Gooch & Housego PLC - Interim Results

June 08 1998 - 3:33AM

UK Regulatory

RNS No 5435c

GOOCH & HOUSEGO PLC

8th June 1998

MAIDEN INTERIM RESULTS SINCE FLOTATION

"TURNOVER UP 13%"

Gooch & Housego PLC, ("G&H"), the specialist manufacturer of

precision optical components and bespoke glass engineering

items, acousto-optic devices and instruments for measuring

optical radiation, today announces its maiden interim results

since flotation on AIM in December 1997, for the six months to

31 March 1998.

HIGHLIGHTS

* Turnover of #3,662.000

* Pre tax profit of #826,000

* UK - business recorded 24% sales growth over the same period

in 1997. Sales of acousto-optic products increased by 35% now

accounting for 65% of UK turnover, up from 59% last year.

* US - New Orlando 25,000 sq ft. factory opened in February

1998.

Commenting on the results, Archie Gooch, Executive Chairman,

said:

"We are delighted with these results, particularly with the

strong contribution from our acousto-optic products. Our state-

of-the-art Q-switch driver developed in the US is beginning to

find acceptance in the market, supported by our advantageous

patent position."

CHAIRMANS STATEMENT

I am pleased to submit my first report following the successful

flotation of Gooch & Housego PLC in December 1997. As a result

of the flotation we have experienced considerable additional

interest in the activities of the company. We now have 343

shareholders.

THE GROUP

Gooch & Housego has performed well during the six months to 31

March 1998, with turnover up by 13% and pre tax profits ahead of

budget, whilst simultaneously making considerable changes and

improvements within the group and to our facilities. Following

the flotation, the Group had net current assets of #2,369,000

(30 September 1997 #1,241,000). In the six months ended 31

March 1998 the group generated cash flows from operations of

#786,000 and had surplus cash resources of #1,337,000 at the

half year.

UNITED KINGDOM

The United Kingdom business has recorded a 24% sales growth over

the same period last year with a substantial improvement in

operating profits. Sales of acousto-optic products have

increased by 35% and now account for 65% of UK turnover, up from

59% last year. The manufacture of acousto-optics utilises our

highly specialised traditional optical production facility and

so the gradual change in sales emphasis does not translate into

a significant change in work patterns. The traditional optical

business continues to operate satisfactorily and shows steady

gains in sales and profits. A new state-of-the-art automated

lens-manufacturing machine has been ordered at a cost of

#160,000. It is due for delivery in June 1998, and should

expand our lens production considerably. Overall the comparison

with last year illustrates a very satisfactory result. With the

UK order book currently at a record level there is a high level

of confidence for the future.

Early this year confirmation was received that the Company has

been awarded funding to the value of #48,000 by the Department

of Trade and Industry under the SMART scheme in support of the

development of a fibre-optic re-routing switch. The project,

which has the acronym "COMFORT", started on 1st March 1998 and

will last eighteen months.

Research projects are ongoing in a number of areas. One of

these has recently resulted in the assignment of a patent from

the University of Kent to the Company in the field of optical

modulation, which will complement our activities in the field of

acousto-optics, and may with further development, give us a

considerable advantage in the market place.

Installation of a new computer system that will fully integrate

all of the Companys main activities, from accounts to

production control, is on schedule. Hardware and software have

been installed and training and consultancy are continuing. The

system will be fully operational early in 1999. At the same

time the Company will be fully year 2000 compliant.

UNITED STATES

The US business, Optronic Laboratories Inc., has had a difficult

second quarter to the year. Whilst achieving a pre tax profit

of $180,000 for the half year, I regret to say that they are

currently trading below expectations. They operate in a highly

specialised market area, which has experienced a downturn in

activity in recent months resulting in a decline in orders. The

current level of interest is, however, strong and it is hoped

that this situation can soon be corrected.

The new Orlando factory was completed on time in January 1998

and the move of premises took place later the same month. I was

pleased to open the new facility on 25th February 1998. The

facility provides 25,000 sq. ft. of ground floor space and will

accommodate all of Optronic Laboratories current activities as

well as the new RF driver business, while still allowing room

for the growth of the instrumentation, RF electronics and optics

businesses. The old factory has been sold at a small profit

subsequent to the half-year results, realising cash of $540,000.

Our state-of-the-art Q-switch driver was developed at O.L.I.,

and is beginning to find wider acceptance in the market and

routine production has commenced. Now that a wide range of

drivers can be offered we can begin to exploit our advantageous

patent position. (Optronic Laboratories is joint licensee of a

key patent relating to Q-switch drivers.) To date only a small

fraction of the Q-switch driver market has been addressed and

currently sample units are under evaluation in USA, Europe and

Japan.

Optronic Laboratories has functioned semi-autonomously under the

President Mr Bill Schneider, since our acquisition from him in

October 1995. He has now decided to step-down as President, and

it is intended to retain his skill as a Scientific Adviser,

where the benefits of his vast experience in the industry will

continue to be available to the Company. I thank Bill for his

considerable efforts over the last two and a half years.

I welcome Steve Denomme (formerly Vice President of Finance and

Production) to his new role as President, and look forward to

working closely with him in the future as the operations of both

businesses are brought closer together.

SUMMARY AND OUTLOOK

The performance of the UK business is very encouraging with a

record order book, but the US business has performed less

satisfactorily and steps have been taken to address the

problems. A number of exciting new contracts and opportunities

are currently being considered. Overall the Group is trading in

line with expectations, and there is a high level of confidence

in the future.

DIVIDEND

The Board has declared an interim dividend of 0.5p per Ordinary

Share. The dividend will be payable on 16 July 1998 to all

shareholders registered on 19 June 1998.

Archie Gooch M.B.E. J.P.

Executive Chairman

Copies of this Statement will be sent to Shareholders on 8th

June 1998, and will be available from The Old Magistrates Court,

Ilminster, Somerset.

GOOCH & HOUSEGO PLC

UNAUDITED CONSOLIDATED PROFIT AND LOSS ACCOUNT

6 months 12 months

ended ended

31 March 98 30 Sept 97

#000 #000

Turnover 3,662 6,718

Changes in stocks of finished goods

and work in progress 104 51

Other operating income 25 128

Raw materials and consumables (817) (1,498)

Other external charges (221) (396)

Staff costs (1,401) (2,618)

Depreciation (122) (241)

Other operating charges (404) (644)

---------- ----------

Operating profit 826 1,500

Exceptional item; Profit on

disposal of fixed assets - 149

----------- -----------

Profit on ordinary activities

before interest 826 1,649

Other interest receivable

and similar income 33 7

Interest payable and similar

charges (33) (80)

----------- -----------

Profit on ordinary activities

before taxation 826 1,576

Tax on profit on ordinary

activities (249) (465)

------------ -----------

Profit on ordinary activities

after taxation 577 1,111

Dividends on equity shares (85) (51)

------------ ------------

Retained profit for the

financial period 492 1,060

============ ============

Earnings per ordinary share 3.6p 7.4p

============ ===========

All of the amounts above are in respect of continuing operations

Earnings per ordinary share is calculated on profit on ordinary

activities after taxation, using the weighted average number

of shares in issue for the period, of which there were

16,150,630 (1997: 14,999,400)

UNAUDITED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

6 months 12 months

ended ended

31 March 98 30 Sept 97

#000 #000

Profit for the period 577 1,111

Currency translation

differences on foreign

currency net investments (71) (34)

------------ ------------

Total gains and losses

for the financial period 506 1,077

------------- ------------

UNAUDITED CONSOLIDATED BALANCE SHEET

6 months 12 months

ended ended

31 March 98 30 Sept 97

#000 #000

FIXED ASSETS

Intangible assets 5 5

Tangible assets 2,862 2,175

-------------- -------------

2,867 2,180

============= =============

CURRENT ASSETS

Stocks 918 835

Debtors 1,736 1,659

Cash at bank and in hand 1,337 278

--------------- --------------

TOTAL CURRENT ASSETS 3,991 2,772

--------------- --------------

CREDITORS: amounts falling

due within one year (1,622) (1,531)

--------------- --------------

NET CURRENT ASSETS 2,369 1,241

=============== =============

TOTAL ASSETS LESS CURRENT

LIABILITIES 5,236 3,421

CREDITORS:

amounts falling due

after more than one year (412) (548)

---------------- -------------

NET ASSETS 4,824 2,873

=============== =============

CAPITAL AND RESERVES

Called up share capital 3,381 5

Share premium 1,115

Revaluation reserve 308 308

Goodwill reserve (1,335) (1,335)

Profit and loss account 1,355 3,895

-------------- ------------

EQUITY SHAREHOLDERS FUNDS 4,824 2,873

============= ============

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT

6 months 12 months

ended ended

31 March 98 30 Sept 97

Note #000 #000

Cash flow from operating

activities (1) 786 1,640

Returns on investments

and servicing of finance:

Interest received 33 7

Interest paid (37) (71)

Interest element of

hire purchase contracts (3) (7)

----------- ----------

Net cash (outflow)/inflow

from returns on

investments and servicing

of finance (7) (71)

Taxation

UK tax paid (11) (252)

Overseas tax paid (20) (128)

----------- ------------

Cash outflow from taxation (31) (380)

Capital expenditure and

financial investment

Purchase of tangible

fixed assets (934) (899)

Sale of tangible fixed assets 1

------------ -------------

Net cash outflow from capital

expenditure and financial

investment (933) (899)

Equity dividends paid (26) (26)

------------ -------------

Net cash (outflow)/inflow

before financing (211) 264

Financing

Receipts from share issue 2,000

Cost of share issue (504)

Inception of hire purchase

contracts 76

Repayment of bank loan (119) (233)

Hire purchase repayment (5) (27)

-------------- -----------

Net cash inflow/(outflow)

from financing 1,372 (184)

Increase/(decrease) in cash

in the period (2) 1,161 80

============= ===========

Notes to the cash flow statement

(1) Reconciliation of operating profit to operating cash flows

6 months 12 months

ended ended

31 March 98 30 Sept 97

#000 #000

Operating profit 826 1,500

Exceptional item 149

Depreciation 141 262

Loss on disposal of assets

damaged in fire 40

Increase in stock (97) (122)

Increase in debtors (86) (282)

Increase in creditors 2 93

---------- ------------

786 1,640

========== ============

(2)Reconciliation of net cash inflow to movement in net debt

6 months 12 months

ended ended

31 March 98 30 Sept 97

#000 #000

Increase in cash in the period 1,161 80

Cash outflow from decrease in

debt and lease financing 124 260

----------- -----------

Changes in net debt resulting

from cashflows 1,285 340

New finance leases (76)

Translation difference (8) (4)

------------ ------------

Movement in net debt in the period 1,277 260

Net debt at 1 October 1997 (569) (829)

------------ ------------

Net debt at 31 March 1998 708 (569)

=========== ===========

The comparative figures for the year to 30 September 1997 are an

abridged version of the Accounts filed with the Registrar of

Companies, on which unqualified audit opinion has been given.

For further information:

Archie Gooch/Gareth Jones

Gooch & Housego PLC Tel: 01460 52271

David Scott

Sutherlands Tel: 0171 628 2030

Tim Thompson/Jennie Roberts

Buchanan Communications Ltd Tel: 0171 466 5000

END

IR ALLVDRRIEIAT

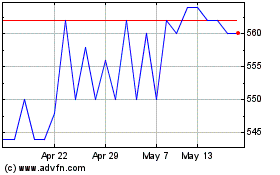

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From May 2024 to Jun 2024

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jun 2023 to Jun 2024