Foresight Slr Fnd Ld Foresight Solar Fund Limited : Interim Management Statement And Dividend Announcement - Replacement

May 08 2015 - 12:23PM

UK Regulatory

TIDMFSFL

FORESIGHT SOLAR FUND LIMITED

This replaces the announcement released at 7:00am on 27 April 2015. The

original announcement incorrectly stated the NAV per share as 101.1

pence as at 31 March 2015. This was due to an error in the NAV per share

calculation. The total NAV for the portfolio and all other details of

the announcement remain unchanged.

Replacement: Interim Management Statement and Dividend Announcement

Foresight Solar Fund Limited ("FSFL" or the "Company"), the listed

renewable infrastructure fund investing solely in operational UK Solar

plants today announces its Interim Management Statement ("IMS").

This statement relates to the period from 1 January 2015 to 31 March

2015. Unless otherwise noted, the financial information provided in this

IMS is unaudited.

Highlights

-- Net Asset Value ("NAV") increased from GBP209.8m as at 31 December 2014

to GBP244.7m as at 31 March 2015, taking the NAV per Ordinary Share to

100.2p (31 December 2014: 100.9p).

-- The Company raised GBP36.1 million of gross proceeds in the second

fundraising under its placing programme in March 2015.

-- The acquisition of the 37MW Kencot asset reached financial completion on

27 March 2015. The Company has the contractual right to all revenue

generated by Kencot since the start of its operations in September 2014.

-- The Company finalised the connection of the 2.2MW extension at its

Wymeswold plant, increasing capacity by 7% to 34.4MW. The extension was

connected to the Grid in March 2015 and will therefore be eligible for

the 1.4 ROC rate.

-- All ten assets in the Company's 233MW portfolio are fully operational and,

more critically, all received ROC accreditation ahead of the 31 March

2015 cliff edge deadline for ROC projects greater than 5MW.

-- Several large project acquisitions are currently under consideration by

the Company that are part of a significant pipeline of assets under

exclusivity.

-- The second interim dividend of 3.0 pence per Ordinary Share was paid on

27 March 2015, representing a 6.0 pence dividend per Ordinary Share in

respect of the Company's first full financial period ended 31 December

2014.

-- The first quarterly dividend of 1.52 pence in respect of the period from

1 January to 31 March 2015 was approved on 23 April 2015 and will be paid

on 30 June 2015.

Dividend Timetable

Ex-dividend Date 18 June 2015

Record Date 19 June 2015

Payment Date 30 June 2015

Operational Assets

-- The Company's 233MW, ten asset UK Solar portfolio is fully operational.

-- The acquisition of the 37MW Kencot asset reached financial completion on

27 March 2015. The plant was connected to the Grid in September 2014 and

received ROC accreditation at the rate of 1.4 ROCs/MWh. The Company has

the contractual right to all revenue generated by Kencot since the start

of its operations in September 2014.

-- The 2.2MW extension at Wymeswold was connected to the Grid in March 2015

and will therefore be eligible for the 1.4 ROC rate. The extension does

not affect the 2.0 ROC accreditation for the original 32.2MW plant which

was acquired by the Company in November 2013, having been connected to

the Grid in March 2013.

-- There is no debt at the underlying project level in line with the

Company's stated strategy.

-- Performance of the portfolio for the period has been in-line with the

expectations of the Investment Manager.

Financing Strategy

-- The Company has refinanced and extended its revolving acquisition

facility from GBP100 million to GBP120 million with the objective of

supporting future project acquisitions.

-- The facility has been refinanced through RBS and Santander on

preferential terms against the originally facility as follows:

-- GBP100 million, 3 year tranche at a cost of 225 bps + Libor; and

-- GBP20 million, 1 year tranche at a cost of 185 bps + Libor.

-- The Company has announced its intention to introduce long-term financing

and is currently evaluating a number of opportunities available in the

market.

-- Foresight Group, the Company's investment adviser, has previously

implemented long-term financing facilities having successfully refinanced

an existing retail solar fund which recently crystallised a doubling of

the investors' original investment.

Portfolio Valuation

-- Net Asset Value increased from GBP209.8m as at 31 December 2014 to

GBP244.7m as at 31 March 2015, taking the NAV per Ordinary Share to

100.2p (31 December 2014: 100.9p).

-- The Company has adjusted its forward power curve forecast to reflect the

most recent forecasts released by independent energy market consultants.

Excluding all other factors, this led to a reduction in NAV. It should be

noted that the independent forecasts continue to assume an increase in

power prices in real terms over the medium to long-term.

-- The negative impact of power curves on NAV has been more than offset

through a combination of increased operational efficiencies within the

portfolio through the re-negotiation and improvement of key contractual

terms, together with the continued reduction of the discount rate.

Dividend

-- A second interim dividend of 3.0 pence per Ordinary Share was paid on 27

March 2015, representing a 6.0 pence dividend per Ordinary Share in

respect of the Company's first full financial period ended 31 December

2014.

-- The Directors continued intention is to pay a sustainable, index-linked

dividend to Shareholders. The Directors target is accordingly to deliver

a dividend of 6.08 pence (6.00 pence inflated by RPI for 2014) for the

year from 1 January to 31 December 2015, in line with the Company's

dividend policy.

-- The first quarterly dividend of 1.52 pence in respect of the period from

1 January to 31 March 2015 was approved on 23 April 2015 and will be paid

on 30 June 2015.

Placing Programme

-- The Company has established a Placing Programme under the Prospectus

dated 25 September 2014 in respect of proposed issues of up to 200

million new Ordinary Shares.

-- Through this Placing Programme, the Company raised GBP60.1 million of

gross proceeds in its initial placing in October 2014, with an additional

GBP36.1 million of gross proceeds raised in its second placing in March

2015.

Pipeline

-- The Company has a significant pipeline of assets under exclusivity.

-- The March 2015 1.4 ROC banding deadline for assets over 5MW drove large

amounts of activity and new capacity being installed in the first quarter

of 2015. This scale of UK installed solar capacity has created an active

market in large-scale secondary assets, and as such the Company is

reviewing a number of secondary opportunities.

-- Portfolios of new projects under 5MW planned to be installed under the

1.3 ROC banding period are also expected to provide an attractive source

of new investment opportunities in the short-term.

ENDS

For further information, please contact:

Foresight Group

Elena Palasmith epalasmith@foresightgroup.eu +44 (0)20 3667 8100

Stifel +44 (0)20 7710 7600

Mark Bloomfield

Neil Winward

Tunga Chigovanyika

J.P. Morgan Cazenove

William Simmonds +44 (0)20 7742 4000

Notes to Editors

About Foresight Solar Fund Limited ("The Company" or "FSFL")

FSFL is a Jersey-registered closed-end investment company. The Company

invests in ground based UK solar power assets to achieve its objective

of providing shareholders with a sustainable and increasing dividend

with the potential for capital growth over the long-term.

The Company raised proceeds of GBP150m through an initial public

offering ("IPO") of shares on the main market of the London Stock

Exchange in October 2013. In October 2014, the Company announced a

GBP200m Placing Programme open until September 2015, of which GBP96.2m

has been raised to date.

About Foresight Group

Foresight Group was established in 1984 and today is a leading

independent infrastructure and private equity investment manager with

GBP1.4 billion of assets under management. As one of the UK's leading

solar infrastructure investment teams Foresight funds currently manage

GBP1 billion in 50 separate operating Photovoltaic ("PV") plants in the

UK, the USA and southern Europe.

In May 2013 Foresight executed an innovative refinancing of its existing

UK solar assets through the issue of a GBP60m London Stock Exchange

listed index-linked Solar Bond.

Foresight Group has offices in London, Nottingham, Guernsey, Rome and

San Francisco.

www.foresightgroup.eu

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Foresight Solar Fund Limited via Globenewswire

HUG#1920276

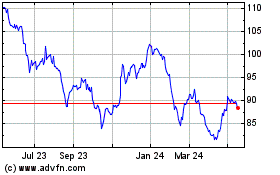

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Jun 2024 to Jul 2024

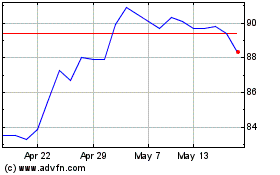

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Jul 2023 to Jul 2024