TIDMCEY

RNS Number : 9995N

Centamin PLC

27 May 2020

27 May 2020

Centamin plc

("Centamin" or "the Company")

(LSE:CEY, TSX:CEE)

Notice of Annual General Meeting and Publication of 2019 Annual

Report and Accounts

for the twelve months ended 31 December 2019

In accordance with Listing Rule 9.6.1, today Centamin has

submitted the 2020 Notice of Annual General Meeting ("the Notice")

and the 2019 Annual Report and Accounts ("2019 Annual Report") to

the National Storage Mechanism. Both documents will shortly be

available for inspection at http://www.morningstar.co.uk/uk/NSM%20

and the Company's website www.centamin.com .

Mailing of the Notice, proxy forms for the 2020 Annual General

Meeting ("AGM") and related ancillary documentation to shareholders

will commence shortly.

2020 ANNUAL GENERAL MEETING

The AGM is to be held on 29 June 2020 at the Company's

registered office, 2 Mulcaster Street, St Helier, Jersey, at 11:00

am BST (UK time). The business to be considered by shareholders at

the AGM is set out in the Notice, which includes explanatory notes

on each of the Resolutions.

Given the unprecedented global situation with COVID-19,

regulators, governments and public health authorities have issued

varying directives which have impacted the timing and structure of

the AGM. In addition to adhering to the imposed restrictions and

guidance, Centamin has imposed further proactive measures to

safeguard the health and wellbeing of our workforce, stakeholders

and communities.

In accordance with social distancing measures and government

restrictions on gatherings of no more than two people, outside of

your household, the AGM will be held with only the minimum number

of shareholders present as required to form a quorum under the

Company's Articles of Association, and whom will be officers or

employees of Centamin. To ensure safety, other shareholders will

not be able to gain access to the AGM on this occasion.

We ask that shareholders abide by the instructions to stay at

home and participate in the AGM by appointing a proxy to vote on

the Resolutions set out in the Notice as soon as possible.

Shareholders are strongly encouraged to appoint the chair of the

meeting as their proxy if they wish to participate in the meeting

and ensure their votes on the Resolutions are counted.

All Resolutions for consideration at the AGM will be voted on a

poll, rather than a show of hands, and all proxy votes cast will

count towards the poll votes. The Board would like to encourage all

shareholders to complete, sign and return the Proxy Form to our

Registrars as soon as possible and no later than 11.00am BST (UK

time) on 25 June 2020.

Despite these exceptional circumstances, shareholder engagement

is important to the Company and therefore all shareholders will

have the opportunity to listen to the formal business of the AGM

via conference call or webcast. Please find below the required

participation details:

Webcast link :

https://www.investis-live.com/centamin/5ec3f60427577e10009f093d/gtrd

Conference call

Dial-in telephone numbers:

United Kingdom +44 (0) 203 936 2999

United States +1 646 664 1960

South Africa +27 (0)87 550 8441

All other locations +44 (0) 203 936 2999

Participation access code : 394543

If a shareholder would like to ask a question about the formal

business of the AGM, please email your questions to

info@centamin.com by 11:00 am on Thursday, 25 June 2020 so they can

be addressed at the meeting.

The Board will continue to closely monitor the rapidly

developing situation with COVID-19, as well as the latest

government guidance, as to how it may affect the arrangements for

the AGM, which may have to change on short notice. If it becomes

necessary to change the arrangements for the AGM, information will

be found on the Company website and via a regulatory

announcement.

2019 ANNUAL REPORT AND ACCOUNTS

The Company published the audited annual results for the twelve

months ended 31 December 2019 on 18 May 2020, and a copy of the

announcement is available on the Company's website. These results,

together with the information in the below appendices, constitute

the information required in accordance with the FCA's Disclosure

Guidance and Transparency Rule 6.3.5R. Page references included

herein refer to page numbers in the 2019 Annual Report. This

announcement should be read in conjunction with, and is not a

substitute for reading, the 2019 Annual Report.

For more information, please visit the website www.centamin.com

or contact:

Centamin plc Buchanan

Alexandra Carse, Investor Relations Bobby Morse

+44 (0) 7700 713 738 Chris Judd

alexandra.carse@centamin.je Kelsey Traynor

+ 44 (0) 20 7466 5000

centamin@buchanan.uk.com

APPIX A - Principal Risks and Uncertainties

The Principal Risks and Uncertainties are set out in the table

below. A summary was also announced on 18 May 2020 and the Risk

Management and Principal Risk report is available on pages 66 to 81

of the 2019 Annual Report.

PRINCIPAL NATURE OF RISK MITIGATION COMPANY OBJECTIVE RISK APPETITE

RISK / STRATEGY

Strategic The Sukari Gold Mine Sukari Gold Mine: the At Sukari, the process Level: Informed

Risk currently project plant has been Risk appetite

Loss of constitutes Centamin's at Sukari has two designed with is at an acceptable

revenue main distinct sufficient level, with appropriate

due mineral resource and ore sources (open pit resilience and levels of mitigation

to single sole and redundancies in place to reduce

project mineral reserve, underground), the within the operating the likelihood

dependency near-term processing cycle. of significant

production and plant has two separate loss of revenue

revenue. Whilst flotation The exploration due to single

the resource base in circuits and two projects across project dependency.

West separate the business provide

Africa is growing, the power stations. Whilst a well-balanced

regional one project pipeline,

exploration is not project, the nature of with potential to

sufficient the add incremental

to support the design of the plant shareholder value

development provides by increasing

of a mining operation adequate mitigation production

at the and reduces across the Group.

time of reporting. We the relative

recognise likelihood of The regional

the COVID-19 pandemic dependence compared to exploration

may a single on the licence

impact this risk but layer plant design. portfolio

have The second in West Africa

covered this further circuit of the process continues.

on page plant A maiden reserve

20. has been fully is targeted for

operational 2021 at the Doropo

Until further for over two years, Project, with potential

production growth which revenue generation

beyond Sukari is shows the resilience in the future.

identified, of the

the potential impact project. In addition,

remains the

high and safeguarding plant is fed by both

the the open

project is paramount pit and underground

to the operation,

Company. The providing higher and

identification lower-grade

of significant ore to the processing

resources in plant.

Côte d'Ivoire and Operational activity

timeline and production

to build an operation is expected to

in the continue at

region has resulted in above nameplate

an capacity.

improving trend. Other mitigating

factors,

outside the single

project

at Sukari, include the

continued

focus on longer term

growth

and expansion through

exploration

and acquisition

targets both

inside and outside of

Egypt.

----------------------- ----------------------- ------------------------ ------------------------

Strategic Whilst Centamin Maintaining relations A key objective Level: Balanced

Risk retains control : with of the Company is Risk appetite

Sukari Gold over the project, the the onset of profit to is at an acceptable

Mine holding sharing maintain our social level, with appropriate

relationship company, SGM, is with EMRA last year, license to operate. levels of mitigation

with our jointly owned managing This is achieved in place.

partners by the Company's timing and quantum of through co-operation,

EMRA wholly owned payments, regular meetings

subsidiary, PGM and as well as applying and correspondence

EMRA with and interpreting with EMRA, as well

equal board certain provisions of as making sure that

representation the the terms and

from both parties. The Concession Agreement, conditions

board is important of the Concession

of SGM operates by way in maintaining a good Agreement governing

of relationship the mine are fully

simple majority. with EMRA. Future complied with.

Should a expenditure

dispute arise which and recovery of

cannot qualifying

otherwise be amicably capital expenditure

resolved, will also

arbitration or other need to be managed, to

proceedings be

may need to be appropriately cost

employed. recovered

by the Company.

The successful

management

of the Sukari Gold

Mine is

in part dependent on

maintaining

a good working

relationship

with EMRA. The Group

has regular

meetings with

officials from

EMRA and invests time

in liaising

with relevant ministry

and

other governmental

representatives.

----------------------- ----------------------- ------------------------ ------------------------

Strategic The Group's corporate Tax exposure: the To minimise the Level: Balanced

Risk structure Group engages complexity of the Simplification

Jurisdictional includes operational tax advisers to corporate structures of the structure

taxation activity provide local ensuring tax neutrality is ongoing; however,

exposure in Egypt and West advice at an within the holding the mitigation

Africa held operational level group entities. in place is at

through holding as well as corporate an acceptable

companies and structuring level and therefore

in Australia and the advice at a corporate operating within

United level. the parameters

Kingdom. Exposure to The Company has of our current

changing developed risk

cross jurisdictional a global tax strategy appetite.

tax legislation to take

could have an adverse account of the

effect required regulations

on the Company's relevant to Centamin.

ability to The

repatriate revenues. Company's strategy is

to ensure

A key milestone under taxes are paid at an

the operational

terms of the Sukari level and tax leakage

Concession is reduced

Agreement is the through the holding

entitlement structure.

to a further 15-year

exemption In respect to

from any taxes imposed extending the

by tax exemption, the

the Egyptian Board do

government on not foresee any issues

the revenues generated in

from the granting of this

the Sukari Gold Mine. approval

The in line with the

application by PGM and conditions

EMRA summarised in the

to extend the tax free adjacent

period paragraph and continue

for a further 15 years to

is monitor compliance to

due in April 2025, and allow

a condition the extension to be

to the renewal is that granted

there in the near future.

are no tax disputes

outstanding

from the initial

period as

well as certain

planned exploration

activities on the

concession

as agreed between the

parties.

----------------------- ----------------------- ------------------------ ------------------------

External The extent of the The Group is 100% The Company does Level: Balanced

Risk Company's exposed not currently hedge The strategy

Gold price financial performance to the gold price; against the price is aligned with

is due however, of gold or exposure the

in part to the price the cash costs of the to currencies. risk appetite

of gold, Sukari of the Company.

which the Company has Gold Mine remain low The Board does

no influence compared not take any

over. Revenues from with the industry unnecessary risks

gold sales norm. in relation

are in US dollars and to the price

Centamin of gold recognising

has exposure to costs that this risk

in other is outside the

currencies including Board's control

Egyptian influenced by

pounds, Australian external factors.

dollars

and sterling.

Centamin manages its

exposure

to gold price by

keeping operating

costs as low as

possible.

----------------------- ----------------------- ------------------------ ------------------------

External The Company's The Concession Maintain a detailed Level: Balanced

Risk operational Agreement with understanding of The Company operates

Political activities are EMRA and the Egyptian the political within acceptable

risk - Egypt primarily in government environment limits and the

Egypt, a country that was ratified into in which we operate operation has

has Egyptian as well as a continued to

been subject to civil Law no. 222 of 1994, constructive be unaffected

and which relationship with despite a number

military disturbance. further protects the government. The of major political

Future Company's Company undertakes events occurring

political and economic licence rights and to abide by the in Egypt. The

conditions sets the spirit and letter Company supports

in Egypt could change applicable tax regime of the Concession Egypt's development

with for Agreement as well of a modern mining

future governments a number of years. as local laws and code.

adopting This law regulations.

different policies received full

that may parliamentary

impact the development approval as required

and by Egyptian

ownership of mineral law.

resources.

Policy changes and

licensing

may also impact the

use of

explosives, tenure of

mineral

concessions, taxation,

royalties,

exchange rates,

environmental

protection, labour

relations,

repatriation of income

and

capital. Changes may

also

impact the ability

to import key supplies

and

export gold.

The potential for

serious

impact should be

balanced

against the Egyptian

government's

support of Centamin's

investment

and contribution to

both revenue

and development of the

mining

industry. New laws

have been

introduced to protect

and

therefore encourage

foreign

investment, which is a

positive

step for the country.

Law

no. 32 has been

confirmed

by Parliament,

although it

remains subject to a

challenge

in the Supreme Court.

The issuing of the new

mining

regulations in January

2020

provides further

optimism

for a healthy mining

industry

to prosper in Egypt.

----------------------- ----------------------- ------------------------ ------------------------

External The Company operates Policies have Maintain relationships Level: Balanced

Risk in Burkina developed over with all key The Company operates

Political Faso and Côte many years to stakeholders, within

risk - West d'Ivoire. encourage foreign including regional acceptable limits.

Africa There are no investment and the governments, landowners

assurances that development and local chiefs.

future political and of mining operations, The Company meets

economic which its environmental

conditions in these continues to be the and operational

countries focus commitments set

will not result in the of governments in out in the permits/

governments these regions. grants and local

adopting different Centamin actively laws/regulations.

policies monitors

in respect to foreign legal and political

development developments,

and ownership of engaging in dialogue

exploration with

and exploitation relevant government

licences. and legal

policymakers to

The worsening discuss all

political and key legal and

security situation in regulatory

Burkina developments.

Faso denotes a

downward trend

on the Company's

exposure

to political risk. In

Côte

d'Ivoire, the relative

stable

government and strong

exploration

results provide a

consistent

trend.

----------------------- ----------------------- ------------------------ ------------------------

External Centamin's finances, In order to mitigate To minimise exposure Level: Balanced

Risk and its this to litigation and The Company is

Litigation ability to operate in risk Centamin has (a) reduce the impact operating

Egypt, taken of actions by complying within its risk

may be adversely appropriate legal with all relevant appetite parameters

affected advice and laws and regulations and the mitigation

by current and any continues actively to and to defend and/ in place is at

future pursue or bring any actions an acceptable

litigation proceedings its legal rights with necessary to protect level.

and respect the Company's assets,

it is possible that to its existing cases rights and reputation.

further (its

litigation could be legal advisers believe

initiated that

against Centamin at Centamin will

any time. ultimately be

Centamin is currently successful in both of

involved these

in litigation that cases); and (b)

relates actively monitors

both to (a) the activity in both court

validity of and

its exploitation lease local media for signs

at of any

Sukari and (b) the legislative or similar

price at which it can developments

purchase that may threaten its

Diesel Fuel Oil. operations,

finances or prospects.

The

potential for serious

impact

should be balanced

against

Centamin's adherence

to local

laws and agreements;

the Egyptian

government's support

of Centamin's

investment; Law no. 32

of

2014 that should

protect Centamin

against litigation by

third

parties; and the fact

that

Egypt and Australia

(PGM's

place of

incorporation) have

in place a bilateral

investment

treaty.

----------------------- ----------------------- ------------------------ ------------------------

Operational Time and costs of The exploration for To ensure a progressive Level: High

Risk brownfields precious pipeline of The Company operates

Failure exploration activity metal may not be greenfield and its exploration

to achieve are recognised successful advance-stage programmes within

exploration as exploration and and is highly exploration projects acceptable risk

development evaluation speculative to serve the next appetite parameters,

success assets ("E&E assets") in nature. Before stage of growth with a results-driven

on the undertaking for the Company. approach to future

statement of financial any exploration exploration and

position. projects, Ensure systematic an opportunistic

E&E assets continue to a full risk assessment exploration programmes mind set when

be in are carried out evaluating new

carried on the balance undertaken covering with costs attributed ground or projects.

sheet country to licence areas

where there is ongoing risk, industry risks and prospects so

planned as well that they can be

activity and the right as a detailed assessed for

of technical review impairment.

tenure is current. of the underlying

geological

There can be no data available.

guarantee Management

that an exploration implements systematic

project drilling

progresses to an programmes across its

economic exploration

resource and therefore projects, with costs

there aggregated

remains a risk that appropriately to

E&E assets licence areas

are partially or fully and prospects.

impaired

during a financial Commitments associated

period with

where either a licence renewals may

decision is require

made to discontinue a further negotiation

project with governments

or no further activity to either renew or

is extend

scheduled. existing permits that

may

be

subject to expiry.

----------------------- ----------------------- ------------------------ ------------------------

Operational Mineral resource and Management has To achieve reliable Level: Informed

Risk reserve implemented and consistent The Company operates

Reserve figures are prepared processes to production, within acceptable

and by Centamin continuously whilst optimising risk appetite

Resource personnel and reviewed monitor and evaluate the potential of parameters.

estimate by the current the operation. The

externally appointed life of the Sukari Company provides Details of the

independent Gold Mine, timely and accurate Reserve and Resource

geologists. By their mine plans and information to the estimates as

nature, production market on production at 18 July 2019

mineral resources and targets. The most levels and forecasts. are set out in

reserves recent technical the supplementary

are estimates based on report was completed information to

a range in Form the Annual Report

of assumptions, 43-101 dated 23 and explained

including October 2015 further in the

geological, and is available at Operational Review.

metallurgical, www.sedar.com.

technical and economic The latest updated

factors. reserve

Other variables and resource statement

include expected for

costs, inflation Sukari was announced

rates, gold on 18

price, grade May 2020 with an

downgrades and effective

production outputs. date of 18 July 2019.

There Preliminary

can be no guarantee resource statements

that the have been

anticipated tonnages provided for Doropo

or grades and the

expected by Centamin ABC Project in

will Côte d'Ivoire

be achieved both from as well as Konkera in

the Burkina

underground operation Faso.

or open

pit.

----------------------- ----------------------- ------------------------ ------------------------

Operational Centamin prepares The realisation of To achieve reliable Level: Informed

Risk annual estimates production and consistent The Company operates

Failure for future gold estimates are production, whilst within acceptable

to achieve production dependent on, optimising the risk appetite

production from the Sukari Gold amongst other things: potential parameters.

estimates Mine. the of the operation.

There can be no accuracy of mineral The Company provides

assurance reserve timely and accurate

that Centamin and resource information to the

will achieve its estimates; the market on production

production accuracy of levels and forecasts.

estimates and such assumptions regarding

failure ore

could have a material grades and recovery

and rates;

adverse effect on the ore tonnes and

Centamin's grade mined

future cash flows, from the underground

profitability, operation

results of operations which are outside the

and current

financial condition. reserve base; ground

It should conditions;

be specifically noted skilled and motivated

that labour

the potential quantity force; processing

and capacity

grade from the Sukari and maintenance

underground policies;

mine is conceptual in and logistics for

nature, consumables

that there has been and parts.

insufficient

exploration to define

a mineral

resource and that it

is uncertain

if further exploration

will

result in the target

being

delineated as a

mineral resource.

The Board recognises

that

whilst operational

performance

stabilised in 2019,

the period

in Q3 2019 was

challenging,

with an improving

production

profile across Q4 2019

that

helped ensure delivery

of

production at slightly

below

the lower end of

guidance

in 2019.

Further we recognise

the potential

impact of COVID-19

which we

have addressed on page

20

as of the time of

publishing

there was no

additional concerns.

----------------------- ----------------------- ------------------------ ------------------------

Appendix B - Related Party Transactions

Details were announced on 18 May 2020 and the information can

also be found on page 211 to 214 in note 6.1 of the financial

statements in the 2019 Annual Report.

Appendix C - Directors' Responsibility Statement

Details can be found on page 166 of the 2019 Annual Report

Directors' responsibilities in respect of the annual report and

financial statements

The Directors are responsible for preparing the Annual report

and the financial statements in accordance with applicable law and

regulations.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the Directors

have prepared the Group financial statements in accordance with

IFRS as adopted by the European Union. Under company law the

Directors must not approve the Group financial statements unless

they are satisfied that they give a true and fair view of the state

of affairs of the Group and of the profit or loss of the Group for

that period. In preparing the financial statements, the Directors

are required to:

-- select suitable accounting policies and then apply them consistently;

-- state whether applicable IFRS as adopted by the European

Union have been followed, subject to any material departures

disclosed and explained in the financial statements;

-- make judgments and accounting estimates that are reasonable and prudent; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group will continue

in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group's

transactions and disclose with reasonable accuracy at any time the

financial position of the Group and enable them to ensure that the

financial statements and the Directors' remuneration report comply

with the Companies (Jersey) Law, 1991.

The Directors are also responsible for safeguarding the assets

of the Group and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the United Kingdom and

Jersey governing the preparation and dissemination of financial

statements may differ from legislation in other jurisdictions.

The Directors consider that the Annual Report and financial

statements, taken as a whole, are fair, balanced and understandable

and provides the information necessary for shareholders to assess

the Group's position and performance, business model and

strategy.

The Directors have undertaken a robust assessment of the

principal risks impacting the Company. The assessment identified

strategic and operational risks at a corporate level and principal

risks impacting our operations in Egypt and West Africa. Details of

the risk assessment can be found in the audit and risk committee

report on pages 136 and 138 and the risk management and principal

risks section of the strategic report on pages 66 to 81.

The Board receives written assurances from the CFO and Senior

Management that to the best of their knowledge and belief, the

Group's financial position presents a true and fair view and that

the financial statements are founded on a sound system of risk

management, internal compliance and control. Further, they confirm

that the Group's risk management and internal compliance is

operating efficiently and effectively. The Board recognises that

internal control assurances from the CFO and Senior Management can

only be reasonable rather than absolute, and therefore they are not

and cannot be designed to detect all weaknesses in control

procedures.

The financial statements have been audited by

PricewaterhouseCoopers LLP, independent auditor, who was given

unrestricted access to all financial records and related

information, including minutes of all shareholder, Board and

committee meetings.

The financial statements were authorised by the Board of

Directors for issue and signed on their behalf by Ross Jerrard

(CFO) and Darren Le Masurier (Company Secretary) on 18 May

2020.

Each of the Directors, whose names and functions are listed in

the governance report, confirm that, to the best of their

knowledge:

-- the Group financial statements, which have been prepared in

accordance with IFRS as adopted by the European Union, give a true

and fair view of the assets, liabilities, financial position and

profit of the Group; and

-- the strategic and governance report includes a fair review of

the development and performance of the business and the position of

the Group, together with a description of the principal risks and

uncertainties that it faces.

In the case of each Director in office at the date the

governance report is approved:

-- so far as the Director is aware, there is no relevant audit

information of which the Group's auditor is unaware; and

-- they have taken all the steps that they ought to have taken

as a Director in order to make themselves aware of any relevant

audit information and to establish that the Group's auditor is

aware of that information.

On behalf of the Board:

Ross Jerrard Darren Le Masurier

Chief Financial Officer Company Secretary

Director On behalf of the Board

18 May 2020 18 May 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCKKABBKBKBDPB

(END) Dow Jones Newswires

May 27, 2020 02:00 ET (06:00 GMT)

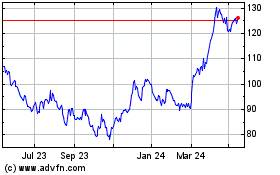

Centamin (LSE:CEY)

Historical Stock Chart

From Oct 2024 to Nov 2024

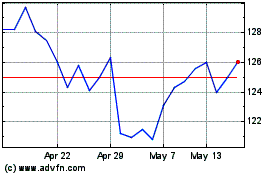

Centamin (LSE:CEY)

Historical Stock Chart

From Nov 2023 to Nov 2024