TIDMGRP

RNS Number : 9370T

Greencoat Renewables PLC

09 July 2018

THIS ANNOUNCEMENT (INCLUDING THE APPIX) IS NOT FOR RELEASE,

PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, DIRECTLY OR

INDIRECTLY, BY ANY MEANS OR MEDIA, IN OR INTO OR FROM THE UNITED

STATES, CANADA, AUSTRALIA, NEW ZEALAND, JAPAN, OR THE REPUBLIC OF

SOUTH AFRICA, ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA (OTHER

THAN IRELAND, THE UNITED KINGDOM, BELGIUM, FRANCE, GERMANY, THE

NETHERLANDS, SPAIN OR SWEDEN (TOGETHER "ELIGIBLE MEMBER STATES),

AND THEN, ONLY TO PERSONS IN ELIGIBLE MEMBER STATES WHO ARE NOT

RETAIL INVESTORS) OR ANY OTHER JURISDICTION IN WHICH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN THE COMPANY.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

9 July 2018

Greencoat Renewables Launches 12 month 250 million Share

Issuance Programme

Notice of General Meeting

Launch of Initial Placing of approximately 100 million New

Shares to finance attractive acquisition pipeline in Ireland

09 July 2018 | Greencoat Renewables PLC ("Greencoat Renewables"

or "the Company"), the renewable infrastructure company, invested

in euro-denominated assets, is pleased to announce a 12 month Share

Issuance Programme of up to 250 million New Shares in a number of

tranches, to provide the Company with greater financial capacity to

take advantage of an increasingly active secondary market for wind

assets in Ireland.

The Company intends to issue approximately 100 million Placing

Shares at a price of EUR1.01 per Placing Share pursuant to the

first tranche of the Share Issuance Programme, being the

Initial Placing, which is being launched today.

In line with the Company's strategy, the net proceeds of the

Initial Placing will be used to refinance the Company's Revolving

Credit Facility, allowing the Company to make acquisitions whilst

maintaining total gearing (currently 43%) within the target range.

The Share Issuance Programme will, the Board believes, provide the

Company with the financial flexibility to raise further equity as

value-accretive investment opportunities continue to arise and

enable the Company to deliver effectively on its stated

strategy.

Implementation of the Share Issuance Programme requires the

approval of the Company's shareholders at the EGM to be held on 1

August 2018. The Board believes that the Share Issuance Programme

is in the best interests of shareholders as a whole and unanimously

recommends that Shareholders vote in favour of the resolutions in

respect of the Share Issuance Programme at the EGM. The Directors

intend to vote in favour of the resolutions in respect of their own

beneficial holdings of Ordinary Shares which amount in aggregate to

150,000 Ordinary Shares, constituting 0.06 % of the issued Ordinary

Share capital.

Ronan Murphy, who is a Director, intends to participate in the

Initial Placing by subscribing for approximately EUR25,000 worth of

New Shares, so that following completion of the Initial Placing, he

will hold c. 124,752 Ordinary Shares, representing c. 0.03% of the

enlarged issued Ordinary Share capital of the Company (assuming 100

million New Shares are issued pursuant to the Initial Placing).

Emer Gilvarry, who is also a Director, intends to participate in

the Initial Placing, subscribing for approximately EUR50,000 worth

of New Shares, so that following completion of the Initial Placing,

she will hold c. 49,505 Ordinary Shares, representing c. 0.01% of

the enlarged issued Ordinary Share capital of the Company (assuming

100 million New Shares are issued pursuant to the Initial

Placing).

Rónán Murphy, Chairman of Greencoat Renewables, commented:

"We are very pleased with the progress made over the past twelve

months, achieving the operational and strategic targets we laid out

at IPO. The secondary market for operating wind assets in Ireland

continues to grow apace, with an increasing number of opportunities

large and small. We believe Greencoat Renewables is uniquely well

positioned to take advantage of this market opportunity.

While the Company expects to continue to expand its portfolio,

shareholder returns remain paramount and we have a disciplined

approach to acquisitions to ensure we continue to deliver a

progressive dividend policy and an attractive overall return."

Background to, and Reasons for, the Share Issuance Programme

Delivery of Strategy

Greencoat Renewables listed in July of 2017 in an oversubscribed

IPO, raising gross proceeds of EUR270 million. Since listing, the

Company has delivered on its stated strategy at IPO:

-- Paid a pro rata 6 cent annual dividend for period since

listing in 2017, and announced a 6 cent target dividend for the

2018 full year;

-- Three additional wind generation asset investments completed,

acquiring Lisdowney, Tullynamoyle 2, and Dromadda More wind farms,

increasing installed capacity from 137MW to 194MW, representing

overall portfolio growth of >40%;

-- Put in place a Revolving Credit Facility to refinance project

finance debt and fund acquisitions; and

-- Maintained operational performance of the portfolio in line with management expectations.

Irish Market Background

Ireland remains an attractive location for investment in wind

assets, with a reliable wind resource and robust regulatory regime

underpinned by REFIT 2. The introduction of the new I-SEM market

structure in October 2018 is expected to allow the Irish

electricity market to be integrated within a pan European market

and to allow increasing volumes of renewable electricity to be

generated while ensuring all renewable generators are balanced or

focused on being balanced.

Strength of Acquisition Pipeline in Ireland

The Company has a significant pipeline of opportunities to

acquire wind farms in Ireland, and the Company wishes to ensure

that it is in a position to capitalise on these opportunities as

and when they become available. The Company is therefore proposing

the Share Issuance Programme under which it will be able to issue

New Shares to take advantage of such investment opportunities as

they arise, by way of drawing on the Revolving Credit Facility

(having repaid some or all of its existing borrowings from the

proceeds of the Initial Placing) and, then, subsequent

placings.

The Irish secondary market for wind assets remains very active,

with over 4GW of assets on schedule to be operational by 2020. The

past 18 months has seen over 500MW of operating assets being

acquired from a wide range of sellers from large scale utilities to

smaller local developers. Through its expertise and relationships,

Greencoat Renewables is very well placed to transact across the

market and it has in excess of 200MW of an acquisition pipeline

under consideration.

Benefits of the Share Issuance Programme

The Directors believe that the Share Issuance Programme will

confer the following benefits for Shareholders and the Company:

(i) allows the Company to repay part or all of its borrowings

under its existing loan facilities, enabling it to take advantage

of the significant pipeline of opportunities presently under

consideration;

(ii) the phased issuance of equity allows the Company to manage

its leverage and ensure that it is appropriate, based on the

portfolio at the time; and

(iii) receiving the approval of Shareholders for the full

issuance of New Shares under the Share Issuance Programme allows

the Company to raise further tranches of equity more quickly and

cost-efficiently within the 12 month authorisation period.

NAV per Share Accretive

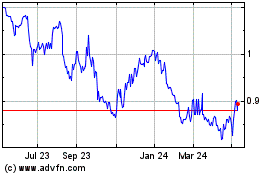

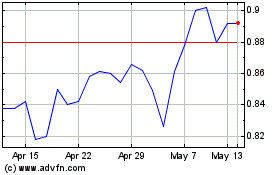

The Placing Price represents a discount of 2.4% to the closing

price per Ordinary Share of EUR1.05 on Euronext Dublin and 3.6% to

the closing price per Ordinary Share of EUR1.063 on the London

Stock Exchange on 6 July 2018 (each closing price adjusted for the

1.5 cent per Ordinary Share dividend payable with respect to the

quarter ended 30 June 2018). The Placing Price represents a premium

of 4.3% to the last reported NAV of 96.8 cent per Ordinary Share as

at 30 June 2018.

Proposed Share Issuance Programme

Under the Share Issuance Programme, Greencoat Renewables intends

to, subject to shareholder approval, issue up to 250 million New

Shares.

-- The Share Issuance Programme is being implemented to raise

additional capital over a 12 month period to provide the Company

with greater financial capacity to take advantage of the strong

pipeline of opportunities available to the Company.

-- As part of the Share Issuance Programme, subject to

shareholder approval, the Company will issue approximately 100

million Placing Shares pursuant to the Initial Placing at a Placing

Price of EUR1.01 per Placing Share (ex-dividend). The final size of

the Initial Placing is expected to be announced on, or around, 24

July 2018 and may vary from the number detailed in this

Announcement.

-- The net proceeds from the Initial Placing will be used

towards repaying borrowings under the Company's Revolving Credit

Facility, allowing the Company to make acquisitions whilst

maintaining leverage (currently 43%) within the target range.

-- New Shares may be allotted and issued under the Share

Issuance Programme for a period of 12 months commencing on the date

of passing of the resolutions at the EGM (or any earlier date on

which the Share Issuance Programme is fully subscribed or that the

Board, in its sole discretion, determines).

-- The Company may, at its discretion, agree to or stipulate

additional conditions to any Subsequent Placings. If any of these

conditions are not met, the issue of the relevant tranche of New

Shares pursuant to the Share Issuance Programme will not

proceed.

Notice of EGM

-- The Initial Placing and Share Issuance Programme are not

underwritten, and are conditional on, inter alia, shareholder

approval at the EGM to be held on 1 August 2018.

-- A Circular setting out full details of the proposals to be

considered at the EGM in respect of the Share Issuance Programme,

and which includes a notice of the EGM, has been dispatched to

Company shareholders today.

-- The EGM will be held at Davy House, 49 Dawson Street, Dublin

2, Ireland on 1 August 2018 at 9 a.m. Further details are set out

below.

-- An electronic copy of the Circular will shortly be available on the Company's website http://www.greencoat-renewables.com/.

AIFMD Disclosures

The Company is categorised as an externally managed alternative

investment fund for the purposes of the Alternative Investment Fund

Managers Directive (Directive 2011/61/EU) ("AIFMD"). The attention

of all Shareholders and any prospective investors in the Company,

through the Share Issuance Programme or otherwise, is drawn to

those disclosures required to be made under AIFMD from time to time

and which are available on the Company's website:

http://www.greencoat-renewables.com/investors/disclosures/aifmd.

Details of the Initial Placing

The Initial Placing is being conducted, subject to the

satisfaction of certain conditions set out in the Appendix to this

Announcement (which forms part of this Announcement) through a

non-pre-emptive institutional placing which will be launched

immediately following this Announcement and will be made available

to Placees.

J&E Davy (trading as Davy) and RBC Europe Limited (trading

as RBC Capital Markets) are acting as Joint Bookrunners in respect

of the Initial Placing.

Davy and RBC, being the Joint Bookrunners, will today commence

the Bookbuild process in respect of the Initial Placing to

determine demand for participation in the Initial Placing. No

commissions will be paid to Placees or by Placees in respect of any

Placing Shares. The book will open with immediate effect. Members

of the public are not entitled to participate in the Initial

Placing.

The Joint Bookrunners have entered into the Placing Agreement

with the Company and the Investment Manager under which, subject to

the conditions set out therein, the Joint Bookrunners agree to use

their respective reasonable endeavours to procure Placees for the

Placing Shares at the Placing Price as set out in the Placing

Agreement.

The final number of Placing Shares will be decided at the close

of the Bookbuild by the Company and the Joint Bookrunners.

All Placees who participate in the Intial Placing will be

required to make bids for Placing Shares at the Placing Price. The

timing of the closing of the book, pricing and allocations are at

the discretion of the Company, Davy and RBC. Details of the number

of Placing Shares will be announced as soon as practicable after

the close of the Bookbuild.

The Placing Shares, when issued, will be fully paid and will

rank pari passu in all respects with the existing Ordinary Shares

of the Company, including the right to receive all dividends and

other distributions declared, made or paid after the date of issue.

The Company currently has 270,000,000 Ordinary Shares in issue.

Applications for Admission to Trading

The Company will apply to Euronext Dublin and to the London

Stock Exchange for the Placing Shares to be admitted to trading on

ESM and AIM respectively. It is expected that settlement of the

Placing Shares will occur, Admission will become effective and that

dealings will commence in the Placing Shares at 8.00 a.m. on 2

August 2018. The Initial Placing is conditional, among other

things, upon Admission becoming effective and the Placing Agreement

not being terminated in accordance with its terms. The Appendix

sets out further information relating to the Bookbuild and the

terms and conditions of the Initial Placing.

By choosing to participate in the Initial Placing and by making

an oral and legally binding offer to acquire Placing Shares,

investors will be deemed to have read and understood this

Announcement in its entirety and to be making such offer on the

terms and subject to the conditions in it, and to be providing the

representations, warranties, indemnities, acknowledgements and

undertakings contained in the Appendix.

This Announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notice" section of this Announcement.

This Announcement contains inside information for the purposes

of the Market Abuse Regulation (EU) No 596/2014 ("MAR").

The person responsible for arranging release of this

Announcement on behalf of the Company is Bertrand Gautier.

For further information on the Announcement, please contact:

Greencoat Renewables PLC: +44 20 7832 9400

Bertrand Gautier

Paul O'Donnell

Tom Rayner

Davy (Joint Bookrunner, Nomad and ESM Adviser) +353 1 6796363

Fergal Meegan

Ronan Veale

Barry Murphy

RBC (Joint Bookrunner) +44 20 7653 4000

Matthew Coakes

Duncan Smith

Jonathan Hardy

FTI Consulting (Media Enquiries) +353 1 765 0886

Jonathan Neilan

Melanie Farrell

About Greencoat Renewables PLC

Greencoat Renewables PLC is an investor in euro-denominated

renewable energy infrastructure assets and is focused on the

acquisition and management of operating wind farms in Ireland. It

is managed by Greencoat Capital LLP, an experienced investment

manager in the listed renewable energy infrastructure sector.

Greencoat Capital LLP is a leading European renewable investment

manager EUR3bn of assets under management across a number of funds

in wind and solar infrastructure and private equity, and overseen

by a strong and experienced independent board.

For more information about Greencoat Renewables PLC, please

visit http://www.greencoat-renewables.com/

For more information about Greencoat Capital LLP, please visit

http://www.greencoat-capital.com

IMPORTANT NOTICE

This Announcement, including the Appendix, and the information

contained herein is not for release, publication or distribution,

directly or indirectly, in whole or in part, in or into or from the

United States, Canada, Australia, New Zealand, Japan, the Republic

of South Africa or any other jurisdiction where to do so might

constitute a violation of the relevant laws or regulations of such

jurisdiction.

This Announcement does not constitute or form part of any offer

to sell, or any solicitation of an offer to buy, securities in the

United States. Securities may not be offered or sold in the United

States absent (i) registration under the Securities Act or (ii) an

available exemption from registration under the Securities Act. The

Placing Shares have not been and will not be registered under the

Securities Act or under the securities laws of any state or other

jurisdiction of the United States and may not be offered, sold,

resold or delivered, directly or indirectly, in or into the United

States absent registration except pursuant to an exemption from or

in a transaction not subject to the registration requirements of

the Securities Act. No public offering of the Placing Shares is

being made in the United States.

This Announcement does not constitute an offer to sell or issue

or a solicitation of an offer to buy or subscribe for Placing

Shares in any jurisdiction including, without limitation, the

United States, Canada, Australia, Japan, the Republic of South

Africa or any other jurisdiction in which such offer or

solicitation is or may be unlawful (a "Prohibited Jurisdiction").

This Announcement and the information contained herein are not for

publication or distribution, directly or indirectly, to persons in

a Prohibited Jurisdiction unless permitted pursuant to an exemption

under the relevant local law or regulation in any such

jurisdiction. No action has been taken by the Company, the Joint

Bookrunners or any of their respective affiliates that would permit

an offer of the Placing Shares or possession or distribution of

this Announcement or any other publicity material relating to such

Placing Shares in any jurisdiction where action for that purpose is

required. Persons receiving this Announcement are required to

inform themselves about and to observe any such restrictions.

This Announcement and any offer if made subsequently is subject

to the Alternative Investment Fund Managers Directive ("AIFMD") as

implemented by Member States of the European Economic Area. This

Announcement and any offer if made subsequently is directed only at

professional investors in the following member states: Ireland, the

United Kingdom, Belgium, France, Germany, the Netherlands, Spain

and Sweden (together the "Eligible Member States"). The Investment

Manager has not registered a passport for marketing under the

passporting programme set out in the AIFMD in any other member

state (each an "Ineligible Member State"). This Announcement may

not be distributed in any Ineligible Member State and no offers

subsequent to it may be made or accepted in any Ineligible Member

State. The attention of all prospective investors is drawn to

disclosures required to be made under the AIFMD which are set out

on the Company's website (including as set out in its most recent

annual report and accounts).

This Announcement is directed at and is only being distributed

to: (A) persons in member states of the European Economic Area who

are "qualified investors", as defined in article 2.1(e) of the

Prospective Directive (Directive 2003/71/EC) as amended, (B) if in

the United Kingdom, persons who (i) have professional experience in

matters relating to investments who fall within the definition of

"investment professionals" in article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 as

amended (the "FPO") or fall within the definition of "high net

worth companies, unincorporated associations etc" in article

49(2)(a) to (d) of the FPO and (ii) are "qualified investors" as

defined in section 86 of FSMA or (C) otherwise to persons to whom

it may otherwise lawfully be communicated (each, a "Relevant

Person"). No other person should act or rely on this Announcement

and persons distributing this Announcement must satisfy themselves

that it is lawful to do so. By accepting the terms of this

Announcement, you represent and agree that you are a Relevant

Person.

The distribution of the Placing Shares in Switzerland will be

exclusively made to, and directed at, regulated qualified investors

(the "Regulated Qualified Investors"), as defined in Article

10(3)(a) and (b) of the Swiss Collective Investment Schemes Act of

23 June 2006, as amended ("CISA"). Accordingly, the Company has not

been and will not be registered with the Swiss Financial Market

Supervisory Authority ("FINMA") and no Swiss representative or

paying agent has been appointed in Switzerland. This Announcement

and/or any other offering materials relating to the Placing Shares

may be made available in Switzerland solely to Regulated Qualified

Investors.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement should seek appropriate advice before taking

any action.

Any indication in this Announcement of the price at which the

Ordinary Shares of the Company have been bought or sold in the past

cannot be relied upon as a guide to future performance. Persons

needing advice should consult an independent financial adviser. No

statement in this Announcement is intended to be a profit forecast

and no statement in this Announcement should be interpreted to mean

that earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings per share of the Company.

The Placing Shares to be issued pursuant to the Initial Placing

and the Share Issuance Programme will not be admitted to trading on

any stock exchange other than AIM and ESM.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

This Announcement has been issued by and is the sole

responsibility of the Company. Neither of the Joint Bookrunners,

nor any of their respective affiliates accept any responsibility

whatsoever for the contents of the information contained in this

Announcement or for any other statement made or purported to be

made by or on behalf of the Joint Bookrunners or any of their

respective affiliates in connection with the Company, the Placing

Shares or the Share Issuance Programme. The Joint Bookrunners and

each of their respective affiliates accordingly disclaim all and

any liability, whether arising in tort, contract or otherwise in

respect of any statements or other information contained in this

Announcement and no representation or warranty, express or implied,

is made by the Joint Bookrunners or any of their respective

affiliates as to the accuracy, completeness or sufficiency of the

information contained in this Announcement.

Davy, which is regulated in Ireland by the Central Bank of

Ireland is acting as a Joint Bookrunner for the Company and no-one

else in connection with the Share Issuance Programme and the

Initial Placing and is not, and will not be, responsible to anyone

other than the Company for providing the protections afforded to

its clients nor for providing advice in relation to the Share

Issuance Programme, the Initial Placing and/or any other matter

referred to in this Announcement.

RBC, which is authorised in the United Kingdom by the Prudential

Regulatory Authority and regulated by the FCA and the Prudential

Regulatory Authority, which is authorised and regulated in the

United Kingdom by the FCA is acting for the Company and for no one

else in connection with the Share Issuance Programme and the

Initial Placing and is not, and will not be, responsible to anyone

other than the Company for providing the protections afforded to

its clients nor for providing advice in relation to the Share

Issuance Programme, the Initial Placing and/or any other matter

referred to in this Announcement.

In connection with the Initial Placing, each of the Joint

Bookrunners and any of their respective affiliates, acting as

investors for their own accounts, may purchase Placing Shares and

in that capacity may retain, purchase, sell, offer to sell or

otherwise deal for their own accounts in such Placing Shares and

other securities of the Company or related investments in

connection with the Initial Placing or otherwise.

This Announcement does not identify or suggest, or purport to

identify or suggest, the risks (direct or indirect) that may be

associated with an investment in the Placing Shares. Any investment

decision to buy Placing Shares in the Initial Placing must be made

solely on the basis of publicly available information, which has

not been independently verified by the Joint Bookrunners.

This Announcement contains (or may contain) certain

forward-looking statements with respect to certain of the Company's

current expectations and projections about future events and the

Company's future financial condition and performance. These

statements, which sometimes use words such as "aim", "anticipate",

"believe", "may", "will", "should", "intend", "plan", "assume",

"estimate", "expect" (or the negative thereof) and words of similar

meaning, reflect the directors' current beliefs and expectations

and involve known and unknown risks, uncertainties and assumptions,

many of which are outside the Company's control and difficult to

predict, that could cause actual results and performance to differ

materially from any expected future results or performance

expressed or implied by the forward-looking statement. Statements

contained in this Announcement regarding past trends or activities

should not be taken as a representation that such trends or

activities will continue in the future. The information contained

in this Announcement speaks only as of the date of this

Announcement and is subject to change without notice and the

Company does not assume any responsibility or obligation to, and

does not intend to, update or revise publicly or review any of the

information contained herein, whether as a result of new

information, future events or otherwise, except to the extent

required by Euronext Dublin, the London Stock Exchange, the Central

Bank of Ireland, the FCA or by applicable law. No statement in this

Announcement is or is intended to be a profit forecast or profit

estimate or to imply that the earnings of the Company for the

current or future financial years will necessarily match or exceed

the historical or published earnings of the Company.

The price of shares and the income from them may go down as well

as up and investors may not get back the full amount invested on

disposal of shares acquired. Past performance is no guide to future

performance and persons needing advice should consult an

independent financial adviser.

This Announcement does not constitute a recommendation

concerning any investor's options with respect to the Initial

Placing. The price of shares and any income expected from them may

go down as well as up and investors may not get back the full

amount invested upon disposal of the shares. Past performance is no

guide to future performance. The contents of this Announcement are

not to be construed as legal, business, financial or tax advice.

Each investor or prospective investor should consult his, her or

its own legal adviser, business adviser, financial adviser or tax

adviser for legal, financial, business or tax advice.

Information to Distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the Product Governance

Requirements) may otherwise have with respect thereto, the Placing

Shares have been subject to a product approval process, which has

determined that the Placing Shares are: (i) compatible with an end

target market of investors who meet the criteria of professional

clients and eligible counterparties, each as defined in MiFID II;

and (ii) eligible for distribution through all distribution

channels as are permitted by MiFID II (the "Target Market

Assessment"). Notwithstanding the Target Market Assessment,

Distributors should note that: the price of the Placing Shares may

decline and investors could lose all or part of their investment;

the Placing Shares offer no guaranteed income and no capital

protection; and an investment in the Placing Shares is compatible

only with investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom. The Target

Market Assessment is

without prejudice to the requirements of any contractual, legal

or regulatory selling restrictions in relation to the Initial

Placing. Furthermore, it is noted that, notwithstanding the Target

Market Assessment, the Joint Bookrunners will only procure

investors who meet the criteria of professional clients and

eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

DEFINITIONS USED IN THIS ANNOUNCEMENT

"Admission" means admission of the Placing Shares to trading on

AIM and ESM under the Share Issuance Programme;

"AIFMD" means Alternative Investment Fund Managers Directive

(Directive 2011/61/EU);

"AIM" means the Alternative Investment Market, a market

regulated by the London Stock Exchange;

"Announcement" means this announcement and the Appendix;

"Board" means the board of Directors or a duly constituted

committee thereof;

"Bookbuild" means a bookbuilding process in respect of the

Initial Placing;

"Circular" means a circular setting out full details of the

proposals to be considered at the EGM in respect of the Share

Issuance Programme, including the notice of EGM;

"Davy" means J&E Davy, trading as Davy including its

affiliate Davy Corporate Finance and other affiliates, or any of

its subsidiary undertakings;

"Directors" means the directors from time to time of the Company

and Director is to be construed accordingly;

"ESM" means the Enterprise Securities Market, a market regulated

by Euronext Dublin;

"Euronext Dublin" means the Irish Stock Exchange plc trading as

Euronext Dublin;

"EGM" means the extraordinary general meeting of the Company to

consider the Proposals, convened for 9.00 a.m. on 1 August 2018 or

any adjournment thereof, notice of which is set out in the

Circular;

"Joint Bookrunners" and each a "Joint Bookrunner" means Davy and

RBC;

"Initial Placing" means the placing of the Placing Shares

pursuant to the first tranche of Share Issuance Programme;

"Investment Manager" means Greencoat Capital LLP;

"IPO" means the Company's initial offering and listing of its

Ordinary Shares on the AIM of the LSE and the ESM of Euronext

Dublin in July 2017, raising EUR270 million through the issue of

270 million Ordinary Shares at an issue price of EUR1.00 per

Ordinary Share;

"London Stock Exchange" or "LSE" means the London Stock Exchange

plc;

"MAR" means Market Abuse Regulation (EU) No 596/2014;

"New Shares" means the new Ordinary Shares to be issued pursuant

to the Share Issuance Programme;

"Ordinary Share" means an ordinary share of EUR0.01 each in the

capital of the Company;

"Placees" means new and existing eligible investors under the

Share Issuance Programme;

"Placing Agreement" means the placing agreement between the

Company, the Investment Manager and the Joint Bookrunners dated 9

July 2018;

"Placing Price" means EUR1.01 per Placing Share;

"Placing Shares" means approximately 100 million New Shares that

the Company is seeking to issue in the Initial Placing;

"Prohibited Jurisdiction" means any jurisdiction including,

without limitation, the United States, Canada, Australia, Japan,

the Republic of South Africa or any other jurisdiction in which

such offer or solicitation of New Shares is or may be unlawful;

"Q2 Dividend" means the 1.5 cent per Ordinary Share dividend

payable by the Company with respect to the quarter ended 30 June

2018;

"RBC" means RBC Europe Limited (trading as RBC Capital

Markets);

"Revolving Credit Facility" means the revolving credit facility

entered into by the Company on 19 December 2017;

"Share Issuance Programme" means the proposed placing of up to

250 million New Shares pursuant to the Initial Placing and, if

applicable, any subsequent placings prior to the closing date of

the Share Issuance Programme; and

"Shareholder" means a registered holder of an Ordinary

Share.

APPIX

TERMS AND CONDITIONS OF THE INTIAL PLACING

IMPORTANT INFORMATION FOR PLACEES ONLY

MEMBERS OF THE PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN THE

INITIAL PLACING. THIS ANNOUNCEMENT AND THE TERMS AND CONDITIONS SET

OUT AND REFERRED TO HEREIN ARE DIRECTED ONLY AT PERSONS SELECTED BY

THE JOINT BOOKRUNNERS WHO ARE:

(A) Persons in the following Member States of the European

Economic Area: Ireland, the United Kingdom, Belgium, France,

Germany, the Netherlands, Spain and Sweden (together, the "Eligible

Member States") who are "professional investors" for the purposes

of directive 2011/61/EU as amended (the "alternative investment

fund managers directive" or "AIFMD") AND

(B) IF IN THE UNITED KINGDOM, PERSONS WHO (I) HAVE PROFESSIONAL

EXPERIENCE IN MATTERS RELATING TO INVESTMENTS WHO FALL WITHIN THE

DEFINITION OF "INVESTMENT PROFESSIONALS" IN ARTICLE 19(5) OF THE

FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER

2005 AS AMED (THE "FPO") OR FALL WITHIN THE DEFINITION OF "HIGH NET

WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS ETC" IN ARTICLE

49(2)(A) TO (D) OF THE FPO AND (II) ARE "QUALIFIED INVESTORS" AS

DEFINED IN SECTION 86 OF THE FINANCIAL SERVICES AND MARKETS ACT

2000 ("FSMA") OR

(C) OTHERWISE PERSONS TO WHOM IT MAY OTHERWISE LAWFULLY BE

COMMUNICATED (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS

"RELEVANT PERSONS"). THIS ANNOUNCEMENT AND THE TERMS AND CONDITIONS

SET OUT HEREIN MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE

NOT RELEVANT PERSONS.

DISTRIBUTION OF THIS ANNOUNCEMENT IN CERTAIN JURISDICTIONS MAY

BE RESTRICTED OR PROHIBITED BY LAW. PERSONS DISTRIBUTING THIS

ANNOUNCEMENT MUST SATISFY THEMSELVES THAT IT IS LAWFUL TO DO

SO.

THE INFORMATION CONTAINED HEREIN IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, AUSTRALIA, THE REPUBLIC OF SOUTH AFRICA, CANADA, NEW

ZEALAND, JAPAN, ANY INELIGIBLE MEMBER STATE OR ANY JURISDICTION IN

WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT (AND THE INFORMATION CONTAINED HEREIN) DOES NOT

CONSTITUTE AN OFFER OF SECURITIES FOR SALE IN THE UNITED STATES,

AUSTRALIA, THE REPUBLIC OF SOUTH AFRICA, CANADA, NEW ZEALAND,

JAPAN, ANY INELIGIBLE MEMBER STATE OR IN ANY OTHER JURISDICTION IN

WHICH THE SAME WOULD BE UNLAWFUL (EACH A "PROHIBITED

JURISDICTION").

THE PLACING SHARES (AS DEFINED BELOW) HAVE NOT BEEN AND WILL NOT

BE REGISTERED UNDER THE US SECURITIES ACT OF 1933 (THE "SECURITIES

ACT"), OR UNDER THE APPLICABLE SECURITIES LAWS OF ANY STATE OR

OTHER JURISDICTION OF THE UNITED STATES, AND MAY NOT BE OFFERED,

SOLD, TAKEN UP, RESOLD, TRANSFERRED OR DELIVERED, DIRECTLY OR

INDIRECTLY WITHIN, INTO OR IN THE UNITED STATES, EXCEPT PURSUANT TO

AN APPLICABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO,

THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN

COMPLIANCE WITH THE SECURITIES LAWS OF ANY RELEVANT STATE OR OTHER

JURISDICTION OF THE UNITED STATES. THERE WILL BE NO PUBLIC OFFER OF

THE PLACING SHARES IN THE UNITED STATES.

This Announcement and any offer if made subsequently is subject

to the Alternative Investment Fund Managers Directive as

implemented by Member States of the European Economic Area. This

Announcement and any offer if made subsequently is directed only at

professional investors in the Eligible Member States. The

Investment Manager has not registered a passport for marketing

under the passporting programme set out in the AIFMD in any other

member state (each an "Ineligible Member State"). This Announcement

may not be distributed in any Ineligible Member State and no offers

subsequent to it may be made or accepted in any Ineligible Member

State. The attention of all prospective investors is drawn to

disclosures required to be made under the AIFMD which are set out

on the Company's website (including as set out in its most recent

annual report and accounts).

This Announcement and the information contained herein are not

for publication or distribution, directly or indirectly, to persons

in a Prohibited Jurisdiction unless permitted pursuant to an

exemption under the relevant local law or regulation in any such

jurisdiction. No action has been taken by Greencoat Renewables PLC

(the "Company" or "Greencoat Renewables"), the Joint Bookrunners or

any of their respective Affiliates (as defined below) that would

permit an offer of the Placing Shares or possession or distribution

of this Announcement or any other publicity material relating to

such Placing Shares in any jurisdiction where action for that

purpose is required. Persons receiving this Announcement are

required to inform themselves about and to observe any such

restrictions. Any investment or investment activity to which this

Announcement and the information contained herein relate is

available only to Relevant Persons.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement should seek appropriate advice before taking

any action.

Any indication in this Announcement of the price at which the

Ordinary Shares of the Company have been bought or sold in the past

cannot be relied upon as a guide to future performance. Persons

needing advice should consult an independent financial adviser. No

statement in this Announcement is intended to be a profit forecast

and no statement in this Announcement should be interpreted to mean

that earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings per share of the Company.

Information to distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the Product Governance

Requirements) may otherwise have with respect thereto, the Placing

Shares have been subject to a product approval process, which has

determined that the Placing Shares are: (i) compatible with an end

target market of (a) investors who meet the criteria of

professional clients and (b) eligible counterparties, each as

defined in MiFID II; and (ii) eligible for distribution through all

distribution channels as are permitted by MiFID II (the "Target

Market Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

Shares offer no guaranteed income and no capital protection; and an

investment in the Placing Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who

(either alone or in conjunction with an appropriate financial or

other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom. The Target Market

Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Initial Placing. Furthermore, it is noted that,

notwithstanding the Target Market Assessment, the Joint Bookrunners

will only procure investors who meet the criteria of professional

clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

Davy, which is regulated in Ireland by the Central Bank of

Ireland is acting as a Joint Bookrunner for the Company and no-one

else in connection with the Share Issuance Programme and the

Initial Placing and is not, and will not be, responsible to anyone

other than the Company for providing the protections afforded to

its clients nor for providing advice in relation to the Share

Issuance Programme, the Initial Placing and/or any other matter

referred to in this Announcement.

RBC, which is authorised in the United Kingdom by the Prudential

Regulatory Authority and regulated by the FCA and the Prudential

Regulatory Authority, which is authorised and regulated in the

United Kingdom by the FCA is acting for the Company and for no one

else in connection with the Share Issuance Programme and the

Initial Placing and is not, and will not be, responsible to anyone

other than the Company for providing the protections afforded to

its clients nor for providing advice in relation to the Share

Issuance Programme, the Initial Placing and/or any other matter

referred to in this Announcement.

By participating in the Initial Placing, each person who is

invited to and who chooses to participate in the Initial Placing (a

"Placee") by making or accepting an oral offer to take up Placing

Shares is deemed to have read and understood this Announcement in

its entirety (including this Appendix) and to be providing the

representations, warranties, undertakings, agreements and

acknowledgements contained herein.

EACH PLACEE SHOULD CONSULT WITH ITS OWN ADVISERS AS TO LEGAL,

REGULATORY, TAX, BUSINESS AND RELATED ASPECTS OF AN ACQUISITION OF

PLACING SHARES.

Details of the Placing Agreement and the Placing Shares

The Company has today entered into a placing agreement (the

"Placing Agreement") with the Joint Bookrunners and the Investment

Manager. Pursuant to the Placing Agreement, the Joint Bookrunners

have, subject to the terms set out therein, severally agreed to use

their respective reasonable endeavours, as agents of the Company,

to procure Placees for the Placing Shares (the "Initial Placing").

No element of the Initial Placing is underwritten.

The Placing Shares will, when issued be subject to the articles

of association of the Company, be credited as fully paid and will

rank pari passu in all respects with each other and with the

existing Ordinary Shares in the capital of the Company, including

the right to receive dividends (but excluding for the avoidance of

doubt, the Q2 Dividend) and other distributions declared, made or

paid in respect of the Ordinary Shares after the date of issue of

the Placing Shares.

The Placing Shares will be issued free of any encumbrance, lien

or other security interest.

Completion of the Initial Placing is conditional, inter alia,

upon the passing of the Resolutions set out in the Circular.

Application for listing and admission to trading

The Company will apply to Euronext Dublin and to the London

Stock Exchange for the Placing Shares to be admitted to trading on

ESM and AIM respectively ("Admission"). It is expected that

Admission will become effective on or around 8.00 a.m.

(Dublin/London time) on 2 August 2018, and that dealings in the

Placing Shares will commence at that time.

Bookbuild

Commencing today, the Joint Bookrunners will be conducting a

bookbuilding process (the "Bookbuilding Process") to determine

demand for participation in the Initial Placing by Placees. This

announcement gives details of the terms and conditions of, and the

mechanics of participation in, the Initial Placing.

Participation in, and principal terms of, the Bookbuilding

Process

Participation in the Initial Placing will only be available to

persons who may lawfully be, and are, invited to participate by the

Joint Bookrunners (or either of them). The Joint Bookrunners and

their respective Affiliates are entitled to participate as Placees

in the Bookbuilding Process.

The books will open with immediate effect. The Bookbuilding

Process is expected to close not later than 5 p.m. (Dublin/London

time) on 23 July 2018, but may be closed earlier at the discretion

of the Joint Bookrunners. A further announcement will be made

following the close of the Bookbuilding Process detailing the

number of Placing Shares which are being placed (the "Placing

Results Announcement"). The Joint Bookrunners may, in agreement

with the Company, accept bids that are received after the

Bookbuilding Process has closed.

A bid in the Bookbuilding Process will be made on the terms and

conditions in this Announcement and will be legally binding on the

Placee on behalf of which it is made and, except with the Joint

Bookrunners' consent, will not be capable of variation or

revocation after the close of the Bookbuilding Process.

A Placee who wishes to participate in the Bookbuilding Process

should communicate its bid by telephone to the usual sales contact

at Davy or RBC. Each bid should state the number of Placing Shares

which the prospective Placee wishes to subscribe for at the Initial

Placing Price. If successful, the relevant Joint Bookrunner will

re-contact and confirm orally to Placees following the close of the

Bookbuilding Process the size of their respective allocations and a

trade confirmation will be dispatched as soon as possible

thereafter. The relevant Joint Bookrunner's oral confirmation of

the size of allocations and each Placee's oral commitments to

accept the same will constitute an irrevocable legally binding

agreement upon such person (who will at that point become a Placee)

in favour of the Company and such Joint Bookrunner pursuant to

which each such Placee will be required to accept the number of

Initial Placing Shares allocated to the Placee at the Initial

Placing Price and otherwise on the terms and subject to the

conditions set out herein and in accordance with the Company's

articles of association. Each Placee's allocation and commitment

will be evidenced by a trade confirmation issued to such Placee by

the Joint Bookrunner. The terms of this Appendix will be deemed

incorporated in that trade confirmation. Each such Placee will have

an immediate, separate, irrevocable and binding obligation, owed to

the relevant Joint Bookrunner, to pay it or (as it may direct) one

of its Affiliates in cleared funds an amount equal to the product

of the Initial Placing Price and the number of Placing Shares

allocated to such Placee. By participating in the Bookbuild, each

Placee agrees that its rights and obligations in respect of the

Initial Placing will terminate only in the circumstances described

below and will not be capable of rescission or termination by the

Placee after confirmation (oral or otherwise) by a Joint

Bookrunner.

The Joint Bookrunners reserve the right to scale back the number

of Placing Shares to be subscribed by any Placee in the event of an

oversubscription under the Initial Placing. The Manager also

reserves the right not to accept offers to subscribe for Placing

Shares or to accept such offers in part rather than in whole. The

acceptance of offers shall be at the absolute discretion of the

Joint Bookrunners. The Joint Bookrunners shall be entitled to

effect the Initial Placing by such alternative method to the

Bookbuilding Process as they shall in their absolute discretion

determine. The Company reserves the right (upon agreement with the

Joint Bookrunners) to reduce or seek to increase the amount to be

raised pursuant to the Initial Placing.

To the fullest extent permissible by law, neither Joint

Bookrunner, nor any holding company thereof, any subsidiary

thereof, any subsidiary of any such holding company, any branch,

affiliate or associated undertaking of any such company nor any of

their respective directors, officers and employees (each an

"Affiliate") nor any person acting on their behalf shall have any

liability to Placees (or to any other person whether acting on

behalf of a Placee or otherwise). In particular, neither Joint

Bookrunner, nor any of their respective Affiliates nor any person

acting on their behalf shall have any liability (including, to the

extent legally permissible, any fiduciary duties), in respect of

its conduct of the Bookbuilding Process or of such alternative

method of effecting the Initial Placing as the Joint Bookrunners

and the Company may determine. No commissions will be paid to

Placees or by Placees in respect of any Placing Shares.

Each Placee's obligations will be owed to the Company and to the

relevant Joint Bookrunner. Following the oral confirmation referred

to above, each Placee will also have an immediate, separate,

irrevocable and binding obligation, owed to the Company and the

relevant Joint Bookrunner as agent of the Company, to pay to the

relevant Joint Bookrunner (or as it may direct) in cleared funds an

amount equal to the product of the Initial Placing Price and the

number of Placing Shares such Placee has agreed to acquire. The

Joint Bookrunners will procure the allotment of the Placing Shares

to each Placee following each Placee's payment to the Manager of

such amount.

All obligations of the Joint Bookrunners under the Initial

Placing will be subject to fulfilment of the conditions referred to

below under "Conditions of the Placing".

Conditions of the Initial Placing

The Initial Placing is conditional upon the Placing Agreement

becoming unconditional and not having been terminated in accordance

with its terms.

The obligations of the Joint Bookrunners under the Placing

Agreement are conditional, inter alia, on:

1. none of the representations and warranties on the part of the

Company and the Investment Manager contained in the Placing

Agreement being untrue or inaccurate, in any material respect, or

misleading on and as of the date of the Placing Agreement and at

all times between the date of the Placing Agreement and Admission,

as though they had been given and made by reference to the facts

and circumstances then subsisting;

2. the performance by the Company and the Investment Manager of

their respective obligations and undertakings under the Placing

Agreement insofar as they fall to be performed prior to

Admission;

3. the Resolutions having been duly passed at the EGM; and

4. Admission occurring not later than 8.00 a.m. (Dublin/London

time) on 2 August 2018 or such later time as the Company and the

Joint Bookrunners may agree in writing (but in any event not later

than 8.00 a.m. (Dublin/London time) on 9 August 2018).

If (a) any condition is not satisfied in all respects (or to the

extent permitted under the Placing Agreement waived by the Joint

Bookrunners), or (b) the Placing Agreement is terminated in the

circumstances specified below, the Initial Placing will lapse and

each Placee's rights and obligations hereunder shall cease and

determine at such time and no claim may be made by a Placee in

respect thereof. Neither the Joint Bookrunners, nor the Company,

nor any of their respective Affiliates shall have any liability to

any Placee (or to any other person whether acting on behalf of a

Placee or otherwise) in respect of any decision it may make as to

whether or not to waive or to extend the time and/or date for the

satisfaction of any condition in the Initial Placing Agreement or

in respect of the Initial Placing generally.

By participating in the Initial Placing, each Placee agrees that

its rights and obligations hereunder terminate only in the

circumstances described below under "Right to terminate under the

Placing Agreement", and will not be capable of rescission or

termination by the Placee.

Right to terminate under the Placing Agreement

The Joint Bookrunners may, at any time before Admission,

terminate the Placing Agreement by giving notice to the Company and

the Investment Manager if, inter alia:

1. there has been a breach, by the Company or the Investment

Manager, of any of the representations, warranties or undertakings

in the Placing Agreement which, in the good faith opinion of either

of the Joint Bookrunners, is material; or

2. it comes to the notice of the Joint Bookrunners that any

statement contained in this Announcement, or any other document or

announcement issued or published by or on behalf of the Company in

connection with the Initial Placing, is or has become untrue,

incorrect or misleading and which, in the good faith opinion of

either of the Joint Bookrunners, is material; or

3. in the reasonable opinion of either of the Joint Bookrunners

there shall have been a material adverse change (whether or not

foreseeable at the date of the Placing Agreement) in the condition

(financial, operational, legal or otherwise) or in the trading

position, earnings, management, business affairs, solvency, credit

rating or prospects of the Company, the Group or Investment

Manager, whether or not arising in the ordinary course of business;

or

4. there occurs, in the good faith opinion of either of the

Joint Bookrunners, any material adverse change in the financial

markets in the United States, the United Kingdom or in any member

or associate member of the European Union or the international

financial markets, any outbreak or escalation of hostilities, war,

act of terrorism, declaration of emergency or martial law or other

calamity or crisis or event or any change or development involving

a prospective change in national or international political,

financial, economic, monetary or market conditions or currency

exchange rates or controls, the effect of which (either singly or

together) is such as to make it in the good faith judgement of

either of the Joint Bookrunners impracticable or inadvisable to

market the Placing Shares or to enforce contracts for sale of or

subscription for the Placing Shares, or which may prejudice the

success of the Initial Placing or dealings in Placing Shares in the

secondary market.

By participating in the Initial Placing, each Placee agrees with

the Joint Bookrunners that the exercise (or the refraining from

exercise) by the Joint Bookrunners of any right of termination or

other discretion under the Placing Agreement shall be within the

absolute discretion of the Joint Bookrunners and that the Joint

Bookrunners need not make any reference to the Placees in this

regard and that, to the fullest extent permitted by law, the Joint

Bookrunners shall have no liability whatsoever to the Placees in

connection with any such exercise.

Lock-up

The Company has undertaken to the Joint Bookrunners that,

between the date of the Placing Agreement and 180 days after

Admission, it will not, without the prior written consent of the

Joint Bookrunners enter into certain transactions involving or

relating to the Ordinary Shares, subject to certain carve-outs

agreed between the Joint Bookrunners and the Company.

By participating in the Initial Placing, Placees agree that the

exercise by the Joint Bookrunners of any power to grant consent to

waive the undertaking by the Company of a transaction which would

otherwise be subject to the lock-up under the Placing Agreement

shall be within the absolute discretion of the Joint Bookrunners

and that they need not make any reference to, or consultation with,

Placees and that they shall have no liability to Placees whatsoever

in connection with any such exercise of the power to grant

consent.

No prospectus or admission document

No prospectus or admission document has been or will be prepared

in relation to the Initial Placing and no such prospectus or

admission document is required (in accordance with the Directive

2003/71/EC as amended (the "Prospectus Directive") and the AIM

Rules and ESM Rules respectively) to be published and Placees'

commitments will be made solely on the basis of the information

contained in this Announcement and any information previously

published by or on behalf of the Company by notification to a

Regulatory Information Service. Each Placee, by accepting a

participation in the Initial Placing, agrees that the content of

this Announcement is exclusively the responsibility of the Company

and confirms to the Joint Bookrunners and the Company that it has

neither received nor relied on any information, representation,

warranty or statement made by or on behalf of the Joint Bookrunners

(other than the amount of the relevant Placing participation in the

oral confirmation given to Placees and the trade confirmation

referred to below), any of their respective Affiliates, nor any

persons acting on their behalf or the Company and neither the Joint

Bookrunners nor any of their respective Affiliates, any persons

acting on their behalf, nor the Company will be liable for the

decision of any Placee to participate in the Initial Placing based

on any other information, representation, warranty or statement

which the Placee may have obtained or received (regardless of

whether or not such information, representation, warranty or

statement was given or made by or on behalf of any such persons).

By participating in the Initial Placing, each Placee acknowledges

to and agrees with the Joint Bookrunners for itself and as agent

for the Company that, except in relation to the information

contained in this Announcement, it has relied on its own

investigation of the business, financial or other position of the

Company in deciding to participate in the Initial Placing. Nothing

in this paragraph shall exclude the liability of any person for

fraudulent misrepresentation.

Registration and settlement

Settlement of transactions in the Placing Shares (ISIN

IE00BF2NR112) following Admission will take place within the CREST

system, using the DVP mechanism, subject to certain exceptions. The

Joint Bookrunners reserve the right to require settlement for and

delivery of the Placing Shares to Placees by such other means that

they deem necessary, if delivery or settlement is not possible or

practicable within the CREST system within the timetable set out in

this announcement or would not be consistent with the regulatory

requirements in the Placee's jurisdiction.

Each Placee allocated Placing Shares in the Initial Placing will

be sent a trade confirmation stating the number of Placing Shares

allocated to it, the Placing Price, the aggregate amount owed by

such Placee to the Manager and settlement instructions. Placees

should settle against CREST ID: 189 for Davy and CREST ID: 388 for

RBC. It is expected that such trade confirmation will be despatched

on 24 July 2018 and that this will also be the trade date. Each

Placee agrees that it will do all things necessary to ensure that

delivery and payment is completed in accordance with either the

standing CREST or certificated settlement instructions which it has

in place with the Joint Bookrunners.

It is expected that settlement will be on 2 August 2018 on a DVP

basis in accordance with the instructions set out in the trade

confirmation unless otherwise notified by the Joint

Bookrunners.

Interest is chargeable daily on payments not received from

Placees on the due date in accordance with the arrangements set out

above at the rate of two percentage points above the base rate of

LIBOR as determined by the Joint Bookrunners.

Each Placee is deemed to agree that if it does not comply with

these obligations, the Joint Bookrunners may sell any or all of the

Placing Shares allocated to the Placee on such Placee's behalf and

retain from the proceeds, for the Joint Bookrunners' own account

and profit, an amount equal to the aggregate amount owed by the

Placee plus any interest due. The Placee will, however, remain

liable for any shortfall below the aggregate amount owed by such

Placee and it may be required to bear any stamp duty or stamp duty

reserve tax (together with any interest or penalties) which may

arise upon the sale of such Placing Shares on such Placee's

behalf.

If Placing Shares are to be delivered to a custodian or

settlement agent, the Placee should ensure that the trade

confirmation is copied and delivered immediately to the relevant

person within that organisation.

Insofar as Placing Shares are registered in the Placee's name or

that of its nominee or in the name of any person for whom the

Placee is contracting as agent or that of a nominee for such

person, such Placing Shares will, subject as provided below, be so

registered free from any liability to stamp duty or stamp duty

reserve tax. If there are any circumstances in which any other

stamp duty or stamp duty reserve tax is payable in respect of the

issue of the Placing Shares, neither the Joint Bookrunners nor the

Company shall be responsible for the payment thereof. Placees will

not be entitled to receive any fee or commission in connection with

the Initial Placing.

Representations and Warranties

By participating in the Initial Placing, each Placee (and any

person acting on such Placee's behalf):

1. represents and warrants that it has read and understood this

Announcement in its entirety (including this Appendix) and

acknowledges that its participation in the Initial Placing will be

governed by the terms of this announcement (including this

Appendix);

2. acknowledges that no prospectus, admission document or

offering document has been or will be prepared in connection with

the Initial Placing; and it has not received and will not receive a

prospectus, admission document or other offering document in

connection with the Bookbuilding Process, the Initial Placing or

the Placing Shares;

3. agrees to indemnify on an after-tax basis and hold harmless

each of the Company, the Joint Bookrunners, their respective

Affiliates and any person acting on their behalf from any and all

costs, claims, liabilities and expenses (including legal fees and

expenses) arising out of or in connection with any breach of the

representations, warranties, acknowledgements, agreements and

undertakings in this Announcement and further agrees that the

provisions of this Announcement shall survive after completion of

the Initial Placing;

4. acknowledges that the Placing Shares of the Company will be

admitted to trading on ESM and AIM, and the Company is therefore

required to publish certain business and financial information in

accordance with the rules and practices of Euronext Dublin, the

London Stock Exchange and the Market Abuse Regulation (EU

Regulation No. 596/2014 (the "MAR") (collectively, the "Exchange

Information") and that the Placee is able to obtain or access the

Exchange Information without undue difficulty;

5. acknowledges that neither the Joint Bookrunners, nor any of

their respective Affiliates nor any person acting on their behalf

has provided, and will not provide it with any material or

information regarding the Placing Shares or the Company; nor has it

requested the Joint Bookrunners, nor any of their respective

Affiliates nor any person acting on their behalf to provide it with

any such material or information;

6. acknowledges that the content of this announcement is

exclusively the responsibility of the Company and that neither the

Joint Bookrunners, nor any of their respective Affiliates nor any

person acting on their behalf will be responsible for or shall have

any liability for any information, representation or statement

relating to the Company contained in this Announcement or any

information previously published by or on behalf of the Company and

neither the Joint Bookrunners, nor any of their respective

Affiliates nor any person acting on their behalf will be liable for

any Placee's decision to participate in the Initial Placing based

on any information, representation or statement contained in this

Announcement or otherwise. Each Placee further represents, warrants

and agrees that the only information on which it is entitled to

rely and on which such Placee has relied in committing to subscribe

for the Placing Shares is contained in this Announcement and any

Exchange Information, such information being all that it deems

necessary to make an investment decision in respect of the Placing

Shares, and that it has relied on its own investigation with

respect to the Placing Shares and the Company in connection with

its decision to subscribe for the Placing Shares and acknowledges

that it is not relying on any investigation that the Joint

Bookrunners, any of their respective Affiliates or any person

acting on their behalf may have conducted with respect to the

Placing Shares or the Company and none of such persons has made any

representations to it, express or implied, with respect

thereto;

7. acknowledges that it has knowledge and experience in

financial, business and international investment matters as is

required to evaluate the merits and risks of subscribing for the

Placing Shares. It further acknowledges that it is experienced in

investing in securities of this nature and is aware that it may be

required to bear, and is able to bear, the economic risk of, and is

able to sustain, a complete loss in connection with the Initial

Placing. It has had sufficient time to consider and conduct its own

investigation with respect to the offer and subscription for the

Placing Shares, including the tax, legal and other economic

considerations and has relied upon its own examination and due

diligence of the Company and its affiliates taken as a whole, and

the terms of the Initial Placing, including the merits and risks

involved;

8. represents and warrants that it if it has received any inside

information (for the purposes of the MAR or other applicable law)

about the Company in advance of the Initial Placing, it has not (a)

dealt (or attempted to deal) in the securities of the Company; (b)

encouraged, recommended or induced another person to deal in the

securities of the Company; or (c) unlawfully disclosed such

information to any person, prior to the information being made

publicly available;

9. acknowledges that it has not relied on any information

relating to the Company contained in any research reports prepared

by the Joint Bookrunners, their respective Affiliates or any person

acting on their behalf and understands that (i) neither the Joint

Bookrunners, nor any of their respective Affiliates nor any person

acting on their behalf has or shall have any liability for public

information or any representation; (ii) neither the Joint

Bookrunners, nor any of their respective Affiliates nor any person

acting on their behalf has or shall have any liability for any

additional information that has otherwise been made available to

such Placee, whether at the date of publication, the date of this

Announcement or otherwise; and that (iii) neither the Joint

Bookrunners, nor any of their respective Affiliates nor any person

acting on their behalf makes any representation or warranty,

express or implied, as to the truth, accuracy or completeness of

such information, whether at the date of publication, the date of

this Announcement or otherwise;

10. represents and warrants that (i) it is entitled to acquire

the Placing Shares under the laws and regulations of all relevant

jurisdictions which apply to it; (ii) it has fully observed such

laws and regulations and obtained all such governmental and other

guarantees and other consents and authorities which may be required

thereunder and complied with all necessary formalities; (iii) it

has all necessary capacity to commit to participation in the

Initial Placing and to perform its obligations in relation thereto

and will honour such obligations; (iv) it has paid any issue,

transfer or other taxes due in connection with its participation in

any territory; and (v) it has not taken any action which will or

may result in the Company, the Joint Bookrunners, any of their

respective Affiliates or any person acting on their behalf being in

breach of the legal and/or regulatory requirements of any territory

in connection with the Initial Placing;

11. it and each account it represents is not, and at the time

the Placing Shares are subscribed for, neither it nor the

beneficial owner of the Placing Shares will be, a citizen, resident

or national of Australia, the Republic of South Africa, Canada,

Japan, New Zealand, any Ineligible Member State or any jurisdiction

in which it would be unlawful to make or accept an offer of the

Placing Shares and acknowledges that the Placing Shares have not

been and will not be registered under the securities legislation of

Australia, the Republic of South Africa, Canada, Japan, New Zealand

or any Ineligible Member State and, subject to certain exceptions,

may not be offered, sold, transferred, taken up, renounced,

distributed or delivered, directly or indirectly, within or into

those jurisdictions;

12. it will not distribute, forward, transfer or otherwise

transmit this Announcement or any other materials concerning the

Initial Placing (including any electronic copies thereof), in or

into the United States, Australia, the Republic of South Africa,

Canada, Japan, New Zealand or any Ineligible Member State;

13. represents and warrants that it understands that the Placing

Shares have not been and will not be registered under the

Securities Act or under the securities laws of any state or other

jurisdiction of the United States and may only be acquired in

"offshore transactions" as defined in and pursuant to Regulation S

under the Securities Act or in transactions exempt from or not

subject to the registration requirements of the Securities Act;

14. represents and warrants that its acquisition of the Placing

Shares has been or will be made in an "offshore transaction" as

defined in and pursuant to Regulation S under the Securities

Act;

15. represents and warrants that it will not offer or sell,

directly or indirectly, any of the Placing Shares in the United

States except in accordance with Regulation S or pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act;

16. understands that upon the initial issuance of, and until

such time as the same is no longer required under the Securities

Act or applicable securities laws of any state or other

jurisdiction of the United States, any certificates representing

the Placing Shares (to the extent such Placing Shares are in

certificated form), and all certificates issued in exchange

therefore or in substitution thereof, shall bear a legend setting

out the restrictions relating to the transfer of the certificated

security including with respect to restrictions relating to the

United States federal securities laws;

17. represents and warrants that, if it is a financial

intermediary, as that term is used in Article 3(2) of the

Prospectus Directive, the Placing Shares purchased by it in the

Initial Placing will not be acquired on a non-discretionary basis

on behalf of, nor will they be acquired with a view to their offer

or resale to, persons in an Ineligible Member State or an Eligible

Member State which has implemented the Prospectus Directive other

than to persons (i) who are: "qualified investors" as defined in

Article 2.1(e) of the Prospectus Directive or who otherwise fall