TIDMCNS

RNS Number : 6525Z

Corero Network Security PLC

20 March 2012

Corero Network Security plc (AIM: CNS)

("Corero", the "Company" or the "Group")

Full year results

Corero Network Security plc,the AIM listed network security and

business software provider, is pleased to announce its full year

audited results for the year ended 31 December 2011.

Financial highlights

-- Consolidated revenue GBP11.3million (2010: GBP3.0 million)

-- Consolidated operating profit* GBP287,000 (2010: GBP333,000)

-- Adjusted consolidated loss before tax** GBP260,000 (2010: loss GBP32,000)

-- Loss per share 2.75p (2010: 0.68p)

-- Cash of GBP4.3 million at 31 December 2011 (2010: GBP7.2 million)

-- Raised GBP4.56 million (before costs) on 6 March 2012 by way

of a placing to support the growth of the Corero Network Security

business

* before depreciation, amortisation, acquisition and

restructuring costs and financing

** excluding acquisition and restructuring costs and

amortisation of acquired intangible assets

Operating highlights

-- Corero Network Security division

-- Acquired Top Layer Networks in March 2011, renamed Corero Network Security

-- Repositioned through investments in product development and a

new international sales organisation

-- 78 new customers in 2011 with an average order value of GBP36,000

-- Sales order intake up on the previous year

-- Management team reshaped

-- Launch of DDoS Defence System ('DDS'), a network-layer and

application-layer Distributed Denial of Service ('DDoS') defence

product

-- Corero Business Systems division

-- Revenue up 45% on 2010

-- 36% operating profit margin (2010: 34%)

-- Won contracts from 192 Academies (2010:70)

-- Reseller agreement signed with Serco Learning, part of FTSE 100 Serco plc

-- Management team strengthened

Jens Montanana, Corero Chairman said: "The progress in the

Corero Network Security division since the Top Layer acquisition,

and strong performance of Corero Business Systems, has been very

encouraging.

"Corero Network Security and Corero Business Systems are well

placed to capitalise on the opportunities in their respective

markets and deliver growth with a strong sales pipeline of

opportunities going into 2012.

"The placing in March 2012 which raised GBP4.3 million after

costs will allow Corero to further penetrate the network security

market and ensure that it is well placed to fully exploit

opportunities in network security, an area which is becoming ever

more relevant to businesses in light of increasing cyber

attacks."

Enquiries:

Corero Network Security plc

Andrew Miller, Group Chief Operating Tel: 01923 897 333

Officer

finnCap

Sarah Wharry / Henrik Persson Tel: 020 7220 0500

Stephen Norcross (Corporate Broking)

Walbrook PR Tel: 020 7933 8780

Fiona Henson (Media Relations) Mob: 07886 335 992 or fiona.henson@walbrookpr.com

Paul Cornelius (Investor Relations) Mob: 07827 879 460 or paul.cornelius@walbrookir.com

About Corero Network Security

Corero Network Security plc, is a software focused business with

a leading position in its two markets: network security and

business management solutions.

-- Corero Network Security is an international network security

company and the leading provider of Distributed Denial of Service

(DDoS) defence and Intrusion Prevention System (IPS) solutions.

Corero's products and services provide comprehensive, integrated,

high-performance protection against constantly evolving

network-borne cyber threats. Customers include enterprises, service

providers and government organisations worldwide. Corero's

appliance-based solutions are highly adaptive and pre-emptively

respond to modern cyber attacks, known and unknown, protecting

critical information and online assets. Corero's products have

superior performance, are highly scalable, and feature the lowest

latency and best reliability in the industry

-- Corero Business Systems is a leading provider of powerful and

dynamic modular accounting, human resources, payroll and learner

management information software to the schools (including

academies) and further education sectors in the UK and

internationally.

Overview

2011 was a transformational year for Corero with the acquisition

and successful integration of Top Layer Networks, Inc. ("Top

Layer") coupled with the continuing growth of the Corero Business

Systems division ("CBS"). The Top Layer acquisition closed on 2

March 2011 and Top Layer was rebranded Corero Network Security

("CNS") in June 2011.

Corero plc was also renamed as Corero Network Security plc on 29

June 2011.

CNS has made significant progress post acquisition, with the

establishment of an international sales team and considerable

investment into product development, leading to increased sales

momentum and order intake. In addition, CBS has experienced strong

growth during the period.

In the year ended 31 December 2011 the Group reported revenues

of GBP11.3 million (2010: GBP3.0 million) and operating profit

before depreciation, amortisation, acquisition and restructuring

costs and financing of GBP287,000 (2010: GBP333,000).

Business strategy

The strategy for the Corero Network Security division is to

drive organic revenue growth through increased marketing and

industry visibility of the business' approach and product

capabilities. In addition, Corero will continue to develop its

international, channel focused sales model to access new markets

and customers. The division will also invest in product

development, with the emphasis on Cyber defence/attack solutions

with its IPS and DDoS protection product offerings and services.

The business will continue to explore opportunities that can

complement its buy and build strategy.

The strategy for the Corero Business Systems division will be to

continue to invest for growth. The focus will remain on the

education sector where CBS has a strong market position,

particularly in the further education college and academy markets

in England. Development will continue on Resource Financials &

HR and Resource EMS with additional modules to meet customer

requirements. Opportunities in new customer segments and in

international markets will also be evaluated.

The Group will continue to manage and operate Corero as two

separate divisions with a small central overhead.

Operational Review

Corero Network Security review

Corero's acquisition of Top Layer marked the first step in the

Company's stated strategy to build an international network

security business delivering software and hardware solutions to

mid-market and enterprise customers, telecommunication service

providers and government agencies, through an international network

of distributors, integrators and specialised channels partners.

CNS reported revenue of GBP6.9 millionand an operating

lossbefore depreciation, amortisation, acquisition and

restructuring costs and financing of GBP550,000 in the period since

the 2 March 2011 acquisition date.

CNS sales order intake (bookings) in the year ended 31 December

2011 was $12.0 million (GBP7.5 million) with an average value per

customer of $47,000 (GBP29,000). This compared to $11.7 million

(GBP7.6 million) in 2010 with an average value per customer of

$32,000 (GBP21,000). The increase in order intake along with the

increase in the average value per customer was encouraging,

particularly in the light of the restructuring of the US sales team

post the acquisition and establishing the international team in the

second half of 2011.

CNS secured 78 new customers in 2011 with an average order value

per customer of $57,000 (GBP36,000). This added new customers in

the core vertical markets of finance and banking, education,

defence, on-line gaming and e-Retail. New customer wins included

significant orders from: bwin (one of the world's largest on-line

gaming companies); City of Baltimore; a leading spread betting and

CFD provider; an award winning developer and publisher of online

games; and Bridgepoint Education (an on-line & campus based

Higher Education provider). Particularly pleasing was new business

wins with major telecommunications service providers in France and

Spain.

In addition, material upgrade orders were secured from existing

customers including Party Gaming (which was acquired by bwin in

2011); a Texas based clinical healthcare provider;

one of the largest health insurance associations in the United

States; one of the largest insurers in the United States; and an

agency of the United States Department of Defense.

In 2011, CNS secured maintenance and Threat Update Service

renewals of $2.8 million (GBP1.75 million) including material

renewals from a leading US based insurer and one of the world's

largest energy companies.

In the period since the acquisition closed, a number of

important milestones have been achieved:

-- Management team reshaped with the appointment of new CEO, VP

of Engineering, Chief Marketing Officer, VP Sales North America and

VP of Finance.

-- Launch of DDoS Defence System ('DDS'), a network-layer and

application-layer Distributed Denial of Service ('DDoS') defence

product.

-- Launch of DDoS defence support services, SecureWatch Plus, a

comprehensive suite of DDoS defence, configuration optimisation,

monitoring and response services.

-- Significant new investment and progress made in growing the product development team.

-- Sales teams recruited in France, Italy, Malaysia, Spain and Taiwan.

-- The rebranding of Top Layer to "Corero Network Security".

-- Licensing agreement with Kaspersky Lab, a leading developer

of threat management solutions, to augment Corero's Intrusion

Prevention ("IPS") solution.

-- Appointment of over 30 new channel partners.

The security market dynamics and opportunity for Corero Network

Security

The network security market is forecast to continue to grow

strongly, fuelled by escalating cyber threats, economic disruption

and associated costs as cyber attacks multiply, and growing

security compliance and business continuity requirements (Gartner

forecast cumulative annual growth of over 8% in the period to

2014).

The nature, frequency and sophistication of cyber attacks

continue to increase across all spectrums:

-- Cyber-crime driven by financial motivation of cyber criminals.

-- Cyber-activism which in 2011 saw hacktivism (the convergence

of hacking and activism) activities increase significantly with the

exploits of groups such as Anonymous and Lulzsec.

-- Cyber-espionage and cyber-warfare impacting both government

and commercial organisations targeting national security

information, trade secrets and intellectual property assets.

Cyberspace is increasingly being regarded as the new frontline of

warfare - the fifth domain along with land, sea, air and space.

-- Cyber-terrorism which US intelligence agencies consider is

likely to overtake terrorism as the number one threat facing the

US.

According to independent research recently commissioned by

Corero, DDoS attacks are becoming increasingly prevalent with 31%

of organisations having suffered an attack in the past 12 months.

The research, conducted by VansonBourne, questioned 300 mid to

large-sized enterprises in the UK and US and found US companies

were twice as likely to be attacked as those in the UK, with 63% of

US and 29% of UK IT directors concerned over future attacks.

Political and ideological motivation was cited as the largest

source of DDoS attacks among UK companies with the retail sector

most concerned. In the US 52% of attacks were caused by competitors

seeking unfair business advantages.

The security market is fragmented, with Gartner estimating that

only 44% of the market share belongs to the top five vendors. In

this fragmented and ever changing market many established leaders

are losing market share to smaller players with new offerings to

meet new threats.

CNS's products and services offer an effective first line of

defence against cyber attacks. With a strong software centric

platform, Corero has the flexibility and performance to address the

challenges of customers today and into the future.

Corero Business Systems review

Revenues for the CBS division increased by 45% in 2011 to GBP4.4

million(2010: GBP3.0 million). CBS sales order intake in the year

to 31 December 2011 was GBP5.1 million (compared to GBP3.4 million

in 2010).

CBS reported an operating profit before depreciation,

amortisation, acquisition and restructuring costs and financing of

GBP1.6 million (2010: GBP1.0 million).

The CBS division won new contracts from 192 Academies in the 12

months ended 31 December 2011, compared with 70 in 2010, underlying

its strong position in this growth market. In addition, despite the

tight Public Sector spending environment, CBS won four new

contracts with sixth form colleges in 2011. These included three

colleges, St John Rigby in Wigan, Joseph Chamberlain in Birmingham

and St Dominic's in Harrow for the Resource EMS solution, CBS'

Learner Management Information System and one new college,

Blackpool Sixth Form, for its Resource Financials solution.

Key achievements in 2011 include:

-- Reseller agreement signed with Serco Learning, part of FTSE 100 Serco plc.

-- Strategic partnerships with two schools and academy groups:

o The School Partnership Trust - a Leeds based educational

charity, awarded 'Accredited Schools Group Status' in 2010, with 20

schools and Academies.

o The Kemnal Academies Trust - a Kent based multi-Academy Trust

with 26 secondary and primary Academies, who are establishing one

of the first new Teaching Schools.

-- Strengthening of the management team by appointment of Sales

Director, HR Manager, Product Manager and Service Delivery

Manager.

-- Additional sales talent recruited - sales team increased from

6 at 31 December 2010 to 10 at 31 December 2011.

-- Launch of Resource Financials v7, CBS' next generation financial software solution.

Financial performance

For the year ended 31 December 2011, the Group reported an

operating profit before depreciation, amortisation, acquisition and

restructuring costs and financing of GBP287,000 (2010: GBP333,000)

and a loss after taxation of GBP1.2 million(2010: profit

GBP404,000). This included an unrealised exchange gain of GBP73,000

arising on intercompany balances.

Central costs were GBP756,000 (2010: GBP693,000). Central costs

relate to the Group finance and administration functions as well as

the costs associated with the Company's listing on AIM. Central

costs in 2011 include a full year of costs of the management team

and directors appointed in August 2010.

Interest costs were GBP224,000 (2010: GBP199,000) comprising

interest on the Loan Notes issued by Top Layer Networks, Inc

(subsequently renamed Corero Network Security, Inc) as part of the

purchase consideration for Top Layer and the Corero Network

Security working capital facility. The interest in 2010 relates to

interest on the Cumulative Unsecured Loan Stock ('CULS') which was

redeemed by the Company in the year ended 31 December 2010.

Interest received was GBP61,000 (2010: GBP32,000).

The loss per share was 2.75p (2010: 0.68p).

The Group's net assets at the year end were GBP11.5 million

(2010: GBP6.9 million).

The closing cash balance was GBP4.3million (2010: GBP7.2

million). The net reduction in cash and cash equivalents was

GBP931,000 (2010: net increase GBP768,000).

In 2011 the Company raised GBP2.3 million (before expenses) of

which the directors contributed GBP0.9 million.

Post balance sheet event

On 6 March 2012, the Company raised GBP4.56 million (before

issue costs), of which the directors and senior management

contributed GBP1.4 million, by way of a placing of 10,615,694 new

ordinary shares at a price of 43p per share. The money was raised

to support the growth of the Corero Network Security business by

investing in the sales of marketing functions of the business to

gain end-user customer and channel partner awareness, and investing

in its product development capabilities.

Outlook

Significant progress has been made in the Corero Network

Security business. The business and management team have been

reshaped and the groundwork laid to drive incremental business in

many exciting new international markets. This division is well

positioned to deliver growth in 2012.

Corero Business Systems performed strongly in 2011 and is

expected to continue its robust and profitable development into

2012. The early opportunities identified in this division's core

customer segment have enabled the business to build a strong

presence and annuity base in the UK education market.

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2011

Existing continuing Acquired Continuing total Total

2011 2011 2011 2010(1)

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 4,393 6,872 11,265 3,020

Cost of sales (857) (1,699) (2,556) (593)

-------------------- --------- ----------------- --------

Gross profit 3,536 5,173 8,709 2,427

-------------------------------------------------------- -------------------- --------- ----------------- --------

Operating expenses before highlighted items (2,699) (5,723) (8,422) (2,094)

- Depreciation and amortisation of intangible assets (219) (730) (949) (198)

- Acquisition and restructuring costs (306) (297) (603) (60)

-------------------------------------------------------- -------------------- --------- ----------------- --------

Operating expenses (3,224) (6,750) (9,974) (2,352)

Operating profit/(loss) 312 (1,577) (1,265) 75

Finance income 61 - 61 32

Finance costs - (224) (224) (199)

-------------------- --------- ----------------- --------

Profit/(loss) before taxation 373 (1,801) (1,428) (92)

Taxation - 192 192 -

-------------------- --------- ----------------- --------

Profit/(loss) for the year from continuing/acquired

operations 373 (1,609) (1,236) (92)

Profit from discontinued operations - - - 4

Profit from sale of discontinued operations - - - 492

-------------------- --------- ----------------- --------

Profit/(loss) for the year 373 (1,609) (1,236) 404

-------------------- --------- ----------------- --------

Total profit/(loss) for the year attributable to:

Equity holders of the parent 345 (1,609) (1,264) 404

Non-controlling interest 28 - 28 -

-------------------- --------- ----------------- --------

373 (1,609) (1,236) 404

-------------------- --------- ----------------- --------

Other comprehensive income

Difference on translation of foreign subsidiary - 25 25 -

-------------------- --------- ----------------- --------

Total comprehensive income/(expense) for the year 373 (1,584) (1,211) 404

-------------------- --------- ----------------- --------

Total comprehensive income/(expense) for the year

attributable to:

Equity holders of the parent 345 (1,584) (1,239) 404

Non-controlling interest 28 - 28 -

-------------------- --------- ----------------- --------

Total 373 (1,584) (1,211) 404

-------------------- --------- ----------------- --------

(1) restated for change in cost of sales accounting policy as

per Interim Results.

There were no acquisitions in 2010.

Basic and diluted (loss)/earnings per share

2011 2010

Pence Pence

Basic loss per share from continuing and acquired operations (2.75) (0.68)

Basic earnings per share from discontinued operations - 3.67

------- -------

Basic (loss)/earnings per share (2.75) 2.99

Diluted loss per share from continuing and acquired operations (2.58) (0.62)

Diluted earnings from discontinued operations - 3.35

Diluted (loss)/earnings per share (2.58) 2.73

======= =======

In the previous year the diluted earnings per share figure was

omitted from the approved financial statements in error. As a

result this has been calculated and included within the financial

statements this year. There was no difference between basic and

diluted earnings per share for the year ended 31 December 2009.

Consolidated Statement of Financial Position

as at 31 December 2011

2011 2010

GBP'000 GBP'000

Assets

Non-current assets

Goodwill 12,144 509

Acquired intangible assets 3,008 5

Capitalised development expenditure 1,484 591

Property, plant and equipment 655 36

17,291 1,141

Current assets

Inventories 241 -

Trade and other receivables - due in less than one year 3,266 818

Trade and other receivables - due in more than one year 158 2

Cash and cash equivalents 4,312 7,186

-------- --------

7,977 8,006

Liabilities

Current Liabilities

Trade and other payables (2,824) (735)

Borrowings (176) -

Deferred income (5,416) (1,485)

Provisions - (4)

(8,416) (2,224)

Net current (liabilities)/assets (439) 5,782

Non-current liabilities

Borrowings (3,557) -

Deferred income (808) -

Deferred taxation (1,012) -

-------- --------

(5,377) -

-------- --------

Net assets 11,475 6,923

-------- --------

Equity

Ordinary share capital 477 319

Deferred share capital 4,542 4,542

Shares to be issued 80 -

Share premium 19,846 14,341

Merger reserve - 1,023

Share options reserve 166 146

Non-controlling interest 28 -

Translation reserve 25 -

Retained earnings (13,689) (13,448)

-------- --------

Total surplus attributable to equity holders 11,475 6,923

-------- --------

Consolidated Statement of Cash Flows

for the year ended 31 December 2011

Cash flow from operating activities 2011 2010

GBP'000 GBP'000

Continuing operations

Loss before taxation (1,428) (92)

Adjustments for:

Amortisation of acquired intangible assets 576 7

Amortisation of capitalised development costs 201 168

Depreciation 172 22

Finance income (61) (32)

Finance expense 224 199

Decrease in provisions (4) (8)

Share based payment charge 20 131

Changes in working capital

Increase in inventories (94) -

Increase in trade and other receivables (1,729) (344)

Increase in payables 1,192 424

------- -------

Cash (used)/generated from continuing operations (931) 475

Net cash from discontinued operations - 293

------- -------

Net cash from operating activities (931) 768

Cash flows from investing activities

Acquisition of subsidiaries, net of cash acquired (2,283) -

Purchase of intangible assets (38) -

Capitalised development expenditure (1,094) (367)

Purchase of property, plant and equipment (629) (24)

------- -------

Net cash used in investing activities (4,044) (391)

Cash flows from financing activities

Net proceeds from issue of ordinary share capital 2,089 6,383

Term loan received 162 -

Finance income 61 32

Finance expense (10) (292)

Capital element of finance lease repayments (14) -

Repayment of credit facility (187) -

------- -------

Net cash from financing activities 2,101 6,123

Net (decrease)/increase in cash and cash equivalents (2,874) 6,500

Cash and cash equivalents at 1 January 7,186 686

------- -------

Cash and cash equivalents at 31 December 4,312 7,186

------- -------

Consolidated Statement of Cash Flows

continued

Significant non-cash transactions

a) The conversion of 50% of the convertible unsecured loan stock

to equity

b) Disposal proceeds of the sale of the Financial Markets

division

c) Part of the purchase consideration for the acquisition of Top

Layer Networks, Inc

Consolidated Statement of Changes in Equity

for the year ended 31 December 2011

2002 Ordinary

and

deferred Shares Share Share CULS Profit

share to be premium Merger options equity Non-controlling Translation and loss

capital issued account reserve reserve reserve interest reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

1 January

2010 4,557 - 6,369 1,023 14 146 - - (13,898) (1,789)

Share based

payments - - - - 132 - - - 132

Redemption

of CULS - - - - - (146) - - 146 -

CULS fair

value adjustments - - - - - - - - 567 567

Issue of

share capital 304 - 7,972 - - - - - (667) 7,609

Profit for

year ended

31 December

2010 - - - - - - - - 404 404

--------- -------- -------- -------- -------- -------- ---------------- ------------ --------- --------

31 December

2010 4,861 - 14,341 1,023 146 - - - (13,448) 6,923

Share based

payments - - - - 20 - - - - 20

Issue of

share capital 158 - 5,505 - - - - - - 5,663

Merger reserve

transfer - - - (1,023) - - - - 1,023 -

Shares to

be issued - 80 - - - - - - - 80

Other comprehensive

income - - - - - - - 25 - 25

Loss for

the year

ended 31

December

2011 - - - - - - 28 - (1,264) (1,236)

--------- -------- -------- -------- -------- -------- ---------------- ------------ --------- --------

31 December

2011 5,019 80 19,846 - 166 - 28 25 (13,689) 11,475

--------- -------- -------- -------- -------- -------- ---------------- ------------ --------- --------

Notes

1. Segment reporting

Unallocated

Reportable Operating Segments Items

Business

Network Security Systems Central Costs Total

2011 2010 2011 2010 2011 2010 2011 2010

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

to external

customers

Product

and licence 3,042 - 1,233 556 - - 4,275 556

Professional

services 152 - 1,266 699 - - 1,418 699

Support 3,678 1,894 1,765 - - 5,572 1,765

--------- -------- -------- -------- -------- -------- -------- --------

Total 6,872 - 4,393 3,020 - - 11,265 3,020

Cost of

sales (1,699) - (857) (593) - - (2,556) (593)

--------- -------- -------- -------- -------- -------- -------- --------

Gross profit 5,173 - 3,536 2,427 - - 8,709 2,427

Operating

expenses (5,723) - (1,947) (1,406) (732) (557) (8,402) (1,963)

Share options

charge - - - - (20) (131) (20) (131)

--------- -------- -------- -------- -------- -------- -------- --------

Operating

(loss)/profit

before depreciation,

amortisation,

acquisition

and restructuring

costs and

financing (550) - 1,589 1,021 (752) (688) 287 333

Depreciation (146) - (22) (26) (4) (5) (172) (31)

Amortisation

of intangible

assets (584) - (193) (167) - - (777) (167)

--------- -------- -------- -------- -------- -------- -------- --------

Operating

(loss)/profit

before acquisition

and restructuring

costs and

financing (1,280) - 1,374 828 (756) (693) (662) 135

Acquisition

and restructuring

costs (297) - - - (306) (60) (603) (60)

--------- -------- -------- -------- -------- -------- -------- --------

(Loss)/profit

before financing (1,577) - 1,374 828 (1,062) (753) (1,265) 75

Finance

income - - - - 61 32 61 32

Finance

costs (224) - - - - (199) (224) (199)

--------- -------- -------- -------- -------- -------- -------- --------

(Loss)/profit

before taxation (1,801) - 1,374 828 (1,001) (920) (1,428) (92)

Taxation 192 - - - - - 192 -

--------- -------- -------- -------- -------- -------- -------- --------

(Loss)/profit

after taxation (1,609) - 1,374 828 (1,001) (920) (1,236) (92)

--------- -------- -------- -------- -------- -------- -------- --------

2. Sundry Information

The financial information set out above does not constitute the

Company's Annual Report and Financial Statements for the years

ended 31 December 2011 or 2010. The Annual Report and Financial

Statements for 2010 have been delivered to the Registrar of

Companies and those for 2011 will be delivered following the

Company's annual general meeting. The auditor's reports on both the

2011 and 2010 accounts were unqualified, did not draw attention to

any matters by way of emphasis and did not contain statements under

s498(2) or (3) of the Companies Act 2006. Whilst the financial

information included in this preliminary announcement has been

computed in accordance with International Financial Reporting

Standards (IFRSs) this announcement does not itself contain

sufficient information to comply with IFRSs.

Copies of the Annual Report and Financial Statements for the

year to 31 December 2011 will be posted to shareholders shortly and

will be obtainable from the Company's registered offices or

www.coreroplc.com when published.

The information in this preliminary announcement was approved by

the board on 19 March 2012.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BKCDBKBKBKND

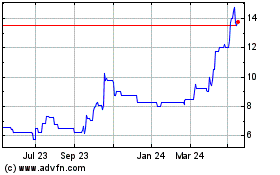

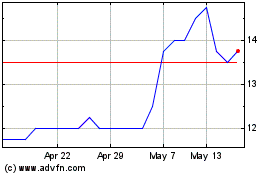

Corero Network Security (LSE:CNS)

Historical Stock Chart

From Sep 2024 to Oct 2024

Corero Network Security (LSE:CNS)

Historical Stock Chart

From Oct 2023 to Oct 2024