TIDMGIF

RNS Number : 0392F

Gulf Investment Fund PLC

17 March 2022

THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO, CANADA, JAPAN,

NEW ZEALAND AND THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE TO DO SO MAY RESULT IN THE CONTRAVENTION OF ANY

REGISTRATION OR OTHER LEGAL REQUIREMENT OF SUCH JURISDICTION

17 March 2022

Legal Entity Identifier: 2138009DIENFWKC3PW84

Gulf Investment Fund PLC

("GIF" or the "Company")

Tender Offer

The Company announces the launch of the tender offer for up to

100 per cent. of each Shareholder's holding in the Company, details

of which were set out in the circular of the Company dated 3

December 2021 (the "Circular"). This tender offer is being proposed

in line with the authority that was granted by Shareholders at the

Company's Annual General Meeting held on 31 December 2021 and is

referred to as the March 2022 Tender Offer in the Circular (but

hereinafter referred to as the "Tender Offer").

Capitalised terms in this announcement ("Tender Offer

Announcement"), unless otherwise defined, have the same meanings

given to them in the Circular. The Circular is available to view on

the Company's website at

https://www.gulfinvestmentfundplc.com/publications/circulars/ .

The Tender Price will be dependent on the price at which the

assets comprising the Tender Pool are fully realised and the

apportionment of the costs associated with the Tender Offer

(expected to be approximately US$100,000) across the Tendered

Shares. Dependent on the number of Tendered Shares, the allocation

of these costs may represent a material discount to the NAV per

Share at the Calculation Date. In such instances, in accordance

with the terms and conditions of the Tender Offer (which are set

out in full below), where the Directors consider, in their opinion

acting reasonably, that it is no longer in the best interests of

the Company or Shareholders to proceed with the Tender Offer, the

Company may terminate the Tender Offer.

Outline of the Tender Offer

Shareholders on the Register at 5.30 p.m. on 21 March 2022 (the

"Record Date") are invited to either (i) continue their full

investment in the Company; or (ii) save for Restricted

Shareholders, tender some or all of their Shares held at the Record

Date.

The Company's assets and liabilities will be valued as at 5.30

p.m. on 1 April 2021 (the "Calculation Date") and allocated between

two pools - the Continuing Pool and the Tender Pool - and the

Investment Adviser will be instructed to realise the assets

allocated to the Tender Pool as soon as practicable and the

proceeds (after payment of tender costs) used to repurchase the

Tendered Shares (defined below).

The Tender Price will be determined once the Company's assets

have been allocated between the Continuing Pool and the Tender

Pool, the assets contained in the Tender Pool have been fully

realised and all the liabilities (including the costs of the

proposals) to be borne by the Tender Pool have been accounted for.

The Tender Price will be paid to Shareholders in US Dollars.

Further details on the terms and conditions of the Tender Offer are

set out in full below.

The Tender Offer is being made directly by the Company which

will, on the terms and subject to the conditions of the Tender

Offer being satisfied, purchase at the Tender Price the Shares

validly tendered ("Tendered Shares").

Any Tendered Shares tendered will be cancelled.

As it would not be in the interests of Shareholders to be

invested in a sub-scale illiquid fund, the Company shall not be

obliged to proceed with any tender offer where the Directors, in

their sole discretion, believe the result of any such tender offer

would reduce the Company to such a size that it would no longer be

fit for purpose (this being a minimum size condition). The minimum

size condition in respect of the Tender Offer shall be a post

Tender Offer share capital of not less than 38,000,000 Shares (the

"Minimum Size Condition"). In the event that applications are

received in respect of the Tender Offer such that the number of

Shares remaining in issue following completion of the Tender Offer

will be less than 38,000,000 Shares, meaning that the Minimum Size

Condition could not be met, the Tender Offer shall not proceed. The

Company will announce via a Regulatory Information Service on 1

April 2021 (the "Confirmation Date") whether the Minimum Size

Condition has been met and, accordingly, whether the Tender Offer

will proceed.

In addition to the Minimum Size Condition, the Tender Offer is

conditional, inter alia, on the Company satisfying the

distributable profits requirements under Isle of Man law at the

time of the Tender Offer and the other conditions more fully set

out in the terms and conditions of the Tender Offer (set out below

in full).

The Circular provides more information in relation to the Tender

Offer, including, inter alia, certain risks relating to the Tender

Offer (contained in paragraph A of Part 8 of the Circular) and a

general guide relating to taxation in the United Kingdom based on

UK law and HMRC's published practice as at the date of the Circular

(contained in Part 6 of the Circular).

Intentions of the Investment Adviser

The Investment Adviser has indicated its intention to remain

invested in the Company and will not participate in the Tender

Offer.

Expected Timetable of Principal Events

The expected timetable for the Tender Offer is as follows:

Tender Offer opens 17 March 2022

Record Date for participation in the 5.30 p.m. on 21 March

Tender Offer 2022

Latest time and date for receipt of 1.00 p.m. on 31 March

Tender Forms and/or for settlement of 2022

TTE Instructions in respect of the Tender

Offer (the "Closing Date")

Confirmation Date and announcement regarding 1 April 2022

the Minimum Size Condition(1)

If the Minimum Size Condition is satisfied:

Calculation Date 5.30 p.m. on 1 April 2022

Establishment of Tender Pool and Continuing 4 April 2022

Pool

Realisation of the Tender Pool commences 5 April 2022

Realisation of the final assets in the as soon as practicable

Tender Pool announced; Tender Price after commencement of

announced; cheque despatched and CREST the realisation of the

accounts credited with proceeds in respect Tender Pool

of successfully Tendered Shares; balancing

certificates despatched and CREST accounts

credited in respect of unsold Shares

Notes:

1 The Company will announce via a Regulatory Information Service

provider on the Confirmation Date whether the Minimum Size

Condition has been met. If the Minimum Size Condition is not met

the Tender Offer will not proceed and the Company will instead put

forward proposals to Shareholders for the Company to be wound up

with a view to returning cash to Shareholders or to enter into

formal liquidation.

Each of the times and dates in the expected timetable may be

extended or brought forward without further notice. If any of the

above times and/or dates change, the revised time(s) and/or date(s)

will be notified to Shareholders by an announcement through a

Regulatory Information Service provider.

All references to times are to London times.

Legal Entity Identifier: 2138009DIENFWKC3PW84

For further information:

Anderson Whamond Via Apex Corporate Services

Gulf Investment Fund plc

Ian Dungate/Suzanne Jones +44 (0) 1624 630400

Apex Corporate Services (IOM) Limited

Sapna Shah/Alex Collins/Atholl Tweedie +44 (0) 20 7886 2500

Panmure Gordon

William Clutterbuck +44 (0) 20 7379 5151

Maitland/AMO

Terms and Conditions of the Tender Offer

1. Tenders

1.1. All Shareholders (other than Restricted Shareholders) on

the Register as at the Record Date may tender some or all of their

Shares held at the Record Date for purchase by the Company on and

subject to these terms and conditions set out in this Tender Offer

Announcement and, in respect of Shareholders holding their Shares

in certificated form, the Tender Form.

1.2. This Tender Offer Announcement is available to download

from the Company's website at

https://www.gulfinvestmentfundplc.com/publications/ . The Circular

is available to view or download on the Company's website at

https://www.gulfinvestmentfundplc.com/publications/circulars/ .

Apex Corporate Services (IOM) Limited will send by post to the

registered holders of Shares in certificated form a hard copy of

this Tender Offer Announcement and a hard copy personalised Tender

Form for use in connection with the Tender Offer. For an additional

or replacement of the hard copy Tender Form, this can be requested

from the Receiving Agent, Link Group, Corporate Actions, Central

Square, 29 Wellington Street, Leeds LS1 4DL.

1.3. Changes of a technical or administrative nature to these

terms and conditions may be made at the Directors' discretion and

will be published on the Company's website at

https://www.gulfinvestmentfundplc.com/publications/ . Shareholders

accepting the Tender Offer will be deemed to have accepted such

changes, if any.

1.4. Shareholders are not obliged to tender any Shares during

the Tender Offer. If Shareholders wish to continue their existing

investment in the Company at the same level, they should not return

the Tender Form or TTE Instruction in respect of the Tender

Offer.

1.5. Tender Purchases will be made at the Tender Price. The

Company will calculate the Tender Price for the Tender Offer in

accordance with the provisions set out in paragraph 4 of these

terms and conditions. The calculations approved by the Directors

will be conclusive and binding on all Shareholders. The

consideration for each Tender Purchase will be paid in accordance

with the settlement procedures set out in paragraph 6.4 below.

1.6. Subject to the Tender Offer becoming unconditional and

unless the Tender Offer has been terminated, the Company will

purchase the validly and successfully tendered Shares of

Shareholders in accordance with these terms and conditions.

2. Conditions, suspension and termination

2.1. In structuring the Tender Offer, the Board has sought to

provide a mechanism through which to provide liquidity to those

Shareholders that want it and, for those Shareholders who wish to

continue their investment in the Company, to provide some assurance

as to its minimum size.

2.2. The Tender Offer is subject to the following

conditions:

2.2.1. the Minimum Size Condition - the Company will announce

via a Regulatory Information Service on the Confirmation Date

whether the Minimum Size Condition has been met and, accordingly,

whether the Tender Offer will proceed;

2.2.2. the Company satisfying the distributable profits

requirements under Isle of Man law at the time of the Tender Offer;

and

2.2.3. the Tender Offer not having been terminated in accordance

with this paragraph 2.2 prior to the fulfilment of the conditions

referred to in sub-paragraphs 2.2.1 to 2.2.2 above.

2.3. It would not be in the interests of Shareholders to be

invested in a sub-scale illiquid fund. Accordingly, the Company

shall not be obliged to proceed with the Tender Offer where the

Minimum Size Condition is not met. In the event that validly

completed Tender Forms are received in relation to the Tender Offer

in respect of such aggregate number of Shares which means that the

Minimum Size Condition cannot be met, the Directors will instead

put forward proposals to Shareholders for the Company to be wound

up with a view to returning cash to Shareholders or to enter into

formal liquidation. The Company will not purchase Shares pursuant

to the Tender Offer unless the applicable conditions have been

satisfied in full (or waived, where applicable).

2.4. If the Directors, at any time prior to effecting the

purchase of the Tendered Shares in respect of the Tender Offer

consider, in their opinion acting reasonably that (i) there has

occurred a change in national or international financial, economic,

political or market conditions such that it has either become

impractical or inappropriate for the Company to dispose of its

investments without materially harming Shareholders as a whole,

including amongst other things, the cost of realisation of

investments having become excessive, (ii) the completion of the

purchase of Shares under the Tender Offer would have unexpected

adverse fiscal consequences (whether by reason of a change in

legislation or practice or otherwise) for the Company or its

Shareholders if the Tender Offer were to proceed, or (iii) it is no

longer in the best interests of the Company or Shareholders to

proceed with the Tender Offer, the Company may either terminate the

Tender Offer or postpone the completion of the Tender Offer for up

to 30 Business Days, after which the Tender Offer, if and to the

extent not then completed by reason of the postponement

circumstances continuing, will lapse.

3. Announcement of the Tender Offer and Minimum Size Condition

3.1. At the Confirmation Date, the Company will announce details

of the aggregate number of Shares in respect of which validly

completed Tender Forms have been received, whether the Minimum Size

Condition has been met and therefore whether the Tender Offer will

proceed. If the Minimum Size Condition is not satisfied the Tender

Offer will not proceed. If the Minimum Size Condition is satisfied

all of the Company's assets and liabilities will be valued and

allocated between the Continuing Pool and the Tender Pool on the

basis set out under paragraph 4 (Tender Price) below.

4. Tender Price

4.1. The Tender Price will be calculated in accordance with this

paragraph 4 and will be announced once all the assets in the Tender

Pool have been fully realised which will be as soon as practicable

after the commencement of the realisation of the Tender Pool.

4.2. The assets and liabilities of the Company will be allocated

between the Continuing Pool and the Tender Pool on the Calculation

Date by the Directors (in consultation with the Company's advisers)

on the basis set out below.

4.3. The Tender Offer Formula Asset Value is an amount

representing the proportionate value of the Company attributable to

the Tendered Shares and will be calculated on the Calculation Date

on the following basis:

Tender Offer Formula Asset Value = (i) NAV per Share on

Calculation Date

multiplied by

(ii) the number of Tendered Shares

4.4. The Tender Offer Formula Asset Value determines the initial

allocation of assets to the Tender Pool after which it will be

operated as described below.

4.5. Following the allocation of assets and liabilities to the

Continuing Pool and the Tender Pool, the Board will instruct the

Investment Adviser to commence realisation of the assets comprising

the Tender Pool.

4.6. The Tender Pool will bear all costs associated with the

realisation of such assets and in order to implement the Tender

Offer. The Tender Pool will also bear its share of the operating

costs of the Company on a pro rata basis. All changes in value of

the assets allocated to the Tender Pool will be attributable solely

to the Tender Pool. Following the date upon which all of the assets

comprising the Tender Pool have been fully realised, and all

liabilities to be borne by the Tender Pool (other than any stamp

duty or stamp duty reserve tax payable) met, the Directors will

select a date upon which the Final Tender Offer Asset Value of the

Tender Pool will be calculated (the "Tender Pool Determination

Date").

4.7. The Final Tender Offer Asset Value will equal the unaudited

Net Asset Value of the assets in the Tender Pool on the Tender Pool

Determination Date (which for the avoidance of doubt will take

account of the costs of realisation of the Tender Pool) less any

stamp duty or stamp duty reserve tax arising on the repurchase of

Shares by the Company. The Tender Pool Determination Date will be

as soon as practicable following realisation of the assets in, and

accounting for liabilities (other than any stamp duty or stamp duty

reserve tax to be payable) to be borne by, the Tender Pool.

4.8. If prior to the Tender Pool Determination Date the non-cash

assets remaining in the Tender Pool represent 10 per cent. or less

of the Tender Pool's initial value and the Directors believe that

it would be in the best interests of the Tendering Shareholders to

complete the realisation of the Tender Pool, they will direct the

Investment Adviser to sell the remaining assets of the Tender Pool

at the best price available, failing which such assets will be

transferred to the Continuing Pool at a price to be determined by

the Directors taking into account the fact that the assets cannot

otherwise be fully realised in a timely and value-effective

manner.

4.9. The Tender Price will be determined by the Company (in

consultation with its advisers) as soon as practicable after the

assets in the Tender Pool have been fully realised and all the

liabilities (including the costs of implementing the Tender Offer)

to be borne by the Tender Pool have been accounted for. The Tender

Price will be an amount equal to the Final Tender Offer Asset Value

divided by the total number of Tendered Shares (rounded down to

four decimal places) in each case on the Tender Pool Determination

Date.

4.10. The Tender Price will be paid to Shareholders in US

Dollars and will be effected by the despatch of cheques drawn on an

account of a branch of a United Kingdom clearing bank, or the

crediting of CREST accounts as appropriate.

Allocation of assets to the Continuing Pool and the Tender

Pool

4.11. The assets and liabilities of the Company will be

allocated between the Continuing Pool and the Tender Pool on the

Calculation Date by the Directors (in consultation with the

Company's advisers) on the basis set out below:

4.11.1. all liabilities recognised in the Company's accounting

records will be allocated to the Continuing Pool;

4.11.2. all debtors and other receivables will be allocated to the Continuing Pool;

4.11.3. any investments whose quotation has been suspended and

any other assets which the Directors consider it would be

inappropriate to transfer to the Tender Pool (for example, stocks

subject to corporate actions) will be allocated to the Continuing

Pool at the value reflected in the accounting records (which will

reflect the Directors' assessment of fair value);

4.11.4. all quoted investments, other than those included under

paragraph 4.11.3 above, and such other investments as the Directors

determine, will be allocated pro rata between the Continuing Pool

and the Tender Pool by reference to the respective values of each

pool. For such purposes the calculations will be rounded to the

nearest whole number of securities for each security so allocated

or otherwise as the Directors determine; and

4.11.5. the near cash assets of the Company will be divided in

whatever proportion is necessary such that the net assets

attributable to the Tender Pool are equal to the Tender Offer

Formula Asset Value and the net assets attributable to the

Continuing Pool are equal to the Net Asset Value of the Company

less the Tender Offer Formula Asset Value.

4.12. In allocating and/or valuing assets and liabilities

pursuant to this paragraph 4, the Directors shall be entitled, in

any case where the proper allocation of an asset or liability is in

doubt, or where the valuation of any asset or liability in

accordance with any of the above provisions is, in the opinion of

the Directors, incorrect or unfair, to adopt an alternative basis

of allocation or method of valuation (as the case may be) and to

allocate assets as the Directors fairly consider.

4.13. The net asset value of the assets and liabilities

allocated on the establishment of the Tender Pool will equal the

Tender Offer Formula Asset Value (calculated in accordance with

this paragraph 4). The Company's assets and liabilities will be

valued as at the Calculation Date and thereafter allocated between

the Continuing Pool and the Tender Pool on the basis set out above.

The Investment Adviser will be instructed by the Board to realise

the assets allocated to the Tender Pool as soon as possible.

4.14. The Tender Pool will bear the costs of realising the

assets in the Tender Pool and the amount of any stamp duty or stamp

duty reserve tax payable on the repurchase by the Company of the

Shares. Shareholders who validly tender some or all of their Shares

will receive a pro rata share of the net proceeds of the Tender

Pool, less associated costs. The assets of the Tender Pool will be

fully realised as soon as practicable after the commencement of the

realisation of the Tender Pool such that final cash payments can be

made to the Tendering Shareholders as soon as practicable

thereafter. However, under the Tender Offer the Company reserves

the right to defer the Tender Pool realisations and/or cash

payments if the Board believes this to be in the best interests of

Shareholders as a whole.

4.15. If prior to the Tender Pool Determination Date the

non-cash assets remaining in the Tender Pool represent 10 per cent.

or less of the Tender Pool's initial value and the Directors

believe that it would be in the best interests of the Tendering

Shareholders to complete the realisation of the Tender Pool, they

will direct the Investment Adviser to sell the remaining assets of

the Tender Pool at the best price available, failing which such

assets will be transferred to the Continuing Pool at a price to be

determined by the Directors taking into account the fact that the

assets cannot otherwise be fully realised in a timely and

value-effective manner.

4.16. The Investment Adviser will prepare, or procure the

preparation of, the calculation of the Net Asset Value, the Tender

Offer Formula Asset Value, the value of the Tender Pool, the Final

Tender Offer Asset Value and the Tender Price, all of such

calculations shall be subject to review and approval by the Board

(in consultation with its advisers). In the event of a dispute

regarding any such calculations, such dispute will be determined by

a chartered accountant selected by agreement between the Company

and the Investment Adviser, or, in default of such agreement,

within 14 days of the relevant date on which the calculation is

made, selected by the President for the time being of the Institute

of Chartered Accountants in England and Wales. Such chartered

accountant will act as an expert and not as an arbitrator and their

determination shall be final and legally binding on all parties,

provided that any such chartered accountant will be bound by any

basis of allocation or method of valuation agreed between the

Investment Adviser and the Company.

5. Procedure for tendering Shares

5.1. There are different procedures for tendering Shares

depending on whether the Shares are held in certificated or

uncertificated form (i.e. in CREST).

5.2. Shareholders (other than Restricted Shareholders) who hold

Shares in certificated form must complete, sign and return a Tender

Form in accordance with paragraph 5.4 below and the instructions

printed on the Tender Form.

5.3. If the Shares are held in uncertificated form (i.e. in

CREST) they may be tendered only by sending a TTE Instruction in

accordance with the procedure set out in paragraph 5.5 below.

Shareholders should send separate TTE Instructions for Shares held

under different member account IDs.

5.4. Shares held in certificated form (that is, not in CREST)

5.4.1. To tender your Shares held in certificated form, you must

complete, sign and return a Tender Form (a personalised hard copy

being sent by Apex Corporate Services (IOM) Limited to registered

holder of Shares held in certificated form) together with the

relevant share certificate(s) and/or other documents of title in

accordance with the instructions printed on the Tender Form (which

shall be deemed to form part of the Tender Offer).

5.4.2. Shareholders (other than Restricted Shareholders) should

complete separate Tender Forms for Shares held in certificated form

but under different designations. The share certificate(s) and/or

other document(s) of title should be returned with the Tender

Form(s). Additional or replacement Tender Forms will be available

from the Receiving Agent, whose details are as follows: Link Group,

Corporate Actions, Central Square, 29 Wellington Street, Leeds LS1

4DL.

5.4.3. The completed and signed Tender Form should be sent by

post to the Receiving Agent so as to arrive as soon as possible and

in any event not later than the Closing Date. Tender Forms received

after this time may be rejected. No acknowledgement of receipt of

documents will be given. Any Tender Form received in an envelope

postmarked from a Restricted Territory or otherwise appearing to

the Company or its agents to have been sent from any Restricted

Territory may be rejected as an invalid tender. Further provisions

relating to Restricted Shareholders are contained in paragraph 11

(Restricted Shareholders and other Overseas Shareholders)

below.

5.4.4. If your share certificate(s) and/or other document(s) of

title are not readily available (for example, if they are with your

stockbroker, bank or other agent), the Tender Form should

nevertheless be completed, signed and returned as described above

so as to be received by the Receiving Agent no later than the

Closing Date together with any share certificate(s) and/or other

document(s) of title you may have available, accompanied by a

letter stating that the (remaining) share certificate(s) and/or

other document(s) of title will be forwarded as soon as possible

thereafter and, in any event, no later than the Closing Date.

5.4.5. The Receiving Agent, acting as the Company's agent, will

effect such procedures as are required to transfer your Shares to

the Company under the Tender Offer.

5.4.6. If you have lost your share certificate(s) and/or other

document(s) of title, you should write to the Registrar at Link

Group, Central Square, 29 Wellington Street, Leeds LS1 4DL to

request a letter of indemnity in respect of the lost share

certificate(s) which, when completed in accordance with the

instructions given, should be returned to the Registrar to the same

address so as to be received no later than the Closing Date.

5.5. Shares held in uncertificated form (that is, in CREST)

5.5.1. If the Shares you wish to tender are held in

uncertificated form do not complete a Tender Form. You should take

(or procure to be taken) the action set out below to transfer (by

means of a TTE Instruction) the number of Shares held as at the

Tender Offer Record Date which you wish to tender in respect of the

Tender Offer to an escrow balance, specifying the Receiving Agent

in its capacity as a CREST receiving agent under its participant ID

(referred to below) as the escrow agent, as soon as possible and,

in any event, so that the TTE Instruction settles not later than

the Closing Date.

5.5.2. If you are a CREST sponsored member, you should refer to

your CREST sponsor before taking any action. Your CREST sponsor

will be able to confirm details of your participant ID and the

member account ID under which your Shares are held. In addition,

only your CREST sponsor will be able to send the TTE Instruction to

Euroclear UK & International in relation to the Shares which

you wish to tender.

5.5.3. You should send (or, if you are a CREST sponsored member,

procure that your CREST sponsor sends) a TTE Instruction to

Euroclear UK & International, which must be properly

authenticated in accordance with Euroclear UK & International's

specification and which must contain, in addition to other

information that is required for the TTE Instruction to settle in

CREST, the following details:

-- the ISIN number of the Shares which is IM00B1Z40704;

-- the number of uncertificated Shares to be transferred to an escrow balance;

-- your member account ID;

-- your participant ID;

-- the participant ID of the escrow agent, Link Group in its

capacity as a CREST receiving agent, which is RA10;

-- the member account ID of the escrow agent, Link Group in its

capacity as a CREST receiving agent, which is 21689GIF;

-- the Corporate Action Number for the Tender Offer. This is

allocated by Euroclear UK & International and can be found by

viewing the relevant corporate action details in CREST;

-- the intended settlement date for the TTE Instruction;

-- input with the standard delivery instruction, priority 80; and

-- a contact telephone number to be inserted in the shared note field.

5.5.4. After settlement of the TTE Instruction, you will not be

able to access the Shares concerned in CREST for any transaction or

for charging purposes, notwithstanding that they will be held by

the Receiving Agent as your escrow agent until completion or

termination or lapsing of the Tender Offer. If the Tender Offer

becomes wholly unconditional, the Receiving Agent will transfer the

Shares which are accepted for purchase by the Company to itself as

the Shareholder's agent for onward sale to the Company.

5.5.5. You are recommended to refer to the CREST Manual

published by Euroclear UK & International for further

information on the CREST procedures outlined above.

5.5.6. In addition, you should arrange separate TTE Instructions

for Shares held in uncertificated form but under different member

account IDs.

5.5.7. You should note that Euroclear UK & International

does not make available special procedures in CREST for any

particular corporate action. Normal system timings and limitations

will therefore apply in connection with a TTE Instruction and its

settlement. You should therefore ensure that all necessary action

is taken by you (or by your CREST sponsor) to enable a TTE

Instruction relating to your Shares to settle prior to the Closing

Date. In connection with this, you are referred in particular to

those sections of the CREST Manual concerning practical limitations

of the CREST system and timings.

5.5.8. Normal CREST procedures (including timings) apply in

relation to any Shares that are, or are to be, converted from

uncertificated to certificated form, or from certificated to

uncertificated form, during the course of the Tender Offer (whether

such conversion arises as a result of a transfer of Shares or

otherwise). Shareholders who are proposing to convert any such

Shares are recommended to ensure that the conversion procedures are

implemented in sufficient time to enable the person holding or

acquiring the Shares as a result of the conversion to take all

necessary steps in connection with such person's participation in

the Tender Offer (in particular, as regards delivery of share

certificates and/or other documents of title or transfer to an

escrow balance as described above) prior to the Closing Date.

5.6. Validity of Tender Forms and TTE Instructions

5.6.1. Notwithstanding the powers in paragraph 11.5 below, the

Company reserves the right to treat as valid only Tender Forms and

TTE Instructions which are received entirely in order by the

Closing Date, which are accompanied (in the case of Shares held in

certificated form) by the relevant share certificate(s) and/or

other document(s) of title or a satisfactory indemnity in lieu in

respect of the entire number of Shares tendered.

5.6.2. Notwithstanding the completion of a valid Tender Form or

sending of a TTE Instruction, the Tender Offer may be suspended,

terminate or lapse in accordance with these terms and

conditions.

5.6.3. The decision of the Company as to which Shares have been

validly tendered shall be conclusive and binding on Shareholders

who participate in the Tender Offer.

5.7. Information on procedure for tendering

If you have any queries regarding the procedure for tendering

your Shares please contact the Company's Receiving Agent on +44

(0)371 664 0321. Calls are charged at the standard geographic rate

and will vary by provider. Different charges may apply to calls

from mobile telephones. Calls from outside the United Kingdom will

be charged at the applicable international rate. Lines are open

between 9.00 a.m. - 5.30 p.m., Monday to Friday excluding public

holidays in England and Wales. Please note that the Receiving Agent

cannot provide any financial, legal or tax advice and calls may be

recorded and monitored for security and training purposes.

6. Announcement of the results of the Tender Offer, the Tender Price and settlement

6.1. Unless terminated in accordance with these terms and

conditions, the Tender Offer will close for Shareholders on the

Closing Date. On the Confirmation Date, the Company will release an

announcement via a Regulatory Information Service informing

Shareholders of the aggregate number of Shares in respect of which

Tender Requests have been made. If the Directors, in their sole

discretion, decide not to proceed with the Tender Offer for the

reasons described in paragraph 2.3 above, the Tender Offer will not

proceed. In such event, the Directors will instead put forward

proposals to Shareholders for the Company to be wound up with a

view to returning cash to Shareholders or to enter into formal

liquidation. If the Tender Offer is to proceed, the Directors will

make arrangements for all of the Company's assets and liabilities

will be valued and allocated between the Continuing Pool and the

Tender Pool on the basis set out in paragraph 4 above.

6.2. Delivery of cash to Shareholders for the Shares to be

purchased pursuant to the Tender Offer will be made by the

Receiving Agent on behalf of the Company. The Receiving Agent will

act as agent for Tendering Shareholders for the purpose of

receiving the cash and transmitting such cash to Tendering

Shareholders. Interest will not be paid on the cash to be paid by

the Company regardless of any delay in making such payment.

6.3. If any Tendered Shares are not purchased because of an

invalid tender, the lapse or termination of the Tender Offer or

otherwise, relevant share certificate(s) evidencing any such Shares

and other document(s) of title, if any, will be returned or sent by

post at such Shareholder's risk as promptly as practicable, to the

relevant tendering Shareholder, or, in the case of Shares held in

uncertificated form (that is, in CREST), the Receiving Agent will

provide instructions to Euroclear UK & International to

transfer all Shares held in escrow balances by TFE Instruction to

the original available balances to which those Shares relate.

6.4. For the Tender Offer, settlement of the consideration to

which any Shareholder is entitled pursuant to valid tenders

accepted by the Company is expected to be made as follows in

accordance with the timetable set out by the Company in respect of

that particular Tender Offer:

6.4.1. Shares held in certificated form (that is, not in CREST)

Where an accepted tender relates to Shares held in certificated

form, cheques for the consideration due will be despatched by the

Receiving Agent by first class post to the person or agent whose

name and address is set out in Box 1 (or, if relevant, Box 4A or 4B

of the Tender Form), or if none is set out, to the registered

address of the tendering Shareholder or, in the case of joint

holders, the address of the first named. All cash payments will be

made in US Dollars by cheque drawn on a UK clearing bank.

6.4.2. Shares held in uncertificated form (that is, in CREST)

Where an accepted tender relates to Shares held in

uncertificated form, the consideration due will be paid through

CREST by the receiving agent (on behalf of the Company) procuring

the creation of a CREST payment in favour of the tendering

Shareholder's payment bank in accordance with the CREST payment

arrangements.

6.4.3. Timing of settlement

The payment of any consideration to Shareholders for Tender

Purchases will be made only after the relevant TTE Instruction has

settled or (as the case may be) timely receipt by the Receiving

Agent of share certificate(s) and/or other requisite document(s) of

title evidencing such Shares and any other documents required for

the Tender Offer.

6.5. If only part of a holding of Shares is sold pursuant to the Tender Offer then:

6.5.1. where the Shares are held in certificated form (that is,

not in CREST), the relevant Shareholder will be entitled to receive

a certificate in respect of the balance of the remaining Shares;

and

6.5.2. where the Shares are held in uncertificated form (that

is, in CREST), unsold Shares will be transferred by Link Group by

means of a TFE Instruction to the original available balance from

which those Shares came.

6.6. The Tender Price will be announced by the Company once all

the assets in the Tender Pool have been fully realised which will

be as soon as practicable after the commencement of the realisation

of the Tender Pool. Tender Purchases will result in the relevant

number of Shares purchased being cancelled and therefore the

percentage voting rights attached to the remaining Shares in issue

will increase proportionately. Accordingly, the announcement will

also contain information notifying Shareholders of the percentage

increase in voting rights attaching to each of the Shares remaining

in issue.

7. Representations and Warranties - Tenders by means of a Tender Form

7.1. Each Shareholder by whom, or on whose behalf, a Tender Form

is executed irrevocably undertakes, represents, warrants and agrees

to and with the Company (so as to bind itself and its personal

representatives, heirs, successors and assigns) that:

7.1.1. the execution of the Tender Form shall constitute an

offer to sell to the Company such Shareholder's entire holding of

Shares if Box 2A is completed, or such number of Shares as is

inserted in Box 2B of the Tender Form, in each case, on and subject

to these terms and conditions and the Tender Form and that, once

lodged, such offer shall be irrevocable;

7.1.2. if in the Company's determination, in its absolute

discretion, an entry has been made in Box 2B which is greater than

the number of Shares held by the Shareholder to whom the Tender

Form relates as at the Record Date, then, provided that the Tender

Form is otherwise in order and accompanied by all other relevant

documents, the tender will be deemed to be a tender in respect of

all the Shares held by that Shareholder as stated in Box 1;

7.1.3. such Shareholder has full power and authority to tender,

sell, assign or transfer the Shares in respect of which such offer

is accepted (together with all rights attaching thereto) and, when

the same are purchased by the Company, they will acquire such

Shares with full title guarantee and free from all liens, charges,

encumbrances, equitable interests, rights of pre-emption or other

third party rights of any nature and together with all rights

attaching thereto on or after the Closing Date, including the right

to receive all dividends and other distributions declared, paid or

made after that date;

7.1.4. the execution of the Tender Form will, subject to the

Tender Offer becoming wholly unconditional, constitute the

irrevocable appointment of any Director or officer of the Company

as such Shareholder's attorney and/or agent ("attorney"), and an

irrevocable instruction to the attorney to complete and execute all

or any instruments of transfer and/or other documents at the

attorney's discretion in relation to the Shares referred to in

paragraph 7.1.1 above in favour of the Company or such other person

or persons as the Company may direct and to deliver such

instrument(s) of transfer and/or other documents at the discretion

of the attorney, together with the share certificate(s) and/or

other document(s) relating to such Shares, for registration within

six months of the Tender Offer becoming unconditional and to do all

such other acts and things as may in the opinion of such attorney

be necessary or expedient for the purpose of, or in connection

with, the Tender Offer and to vest such Shares in the Company or

its nominee(s) or such other person(s) as the Company may

direct;

7.1.5. such Shareholder agrees to ratify and confirm each and

every act or thing which may be done or effected by the Company or

any of its Directors or officers or any person nominated by the

Company in the proper exercise of its or their powers and/or

authorities hereunder;

7.1.6. such Shareholder will deliver to the Receiving Agent

their share certificate(s) and/or other document(s) of title in

respect of the Shares referred to in paragraph 7.1.1 above, or an

indemnity acceptable to the Company in lieu thereof, or will

procure the delivery of such document(s) to the Receiving Agent as

soon as possible thereafter and, in any event, no later than the

Closing Date;

7.1.7. such Shareholder shall do all such acts and things as

shall be necessary or expedient and execute any additional

documents deemed by the Company to be desirable, in each case to

complete the purchase of the Shares and/or to perfect any of the

authorities expressed to be given hereunder;

7.1.8. if such Shareholder is an Overseas Shareholder, (a) he is

not in a Restricted Territory or in any territory in which it is

unlawful to make or accept the Tender Offer, (b) he has fully

observed any applicable legal and regulatory requirements of the

territory in which such Overseas Shareholder is resident or

located, and (c) the invitation under the Tender Offer may be made

to and accepted by him under the laws of the relevant

jurisdiction;

7.1.9. such Shareholder has not received or sent copies or

originals of this Tender Offer Announcement or Tender Form or any

related documents (or previously, the Circular) to a Restricted

Territory and has not otherwise utilised in connection with the

Tender Offer, directly or indirectly, the mails or any means or

instrumentality (including, without limitation, facsimile

transmission, internet, telex and telephone) of interstate or

foreign commerce, or of any facility of a national securities

exchange, of any Restricted Territory, that the Tender Form has not

been mailed or otherwise sent in, into or from any Restricted

Territory and that such Shareholder is not tendering any Shares

pursuant to the Tender Offer from any Restricted Territory;

7.1.10. the provisions of the Tender Form shall be deemed to be

incorporated into these terms and conditions;

7.1.11. the despatch of a cheque in respect of the Tender Price

to a Shareholder at his/her registered address or such other

address as is specified in the Tender Form will constitute a

complete discharge by the Company of its obligations to make such

payment to such Shareholder;

7.1.12. on execution the Tender Form takes effect as a deed; and

7.1.13. the execution of the Tender Form constitutes such

Shareholder's submission to the non-exclusive jurisdiction of the

High Court of England and Wales (the "Court") in relation to all

matters arising out of or in connection with the Tender Offer or

Tender Form.

7.2. A reference in this paragraph 7 to a Shareholder includes a

reference to the person or persons executing the Tender Form and in

the event of more than one person executing a Tender Form, the

provisions of this paragraph will apply to them jointly and to each

of them.

8. Representations and Warranties - Tenders through CREST

8.1. Each Shareholder by whom, or on whose behalf, a tender

through CREST via a TTE Instruction is made irrevocably undertakes,

represents, warrants and agrees to and with the Company (so as to

bind itself and its personal representatives, heirs, successors and

assigns) that:

8.1.1. the input of the TTE Instruction shall constitute an

offer to sell to the Company such number of Shares as are specified

in the TTE Instruction or deemed to be tendered, in each case, on

and subject to these terms and conditions and that once the TTE

Instruction has settled, such offer shall be irrevocable;

8.1.2. such Shareholder has full power and authority to tender,

sell, assign or transfer the Shares in respect of which such offer

is accepted (together will all rights attaching thereto) and, when

the same are purchased by the Company, it will acquire such Shares

with full title guarantee and free from all liens, charges,

encumbrances, equitable interests, rights of pre-emption or other

third party rights of any nature and together will all rights

attaching thereto, on or after the Closing Date including the right

to receive all dividends and other distributions declared, paid or

made after that date;

8.1.3. the input of the TTE Instruction will, subject to the

Tender Offer becoming unconditional, constitute the irrevocable

appointment of the Receiving Agent as the escrow agent for the

Tender Offer and an irrevocable instruction and authority to the

Receiving Agent: (i) subject to the Tender Offer becoming wholly

unconditional, to transfer to itself by means of CREST and then to

transfer to the Company by means of CREST all of the Relevant

Shares (as defined below) in respect of which the Tender Offer is

accepted or deemed to be accepted, or to provide all or any

instructions on behalf of the relevant Shareholder in respect of

transferring the Relevant Shares (as defined below) in CREST to

such person or persons as the Company may direct, in each case not

exceeding the number of Shares which have been tendered pursuant to

the Tender Offer; and (ii) if the Tender Offer is terminated or

does not become unconditional and lapses, or there are Shares which

have not been successfully tendered under the Tender Offer, to give

instructions to Euroclear UK & International, as promptly as

practicable after such lapse, termination or unsuccessful tender,

to transfer Relevant Shares to the original available balances from

which those Shares came. For the purposes of this paragraph,

"Relevant Shares" means Shares in uncertificated form in respect of

which a transfer or transfers to escrow has or have been effected

pursuant to the procedures described in this paragraph;

8.1.4. such Shareholder agrees to ratify and confirm each and

every act or thing which may be done or effected by the Company or

any of its Directors or any person nominated by the Company or the

Receiving Agent in the proper exercise of its powers and/or

authorities hereunder;

8.1.5. such Shareholder shall do all such acts and things as

shall be necessary or expedient and execute any additional

documents deemed by the Company to be desirable, in each case to

complete the purchase of the Shares and/or to perfect any of the

authorities expressed to given hereunder;

8.1.6. if such Shareholder is an Overseas Shareholder, (a) he is

not in the Restricted Territories or in any territory in which it

is unlawful to make or accept the Tender Offer, (b) he has fully

observed any applicable legal and regulatory requirements of the

territory in which such Overseas Shareholder is resident or

located, and (c) the Overseas Shareholder has ensured that the

invitation under the Tender Offer may be made to and accepted by

him under the laws and regulations of the relevant

jurisdiction;

8.1.7. such Shareholder has not received or sent copies or

originals of this Tender Offer Announcement or any related

documents to a Restricted Territory and has not otherwise utilised

in connection with the Tender Offer, directly or indirectly, the

mails or any means of instrumentality (including, without

limitation, facsimile transmission, internet, telex or telephone)

or interstate or foreign commerce, or of any facility of a national

securities exchange, of any Restricted Territory, and that such

Shareholder is not tendering any Shares pursuant to the Tender

Offer from any Restricted Territory;

8.1.8. the creation of a CREST payment in respect of the Tender

Price in favour of such Shareholder's payment bank in accordance

with the CREST payment arrangements as referred to in paragraph

6.4.2 above will constitute a complete discharge by the Company of

its obligations to make such payment to such Shareholder; and

8.1.9. the input of the TTE Instruction constitutes such

Shareholder's submission to the non-exclusive jurisdiction of the

Court in relation to all matters arising out of or in connection

with the Tender Offer or the TTE Instruction.

8.2. If the appointment of the Receiving Agent as escrow agent

for the Tender Offer under paragraph 8.1.3 above shall be

unenforceable or invalid or shall not operate so as to afford the

benefit or authority expressed to be given in paragraph 8.1.3, the

Shareholder shall with all practicable speed do all such acts and

things and execute all such documents that may be required to

enable Link Group to secure the full benefits of paragraph 8.1.3

above.

8.3. If, for any reason, any Shares in respect of which a TTE

Instruction has been made are, prior to the Closing Date, converted

into certificated form, the tender through CREST in respect of such

Shares shall cease to be valid and the Shareholder will need to

comply with the procedures for tendering Shares in certificated

from as set out in these terms and conditions in respect of the

Shares so converted, if it wishes to make a valid tender of such

Shares pursuant to the Tender Offer.

9. Additional provisions

9.1. Each Shareholder (other than a Restricted Shareholder) will

be entitled, subject to these terms and conditions, to have

accepted in the Tender Offer valid tenders to the Company. In

respect of Shares held in certificated form, if in the Company's

determination (in its absolute discretion) Box 2 of the Tender Form

has not been validly completed in respect of the number of Shares

to be tendered and provided that the Tender Form is otherwise in

order and accompanied by all other relevant documents, a

Shareholder may be deemed to have accepted the Tender Offer in

respect of all of the Shares being tendered by the Tendering

Shareholder. For the avoidance of doubt, if the number of Shares

inserted in Box 2B of the Tender Form is higher than the number of

Shares actually held by the Tendering Shareholder on the Record

Date or the Closing Date, the Tendering Shareholder will be deemed

to have tendered such lower number of Shares.

9.2. Shares sold by Shareholders pursuant to the Tender Offer

will be acquired with full title guarantee and free from all liens,

charges, encumbrances, equitable interests, rights of pre-emption

or other third party rights of any nature and together with all

rights attaching thereto on or after the Closing Date, including

the right to receive all dividends and other distributions

declared, paid or made after that date.

9.3. Each Shareholder who tenders or procures the tender of

Shares will thereby be deemed to have agreed that, in consideration

of the Company agreeing to process its tender, such Shareholder,

will not revoke its tender or withdraw its Shares. Shareholders

should note that once tendered, Tendered Shares may not be sold,

transferred, charged or otherwise disposed of pending completion of

the Tender Offer.

9.4. Any omission to despatch the Tender Offer Announcement or

the Tender Form or any notice required to be despatched under the

terms of the Tender Offer to, or any failure to receive the same

by, any person entitled to participate in the Tender Offer shall

not invalidate the Tender Offer in any way or create any

implication that the Tender Offer has not been made to any such

person.

9.5. No acknowledgement of receipt of any Tender Form, TTE

Instruction, share certificate(s) and/or other document(s) of title

will be given. All communications, notices, certificates, documents

of title and remittances to be delivered by or sent to or from

Shareholders (or their designated agents) will be delivered by or

sent to or from such Shareholders (or their designated agents) at

their own risk.

9.6. All powers of attorney and authorities on the terms

conferred by or referred to in these terms and conditions or in the

Tender Form are given by way of security for the performance of the

obligations of the Shareholders concerned and are irrevocable in

accordance with section 4 of the Powers of Attorney Act 1971.

9.7. Subject to paragraphs 10 (Miscellaneous) and 11 (Restricted

Shareholders and other Overseas Shareholders) below, all tenders by

Shareholders holding their Shares in certificated form must be made

on the prescribed Tender Form, fully completed in accordance with

the instructions set out thereon which constitute part of these

terms and conditions of the Tender Offer. A Tender Form or TTE

Instruction will only be valid when the procedures contained in

these terms and conditions are complied with. The Tender Offer will

be governed by and construed in accordance with the laws of England

and Wales.

9.8. If the Tender Offer is terminated or lapses in accordance

with these terms and conditions, all documents lodged pursuant to

the Tender Offer will be returned promptly by post, within 14

Business Days of the Tender Offer terminating or lapsing, to the

person or agent whose name and address is set out in Box 1 or, if

relevant, Box 4A or 4B of the Tender Form or, if none is set out,

to the tendering Shareholder or, in the case of joint holders, the

first named at his or her registered address as shown in Box 1. In

the case of Shares held in uncertificated form, the Receiving Agent

in its capacity as the escrow agent will, within 14 Business Days

of the Tender Offer terminating, give instructions to Euroclear to

transfer all Shares held in escrow balances and in relation to

which it is the escrow agent for the purposes of the Tender Offer

by TFE Instruction to the original available balances from which

those Shares came. In any of these circumstances, Tender Forms and

TTE Instructions will cease to have any effect.

9.9. The instructions, terms, provisions and authorities

contained in or deemed to be incorporated in the Tender Form shall

constitute part of these terms and conditions. The definitions set

out in this Tender Offer Announcement (as applicable) apply to the

terms and conditions of the Tender Offer to which that document

relates, including the Tender Form.

9.10. Subject to paragraphs 10 (Miscellaneous) and 11

(Restricted Shareholders and other Overseas Shareholders) below,

the Tender Offer is open to Shareholders on the Register at the

Record Date and will close at the Closing Date. Tender Forms, share

certificate(s) and/or other document(s) of title or indemnities or

TTE Instructions received after that time may be accepted or

rejected by the Company in its absolute discretion.

9.11. Further copies of this Tender Offer Announcement may be

obtained from the Company's website at

https://www.gulfinvestmentfundplc.com/publications/ or from Link

Group on 0371 064 0321. Calls are charged at the standard

geographic rate and will vary by provider. Different charges may

apply to calls from mobile telephones. Lines are open from 9.00

a.m. - 5.30 p.m., Monday to Friday excluding public holidays in

England and Wales. Please note that Link Group cannot provide any

financial, legal or tax advice and calls may be recorded and

monitored for security and training purposes.

9.12. Each Shareholder tendering Shares in the Tender Offer

represents, warrants and confirms to the Company that it has

observed all relevant legislation and regulations, in particular

(but without limitation) that relate to anti-money laundering (the

"Anti-Money Laundering Legislation"), and, in all such cases, its

offer to tender Shares in the Tender Offer is made on the basis

that it accepts full responsibility for any and all such

requirements under the Anti-Money Laundering Legislation and

warrants and represents that such requirements have been satisfied,

and each Shareholder tendering Shares in the Tender Offer

acknowledges that, due to money laundering prevention requirements

operating within their respective jurisdictions, the Company, the

Administrator, the Registrar and the Receiving Agent for the Tender

Offer may require proof of addresses and identity or corporate

existence, as applicable, before an offer to tender Shares can be

processed and that each of the Company, the Administrator and the

Registrar shall be held harmless and indemnified by each such

Shareholder against any loss ensuing due to the failure to process

a Shareholder's offer to tender Shares if such information as has

been required, has not been provided by it.

10. Miscellaneous

10.1. Any change to the terms, or any extension or termination

of the Tender Offer will be followed as promptly as practicable by

a public announcement thereof no later than 1.00 p.m. on the

Business Day following the date of such changes. Such an

announcement will be released via a Regulatory Information Service.

References to the making of an announcement by the Company includes

the release of an announcement on behalf of the Company by Panmure

Gordon to the press and delivery of, or telephone or facsimile or

other electronic transmission of, such announcement to a Regulatory

Information Service.

10.2. All Tendered Shares bought back by the Company will be cancelled.

10.3. Except as contained in this Tender Offer Announcement no

person has been authorised to give any information or make any

representations with respect to the Company or the Tender Offer

and, if given or made, such other information or representations

should not be relied on as having been authorised by the Company.

Under no circumstances should the delivery of this Tender Offer

Announcement or the delivery of any consideration pursuant to the

Tender Offer create any implication that there has been no change

in the assets, properties, business or affairs of the Company since

the date of this Tender Offer Announcement.

10.4. The Company reserves the absolute right to inspect (either

itself or through its agents) all Tender Forms and TTE Instructions

and may consider void and reject any tender that does not in the

Company's sole judgement (acting reasonably) meet the requirements

of the Tender Offer to which such Tender Form or TTE Instruction

relates. The Company also reserves the absolute right to waive any

defect or irregularity in the tender of any Shares, including any

Tender Form and/or TTE Instruction (in whole or in part) which is

not entirely in order or which is not accompanied by the related

share certificate(s) and/or other document(s) of title or an

indemnity acceptable to the Company in lieu thereof. In that event,

however, the consideration in the Tender Offer will only be

despatched when the Tender Form is entirely in order and the

relevant share certificate(s) and/or other document(s) of title or

indemnities satisfactory to the Company has/have been received. The

Company, the Receiving Agent or any other person will not be under

any duty to give notification of any defects or irregularities in

tenders or incur any liability for failure to give any such

notification.

10.5. The provisions of the UK Contracts (Rights of Third

Parties) Act 1999 do not apply to the Tender Offer.

11. Restricted Shareholders and other Overseas Shareholders

11.1. The provisions of this paragraph and any other terms of

the Tender Offer relating to Restricted Shareholders may be waived,

varied or modified as regards specific Shareholders or on a general

basis by the Company but only if the Company is satisfied that such

waiver, variance or modification will not constitute or give rise

to a breach of applicable securities or other laws.

11.2. Overseas Shareholders should inform themselves about and

observe any applicable legal requirements. It is the responsibility

of any such Overseas Shareholder wishing to tender Shares to

satisfy himself/herself as to the full observance of the laws of

the relevant jurisdiction in connection herewith, the compliance

with other necessary formalities and the payment of any transfer or

other taxes or other requisite payments due in such jurisdiction.

Any such Overseas Shareholder will be responsible for the payment

of any such transfer or other taxes or other requisite payments due

by whomsoever payable and the Company and any person acting on its

behalf shall be fully indemnified and held harmless by such

Overseas Shareholder for any such transfer or other taxes or other

requisite payments such person may be required to pay. No steps

have been taken to qualify Tender Offer or to authorise the

extending of Tender Offer or the distribution of this Tender Offer

Announcement and Tender Forms, as well as the Circular, in any

territory outside the United Kingdom.

11.3. The Tender Offer will not be made to Restricted

Shareholders. Restricted Shareholders are being excluded from the

Tender Offer to avoid offending applicable local laws relating to

the implementation of the Tender Offer. Accordingly, copies of this

Tender Offer Announcement, Tender Forms and any related documents

(including the Circular) are not being and must not be mailed or

otherwise distributed into any Restricted Territory, including to

Shareholders with registered addresses in Restricted Territories,

or to persons who the Company knows to be custodians, nominees or

trustees holding Shares for persons in Restricted Territories.

Persons receiving such documents (including, without limitation,

custodians, nominees and trustees) should not distribute or send

them in or into a Restricted Territory or use such mails or any

such means, instrumentality or facility in connection with the

Tender Offer, as so doing will render invalid any related purported

acceptance of the Tender Offer. Persons wishing to accept the

Tender Offer should not use such mails or any such means,

instrumentality or facility for any purpose directly or indirectly

relating to acceptance of that Tender Offer. Envelopes containing

Tender Forms postmarked from a Restricted Territory or otherwise

despatched from a Restricted Territory or Tender Forms which

provide Restricted Territory addresses for the remittance of cash

or return of Tender Forms will be rendered void.

11.4. A Shareholder will be deemed not to have made a valid

tender if (i) such Shareholder is unable to make the

representations and warranties set out in paragraph 7.1.8 (if

relevant) and 7.1.9 above or paragraph 8.1.6 (if relevant) and

8.1.7 above, or (ii) such Shareholder inserts in Box 4A or 4B of

the Tender Form the name and address of a person or agent in a

Restricted Territory to whom he wishes the consideration to which

such Shareholder is entitled in the Tender Offer to be sent; or

(iii) the Tender Form received from him/her is in an envelope

postmarked in, or which otherwise appears to the Company or its

agents to have been sent from, a Restricted Territory. The Company

reserves the right, in its absolute discretion, to investigate, in

relation to any acceptance, whether the representations and

warranties referred to in paragraph 7.1.8 (if relevant) and 7.1.9

above or in paragraph 8.1.6 (if relevant) and 8.1.7 above given by

any Shareholder are correct and, if such investigation is

undertaken and as a result the Company determines (for any reason)

that such representations and warranties are not correct, such

acceptance shall not be valid.

11.5. If, in connection with the Tender Offer, notwithstanding

the restrictions described above, any person (including, without

limitation, custodians, nominees and trustees), whether pursuant to

a contractual or legal obligation or otherwise, forwards this

Tender Offer Announcement, the Tender Form or any related offering

documents in or into a Restricted Territory or uses the mails of,

or any means or instrumentality (including, without limitation,

facsimile transmission, telex, internet and telephone) of

interstate or foreign commerce of, or any facility of a national

securities exchange in, a Restricted Territory in connection with

such forwarding, such person should (i) inform the recipient of

such fact; (ii) explain to the recipient that such action may

invalidate any purported acceptance by the recipient; and (iii)

draw the attention of the recipient to this paragraph.

11.6. Overseas Shareholders (who are not Restricted

Shareholders) should inform themselves about and observe any

applicable legal or regulatory requirements. If you are in any

doubt about your position, you should consult your professional

adviser in the relevant territory.

12. Modifications

12.1. These terms and conditions shall have effect subject to

such non-material modifications or additions as the Company may

from time to time approve in writing. The times and dates referred

to in this Tender Offer Announcement may be amended by the Company

and notified to Shareholders via an announcement through a

Regulatory Information Service. Details of any such changes will

also appear on the Company's website at

https://www.gulfinvestmentfundplc.com/publications/ .

12.2. The Company may, in its discretion, require some or all of

a Shareholder's Tendered Shares to instead be transferred to a

third party purchaser and each Shareholder shall comply in a timely

fashion with any such requirements of the Company, provided always

that each such Shareholder shall not receive less consideration for

the transfer of the Tendered Shares than it would have received

from the Company pursuant to the Tender Offer. Each Shareholder

shall be deemed to have given the same representations and

warranties (mutatis mutandis) referred to in these terms and

conditions in respect of the Tendered Shares to be transferred to a

third party.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TENBKABQABKDPND

(END) Dow Jones Newswires

March 17, 2022 03:00 ET (07:00 GMT)

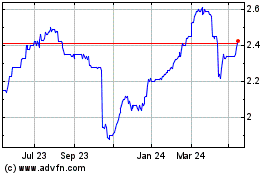

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Oct 2024 to Nov 2024

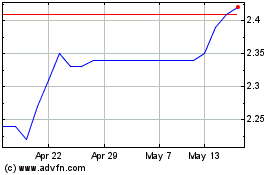

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Nov 2023 to Nov 2024