Derwent London PLC 1-5 Grosvenor Place SW1 (3426H)

June 19 2013 - 2:00AM

UK Regulatory

TIDMDLN

RNS Number : 3426H

Derwent London PLC

19 June 2013

19 June 2013

Derwent London in talks to sell its interest in 1-5 Grosvenor

Place SW1 to Peninsula Hotels for GBP132.5 million

Following the announcement made by The Hongkong & Shanghai

Hotels, Limited ("Peninsula Hotels") on the Hong Kong Stock

Exchange, Derwent London plc ("Derwent London"/ "the Group")

announces that it has entered into non-binding heads of terms to

sell its 50% interest in 1-5 Grosvenor Place SW1 to Peninsula

Hotels for GBP132.5 million before costs. As at 31 December 2012

the Group's interest was valued at GBP78 million. The proposed

transaction reflects a 70% premium to that valuation.

The existing properties comprise mainly offices and extend to

168,000 sq ft (15,600m(2) ), net, at Hyde Park Corner,

Belgravia.

In 2012, Derwent London and Grosvenor, the freeholder of 1-5

Grosvenor Place, restructured their interests and established a

joint venture. Under that agreement Derwent London's leases, which

were due to expire in 2063 and 2084, were restructured onto a

150-year term. Simultaneously the Group sold 50% of its ownership

to Grosvenor for GBP67.3 million.

On completion of the proposed transaction with Peninsula Hotels,

Derwent London will have received proceeds of almost GBP200 million

from 1-5 Grosvenor Place since the start of 2012.

It is intended that, following the disposal of Derwent London's

interest, Peninsula Hotels and Grosvenor will work together towards

redevelopment of the site as an hotel and residential scheme.

The heads of terms entered into with Peninsula Hotels are not

legally binding and consequently the sale may or may not

proceed.

Derwent London has a committed capital expenditure programme of

around GBP400 million and is currently on site at projects

totalling over 400,000 sq ft (37,200m(2) ). Over the next 12 months

Derwent London will start construction of a further 345,500 sq ft

(32,050m(2) ) with our White Collar Factory offices at Old Street

EC1, retail space at 18-30 Tottenham Court Road W1 complementing

our current office scheme at 1-2 Stephen Street W1 (together

127,000 sq ft/ 11,800m(2) ) and a residential development at 73

Charlotte Street W1. The regeneration of 385,000 sq ft (35,800m(2)

) at 80 Charlotte Street W1 will now commence in early 2015.

John Burns, Chief Executive Officer at Derwent London,

commented:

"These heads of terms move Derwent London towards securing most

of our anticipated gain from the redevelopment of 1-5 Grosvenor

Place. The Group will receive the proceeds five to six years ahead

of the expected completion date for the scheme and continues to

invest in other opportunities, principally its extensive

development pipeline which amounts to over 2.5 million sq ft of

space that could potentially be delivered before 2020."

-ends-

For further information please contact:

Derwent London 020 7659 3000

John Burns, Chief Executive Officer

Damian Wisniewski, Finance Director

Paul Williams, Executive Director

Louise Rich, Head of Investor Relations

Brunswick Group 020 7404 5959

Elizabeth Adams

Sheena Shah

Notes to editors

Derwent London

Derwent London owns a portfolio of commercial real estate

predominantly in central London valued at GBP2.9bn as at 31

December 2012, making us the largest London-focused real estate

investment trust (REIT).

Our experienced team has a proven record of value creation

through development, refurbishment and asset management activities.

We take a fresh approach to each building, adopting a design-led

and tenant-led philosophy. We focus on buildings with reversionary

mid-market rents, particularly those in improving locations around

the West End and the City borders.

The business is grounded on a strong balance sheet with modest

leverage, a robust income stream and flexible financing.

Landmark schemes in our portfolio of 5.4 million sq ft

(505,800m(2) ) as at 31 December 2012 include Angel Building EC1,

Buckley Building EC1, Qube W1, Horseferry House SW1 and Tea

Building E1.

Derwent London came seventh overall in the 2012 Management Today

awards for 'Britain's Most Admired Companies', topping the real

estate sector for the third year in a row. Earlier in 2012 the

Group won the Estates Gazette Property Company of the Year -

Offices award. Last year the Tea Building also won a RIBA regional

award and an AJ Retrofit award for the 'Green Tea' refurbishment to

improve the environmental performance of the building.

For further information see www.derwentlondon.com or follow us

on Twitter at @derwentlondon.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISUWVBROAANAAR

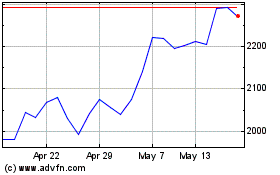

Derwent London (LSE:DLN)

Historical Stock Chart

From May 2024 to Jun 2024

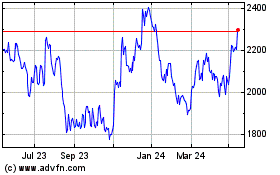

Derwent London (LSE:DLN)

Historical Stock Chart

From Jun 2023 to Jun 2024