Gulf Investment Fund PLC Tender Results Announcement (9516G)

April 01 2022 - 6:00AM

UK Regulatory

TIDMGIF

RNS Number : 9516G

Gulf Investment Fund PLC

01 April 2022

THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO, CANADA, JAPAN,

NEW ZEALAND AND THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE TO DO SO MAY RESULT IN THE CONTRAVENTION OF ANY

REGISTRATION OR OTHER LEGAL REQUIREMENT OF SUCH JURISDICTION

1 April 2022

Gulf Investment Fund plc (Ticker: GIF)

Results of Tender Offer

Minimum Size Condition passed

Further to the Tender Offer announcement on 17 March 2022 (the

"Announcement"), the Tender Offer closed at 1.00 p.m. on 31 March

2022.

5,214,956 shares were validly tendered, equal to 11.3 per cent.

of the shares in issue as at 21 March 2022. The Board of Gulf

Investment Fund plc (the "Company") is pleased that the resulting

post Tender Offer share capital will therefore be 41,105,216

Shares, which is in excess of the Minimum Size Condition (set out

in the circular to shareholders dated 3 December 2021 (the

"Circular") and re-confirmed in the Announcement).

In line with the terms of the Tender Offer the Directors will

allocate the assets and liabilities of the Company between the

Continuing Pool and the Tender Pool on the Calculation Date.

Following the allocation of assets and liabilities to the

Continuing Pool and the Tender Pool, the Board will instruct the

Investment Adviser to sell the assets in the Tender Pool. The

Company will continue to prepare and publish NAV announcements for

the Continuing Pool only.

The Tender Pool will bear all costs associated with the sale of

such assets and in order to implement the Tender Offer, including

an amount equal to any stamp duty or stamp duty reserve tax payable

in respect of the repurchase of the Tendered Shares by the Company.

The Tender Pool will also bear its share of the operating costs of

the Company on a pro rata basis. All changes in value of the assets

allocated to the Tender Pool will be attributable solely to the

Tender Pool.

After all of the assets in the Tender Pool have been sold, and

all liabilities to be borne by the Tender Pool (other than any

stamp duty or stamp duty reserve tax payable) are met, the

Directors will select a date upon which the Final Tender Offer

Asset Value of the Tender Pool will be calculated (the "Tender Pool

Determination Date"). The Final Tender Offer Asset Value will equal

the unaudited Net Asset Value of the assets in the Tender Pool on

the Tender Pool Determination Date (which for the avoidance of

doubt will take account of the costs of realisation of the Tender

Pool) less any stamp duty or stamp duty reserve tax arising on the

repurchase of Shares by the Company. The Tender Pool Determination

Date will be as soon as practicable following realisation of the

assets in, and accounting for liabilities (other than any stamp

duty or stamp duty reserve tax to be payable) to be borne by, the

Tender Pool. The Tender Price will be an amount equal to the Final

Tender Offer Asset Value divided by the total number of Tendered

Shares (rounded down to four decimal places) in each case on the

Tender Pool Determination Date. The Investment Adviser currently

anticipates that the orderly realisation of the investments in the

Tender Pool will be completed by mid-April. A further announcement

will be made in due course.

Completion of the Tender Offer remains subject to certain

conditions set out in paragraph 2 of the terms and conditions of

the Tender Offer which is contained in the Announcement. Subject to

completion of the Tender Offer, the Investment Adviser will

continue to hold 17,319,759 Shares in the Company representing

approximately 42.1 per cent. of the post Tender Offer share

capital.

Future Tender Offers

In light of the ongoing Shareholder support for the Company and

consistent with the proposals set out in the Circular and approved

by Shareholders at the Annual General Meeting on 31 December 2021,

the Company intends to implement the second 2022 Tender Offer in

September 2022.

For the purposes of this announcement, unless otherwise defined,

capitalised words and phrases shall have the meaning given to them

in the Circular.

Legal Entity Identifier: 2138009DIENFWKC3PW84

For further information:

Anderson Whamond Via Apex Corporate Services

Gulf Investment Fund plc

Ian Dungate/Suzanne Jones +44 (0) 1624 630400

Apex Corporate Services (IOM) Limited

Sapna Shah/Alex Collins/Atholl Tweedie +44 (0) 20 7886 2500

Panmure Gordon

William Clutterbuck +44 (0) 20 7379 5151

Maitland/AMO

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RTEMZGGDLMZGZZG

(END) Dow Jones Newswires

April 01, 2022 06:00 ET (10:00 GMT)

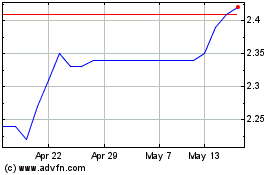

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Oct 2024 to Nov 2024

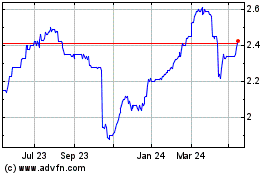

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Nov 2023 to Nov 2024