TIDMBSE

AIM and Media Release

28 July 2020

BASE RESOURCES LIMITED

Quarterly Activities Report - June 2020

Key Points

* Kwale Operations has maintained operational consistency throughout the

quarter with health and safety protocols in place to minimise the risk of

COVID-19 to personnel and surrounding communities.

* FY20 production achieved at the higher end of guidance ranges.

* Production guidance provided for FY21.

* Ongoing firm demand from customers in the quarter supported further upward

movement in ilmenite prices, while rutile and zircon prices remained

steady.

* Kwale South Dune Mineral Resources and Ore Reserves updated to reflect

depletion due to mining as well as the lower ore density experienced since

commencing mining on the South Dune deposit.

* Toliara Project front-end engineering design, lender due diligence and

discussions with the Government of Madagascar progressed within the

constraints of the country's, and wider, COVID-19 responses.

* Activities to support vulnerable local communities affected by COVID-19 in

Kenya and Madagascar continued including the donation of food, medical and

hygiene supplies.

* With net cash of US$87.6 million at 30 June, the Company is in a robust

financial position.

African mineral sands producer, Base Resources Limited (ASX & AIM: BSE) (Base

Resources or the Company) is pleased to provide a quarterly operational,

development and corporate update.

Supported by firm customer demand, production at the Company's Kwale Mineral

Sands Operations (Kwale Operations) in Kenya has continued uninterrupted.

Discussions with the Government of Madagascar on fiscal terms, and the lifting

of the suspension of on-the-ground activities, for the Toliara Project

continued within the constraints of the Government's response to the ongoing

COVID-19 pandemic. Other activities to progress the project, such as front-end

engineering design and lender due diligence, continued in the quarter.

A PDF version of this announcement is available from the Company's website:

www.baseresources.com.au.

COVID-19 UPDATE

Base Resources continues to closely monitor the COVID-19 pandemic and its

impacts on the Company's business, people and other stakeholders. Kwale

Operations continues to operate under a suite of mitigations aimed at

protecting the health and safety of our employees and neighbouring communities,

including substantially modified workplace practices, with a reduced on-site

workforce and a focus on hygiene and social distancing measures to minimise the

risk of COVID-19 transmission. However, balancing the considerations of

employee and community health, operational safety, community benefits,

government policy, customer demand and financial prudence, a halt to, or

curtailment of, operations at some point in the future remains possible if

circumstances change.

The Company is also working with Kenyan national and local authorities to

ensure compliance with Government COVID-19 reduction measures as well as

assisting governments and communities in both Kenya and Madagascar with several

initiatives, primarily involving the construction of hygiene facilities,

distribution of food and provision of medical supplies and equipment.

KWALE OPERATIONS

Production & Sales June 2019 Sept 2019 Dec 2019 Mar 2020 June 2020

Quarter Quarter Quarter Quarter Quarter

Production (tonnes)

Ilmenite 88,789 73,808 91,406 105,035 84,843

Rutile 22,588 16,390 19,812 23,683 19,035

Zircon 7,063 6,980 7,923 9,163 7,590

Zircon low 347 466 546 780 578

grade

Sales (tonnes)

Ilmenite 99,620 60,109 106,544 87,819 102,364

Rutile 31,889 14,018 13,078 25,280 27,268

Zircon 7,968 6,713 7,090 7,377 9,086

Zircon low 219 839 616 - 1,516

grade1

[Note (1): Reported as tonnes of zircon contained in concentrate, it realises

90% to 100% of the value of the equivalent volume of standard grade zircon, due

to rutile credits.]

Mining operations continued steadily on the South Dune orebody with mined

tonnage of 4.3Mt at a grade of 3.9% heavy mineral (HM), both in line with the

previous quarter.

Subsequent to the quarter end, an update to the Kwale South Dune Mineral

Resources and Ore Reserves was released reflecting a 5% reduction in estimated

material bulk density, a reduction in the size of the prospecting licence

omitting some low grade material, sterilisation of sub-economic material and

depletion due to mining2. The change to estimated material bulk density is a

result of routine reconciliations between the resource model estimates and

run-of-mine operating data gained since mining commenced on the South Dune in

July 2019.

[Note (2): Refer to Base Resources' market announcement "Updated Kwale South

Dune Mineral Resources and Ore Reserves estimate" released on 27 July 2020,

which is available at https://baseresources.com.au/investors/announcements/.]

Mining & WCP June 2019 Sept 2019 Dec 2019 Mar 2020 June 2020

Performance Quarter Quarter Quarter Quarter Quarter

Ore mined (tonnes) 3,644,160 4,909,999 4,579,386 4,295,645 4,271,811

HM % 3.52 2.66 4.22 3.86 3.87

HMC produced 131,475 114,149 189,952 153,754 148,699

(tonnes)

Wet concentrator plant (WCP) production of heavy mineral concentrate (HMC) was

marginally lower at 149kt (last quarter: 154kt). HMC stocks increased slightly

to 16kt at quarter end (last quarter: 13kt). Sand tails continued to be

deposited into the mined-out Central Dune area and rehabilitation work on the

Central Dune and the mined-out areas of the South Dune also continued.

MSP Performance June 2019 Sept 2019 Dec 2019 Mar 2020 June 2020

Quarter Quarter Quarter Quarter Quarter

MSP Feed (tonnes of 160,766 121,600 155,217 186,197 145,550

HMC)

MSP feed rate (tph) 76 67 86 90 78

MSP recovery %

Ilmenite 100 103 100 99 99

Rutile 104 103 102 99 100

Zircon 76 86 88 87 85

Total mineral separation plant (MSP) feed tonnage was lower than the prior

quarter, constrained by HMC production and low inventories. Recoveries were

slightly higher than the previous quarter except for zircon.

Bulk loading operations at the Company's Likoni Port facility continued to run

smoothly, dispatching more than 125kt of bulk ilmenite and rutile during the

quarter (last quarter: 110kt). Containerised shipments of rutile and zircon

through the Mombasa Port proceeded according to plan.

Summary of unit costs June 2019 Sept 2019 Dec 2019 Mar 2020 June 2020

& Revenue per tonne (US$) Quarter Quarter Quarter Quarter Quarter

Unit operating costs per $127 $173 $140 $128 $153

tonne produced

Unit cost of goods sold per $180 $213 $141 $175 $189

tonne sold

Unit revenue per tonne of $482 $469 $355 $476 $479

product sold

Revenue: Cost of goods sold 2.7 2.2 2.5 2.7 2.5

ratio

Total operating costs of US$17.2 million were marginally lower (last quarter:

US$17.7 million) due to lower processing costs and rehabilitation provision

charges. Despite the lower total operating costs, the reduced production

levels resulted in higher unit operating costs of US$153 per tonne produced

(rutile, ilmenite, zircon, and low-grade zircon) (last quarter: US$128 per

tonne).

Unit cost of goods sold is influenced by both the underlying operating costs

and product sales mix. Operating costs are allocated to each product based on

revenue contribution, which sees the higher value rutile and zircon products

attracting a higher cost per tonne than the lower value ilmenite. Therefore,

the greater the sales volume of rutile and zircon relative to ilmenite in a

quarter, the higher both unit revenue per tonne and unit cost of goods sold

will be.

Ilmenite, and most of the rutile, is sold in bulk, with typical shipment sizes

of 50-54kt for ilmenite and 10-12kt for rutile, which means any given quarter

will usually contain either one or two bulk rutile and ilmenite sales. Zircon

is sold in smaller parcels and sales generally align with production volume.

Product sales mix will therefore vary depending on the number of bulk shipments

of ilmenite and rutile in each quarter.

Cost of goods sold of US$189 per tonne sold (operating costs, adjusted for

stockpile movements, and royalties) was higher due to increased unit operating

costs (last quarter: US$175 per tonne). The proportion of rutile and zircon

sold in the quarter was in line with the prior quarter, as were product prices,

resulting in the average revenue per tonne of US$479 per tonne remaining steady

(prior quarter: US$476 per tonne). From the combination of these factors, the

revenue to cost of goods sold ratio for the quarter decreased to 2.5 (last

quarter: 2.7).

Production Guidance FY20 FY20 FY21

(tonnes) Guidance Range Actual Guidance Range

Rutile 75,000 to 81,000 78,920 70,000 to 80,000

Ilmenite 335,000 to 355,000 355,093 270,000 to 300,000

Zircon 29,000 to 32,000 31,657 23,000 to 27,000

Total Kwale Operations production for the 2020 financial year (FY20) was within

the provided guidance range. The FY21 production guidance stated above is

based on the following assumptions:

* Mining of 17.2Mtat an average HM grade of 3.24%, with all FY21 volume

coming from Ore Reserves3. The forecast volume mined in FY21 is 5% lower

when compared to the 18.1Mt achieved (at 3.63% HM) in FY20 due to downtime

and reduced production associated with the relocation of the mine

collection hopper (which consolidates individual mining unit feed prior to

pumping to the WCP) in July 2020 and slightly lower forecast average mining

rates.

* Average MSP feed rate of 66tph constrained by HMC production and low

inventories.

* Average MSP product recoveries of 100.5% for rutile, 100% for ilmenite and

84% for zircon.

[Note (3): The Ore Reserves estimate underpinning the above production guidance

was prepared by Competent Persons in accordance with the JORC Code (2012

edition). For further information regarding the Ore Reserves estimate refer to

Base Resources' announcement on 27 July 2020 "Updated Kwale South Dune Mineral

Resources and Ore Reserves estimate" available at https://baseresources.com.au/

investors/announcements/. The above production guidance is the result of

detailed studies based on the actual performance of the Kwale mine and

processing plant. These studies include the assessment of mining,

metallurgical, ore processing, environmental and economic factors.]

MARKETING

Despite global uncertainty created by the COVID-19 pandemic, demand for all

products remained firm during the quarter.

Global pigment producers have generally indicated that demand for pigment held

up during the early part of the June quarter, but began to decline through May

and June as the impact from COVID-19 related shutdowns in various regions

started to take effect. However, the decline in pigment demand appears to have

been less than initially anticipated - likely due to some pigment sectors (e.g.

plastics and DIY paint and other coatings) performing better than expected.

This resulted in pigment production levels exceeding expectations for most of

the quarter and sustained firm demand for pigment feedstock through the quarter

and led to continued tight markets for sulphate ilmenite and high-grade

chloride feedstocks (including rutile) supporting ilmenite and rutile prices.

In China, while a number of smaller pigment producers have curtailed

production, the large pigment producers have maintained production which has

sustained demand for our ilmenite through the June quarter. Global pigment

producers have indicated they started to wind back production at the end of the

June quarter and into the beginning of the September quarter.

While rutile supply remains constrained, a decrease in demand from pigment and

other minor end use sectors is expected to put pressure on prices through the

remainder of calendar year 2020. The Company has sales contracts in place for

most of its forecast rutile production for the remainder of calendar year

2020.

Despite the uncertain outlook for pigment demand, Chinese pigment producers

(the Company's main ilmenite customers) have again re-confirmed their demand

for ilmenite and their intention to proceed with planned shipments over the

remainder of calendar year 2020. Chinese domestic pigment demand has been

recovering since shutdowns in February 2020 and has partially off-set a decline

in export demand. The COVID-19 related shutdowns of ilmenite production in

China and India through the March and June quarters further exacerbated the

global ilmenite shortage. The market for ilmenite remains tight in the early

stages of the September quarter.

Subdued demand for zircon continued through the quarter is in line with

expectations. However, COVID-19 related suspensions of mining activity in

South Africa, combined with some major zircon producers reducing supply to meet

market conditions, has led to a relatively balanced market and prices have

remained stable.

The Company was fully sold on zircon production for the quarter at prices

reasonably consistent with March quarter contracts. Sales contracts have now

been secured for all zircon production in the September quarter at prices

consistent with the June quarter. Demand for zircon end products remains

uncertain over the coming months, but it is expected that adjustments to supply

from major zircon producers will continue to provide some stability to market

prices.

SAFETY

There were no lost time injuries during the quarter or in the past year, at

Kwale Operations' or the Toliara Project, resulting in a lost time injury

frequency rate (LTIFR) for the group of zero. Compared to the Western

Australian All Mines 2018/2019 LTIFR of 2.2, this is an exceptional performance

reflective of the ongoing focus and importance placed on safety by management.

Base Resources' employees and contractors have now worked 20.9 million

man-hours lost time injury (LTI) free, with the last LTI recorded in early

2014. One medical treatment injury was recorded during the quarter when an

employee required stitches after cutting their hand. As a result, Base

Resources total recordable injury frequency rate (TRIFR) is 0.24 per million

hours worked.

As reported in the Company's December 2019 quarterly4, in January 2020, an

incident with Kwale Operations haulage contractor tragically resulted in a

fatal injury to another road user on a public road. The safety of Base

Resources' activities for its people and the communities in which it operates

is a fundamental commitment for the Company and the incident was addressed at

the highest level. Consistent with the findings of the internal investigation

into this incident, a number of changes have been implemented to further

improve oversight of maintenance and safety practices across all contractors.

[Note (4): Refer to Base Resources' market announcement "Quarterly Activities

Report - December 2019" released on 23 January 2020, which is available at

https://baseresources.com.au/investors/announcements/.]

COMMUNITY AND ENVIRONMENT

Kwale Operations

Base Resources has continued to assist the Kwale community manage the COVID-19

pandemic, including collaborating with county and national health authorities

to train community health workers on COVID-19 awareness programs and providing

additional community-based handwashing equipment to help improve sanitation.

Food support programs continued, in conjunction with local and national

authorities, to cater for the economic impact on tourism and unemployment in

the Kwale region. On a national level, during the quarter the Company donated

100 high flow oxygen ventilators to the Kenyan Ministry of Health for

deployment within the Kenyan health system. Base Resources was recognised by

President Kenyatta with a Madaraka (Independence) Day national award for the

Company's contribution to the fight against COVID-19.

Agricultural livelihood programs at Kwale made progress despite restrictions on

gatherings and meetings. Work resumed on PAVI's processing facilities to

prepare for the 2020 planting season which has recently commenced with good

rains supporting promising yields for maize, sorghum, cotton, green grams,

various spices and sunflower. Measures have been put in place to continue to

progress these activities in compliance with ongoing government restrictions

implemented as a result of the COVID-19 pandemic.

Land rehabilitation activities increased significantly on the mine site with

the continued support of community groups supplying indigenous legumes and

grass seed. Revegetation is undertaken with the collaboration of youth groups

from neighbouring villages ensuring local communities are fully involved in the

process, achieving the best outcomes.

Toliara Project

All community training programs and social infrastructure construction remained

on hold with the government's suspension of on-the-ground activities on the

Toliara Project. The 24 Malagasy apprentices training in Kenya at Kwale

Operations have remained on site and are subject to restricted movements

consistent with government requirements and Company protocols addressing

COVID-19 risks.

Base Resources continues to work with local authorities to assist in the

response to public health challenges in the Toliara region by providing support

for food distribution in conjunction with local groups through the regional

government's COVID-19 response committee. This has also included the provision

of hygiene facilities and personal protective equipment and, together with a

leading local women's group, establishment of a face-mask manufacturing

facility in Toliara with completed masks being donated to the community.

BUSINESS DEVELOPMENT

Toliara Project development - Madagascar

In November 2019, the Government of Madagascar required the Company to

temporarily suspend on-the-ground activity on the Toliara Project while

discussions on fiscal terms applying to the project were progressed5. Activity

remains suspended as Base Resources continues to engage the Government in

relation to the fiscal terms applicable to the Toliara Project. Discussions

have been limited as the Government focuses on managing the COVID-19 pandemic.

As noted in the March 2020 quarterly, with the effective shutdown of

Government, international travel restrictions and broader COVID-19 measures and

impacts both in Madagascar and globally, a final investment decision (FID) to

proceed with the development of the Toliara Project will be delayed beyond the

September 2020 target date that had been contemplated in the definitive

feasibility study released in December 20196. Further guidance on a revised

FID date for the Toliara Project will be provided when there is greater clarity

on the trajectory of resumption of global economic activity.

Key activities during the quarter included:

* Continued positive engagement with the Government in relation to fiscal

terms and resumption of activity that has now seen encouragement for the

Company to lodge an application under Large Mining Investment Law (LGIM) as

the mechanism that will provide stability of fiscal terms.

* Preparation of the LGIM application.

* Resource, schedule and budget planning in light of the delays caused by the

COVID-19 pandemic.

* Progression of prospective lender due diligence.

* Progression of meaningful front-end engineering design (FEED) activities.

* Continued negotiations with preferred tenderers, ensuring tender validity

extensions for the river bridge, marine, piling and power contract

packages.

Key activities planned for the coming quarter include:

* Translation and submission of the LGIM application to the Government.

* Continuation of discussions with prospective lenders and equity partners.

* Progression of meaningful FEED activities to a logical point so they can be

parked. These activities will recommence six months prior to FID.

* Continued development of the Toliara Project's Environmental and Social

Management System.

* Continuation of implementation readiness systems development.

Total expenditure on the Toliara Project for the quarter was US$4.9 million

(last quarter: US$3.3 million).

[Note (5): Refer to Base Resources' market announcement "Toliara Project -

Government of Madagascar statement" released on 7 November 2019, which is

available at https://baseresources.com.au/investors/announcements/.

Note (6): Refer to Base Resources' market announcement "DFS reinforces Toliara

Project's status as a world class mineral sands development" released on 12

December 2019, which is available at https://baseresources.com.au/investors/

announcements/.]

Extensional exploration - Kenya

Mining tenure arrangements continued to progress with the Kenyan Ministry of

Petroleum and Mining as a precursor to an anticipated updated Ore Reserves

estimate to incorporate additional Mineral Resources defined within the Kwale

Prospecting Licence (PL 2018/0119) but outside the current mining lease SML23.

However, progress has slowed as the government focuses on combating the

COVID-19 pandemic.

The pre-feasibility study for mining the North Dune Resource was progressed and

remains on schedule for completion in early 2021.

Completion of the remaining drilling program (4,200 metres) in the North-East

Sector (Kwale East) of PL 2018/0119 remains on hold pending community access

being secured. Further drilling of the northern sections of the Vanga

Prospecting License (PL/2015/0042) remains on hold pending resolution of

community access issues. A north eastern extension of the Vanga Prospecting

Licence is under application (App No/1753) to cover further prospective ground

which has since become available.

The additional prospecting licence applications lodged for an area south of

Lamu (Apps No/2136, 2146 and 2153) together with an area in the Kuranze region

of Kwale county about 70 km west of Kwale Operations (App No/2123) remain in

progress through the granting process. Expenditure on exploration activities

in Kenya during the quarter was US$0.2 million (last quarter: US$0.1 million).

CORPORATE

Kenyan VAT receivable

As previously announced, Base Resources has refund claims for VAT paid in

Kenya, relating to both construction of the Kwale Project and the period since

operations commenced, which totalled approximately US$17.9 million at 30 June

2020. These claims are proceeding through the Kenya Revenue Authority process

with refunds totalling US$2.6 million received during the quarter (last

quarter: US$3.1 million). Base Resources is continuing to engage with the

Kenyan Treasury and the Kenya Revenue Authority, seeking to expedite the refund

claims.

FY20 full year financial results

The Company is targeting release of its FY20 audited consolidated financial

statements in the week commencing 24 August 2020. Timing confirmation and

shareholder and investor call details will be advised closer to the planned

release.

In summary, at 30 June 2020:

* Net cash of US$87.6 million, consisting of:

+ Cash and cash equivalents of US$162.6 million.

+ Revolving Credit Facility debt of US$75.0 million.

* 1,171,609,774 fully paid ordinary shares on issue.

* 69,167,541 performance rights issued pursuant to the terms of the Base

Resources Long Term Incentive Plan, comprising:

+ 6,527,607 vested performance rights, which remain subject to exercise7.

+ 62,639,934 unvested performance rights, which are subject to

performance testing in accordance with their terms of issue.

[Note (7): Vested performance rights have a nil cash exercise price and,

unless exercised beforehand, these rights expire on 30 September 2024.]

Forward looking statements

Certain statements in or in connection with this announcement contain or

comprise forward looking statements. Such statements may include, but are not

limited to, statements with regard to capital cost, capacity, future production

and grades, sales projections and financial performance and may be (but are not

necessarily) identified by the use of phrases such as "will", "expect",

"anticipate", "believe" and "envisage". By their nature, forward looking

statements involve risk and uncertainty because they relate to events and

depend on circumstances that will occur in the future and may be outside Base

Resources' control. Accordingly, results could differ materially from those

set out in the forward-looking statements as a result of, among other factors,

changes in economic and market conditions, success of business and operating

initiatives, changes in the regulatory environment and other government

actions, fluctuations in product prices and exchange rates and business and

operational risk management. Subject to any continuing obligations under

applicable law or relevant stock exchange listing rules, Base Resources

undertakes no obligation to update publicly or release any revisions to these

forward-looking statements to reflect events or circumstances after today's

date or to reflect the occurrence of unanticipated events.

ENDS.

For further information contact:

James Fuller, Manager Communications and Investor UK Media Relations

Relations

Base Resources Tavistock Communications

Tel: +61 (8) 9413 7426 Jos Simson and Barnaby Hayward

Mobile: +61 (0) 488 093 763 Tel: +44 (0) 207 920 3150

Email: jfuller@baseresources.com.au

This release has been authorised by the Board of Base Resources.

About Base Resources

Base Resources is an Australian based, African focused, mineral sands producer

and developer with a track record of project delivery and operational

performance. The Company operates the established Kwale Operations in Kenya

and is developing the Toliara Project in Madagascar. Base Resources is an ASX

and AIM listed company. Further details about Base Resources are available at

www.baseresources.com.au

PRINCIPAL & REGISTERED OFFICE

Level 1, 50 Kings Park Road

West Perth, Western Australia, 6005

Email: info@baseresources.com.au

Phone: +61 (0)8 9413 7400

Fax: +61 (0)8 9322 8912

NOMINATED ADVISOR

RFC Ambrian Limited

Stephen Allen

Phone: +61 (0)8 9480 2500

BROKER

Berenberg

Matthew Armitt / Detlir Elezi

Phone: +44 20 3207 7800

END

(END) Dow Jones Newswires

July 28, 2020 02:00 ET (06:00 GMT)

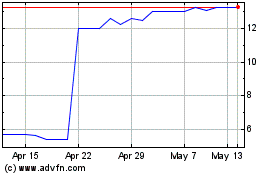

Base Resources (LSE:BSE)

Historical Stock Chart

From May 2024 to Jun 2024

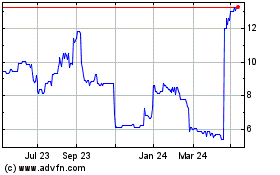

Base Resources (LSE:BSE)

Historical Stock Chart

From Jun 2023 to Jun 2024