TIDMQIF

RNS Number : 2436U

Qatar Investment Fund PLC

23 October 2017

Legal Entity Identifier: 2138009DIENFWKC3PW84

23 October 2017

Qatar Investment Fund plc ("QIF" or the "Company")

Q3 2017 Investment Report

Qatar Investment Fund plc (LSE: QIF), today issues its Q3 2017

Investment Report for the period 1 July 2017 to 30 September 2017,

a pdf copy of which can be obtained from QIF's website at:

www.qatarinvestmentfund.com.

QIF was established to capitalize on the investment

opportunities in Qatar and the Gulf Cooperation Council ("GCC")

region, arising from the economic growth being experienced in the

area. The Company invests in quoted Qatari equities listed on the

Qatar Exchange ("QE") in addition to companies soon to be listed,

with a possible allocation of up to 15% in other listed companies

elsewhere in the GCC region. The Investment Adviser invests using a

top-down screening process combined with fundamental industry and

company analysis.

QIF Quarterly Report - Q3 2017

3 months ended 30 September 2017

Highlights

Qatar Investment Fund

Ø Qatar Investment Fund Plc's net asset value per share fell

3.8% vs. a fall of 8.0% by Qatar Exchange Index

Qatar

Ø 100 days since the beginning of the trade embargo by

neighbouring countries, the Qatari economy is showing

resilience

Ø Qatari government deposited $39 billion into the banking

system to mitigate $30 billion outflows

Ø Credit growth: 7.3% in the year to August

Ø Deposit growth: 9.2% in the year to August

Ø Qatar's population exceeded 2.6 million in September 2017, up

7.7% on August

Ø Qatar's producer price index rose 10.4% in August compared to

August 2016

Ø Qatar's overall GDP grew 0.6% in Q2 2017 vs. Q2 2016, with

non-hydrocarbon growth of 3.9%

QIF Performance

Source: Bloomberg, Qatar Insurance Company (QIC)

On 30 September 2017, the Qatar Investment Fund plc (QIF) share

price was trading at an 11.6% discount to net asset value (NAV) per

share.

Historic Performance

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Q3

5M 2017

----------------- ------ ------- ------ ------ ------ ------ ------ ------ ------- ------ ------

QIF NAV* 13.9% -36.4% 10.4% 29.9% 1.3% -4.7% 24.2% 20.6% -14.6% -2.6% -3.8%

----------------- ------ ------- ------ ------ ------ ------ ------ ------ ------- ------ ------

QE Index 27.0% -28.8% 1.1% 24.8% 1.1% -4.8% 24.2% 18.4% -15.1% 0.1% -8.0%

----------------- ------ ------- ------ ------ ------ ------ ------ ------ ------- ------ ------

QIF Share Price 15.5% -67.5% 97.3% 23.0% -2.3% 2.4% 26.4% 17.4% -17.0% -4.5% 5.1%

----------------- ------ ------- ------ ------ ------ ------ ------ ------ ------- ------ ------

Source: Bloomberg, QIC; Note: *Net of dividends paid

Qatar economy resilient in first 100 days of the GCC rift

Qatar's economy has shown resilience in the face of the dispute

with Saudi Arabia, Bahrain, Egypt and the UAE. This is contrary to

most expectations. Hydrocarbon exports have continued virtually

uninterrupted, new trade routes have been established and the

government is encouraging a higher degree of economic

self-sufficiency. Goods imported from neighbouring countries are

now re-routed through Iran, India and Turkey, without great impact

on consumers. Qatar is also working on developing the necessary

mechanisms to reduce costs and improve the efficiency of the supply

chain for the import of goods and services. While the embargo

initially disrupted some economic activity, this impact has since

reduced.

The embargo particularly impacted two sectors of the economy:

international trade and banking.

Imports fell in June and July, although they rebounded 40% in

August, almost returning to their pre-dispute level. Food and

beverage prices climbed 4.5% in July compared to a year earlier,

the fastest rise since 2014, with a quarterly rise of 4.2% compared

to Q2 2017. In August food and beverage prices rose 2.8% from

August 2016 and fell back 0.6% from July, as the country

established new routes to obtain food.

Chart: Qatar's Consumer Price Inflation (CPI) and Food price

inflation

Source: MDPS

The recent opening of Hamad port, one of the largest in the

region, has supported imports, with the expansion of several new

shipping routes, including to India, Oman, Turkey and Pakistan.

Qatar also launched projects aimed at boosting food production and

the tourism sector. Qatar's announcement that it plans to raise its

liquefied natural gas (LNG) output by 30% prepares it for greater

economic independence in the long term.

The banking sector has also been affected. It was expected that

Qatari banks would be impacted as some banks from the disputing

countries withdrew deposits and loans. While this did occur, the

impact on bank balance sheets was mitigated by liquidity injections

from the Qatar Central Bank and increased public-sector deposits.

Overall, the banking sector remains resilient with high asset

quality and strong capitalisation.

Worries that trade disruption would impact infrastructure

projects has been mitigated by the level of inventory which Qatar

has maintained and the availability of construction materials from

alternative sources.

A decline in visitors to Qatar from neighbouring countries has

meant a renewed drive to attract international tourists has been

launched. Visa restrictions have been lifted and the construction

of new hotels and other tourism projects are underway.

On 30 August 2017, the International Monetary Fund (IMF)

predicted growth outside the oil and gas sector in Qatar would

moderate to 4.6% in 2017 from 5.6% in 2016, and to 4.8% over the

medium term. It also forecast that the central government's budget

deficit would shrink to 5.9% of GDP in 2017 from 8.8% in 2016, and

continue falling in 2018, when Qatar would introduce a value added

tax. Qatar's current account is projected to improve to a surplus

of c.3.9% of GDP in 2017 from a deficit of 7.7% in 2016, due to

higher oil and gas prices.

Chart: Qatar to remain fastest growing economy despite

blockade

Source: IMF (April 2017), Qatar GDP growth estimates from

Moody's (8(th) August, 2017)

The price of Qatar's 5-year credit default swaps, which had

increased to 125.22 bps in early July, had reduced to 97.18 bps by

the end of September.

Chart: Qatar Credit Default Swap (CDS) normalised after initial

spikes following blockade

Source: Bloomberg

Qatar Banking system to manage funding pressures with strong

support from sovereign fund

Q3 was challenging for the Qatari economy and the nation's

banks. Moody's Investors Service changed its outlook on the Qatari

banking system to negative from stable in August, citing weakening

operating conditions and continued funding pressures.

Table: Moody's and S&P Country Rating and Outlook

Country Moody's Rating (Outlook) S&P Rating (Outlook)

------------- ------------------------- ---------------------

Qatar Aa3 (Negative) AA- (Negative)

------------- ------------------------- ---------------------

Abu Dhabi Aa2 (Stable) AA (Stable)

------------- ------------------------- ---------------------

Saudi Arabia A1 (Stable) A- (Stable)

------------- ------------------------- ---------------------

Kuwait Aa2 (Stable) AA (Stable)

------------- ------------------------- ---------------------

Oman Baa2 (Negative) BB+ (Negative)

------------- ------------------------- ---------------------

Bahrain B1 (Negative) BB- (Negative)

------------- ------------------------- ---------------------

Source: Moody's and S&P Website

Qatari banks faced large net outflows of non-domestic customer

deposits (June 2017: QAR 13.9 billion; July 2017: QAR 13.5 billion;

August 2017: QAR 8.2 billion) mostly from customers in the

boycotting Arab countries. Such deposits in Qatar accounted for

18.8% of total banks deposits in August, down from 24.2% in May.

However, total deposits at the banks in Qatar rose 2.7% in August

compared to July, 9.2% YTD and 20.0% vs. August 2016 to QAR 793.6

billion, mainly supported by public-sector companies, which are

addressing the funding and liquidity challenge by placing more

deposits in the banking system.

Chart: Non-Resident Deposits as % of total deposits in GCC

Countries

Source: Central Banks (Note: for Kuwait and Oman August 2017

data was not available at the time of writing this report)

So far Qatari banks do not appear to be significantly impacted

in their domestic business. Total domestic credit growth was up

1.2% in August compared to July, 8.2% YTD and 15.2% compared to

August 2016. At the same time, total credit rose 1.0% in August

compared to July, 7.3% YTD and 14.6% compared to August 2016.

Public sector credit growth increased 1.3% compared to July, 14.2%

YTD and 31.4% compared to August 2016. At the same time, private

sector credit was up 0.8% compared to July, 2.5% YTD and 5.6%

compared to August 2016.

As a result, the Loan to Deposit ratio stood at 114.1% in August

(vs. 116.0% in July, 114.4% in June and 116.1% in December

2016).

Chart: Qatar Credit and Deposit growth remained strong

Source: QCB

The regional dispute led to an increase in financing costs for

banks in international debt markets. August 2017 data from Qatar

Central Bank (QCB) shows an increase in deposit rates: from 2.67%

in May to 2.77% in July but 2.73% in August. The overall impact on

each bank will depend on how much it relies on non-domestic sources

for funding. At the same time, yields on Qatar 10-year bonds and

credit spreads are back to pre-blockade levels. The Qatari 10-year

bond yield is now below the Saudi equivalent bond. There has been a

positive demand for Qatar National Bank's (QNB's) recent bond

issues from overseas investors.

Moody's reported problem loans are likely to increase to around

2.2% of gross loans by 2018, up from 1.7% in December 2016. Despite

this increase, the NPL ratio will remain among the lowest in the

GCC. Moody's also expects tangible common equity to increase to

around 15.5% of risk-weighted assets by end 2018 from 14.4% in

December 2016, driven by slower-than-normal credit growth and

higher profit retention.

Chart: Qatar System-wide NPL ratio to remain lowest in the

GCC

Source: Central Banks Financial Stability Reports, World Bank,

NPL estimates from Moody's

Note: for the UAE, Moody's estimated NPL's in the range of 5.5%

to 6.0%

The government investment in infrastructure will drive credit

demand, however, deposits could expand at a slower pace, increasing

the banking sector's reliance on external funding, particularly

from Europe and Asia.

Regional Market Overview

Most GCC markets edged down in Q3 2017. In September 2017, the

Qatari market fell 5.5%, finishing the quarter down 8.0%. Fitch

downgraded Qatar's sovereign rating one notch to AA- with a

'Negative' outlook, bringing it in line with S&P and Moody's,

which had downgraded Qatar in June and July.

The MSCI GCC index dropped 0.7% in Q3 2017, having ended 3.0% up

in Q2. Dubai was the best performing index in Q3, up 5.1%.

Crude prices closed nearly 20% higher in Q3 due to a weak

dollar, declining crude inventories in the US following Hurricane

Harvey and Irma, as well as a broader recovery in the commodity

market. Ongoing discussions to extend the OPEC oil production cut

agreement beyond the deadline of March 2018 also helped.

Portfolio Structure

Top 10 Holdings

Company Name Sector % share of NAV

------------------------------ ---------------------------- ---------------

Qatar National Bank Banks & Financial Services 18.1%

------------------------------ ---------------------------- ---------------

Masraf Al Rayan Banks & Financial Services 11.4%

------------------------------ ---------------------------- ---------------

Industries Qatar Industrials 9.2%

------------------------------ ---------------------------- ---------------

Qatar Electricity & Water Co Industrials 8.7%

------------------------------ ---------------------------- ---------------

Ooredoo Telecoms 8.3%

------------------------------ ---------------------------- ---------------

Barwa Real Estate Real Estate 6.2%

------------------------------ ---------------------------- ---------------

Qatar Gas Transport Transportation 5.3%

------------------------------ ---------------------------- ---------------

Commercial Bank of Qatar Banks & Financial Services 5.3%

------------------------------ ---------------------------- ---------------

Gulf International Services Industrials 4.1%

------------------------------ ---------------------------- ---------------

Qatar National Cement Co Industrials 3.5%

------------------------------ ---------------------------- ---------------

Source: QIC

In Q3, QIF's top 10 holdings increased to 80.2% from 70.4% of

NAV, primarily due to an increase in holdings of QNB and Qatar

Electricity & Water Company. The Investment Adviser reduced

exposure in Industries Qatar to 9.2% from 10.9%, as lower steel

revenues and decline in fertilizers and polyethylene sales volume

led to weak performance of the company. Cash holding was lower at

2.4% in Q3 2017 compared to 10.0% in Q2 2017, as the Investment

Adviser increased its exposure to the UAE and made fresh

investments in Omani companies (nil in the last quarter).

Country Allocation

As at 30 September 2017, QIF had 28 holdings: 16 in Qatar, 9 in

the UAE and 3 in Oman (Q2 2017: 26 holdings: 19 in Qatar and 7 in

the UAE). The Investment Adviser increased exposure to the UAE to

10.4% from 7.1%. In Q3 2017, the Investment Adviser invested 1.7%

of the portfolio in Omani companies.

Source: QIC

Sector Allocation

As at 30 September 2017:

Source: QIC

QIF remained underweight the Qatari Banking sector (including

Financial Services) at 42.1% of NAV vs. QE index weighting of 48.2%

(Q2 2017: 46.4%). QNB remains QIF's largest holding (18.1% of NAV).

For the period between December 2016 to August 2017, credit in

Qatar continued to grow (up 6.6%) driven by the public sector (up

14.2%). The Investment Adviser believes that loan growth will

continue in the medium to long term, as the Qatari government is

expected to continue with its infrastructure development plans,

notwithstanding the current standoff. Moderately higher oil and gas

prices are anticipated to push growth higher, giving impetus to

domestic demand in Qatar.

Industrials remain QIF's second largest exposure at 25.5% of NAV

(Q2 2017: 23.3%), led by Industries Qatar (9.2% of NAV). However,

the holding in Industries Qatar decreased to 9.2% from 10.9% in Q2

2017. On the other hand, holding in Qatar Electricity & Water

Company increased to 8.7% from 5.7% in Q2 2017.

QIF has no exposure to the Insurance sector (vs. 2.9% in Q2

2017). Exposure to Real Estate and Telecoms sectors rose to 11.8%

and 10.5% from 10.1% and 7.7%, respectively. This was due to new

investments in the UAE and Oman (Oman Telecom, Ooredoo Oman).

The exposure to the Transportation sector increased to 6.7% from

5.9% in Q2 2017, while exposure to the Services & Consumer

Goods sector reduced to 1.1% (Q2 2017: 2.3%).

Qatar: Corporate profits declined 8.0% in H1 2017

The combined profit of Qatari listed companies was down 8.0% in

H1 2017 compared to H1 2016. On a quarterly basis, the combined

profit of Qatari listed companies saw a drop of 14.8% in Q2 2017

compared to the same period last year.

Sector Profitability (net profit/loss in QAR 000's)

Sector H1 2016 H1 2017 % change Q2 2016 Q2 2017 % change

-------------------------------- ------------ ----------- --------- ------------ ----------- ---------

Banks & Financial Institutions 10,693,161 10,801,102 1.0% 5,608,673 5,496,054 -2.0%

-------------------------------- ------------ ----------- --------- ------------ ----------- ---------

Services &Consumer Goods 1,101,877 862,442 -21.7% 565,311 444,173 -21.4%

-------------------------------- ------------ ----------- --------- ------------ ----------- ---------

Industry 4,193,765 3,599,911 -14.2% 2,475,193 1,749,664 -29.3%

-------------------------------- ------------ ----------- --------- ------------ ----------- ---------

Insurance 759,348 631,067 -16.9% 324,971 222,436 -31.6%

-------------------------------- ------------ ----------- --------- ------------ ----------- ---------

Real Estate 2,520,192 2,363,912 -6.2% 997,502 702,904 -29.5%

-------------------------------- ------------ ----------- --------- ------------ ----------- ---------

Telecoms* 1,461,858 1,096,780 -25.0% 583,219 512,667 -12.1%

-------------------------------- ------------ ----------- --------- ------------ ----------- ---------

Transportation 1,154,314 780,851 -32.4% 516,002 303,059 -41.3%

-------------------------------- ------------ ----------- --------- ------------ ----------- ---------

Total 21,884,515 20,136,065 -8.0% 11,070,871 9,430,957 -14.8%

-------------------------------- ------------ ----------- --------- ------------ ----------- ---------

Source: Qatar Exchange; *Excluding Vodafone Qatar because of

31(st) March year end, Q2 2017 includes the net profit of

Investment Holding Group which got listed in August 2017

Profits in the Banking and Financial Services sector rose 1.0%

in H1 2017. Growth was driven by a 1.0% rise in net income of

Qatari listed banks. During the first eight months of 2017 credit

growth remained healthy, up 6.6%, driven by public sector growth

(+14.2%). Profit of conventional banks rose 1.3% during H1 2017,

compared to a 0.3% rise in the profits of Islamic banks. QNB

reported a profit growth of 6.5% in H1 2017. Qatar Islamic Bank,

Qatar International Islamic Bank, Ahli Bank and Doha Bank reported

profit growth of 10.4%, 5.0%, 2.8% and 1.0%, respectively.

Commercial Bank of Qatar reported a fall in profit, down 64.1%,

mainly due to a substantial rise in loan loss provisions, while

Masraf Al Rayyan Bank's profit was down 3.0%.

Profits in the Services & Consumer Goods sector dropped

21.7% during H1 2017, primarily due a decline in profits of Qatar

Fuel (-31.0%), following new terms for fuel supplies and an

increase in pension contributions. In the same period, Mannai

Corporation, Salam International, and Qatar Cinema also reported

lower profits. However, Widam, Medicare, and Zad Holding Co.

reported a rise in profits in H1 2017.

Profits in the Industrials sector dropped 14.2% in H1 2017, as

all companies in the sector, excluding Qatar Industrial and

Manufacturing Co. and Qatar Electricity & Water Co., reported

reduced profits. Industries Qatar's profit, which had risen 33.1%

in Q1 2017, dropped in Q2 2017 (-47.2%) on lower steel revenues and

a decline in fertilizers and polyethylene sales volume.

In H1 2017, the profit of the Insurance sector fell 16.9%

compared to H1 2016, as Qatar Insurance Company and Qatar General

& Reinsurance Company reported profit drops of 16.2% and 53.7%,

respectively.

Real Estate sector profits in H1 2017 declined 6.2%, driven by a

significant drop in profits of Barwa, United Dev. Company and

Mazaya Qatar, but the drop was limited by a rise in profits of

Ezdan (up 24.5%).

The Qatari Telecom sector comprises of Vodafone Qatar and

Ooredoo. Ooredoo reported a 25.0% fall in profits in H1 2017,

mainly due to higher tax expense, increase in royalties and lower

foreign currency gains in H1 2017. Vodafone Qatar is excluded from

this profit comparison, since its fiscal year ends on 31 March.

In the Transportation sector, profits declined 32.4%, as Qatar

Navigation Company and Qatar Gas Transport Company reported profit

declines of 51.6% and 18.4%, respectively in H1 2017. However, Gulf

Warehousing Company reported a 3.9% growth for the same period.

Other Recent Developments

India looks to boost Qatar LNG import volume

India's LNG imports are expected to rise by 10%, to over 30

million metric ton per annum (MTPA) by 2020, versus 19 million MTPA

in 2016.

India is Qatar's third largest export destination. Currently,

the Qatar-India trade is around $10-$10.5 billion, of which $9-$9.5

billion is the value of Qatar's exports to India, mostly LNG and

petrochemicals.

Qatar signs 15-year LNG deal with Bangladesh

Qatar's RasGas sealed a 15-year LNG Sales and Purchase Agreement

(SPA) with Bangladesh Oil, Gas and Mineral Corporation

(Petrobangla). RasGas will supply 2.5 million MTPA of LNG to

Petrobangla for 15 years.

Qatargas to deliver 1.5 million MTPA of LNG to Turkey's

Botas

Qatargas signed a medium-term SPA with Turkey's Botas to deliver

1.5 MTPA of LNG for three years starting in October 2017.

Qatargas and Shell sign new LNG deal

Qatargas also signed a SPA with Shell to deliver up to 1.1 MTPA

of LNG for five years. This deal provides Qatargas with access to

Shell's gas sales portfolio in the United Kingdom and continental

Europe, as well as the flexibility to manage LNG deliveries to its

global client portfolio.

Qatar banks to comply with 'IFRS 9' from next year

QCB will be one of the first banks in the region to implement

the accounting provisions in accordance with International

Financial Reporting Standards 9 Financial Instruments from the next

financial year. QCB has been the regional leader in terms of

complying with international banking reporting standards.

Qatar second best competitive economy in the Arab world for

2017-18: WEF

Qatar has been rated as the second best competitive economy in

the Arab world by the World Economic Forum (WEF). Qatar has been

ranked 25(th) globally, ahead of Saudi Arabia and Bahrain (30(th)

and 44(th) ). However, Qatar's global position slipped from 18(th)

the previous year.

New shipping lines opened to connect with Hamad port

Hamad Port has been making economic gains and has seen the

launch of some 15 direct lines to date, which have contributed to

reducing costs and shortening travel time. This is in the interest

of importers whose goods arrive directly from the ports of origin

to Qatar without the need for intermediate ports. Hamad Port's

three major container terminals with a capacity of 7.5 million

twenty-foot equivalent units (TEUs) per year, will play a major

role in transporting goods for all countries in the region. Adding

new shipping lines will pave the way for a more developed Qatari

economy.

Hamad Port eyes 35% of region's trade in 2 years, says transport

minister

The $7.4 billion Hamad Port, covering 30,000 square kilometres,

has already won 27% of the regional trade in the Middle East since

opening in December 2015. Part of the port's strategy is to gain

35% of the total regional trade in 2018 thanks to its strategic

location and superior facilities.

Qatar's Transport minister has praised the private sector's role

in the construction and operation of the Hamad Port, which was

responsible for 60% of the work. The private sector will have a

major portion of the construction work of the second phase, with

projects worth QAR 5 billion to be completed and delivered between

2020 and 2021.

FTSE added Gulf Warehousing Co to FTSE Qatar Index in its

semi-annual review

In the periodical rebalancing act, FTSE removed Qatari Investor

Group, Aamal Co. and Qatar Navigation (Milaha) from the Index while

adding Gulf Warehousing Co. The changes to the FTSE Qatar index

came in effect from September 18.

QSE revised its QE, QE Al Rayan Islamic and QE All Share Index

constituents

In its semiannual review of index constituents, Qatar Stock

Exchange (QSE) removed Aamal and Qatar Insurance from the QE index

while adding Al Meera Consumer Goods Company, Qatar First Bank and

Mazaya Qatar. Qatar Islamic Insurance will join QE Al Rayan Islamic

Index and Ahli Bank will be removed from QE All share Index and QE

Banks and Financial Services Index.

Macroeconomic Update

According to the Ministry of Development Planning and Statistics

(MDPS), the Qatari economy grew 0.6% year-on-year (YoY) in Q2 2017,

while the GDP growth stood at 0.5% compared to Q1 2017. The

hydrocarbon sector contracted by 2.7% over Q2 2016, but compared to

Q1 2017, it recorded a growth of 1.0%. The non-hydrocarbon sector

showed a better performance in Q2 2017 as it grew by 3.9% YoY in Q2

2017. Its growth was flat compared to Q1 2017.

Population growth is expected to remain strong as large projects

related to the 2022 FIFA World Cup continue to attract expatriates.

As a result, personal consumption is expected to remain strong and

continue to benefit domestic consumer and services sector

companies.

In August 2017 imports were 7.8% lower than August 2016.

Exports, the vast majority being natural gas and oil, climbed

17.7%. As a result, Qatar's trade surplus expanded 45.4% to QAR

12.62 billion in August 2017.

Qatar's industrial producer's earnings displayed robust

performance in August 2017 mainly on higher prices for

hydrocarbons, refined petroleum products and other chemical

products and fibers. Qatar's PPI rose 10.4% YoY and 2.2%

month-on-month in August 2017.

The IMF, in August stated that Qatar has acted effectively in

protecting its economy against the Gulf sanctions, in part due to

the measures of rerouting trade to other nations and establishing

new sources of food supply.

The Investment Adviser believes that Qatar's real GDP growth

will continue to be robust in the long term, assuming the GCC

dispute reaches some form of negotiated settlement. This belief is

driven by growth in the non-hydrocarbon sector. However, near-term

economic growth could be impacted by the regional dispute.

Valuations

Market Market Cap. PE (x) PB (x) Dividend Yield (%)

-------------- ------------ ------------------------ ----------------- ---------------------

$ million Current 2017E 2018E Current 2017E Current 2017E

-------------- ------------ -------- ------ ------ --------- ------ ----------- --------

Qatar 91,853 13.24 11.69 10.23 1.23 1.40 4.84 3.93

-------------- ------------ -------- ------ ------ --------- ------ ----------- --------

Saudi Arabia 458,753 17.70 14.47 12.94 1.67 1.54 3.30 3.44

-------------- ------------ -------- ------ ------ --------- ------ ----------- --------

Dubai 84,526 101.54 12.08 9.60 1.31 1.20 3.96 4.25

-------------- ------------ -------- ------ ------ --------- ------ ----------- --------

Abu Dhabi 116,592 16.26 11.91 11.29 1.28 1.31 4.65 4.74

-------------- ------------ -------- ------ ------ --------- ------ ----------- --------

Oman 14,656 12.11 11.40 10.18 1.09 1.03 5.06 5.34

-------------- ------------ -------- ------ ------ --------- ------ ----------- --------

Source: Bloomberg, Prices as of 05 October 2017

The diplomatic rift saw the Qatari stock market fall on investor

concerns about Qatar's trade, labour market and liquidity

conditions. It is now trading on a PE of 13.24x, below most GCC

markets while also yielding 4.84%.

Outlook

The Investment Adviser believes that Qatar is positioned for

long-term growth as a result of higher oil and gas output and

further expansion in the construction, financial services and

transportation sectors. However, the ongoing GCC dispute could have

a short-term impact on economic growth. The Investment Adviser

believes that the dispute will be resolved but the timing is

uncertain. A negotiated resolution is most likely and anticipated

to happen gradually.

Higher government and public-sector deposits, credit growth and

major ongoing projects should support to the Qatari economy and its

financial system. Liquidity may improve in the coming months with

higher energy prices and bond issuances. Qatar's industrial

production rose in July and August compared to June, showing a

positive trend in the manufacturing sector.

If oil prices stay above budgeted levels (of $45) would provide

the Qatari government flexibility in continuing its planned

infrastructure projects. Regardless, Qatar's fiscal buffers and

sizeable assets will allow it to remain a strong player in the

region.

The Investment Adviser believes that the Qatari economy is

strong enough to face the current challenging scenario. However,

markets could be volatile until a settlement is reached.

The company news service from the London Stock Exchange

END

MSCMMBITMBBTBJR

(END) Dow Jones Newswires

October 23, 2017 02:00 ET (06:00 GMT)

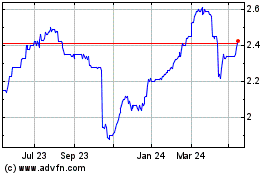

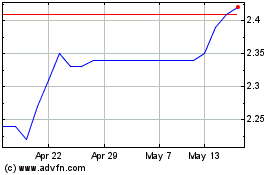

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Nov 2023 to Nov 2024