Gulf Investment Fund PLC Quarterly Report 30 September 2023 (2716Q)

October 16 2023 - 10:00AM

UK Regulatory

TIDMGIF

RNS Number : 2716Q

Gulf Investment Fund PLC

16 October 2023

16 October 2023

Legal Entity Identifier: 2138009DIENFWKC3PW84

30 September 2023

Gulf Investment Fund plc (GIF) Quarterly Report for 3 months to

30 September 2023

-- Net Asset Value (NAV) down 1.0 per cent (S&P GCC Index

down 1.5 per cent).

-- Outlook for the GCC remains good with socio-economic reforms,

tourism initiatives and mega infrastructure projects.

Performance

GIF outperformed its benchmark (S&P GCC Composite Index) in

the quarter by 0.6 per cent. The fund was helped by a slight

underweight in Saudi Arabia (which was down 3.5 per cent) and

Kuwait (down 2.0 per cent) and being overweight in Dubai (up 9.8%)

and Qatar (up 1.8 per cent). In the nine months to the end of

September the GIF NAV is ahead 19.4 per cent, outperforming the

benchmark by 15.7 per cent.

In terms of stocks, positive performance came from holdings in

Gulf International Services (up 61.1% in the quarter), Emaar

properties (up 25.4%), Qatar Insurance Company (up 23.0%), Emirates

National Bank of Dubai (up 19.9%) and Maharah Human Resources (up

17.8%).

Holdings that contributed negatively were Middle East Healthcare

(down 22.1%), Banque Saudi Fransi (down 12.5%) and Saudi National

Bank (down 10.9%).

On 30 September 2023, the GIF share price was trading at a 0.5

per cent discount to NAV (five-year average discount 6.5 per

cent).

Portfolio changes

During the quarter GIF increased exposure to financials,

industrials, and energy sectors, as valuations look undemanding

coupled with attractive growth profiles.

The financial sector weighting increased to 38.5 per cent of NAV

from 35.0 per cent in 3Q 2023, as Dubai Islamic Bank joined the

portfolio. Dubai Islamic Bank has a well-diversified financing book

with loan growth expected in 2023.

Exposure to the industrial sector increased from 27.9 per cent

to 29.6 per cent as newly listed Lumi Rental Company and

soon-to-listed Ades Holding Company were added to the portfolio.

Lumi surged 30 per cent at its trading debut having been 94 times

subscribed. With a vehicle fleet of c.22,000, it is well placed to

capture car leasing demand and tourism growth in Saudi Arabia.

Meanwhile, ADES is one of the largest drillers in the MENA region

which is expected to benefit from a ramp up in rig deployment as

well higher charter rates for rigs.

GIF also added a holding in Saudi Airlines Catering. This is the

single largest airline catering company in Saudi Arabia and is a

beneficiary of catering demand for operations tied to the Giga

projects.

The fund's weighting in real estate rose from 4.8 per cent of

NAV to 5.0 per cent of NAV, as we added Barwa Real Estate into the

portfolio. The fund reduced exposure to materials, utilities and

consumer discretionary to capture better opportunities

elsewhere.

Relative to the benchmark, the fund remains overweight Qatar

(28.5 per cent vs an index weighting of 10.0 per cent) but is

underweight Saudi Arabia (51.7 per cent vs benchmark weight of 59.1

per cent), UAE (13.2 per cent vs benchmark weight of 19.2 per cent)

and Kuwait (4.8 per cent vs benchmark weight of 9.9 per cent).

Qatar still trades at a discount to its GCC peers, with an

undemanding 11 times earnings.

GIF ended the quarter with 28 holdings: 16 in Saudi Arabia, 8 in

Qatar, 3 in the UAE, and 1 in Kuwait; maintaining its concentrated

portfolio approach. The cash position stood at 1.7 per cent.

Outlook

Global financial markets are facing stronger headwinds on

increased interest rates, geopolitical tensions and rising bond

yields. GCC remains a relative bright spot on where these headwinds

are less and are offset by domestic resilience and sustained public

and private spending.

The outlook for the GCC remains good with mega infrastructure

projects, tourism initiatives and socio-economic reforms coming

through. The IMF projects GCC GDP growth to be 2.9 per cent and 3.3

per cent in 2023 and 2024. More importantly, non-oil GDP growth is

expected to be 4.2 per cent and 3.9 per cent in 2023 and 2024

respectively.

Tourism-related industries are a major driver of non-energy

growth. Visitors to Dubai increased by 20.1 per cent year on year

in the first half of 2023, with a record 8.6 million visitors,

surpassing pre-pandemic level of 8.4 million visitors. In Saudi

Arabia, tourism revenue surged 225 per cent to US$9.9 billion in Q1

2023 compared to Q1 2022. The country hosted 7.8 million tourists

in Q1 2023, which marked a 64 per cent increase versus pre pandemic

in Q1 2019. The Saudi government hopes to attract 100 million

visitors by 2030.

In its September report, OPEC retains its oil demand forecast

which sees year-on-year growth of 2.44 million bpd and 2.25 million

bpd respectively for 2023 and 2024.

The IMF projects GCC inflation at around 2.9 per cent and 2.3

per cent in 2023 and 2024. The lower inflation in the GCC economies

gives the necessary bandwidth to the GCC governments to continue

and/or increase their fiscal spending.

GIF Country Allocation as of 30 Sept 2023 Top 5 Holdings

===========================================

Company Country Sector % NAV

===========================================

Saudi National Bank Saudi Arabia Financials 7.9%

Qatar Navigation Qatar Industrials 7.4%

Qatar Gas Transport Qatar Energy 5.5%

Qatar Insurance Co. Qatar Financials 5.2%

Emirates NBD UAE Financials 5.1%

===================== ============== ========================================================= ======

Source: QIC; as of 30 Sept 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFSVITLRLIV

(END) Dow Jones Newswires

October 16, 2023 10:00 ET (14:00 GMT)

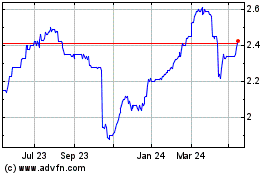

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Oct 2024 to Nov 2024

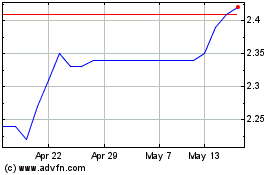

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Nov 2023 to Nov 2024