RNS Number:2048H

Computacenter PLC

14 March 2000

COMPUTACENTER PLC

PRELIMINARY RESULTS

Computacenter plc, the UK's largest company specialising in the provision

of distributed information technology and related services to large

corporate and public sector organisations, today announces preliminary

results for the year ended 31 December 1999.

Highlights

* Group turnover increased 11.0% to #1.76 billion (1998: #1.59

billion)

* Profit before tax increased 16.3% to #75.1 million (1998: #64.6

million)

* Earnings per share (diluted) up 19.6% to 28.1p (1998: 23.5p)

* Strong services growth across the Group

* Strong sales growth in France (up 34.5%) and Germany (up 94.9%)

Commenting on the results, Chief Executive Mike Norris said:

"I am pleased to be able to report another strong year of profit and

earnings growth for Computacenter. We have made significant progress in

developing our service portfolio and delivering value added services to

both existing and new customers. We fully expect this to continue in 2000

across all our businesses."

For further information:

Computacenter plc 07801 452854

Mike Norris, Chief Executive

Phil Williams, Corporate Development Manager

Brunswick Group Limited 0207 404 5959

Rob Pinker

Catriona Booth

Sara Musgrave

CHAIRMAN'S STATEMENT

I am delighted to be able to report another record year for Computacenter -

our seventeenth successive year of turnover and profits growth in the UK.

In the financial year ended 31 December 1999, Group turnover grew by 11% to

#1.76 billion and profit before tax grew by 16.3% to #75.1 million. Diluted

earnings per share grew by 19.6% to 28.1p.

These results are particularly pleasing because 1999 was an exceptionally

difficult year to forecast. Most of Computacenter's customers spent

heavily in preparation for the new millennium but a great deal of this work

was completed in the early part of 1999 and in 1998. The consequence was

that the sales of product slowed, as expected, towards the end of 1999 as

customers endeavoured to 'lock-down' their IT systems. In our interim

report we said that the indications were that demand would slow but that

the effect would be modest. I am pleased to report that this was the case,

although the overall impact of Y2000 was that Computacenter's growth in

turnover in 1999 as a whole was less than we have enjoyed in recent years.

The slower growth in product sales was offset by continued strong growth in

our service businesses. By the end of 1999, over half of our staff were

employed directly in the provision of professional and managed support

services to our clients. The rapid growth of services is the principal

reason for the improvement in net profit margins at both the UK and Group

level.

The Group's success in developing our service business is the direct result

of a strategy of sustained high investment in the development of our

services capability over a number of years. This investment - in

recruitment, training, systems and the development of best practices -

continued in 1999 and was, as always, expensed through the profit and loss

account. The Board was very satisfied with the rate at which we were able

to grow our service businesses in 1999 and remains confident in our ability

to grow service revenues strongly in the future.

Another major area of investment for the Group began to come on-stream in

the second half of the year as over 800 of our staff moved into our new

European headquarters building in Hatfield, Hertfordshire. Work on our new

operations centre is continuing and we expect it to become operational in

the second half of 2000. This state-of-the-art facility is intended to be

the source of significant competitive advantage in future years.

Our French operation also moved into a new headquarters and operations

centre in the first half of 1999. This move helped to fuel significant

sales growth, particularly in the second half of the year. The full year

turnover of Computacenter France, at #223.0 million, was up 34.5% compared

to 1998 and operating profits, at #4.6 million, grew by 67.3%.

Computacenter France is now established as one of the top three competitors

in the French market providing an excellent base for further growth.

Computacenter Germany also grew substantially, albeit from a much smaller

base and turnover nearly doubled to #72.3 million. However, operating

losses were larger than expected at #2.9 million, reflecting our rapid

growth rate in the face of a relatively weak, pre-millennial market.

There were a number of other notable developments during the course of

1999. In November the Group announced an exclusive agreement with Gateway

Computers to market 'Service-Direct', a unique approach that combines the

speed and cost advantages of Gateway's built-to-order manufacturing with

Computacenter's service expertise.

Our On-Trac electronic procurement system continued to expand with 150 new

customers coming on-line in 1999. Trading electronically with our

customers in this way enables us to reduce costs and increase service

levels to the benefit of both parties. 1999 saw the launch of a fully web-

enabled version of On-Trac.

In November Computacenter plc formed Biomni, a joint venture with

Computasoft e-Commerce Ltd, the developer of On-Trac, to target the wider

business-to-business e-commerce opportunity. In February 2000, the Board

announced its decision to explore the possibility of a public listing for

Biomni.

The iGroup, Computacenter's e-business division, also grew rapidly in 1999

and launched several new and innovative products and services. The total

investment made in this area and expensed through the profit and loss

account during the year, exceeded #3 million. We are very enthusiastic

about the Group's ability to develop e-commerce products and services and

the scale of the opportunity open to us in this burgeoning market.

As always, Computacenter remains a people business. Our commercial success

depends on the quality of our service and that, in turn, depends on the

quality, training, motivation and teamwork of our staff. Widespread share

ownership remains our goal and in the last year we have continued to

encourage employee share ownership via our popular ShareSave scheme. Today

I am pleased to report that over 55% of Group employees are shareholders.

Once again I would like to thank all of our staff for their commitment,

enthusiasm and hard work. They are the driving-force behind

Computacenter's success.

The new developments described above, combined with the solid progress made

in the last twelve months, particularly the development of our service

businesses, provide a sound base from which to go forward. Factors such as

the introduction of Windows 2000 and the widespread adoption of e-commerce

solutions will continue to drive the market forward and we are confident

that Computacenter is well positioned to take advantage of the expected

growth in demand.

Finally, consistent with the dividend policy set out in our flotation

prospectus, I am pleased to recommend a final dividend of 2.9p per share,

payable on 29 May 2000 to registered shareholders as at 8 May 2000.

PW Hulme, Chairman.

Chief Executive's Review

During 1999 Computacenter continued to invest across all of its businesses,

consolidating its position as the leading supplier of distributed IT and

related services to the European corporate and public sector marketplace.

In 1999 this investment strategy resulted in a Group turnover of #1.76

billion, a growth of 11.0%. Profit before tax increased by 16.3% from #64.6

million to #75.1 million and our after-tax earnings by 22.1% from #43.4

million to #53.0 million.

International sales grew significantly in 1999, with #300.1million (17.0%)

of the total Group turnover coming from sales in France, Germany and

Belgium. The greater part of revenues, the remaining #1.46 billion, or

83.0%, was again generated by our UK businesses.

As in previous years, recruitment and training remained our biggest

investment with headcount across the Group growing by 22.6% to 5,618 at the

end of 1999.

During the year, we also continued to increase our investment in the

development of best practices and systems that allow us to deliver our

growing range of services cost effectively and to the highest quality

standards. These included PRIDE 3, the latest release of our established

project management methodology and LINX, the help-desk system used by our

international call-centre.

We believe that the increasing economies of scale we enjoy in these areas

are a significant source of competitive advantage for the Group.

Market performance

1999 was an exceptional year. A major focus of our customers for the first

half of the year was investment to ensure Y2000 compliance of mainframe and

associated business systems. As anticipated, growth in the market for

distributed IT products slowed in the second half as compliance projects

were completed and other projects postponed. Demand for our services

however remained strong throughout the second half of the year, with the

result that, overall, our managed services contract base grew 32% over

1999.

We anticipate increased customer focus on distributed IT investment during

2000 as organisations re-focus on deployment of IT for competitive

advantage. The huge anticipated growth of business-to-business e-commerce

systems and the arrival of Microsoft's Windows 2000 operating system will

both serve as significant growth drivers for the Group over the coming

year, particularly in the second half.

1999 saw a continued decline in PC prices across the Group. We welcome the

long-term decline in hardware prices, as it opens up new applications for

distributed IT - enabling our customers to increase their investment in new

technology, so fuelling demand for the Group's services.

UK Operations

The continuing growth in demand for our services has necessitated some

reorganisation to streamline our service provision. We have therefore

established three dedicated service divisions in the Group employing

specialist staff to develop and deliver solutions to our customers. The

three divisions: Supply-Chain Services, Managed Services and Professional

Services, engage with customers through Computacenter's account management

team. Our account managers provide the vital link in identifying and

managing customer requirements and engaging the appropriate service

providers within the Group.

Supply-Chain Services

Although the rate in growth of product sales slowed in 1999 compared to the

previous year, we continued to invest in people, systems and infrastructure

to support the anticipated release of pent-up demand in 2000. Development

of our new headquarters offices and operations centre in Hatfield,

Hertfordshire, continued apace, with our office complex, housing more than

1,000 staff, opening in October 1999. This move has brought together both

staff and management previously located in the surrounding area, into a

much-improved working environment with corresponding benefits. Our new

34,000-sq. metre operations centre on the same site remains on target to

open in the second half of 2000.

Our On-Trac electronic commerce system continued to be a major investment

area for the Group. 1999 saw the successful implementation of our fully web-

enabled customer system. Over 550 customers across the Group currently use

the system, a growth of more than 37% in the last year.

In November we entered into a commercial agreement with Gateway Computers,

a global supplier of PCs. Our goal was to develop an optimised customer

delivery model that combines the benefits of Gateway's built-to-order PC

assembly with Computacenter's value-added services. We believe this is a

unique approach, offering customers increased value and flexibility. We

anticipate that the superior logistics capability offered by our new

Hatfield operations centre will allow us to develop this model further in

due course.

Managed Services

Much of Computacenter's growth in 1999 was due to expanding relationships

with existing long-term corporate customers such as Scottish & Southern

Energy plc. In particular, this was reflected in the demand for our managed

services, where the growth in our contract base was greater than for the

company as a whole. UK staff numbers in our Managed Services Division grew

to 1,907, an increase of 22.2%. We were also successful in attracting a

number of new managed service contract customers during the year, including

Avis Europe plc and Save the Children UK.

Professional Services

Demand for our technical consulting services has again been one of the

fastest areas of growth within the Group. The appointment of Computacenter

as a Microsoft Alliance Partner in October 1998 has helped to fuel this

demand and enabled us to invest in training additional Microsoft accredited

professionals in 1999 to fulfil customers' requirements. This brings our

number of personal Microsoft accreditations in the UK to over 1,300.

During 1999 we have seen the first successes of The iGroup, our e-business

division formed in 1998. We continued to invest in The iGroup in 1999,

establishing a group of over 60 specialists with Internet and Intranet

design, development and consulting skills. During the year we brought to

market a number of innovative e-commerce products and services, which have

been taken up by our customer base. We are very encouraged by progress made

and anticipate significant growth as the move to streamline business

processes via e-commerce based solutions accelerates in 2000.

Computacenter was also appointed as a member of Microsoft's Rapid

Deployment Programme for Windows 2000 early in 1999. We anticipate healthy

demand for our Microsoft consulting services in 2000 and beyond with the

deployment of Windows 2000 by corporate and government organisations across

Europe.

During 1999, Y2000 compliance projects led to a corresponding rise in

demand for our project management capability. As the client-server platform

becomes the preferred technology base for many line-of-business

applications, the solutions we sell and support continue to increase in

scale, complexity and strategic importance to organisations. As a result,

customers are increasingly turning to Computacenter to project manage the

deployment of distributed technology.

Customer Relationships

Growth of the Group is dependent on our ability to retain existing

customers and deliver real value via our services. During 1999 we were

successful in extending our relationship with our largest customer, British

Telecom, with a new three year contract and an option to renew for a

further two years. The range of services now supplied to BT includes

maintenance, supply chain re-engineering and implementation of distributed

IT into BT's business units. Other contract extensions included Shell

Service, Credit Suisse First Boston (CSFB) and Cisco Systems.

Computacenter also grew its customer base in 1999 with a number of notable

new account wins during the year that included on-site Managed Services.

New UK customers included Royal & SunAlliance, The Houses of Parliament and

Vodafone Retail. 1999 was also a successful year for our UK Government

Division where we continued to invest in developing our Government

Catalogue (GCat) contractual business with staff numbers more than doubling

to 163. Notable new government customers included the Greater London

Authority and National Probation Services.

We believe that Computacenter's scale and ability to deliver value

consistently through its entire range of IT services, combined with our e-

commerce capability, provide significant competitive advantages that will

enable us to capture further market share in 2000.

International Operations

Computacenter continues to develop its international capability via its

direct subsidiaries in France, Germany and, more recently, Belgium. As a

whole, international operations increased as a percentage of Group revenue

from 13% in 1998 to 17% in 1999. Our focus remains to capture market share

rapidly and to deploy core Computacenter operational systems and business

practices already proven in our UK business operations.

Computacenter France

Computacenter France grew ahead of the market during 1999 with turnover up

34.5% to #223.0 million and profits up 67.3% to #4.6 million. Headcount

grew to 756, up 37.7% on 1998. A large part of our recruitment was in

service divisions, where growth exceeded that for Computacenter France as a

whole. Significant new customer account wins for the year included the DGA

(General Armament Delegation) at the French Ministry of Defence.

Due to the rapid expansion of the French business and our plans for future

growth, we moved into a new larger operations and headquarters facility in

Paris during the first half of the year. Computacenter France's

performance, during the second half of 1999 in particular, and the

investments we have made to accommodate future growth, promise well for

2000 and beyond.

Computacenter Germany

In Germany, as in other markets, trading conditions were influenced by

Y2000 issues and Computacenter's financial performance was impacted by the

relatively small scale of our German operations. However, as in France, we

continued to invest in Germany throughout the year with staff headcount

growing by 62.3% to 362 at the end of 1999. In the first half of 1999 we

moved to a new operations centre and opened new offices in Hanover,

Stuttgart and Nuremberg. Significant customer account wins for the year

included MEAG (Munich Re-insurance Group), and Preussag Group. Contract

extensions included Dresdner Bank Group, DVAG and Hapag-Lloyd.

ICG

International Computer Group (ICG), of which Computacenter was a founding

member in 1989, remains our core delivery mechanism for products and

services outside the European markets serviced directly by Computacenter.

This international joint venture now covers 53 countries throughout the

world.

Other Businesses

In November we announced the launch of Biomni Ltd, a 50% joint venture

between Computacenter plc and Computasoft e-Commerce Ltd. Computasoft has

been responsible for developing Computacenter's On-Trac electronic

procurement system since 1991. Biomni has been established to capitalise on

over nine years of experience in developing business-to-business e-commerce

solutions.

Acquisitions

In the second quarter of 1999 we made our first acquisition as a public

company, establishing a small subsidiary in Brussels, Belgium, which

employed 27 staff at the end of 1999. We also strengthened our services

capability by acquiring a UK based IT disposal services company, RDC, which

continues to operate under its own name. In the fourth quarter we acquired

the assets of Metrologie, a UK based subsidiary of CHS UK Holdings Ltd,

whose enterprise distribution business specialises in UNIX systems,

consulting and integration services. This has been successfully integrated

into our UK distribution business, Computacenter Distribution (CCD), which

provides hardware and a range of services to small and medium sized

resellers.

While our focus for 2000 clearly remains on investing for growth in our

existing businesses, we will continue to evaluate other market

opportunities as they arise.

Our Staff

I would like to thank all of our staff for their outstanding efforts.

Whether working alone or in teams they 'made the difference' to our

customers once again in 1999. This year we awarded 425 'Champions of

Quality' prizes to staff who demonstrated outstanding commitment to

delivering customer service, a record number of awards.

Our goal has always been to encourage widespread share ownership within the

company. During 1999 we launched our third Inland Revenue approved

ShareSave scheme, enabling qualifying staff to benefit from share ownership

within Computacenter. At the end of 1999, 55% of staff owned shares in the

Group.

Outlook

We have made considerable progress during 1999 in developing our service

portfolio and delivering value added services to both existing and new

customers. We anticipate continued strong growth for our services in 2000,

not only in the UK but also across Europe as our international businesses

develop further. We also believe that the significant pent-up demand within

our customer base due to Y2000 will start to be released during the first

half of the year. We anticipate this will accelerate in the second half, as

remaining compliance projects are completed and other projects, including

Windows 2000 roll-outs, are implemented. We strongly believe the

investments we made in 1999, and continue to make, will leave us well

positioned to take advantage of this future demand.

MJ Norris, Chief Executive.

GROUP PROFIT AND LOSS ACCOUNT

For the year ended 31 December 1999

1999 1998

#'000 #'000

TURNOVER 1,760,628 1,586,238

OPERATING COSTS (1,685,016) (1,519,942)

------- -------

OPERATING PROFIT 75,612 66,296

Share of operating loss of associate - (12)

Interest received and similar income 7,238 4,945

Interest payable and similar charges (7,714) (6,626)

------- -------

PROFIT ON ORDINARY

ACTIVITES BEFORE TAXATION 75,136 64,603

Tax on profit on ordinary activities (22,125) (21,232)

------- -------

PROFIT ON ORDINARY

ACTIVITIES AFTER TAXATION 53,011 43,371

Minority interests - equity (48) (77)

------- -------

PROFIT ATTRIBUTABLE TO MEMBERS OF THE

PARENT COMPANY 52,963 43,294

Dividends - ordinary dividends on

equity shares (5,291) (4,302)

------- -------

RETAINED PROFIT FOR THE YEAR 47,672 38,992

====== ======

Earnings per share - Basic 30.6p 27.0p

- Diluted 28.1p 23.5p

GROUP STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

For the year ended 31 December 1999

1999 1998

#'000 #'000

Profit attributable to members of the

parent company for the financial year 52,963 43,294

Exchange differences on retranslation of

net assets of associated and subsidiary

undertakings (2,029) 287

------- -------

Total Recognised gains for the year 50,934 43,581

====== ======

GROUP BALANCE SHEET

at 31 December 1999

1999 1998

#'000 #'000

FIXED ASSETS

Intangible assets 3,756 -

Tangible assets 96,647 59,768

Investments 2,815 1,467

------- -------

103,218 61,325

CURRENT ASSETS

Stocks 92,884 109,853

Debtors : gross 244,364 237,855

Less non returnable proceeds (187) (1,293)

------- -------

244,177 236,562

Cash at bank and in hand 63,688 63,601

400,749 410,016

CREDITORS: amounts falling due

within one year (292,753) (307,382)

NET CURRENT ASSETS 107,996 102,634

------- -------

TOTAL ASSETS LESS CURRENT LIABILITIES 211,214 163,869

CREDITORS: amounts falling due after

more than one year (41,008) (42,013)

PROVISION FOR LIABILITIES

AND CHARGES (1,736) (1,035)

------- -------

TOTAL ASSETS LESS LIABILITIES 168,470 120,821

====== ======

CAPITAL AND RESERVES

Called up share capital 9,043 8,678

Share premium account 57,055 49,850

Profit and loss account 102,194 62,144

------- -------

Shareholders' funds - equity 168,292 120,672

Minority interests - equity 178 149

------- -------

168,470 120,821

====== ======

Approved by the Board of Directors

PW Hulme Chairman

MJ Norris Chief Executive

GROUP STATEMENT OF CASH FLOWS

For the year ended 31 December 1999

1999 1998

#'000 #'000

CASH INFLOW FROM OPERATING

ACTIVITIES 81,924 63,734

RETURNS ON INVESTMENTS AND SERVICING

OF FINANCE (262) (2,084)

TAXATION

Corporation tax paid (25,284) (17,486)

CAPITAL EXPENDITURE AND FINANCIAL

INVESTMENT (49,778) (40,179)

ACQUISITIONS AND DISPOSALS (3,806) (71)

EQUITY DIVIDENDS PAID (4,482) -

------- -------

CASH (OUTFLOW)/INFLOW BEFORE

FINANCING (1,688) 3,914

FINANCING

Issue of shares 2,470 50,115

Decrease in debt (2,217) (4,257)

------- -------

(DECREASE)/INCREASE IN CASH IN THE

YEAR (1,435) 49,772

====== ======

GROUP STATEMENT OF CASHFLOWS

For the year ended 31 December 1999

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET DEBT

31 December 31 December

1999 1998

#'000 #'000

NET CASH AT 1 JANUARY 1999 21,126 (32,689)

(Decrease)/increase in cash in the

year (1,435) 49,772

Cash outflow from repayment of debt

and lease finance 2,217 4,257

------- -------

Change in net cash resulting from

cash flows 782 54,029

Non cash changes in debt (214) (214)

Increase in debt on acquisition of

subsidiary (542) -

------- -------

NET CASH AT 31 DECEMBER 1999 21,152 21,126

====== ======

NOTES TO THE ACCOUNTS

1 ACCOUNTING POLICIES

Basis of preparation

The preliminary financial information has been prepared on the basis of the

accounting policies set out in the Group's statutory accounts for the year

ended 31 December 1999.

2 TURNOVER AND SEGMENTAL ANALYSIS

Turnover represents the amounts derived from the provision of goods and

services which fall within the Group's ordinary activities, stated net of

VAT. The Group operates in one principal activity, that of the provision of

distributed information technology and related services.

An analysis of turnover by destination and origin, operating profit and net

assets is given below:

Turnover by Destination

1999 1998

#'000 #'000

UK 1,448,805 1,365,906

France & Belgium 226,640 165,764

Germany 77,164 39,020

Rest of the World 8,019 15,548

------- -------

1,760,628 1,586,238

====== ======

Turnover by Origin

1999 1998

#'000 #'000

UK 1,460,523 1,383,357

France & Belgium 227,789 165,773

Germany 72,316 37,108

------- -------

1,760,628 1,586,238

====== ======

Operating Profit

1999 1998

#'000 #'000

UK 74,028 64,929

France & Belgium 4,453 2,747

Germany (2,869) (1,380)

------- -------

75,612 66,296

====== ======

All turnover and operating profit relates to continuing operations.

3 OPERATING COSTS

1999 1998

#'000 #'000

Decrease/(Increase) in stocks 16,969 (1,608)

of finished goods

Goods for resale and 1,322,101 1,254,418

consumables

Staff costs 205,366 153,619

Depreciation and other amounts

written off tangible and

intangible assets 12,407 10,691

Other operating charges 128,173 102,822

------- -------

1,685,016 1,519,942

====== ======

4 TAX ON PROFIT ON ORDINARY ACTIVITES

The charge based on the profit for the year comprises:

1999 1998

#'000 #'000

UK Corporation tax

Current 21,424 20,197

Deferred tax 701 1,035

------- -------

22,125 21,232

====== ======

5 DIVIDEND

The Directors recommend the payment of a dividend of 2.9p per share (1998:

2.5p per share) representing and aggregate charge of #5,291,000 (1998:

#4,301,000). The Computacenter ESOP trust has waived the dividends payable

in respect of 1,432,595 (1998: 1,475,170) ordinary shares that it owns

which are not allocated to employees. The Computacenter Trustees Limited

have waived dividends in respect of 569,307 shares which it owns which are

not allocated to employees and the Computacenter Quest ("Qualifying

Employee Scheme Trust") has similarly waived dividends in respect of

497,650 shares that it owns. Accordingly dividends payable have been

reduced by #72,000 in total.

6 EARNINGS PER SHARE

The calculation of earnings per ordinary share is based on profit

attributable to members of the holding Company of #52,963,000 (1998:

#43,294,000) and on 172,865,000 (1998: 160,535,000) ordinary shares, being

the weighted average number of ordinary shares in issue during the year

after excluding the shares owned by the Computacenter Employee Share Trust,

the Computacenter Trustees Limited and the Computacenter Quest.

The diluted earnings per share is based on the same earnings figure of

#52,963,000 (1998:# 43,294,000) and on 188,366,000 (1998: 184,242,000)

ordinary shares, calculated as the basic weighted average number of

ordinary shares, plus 15,501,000 (1998: 23,707,000) dilutive share options.

7 RECONCILIATION OF OPERATING PROFIT TO OPERATING CASH FLOWS

1999 1998

#'000 #'000

Operating profit 75,612 66,296

Depreciation 12,345 -

Amortisation 62 10,691

(Profit) / loss on disposal of fixed

assets (490) 407

Increase in debtors (7,243) (70,842)

Decrease/(Increase) in stocks 17,030 (1,608)

Increase in creditors (13,632) 57,976

Currency and other adjustments (1,760) 814

Net cash inflow from operating

activities 81,924 63,734

8 PUBLICATION OF NON STATUTORY ACCOUNTS

The financial information contained in this preliminary statement does not

constitute statutory accounts as defined in section 240 of the Companies

Act 1985. The financial information set out in this announcement is

extracted from the full Group financial statements for the year ended 31

December 1999 which contain an unqualified audit report.

END

FR BCGDXUDBGGGX

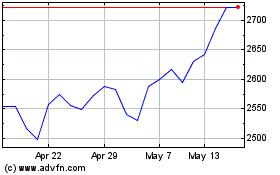

Computacenter (LSE:CCC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Computacenter (LSE:CCC)

Historical Stock Chart

From Jul 2023 to Jul 2024