RNS No 3743f

GOOCH & HOUSEGO PLC

20th January 1999

GOOCH & HOUSEGO PLC

PRELIMINARY RESULTS FOR THE YEAR ENDED 30 SEPTEMBER 1998

Gooch & Housego PLC ("G&H"), the specialist manufacturer of

precision optical components and bespoke glass engineering

items, acoustic-optic devices and instruments for measuring

optical radiation, today announces preliminary results for

the year ended 30 September 1998.

Highlights

* Turnover increased by 6.5% to #7,154,000 (1997:

#6,718,000)

* Profit before tax and exceptional credits increased by

21% to #1,727,000 (1997: #1,427,000)

* Profit before tax increased by 15% to #1,812,000

(1997: #1,576,000)

* UK business increased pre-tax profits by 14.7% to

#1,448,000 on turnover of #4,565,000, up 14.1%

* Management changes in US led to an improvement in 2nd

half results

* Recommended final dividend of 1.2p per share making a

total for the year of 1.7p

Archie Gooch, Chairman of Gooch & Housego commented:

"The developments that are taking place in many of the

activities of the group, including potential acquisitions,

leave it well positioned for continued growth and

profitability. The increasingly broad product spread

resulting from these developments will benefit both the UK

and the USA operations, and as a result I continue to be

optimistic about the future success of Gooch & Housego."

For further information:

Archie Gooch/ Gareth Jones

Gooch & Housego PLC Tel: 01460 52271

Tim Thompson/ Jennie Roberts

Buchanan Communications Tel: 0171 4665000

Trevor Inglis

Sutherlands Ltd Tel: 0171 628 2030

Extract from the annual report and accounts

Chairmans Statement

Introduction

This is Gooch & Housego PLCs first Annual Report and

Accounts since its flotation on the Alternative Investment

Market in December 1997, and follows Interim Results sent to

shareholders in June 1998. I am pleased to report on a year

that combined successful financial results with significant

and ongoing developments aimed at strengthening and expanding

the group.

Results for the Year

Overall group results for the year are pleasing with profits

in line with our expectations at the time of flotation. Group

pre-tax profits for the year ended 30th September 1998 were

#1,812,000, including an exceptional profit on the sale of US

property of #85,000, representing an increase of 15% relative

to the previous financial year. The comparative increase in

pre-tax profits before exceptional items was 21%. Turnover

increased by 6.5% to #7,154,000.

United Kingdom

The United Kingdom business continued its strong performance

with an increase in pre-tax profits of 14.7% to #1,448,000 on

a turnover that increased by 14.1% to #4,565,000. Sales of

acousto-optics, including RF drivers, increased by 18% on the

previous year and now account for 65% of turnover. During the

summer the group invested in an advanced automated lens

manufacturing facility, which has significantly increased the

lens production capacity and will enable further growth of

the traditional optics business. Worldwide problems in the

semiconductor industry have been accompanied by a slackening

in demand for Q-switches. However the UK year end total order

book stood at a record level of #2,199,000, up 18% on the

1997 level. Given the prevailing market conditions this is a

satisfactory figure. Implementation of a fully integrated

computer system and associated software is continuing and

good progress is being made. The system, which will be fully

operational during the current financial year, should deliver

real production and administrative savings.

United States

The United States business, Optronic Laboratories Inc., has

shown improvement in the second half of the year following

the management changes referred to in my interim report, and

this improvement looks set to continue. Pre-tax profit for

the year was up by 19.4% at $602,000, albeit including profit

on the sale of vacated property, on a turnover of $4,505,000.

Steve Denomme, in his new role as President, has introduced

several changes including the appointment of a new marketing

manager. This will enable Optronic Laboratories to take

better advantage of its leading product range.

It is Gooch & Housegos policy to develop the business of

Optronic Laboratories to more effectively market the groups

leading products in the US market for optics and acousto-

optics, as well as extending the core instrumentation product

range to address a wider market. The first step in this

process was the successful development of a range of RF

drivers for use with our acousto-optics Q-switches, and these

are now achieving increased market penetration. The

completion of the new 25,000 square foot factory in Orlando,

opened in February 1998, was the next phase, creating

considerable additional space for new projects, including, in

particular, the manufacture of precision optics which, until

now, had been carried out entirely at the groups UK site.

US Optics Manufacturing

An optics manufacturing facility is being established at the

new Orlando facility that will allow G&H to address the large

US optics market as a US manufacturer, thereby overcoming any

resistance or financial disadvantage that we may have

hitherto suffered as a foreign supplier. In particular, this

will enable us to compete on even terms for the supply of

optics to a major potential US government customer that is

forced to pay a 12% surcharge when purchasing goods from non-

US companies. Jeff Orton, a specialist in optical

manufacturing with previous experience of establishing a new

facility, joined G&H in June and, after a period of

familiarisation with the companys products and methods in

the UK, moved to Orlando in September to begin the set-up

process.

A new range of instrument products targeted at higher volume

industrial markets should result from a joint development

between the UK and USA companies. These will complement the

current range of low volume laboratory instruments.

Directors

Two non-executive directors were appointed to the Board in

1997. Jan Melles brings extensive knowledge of the photonics

industry and mergers and acquisitions, whilst Andrew Davison

has considerable city and finance expertise.

Flotation

The group was successfully floated on the Alternative

Investment Market on 12th December 1997 with 33.3% of the

enlarged issued share capital passing into public hands. Of

the funds raised approximately #1,495,000 was for investment

in the group, notably for the construction of the new factory

in Orlando and additional automated manufacturing equipment

in Ilminster.

Dividend

The Board has recommended a final dividend of 1.2p per

ordinary share. This makes a total for the year of 1.7p.

Subject to approval at the Annual General Meeting, the final

dividend will be payable on 26th February 1999 to all

shareholders registered on 5th February 1999.

Strategy

The research and development of photonic devices and

systems for our next generation of products continues to be a

high priority. Work has commenced on the commercialisation of

a fibre-optic re-routing switch that if successful will find

applications in the telecommunications market. This project,

supported under the Department of Trade and Industrys SMART

scheme, has allowed us to strengthen the research and

development team through the recruitment of an additional

post-doctoral physicist. A number of other research and

development projects looking into new devices and instruments

are running in parallel and involve collaboration between the

UK and US companies and with universities.

Gooch and Housego will continue to concentrate on the

manufacture of photonic products for a worldwide market. It

is our aim to be a world leader in each of our spheres of

activity. Growth will be achieved organically through

internal investment and research and development; and by

acquisition. Since flotation the Board have investigated

several potential acquisitions, both in the UK and the USA,

and we hope that we shall be in a position to make an

announcement in respect of one such initiative shortly.

Outlook

The developments that are taking place in many of the

activities of the group, including potential acquisitions,

leave it well positioned for continued growth and

profitability. The increasingly broad product spread

resulting from these developments will benefit both the UK

and the USA operations, and as a result I continue to be

optimistic about the future success of Gooch and Housego.

Finally I would like to thank both the UK and USA workforce

and directors for the part they have played in achieving yet

another good year for the company.

Archie Gooch M.B.E. J.P.

Executive Chairman

GROUP PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 30 SEPTEMBER 1998

Note 1998 1997

#000 #000

Turnover 7,154 6,718

Changes in stocks of

finished goods and work in 321 51

progress

Own work capitalised 19 -

Other operating income 35 128

Raw materials and (1,575) (1,498)

consumables

Other external charges (430) (396)

Staff costs (2,765) (2,618)

Depreciation (257) (241)

Other operating charges (801) (644)

------- -------

Operating profit 1,701 1,500

Exceptional item: Profit

on disposal of fixed assets 85 149

------- -------

Profit on ordinary

activities before 1,786 1,649

Interest

Other interest receivable

and similar Income 88 7

Interest payable and

similar charges (62) (80)

------- -------

Profit on ordinary

activities before 1,812 1,576

Taxation

Tax on profit on ordinary (569) (465)

activities ------- -------

Profit on ordinary

activities after

Taxation 1,243 1,111

Dividends on equity shares (288) (51)

------- --------

Retained profit for the

financial year 955 1,060

======= ========

Earnings per 20p ordinary

share 7.5p 7.4p

All operations undertaken by the Group during the current

year are continuing.

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

FOR THE YEAR ENDED 30 SEPTEMBER 1998

1998 1997

#000 #000

Profit for the financial year 1,243 1,111

Currency translation differences

on foreign currency net (55) (34)

investments ------ ------

Total recognised gains and losses

for the financial year 1,188 1,077

======= ======

No note of historical cost profit for the group or the

company has been presented as the difference between the

reported profit and the historical cost profit is immaterial.

CONSOLIDATED BALANCE SHEET AS AT 30 SEPTEMBER 1998

Note

1998 1997

#000 #000 #000 #000

FIXED ASSETS

Intangible assets 4 5

Tangible assets 2,955 2,175

----- ------

2,959 2,180

CURRENT ASSETS

Stocks 1,178 835

Debtors 1,591 1,659

Cash at bank and in hand 1,416 278

------ -----

4,185 2,772

CREDITORS: amounts

falling due within one

year (1,571) (1,531)

------ ------

NET CURRENT ASSETS 2,614 1,241

------ ------

TOTAL ASSETS LESS

CURRENT LIABILITIES 5,573 3,421

CREDITORS: amounts

falling due after more

than one year (305) (547)

------ ------

5,268 2,874

====== ======

CAPITAL AND RESERVES

Called up share capital 3,381 5

Share premium account 1,113 -

Revaluation reserve 308 308

Goodwill reserve (1,335) (1,335)

Profit and loss account 1,801 3,896

------ -------

EQUITY SHAREHOLDERS

FUNDS 5,268 2,874

====== =======

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEAR ENDED 30 SEPTEMBER 1998

Note

1998 1997

#000 #000 #000 #000

Cash flow from

operating activities 1,423 1,451

Returns on investments

and servicing of

finance

Interest received 88 7

Interest paid (67) (71)

Interest element of

hire purchase

contracts (7) (7)

------- ------

Net cash

inflow/(outflow) from

returns on investments 14 (71)

and servicing of

finance

Taxation

UK tax paid (374) (252)

Overseas tax paid (68) (128)

------- -------

Cash outflow from (442) (380)

taxation

Capital expenditure and

financial investment

Purchase of tangible (1,193) (899)

fixed assets

Sale of tangible fixed 286 189

assets ------ -------

Net cash outflow from

capital expenditure

and financial (907) (710)

investment

Equity dividends paid (111) (26)

------ ------

Cash (outflow)/inflow

before financing (23) 264

Financing

Cash inflow from

flotation 1,495 -

Inception of hire purchase - 76

contracts

Repayment of bank loan (219) (233)

Capital element of hire

purchase contracts (11) (27)

------- ------

Net cash

inflow/(outflow) from 1,265 (184)

financing ----- -----

Increase in cash in the 1,242 80

year ====== =====

NOTES TO THE CASH FLOW STATEMENT

1. (i)Reconciliation of operating profit to operating cash flows

1998 1997

#000 #000

Operating profit 1,701 1,500

Depreciation 258 262

(Increase) in stock (362) (122)

(Increase) in debtors (95) (282)

(Decrease)/increase in creditors (79) 93

------ ------

1,423 1,451

====== ======

(ii) Cash flow relating to exceptional items

The cash inflows in the year ended 30 September 1998 include

a cash inflow of #301,000 received from the net proceeds of

selling the Orlando factory (note 7). The prior years

inflow includes #232,000 from the proceeds of an insurance

claim arising from a fire in the Ilminster factory.

(iii)Reconciliation of net cash inflow to movement in

net funds/(debt)

1998 1997

#000 #000

Increase in cash in the year 1,242 80

Cash outflow from decrease in debt 230 260

and lease financing ------ ------

Changes in net debt resulting from 1,472 340

cash flows

New finance leases - (76)

Translation difference (12) (4)

------ -------

Movement in net debt in the year 1,460 260

Net debt at 1 October 1997 (567) (827)

------ -------

Net funds/(debt) at 30 September 893 (567)

1998 ====== =======

NOTES

1. EXCEPTIONAL ITEM

Optronic Laboratories Inc moved into a purpose built factory

in Orlando in February 1998 and the old factory was sold in

May 1998 realising a profit of #85,000.

In 1997 the exceptional item arose from insurance claim

proceeds following a fire in the Ilminster factory which

destroyed or badly damaged some fixed assets.

2. Copies of this Statement will be sent to Shareholders on 28th

January 1999, and will be available from The Old Magistrates

Court, Ilminster, Somerset.

END

FR CCCCQODKDQDD

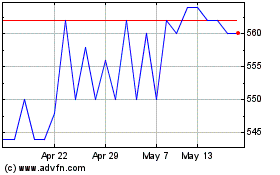

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From May 2024 to Jun 2024

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jun 2023 to Jun 2024