Crystal Amber Fund Limited Monthly Net Asset Value and declaration of dividend

July 06 2012 - 7:45AM

UK Regulatory

TIDMCRS

6 July 2012

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Monthly Net Asset Value and declaration of dividend.

Crystal Amber Fund announces that its unaudited net asset value ("NAV") per

share on 30 June 2012 was 105.59p (31 May 2012: 106.91p per share).

The proportion of the Fund's NAV at 30 June 2012 represented by the ten largest

holdings, other investments and cash (including accruals), was as follows:

Top ten holdings Pence per share Percentage of investee

equity held

TT Electronics plc 19.0 4.8%

Renishaw plc 10.5 0.6%

N Brown Group plc 8.7 0.8%

Sutton Harbour Holdings 8.6 26.9%

plc

Omega Insurance Holdings 8.6 * 3.2%

Ltd

Devro plc 7.6 0.9%

Tribal Group plc 5.6 4.2%

API Group plc 5.4 7.3%

Norcros plc 4.9 4.6%

JJB Sports plc 4.7 7.1%

Total of ten largest 83.6

holdings

Other investments 18.6

Cash and accruals 3.4

Total NAV 105.6

* Position valued at the quoted bid price of 65.75p per share

Investment advisor's commentary on the portfolio

Despite a difficult macroeconomic backdrop and a general flight to safety as

Eurozone concerns amplified substantially over the quarter to 30 June 2012, the

Fund's NAV was relatively stable, declining by only 0.3 per cent. The Fund's

predominant focus has continued to be on quality, cash generative businesses

combined with asset backing and insulated performance in what has been an

adverse environment. Over the six months to 30 June 2012, the Fund's NAV has

increased by 19 per cent. The Fund continues to maintain a tight oversight of

and regular contact with its investee companies.

During the quarter, the share price of Tribal Group appreciated by 15.5 per

cent to 87p compared to the Fund's cost of investment of 41.8p. N Brown Group,

the Fund's third largest holding, was also a positive contributor, with its

share price appreciating 8.7 per cent during the period. After the period end,

N Brown Group announced significant management succession changes and the share

price increased by a further 5 per cent.

API Group's share price has continued to strengthen following the release of

its full year results. The Fund commenced stake building in February 2012 and

is now the third largest shareholder. At 30 June 2012, the share price was more

than 40 per cent above the Fund's cost of investment. We remain confident in

both API Group's prospects and the ultimate release of value through

significant surplus property disposals in New Jersey.

General stock market risk aversion and a de-rating in cyclical stocks

contributed to a 4.7 per cent decline in the share price of TT Electronics.

Management has indicated that the benefits of past investment and future cost

savings will accelerate in the second half of the year. We remain confident in

the management's ability to increase margins with self-help measures, the

strategic value of its client relationships and importantly management's

ability to release value through the disposal of its non-core secure power

operations. We also regard share price weakness as a potential catalyst to

corporate activity.

During the quarter, the share price of Sutton Harbour declined by 6.5 per cent.

Last week, the company published its audited full year results with net asset

value of 43.1p. Whilst the company has made progress in re-aligning its cost

base and being ready to start building the 171 berth marina in Millbay,

Plymouth, the share price is at a 50 per cent discount to net asset value. The

Fund has recently put forward specific ideas to management with the objective

of bringing about a share price re-rating.

Omega Insurance announced on 25 April 2012 a recommended cash acquisition by

Canopius Group at 67p per share, a 12 per cent discount to the NAV at 31

December 2011. At the general meeting of Omega Insurance on 7 June 2012, 90 per

cent of shares were voted in favour of the acquisition and the acquisition is

expected to complete once the remaining regulatory conditions have been

satisfied.

The Fund took advantage of general stock market weakness during the quarter and

utilised its cash reserves to acquire and accumulate positions. At the period

end, cash levels were 3.3p per share (March 31:15.9p; May 31: 8.4p). Cash

resources are expected to rise in the coming weeks, following the receipt of

more than GBP5 million (8.6p per share) from the Omega Insurance proceeds.

Dividend

The board has today declared an interim dividend of 0.5p per ordinary share in

respect of the year ended 30 June 2012. The dividend will be paid on 20 August

2012 to shareholders on the register (the record date) on 20 July 2012. The

shares will be quoted ex-dividend on 18 July 2012.

For further enquiries please contact:

Crystal Amber Fund Limited

William Collins (Chairman)

Tel: 01481 716 000

Merchant Securities Limited - Nominated Adviser

David Worlidge/Simon Clements

Tel: 020 7628 2200

Numis Securities Limited - Broker

Nathan Brown/Hugh Jonathan

Tel: 020 7260 1426

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein

Tel: 020 7478 9080

END

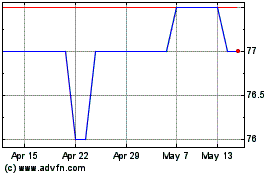

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Sep 2024 to Oct 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Oct 2023 to Oct 2024