TIDMCRS

RNS Number : 4846X

Crystal Amber Fund Limited

15 February 2012

15 February 2012

THIS ANNOUNCEMENT REPLACES THE 'INTERIM MANAGEMENT STATEMENT'

RELEASED TODAY AT 12.30PM UNDER RNS NUMBER 4742X. HEADLINE SHOULD

READ 'INTERIM RESULTS' AND NOT 'INTERIM MANAGEMENT STATEMENT' AS

PREVIOUSLY STATED. ALL OTHER DETAILS REMAIN UNCHANGED. THE FULL

ANNOUNCEMENT TEXT IS REPEATED BELOW.

Crystal Amber Fund Limited

(the 'Fund' or the 'Company')

Interim results for the six months ended 31 December 2011

The Company announces its interim results for the six months

ended 31 December 2011.

Highlights:

-- The proceeds from the Pinewood Shepperton PLC disposal were

reinvested to build significant positions in TT Electronics PLC,

Renishaw PLC and Devro PLC.

-- The subsequent realised and unrealised gains of the new

positions in TT Electronics PLC and Renishaw PLC have added 5.8p to

Net Asset Value ("NAV") per share as at 31 January 2012.

-- A strategic stake in Sutton Harbour Holdings PLC was secured

post period end at a 58% discount to the company's latest net asset

value.

-- NAV per share at 31 December 2011 was 88.72p (30 June 2011: 109.01p per share).

-- During January, the Fund posted a 15% increase in NAV to 101.99p per share.

-- The Fund's management continues to pursue its policy of constructive activism.

"The period under review saw a continuation of political and

economic uncertainty which fed through into considerable turbulence

in financial markets. The Fund took advantage of the equity market

sell-off in August and September to acquire stakes in what we

consider to be quality companies trading at what we believe to be

attractive valuations. It is pleasing to see that these investments

have already generated significant returns for the Fund

contributing to the 15% increase in NAV for the month of

January."

William Collins, Chairman

Enquiries

Crystal Amber Fund Limited

William Collins - Chairman Tel: 01481 716

000

Merchant Securities Limited

David Worlidge Tel: 020 7628

2200

CHAIRMAN'S STATEMENT

I am pleased to present the interim results of Crystal Amber

Fund Limited, covering the six month period to 31 December 2011

("the period").

The economic environment deteriorated progressively over the

summer, with indicators pointing towards a recovery much weaker

than expected. This fragile growth outlook, combined with concerns

over European government debt levels and the solvency of its

financial system, triggered a market sell-off in August. Subsequent

changes in the risk appetite of investors caused increased

volatility throughout the period.

In our opinion, an indiscriminate de-rating took place during

the sell-off and this enabled the Fund to opportunistically acquire

stakes in target companies affected by this market weakness. The

subsequent realised and unrealised increase in value of the new

positions in TT Electronics PLC and Renishaw PLC has added 5.8p to

the Net Asset Value ("NAV") per share as at 31 January 2012.

Conversely, the share price of Omega Insurance Holdings Limited,

which fell over 31% in the period under review, has been the main

detractor from the Fund's NAV. However, we remain engaged with the

company and are confident in the intrinsic value of Omega's Lloyds

platform.

In October, the Fund presented a proposal to Sutton Harbour

Holdings PLC for raising additional equity capital. This was

accepted by the Board and your Fund invested GBP2.7 million (at a

discount to NAV of approximately 58%) as part of the additional

GBP6 million capital raised in January 2012.

As at 31 December 2011, equity holdings represented 85.5% of the

Fund. Cash and liquid resources were in excess of GBP7.5 million.

Since the period end cash has further reduced due to investments

having been made as mentioned above.

We remain confident in our process of identifying undervalued

companies and engaging with boards and management to help and

encourage them to generate better returns for shareholders.

Net asset value fell from GBP65.4 million (109.01p per share) at

30 June 2011 to an unaudited GBP53.2 million (88.72p per share) at

31 December 2011, although I am pleased to report that as at 31

January 2012, the Fund's NAV had increased by 15% to 101.99p per

share.

William Collins

Chairman

Investment Manager's Report

During the period the Fund has focused on realising value from

core holdings and reinvesting the proceeds from the sale of its

former largest holding, Pinewood Shepperton PLC ("Pinewood").

We have reinvested a substantial proportion of the Pinewood

proceeds into a number of targets such as TT Electronics PLC and

Renishaw PLC. These companies offer good potential for value

enhancement, being debt free with strong customer franchises and

access to growth markets outside Europe. In the case of TT

Electronics PLC, the Fund is now one of its three largest

shareholders having bought its stake at an attractive level

following the stock's de-rating in August 2011.

The Fund also increased its holding in Devro PLC, a company in

which the Fund has been a shareholder for the last three years.

Cash reserves at the period end comprise 14% of the Fund,

allowing the Fund to take advantage of opportunities. For example,

in December, the Fund committed to participate in a conditional

placing and open offer to refinance Sutton Harbour Holdings PLC, in

order to allow the company to execute its Millbay marina project

located in Plymouth and pay down some of the current debt.

Following the participation in the fundraising at 18p per share and

subsequent market purchases, the Fund's resulting shareholding in

the company is 26.2% of the enlarged issued share capital as at 31

January 2011. The Directors of the Fund believe that following the

fundraising, Sutton Harbour's net asset value is in excess of 42p

per share.

Total Assets as at 31 December 2011:

GBPm Pence per share % of investee equity held

------------------------------ ----- ---------------- --------------------------

TT Electronics PLC 12.0 20.0 5.8%

Renishaw PLC 5.0 8.3 0.7%

N Brown Group PLC 5.0 8.3 0.8%

Omega Insurance Holdings Ltd 4.3 7.2 3.2%

Devro PLC 3.9 6.4 0.9%

Other equities 15.3 25.6

------------------------------ ----- ---------------- --------------------------

Total equities 45.5 75.8

Cash and net current assets 7.7 12.9

------------------------------ ----- ---------------- --------------------------

Total Assets 53.2 88.7

------------------------------ ----- ---------------- --------------------------

TT Electronics PLC ("TT Electronics")

TT Electronics produces electrical components, sensors and

secure power supply systems. Since the current management arrived

in 2008, it has divested from non-core businesses, reorganised

production and client facing functions and eliminated debt of over

GBP100 million, moving to a net cash position of GBP15 million at

the end of 2011.

The Fund has built a significant position in the company since

it de-rated in August 2011 and is now the third largest

shareholder. In our opinion, the delivery of TT Electronics' clear

operating targets depends on self-help measures and could double

operating profits over the next two years. The company's client

base, including German premium auto brands, is evidence of a

valuable franchise.

Renishaw PLC ("Renishaw")

Renishaw is the global leading engineer of metrology

instruments, which are used for a wide variety of industrial

production and product quality control functions. The company is

managed by its two founders, Sir David McMurtry and John Deer, who

own 53% of its share capital. The company has a strong balance

sheet with net cash to support its outstanding industry positioning

in attractive markets such as the automation of industry in China.

The Fund took this position opportunistically following the stock

de-rating in August 2011.

N Brown Group PLC ("Brown")

Brown is a home shopping retailer, with a strong position in the

special size clothes market and we consider the management of Brown

to be prudent. From a catalogue shopping background, the group now

generates nearly 50% of its sales on the internet. Additionally,

Brown has initiated its geographic expansion in the US and German

markets.

The Fund has invested in Brown since 2008 and has increased its

position by 60% over the last six months.

Omega Insurance Holdings Limited ("Omega")

Omega is a Lloyd's insurer and reinsurer. Historically, it has

enjoyed an excellent underwriting record. The Fund built up its

holding in mid-2010 having assessed the replacement cost of Omega's

insurance platform.

The markets in which Omega operates have become increasingly

challenging over the last year due to a series of natural

disasters. Having been in an offer period since 10 January 2011,

the company received an offer from Haverford Bermuda for 25% of its

share capital and two indicative offers from Canopius Group and

Barbican Insurance, all of which failed. The Manager has engaged

with the bidders and remains confident that the intrinsic value of

the business will be achieved.

Devro PLC ("Devro")

Devro is a global leader in production of edible collagen

castings for sausages. Its strong balance sheet has allowed the

company to invest heavily to improve its production facilities

which we believe will drive operating margin growth through 2012

and 2013. We consider the company to be well-managed with growth

prospects no longer recognised by the stock market.

The Fund has been an investor in Devro since 2008. Having

previously realised a GBP0.8 million profit, over the last six

months the Fund has increased its holding following share price

weakness.

JJB Sports PLC ("JJB")

We are more encouraged by the trading of JJB during the second

half of 2011 despite the exceptionally tough consumer environment.

The management of the company continues to work on the

implementation of the turnaround strategy and Richard Bernstein who

joined the board of JJB in May 2011 is assisting management in this

task.

Other holdings

In July 2011, the Fund announced a significant holding of over 4

million shares in Tribal Group PLC, the education business.

Following the end of its offer period, we held meetings with

management and set out ideas to enhance returns to shareholders. We

are pleased to report that the latest trading statement from Tribal

has been positive.

During the period, the Fund realised further profits in Paypoint

PLC, bringing realised gains from this investment to date to GBP2.9

million. The Fund retains 650,000 shares, which represents the

Fund's sixth largest holding.

Outlook

The economic outlook for the UK and other developed markets

remains uncertain, yet we consider a severe economic downturn

unlikely despite concerns as to the loan quality of UK banks. The

Fund remains focused on identifying quality undervalued companies

with strong balance sheets and diversified geographic revenues,

which in the Manager's opinion offers a more defensive investment

profile together with good opportunities for constructive activism.

It is encouraging that in the month of January, the Fund's NAV grew

by 15%.

Crystal Amber Asset Management (Guernsey) Limited Investment

Manager

Condensed Statement of Comprehensive Income (Unaudited)

for the six months ended 31 December 2011

Six months ended 31 December Six months ended 31 December

2011 2010

Revenue Capital Total Revenue Capital Total

Notes GBP GBP GBP GBP GBP GBP

Income

Dividend income from listed

investments 630,364 - 630,364 1,013,756 - 1,013,756

Director's fees received 5 26,301 - 26,301 - - -

Fixed deposit interest 21,622 - 21,622 5,506 - 5,506

Bank interest 8,401 - 8,401 3,837 - 3,837

---------- ------------- ------------- ---------- ------------ ------------

686,688 - 686,688 1,023,099 - 1,023,099

Net gains on financial

assets at fair value

through profit or loss

Realised gains 4 - 10,249,937 10,249,937 - 883,693 883,693

Movement in unrealised

losses 4 - (21,446,820) (21,446,820) - (9,105,187) (9,105,187)

---------- ------------- ------------- ---------- ------------ ------------

Total income 686,688 (11,196,883) (10,510,195) 1,023,099 (8,221,494) (7,198,395)

Expenses

Transaction costs - 337,956 337,956 - 91,302 91,302

Exchange movements on

revaluation of investments - 135,558 135,558 - (25,600) (25,600)

Management fees 631,229 - 631,229 682,764 - 682,764

Consultancy fees 5 50,000 - 50,000 - - -

Directors' fees 47,500 - 47,500 47,500 - 47,500

Administration fees 38,372 - 38,372 38,454 - 38,454

Custodian fees 14,570 - 14,570 15,553 - 15,553

Audit fees 9,705 - 9,705 8,988 - 8,988

Other expenses 99,173 - 99,173 88,219 - 88,219

---------- ------------- ------------- ---------- ------------ ------------

890,549 473,514 1,364,063 881,478 65,702 947,180

(Loss)/return for the

period (203,861) (11,670,397) (11,874,258) 141,621 (8,287,196) (8,145,575)

========== ============= ============= ========== ============ ============

Basic and diluted

(loss)/earnings per share

(pence) 2 (0.34) (19.45) (19.79) 0.24 (13.81) (13.57)

========== ============= ============= ========== ============ ============

Condensed Statement of Financial Position (Unaudited)

as at 31 December 2011

As at As at As at

31 December 30 June 31 December

2011 2011 2010

(Unaudited) (Audited) (Unaudited)

ASSETS Notes GBP GBP GBP

Cash and cash equivalents 7,583,577 4,067,541 4,459,954

Trade and other receivables 208,353 354,628 63,976

Financial assets designated

at fair value through profit

or loss 4 45,516,815 61,062,843 56,695,250

---------------------------- --------------------- -------------------------

Total assets 53,308,745 65,485,012 61,219,180

---------------------------- --------------------- -------------------------

LIABILITIES

Trade and other payables 75,917 77,926 66,256

---------------------------- --------------------- -------------------------

Total liabilities 75,917 77,926 66,256

---------------------------- --------------------- -------------------------

EQUITY

Capital and reserves

attributable to the Company's

equity shareholders

Share capital 600,000 600,000 600,000

Distributable reserve 56,147,261 56,447,261 56,447,261

Retained (losses)/earnings (3,514,433) 8,359,825 4,105,663

---------------------------- --------------------- -------------------------

Total equity 53,232,828 65,407,086 61,152,924

---------------------------- --------------------- -------------------------

Total liabilities and equity 53,308,745 65,485,012 61,219,180

---------------------------- --------------------- -------------------------

Net asset value per share

(pence) 3 88.72 109.01 101.92

============================ ===================== =========================

Condensed Statement of Changes in Equity (Unaudited)

for the six months ended 31 December 2011

Share Distributable Retained earnings Total

--------

Note Capital Reserve Capital Revenue Total Equity

GBP GBP GBP GBP GBP GBP

Opening balance at 1 July

2011 600,000 56,447,261 6,814,554 1,545,271 8,359,825 65,407,086

Net realised gains on

investments 4 - - 10,249,937 - 10,249,937 10,249,937

Net unrealised losses on

investments 4 - - (21,446,820) - (21,446,820) (21,446,820)

Revenue loss for the period - - - (203,861) (203,861) (203,861)

Dividends paid in the

period 7 - (300,000) - - - (300,000)

Transaction costs and

exchange movements - - (473,514) - (473,514) (473,514)

Balance at 31 December 2011 600,000 56,147,261 (4,855,843) 1,341,410 (3,514,433) 53,232,828

======== ============== ============= ========== ============= =============

Share Distributable Retained earnings Total

--------

Note Capital Reserve Capital Revenue Total Equity

GBP GBP GBP GBP GBP GBP

Opening balance at 1 July

2010 600,000 56,447,261 11,073,859 1,177,379 12,251,238 69,298,499

Net realised gains on

investments 4 - - 883,693 - 883,693 883,693

Net unrealised losses on

investments 4 - - (9,105,187) - (9,105,187) (9,105,187)

Revenue profit for the

period - - - 141,621 141,621 141,621

Transaction costs and

exchange movements - - (65,702) - (65,702) (65,702)

Balance at 31 December 2010 600,000 56,447,261 2,786,663 1,319,000 4,105,663 61,152,924

======== ============== ============= ========== ============= =============

Condensed Statement of Cash Flows (Unaudited)

for the six months ended 31 December 2011

Six months Six months

ended ended

31 December 31 December

2011 2010

GBP GBP

Cash flows from operating activities

Dividend income received from listed investments 778,365 1,665,445

Director's fees received 29,698 -

Fixed deposit interest received 21,918 8,139

Bank interest received 8,401 3,837

Management fees paid (631,229) (682,764)

Consultancy fees paid (41,667) -

Directors' fees paid (47,500) (47,500)

Other expenses paid (177,581) (181,200)

------------- -------------

Net cash (outflow)/inflow from operating activities (59,595) 765,957

------------- -------------

Cash flows from investing activities

Purchase of investments (42,270,156) (13,109,670)

Sale of investments 46,483,743 4,475,487

Transaction charges on purchase and sale of investments (337,956) (91,302)

------------- -------------

Net cash inflow/(outflow) from investing activities 3,875,631 (8,725,485)

------------- -------------

Cash flows from financing activities

Dividends paid (300,000) -

------------- -------------

Net cash outflow from financing activities (300,000) -

------------- -------------

Net increase/(decrease) in cash and cash equivalents during the period 3,516,036 (7,959,528)

Cash and cash equivalents at beginning of period 4,067,541 12,419,482

Cash and cash equivalents at end of period 7,583,577 4,459,954

============= =============

Notes to the Unaudited Condensed Financial Statements

for the six months ended 31 December 2011

General Information

Crystal Amber Fund Limited is a closed-ended company

incorporated and registered in Guernsey on 22 June 2007 under the

Companies (Guernsey) Law, 1994 which has been superseded by the

Companies (Guernsey) Law 2008. The address of the registered office

is given on page 2. The Company has been established to provide

shareholders with an attractive total return which is expected to

comprise primarily capital growth but with the potential for

distributions. The Company will achieve this through the investment

in a concentrated portfolio of undervalued companies which are

expected to be predominantly, but not exclusively, listed or quoted

on UK markets and which have a typical market capitalisation of

between GBP100 million and GBP1,000 million. The Company was listed

and admitted to trading on AIM, the market of that name operated by

the London Stock Exchange, on 17 June 2008. The Company was also

listed on the CISX on 17 June 2008. The Company is also a member of

the AIC.

1. SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of

these financial statements are set out below. These policies have

been consistently applied throughout the current period, unless

otherwise stated.

Basis of preparation

The interim financial statements have been prepared in

accordance with the International Accounting Standard ("IAS") 34,

Interim Financial Reporting.

The interim financial statements do not include all the

information and disclosures required in the annual financial

statements and should be read in conjunction with the Company's

annual financial statements for the year to 30 June 2011. The

annual financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS").

The same accounting policies and methods of computation are

followed in the interim financial statements as in the annual

financial statements for the year ended 30 June 2011.

The presentation of the interim financial statements is

consistent with the annual financial statements. Where

presentational guidance set out in the Statement of Recommended

Practice ("SORP") for Investment Trusts issued by the AIC in

January 2003 (revised December 2005) is consistent with the

requirements of IFRS, the Directors have sought to prepare the

financial statements on a basis compliant with the recommendations

of the SORP. In particular, supplementary information which

analyses the Statement of Comprehensive Income between items of a

revenue and capital nature has been presented alongside the total

Statement of Comprehensive Income.

The Company does not operate in an industry where significant or

cyclical variations as a result of seasonal activity are

experienced during the financial year. Income and dividends from

investments will vary according to the construction of the

portfolio from time to time.

Segmental reporting

The Board has considered the requirements of IFRS 8 'Operating

Segments', and is of the view that the Company is domiciled in

Guernsey and is engaged in a single segment of business, being UK

equity instruments. The Board, as a whole, has been determined as

constituting the chief operating decision maker of the Company. The

key measure of performance used by the Board to assess the

Company's performance and to allocate resources is the total return

on the Company's net asset value, as calculated under IFRS, and

therefore no reconciliation is required between the measure of

profit or loss used by the Board and that contained in these

financial statements.

2. BASIC AND DILUTED LOSS PER SHARE

Basic and diluted loss per share is based on the following

data:

Six months Six months

ended ended

31 December 31 December

2011 2010

(Unaudited) (Unaudited)

Loss for the period (GBP11,874,258) (GBP8,145,575)

Average number of issued Ordinary Shares 60,000,000 60,000,000

---------------- ---------------

Basic and diluted loss per share (pence) (19.79) (13.57)

================ ===============

3. NET ASSET VALUE PER SHARE

Net asset value per share is based on the following data:

As at As at As at

31 December 30 June 31 December

2011 2011 2010

GBP GBP GBP

(Unaudited) (Audited) (Unaudited)

Net asset value per balance sheet GBP53,232,828 GBP65,407,086 GBP61,152,924

Number of Ordinary Shares outstanding 60,000,000 60,000,000 60,000,000

-------------- -------------- --------------

Net asset value per share (pence) 88.72 109.01 101.92

============== ============== ==============

4. FINANCIAL ASSETS DESIGNATED AT FAIR VALUE THROUGH PROFIT OR LOSS

1 July 2011 to 31 1 July 2010 1 July 2010 to 31

December 2011 to 30 June 2011 December 2010

(Unaudited) (Audited) (Unaudited)

GBP GBP GBP

Equity investments - UK equity securities 45,516,815 61,062,843 56,695,250

45,516,815 61,062,843 56,695,250

================== ================ ==================

Cost brought forward 77,985,395 65,840,714 65,840,714

Purchases 42,270,156 54,151,989 12,508,668

Sales (46,483,743) (45,680,841) (4,175,278)

Realised gain 10,249,937 3,673,533 883,693

------------------ ---------------- ------------------

Cost carried forward 84,021,745 77,985,395 75,057,797

------------------ ---------------- ------------------

Unrealised losses brought forward (16,949,976) (9,247,423) (9,247,423)

Movement in unrealised losses (21,446,820) (7,702,553) (9,105,187)

------------------ ---------------- ------------------

Unrealised losses carried forward (38,396,796) (16,949,976) (18,352,610)

------------------ ---------------- ------------------

Accumulated effect of exchange rate movements (108,134) 27,424 (9,937)

Fair value 45,516,815 61,062,843 56,695,250

================== ================ ==================

5. RELATED PARTIES

Mark Huntley, Director of the Company, is Managing Director of

the Company's Administrator, Heritage International Fund Managers

Limited, Managing Director of the CISX Listing Sponsor and a

Director of the Investment Manager. During the period the Company

incurred administration fees of GBP38,372 (2010: GBP38,454) of

which GBP18,750 (2010: GBP20,176) was outstanding at the period

end. Mark Huntley also received a Director's fee of GBP10,000

(2010: GBP10,000) of which GBP5,000 (2010: GBP5,000) was

outstanding at the period end.

Richard Bernstein is a Director of the Investment Manager and a

holder of 780,000 Ordinary Shares (2010: 800,000), representing

1.30 per cent. (2010: 1.33 per cent.) of the issued share capital

of the Company at the period end. He is a non-executive Director of

JJB Sports PLC, one of the Company's investments, and during the

period the Company earned GBP26,301 in relation to this

directorship. At the period end, GBP3,397 (2010: GBPNil) had been

received in advance.

The Company also incurred a consultancy fee of GBP50,000 during

the period (2010:GBPNil) in relation to its investment in JJB. This

was paid in by the Investment Manager with the agreement that it

would be reimbursed in full by the Fund. At 31 December 2011, an

amount of GBP8,333 was due from the Company to the Investment

Manager (2010:GBPNil) in relation to this consultancy fee.

During the period the Company incurred management fees of

GBP631,229 (2010: GBP682,764) all of which had been paid at the

period end. The Investment Manager did not earn a performance fee

during the period (2010: GBPnil).

On 16 November 2011, the Investment Manager purchased 237,000

ordinary shares in the Company, resulting in a holding of 1,000,000

ordinary shares in the Company at the period end, which represents

1.67 per cent. (2010: 1.33 per cent.) of the issued share

capital.

All related party transactions are carried out on an arm's

length basis.

6. COMMITMENTS

On 22 December 2011, the Company committed to invest up to

GBP3,546,422 in Sutton Harbour under its placing and open offer

announced on 23 December 2011.

On 18 January 2012, the Company invested GBP2,741,485 in Sutton

Harbour following the closure of the open offer and placing.

7. DIVIDENDS

On 7 July 2011, the Company declared an interim dividend of

GBP300,000, equating to 0.5p per share, which was paid on 12 August

2011 to shareholders on the register on 15 July 2011.

8. POST BALANCE SHEET EVENTS

On 7 February 2012 the Company reported that its unaudited NAV

at 31 January 2012 was 101.99 pence per share.

9. COPIES OF THE INTERIM REPORT

Copies of the Interim Report will be available to download from

the Company's website www.crystalamber.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EADASFFLAEFF

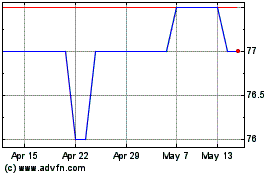

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024