TIDMPMO

RNS Number : 4925K

Premier Oil PLC

22 April 2020

Premier Oil plc (the "Company")

2019 Annual Report and Financial Statements, Sustainability

Report and Revised AGM Date

22 April 2020

Publication of Annual Report and Sustainability Report

Further to the release of the Company's Annual Results on 5

March 2020, the Company announces that it has today published its

Annual Report and Financial Statements for the financial year ended

31 December 2019 (the "2019 Annual Report") and its 2019

Sustainability Report. The 2019 Annual Report was finalised and

approved after close of business on 4 March 2020. Since that date,

the COVID-19 pandemic has had a dramatic impact on the global

economy, and has contributed to the sharpest decline in oil price

in 20 years. As reported in a trading update on 13 March, the Board

of Directors are taking all prudent steps to manage the Company's

short term liquidity position, to reduce forward expenditure

commitments and to redefine the Company's future business plan,

given these new circumstances.

Revised AGM Date

In response to the Government's public health instructions and

stay at home measures regarding the COVID-19 pandemic, the Board

has taken the decision to defer the holding of the Company's 2020

Annual General Meeting ("AGM") from 12 May 2020 to 25 June 2020.

The Board is hopeful that circumstances will improve and that

shareholders will be able to attend the meeting at the later date

if restrictions on public gathering and social distancing

requirements are reduced. It is anticipated that the shareholder

mailing of the AGM notice and annual report will take place on or

around 22 May 2020.

Robin Allan, Executive Director, UK & North Sea, who was due

to leave the Board at the close of the AGM on 12 May 2020, has

agreed to stay on the Board until the close of the AGM on the

revised date of 25 June 2020. He will then continue to work for

Premier as planned, on a part-time consultancy basis, with a focus

on ESG matters and Premier's response to climate change.

Further detail regarding Annual Report

In accordance with Listing Rule 9.6.1., copies of the 2019

Annual Report have been submitted to the UK Listing Authority and

will shortly be available for inspection from the National Storage

Mechanism at www.morningstar.co.uk/uk/nsm . The 2019 Annual Report

is also available to view on the Company's website at

www.premier-oil.com

A condensed set of financial statements and information on

important events that have occurred during the year ended 31

December 2019 and their impact on the financial statements were

included in the Company's 2019 Annual Results announcement on 5

March 2020. That information together with the information set out

below in Appendix 1, which is extracted from the 2019 Annual

Report, fulfil the requirements of DTR 6.3.5. This announcement is

not a substitute for reading the full 2019 Annual Report. Page and

note references in the text in Appendix 1 are made in reference to

the 2019 Annual Report. To view the 2019 Annual Results

announcement, visit the Company website:

www.premier-oil.com/investors

Further enquiries:

Company Secretariat:

Rachel Rickard Tel: +44 (0)20 7730 1111

Investor Relations:

Elizabeth Brooks Tel: +44 (0)20 7730 1111

Disclaimer

This announcement contains certain forward-looking statements

that are subject to the usual risk factors and uncertainties

associated with the oil and gas exploration and production

business. Whilst the Group believes the expectations reflected

herein to be reasonable in light of the information available to it

at this time, the actual outcome may be materially different owing

to factors beyond the Group's control or otherwise within the

Group's control but where, for example, the Group decides on a

change of plan or strategy. Accordingly, no reliance may be placed

on the figures contained in such forward-looking statements.

APPIX 1

Company Risk Factors (required under DTR 4.1.8)

Principal risk factor Risk detail How is it managed?

-------------------------------------- -------------------------------------- --------------------------------------

Production and Uncertain geology, reservoir and well Effective management systems in place

development delivery performance. governing geoscience, reservoir and

and decommissioning well engineering,

execution Availability of oilfield services and production operations activities.

including FPSOs and drilling rigs, These include rigorous production

technology and engineering forecasting and reporting,

capacity, and skilled resources. field and well performance monitoring

and independent reserves auditing.

Adverse fiscal, regulatory, political,

economic, social, security (including Effective management systems in place

cyber) and weather governing project execution, including

conditions. contracting strategy,

cost controls, project team competency

Immaturity of decommissioning in the and functional oversight.

UK resulting in uncertain cost and

timing estimates for Long-term development planning to

decommissioning of assets. ensure timely and cost-effective

access to FPSOs, rigs and

Potential consequences include reduced other essential services.

or deferred production, loss of

reserves, cost overruns Preference for operatorship.

and failure to fulfil contractual

commitments. Specialist decommissioning team in

place coupled with continued focus on

delivering asset

value to defer abandonment

liabilities.

-------------------------------------- -------------------------------------- --------------------------------------

Joint venture partner alignment and Major operations and projects in the Due diligence and regular engagement

supply oil and gas industry are conducted as with partners in joint ventures in

chain delivery joint ventures. both operated and

The joint venture partners may not be non-operated operations and projects.

aligned in their objectives and this Defined management system for

may lead to operational management of non-operated ventures.

inefficiencies and/or project delays. Assure contracted dutyholders comply

Several of our major operations are with local statutory requirements

operated by our (e.g. UK Safety Case

joint venture partners and our Regulations 2015).

ability to influence is sometimes Pursue strategic acquisition

limited due to our small opportunities, where appropriate to

interest in such ventures. gain a greater degree of

Premier is heavily dependent on influence and control.

supply chain providers to deliver Due diligence of supply chain

products and services to providers, including diligence of

time, cost and quality criteria and financial solvency, anti-bribery

to conduct its business in a safe and and corruption controls, and controls

ethical manner. to prevent facilitation of tax

evasion.

Contractor performance management

programme being implemented for major

contracts to manage

contractual performance and delivery,

including periodic audit of the

effectiveness of their

management systems.

Long-term development planning to

ensure timely and cost-effective

access to key oilfield

services.

-------------------------------------- -------------------------------------- --------------------------------------

Organisational The capability of the organisation Premier has created a competitive

capability may be inadequate for Premier to reward package including bonus and

deliver its strategic long-term incentive plans

objectives. to incentivise loyalty and

The capability of the organisation is performance from the existing

a function its structure and the skilled workforce.

deployment and strength Continue to strengthen

of its personnel. organisational capability to achieve

Premier may be unable to attract, strategic objectives. This includes

engage or retain personnel with the resource and succession planning,

right skills and competencies competency and leadership

or to deliver suitable succession development.

plans for senior roles. Continuous improvement and

The Business Management System may be simplification of the Business

inadequate or may not be sufficiently Management System and related

complied with controls

to be effective. appropriate to the size and market

position of the Company.

Continued deployment of contingent

labour through a mature

cost-effective Managed Service

Provider ('MSP') model to rapidly

respond to the peaks and troughs of

labour demand in a volatile

environment.

Staff forums providing a mutual

communication forum between staff,

management and the Board

to address employee matters.

Continued focus on Diversity &

Inclusion across the Group.

Embedded Talent Management and

Succession Planning process.

Complete implementation of

recommendations emerging from

externally facilitated organisation

health check conducted end 2018.

Organisational capability and risk

oversight further enhanced by global

functional review

under new operating charter.

-------------------------------------- -------------------------------------- --------------------------------------

Exploration success and reserves Premier may fail to identify and Focus on proven petroleum systems

addition capture new acreage and resource underpinned by world-class source

opportunities to provide rocks and identify technical

a portfolio of drillable exploration or political discontinuities that we

prospects and future development can exploit using our preferred

projects. evaluation workflows

Specific exploration programmes may to create a competitive advantage.

fail to add expected resource and Continuous improvement in

hence value. exploration management system with

Lender controls may reduce ability strong functional oversight.

to capture and execute the

exploration programme. Manage exploration portfolio to

maintain alignment with strategic

growth and spend targets.

Maintain new ventures activity and

appropriate resourcing.

-------------------------------------- -------------------------------------- --------------------------------------

Commodity price volatility Oil and gas prices are affected by Oil and gas price hedging programmes

global supply and demand and can be to underpin our financial strength

subject to significant and protect our capacity

fluctuations. to fund future developments and

Supply factors that influence these operations.

include the pace of new oil and gas Company investment guidelines that

developments, operational ensure our investment opportunities

issues, natural disasters, adverse are robust to downside

weather, political and security price scenarios.

instability, conflicts

and actions by major oil-exporting

countries.

Demand factors that influence these

include economic conditions, climate

change regulations

and the pace of transition to a low

carbon economy.

Price fluctuations can affect our

business assumptions, our ability to

deliver on our strategy

and our access to capital.

-------------------------------------- -------------------------------------- --------------------------------------

Access to capital Sufficient funds may not be Strong financial discipline through

available to finance the business an established finance management

and fund existing operations system that ensures

and planned growth projects. the Company is able to maintain an

Current Amend and Extend to debt appropriate level of liquidity and

facilities not agreed by the courts financial capacity and

leading to renegotiations to manage the level of assessed risk

with lenders which may have adverse associated with the financial

consequences on the Group's ability instruments. The management

to refinance. system includes a defined delegation

Volatile credit markets, lender of authority to reasonably protect

appetite and investor sentiment may against risk of financial

impact ability to either fraud in the Group.

refinance debt at maturity and/or Proactive engagement with equity

raise equity on attractive terms. markets, banks and lenders to

Breach of delegated authority. maintain access to capital

Financial fraud. markets through the cycle.

An insurance programme to reduce the

potential impact of the physical

risks associated with

exploration and production

activities. This includes business

interruption cover for a proportion

of the cash ow from producing

fields.

Cash balances are invested in

short-term deposits with minimum A

credit rating banks, AAA

managed liquidity funds and A1/P1

commercial paper, subject to Board

approved limits.

Economics of investment decisions

are tested against downside project

scenarios.

Discretionary spend is actively

managed.

-------------------------------------- -------------------------------------- --------------------------------------

Health, safety, Significant asset integrity, process Comprehensive HSES management systems

environment safety or wells incident on operated including:

and security asset. HSES reporting and auditing with a

('HSES') Significant incident arising from focus on the identification and

natural disaster, pandemic, social management of major hazards.

unrest or other external Valid Safety Cases on all operated

cause. assets.

Consequences may include injury, loss Robust crisis management and

of life, environmental damage and emergency response processes in place

disruption to business and tested against.

activities. Senior management visits to operated

facilities to demonstrate commitment

to HSES values.

Learning from internal and

third-party incidents.

Insurance against Business

Interruption.

-------------------------------------- -------------------------------------- --------------------------------------

Host government: Premier operates or maintains Premier strives to be a good

political and fiscal risks interests in some countries where corporate citizen globally, and seeks

political, economic and social to forge strong and positive

transition is taking place or there relationships with governments,

are current sovereignty disputes. regulatory authorities and the

Developments in politics, communities where we do business.

security, laws and regulations can Premier engages in respectful

affect our operations and earnings. industry-wide lobbying and

Consequences may include sustainable corporate responsibility

expropriation of property; and community investment programmes.

cancellation of contract rights; Premier maintains a portfolio of

limits interests which includes operations

on production or cost recovery; in both lower and higher

import and export restrictions; risk environments.

price controls, tax increases Rigorous adherence to Premier's

and other retroactive tax claims; Sustainability Policy and Global Code

and increases in regulatory burden of Conduct.

or changes in local laws Monitor and adhere to local laws and

and regulations. regulations.

Consequences may also include Active monitoring of the political,

threats to the safe operation of economic and social situation in

Company facilities. areas where we do business,

including business continuity plans

tailored to pre-defined levels of

alert.

-------------------------------------- -------------------------------------- --------------------------------------

Climate Change Adverse investor and stakeholder Premier is proactively taking steps

sentiment towards oil and gas sector to address the impact on society of

impacting investability. its operations. We

Cost to comply with climate change set time-bound climate change

related operational regulations and objectives consistent with Paris

disclosure requirements. Agreement targets and also

Longer-term disruption to Premier's demonstrate how we meet those

projects and operations as a result objectives over time, specifically:

of changing weather Board-owned Climate Change Policy

patterns and more frequent extreme with strategy implementation

weather events. monitored by an Executive Climate

Longer-term reduction in demand for Change Committee.

oil and gas products due to the pace Setting of corporate goals and

of commercial deployment annual targets within Group

of alternative energy technologies corporate scorecard and business

and shifts in consumer preference for unit KPIs.

lower greenhouse Physical and transitional climate

gas emission products. change risks associated with our

activities are identified

and actively managed.

We are committed to ensuring that

all new projects sanctioned by us

will deliver net zero

emissions, through our Low Carbon

Projects by Design initiative,

supplemented where necessary

by investments to offset emissions

using carbon credits.

We are undertaking a comprehensive

asset-by-asset review during 2020

identifying projects

to reduce carbon emissions within

our operations and throughout our

supply chain.

Carbon pricing and scenario analysis

is integrated into investment

decision-making.

Climate change performance and

supporting processes with

stakeholders are communicated in

a transparent manner.

Dialogue with shareholders and

lenders on climate change actions.

Collaboration with industry and

other associations on climate change

adaptation and mitigation,

including a framework by which the

industry works towards a target of

net zero greenhouse

gas emissions.

Promote investability though

positive recognition in the annual

FTSE4Good and CDP climate

change reporting submissions.

-------------------------------------- -------------------------------------- --------------------------------------

Key Performance Indicators (required under DTR 4.1.9)

Working interest production (kboepd)

Objective

Premier aims to maximise production from its existing asset base

and, over time, to deliver production growth.

2019 Progress

-- Group Production of 78.4kboepd

-- Group operating efficiency >90%

-- First gas from BIG-P

-- Formal government approval of Catcher North and Laverda developments

Reserves and resources (mmboe)

Objective

Premier aims to grow its reserves and resources base through a

combination of successful exploration and selective

acquisitions.

2019 Progress

-- Upward revision in 2P reserves estimates at the Catcher Area and Natuna Sea Block A

-- Premier upgraded its Zama resource estimates following successful 2019 appraisal campaign

Operating costs US$/boe

Objective

Premier aims to minimise costs from operations without

compromising on health, safety and integrity.

2019 Progress

-- Operating costs of US$18/boe, of which US$11/boe related to

field opex and US$7/boe to FPSO lease costs

-- Low cost base supported by high operating efficiency

Covenant Leverage ratio

Objective

Premier aims to have sufficient headroom against its covenant

leverage ratio to ensure continued covenant compliance and access

to liquidity throughout the commodity price cycle.

2019 Progress

-- Covenant leverage ratio (covenant net debt/ EBITDAX) reduced to 2.3x (2018: 3.1x)

-- Increased EBITDAX of US$1,230 million, up c.13%

Operating cash flow (US$ million)

Objective

Premier aims to maximise cash flow from operations to maintain

financial strength, meet its debt obligations, invest in the future

of the business and deliver long-term returns to shareholders.

2019 Progress

-- Improved cash margins due to increased UK oil production

-- Catcher reached cash payback in October

-- Strong operating cash flow generated by the Group's Asian

assets driven by high uptime and tight cost control

Net debt (US$ billion)

Objective

Premier aims to reduce the absolute level of its net debt in

order to address the imbalance in its capital structure, to ensure

compliance with its financial covenants and to provide the Company

with future financial flexibility.

2019 Progress

-- Net debt reduced from US$2.3 billion to less than US$2 billion

-- Record free cash flow generation of US$320 million

-- Net debt reduced by over US$900 million since October 2017

ROCE %

Objective

Premier is focused on effective capital and balance sheet

management, and quality of earnings through driving operational and

technical efficiencies.

2019 Progress

-- Increased operating cash flows from high operating

efficiency, higher realised sales prices and tight cost control

-- Record free cash flow utilised to repay debt, with capex focused on highest return projects

Total recordable injury rate ('TRIR')

Objective

Premier is committed to managing its operations in a safe and

reliable manner to prevent major accidents and to provide a high

level of protection to its employees and contractors.

2019 Progress

-- No recordable injuries at any of Premier's offshore operated

facilities, supply bases and offices worldwide

Process safety events - IOGP Tier 1 and Tier2

Objective

Premier aims to maintain the highest standards of operational

integrity to prevent any release of hazardous material from primary

containment.

2019 Progress

-- In 2019, there was one Tier 1 Process Safety Event relating

to an oil release at Catcher and one Tier 2 Process Safety Event

relating to a gas release at Catcher

GHG intensity - operated assets ( kgCO2e/boe)

Objective

Premier is committed to proactively taking steps to address the

Group's impact on society and in particular to minimise the climate

impact of its activities.

2019 Progress

-- Greenhouse gas intensity of the Group's operating assets at a record low

-- Commitment to ensuring that all operated projects will be

developed on a net zero emissions basis (Scope 1 and Scope 2)

Directors' responsibility statements (required under DTR

4.1.12)

The Directors are responsible for preparing the Annual Report

and Financial Statements in accordance with applicable law and

regulations.

Group financial statements

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the Directors

are required to prepare the Group financial statements in

accordance with International Financial Reporting Standards

('IFRSs') as adopted by the European Union ('EU') and Article 4 of

the International Accounting Standards ('IAS') Regulation and have

also chosen to prepare the Parent Company financial statements in

accordance with Financial Reporting Standard 101 Reduced Disclosure

Framework. Under company law the Directors must not approve the

financial statements unless they are satisfied that they give a

true and fair view of the state of affairs of the Company and of

the profit or loss of the Company for that period.

In preparing the Parent Company financial statements, the

Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether Financial Reporting Standard 101 Reduced

Disclosure Framework has been followed, subject to any material

departures disclosed and explained in the financial statements;

and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

In preparing the Group financial statements, International

Accounting Standard 1 - 'Presentation of Financial Statements' -

requires that Directors:

-- properly select and apply accounting policies;

-- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

-- provide additional disclosures when compliance with the

specific requirements in IFRSs are insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the entity's financial position and financial

performance; and

-- make an assessment of the Company's and Group's ability to continue as a going concern.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and Group and enable them to

ensure that the financial statements comply with the Companies Act

2006. They are also responsible for safeguarding the assets of the

Company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website (www.premier-oil.com). Legislation in the United

Kingdom governing the preparation and dissemination of financial

statements may differ from legislation in other jurisdictions.

Directors' responsibility statement

We confirm to the best of our knowledge:

1. the Group financial statements, prepared in accordance with

International Financial Reporting Standards, as adopted by the EU,

give a true and fair view of the assets, liabilities, financial

position and profit or loss of the Company and the undertakings

included in the consolidation taken as a whole;

2. the Strategic Report includes a fair review of the

development and performance of the business and the position of the

Company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face; and

3. the Annual Report and Financial Statements, taken as a whole,

are fair, balanced and understandable and provide the information

necessary for shareholders to assess the Company's position and

performance, business model and strategy.

This responsibility statement was approved by the Board of

Directors on 4 March 2020 and is signed on its behalf by:

Tony Durrant

Chief Executive Officer

Richard Rose

Finance Director

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACSPPUUGCUPUUBP

(END) Dow Jones Newswires

April 22, 2020 09:00 ET (13:00 GMT)

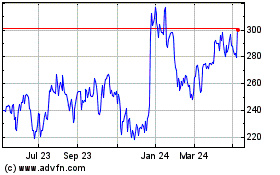

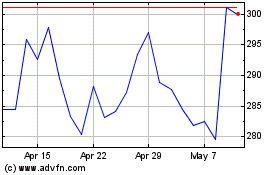

Harbour Energy (LSE:HBR)

Historical Stock Chart

From May 2024 to Jun 2024

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Jun 2023 to Jun 2024