Crystal Amber Fund Limited Net Asset Value December 2012

January 08 2013 - 2:50AM

UK Regulatory

TIDMCRS

8 January 2013

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Monthly Net Asset Value

Crystal Amber Fund announces that its unaudited net asset value ("NAV") per

share on 31 December 2012 was 120.08p (30 November 2012: 117.18p per share).

The proportion of the Fund's NAV at 31 December 2012 represented by the ten

largest holdings, other investments and cash (including accruals), was as

follows:

Top ten holdings Pence per share Percentage of investee equity held

TT Electronics plc 14.4 3.8%

Sutton Harbour Holdings plc 12.8 27.0%

Norcros plc 10.3 8.2%

Devro plc 9.7 1.1%

API Group plc 9.2 8.8%

Northgate plc 7.7 1.1%

Tribal Group plc 7.1 4.4%

Smiths News plc 6.8 1.4%

Renishaw plc 4.4 0.2%

4imprint Group plc 4.3 2.8%

Total of ten largest holdings 86.7

Other investments 12.0

Cash and accruals 21.4

Total NAV 120.1

Investment adviser's quarterly commentary on the portfolio

Over the quarter to 31 December 2012, NAV grew by 12.3%. For the year to 31

December 2012, NAV growth was 35.3%.

Key positive contributors to the NAV performance have been N Brown, Sutton

Harbour, Northgate, API Group and May Gurney. Smaller negative impacts have

come from Devro and TT Electronics.

TT Electronics' share price was flat over the quarter. The Fund's holding in TT

has been reduced during the period to rebalance the portfolio, and in light of

weaker trading in the automotive industry. The Fund has remained actively

engaged with the company, its largest shareholders and other stakeholders.

Sutton Harbour's share price rose by 31.8% over the quarter. This positive

share price performance was despite a more conservative valuation of the

property portfolio. The announcement of Sutton Harbour's indicative master-plan

for development of the 113-acre former airport site has highlighted the long

term value of its assets. The completion of lease agreements for the Millbay

site has allowed Sutton Harbour to start the development of its new King Point

Marina which, in due course, will add scale to its operations. Over the period,

the Fund has progressed its proposals to deliver shareholder value.

Devro's share price was down 6.2% over the quarter. Following a site visit and

additional market research, we engaged in open and constructive dialogue with

the company's board. We advised management to demonstrate more clarity in

making the investment case for Devro and have suggested additional disclosures

on the opportunities for improved profitability through capital investment.

Believing that the outlook for the business is favourable, our aim is to help

Devro to maximise its potential and to set appropriately stretching goals for

its management. We look forward to a continuation of this engagement process.

API's share price rose by 22.1% over the quarter. Following previous board

announcements, API initiated its sale process at the end of September by

inviting tenders. In the announcement of its interim results, API confirmed

that it is in discussions with a number of interested parties. Trading results

highlight the on-going recovery in profitability driven by normalised input

costs and self-help measures. Following multiple site visits and research

meetings, and despite a share price gain of 100% over 2012, we believe that API

remains undervalued.

During the quarter, Northgate's share price appreciated by 26.1%. We have

previously highlighted the scope to achieve benefits in reducing the company's

cost of capital in the current low interest rate environment. Following the

company's interim results in December, we are pleased to note that such an

approach is gaining increasing credence with the analyst community and has lead

to a share price re-rating. In December, the Fund top-sliced its holding.

During the quarter, the Fund disclosed a small position in Thorntons, the

confectioner, worth approximately GBP0.9m.

N Brown's share price rose by 34.6% over the quarter. The arrival of Andrew

Higginson as non-executive chairman has been well received. The Fund was the

first institutional investor to meet him in his new capacity. It was a positive

meeting and we were pleased with the new chairman's initial thoughts on the

company. A positive trading update in October triggered a reappraisal of N

Brown's prospects, which reflect the fact that it is now generating over half

of its sales online, and its favourable prospects in the US. However in our

view, pressure on disposable income of its core customers could remain a

headwind on sales performance in the medium term. Following the share price

strength, the Fund has significantly reduced its holding in the company as the

share price achieved the Fund's price objective.

Further comments on the main investments in the portfolio can be found in the

Fund's 2012 Annual Report (available at www.crystalamber.com).

Share buy-back

During December, the Fund purchased 1,000,000 of its own shares at an average

price of 104.04p per share, which are held as treasury shares. The buy-back has

had the effect of significantly reducing the share price discount to the Fund's

net asset value.

Cash resources

Following strong share price performances in a number of our holdings, the Fund

banked some profits within the portfolio. Over the quarter, cash and accruals

increased from 9.2p per share to 21.4p per share. These cash balances will

enable the Fund to take advantage of fresh investment opportunities which have

been identified.

For further enquiries please contact:

Crystal Amber Fund Limited

William Collins (Chairman)

Tel: 01481 716 000

Merchant Securities Limited - Nominated Adviser

David Worlidge/Simon Clements

Tel: 020 7628 2200

Numis Securities Limited - Broker

Nathan Brown/Hugh Jonathan

Tel: 020 7260 1426

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein

Tel: 020 7478 9080

END

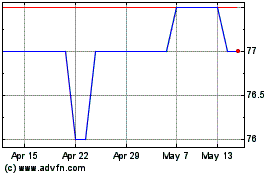

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024