RNS Number:7909N

International Greetings PLC

13 July 2000

Profit up 22*% at International Greetings

Strong performance from US division

Chicken Run Added to Licence Portfolio

International Greetings PLC, the leading manufacturer of

gift wrapping paper, gift accessories, cards, crackers

and licensed stationery, today reported a strong set of

results for the year ended 31 March 2000, showing pre tax

profit up 22% at #9.5*m compared with #7.8m last year.

The Board is recommending a final dividend of 2.9p,

payable on September 8 2000 to shareholders on the

register at the close of business on August 18 2000. The

total dividend for the year rose to 4p, an increase of

20% over last year.

Highlights of the year's performance include:

* *Pre-tax profits up 22% at #9.5million (1999: #7.8

million)

* *Earnings per share up 22% at 16.5p (1999: 13.5p)

* Final dividend per share up 24% at 2.9p (1999:

2.3p)

* Continued strong performance in the US

* Gearing reduced from 81% to 24%

* New company funded employee share scheme

* Figures pre net exceptional items of #97,000

Nick Fisher, Joint Chief Executive, said: "We are

delighted with these results and with the performance of

all our divisions, in particular our US operations.

Having acquired our principal competitor in the States we

are now in a position to achieve significant future

growth in this important market.

"Since acquiring Copywrite, licensed properties have

become an important part of our strategy and we are

delighted to have added Chicken Run to our portfolio.

"Our Christmas order book is well in line with

expectations and, with potential for further

acquisitions, we remain confident in the outlook for the

future."

For further information:

International Greetings 01707 630 630

Nick Fisher, Joint Chief Executive

Grandfield 020 7417 4170

Michael Henman/Nick Astaire

CHAIRMAN'S STATEMENT

These results reflect the high quality of your business

and continue the impressive growth record and performance

of previous years.

I am particularly pleased to report on the progress made

in the US where we saw a significant improvement in

turnover and operating profit more than doubling. The

acquisition in May this year of the assets and trade of

The Stephen Lawrence Company, based in New Jersey, will

represent a further boost to the US business in the

coming years. Stephen Lawrence was our principal

competitor in the US and has been the market leader in

the premium quality gift wrap and accessories market for

much of its 40 year history. The US product range was

also extended by the acquisition in January of Pepperpot,

a gift stationery business which in combination with the

Stephen Lawrence acquisition further enhances the

benefits of the Pepperpot business in the US. In the UK,

progress at Copywrite continues in line with

expectations. In our interim results announcement, I

stated our intention to close its Manchester production

facility in March. This has now been completed within our

planned timescale and budget, and the benefits of this

exercise are now beginning to be reflected in Copywrite's

trading performance.

I have always stressed that the continuing success of our

business has only been possible through the hard work,

dedication and loyalty of our employees, and this

continues to be the case. In recognition of this, the

Board wishes to introduce a new all employee share

incentive scheme under which up to 1.5% of the company's

net profit before tax is to be set aside each year to

fund the acquisition of shares in the company by the

existing employee benefit trust. It is proposed that the

trust will be authorised to distribute these shares to

all qualifying employees on an equal basis, subject to

the rules of the employee benefit trust. A resolution

will be proposed at the forthcoming Annual General

Meeting to approve this plan. Once implemented, this will

help to ensure that all employees have a stake in the

future success of the business.

OUTLOOK

With the seasonal order book for Christmas 2000 in line

with expectations, prospects for the Group's current

business are excellent. As in previous years, the

combination of organic growth supplemented by a selective

acquisition policy gives the Board confidence of

continuing success for the future.

Reflecting this confidence, the Board is recommending a

final dividend of 2.9p per share, making a total for the

year of 4p, an increase of 20% over last year. This

dividend will be paid on 8 September 2000 to shareholders

on the register at the close of business on 18 August

2000.

John Elfed Jones CBE DL

Chairman

REVIEW OF OPERATIONS

Throughout the Group's operating divisions, our strategy

is focused on the retailer and their customer, the

consumer. By tailoring product ranges to the

specifications of individual retailers, we help to

establish consumer loyalty, thereby contributing to

growth in the retailer's market share. Consistent growth

in the Group's turnover and profits demonstrate the

effectiveness of this continuing strategy.

UNITED KINGDOM

OVERVIEW

The programme of upgrading and enhancing manufacturing

facilities continues across all divisions. Improved

production processes, sourcing of new materials and the

creation of innovative design concepts ensure we

consistently provide fresh and unique products within our

sectors. The investment made last year in printing and

finishing equipment in the card division has proved

particularly successful, with this division's sales and

profitability significantly improved over previous years.

Investments in production and design have been

complemented by similar investment in information

technology. During the year we have successfully

implemented new management and financial systems in the

greetings card and cracker divisions. These upgraded

systems will improve efficiency and enhance supply chain

management leading to increased customer service levels

and therefore profitability.

For the first time, this year's results include a full 12

months contribution from Copywrite which shows

profitability moving towards the levels prevailing in the

rest of the Group (see Finance Review). We have

successfully achieved the shift from in-house production

at Manchester to sourcing from outside suppliers without

affecting customer service, and we look forward to seeing

the benefits flowing from this change in future years'

performance.

The acquisition of Pepperpot, a gift stationery business,

has been absorbed into the day to day operations of

Copywrite. We have appointed a product manager

responsible for creating new ranges for both the UK and

US markets, and are pleased to report that the potential

in both markets for Pepperpot products has exceeded our

original expectations. Due to our strong relationship

with Disney Consumer Products, we have been licensed to

market additional gift and stationery categories which

now firmly establishes Copywrite as a one stop supplier

of licensed stationery and gift items for the children's,

adult and collectable markets.

DESIGN

In order to maintain our position as market leader within

the sector, our creative teams actively research consumer

preferences in terms of colour, product and packaging. We

work within a global market and therefore attend trade

shows in the United Kingdom, Continental Europe, the

United States and the Far East in order to keep abreast

of market developments and trends in design. With the

benefit of employing creative teams on both sides of the

Atlantic, we are in a position to be the true world

leader in design in our marketplace. Winning the "Best

Christmas Card Box" at the annual Greetings Industry

Awards in November last year is one example of our

acknowledged design capability.

LICENSING

Our licensing strategy is to develop a portfolio of the

most popular mass market licensed properties, and to

maximise licence opportunities by working in close

partnership with both licensors and our key retail

customers. This approach ensures that we are in a better

position to match production levels with consumer demand.

In addition to existing licence agreements for all Disney

characters, Barbie, Action Man and a number of other well

known characters we have recently signed an exclusive

agreement for our product categories in Europe for the

new Aardman animation film "Chicken Run". This is the

first animated feature film by the creator of Wallace and

Gromit and we are confident that this will be a long term

merchandising success.

OVERSEAS

The profile of our overseas operations has been steadily

increasing in significance over recent years. To reflect

this, we appointed Martin Hornung to the Board of

directors in March 2000 as Executive Director responsible

for the development of the Group's international

activities. During the past nine years as a senior

executive, Martin has built up an extensive knowledge of

all aspects of International Greetings which will be

invaluable in the support of our US and Far East

operations.

The excellent performance of the US division was

highlighted in the Chairman's statement, with both

turnover and profit considerably improved during the past

year. The confidence expressed in last year's annual

report has been well justified by these results and we

remain confident of our continuing success in this

market.

The recent purchase of Stephen Lawrence firmly

establishes our position as the leading premium gift wrap

company in the US market. We intend to retain a sales and

design presence at Stephen Lawrence's previous base in

New Jersey, but to transfer production to our

manufacturing facility in Georgia to take advantage of

economies of scale and overhead reduction.

In response to the growth in materials being sourced from

the Far East, we have established a new company,

International Greetings Asia Ltd. in Hong Kong. One of

our existing executives (with ten years experience in

purchasing and manufacturing) has relocated to Hong Kong

in order to manage the day to day aspects of the

operation. We see this as a strategic development of long

term importance for the Group.

INVESTORS IN PEOPLE

We were delighted that during the year we achieved

Investors in People accreditation for our gift wrap and

cracker divisions in South Wales - more than 50% of our

900 employees are now working under Investors in People

standards and it is our intention that all other

divisions will be accredited in due course.

CONCLUSION

We will continue with our customer and consumer focused

strategy, enhancing our existing businesses organically

and by pursuing acquisitions that meet our predetermined

criteria. This year's results are a testament to success

in delivering this strategy and we are confident of even

greater success in future years.

Anders Hedlund Nick Fisher

Joint Chief Executive Joint Chief Executive

FINANCE REVIEW

* Turnover - #85.5m up 18%

* Operating profit* - #10.8m up 15%

* Shareholders' funds - #22.8m up 28%

Turnover for the year to 31 March 2000 increased by 18%

to #85.5m (1999: #72.2), with operating profit* up by 15%

to #10.8m (1999: #9.4m). Exceptional gains on the sale of

our head office in Hatfield and land and buildings in

Boston, USA of #0.4m were offset by the exceptional cost

of closure of Copywrite's Manchester facility amounting

to #0.5m, to give net exceptional costs of #0.1m.

The overall operating profit margin* showed a small

decrease from 13.1% to 12.6%, but this was almost

entirely due to the inclusion of a full twelve month

period for Copywrite for the first time this year,

compared with an eight month trading period included in

last year's figures. Nonetheless, the operating margin*

at Copywrite improved from 3.5% to 5.1% and with the

closure of the uneconomic production facility at

Manchester, we expect a continuing improvement in

operating margins.

Interest payable decreased from #1.6m to #1.3m, as a

consequence of a combination of improved working capital

management and fixed asset disposals.

Profit before taxation* rose to #9.5m, an increase of 22%

and represents a pre-tax margin of 11.2%, up from 10.9%

last year.

EARNINGS PER SHARE AND DIVIDEND

Basic earnings per share for the year ended 31 March 2000

were 16.3p. Excluding exceptional items, earnings per

share were 16.5p, an increase of 22%. The final dividend

of 2.9p (1999: 2.3p) makes a total dividend for the year

of 4p (1999: 3.3p). The total dividend is covered four

times by the earnings per share, and represents an

increase of 20% over last year.

BALANCE SHEET AND CASHFLOW

The Group's financial position improved considerably

during the year. Shareholders' funds increased by #5m to

#22.8m and debt at 31 March 2000 was #5.5m, down from

#14.5m last year. Tight working capital management and in

particular reduced levels of inventory, together with

fixed assets disposals resulted in this major improvement

which saw gearing reduced from 81% last year to 24% at 31

March 2000.

Interest cover also strengthened significantly during the

year, with operating profits excluding exceptional items

covering the interest expense 8.5 times, up from 6.0

times last year.

* figures before exceptional items

TREASURY OPERATIONS

The Board continues to assess and manage the risks

associated with the treasury functions as the business

develops. Whilst the Copywrite business is less seasonal

than the rest of the Group, overall the Group's business

still retains a strong seasonal element which results in

large variations in working capital requirement. Long

term restriction of the exposure to interest rate

fluctuations on working capital funding is not considered

economically viable. However, where opportunities exist

for the short term, fixing at attractive rates primarily

through the use of acceptance credits, these are

considered.

Mark Collini

Finance Director

CONSOLIDATED PROFIT AND LOSS ACCOUNT

for the year ended 31 March 2000

Note Pre- Exceptional 2000 1999

exceptional items Total #000

Items #000 #000

#000

Turnover 2 85,542 - 85,542 72,151

Cost of sales (58,458) - (58,458) (48,877)

Gross profit 27,084 - 27,084 23,274

Distribution (6,040) - (6,040) (5,055)

expenses

Administrative (10,228) (528) (10,756) (8,803)

expenses

Operating profit 10,816 (528) 10,288 9,416

Profit on

disposal of - 431 431 -

fixed assets

Interest payable

and similar (1,278) - (1,278) (1,581)

charges

Profit on ordinary

activities before 2 9,538 (97) 9,441 7,835

taxation

Tax on profit on 3 (2,833) (2,414)

ordinary

activities

Profit for the

financial year 6,608 5,421

Dividends - equity 4 (1,625) (1,372)

Retained profit

for the financial 4,983 4,049

year

Earnings per 5

share

Basic 16.3 13.5*

Diluted 15.8 13.3*

* Figures adjusted to reflect bonus issue made in

September 1999.

CONSOLIDATED BALANCE SHEET

at 31 March 2000

2000 2000 1999 1999

#000 #000 #000 #000

Fixed assets

Intangible assets -

goodwill 1,417 1,574

Tangible assets 16,233 19,343

17,650 20,917

Current assets

Stocks 14,458 15,687

Debtors 15,205 14,265

Cash at bank and in hand - -

29,663 29,952

Creditors: amounts

falling due within one

year (21,181) (29,910)

Net current assets 8,482 42

Total assets less current 26,132 20,959

liabilities

Creditors: amounts falling

due after more than one

year (1,709) (1,878)

Provisions for liabilities

and charges (687) (685)

Deferred income (889) (552)

Net assets 22,847 17,844

Capital and reserves

Called up share capital 2,032 677

Share premium account 557 1,909

Other reserves 1,306 1,289

Profit and loss account 18,952 13,969

Equity shareholders' funds 22,847 17,844

CONSOLIDATED CASH FLOW STATEMENT

for the year ended 31 March 2000

2000 1999

#000 #000

Net cash inflow from operating

activities 14,627 8,071

Returns on investments and servicing (1,364) (1,522)

of finance

Taxation (3,237) (2,157)

Capital expenditure 273 (7,275)

Acquisitions and disposals (375) (4,111)

Equity dividends paid (1,395) (1,216)

Cash inflow/(outflow) before 8,529 (8,210)

financing

Financing 160 158

Increase/(decrease) in cash 8,689 (8,052)

NOTES

1. BASIS OF INFORMATION

The financial information set out above does not

constitute the company's statutory accounts for the years

ended 31 March 2000 or 1999. Statutory accounts for 1999

have been delivered to the registrar of companies, and

those for 2000 will be delivered following the company's

annual general meeting. The auditors have reported on

those accounts; their reports were unqualified and did

not contain statements under section 237 (2) or (3) of

the Companies Act 1985.

This statement has been prepared on the basis of the

accounting policies as set out in the Group's Annual

Report for the year ended 31 March 1999.

2 SEGMENTAL ANALYSIS

UK and Europe USA Group

2000 1999 2000 1999 2000 1999

#000 #000 #000 #000 #000 #000

Turnover 73,939 63,347 11,603 8,804 85,542 72,151

Operating profit 9,412 8,826 1,404 590 10,816 9,416

before

exceptional items

Exceptional items (157) - 60 - (97) -

Operating profit 9,255 8,826 1,464 590 10,719 9,416

after exceptional

items

Net interest (1,278) (1,581)

Profit on

ordinary 9,441 7,835

activities before

taxation

Net assets 19,404 15,566 3,443 2,278 22,847 17,844

There is no material difference between turnover by

origin, as shown above, and turnover by destination. The

above results relate entirely to continuing operations.

3. TAXATION

2000 1999

#000 #000

UK Corporation Tax 2,129 2,312

Deferred Taxation 80 32

Overseas Taxation - current 630 113

- deferred (78) (28)

Adjustments relating to an

earlier year: 43 (2)

UK Corporation Tax

Overseas taxation 29 (13)

2,833 2,414

4. DIVIDENDS

2000 1999

#000 #000

Interim paid - 1.1 per share 447 424

(1999: 1.0p*)

Final proposed - 2.9p per share 1,178 948

(1999: 2.3p*)

1,625 1,372

5. EARNINGS PER SHARE

2000 1999

Earnings per share 16.3p 13.5p*

Diluted earnings per share 15.8p 13.3p*

The basic earnings per share is based on earnings of

#6,608,000 (1999: #5,421, 000) and the weighted average

number of ordinary shares in issue of 40,631,341 (1999:

40,255,335*). The calculation of diluted earnings is based

on 41,766,923 (1999: 40,872,465*) ordinary shares. The

difference of 1,135,582 (1999: 617,130*) represents the

dilutive effect of outstanding employee share options which

has been calculated in accordance with FRS 14.

* Figures adjusted to reflect bonus share issue made in

September 1999.

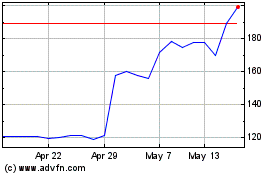

Ig Design (LSE:IGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

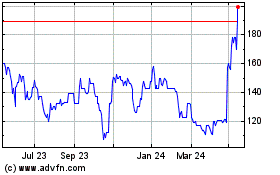

Ig Design (LSE:IGR)

Historical Stock Chart

From Jul 2023 to Jul 2024