TIDMGIF

RNS Number : 7966I

Gulf Investment Fund PLC

21 April 2022

Legal Entity Identifier: 2138009DIENFWKC3PW84

21 April 2022

Gulf Investment Fund plc ("GIF" or the "Company")

Q1 2022 Investment Report

Gulf Investment Fund plc (LSE: GIF), today issues its Q1 2022

Investment Report for the period 1(st) January 2022 to 31(st) March

2022, a pdf copy of which can be obtained from GIF's website at:

www.gulfinvestmentfundplc.com.

GIF seeks exposure to emerging investment opportunities and

positive fundamental factors in the Gulf Cooperation Council

("GCC") region that have not yet been priced in by the market. The

Company invests in quoted equities in the region as well as

companies soon to be listed. The Investment Adviser invests using a

top-down approach monitoring macro trends and identifying promising

sectors and companies in GCC countries.

The Gulf Cooperation Council comprises: Bahrain, Kuwait, Oman,

Qatar, Saudi Arabia and the United Arab Emirates.

GIF Quarterly Report

3 months ended 31(st) March 2022

-- Net asset value (NAV) up 13.9 per cent (S&P GCC Composite

Index +16.8 per cent)

-- Shareholders received 2.47c per share dividend in the

quarter

-- Share price trading at a 1.6 per cent discount to NAV

(five-year average discount 11.4 per cent)

-- GCC growth on firm footing; high oil prices to strengthen

sovereign balance sheets

Performance

Performance

GIF's dividend adjusted NAV rose 13.9 per cent in the quarter,

while the Fund's benchmark, the S&P GCC total return index,

rose 16.8 per cent. A dividend of 2.47c per share was paid on 11

March 2022.

GIF underperformed its benchmark by 2.9 per cent as the fund was

underweight Saudi petrochemical and mining sectors which

outperformed significantly. Additionally, the fund was overweight

Dubai which rose 10.3 per cent, underperforming the benchmark. The

fund continues to be overweight Qatar, which has started to show

results, with Qatar up 16.4 per cent in the quarter.

The fund is overweight UAE, in particular Dubai, as we expect

the ongoing cyclical recovery to continue during the second half of

this year, led by supportive macroeconomic policies, a rebound in

tourism, and revival of regional economic activity. Dubai banks

form more than 10 per cent of our portfolio and trade at a discount

to regional peers, and they have a strong outlook. Capital market

reforms and a strong IPO pipeline will be supportive for Dubai

stocks in 2022.

Large portfolio holdings which contributed positively to

performance were Saudi Tadawul Group Holding Co (up 51.8%) which

owns the Saudi stock exchange, Alinma Bank (up 62.1%), Qatar

Islamic Bank (up 30.1%), Emaar Properties Company (up 22.7%). We

expect Saudi Tadawul group to benefit from increases in fees. We

believe Alinma bank is geared to higher interest rates and will

continue to benefit from higher lending growth in Saudi Arabia.

That said, relative performance was hit by lack of exposure to

Al Rajhi bank (which rose 13.3%), First Abu Dhabi bank (up 29.6%),

National bank of Kuwait (up 18.8%). We believe these names are

trading at expensive valuations.

On 31 March 2022, GIF share price was trading at a 1.6 per cent

discount to NAV. The five-year average discount is 11.4 per

cent.

GCC markets

MSCI World Index fell 5.5 per cent and MSCI EM Index was down

7.3 per cent. Energy and other commodity prices surged following

the Russia-Ukraine war and imposition of sanctions on Russia,

adding to inflation and supply chain fears. Crude oil (Brent)

soared to US$139 per barrel during the quarter following sanctions

on Russian oil. Brent ended the quarter 38.7 per cent higher at

US$108 per barrel.

The Gulf Cooperation Council (GCC) equity markets remained

largely insulated from the global sell-off. All GCC markets but

Oman posted double digit gains during the quarter. The S&P GCC

price index ended the quarter up 15.8 per cent, fueled by the oil

price rise. Among GCC markets, Abu Dhabi led the pack rising 17.2

per cent, followed by Qatar with a 16.4 per cent increase. Saudi

Arabia, Kuwait and Bahrain gained 16.0 per cent, 15.7 per cent and

15.4 per cent, respectively. Dubai and Oman markets rose 10.3 per

cent and 1.8 per cent, respectively.

GIF portfolio

Country allocation

GIF's weightings in GCC markets are based on the Investment

Adviser's assessment of outlook and valuation.

Compared to the benchmark, GIF remained overweight Qatar (41.7

per cent of NAV vs. the S&P GCC Qatar weight of 11.3 per cent),

overweight UAE (21.2 per cent vs 16.1 per cent). GIF is underweight

Saudi Arabia (27.1 per cent vs 59.9 per cent), Kuwait (3.8 per cent

vs 10.3 per cent) and underweight Bahrain (1.3 per cent vs 1.5 per

cent). The fund's cash weighting was 4.9 per cent on 31 March

2022.

During the quarter, the fund increased exposure to Bahrain by

1.3 per cent and exposure to UAE by 1.8 per cent, while exposure to

Saudi Arabia was reduced by 6.0 per cent.

The fund's Qatar overweight arises from Qatar's macroeconomic

resilience, growth prospects and attractive valuations. While Qatar

is trading at a discount to its GCC peers, valuations are

compelling given the upside from the promising macro backdrop. The

North Field Expansion (a 64 per cent increase in LNG production)

will result in robust economic activity in the medium term while

FIFA World Cup activities will provide the much-needed boost to

tourism in 2022. Additionally, Qatar's plan to allow full foreign

ownership of listed companies could attract as much as QAR5.4

billion inflows.

The fund remains underweight Saudi Arabia due to relatively

expensive valuations. Following the Shareek program announcements,

major Saudi stocks, particularly banks rallied. On 31 March 2022

Saudi was trading on a P/E multiple of 21 times compared to MSCI EM

on 13 times.

GIF ended the quarter with 23 holdings: 10 in Saudi Arabia, 7 in

Qatar, 4 in the UAE, 1 in Kuwait and 1 in Bahrain.

Please refer to the IMS on the Company's website

https://www.gulfinvestmentfundplc.com/publications/quarterly-reports/

for a Chart: GIF Country Allocation as of 31 March 2022.

Portfolio

Top 10 holdings

Company Country Sector % NAV weighting

Commercial Bank of Qatar Qatar Financials 10.9%

-------------- ------------- ----------------

Qatar Islamic Bank Qatar Financials 8.1%

-------------- ------------- ----------------

Emaar Properties Company UAE Real Estate 7.0%

-------------- ------------- ----------------

Qatar Gas Transport Qatar Energy 6.1%

-------------- ------------- ----------------

Emirates National Bank of Dubai UAE Financials 6.1%

-------------- ------------- ----------------

Masraf Al Rayan Qatar Financials 6.0%

-------------- ------------- ----------------

Saudi National Bank Saudi Arabia Financials 5.9%

-------------- ------------- ----------------

Qatar Navigation Qatar Industrials 5.6%

-------------- ------------- ----------------

Saudi Tadawul Group Holding Co Saudi Arabia Financials 4.7%

-------------- ------------- ----------------

Dubai Islamic Bank UAE Financials 4.6%

-------------- ------------- ----------------

Source: QIC

The ongoing recovery in the GCC region is expected to solidify

in 2022 on the back of higher oil prices, increased oil production

and strong momentum in non-oil activity. The Investment Adviser

seeks companies likely to benefit from the recovery. That said we

expect markets will remain volatile in the near term, and hence

will continue to focus on companies with solid balance sheets and

stable cash flows, trading at attractive valuations.

Commercial Bank of Qatar (CBQ) is the second-largest commercial

bank in Qatar. As part of its 5-year turnaround strategy, it is

strengthening its balance sheet by cautiously managing its risk

exposure. Under its diversification strategy, CBQ has expanded its

GCC footprint through strategic partnerships including the National

Bank of Oman (NBO) in Oman, United Arab Bank (UAB) in the UAE and

its subsidiary Alternatifbank in Turkey.

Qatar Islamic Bank (QIB) is the largest Islamic bank in terms of

the total assets (49 per cent of total assets of listed Islamic

banks in Qatar) and second largest bank in Qatar by total assets.

QIB's fundamentals continue to remain strong with robust risk

management framework. QIB boasts one of the highest RoEs among its

domestic and regional peers. The bank remains cost efficient, has

strong capitalization and a superior asset quality profile compared

to its peers. Furthermore, raising the FOL limit to 100 per cent

should help boost QIB's weight in major indices such as MSCI EM and

FTSE EM.

Emaar Properties (EMAAR) is the UAE's largest real estate

developer. It includes UAE & international real estate

development, Emaar Malls, Emaar Hospitality, and entertainment

& leasing. The brand EMAAR has a varied retail asset portfolio,

mainly Burj Khalifa, Dubai Mall, and Dubai Fountain. As the economy

reopens footfall should rise in malls and shopping markets. This

recovery, underpinned by property sales will support the topline.

EMAAR also has a growing presence in international markets such as

India, Egypt, Saudi and Turkey. It has a strong balance sheet, a

strong credit profile, debt facilities and brand loyalty.

Qatar Gas Transport Company (Nakilat) is a leader in energy

transportation, with the world's largest LNG shipping fleet of 74

vessels. It is responsible for transporting the country's LNG

production to its global customers and is integral to the state's

LNG supply chain. Taking fleet management in-house and the huge

North Field Expansion project should generate further growth. It

plans to expand capacity with ship building agreements for 100+

vessels worth over QAR70 billion. Nakilat is set to be a

beneficiary of Qatar's LNG expansion.

Emirates NBD is global bank with presence in 13 countries and

over 17 million customers worldwide. Emirates NBD is 4th largest

GCC bank and one of the largest UAE banks. ENBD has strong

management with good track record and has consistently delivered on

targets. The bank is geared to higher interest rates which will

improve its margin profile and profitability. Group has a

significant retail banking franchise in the UAE and leader in

digital banking which will help it to reduce cost to income ratio

in long run. The bank remains strongly capitalized with stable

asset quality outlook.

Sector exposure

Please refer to the IMS on the Company's website

https://www.gulfinvestmentfundplc.com/publications/quarterly-reports/

for a Chart: GIF Sector Allocation as of 31 March 2022.

The Investment Adviser increased exposure to the financial

sector as valuations became attractive; as a result, the financial

sector remained the largest sector allocation for GIF at 51.1 per

cent of NAV. The Investment Adviser believes increase in interest

rates will support GCC bank's profitability. Furthermore, most GCC

banks have strong capital and liquidity buffers to safeguard them

from systematic risk.

The Investment Adviser increased exposure to the communication

sector to 3.9 per cent of NAV (vs 1.6 per cent in 4Q 2021), while

investments in the industrial and information technology sectors

were reduced as valuations looked stretched.

OPEC+ to continue gradual output hikes

OPEC+ continued its modest monthly output boost, unwinding its

pandemic-induced production cuts. The alliance agreed to continue

increasing supply gradually by 0.4 million barrels per day (bpd) in

May, resisting pressure to pump more crude to cool prices.

Furthermore, OPEC+ decided to stop using International Energy

Agency's (IEA) data, replacing it with reports from consultancies

Wood Mackenzie and Rystad Energy. OPEC+ forecasts world oil demand

to grow by 4.2 million bpd in 2022.

GCC: growth on firm footing

Economic recovery in the Gulf is expected to gather pace in

2022, with oil and gas contributing to this faster growth. The IMF

and the World Bank both have expressed optimism on GCC's GDP growth

in 2022, amid rising oil output, stronger oil prices and the growth

of non-oil sectors. The rise in oil prices is expected to help

offset the impact of higher interest rates. The Russia-Ukraine war

is expected to provide GCC states with leverage as sanctions

imposed on Russian oil and gas mean importing countries seek other

energy providers, mainly in the GCC.

Saudi Arabia approved investment of UD$151.9 billion by 2030 to

increase the kingdom's GDP growth. The National Development Fund

(NDF) will inject US$151.9 billion into the economy by 2030, under

the new strategy revealed by the Saudi Crown Prince. As a part of

its new strategy NDF aims to triple the kingdom's non-oil GDP to

US$161.25 billion by 2030, while generating new job opportunities

in the kingdom. Additionally, the fund will support the kingdom's

diversification strategy, encourage exports and local industries

and work as an effective tool to face the fluctuations of economic

challenges. The IMF expects the kingdom's economy to grow by 4.8

per cent, after expanding by an estimated 2.9 per cent in 2021.

The UAE government announced new initiatives to provide

entrepreneurs and Small and Medium Enterprises (SMEs) with several

integrated services aimed at enhancing their growth possibilities

and market share. These include the Government Procurement Program,

the Business Support Program, and the Financing Solutions Program.

These new services represent a continuation and expansion of the

National SME Program's efforts. The IMF sees growth accelerating in

the Emirate on the back of structural reform efforts, increased

foreign investment, and rising oil production. The fund projects a

faster GDP growth of 3.5 per cent for 2022 compared to 2.2 per cent

in 2021.

Qatar is expected to benefit from the upcoming FIFA World Cup

2022 as it will help boost the non-oil sector. Tourism, transport

and hospitality should experience a strong uplift, as about 1.5

million visitors are expected for the month-long tournament later

this year. Qatar is likely to see a structural increase in demand

for liquefied natural gas (LNG) from Europe, as EU authorities

announced interest in diversifying their sources of energy supplies

following the Russia-Ukraine crisis. Additionally, the ongoing

north field expansion will provide opportunity to play a pivotal

role in diversifying European gas imports away from Russia.

The Kuwait government announced a draft budget for FY2022/23

projecting a narrower budget deficit of KWD3.1 billion, down 74.2

per cent amid higher oil prices and reduced spendings. Total

revenues are projected at KWD18.8 billion, a rise of 72.2 per cent,

on the back of higher oil revenues (oil price of US$65/bbl). Total

Spendings to fall 4.8 per cent to KWD21.9 billion, with capital

expenditure accounting for 13.2 per cent of total expenditure.

Furthermore, the proposed budget expects to break even with an oil

price of US$75 per barrel.

Oman announced expansion of free zones to boost the economy and

attract foreign investments in the country. The free zones in

Muscat, Salalah, Sohar and Duqm are expected to bring in economic

benefits by diversifying the state income and bringing prospective

trading partners. The move is aimed to align Oman with

international standards and create a global investment

scenario.

GCC central banks raise interest rates

Gulf central banks increased their benchmark interest rates

following the US Fed's interest rate hike. The Saudi Central Bank

increased both its repo and reverse repo rates by 25 basis points

(bps) each to 1.25 per cent and 0.75 per cent, respectively. The

Central Bank of the UAE raised its base rate, applicable to the

overnight deposit facility, by 25 bps to 0.4 per cent. The central

banks of Kuwait and Bahrain also raised their key interest rates by

25 bps. Meanwhile, the Qatar Central Bank raised its repo rate by

25 basis points to 1.25 per cent.

The Investment Adviser believes the move is the first of many

expected this year and in 2023 and is expected to support

profitability of banks in the region. On average, a 100 bps

increase in benchmark interest rates would boost earnings by 13 per

cent and result in 1 per cent capital accretion for lenders across

the region according to a report by S&P Global Ratings.

GCC's IPO boom continues

After a standout year in 2021, the market for initial public

offerings (IPOs) continues booming across the region. Also, the

Gulf markets have so far remained resilient to the impact of the

Russia-Ukraine war which has affected stock markets across the

world resulting in a slump in new equity offerings. The Saudi

capital market is set for a period of growth, with several IPOs in

the pipeline. In Saudi Arabia, pharmacy firm Nahdi Medical Co.

raised US$1.36 billion, the biggest Saudi IPO since Aramco. PIF

owned digital security company Elm raised around US$818 million

through its IPO. Dubai Financial Market is expected to see a flurry

of offerings this year starting with IPOs of utility provider Dubai

Electricity & Water Authority (DEWA) and Salik (road toll

system). All in, t he IPO pipeline remains strong from both

corporates and potential listings of state-owned assets. Rising

economic activity and a strong IPO pipeline is expected to support

regional stock markets throughout 2022.

Furthermore, the Saudi Tadawul Group announced its intention to

launch new enhancements aiming to strengthen the post trade

infrastructure and increase its efficiency by providing a more

streamlined trading experience, and support market participants to

develop a wide range of securities services. These enhancements

come as a part of its ongoing efforts to develop the Saudi capital

market's infrastructure and reinforce its position as a globally

attractive investment destination.

Other developments

Saudi Arabia rating upgrade

S&P revised Kingdom's outlook to positive from stable citing

improving GDP growth and fiscal dynamics over the medium term amid

improved oil sector prospects, and the government's reform

programs. The rating agency forecasts Saudi real GDP growth to rise

by 5.8 per cent in 2022.

Kuwait rating update

Fitch ratings has downgraded Kuwait's long-term rating to 'AA-',

from 'AA' while affirming a stable outlook. The downgrade comes as

a result of the ongoing political constraints on decision-making

that hinder addressing structural challenges related to heavy oil

dependence, a generous welfare state and a large public sector.

Saudi Arabia announces discovery of new gas fields

Saudi Arabia's state oil company Aramco has discovered five

natural gas fields across four regions of the kingdom. This

includes Shadoon in the Central Region, Shehab and Shurfa in the

Empty Quarter, Umm Khansar at the Northern Border Region and Samna

in the Eastern Region. Furthermore, the five new natural gas fields

can produce over 100 million cubic feet of natural gas per day in

total.

Saudi Arabia transfers US$80 billion Aramco stake to Sovereign

wealth fund

Saudi Arabia has transferred 4 per cent of Saudi Aramco's stake

worth nearly US$80 billion to the kingdom's sovereign wealth fund

known as the Public Investment Fund (PIF). The transfer is aimed at

helping to restructure the country's economy and support the wealth

fund's plans to raise its assets under management to about US$1

trillion by the end of 2025. The government remains the largest

shareholder in Aramco, with a more than 94 per cent stake after the

transfer process.

UAE to introduce corporate tax from June 2023

The UAE has announced a federal corporate tax of 9 per cent on

the profit of businesses from the beginning of their first

financial year that starts on or after June 2023. However, to

support small and medium size enterprises there will be no tax on

profits up to AED375,000 (US$ 102,000). At a standard rate of 9 per

cent the UAE corporate tax rate remains one of the lowest within

the GCC region and amongst the most competitive in the world.

UAE issues law to maintain balance in 2022 general budget

The UAE government issued a federal law for maintaining a

balance in the UAE's 2022 general budget. The law allows the use of

foreign reserves, international debt instruments and portion of

government cash reserves to tackle the financing gap in the

budget.

B ahrain launches golden permanent residency visa program

Bahrain introduced a golden residency visa program to attract

and retain residents, foreign investors and talented individuals.

The golden residency visa will be renewed indefinitely and will

include the right to work in Bahrain, unlimited entry and exit,

along with residency for close family members.

Oman to allow full foreign ownership in listed companies

Oman's stock exchange plans to allow full foreign ownership in

listed companies to attract more investments to its market. The

move is expected to make the bourse more attractive for

international investors as it seeks inclusion within global

emerging market indices. Furthermore, Oman plans to list 35 state

owned companies in the next five years.

Outlook

Outlook

The GCC remains well positioned for robust growth, led by easing

restrictions, sustained economic recovery, increased oil production

and strong momentum in non-oil activity. The IMF expects economic

recovery to gather pace and forecasts high mid-single digit GDP

growth for the GCC region, partly on the back of higher oil prices.

Higher oil prices will help government balance sheets,

complementing fiscal reforms. We foresee all GCC countries

reporting fiscal surpluses in 2022. S tructural transformation away

from hydrocarbons will continue to gain traction.

The Investment Adviser believes that investing in the region is

not just all about oil. It is about diversification, infrastructure

spending, expansion of the non-oil and gas sector, privatization

and economic, social and capital market reforms. The ongoing

socio-economic/structural reforms in Saudi Arabia continues to open

up opportunities for long term investors. The Shareek Program which

is a part of the Kingdom's SAR27 trillion investment plan, is

expected to boost economic growth and strengthen the private

sector. We believe events such as FIFA World Cup 2022 and

large-scale infrastructure projects such as NEOM City, the Red Sea

project and the North Field Gas expansion project, could propel

economic prosperity in the region. Over 1.5 million people could

visit Qatar during the tournament for what could be the world's

first post-Covid mass audience sporting event.

In Saudi Arabia, the government is pressing ahead with an

ambitious reform agenda to deliver economic growth, following a

slow start in recent years. Higher oil prices have refilled the

Kingdom's coffers and are likely to provide additional resources

for PIF and state funds to press ahead with investment plans. Saudi

remains our second largest portfolio holdings at 27.1 per cent,

with exposure mainly in the financial sector of 15.5 per cent to

ride on the nation's progressive economic reforms.

Qatar is the biggest beneficiary of rising energy prices. The

North Field project should boost LNG capacity by 64% with Nakilat

(6.1% of NAV) set to be a beneficiary of the expansion. Qatar's

external and fiscal positions is in a sweet spot, one of the

strongest positions in the GCC.

UAE is enjoying a cyclical recovery, in particular Dubai, which

was impacted last year by Covid restrictions. The easing of these

is increasing economic activity in tourism and retail. As the

economy reopens, EMAAR (7.0% of NAV) with a varied retail asset

portfolio should benefit from footfall rise in malls and shopping

markets. Elsewhere, the switch to a Monday-Friday work week is also

expected to improve UAE's prospects in the medium term.

Overall, we see strong opportunities among the stocks benefiting

from re-opening. Regional banks should benefit from higher

short-term interest rates. We see opportunities arising from

sustained high commodity prices and supply disruptions coinciding

with re-opening pent-up demand.

While global investors generally are underweight Qatar, Kuwait,

and Saudi, the GCC weighting in EM indexes should increase as IPOs

join the market, as Public Investment Fund PIF/government stake

sales are made, and foreign ownership limits (FOL) are raised.

Qatar's weighting should increase as FOL are eased and likely

attracting QAR 5.4 billion of inflows, making us highly positive on

the country. Global investors interest in GCC should increase.

Therefore, foreign inflows to the GCC will continue, attracted by

credible fixed currency rates, generous dividend yields, high oil

prices and market reforms.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBUGDSBGDDGDG

(END) Dow Jones Newswires

April 21, 2022 04:00 ET (08:00 GMT)

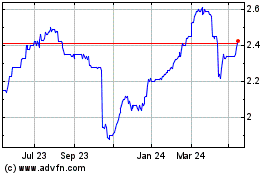

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Oct 2024 to Nov 2024

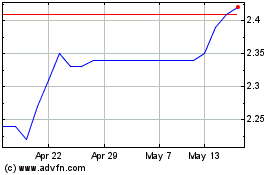

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Nov 2023 to Nov 2024