of business on 14 August 1998.

John Elfed Jones CBE DL

Chairman

Finance review

The Group's strategy of focusing on margin improvements,

combined with controlled turnover growth has again been

responsible for another excellent set of figures, and

continues the trend of recent years.

Turnover for the year to 31 March 1998 showed an increase of

10% to #53.5m (1997: #48.4m) with operating profit up by 31%

to #7.6m (1997: #5.8m). The giftwrap division performed

particularly well, with operating profit up by 33% in the UK

and 71% in the US.

The gross profit margin improved to 33.5% from 29.9%, and

reflected productivity improvements resulting from a

combination of organisational changes and increased capital

investment programmes. Interest payable increased from #0.7m

to #1m due to a combination of higher interest rates and the

redemption of preference shares in February 1997.

Profit before taxation rose to #6.6m, an increase of 29% over

the previous year's underlying figure of #5.1m*.

This year's overall tax charge of #2.149m represents an

effective rate of 32.5% compared with last year's rate of

33.2%*.

Earnings per Share and Dividends

Earnings per share for the year to 31 March 1998 were 33.7p.

This represents an increase of 30% in underlying earnings per

share from 26p*.

* (excluding exceptional items)

The final dividend of 6p makes a total dividend for the year

of 8.6p, which is covered 3.9 times by earnings per share.

Cash flow

As a result of a combination of the anticipated increase in

Christmas 1998 volumes, and the objective of continuously

improving customer service levels by reducing seasonal

production peaks, manufacturing volumes were greatly increased

in the January to March 1998 quarter over the comparable

period in the previous year. Working capital movements, in

particular the increase in stock, reflected this.

Nevertheless, the Group's cash inflow from operating

activities amounted to #4.9m.

Net capital investments during the year amounted to #3.8m,

compared with #2.5m in the previous year. The increase is

largely due to several one-off projects, the largest of which

was an investment of #0.8m in a Thermal Regenerative Unit for

the gravure print facility. Other significant projects

included the installation of fire protection systems

throughout all the Group's main premises and new business

computer systems for our US division.

Financing

We maintain excellent relations with our principal bankers,

HSBC Midland who, in addition to providing increased

facilities for organic growth, have provided the financial

support required for the recent acquisitions referred to in

the Chairman's Statement.

The Group's borrowings amounted to #6.6m at 31 March 1998 and

gearing was a modest 49%. However, due to the seasonality of

the Group's business, interest cover is considered a more

meaningful determinant in assessing the Group's debt capacity.

With operating profits covering the interest expense 7.5

times, the Group's financial position remains strong. This

financial strength will enable us to continue to follow our

strategic objective of maximising earnings and hence

shareholder value and returns.

Mark Collini

Finance Director

Review of operations

UK

Giftwrap

Technological advances in the printing industry mean that we

continually evaluate new opportunities to improve facilities.

In addition to the commissioning of a new printing press, we

invested in a state-of-the-art Thermal Regenerative Unit for

the gravure print facility. This equipment significantly

increases the efficiency of waste handling and reflects our

commitment as an environmentally conscious business.

Further investments were made in the print plant to achieve

specialist finishes. Design is of paramount importance to our

products, not only in terms of the surface pattern, but also

in texture and feel, and we believe these investments will

give us a distinct competitive advantage.

A new 135,000 sq ft group distribution warehouse was

officially opened on 1 June 1998 by the Right Honourable Ron

Davies, MP, Secretary of State for Wales. The extra space

allows for continued growth in seasonal sales and is shared

with the cracker division.

The investment in ribbon extrusion machinery during 1996 has

paid off handsomely with significant increases in both

turnover and UK market share in this product area.

Consequently, to handle future growth, the ribbon

manufacturing operation has been reorganised within the main

giftwrap plant to be an autonomous manufacturing division.

Additional new products are being developed to be sold at the

luxury end of the market in both the UK and US.

Crackers

We have developed specialist machines to automate some of the

processes previously performed manually. This will enable the

production of a superior product in terms of quality and at

the same time reduce manufacturing costs.

The additional storage space created by the new Group

distribution warehouse provides the opportunity to manufacture

many orders earlier than previous years. This has the effect

of easing capacity constraints during the peak summer season

and allows production space for late repeat orders to be made.

A hygienic packing area was established in January to

facilitate the production of confectionery crackers and will

be instrumental in the manufacture of the additional volumes

created by the acquisition of "The Cracker Company". This

purchase gives the cracker division the opportunity to not

only broaden its ranges, but by utilising existing facilities

mentioned above, we expect an immediate positive effect to the

bottom line.

Cards

The card division continues to focus on private label fixed

orders for boxed Christmas cards. Increased investment in

design and new licenced properties resulted in turnover

increasing by 25%. The division has recently been reorganised

in order to implement a strategy of reducing production costs

by worldwide sourcing for both the printing and finishing of

cards and will facilitate further growth in our market share.

USA

The extension to the Georgia factory was completed on time and

was fully operational by 1 May this year. The total area now

exceeds 200,000 sq ft, encompassing printing, manufacturing,

warehouse and distribution activities.

To complement the enlarged plant further operational

investments have been made. Investment in new computer

business systems and additional conversion equipment will

improve efficiency in all areas of the business, and provide

the necessary capacity to fulfill our rapid expansion plans

over the next few years.

A key element in our strategic plan in the US has been the

continual improvement in the quality of designs and product

ranges. By benefitting from the UK's design expenditure and

resources, our US division, trading as "The Gift Wrap Company"

now offers the best range of giftwrap products in the US

market. This success is reflected in the willingness of

leading independent sales organisations to enter into

exclusive agreements to promote and sell our ranges of

products, at the expense of our competitors. Over the last 12

months five such agreements have been signed, covering a total

of 15 states.

Group Design and Marketing

The importance of offering the best designs in our chosen

markets is of primary importance to International Greetings.

To this end, we maintain an on-going investment programme in

this area.Our creative design team has increased in number by over 50%

during the past two years. This reflects the growing design

demands in our markets, which we recognise and support fully

as our main catalyst for growth. Our designers not only create

looks from within the International Greetings design "stable",

but are continually expanding our design horizons with

worldwide research, thereby keeping our customers' ranges at

the forefront of the market place.

We continue with our strategy of offering ranges to include

the most commercial licensed properties and many agreements

are now in place including The Walt Disney Company, Warner

Brothers and BBC Enterprises.

With the widening of product ranges the primary sales drive is

to increase sales to our existing customer base by making

International Greetings a one-stop supplier for as many design

led disposable paper products as possible. We believe this

strategy will create further new account opportunities in the

UK and also in Continental Europe.

New Product Areas

Concentrating on our strengths, we embarked on two new product

trials with a number of our major customers. During the year

our design and product development teams successfully launched

ranges of calendars and packaged everyday cards which have

performed well. We believe both these categories can be

further developed to provide future growth opportunities.

Summary

This past year was an important one for the Group. Apart from

adding the exciting new product category of children's

character stationery to our portfolio, we have also

consolidated and focused our existing operations to create a

solid foundation to achieve our corporate goals.

Anders Hedlund Nick Fisher

Joint Chief Executive Joint Chief Executive

Consolidated profit and loss account

for the year ended 31 March 1998

1998 1997

Notes #000 #000

Turnover 2 53,496 48,431

Cost of sales (35,597) (33,945)

_____ _____

Gross profit 17,899 14,486

Distribution expenses (3,784) (2,924)

Administrative expenses (6,479) (5,742)

_____ _____

Operating Profit 7,636 5,820

Exceptional surplus on disposal

of fixed assets - 742

Interest payable and similar

charges (1,014) (686)

_____ _____

Profit on ordinary activities

before taxation 2 6,622 5,876

Tax on profit on ordinary

activities 3 (2,149) (1,726)

_____ _____

Profit on ordinary activities

a fter taxation 4,473 4,150

Minority interests (27) (17)

_____ _____

Profit for the financial year 4,446 4,133

Dividends

Equity (1,135) (866)

Non-equity - (135)

_____ _____

Retained profit for the

financial year 3,311 3,132

===== =====

Earnings per share 4

Basic 33.7p 31.7p

Excluding exceptional items 33.7p 26.0p

Fully diluted 31.8p

===== =====

The above results relate to continuing activities.

Consolidated balance sheet

at 31 March 1998

1998 1997

#000 #000 #000 #000

Fixed assets

Intangible assets 214 -

Tangible assets 12,291 9,614

_____ _____

12,505 9,614

Current assets

Stocks 14,135 9,846

Debtors 9,747 7,161

Cash at bank and in hand - 1

______ ______

23,882 17,008

Creditors: amounts

falling due within

one year (19,712) (14,637)

______ ______

Net current assets 4,170 2,371

______ ______

Total assets less current

liabilities 16,675 11,985

Creditors: amounts falling

due after more than one year (2,128) (721)

Provisions for liabilities

and charges (479) (355)

Deferred income (624) (745)

______ ______

Net assets 13,444 10,164

Capital and reserves

Called up share capital 661 660

Share premium account 1,631 1,582

Other reserves 1,232 1,254

Profit and loss account 9,920 6,609

______ ______

Equity shareholders' funds 13,444 10,105

Minority interests - 59

______ ______

13,444 10,164

====== ======

These financial statements were approved by the board of

directors on 13 July 1998 and were signed on its behalf by:

N Fisher, Director

M Collini, Director

Consolidated cash flow statement

for the year ended 31 March 1998

1998 1997

#000 #000

Net cash inflow from operating

activities 4,867 6,719

Returns on investments and

servicing of finance (900) (885)

Taxation (1,447) (1,229)

Capital expenditure (3,770) (2,537)

Acquisitions and disposals (250) -

Equity dividends paid (937) (691)

_____ _____

Cash (outflow)/inflow

before financing (2,437) 1,377

Financing 1,065 (2,723)

_____ _____

Decrease in cash (1,372) (1,346)

====== ======

Reconciliation of net cash flow to movement in net debt

for the year ended 31 March 1998

1998 1997

#000 #000

Decrease in cash in the year (1,372) (1,346)

Cash (inflow)/outflow

from financing (852) 948

_____ _____

Change in net debt resulting

from cash flows (2,224) (398)

Inception of finance leases (650) (62)

Translation differences 46 82

_____ _____

Movement in net debt in the year (2,828) (378)

Net debt at beginning of year (3,809) (3,431)

_____ _____

Net debt at end of year (6,637) (3,809)

====== ======

The results for the year ended 31 March 1997 shown above are

not the Group's financial statements for that financial year.

These results have been extracted from the financial

statements which contain unqualified audit reports with no

adverse statements under Section 237(2) or (3) of the

Company's Act 1985. The financial statements for the year

ended 31 March 1997 have been filed with the Registrar of

Companies. Copies of this announcement are available to the

public at the Company's offices at Belgrave House, The Merlin

Centre, Acrewood Way, St Albans, Herts, AL4 0JY until 27 July

1998.

Notes

1. Accounting policies

This statement has been prepared on the basis of the

accounting policies as set out in the Group's 1997/8 Annual

Report.

2 Segmental analysis

UK and Europe USA Group

1998 1997 1998 1997 1998 1997

#000 #000 #000 #000 #000 #000

Turnover 45,713 41,202 7,783 7,229 53,496 48,431

====== ====== ===== ===== ===== ======

Operating

profit 6,969 5,422 667 398 7,636 5,820

===== ===== ===== ===== ===== =====

Exceptional

surplus on

disposal of

fixed assets - 742

Net interest (1,014) (686)

_____ _____

Profit on ordinary

activities

before taxation 6,622 5,876

===== =====

Net assets 11,349 8,371 2,095 1,793 13,444 10,164

===== ===== ===== ===== ===== =====

There is no material difference between turnover by origin, as

shown above, and turnover by destination. The above results

relate entirely to continuing operations.

3 Taxation

1998 1997

#000 #000

UK Corporation tax 1,844 1,656

Deferred taxation 137 45

Overseas taxation - current 62 8

- deferred 38 72

Adjustments relating to an earlier year:

Corporation tax 70 (33)

Deferred taxation (2) (22)

____ _____

2,149 1,726

===== =====

In 1997 profits of #680,000 included within the exceptional

surplus on disposal of fixed assets were not taxable as relief

was available.

4 Earnings per share

1998 1997

#000 #000

Earnings per share excluding

exceptional items 33.7p 26.0p

Earnings per share on

exceptional items - 5.7p

____ _____

Basic earnings per share 33.7p 31.7p

==== ====

The basic earnings per share is based on the earnings of

#4,446,000 (1997: #3,998,000) and the weighted average number

of ordinary shares in issue of 13,198,969 (1997: 12,622,375).

Fully diluted earnings per share are 31.8p based on earnings

of #4,505,000 and a weighted average number of ordinary shares

in issue of 14,163,969 which assumes that all outstanding

options are exercised.

Earnings per share excluding exceptional items is based upon

the earnings, as above, after adjusting for the exceptional

surplus on disposal of fixed assets of #Nil (1997: #742,000).

END

FR FCNCBFDKDOOD

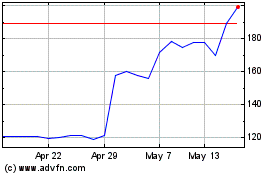

Ig Design (LSE:IGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

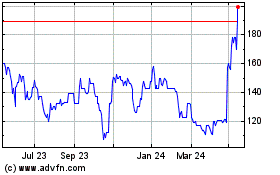

Ig Design (LSE:IGR)

Historical Stock Chart

From Jul 2023 to Jul 2024