Crystal Amber Fund Limited Monthly Net Asset Value and Interim Dividend Declaration

April 08 2016 - 2:00AM

UK Regulatory

TIDMCRS

8 April 2016

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Monthly Net Asset Value and Interim Dividend Declaration

Crystal Amber Fund announces that its unaudited net asset value ("NAV") per

share on 31 March 2016 was 156.5p (29 February 2016: 151.2p per share).

The proportion of the Fund's NAV at 31 March 2016 represented by the ten

largest holdings, other investments and cash (including accruals), was as

follows:

Top ten holdings Pence per share Percentage of investee equity

held

Grainger Plc 32.4 3.4%

Pinewood Group Plc 20.7 6.4%

Dart Group Plc 14.6 1.5%

Leaf Clean Energy Co. 12.5 29.9%

STV Group Plc 12.1 7.3%

Hurricane Energy Plc 10.9 16.1%

Coats Group Plc 9.4 2.4%

FairFX Group Plc 7.8 24.8%

Sutton Harbour Holdings Plc 6.9 29.3%

Hansard Global Plc 4.8 3.3%

Total of ten largest holdings 132.1

Other investments 19.2

Cash and accruals 5.2

Total NAV 156.5

Investment Adviser's commentary on the portfolio

Over the quarter to 31 March 2016, NAV per share grew by 0.4 per cent or 2.0

per cent after adjusting for the 2.5p dividend paid in the period.

The top three positive contributors to NAV growth over the quarter to 31 March

2016 were Pinewood Group plc (3.3 per cent), FairFX Group plc (1.7 per cent)

and Dart Group plc (1.4 per cent). The three main detractors were STV Group plc

(-2.0 per cent), Sutton Harbour Holdings plc (-1.2 per cent) and Grainger plc

(-0.5 per cent).

Dart Group plc

The company issued a trading update on 4 March 2016 indicating that current

year profits would be ahead of market expectations due to a better than

anticipated winter season. The company also stated that it "expects operating

performance for the year ending 31 March 2017 to be broadly in line with the

current year" which led to a substantial upgrade of consensus forecast for

pre-tax profit.

FairFX Group plc ("FairFX")

On 7 March 2016, FairFX announced a GBP5.0 million strategic investment by the

Fund to finance its marketing strategy. The investment was at 20p per share.

Furthermore, in exchange for strategic assistance from the Fund, FairFX issued

the Fund a three-year warrant over 7.5 million shares at an exercise price of

27p per share.

Historically, the company had limited investment to execute its "land grab"

strategy to fully leverage its scalable platform. The Fund's investment, part

of a GBP5.25m fundraising, is expected to accelerate growth. In 2015, FairFX

acquired 75,000 currency card customers, up 54 per cent on 2014. This takes the

total number of customers to 508,000. The Fund notes that market forecasts for

2018 are for earnings per share of 3.8p, placing the shares on a prospective PE

multiple of 8.2.

Grainger plc ("Grainger")

On 4 January 2016, Grainger announced the exchange of contracts, subject to

regulatory approval, to sell its Equity Release division on or before 30 May

2016 for an estimated gross consideration of GBP325 million, comprising GBP175

million cash and the transfer to the buyer of GBP150 million of debt. Grainger

said the sale would significantly reduce its financial and operational costs.

On 28 January 2016, Grainger announced the outcome of its strategy review,

which includes plans to reduce overheads through a streamlined structure, exit

non-core development assets and reduce financing costs with a target of 4 per

cent cost of debt. It also announced plans to invest over GBP850 million by 2020

into the private rented sector to drive the growth of rental income and

dividends.

The Fund welcomes and supports Grainger's actions to streamline the business

and cut costs; however, we remain concerned both with the pace and scope of

cost cutting. We continue to believe that further significant value can be

realised through either a spin-off of the regulated tenancies division or a

sale of Grainger.

Leaf Clean Energy Co. ("Leaf")

In March 2016, Leaf announced a NAV per share of 62.5p as at 31 December 2015,

following the return of GBP6.4 million to shareholders in October 2015. Over 90

per cent of Leaf's value is held in its investment in Invenergy. The process to

exit this investment is ongoing, yet the timing remains uncertain.

The Fund is confident that the value of Invenergy will be released and expects

this to happen in 2016. The Fund believes that the shares, trading at more than

a 40 per cent discount to the December NAV, remain deeply undervalued.

Pinewood Group Plc ("Pinewood")

On 10 February 2016 Pinewood announced that management's expectations of

performance for the year to 31 March were higher than at the time of the

interim results. Pinewood's board appointed Rothschild "to assist with a

strategic review of the overall capital base and structure, which could include

a sale of the company". The Fund believes that whilst the strategic review may

result in the release of value at Pinewood through a possible sale, this would

have been unnecessary had management run the business more efficiently.

Transaction in shares

During the quarter to 31 March 2016, the Fund sold 6.1 million shares from

Treasury at NAV, or 155p per share to an institutional investor. The Fund

subsequently bought back 300,000 shares at an average cost of 147.5p per share.

These shares are held in Treasury.

Dividend

The Board declared an interim dividend of 2.5p per share which was paid on 19

February 2016 to shareholders on record on the register on 22 January 2016.

This interim dividend brings total dividends paid since August 2015 to 5p per

share.

For further enquiries please contact:

Crystal Amber Fund Limited

William Collins (Chairman)

Tel: 01481 716 000

Allenby Capital Limited - Nominated Adviser

David Worlidge/James Thomas

Tel: 020 3328 5656

Numis Securities Limited - Broker

Nathan Brown/Hugh Jonathan

Tel: 020 7260 1426

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein

Tel: 020 7478 9080

END

(END) Dow Jones Newswires

April 08, 2016 02:00 ET (06:00 GMT)

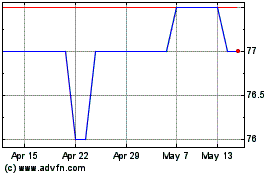

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024