Chariot Oil & Gas Ld AGM Statement (1695P)

June 04 2015 - 2:01AM

UK Regulatory

TIDMCHAR

RNS Number : 1695P

Chariot Oil & Gas Ld

04 June 2015

4 June 2015

Chariot Oil & Gas Limited

("Chariot", the "Company" or the "Group")

AGM Statement

Chariot Oil & Gas Limited (AIM: CHAR), the Atlantic margin

focused oil and gas exploration company, will be holding its Annual

General Meeting at 10.00am today at the offices of finnCap, 60 New

Broad Street, London, EC2M 1JJ.

At the meeting, Larry Bottomley, Chief Executive Officer, will

also provide a brief portfolio overview from the Corporate

Presentation that is available on the Company website

(www.chariotoilandgas.com). There will be no new material

information disclosed.

Over the past year, Chariot has continued to make progress

across all of its assets, during a period that has seen significant

change and challenges in the industry. Within this environment we

have looked to focus on our strategy of risk mitigation and capital

discipline and, as a result of careful management of both our

balance sheet and portfolio, we are able to withstand industry

turbulence and look to capitalise on market opportunities.

In terms of risk mitigation, the team has continued to apply its

technical capabilities, as shown through the substantial prospect

and lead inventory that has been developed across the portfolio.

Our ongoing focus on capital discipline has also been demonstrated

through the dedication to levered partnerships as well as through

the successful fundraising of 2014, and more recently in a 50%

reduction in the Board's remuneration. Whilst this was implemented

as a precautionary measure, it is indicative of the consideration

of the long term interest for the Company and our stakeholders.

Protecting the value of our assets and maintaining a strong

position in negotiations is also crucial to Chariot's success. As

recently announced, we rejected proposed amendments to the

commercial terms on the AziLat farm-out agreement in Brazil as

these did not reflect the high potential of the acreage and, as a

result, the partnership was terminated.

These decisions have all been taken to look to ensure that

Chariot is able to protect its high quality portfolio whilst

retaining the focus on progressing towards drilling.

In line with our strategy, we are near zero cost in Morocco. As

announced on the 21 April 2015, Woodside decided not to elect to

take up their option to increase their holding to 50% but they

continue to have a 25% working interest in Rabat Deep, and funds

received from them to date have covered the back costs and costs of

the 3D seismic programme. This allows us to seek an additional

partner for drilling, specifically the JP-1 prospect which has

gross mean prospective resources of 618mmbbls as assessed by

Netherland Sewell and Associates Inc. ("NSAI"). In addition, we

have also identified several material prospects within the Loukos

and Mohammedia Reconnaissance licences and are excited about the

prospectivity we see across our Moroccan acreage. Datarooms will

open in due course for interested parties.

Our C-19 licence in Mauritania is also near zero cost and the

team has worked hard to de-risk and mature the prospect and lead

inventory further to completing its proprietary 3D seismic survey.

The recent Competent Person's Report from NSAI has confirmed our

evaluation of the material prospective resources of four prospects

of single to multi-stacked targets containing a range of estimates

up to 588mmbbls. In addition, further leads have been identified

offering significant follow-on potential in the success case. With

the recently announced extension, we will undertake further studies

in conjunction with our partners Cairn and the Société

Mauritanienne des Hydrocarbures et de Patrimoine Minier on our

priority targets to further de-risk them prior to drilling with an

additional partner. A dataroom is open and following recent

industry success in the region, Mauritania is generating increased

attention from third parties. We will await further drilling

activity in the area with interest.

In Brazil we have identified discovery potential of between

300-500mmbbls from legacy 2D data and we will undertake our planned

3D seismic programme in 2H 2015, subject to approval of the

Environmental Impact Assessment by the Brazilian authorities. A

dataroom is open as we continue to seek a partner on these

licences, although we will undertake the 3D acquisition

independently to avoid any delays.

In Namibia, through careful renegotiation, we have managed our

risk with regard to our licence commitments. We are evaluating the

data received from the 2D seismic in the Southern and Central

Blocks, integrating this with previously acquired information to

look to optimise 3D seismic programme locations. A dataroom remains

open for potential drilling or seismic partners in the Central

Blocks and further third party activity is expected within this

region over the coming 12 months. Whilst both Brazil and Namibia

are frontier regions and therefore have an increased risk from an

exploration perspective, we see high potential for material

accumulations of hydrocarbons within our licence areas.

We also announce that at the AGM today Heindrich Ndume is

retiring by rotation as a Director of the Board of Chariot. As a

founder of Chariot, Heindrich has been an important member of the

Board since the Company's inception and we would like to thank him

for his contributions. We wish him well with his new ventures in

the future.

We see great opportunities in both our portfolio and in what the

shifts in the business environment may create. We remain

fully-funded for all our commitments and the large scale of the

prospects in Chariot's portfolio means that drilling success would

generate transformational value even at current oil prices.

Concurrent to this, we also continue to look to both progress and

protect the value that we see in our assets and the team continues

to evaluate potential new ventures as well as ensuring an ongoing

focus on risk management and the delivery of our strategy.

-Ends-

For further information

please contact:

Chariot Oil & Gas Limited

Larry Bottomley, CEO +44 (0)20 7318 0450

GMP Securities (Joint

Broker)

Rob Collins, Emily Morris +44 (0)20 7647 2835

Jefferies International

Limited (Joint Broker)

Chris Zeal, Max Jones +44 (0)20 7029 8000

finnCap (Nominated Adviser)

Matt Goode, Christopher

Raggett +44 (0)20 7220 0500

ECM2 Advisory

Natalia Erikssen +44 (0)78 0944 0929

NOTES TO EDITORS

About Chariot

Chariot Oil & Gas Limited is an independent oil and gas

exploration group. It holds licences covering four blocks in

Namibia, one block in Mauritania, three blocks in Morocco and four

licences in the Barreirinhas Basin offshore Brazil. All of these

blocks are currently in the exploration phase.

The ordinary shares of Chariot Oil & Gas Limited are

admitted to trading on the AIM Market of the London Stock Exchange

under the symbol 'CHAR'.

This information is provided by RNS

The company news service from the London Stock Exchange

END

AGMSSDEEDFISEFM

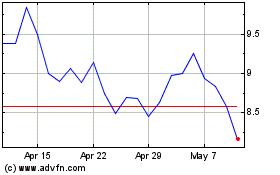

Chariot (LSE:CHAR)

Historical Stock Chart

From Sep 2024 to Oct 2024

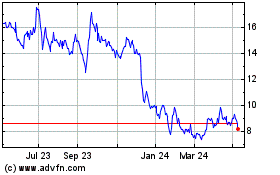

Chariot (LSE:CHAR)

Historical Stock Chart

From Oct 2023 to Oct 2024