TIDMENOG

RNS Number : 9532V

Energean PLC

07 December 2023

Energean plc

("Energean" or the "Company")

Morocco Country Entry and Farm In to Gas Development

London, 7 December 2023 - Energean plc (LSE: ENOG, TASE: ) is

pleased to announce that it has farmed into Chariot Limited's

("Chariot", AIM:CHAR) acreage offshore Morocco, which includes the

18 Bcm (gross) Anchois gas development and significant exploration

prospectivity. This new country entry is well-aligned with

Energean's strategy to become the pre-eminent independent producer

in the Mediterranean, with a focus on high quality gas assets.

Highlights:

-- New country entry in Energean's core Mediterranean region

with acreage underpinned by an attractive gas development

-- Farm in to 45% of the Lixus licence, with the option to

increase to 55% post drilling results, and 37.5% of the Rissana

licence and assumes operatorship of both licences

-- Includes the commercial 18 Bcm (gross) Anchois development,

located near to infrastructure for supply of gas to domestic and

international markets

-- Up front cash consideration of $10 million

-- Appraisal well planned for 2024, targeting an additional 11

Bcm of gross unrisked prospective resource to be commercialised

through the Anchois development

-- Energean to carry Chariot for its share of pre-FID costs,

which are recoverable from Chariot's future revenues

-- Significant additional near-field, near-infrastructure

prospectivity that is expected to add attractive, balanced-risk

growth potential

Dr Leila Benali, Minister of Energy Transition and Sustainable

Development, commented:

"This agreement is pivotal for the wider acreage offshore

Morocco, on its Atlantic coast, a key energy asset for the Kingdom.

We welcome Energean on these licences as the important investments

will contribute greatly to the monetisation of the country's

resources and to our ambitious energy strategy."

Mrs Amina Benkhadra, General Director Office National des

Hydrocarbures et des Mines, ("ONHYM") commented:

"I would like to congratulate both parties on signing this

agreement. The discovery and extensive work to date has set an

excellent foundation on which the project can be developed and this

partnership will now be instrumental in financing and taking it

through the next phase. We look forward to working alongside

Energean and Chariot in bringing the project to first gas."

Mathios Rigas, Chief Executive Officer of Energean,

commented:

"This is an exciting step in the next stage of our development,

one that can only enhance our position as the pre-eminent

independent natural gas producer listed in London. These assets are

particularly attractive as we understand the core geological,

commercial and political drivers of the region, we have a track

record in developing material gas resources prioritised for the

domestic market and they are a complementary fit with our broader

portfolio, not least the potential for surplus supply to other

markets. We look forward to working with our partners Chariot and

ONHYM, and developing an outstanding resource for the benefit of

all parties, including Morocco and its people."

Adonis Pouroulis, Chief Executive Officer of Chariot,

commented:

"In Energean, we have secured a partner with a proven track

record of rapidly building and delivering this kind of offshore

development. Energean also shares our view that Anchois and its

surrounding acreage offers significant upside potential and we are

aligned with our plans moving forward. The new partnership is a key

step in bringing the development of the Anchois field to reality

and we are looking forward to continuing the extensive work

undertaken so far to reach Final Investment Decision."

Assets

Energean has agreed to farm into a 45% working interest in the

Lixus offshore licence, which contains the Anchois gas development

(Chariot 30%, ONHYM 25%), and a 37.5% working interest in the

Rissana licence (Chariot 37.5%, ONHYM 25%). Energean will assume

operatorship for both licences.

Farm in terms

As consideration for the interests in the licences, Energean has

agreed to the following terms:

-- $10 million cash consideration on closing of the transaction

-- Energean agrees to carry Chariot for its share of pre-FID

costs (which are recoverable from Chariot's future revenues, see

terms below), up to a gross expenditure cap of $85 million,

covering:

o drilling of the appraisal well; and

o all other pre-FID costs; and

o up to $7 million of seismic expenditure on the Rissana

licence.

-- $15 million in cash, which is contingent on FID being taken on the Anchois Development.

Post appraisal well option to increase working interest from 45%

to 55%

Following the drilling of the appraisal well, Energean has the

option to increase its working interest in the Lixus licence (which

includes the Anchois development) by 10%, to 55%. On exercise of

this option, the amount payable would be:

-- Chariot's choice between either:

i. 5-year, $50 million of convertible loan notes with a GBP20 strike price and 0% coupon; or

ii. 3 million Energean plc shares, issued immediately upon

exercise of the option but subject to a lock-up period until the

earlier of first gas and 3 years post FID

-- Energean will pay to Chariot a 7% royalty for every dollar

achieved on gas prices (post transportation costs) in excess of a

base hurdle

-- An agreement to carry Chariot's 20% share of development

costs for the Anchois development with the following terms:

o A net expenditure cap of $170 million

o The carry available for development costs is reduced by costs

carried in the pre-FID phase

o All carried amounts are recoverable from 50% of Chariot's

future revenues with interest charged at SOFR + 7%

If the option is not exercised, subject to FID, the partners

agree to progress the Anchois development with an ownership

structure of Energean 45%, Chariot 30%, ONHYM 25%. All amounts

carried by Energean on behalf of Chariot would be recoverable from

Chariot's future revenues under the same terms as above.

The completion of the transaction is subject to government

approval.

Lixus licence and Anchois Development

The Lixus Offshore licence covers an area of approximately 1,794

km2 with water depths ranging from the coastline to 850 m. The area

has extensive data coverage with legacy 3D seismic data covering

approximately 1,425 km2 and five exploration wells have been

drilled historically, including the Anchois-1 and Anchois-2

discovery wells.

Chariot's latest competent persons report covering the Anchois

Field has certified gross 2C contingent resources of 18 Bcm in the

discovered gas sands and gross unrisked prospective resources of 21

Bcm in undrilled sands.

Energean and Chariot plan to drill an appraisal well in 2024,

with the following objectives:

-- To undertake a drill stem test on the main gas-containing sands

-- To target an additional 5 Bcm of recoverable gas with a 61%

geological chance of success through a sidetrack into the O sands

in the Anchois Footwall prospect

-- To target an additional 6 Bcm of recoverable gas with a 49%

geological chance of success through a deepening of the well into

previously undrilled sands in the Anchois North Flank prospect

Once drilled, the well is expected to be retained as a future

producer for the Anchois development.

It is anticipated that the licence contains significant

additional prospectivity that could allow for further

balanced-risk, near-field exploration activity.

Enquiries

For capital markets: ir@energean.com

Kate Sloan, Head of IR and M&A Tel: +44 7917 608 645

For media: pblewer@energean.com

Paddy Blewer, Head of Corporate Communications Tel: +44 7765 250

857

Forward looking statements

This announcement contains statements that are, or are deemed to

be, forward-looking statements. In some instances, forward-looking

statements can be identified by the use of terms such as

"projects", "forecasts", "on track", "anticipates", "expects",

"believes", "intends", "may", "will", or "should" or, in each case,

their negative or other variations or comparable terminology.

Forward-looking statements are subject to a number of known and

unknown risks and uncertainties that may cause actual results and

events to differ materially from those expressed in or implied by

such forward-looking statements, including, but not limited to:

general economic and business conditions; demand for the Company's

products and services; competitive factors in the industries in

which the Company operates; exchange rate fluctuations;

legislative, fiscal and regulatory developments; political risks;

terrorism, acts of war and pandemics; changes in law and legal

interpretations; and the impact of technological change.

Forward-looking statements speak only as of the date of such

statements and, except as required by applicable law, the Company

undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise. The information contained in this

announcement is subject to change without notice.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFSLESMEDSELE

(END) Dow Jones Newswires

December 07, 2023 02:00 ET (07:00 GMT)

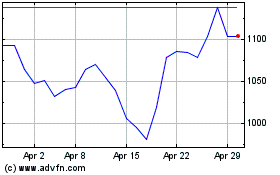

Energean (LSE:ENOG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Energean (LSE:ENOG)

Historical Stock Chart

From Dec 2023 to Dec 2024