TIDMDSG

RNS Number : 2890X

Dillistone Group PLC

25 April 2023

25 April 2023

Dillistone Group Plc

("Dillistone", the "Company" or the "Group")

Final Results

& Investor Presentation

Dillistone Group Plc, the AIM quoted supplier of software for

the international recruitment industry , is pleased to announce its

audited final results for the 12 months ended 31 December 2022.

Highlights

-- Revenue increased by 2% to GBP5 .699m. First revenue growth since 2016.

-- Adjusted(*) loss before tax decreased to GBP0.453m (2021: GBP0.687m) - an improvement of 34%.

-- Adjusted(*) EBITDA increased to GBP0.949m (2021: GBP0.747m) - an improvement of 27%.

-- Recurring revenues represented 89% (2021: 89%) of Group

revenue, which covers administration expenses (excluding

depreciation and amortisation).

-- Total Annual Contract Value (TACV) up 4% to GBP4.99m (2021: GBP4.79m)

-- Order book increased by 3% year on year.

-- Adjusted operating cash from operating activities 45% up at GBP1.189m (2021: GBP0.819m).

-- Cash at period end of GBP0.433m. The Board does not expect

the Group to require additional funding.

Commenting on the results and prospects, Giles Fearnley,

Non-Executive Chairman, said:

"I am pleased to report continued progress for 2022, delivering

financial performance in line with expectations while paying down

debt, delivering sector leading customer service and continuing to

invest for the future."

"The underlying business has improved. The Group has increased

revenue, decreased adjusted loss and improved cash generation. We

have delivered on our strategy and present results in line with

market expectations."

"The Board is pleased to report a positive start to the year. We

expect to see year on year growth in recurring revenue across both

our Executive Search and Contingency sectors in H1 and remains

confident of achieving market expectations for the full year."

Definitions:

* EBITDA adjusted for furlough support

* Operating cash adjusted for Government support received

* (Loss) before tax adjusted for furlough, Government support

and exceptional costs associated with Covid

* TACV is the total annual recurring revenue of all signed

contracts, whether invoiced and included in

deferred revenue or still to be deployed and/or not yet invoiced

See note 7 for a reconciliation to adjusted figures

Investor Presentation: 3pm on Tuesday 25 April 2023

Jason Starr, Chief Executive, and Ian Mackin, Finance Director,

will hold an investor presentation to cover the results and

prospects at 3pm on Tuesday 25 April 2023.

The presentation will be hosted through the digital platform

Investor Meet Company. Investors can sign up to Investor Meet

Company and add to meet Dillistone Group Plc via the following link

https://www.investormeetcompany.com/dillistone-group-plc/register-investor

. For those investors who have already registered and added to meet

the Company, they will automatically be invited.

Questions can be submitted pre-event to

dillistone@walbrookpr.com or in real time during the presentation

via the "Ask a Question" function.

Mello Investor Conference, Chiswick, London - Tuesday 23 and

Wednesday 24 May 2023

Dillistone announces that it expects to present at the Mello

investor conference in Chiswick, London, on Tuesday 23 and

Wednesday 24 May 2023. Investors wishing to attend can find more

details at www.melloevents.com .

Annual Report and Accounts - The final results announcement can

be downloaded from the Company's website (www.dillistonegroup.com).

Copies of the Annual Report and Accounts (in addition to the notice

of the Annual General Meeting) will be sent to shareholders by 19

May 2023 for approval at the Annual General Meeting to be held on

13 June 2023.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Enquiries:

Dillistone Group

Plc

Giles Fearnley Chairman Via Walbrook PR

Jason Starr Chief Executive

Officer

Ian Mackin Finance Director

WH Ireland Limited (Nominated adviser)

Managing Director,

Chris Fielding Corporate Finance 020 7220 1650

Walbrook PR

Tom Cooper / Joe tom.cooper@walbrookpr.com

Walker

020 7933 8780

0797 122 1972

Notes to Editors:

Dillistone Group Plc is a leader in the supply and support of

software and services to the recruitment industry. Dillistone

operates through the Ikiru People ( www.IkiruPeople.com ) brand

.

The Group develops, markets and supports the Talentis,

FileFinder, Infinity, Mid-Office, ISV and GatedTalent products.

Dillistone was admitted to AIM, a market operated by the London

Stock Exchange plc, in June 2006.

Learn about our products:

Talentis Software: https://www.talentis.global/recruitment-software/

Voyager Software: https://www.voyagersoftware.com

GatedTalent Services: https://www.talentis.global/optimization-services/

CHAIRMAN'S STATEMENT

I am pleased to report continued progress in 2022, delivering

financial performance in line with expectations while paying down

debt, delivering sector leading customer service and continuing to

invest for the future.

The underlying business has improved. The Group has increased

revenue, decreased adjusted loss and improved cash generation. We

have delivered on our strategy and present results in line with

market expectations.

The Group achieved its first annual total and recurring revenue

growth since 2016. Total revenue for the year was up 2% to

GBP5.699m, with recurring revenue increasing 1% to GBP5.051m.

For the purposes of obtaining true comparatives, we focus on

measures which are adjusted to remove items of Government support,

acquisition related or exceptional items, to better understand the

underlying business.

Excluding furlough and Government support received in 2021,

adjusted EBITDA increased by 27% to GBP0.949m (FY2021: GBP0.747m).

The adjusted operating loss before acquisition related, furlough

and other items fell by 58% to (GBP0.156m) (FY2021:

(GBP0.375m)).

Adjusted net cash from operating activities, excluding

Government support, is up 45% at GBP1,189m (FY2021: GBP0.819m) with

a similarly adjusted net change in cash and cash equivalents up 58%

at (GBP0.362m) (FY2021: (GBP0.853m)).

Dividends

The Group is not recommending a final dividend in respect of the

year to 31 December 2022 (2021: nil).

Staff

I and the Board would like to pay tribute to our employees

across the Group, acknowledging their commitment and contribution

in facing the challenges of the last few years. It is as a result

of their combined efforts that we are heading into 2023 with

optimism.

Corporate governance

It is the Board's duty to ensure that the Group is managed for

the long-term benefit of all stakeholders.

We welcomed Ian Mackin to the Group Board as Finance Director in

June, stepping up from Financial Controller. Ian replaced Joanne

Curd who resigned to further pursue her voluntary works.

Outlook

Current economic conditions are challenging for the recruitment

industry and as a result we have seen a number of our existing

clients reduce headcount - and therefore licences - and new client

signups are typically of lower value than anticipated.

Generally speaking, any economic slowdown is likely to impact

our executive search clients more than our contingency ones.

However, despite this environment, we are pleased to see that in Q1

2023, our next generation executive search software, Talentis was

our best performing product in terms of both number of new client

sales and TACV growth. Individual order values remain low, partly

reflecting the state of the market, but the Group expects this to

change as the economy recovers.

The Board is pleased to report a positive start to the year. We

expect to see year on year growth in recurring revenue across both

our Executive Search and Contingency sectors in H1 and remain

confident of achieving market expectations for the full year.

Giles Fearnley

Non-Executive Chairman

CEO's Review

Dillistone Group Plc is a global leader in the supply of

solutions and services to the recruitment sector worldwide, working

with executive search, contingent recruiting and in-house staffing

teams in over 1,200 organisations.

We split our products into two groups - products primarily

targeting contingency recruiters (largely, but not exclusively, in

the United Kingdom) and products targeting executive search firms

and in-house executive search teams across the globe.

Contingency recruitment products:

Our products serving this sector are:

-- Infinity, which is an established recruitment CRM used

primarily by agencies in the UK, but also with users in Asia and

Australia. It enables recruitment businesses to manage prospects,

clients, candidates and jobs in one place and offers deep

integration to Office365 and other recruitment industry

complementary solutions. It is one of the few solutions in the UK

market with extensive functionality for permanent, contract and

temporary jobs all in one system;

-- ISV.Online, which is an online skills testing product used by

both recruitment agencies and corporate organisations and has a

strong international footprint. It allows recruiters and HR

professionals to test individuals using our extensive portfolio of

existing tests or to create their own unique tests to meet their

requirements; and

-- Mid-Office, which is a comprehensive pay & bill solution

that allows recruitment businesses and back office service

providers to process timesheets and bridges the gap between paying

workers and invoicing clients. It can be used standalone or

integrated to other recruitment systems including our Infinity

product.

Contingency review:

-- We delivered strong growth in the recurring revenue

associated with this part of our business, generating a combined

GBP3.44m in recurring revenue, (FY2021 GBP3.04m revenue) an

increase of 13%.

-- In December 2021 we announced a major contract win. We are

pleased to report this was successfully implemented in H1 2022 and

the client is now an active reference site.

-- Summer 2022 saw us win a similarly sized contract and this

was successfully implemented in H2. Once again, the client - who

switched from a direct competitor - is now an active reference site

for us.

Since year end, we have announced what has the potential to be

our largest contract win yet, and we expect to deliver a large part

of this contract in 2023.The year saw us discontinue our legacy VDQ

product. During the year we were able to successfully migrate over

half of our VDQ customers to the Infinity platform. Infinity offers

greater functionality and is priced at a premium to VDQ. As a

result, recurring revenue from this group of clients grew by 96%

over the year.

Infinity is used by permanent, contract and temporary

recruitment agencies. However, an increasing percentage of our new

contract wins are from firms that are focussed, at least in part on

the temporary recruitment sector, validating our decision to focus

our efforts on this sector of the market.

Many of our Infinity clients also use our Mid-Office product to

facilitate payments to temporary staff. We have also continued to

develop this product and expect to deliver a significant upgrade to

this product during the second quarter.

Our ISV.online skill testing product continues to generate

meaningful revenue, with half of the UK's largest 10 recruiters

using the platform.

Executive Search products:

Our primary products in the Executive Search sector are:

-- FileFinder, which is an established CRM product with thousands of users Worldwide.

-- GatedTalent, which is a service that helps recruiters source

candidates and candidates find jobs and;

-- Talentis, which is our latest product targeting executive

recruiters and is used for both candidate research and sourcing and

as an executive recruiting CRM.

Executive search review:

We are pleased to report that we have arrested the decline in

revenue for executive search products. Having seen revenue for

these products fall 24% in 2021, revenue fell by 10% in 2022

totalling GBP2.258m compared to GBP2.512m in 2021. However,

performance in H2 improved to a percentage fall of only 6% compared

to the same period in 2021. This trend of improvement is continuing

in 2023, with Q1 revenue above that of Q1 2022.

The largest contribution to our executive search revenues came

from FileFinder, our established executive search CRM product. The

Group has invested in architectural improvements for the platform

over recent years and this has improved the user experience while

also allowing us to deliver the platform in a more cost effective

manner. This, combined with our decision to make our new Talentis

platform available at no charge to most FileFinder clients, has

certainly improved our ability to retain clients on this

product.

GatedTalent is used by a number of FileFinder clients to support

GDPR compliance, whilst also offering recruiters candidate sourcing

functionality. Further revenue is generated from an array of B2C

products. The product continues to make a financial contribution in

its own right and remains cash generative.

Talentis is our next generation executive search software

platform, providing a combination of both candidate sourcing and

project management / CRM functionality. Since launch in Q1 2021,

recurring revenue has grown every quarter, and this trend continued

into Q1 2023.

The Group believes that the Talentis platform is unique in its

scope, which is reflected by the global span of its user base.

Paying clients can now be found on every continent apart from

Antarctica, with North America becoming the fastest growing region

in recent months.

We are continuing to develop this, with significant enhancements

expected in Q2-Q3.

The Board expects Talentis revenue growth to continue and

remains very excited about the potential for the product.

Delivering more, with less.

All of our Group products are developed, sold and supported by

our Ikiru People operating business. Our drive to improve

efficiency has seen us reduce headcount by 37% from its peak, while

maintaining what we believe to be market leading levels of customer

service. Indeed, the Ikiru People TrustPilot score of 4.8 (at

24/04/2023 based on 731 reviews) is, at the time of writing,

unmatched by any of our direct competitors. This speaks volumes for

the performance of our team, and I would like to place on record my

appreciation for the effort and aptitude they show for delivering

exceptional service to our clients.

KPIs and financial performance

As is noted in the financial review, the Group's operational

performance has improved significantly in recent years, although

the extent of the improvement has been masked somewhat in 2022 by

the impact of Government Covid support received in 2021 but not

repeated in 2022.

FY22 FY21 % Move Success measure used by

GBP'000 GBP'000 management

Total revenue 5,699 5,599 2% Year on Year Improvement

--------- --------- ------- -------------------------

Recurring revenue 5,051 5,009 1% Year on Year Improvement

--------- --------- ------- -------------------------

Adjusted EBITDA * 949 747 27% Year on Year Improvement

--------- --------- ------- -------------------------

Adjusted Operating

Cash ** 1,189 819 45% Year on Year Improvement

--------- --------- ------- -------------------------

Adjusted (loss) before

tax *** (453) (687) 34% Year on Year Improvement

--------- --------- ------- -------------------------

* EBITDA adjusted for furlough support

** Operating cash adjusted for Government support received

*** (Loss) before tax adjusted for furlough, Government support

and exceptional costs associated with Covid

Strategy

Over recent years, we have reduced the size of our product range

while broadly maintaining consistent levels of product development

expenditure. In 2022, product development equated to 17.4% of

revenues (2021: 17.6%) and we believe that the Group is now

increasingly seeing the benefit of this. While the economic climate

is challenging, our ability to win ever larger contracts in our

contingent product group, while ending the decline in our executive

search revenue, validates our decisions. We intend to maintain our

current focus, and 2023 will see us deliver significant

improvements to users of both our product groups.

Jason Starr

Chief Executive Officer

Financial Review

Summary

The Group saw progress on the financial turnaround of the

business.

-- Total revenue and recurring revenue grew for the first time since 2016

-- Adjusted EBITDA, excluding furlough support, increased by 27%

-- Adjusted operating loss, before furlough, acquisition,

reorganisation and other items, down by 58%

-- Adjusted net cash from operating activities increased by 45%

This was achieved whilst maintaining the level of investment in

our products.

Revenue

Group revenue increased by 2% to GBP5.699m from GBP5.599m in

FY2021

Revenue by type FY 2022 FY 2021 % Change

GBP'000 GBP'000

----------------------- -------- -------- ---------

Recurring revenue 5,051 5,009 0.8%

Non-recurring revenue 488 427 14.3%

Third party revenue 160 163 (1.8%)

----------------------- -------- -------- ---------

5,699 5,599 1.8%

======================= ======== ======== =========

Recurring revenue % 89% 89% -

Gross profit margin

The gross margin reduced to 86% from 88%. Going forward, the

management team is focused on driving improvements to gross margin

through revenue growth, whilst maintaining a stable cost base. With

Talentis having our highest marginal profit percentage, growth in

Talentis should help drive improvements to gross margin.

Adjusted EBITDA*

The adjusted EBITDA* increased by 27% to GBP0.949m from

GBP0.747m in FY2021. This resulted in a higher EBITDA margin of

16.7%, compared to 13.3% in FY2021, reflecting the Group's leaner

headcount profile, whilst maintaining our customer service.

Operating profit/(loss) and profit/(loss) before tax

The operating loss, before acquisition related, reorganisation

and other items, increased by 11% to stand at (GBP0.156m) from

(GBP0.140m) in FY2021. However, in 2021, the Group received

GBP0.235m in furlough support not received in 2022. Taking this

into account, performance improved greatly with a 58% reduction in

loss to (GBP0.156m) from (GBP0.375m) in FY2021.

Inclusive of acquisition related, reorganisation and other

items, the operating loss increased to (GBP0.319m) from (GBP0.199m)

in FY2021.

The loss before tax increased to (GBP0.453m) from (GBP0.298m) in

FY2021. Using a like for like measure, excluding Government and

furlough support of GBP0.395m, the comparative figure for FY2021 is

(0.693m).

Taxation

The net tax credit for the year GBP0.270m (FY 2021:

GBP0.302m).

Balance sheet

The Group's net assets decreased slightly to GBP3.223m (FY 2021:

GBP3.382m)

Trade and other receivables decreased slightly to GBP0.608m (FY

2021: GBP0.615m). Trade and other payables also decreased slightly

to GBP2.341m (FY2021: GBP2.347m).

R&D development

The Group capitalised GBP1.007m in development costs in the year

(FY 2021: GBP0.987m) as the business continued its commitment to

developing its products. Amortisation of development costs was

GBP0.980m (FY 2021: GBP0.946m)

Financing

The Group continues to pay down its debt. Following the

repayment of the June 2019 loan in June 2021, repayment of the

Government CBIL loan received in June 2020 is now well underway.

This loan of GBP1.5m is repayable over 6 years, with monthly

repayments having commenced in July 2021.

As a result, bank borrowings at 31 December 2022 were GBP1.050m

(2021: GBP1.350m). The Group also has a convertible loan of

GBP0.400m (2021: GBP0.400m), which will not be repaid until the

CBIL loan has been repaid.

Cashflow

Net cash from normalised operating activities (before government

support) increased 45% to GBP1.189m (FY2021: GBP0.819m). Adjusted

net change in cash before government support improved by 58% to

(GBP0.362m) (FY2021: (GBP0.853m)). The Group finished the year with

cash funds of GBP0.433m (2021: GBP0.764m).

Summarised cashflow FY 2022 FY 2021

GBP'000 GBP'000

Adjusted net cash from normalised operating

activities 1,189 819

Investing Activities - net (1,022) (1,008)

Financial Activities - net (529) (664)

-------- --------

Adjusted Net change in cash and cash equivalents (362) (853)

-------- --------

Adjustment for Government Support - 332

-------- --------

Net change in cash and cash equivalents (362) (521)

-------- --------

Cash and cash equivalents at beginning of

year 764 1,291

-------- --------

Effect of foreign exchange rate changes 31 (6)

-------- --------

Cash and cash equivalents at 31(st) December 433 764

======== ========

Going forward, the Board and management teams are focused on

increasing revenues whilst improving the Group's profitability and

cash generation.

Ian Mackin

Finance Director

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2022

2022 2021

Note GBP'000 GBP'000

Revenue 5 5,699 5,599

Cost of sales (816) (685)

------------------------------------- ----- --------- ---------

Gross profit 4,883 4,914

Administrative expenses (5,202) (5,113)

------------------------------------- ----- --------- ---------

Operating loss (319) (199)

------------------------------------- ----- --------- ---------

Adjusted operating (loss)

before acquisition related,

reorganisation and other

items 4 (156) (140)

Acquisition related, reorganisation

and other items 7 (163) (59)

------------------------------------- ----- --------- ---------

Operating (loss) (319) (199)

------------------------------------- ----- --------- ---------

Financial cost (134) (99)

(Loss) before tax (453) (298)

Tax income 8 270 302

(Loss)/profit for the year (183) 4

Other comprehensive income/(loss)

Items that will be reclassified

subsequently to profit and

loss:

Currency translation differences 7 4

Total comprehensive (loss)/profit

for the year (176) 8

------------------------------------- ----- --------- ---------

Earnings per share

Basic 9 (0.93p) 0.02p

Diluted 9 (0.93p) 0.02p

--------- -------- -------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Convertible

Share Share Merger loan Retained Share Foreign

capital premium reserve reserve earnings options exchange Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------- ---------- --------- ------------ ---------- --------- ----------- --------

Balance at 1 January

2021 983 1,631 365 14 208 110 59 3,370

Comprehensive

income

Profit for the

year - - - - 4 - - 4

Other comprehensive

income

Exchange differences

on translation

of overseas

operations - - - - - - 4 4

--------------------- ---------- ---------- --------- ------------ ---------- --------- ----------- --------

Total comprehensive

loss - - - - 4 - 4 8

Transactions with

owners

Share option charge - - - 50 (46) - 4

--------------------- ---------- ---------- --------- ------------ ---------- --------- ----------- --------

Total transactions

with owners - - - - 50 (46) - 4

Balance at 31

December 2021 983 1,631 365 14 262 64 63 3,382

--------------------- ---------- ---------- --------- ------------ ---------- --------- ----------- --------

Comprehensive

income

Loss for the year - - - - (183) - - (183)

Other comprehensive

income

Exchange differences

on translation

of overseas

operations - - - - - - 7 7

Total comprehensive

loss - - - - (183) - 7 (176)

Transactions with

owners

Share option charge - - - 14 3 - 17

Total transactions

with owners - - - - 14 3 - 17

Balance at 31

December 2022 983 1,631 365 14 93 67 70 3,223

--------------------- ---------- ---------- --------- ------------ ---------- --------- ----------- --------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

Group

2022 2021

GBP'000 GBP'000

----------------------------------- ---- --------- ---------- -----

ASSETS

Non-current assets

Goodwill 3,415 3,415

Other intangible assets 2,990 3,142

Property, plant and equipment 25 25

Right of use assets 498 592

Investments - -

----------------------------------- ---- --------- ---------- -----

Total non-current assets 6,928 7,174

----------------------------------- ---- --------- ---------- -----

Current assets

Trade and other receivables 608 615

Current tax receivable 72 29

Cash and cash equivalents 433 764

----------------------------------- ---- --------- ---------- -----

Total current assets 1,113 1,408

----------------------------------- ---- --------- ---------- -----

Total assets 8,041 8,582

----------------------------------- ---- --------- ---------- -----

EQUITY AND LIABILITIES

Equity attributable to owners

of the parent

Share capital 983 983

Share premium 1,631 1,631

Merger reserve 365 365

Convertible loan reserve 14 14

Retained earnings 93 262

Share option reserve 67 64

Foreign exchange reserve 70 63

----------------------------------- ---- --------- ---------- -----

Total equity 3,223 3,382

----------------------------------- ---- --------- ---------- -----

Liabilities

Non-current liabilities

Trade and other payables 241 238

Lease liabilities 483 560

Borrowings 1,150 1,450

Deferred tax liability 226 210

----------------------------------- ---- --------- ---------- -----

Total non-current liabilities 2,100 2,458

----------------------------------- ---- --------- ---------- -----

Current liabilities

Trade and other payables 2,341 2,347

Lease liabilities 77 95

Borrowings 300 300

----------------------------------- ---- --------- ---------- -----

Total current liabilities 2,717 2,742

----------------------------------- ---- --------- ---------- -----

Total liabilities 4,805 5,200

----------------------------------- ---- --------- ---------- -----

Total liabilities and equity 8,041 8,582

----------------------------------- ---- --------- ---------- -----

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEARED 31 DECEMBER 2022

For For For For

the year the year the year the year

ended ended ended ended

31 December 31 December 31 December 31 December

2022 2022 2021 2021

Operating activities GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- ------------- ------------- ------------- -------------

Loss before tax (453) (298)

Adjustment for

Financial cost 134 99

Depreciation and amortisation 1,268 1,335

Share option expense 17 3

Foreign exchange adjustments arising

from operations (24) 10

Operating cash flows before movement

in working capital 942 1,149

Decrease in receivables 20 268

Decrease in payables (16) (639)

Taxation refunded 243 373

---------------------------------------- ------------- ------------- ------------- -------------

Net cash generated from operating

activities 1,189 1,151

Investing activities

Purchases of property, plant and

equipment (15) (21)

Investment in development costs (1,007) (987)

Net cash used in investing activities (1,022) (1,008)

Financing activities

Interest paid (134) (99)

Bank loan repayments made (300) (461)

Lease payments made (95) (144)

Net cash (used in)/generated from

financing activities (529) (664)

---------------------------------------- ------------- ------------- ------------- -------------

Net (decrease)/increase in cash and cash

equivalents (362) (521)

Cash and cash equivalents at beginning

of the year 764 1,291

Effect of foreign exchange rate

changes 31 (6)

---------------------------------------- ------------- ------------- ------------- -------------

Cash and cash equivalents at end

of year 433 764

---------------------------------------- ------------- ------------- ------------- -------------

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 31 DECEMBER 2021

1. Publication of non-statutory accounts

In accordance with section 435 of the Companies Act 2006, the

Directors advise that the financial information set out in this

announcement does not constitute the Group's statutory financial

statements for the year ended 31 December 2022 or 2021, but is

derived from these financial statements. The financial statements

for the year ended 31 December 2021 have been audited and filed

with the Registrar of Companies. The financial statements for the

year ended 31 December 2022 have been prepared in accordance with

UK-adopted international accounting standards, IFRIC

Interpretations and the Companies Act 2006. The financial

statements for the year ended 31 December 2021 have been audited

and will be filed with the Registrar of Companies following the

Company's Annual General Meeting. The Independent Auditors Report

on the Group's statutory financial statements for the years ended

31 December 2022 and 2021 were unqualified and did not draw

attention to any matters by way of emphasis and did not contain

statements under Section 498(2) or (3) of the Companies Act

2006.

2. Basis of preparation

The preliminary announcement is extracted from the consolidated

financial statements of the Group. The financial statements of the

subsidiaries are prepared for the same reporting date as the parent

company. Consistent accounting policies are applied for like

transactions and events in similar circumstances.

All intra-group balances, transactions, income and expenses and

profits and losses resulting from intra-group transactions that are

recognised in assets or liabilities are eliminated in full.

The Group's business activities and financial position, together

with the factors likely to affect its future development,

performance and position have been taken into account in

considering the Group's adoption of the going concern basis.

Together with the financial statements, notes, net current

liability position and cash flows for the year ended 31 December

2022. The Group prepare 3 year budgets and cash flow forecasts to

ensure that the Group can meet its liabilities as they fall

due.

The Group meets its day to day working capital requirements

through its cash balance. It has in place a GBP1.5m CBIL loan,

secured in June 2020, repayable over 6 years with capital

repayments commencing from July 2021. Although the Group has an

overdraft facility, this was not utilised for the entirety of 2022.

The Group's forecasts, taking into account the Board's future

expectations of the Group's performance, indicate that there is

sufficient headroom within its CBIL loan facility. Compliance with

the CBIL covenant has been considered and based on management

expectations and actions, that could practically be taken, the

directors do not consider any reasonable risk to arise from

this.

The cash flow forecasts have been stress tested reviewing

assumptions around new and existing business with growth and

renewal rates being reduced. A reverse stress test was also

prepared to review what reduction in revenue would be necessary to

breach overdraft limits in 2023.

As at the date of this report, the directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

For this reason, they continue to adopt the going concern basis in

preparing the financial statements.

3. Accounting policies

This preliminary announcement has been prepared in accordance

with the accounting policies adopted in the last annual financial

statements for the year to 31 December 2021.

4. Reconciliation of adjusted profits to consolidated statement of comprehensive income

Note Acquisition Acquisition

related, related

reorganisation reorganisation

Adjusted and other Adjusted and other

profits costs profits costs

2022 2022* 2022 2021 2021* 2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ------ --------- ---------------- --------- --------- ---------------- ---------

Revenue 5,699 - 5,699 5,599 - 5,599

Cost of sales (816) - (816) (685) - (685)

------------------------------ --------- ---------------- --------- --------- ---------------- ---------

Gross profit 4,883 - 4,883 4,914 - 4,914

Administrative

expenses (5,039) (163) (5,202) (5,054) (59) (5,113)

------------------------------ --------- ---------------- --------- --------- ---------------- ---------

Operating (loss) (156) (163) (319) (140) (59) (199)

Financial income - - - - - -

Financial cost (134) - (134) (99) - (99)

(Loss) before

tax (290) (163) (453) (239) (59) (298)

Tax income 239 31 270 287 15 302

------------------------------ --------- ---------------- --------- --------- ---------------- ---------

(Loss)/Profit

for the year (51) (132) (183) 48 (44) 4

Other comprehensive

loss net of tax:

Currency translation

differences 7 - 7 4 - 4

Total comprehensive

(Loss)/Profit

for the year net

of tax (44) (132) (176) 52 (44) 8

------------------------------ --------- ---------------- --------- --------- ---------------- ---------

Earnings per share

Basic 9 (0.26p) - (0.93p) 0.24p - 0.02p

Diluted 9 (0.26p) - (0.93p) 0.24p - 0.02p

--------- -------- -------- ------ ------

* See note 9

5. Segment reporting

Divisional segments Ikiru Ikiru

People Central Total People Central Total

2022 2022 2022 2021 2021 2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- -------- -------- -------- -------- -------- --------

Segment revenue 5,699 - 5,699 5,599 - 5,599

-------------------------------------- -------- -------- -------- -------- -------- --------

Segment EBITDA 905 44 949 953 29 982

Depreciation and amortisation

expense (1,105) - (1,105) (1,122) - (1,122)

-------------------------------------- -------- -------- -------- -------- -------- --------

Segment result before reorganisation

and other costs (200) 44 (156) (169) 29 (140)

Reorganisation and other

costs - - - 154 - 154

-------------------------------------- -------- -------- -------- -------- -------- --------

Segment result (200) 44 (156) (15) 29 14

Acquisition related amortisation - (163) (163) - (213) (213)

-------------------------------------- -------- -------- -------- -------- -------- --------

Operating (loss) (200) (119) (319) (15) (184) (199)

Loan interest/ lease interest (31) (103) (134) (35) (64) (99)

-------------------------------------- -------- -------- -------- -------- -------- --------

Loss before tax (453) (298)

Income tax income 270 302

-------------------------------------- -------- -------- -------- -------- -------- --------

(Loss)/profit for the year (183) 4

-------------------------------------- -------- -------- -------- -------- -------- --------

Additions of non-current

assets 1,022 1,022 1,028 1,028

-------------------------------------- -------- -------- -------- -------- -------- --------

Revenue by Business Segment

The following table provides an analysis of the Group's revenue

by product area for the 12 months of the financial year.

2022 2021

GBP'000 GBP'000

--------------------------- ------------------ --------- --- ---------

Recurring income 5,051 5,009

Non-recurring income 488 427

Third party revenues 160 163

5,699 5,599

--------------------------- ------------------ --------- --- ---------

In the table above 'Recurring income' represents all income

recognised over time, whereas 'Non-recurring income' and 'Third

party revenues' represent all income recognised at a point in

time.

Recurring income includes all support services, SaaS and hosting

income and revenue on perpetual licenses with mandatory support

contracts deferred under IFRS 15. Non-recurring income includes

sales of new licenses which do not require a support contract, and

income derived from installing licences including training,

installation and data translation. Third party revenues arise from

the sale of third party software.

It is not possible to allocate assets and additions between

recurring, non-recurring income and third party revenue. No

customer represented more than 10% of revenue of the Group in 2022

or 2021.

Revenue by Business Sector

The following table provides an analysis of the Group's revenue

by market sector.

2022 2021 2020 2019

GBP'000 GBP'000 GBP'000 GBP'000

------------------ --------- --------- --------- ---------

Contingent 3,441 3,087 3,005 3,795

Executive Search 2,258 2,512 3,327 4,232

------------------ --------- --------- --------- ---------

5,699 5,599 6,332 8,027

------------------ --------- --------- --------- ---------

The above table includes years going back to 2019 when revenue

was last reported split between Dillistone, Voyager and GatedTalent

segments for comparative purposes.

For the purposes of the 2019 comparative:

-- Contingent encompasses the Voyager segment

-- Executive Search encompasses both Dillistone and GatedTalent segments.

6. Geographical analysis

The following table provides an estimated of the Group's revenue

by geographic market based on the Customers' country. This is

provided for information only as the Board does not review the

performance of the business from a geographical viewpoint.

Revenue

2022 2021

GBP'000 GBP'000

--------------------------- ------------------- --------- -----------

UK 4,148 3,933

Europe 663 762

Americas 518 526

Australia 147 140

ROW 223 238

------------------------ -------------------- --------- ---------

5,699 5,599

------------------------ -------------------- --------- ---------

Non-current assets by geographical location

2022 2021

GBP'000 GBP'000

---------------------------- ------------------ --------- --- ---------

UK 6,927 7,169

US - 1

Australia 1 4

--------- --- ---------

6,928 7,174

---------------------------- ------------------ --------- --- ---------

7. Acquisition related, reorganisation and other costs

2022 2021

GBP'000 GBP'000

------------------------------------------ --------- ---------

Included within administrative expenses:

Reorganisation and other costs - 6

US government loan (Payment Protection

Program) - (154)

Australian government grant - (6)

Amortisation of acquisition intangibles 163 213

163 59

------------------------------------------ --------- ---------

Reorganisation and other costs include severance payments and

loss of office payments.

Below are reconciliations utilising the items above related to

covid, including furlough payments, to adjusted measures used to

better illustrate the underlying business performance.

2022 2021

GBP'000 GBP'000

------------------- --------- ---------

EBITDA 949 982

Furlough Payments - (235)

Adjusted EBITDA 949 747

--------------------- --------- ---------

2022 2021

GBP'000 GBP'000

---------------------------------------------- --------- ---------

Adjusted operating (loss) before acquisition

related, reorganisation and other items (156) (140)

Furlough Payments - (235)

------------------------------------------------ --------- ---------

Readjusted operating (loss) before

acquisition related, reorganisation

and other items (156) (375)

Acquisition related, reorganisation

and other costs as above (163) (59)

Adjust for:

Reorganisation and other costs - 6

US government loan (Payment Protection

Program) - (154)

Australian government grant - (6)

------------------------------------------------ --------- ---------

Adjusted Operating (Loss) (319) (588)

Financial Cost (134) (99)

Adjusted (Loss) Before Tax (453) (687)

------------------------------------------------ --------- ---------

8. Tax income

2022 2021

GBP'000 GBP'000

-------------------------------------------- ---- ----------- -----------

Current tax (139) (96)

Prior year adjustment - current

tax (146) (121)

-------------------------------------------- ------- ----------- -----------

Total current tax (285) (217)

-------------------------------------------- ------- ----------- -----------

Deferred tax (23) (35)

Prior year adjustment - deferred

tax 69 (60)

Deferred tax rate change from 19%

to 25% in 2021 - 50

Deferred tax re acquisition intangibles (31) (40)

-------------------------------------------- ------- ----------- -----------

Total deferred tax 15 (85)

-------------------------------------------------- ----------- -----------

Tax (income) for the year (270) (302)

-------------------------------------------------- ----------- -----------

Factors affecting the tax credit for

the year

Loss before tax (453) (298)

UK rate of taxation 19.0% 19.0%

Loss before tax multiplied by the UK

rate of taxation (86) (57)

Effects of:

Overseas tax rates - (6)

Impact of deferred tax not provided 17 (1)

Enhanced R&D relief (174) (146)

Disallowed expenses 11 18

Deferred tax rate change from 19%

to 25% in 2021 - 50

Rate difference between CT rate

and deferred tax rate (5) (9)

Rate difference between CT rate

and rate of R&D repayment 43 30

Prior year adjustments (76) (181)

------------------------------------------ ------ ------

Tax (income) (270) (302)

------------------------------------------ ------ ------

9. Earnings per share

2022 2021

Using adjusted Using adjusted

profit 2022 profit 2021

Profit/(loss) attributable (GBP51,000) (GBP183,000) GBP48,000 GBP4,000

to ordinary shareholders

(note 4)

Weighted average number

of shares 19,668,021 19,668,021 19,668,021 19,668,021

Basic profit/(loss) per

share (0.26 p) (0.93 p) 0.24 p 0.02 p

----------------------------- --------------- ------------- --------------- -----------

Weighted average number

of shares after dilution 19,668,021 19,668,021 19,668,021 19,668,021

Fully diluted profit/(loss)

per share (0.26 p) (0.93 p) 0.24 p 0.02 p

----------------------------- --------------- ------------- --------------- -----------

Reconciliation of basic to diluted average number of shares:

2022 2021

---------------------------------------- -------- ----------- -----------

Weighted average number of shares

(basic) 19,668,021 19,668,021

Effect of dilutive potential ordinary

shares - employee share plans - -

---------------------------------------- ---- ---- ----------- -----------

Weighted average number of shares

after dilution 19,668,021 19,670,013

---------------------------------------------- ---- ----------- -----------

There are 476,510 (2021: 493,337) share options not included in

the above calculations, as they are underwater or have been

forfeited.

The impact of the convertible loan notes in the period is not

dilutive and therefore does not impact the calculation of the fully

diluted earnings per share.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FZGZDRDNGFZM

(END) Dow Jones Newswires

April 25, 2023 02:00 ET (06:00 GMT)

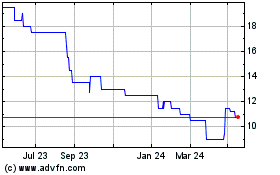

Dillistone (LSE:DSG)

Historical Stock Chart

From Oct 2024 to Nov 2024

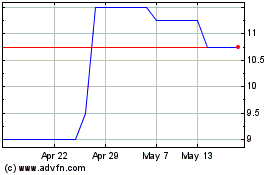

Dillistone (LSE:DSG)

Historical Stock Chart

From Nov 2023 to Nov 2024