Intnl Greetings PLC - Interim Results

January 26 2000 - 2:02AM

UK Regulatory

RNS Number:4102E

International Greetings PLC

26 January 2000

Pre-tax profits up 18%

Good Christmas trading

Encouraging outlook for 2000

International Greetings PLC today announced interim

results for the six months ended 30 September 1999.

International Greetings is one of the world's leading

manufacturers of gift wrapping paper, gift accessories,

greeting cards and crackers and is the UK's leading

supplier of private label greetings products to major

multiples including Woolworths, Tesco and Boots. It also

manufactures character stationery products for a range of

children's characters under licence from Disney, Mattel

and Hasbro.

Highlights for the period included:

* Turnover up 22%, at #33.2 million (1998: #27.2

million)

* Pre-tax profit up 18% at #2.4 million (1998: #2.1

million)

* EPS up 17% at 4.1p (1998: 3.5p)

* Strong performance in US

* Interim dividend up 10% at 1.1p (1998: 1.0p)

* Encouraging orders for Christmas 2000

* Confident in outlook for full year to 31 March 2000

Commenting on today's results, the Chairman, John Elfed

Jones said:

"I am delighted to report that your Company has again

performed extremely well in the six months to 30

September 1999. Total turnover was up 22% at #33.2m,

with Copywrite (our character stationery business)

accounting for #6.7m of this total. Profit before

taxation was up 18% at #2.4m, with earnings per share

increasing by 17%.

"Our US division performed particularly well. With

volumes and margins up, it is now reaping the rewards of

investment and management effort in recent years. The US

market was buoyant in 1999 and we expect this trend to

continue throughout 2000.

"We are pleased with the progress made at Copywrite where

we are in the final stages of our rationalisation

programme. Following a detailed review of costs, we have

decided to close Copywrite's Manchester production

facility with effect from March 2000. Production

previously carried out in Manchester will now be sourced

primarily from outside suppliers, with other operational

activities transferring to Copywrite's head office in

Duxford, Cambridgeshire.

"The refinancing of our new property in Hatfield referred

to in last year's Annual Report and Accounts was

completed through a sale and leaseback of the property in

November 1999. This has resulted in a significant

reduction of debt, and will have a beneficial effect on

both year end gearing and interest charge. The gain on

the disposal of this property and the closure costs of

Copywrite's Manchester facility will be separately

disclosed as exceptional items in the results for the

full year to 31 March 2000, and the net effect of these

items is not expected to be material.

"On 11 January this year, we completed the purchase of

the trade and certain assets of Pepperpot, a gift

stationery business, for a cash consideration of

#375,000. In the nine months to 30 September 1999,

Pepperpot's turnover was #1.2m, of which over 50% was in

the US. Its distribution network and customer base there

are complementary to our own, and this small acquisition

will significantly extend our overall range offering in

that market.

"The late Christmas sales trend experienced by customers

in recent years was once again apparent in 1999.

However, I am pleased to report that the majority of our

customers achieved sales of our products in line with

their expectations, and as a result, we look forward to

the results for the full year to 31 March 2000 with

confidence. Orders received so far for the Christmas

2000 period have also been encouraging. Reflecting this,

your Board has declared an increased interim dividend up

10% to 1.1p net per share. The dividend will be paid on

3 March 2000 to all shareholders on the register on 11

February 2000."

For further information, please contact:

International Greetings PLC 01707 630 630

Nick Fisher, Joint Chief Executive Officer

Mark Collini, Finance Director

Grandfield 0171 417 4170

Michael Henman/Clare Abbot

Group Profit & Loss Account

Six months ended 30th September 1999

Unaudited Unaudited Audited

6 months to 6 months to year ended

30 September 30 September 31 March

1999 1998 1999

#000 #000 #000

Turnover 33,163 27,219 72,151

Operating profit 3,084 2,836 9,416

Interest payable (645) (768) (1,581)

Profit before taxation 2,439 2,068 7,835

Taxation (766) (658) (2,414)

Profit after taxation 1,673 1,410 5,421

Dividend (447) (405) (1,372)

Retained profit 1,226 1,005 4,049

Earnings per share 4.1p 3.5p* 13.5p*

Diluted earnings per share 4.1p 3.5p* 13.3p*

Dividend per ordinary share 1.1p 1.0p* 3.3p*

Note:

1 The figures for the year ended 31 March 1999 are

extracted from the statutory financial statements for

that year, which have been reported on by the auditors

without qualification, and without any statement under

Section 237 (2) or (3) of the Companies Act 1985, and

have been delivered to the Registrar of Companies.

2 The calculation of earnings per share is based on

40,630,091 (6 months to September 1998: 39,932,085*, 12

months to 31 March 1999: 40,255,335*) ordinary shares

being the average number of shares in issue during the

period. The calculation of diluted earnings per share is

based on 41,043,759 (6 months to 30 September 1998:

40,863,690*, 12 months to 31 March 1999 40,872,465*)

ordinary shares calculated in accordance with FRS 14.

3 The taxation charge for the six months ended 30th

September 1999 is based on the estimated tax rate for the

full year.

* Figure adjusted to reflect bonus issue made in

September 1999.

END

IR ILFIDLTIEFII

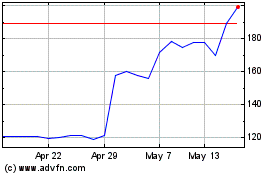

Ig Design (LSE:IGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

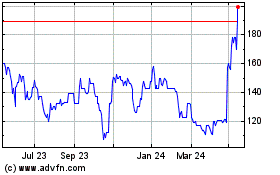

Ig Design (LSE:IGR)

Historical Stock Chart

From Jul 2023 to Jul 2024