Trading Statement

January 25 2002 - 2:30AM

UK Regulatory

RNS Number:4805Q

Comino Group PLC

25 January 2002

COMINO GROUP PLC

TRADING STATEMENT

In its September 2001 trading statement, Comino Group reported that performance

in the first half of its financial year had been significantly below

expectations. The Interims Report confirmed this and the Group announced a loss

for the six months to 30 September 2001 of £1.1 million (before charging

goodwill amortisation of £148,000 and £165,000 of costs associated with the new

venture, Comino Techflow).

The disappointing outcome was principally attributable to three factors: delays

in the award of local authority contracts; increased development costs for

Occupational Pensions and a related deferral of revenue; and an increase in

overheads to support growth which had yet to materialise.

Whilst the Local Government order situation is improving, the prospect list

continues to be affected by slow decision making. As a consequence, although

the Group expects to be profitable in the second half of the year, it may not

now be possible to recoup the full extent of first half losses. However, the

outlook for the Group remains very positive.

Social Housing continues to operate profitably and enjoys a high level of

repeatable income from the customer base. The client base is moving steadily

from legacy software to new generation Comino products.

We have a significant opportunity in Local Government and continue to invest in

this area to provide fully functional e-government compliant products in line

with central government policy. In addition, the upgraded product for our

existing Local Government customers has now been completed and will provide a

better balance between new customer sales and sales to the existing customer

base during the coming year.

Significant progress has been made in tackling the development issues

surrounding the Occupational Pensions product and the underlying problems have

largely been corrected. The problems have seriously impacted this years

performance but the order book is now building and we expect this division to

return to profitability next year.

The current financial year is a disappointment. However, the Company is

strongly positioned in each of its markets and is reinforcing this by the

continuing development of sophisticated, cost effective and flexible solutions.

With patience and with the continuing efforts and commitment of management and

employees, we expect to see the Group's considerable strengths translated into

commensurate profitability in near term.

END

This information is provided by RNS

The company news service from the London Stock Exchange

Cmo (LSE:CMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

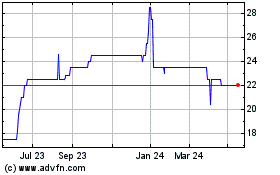

Cmo (LSE:CMO)

Historical Stock Chart

From Jul 2023 to Jul 2024