TIDMBRWM

BlackRock World Mining Trust plc LEI - LNFFPBEUZJBOSR6PW155

Annual Results Announcement (Article 4 Transparency Directive, DTR 4.1)

for the year ended 31 December 2022

Performance record

As at As at

31 December 31 December

2022 2021

Net assets (£'000)¹ 1,299,285 1,142,874

Net asset value per ordinary share (NAV) (pence) 688.35 622.21

Ordinary share price (mid-market) (pence) 697.00 589.00

Reference Index2 - net total return 5,863.32 5,258.16

Premium/(discount) to net asset value3 1.3% (5.3)%

--------------- ---------------

Performance (with dividends reinvested)

Net asset value per share3 +17.7% +20.7%

Ordinary share price3 +26.0% +17.5%

Reference Index2 +11.5% +15.1%

--------------- ---------------

Performance since inception (with dividends

reinvested)

Net asset value per share3 +1,413.6% +1,187.8%

Ordinary share price3 +1,535.8% +1,198.1%

Reference Index2 +979.6% +868.2%

========= =========

For the For the

year ended year ended

31 December 31 December Change

2022 2021 %

Revenue

Net revenue profit after taxation (£'000) 76,013 78,910 -3.7

Revenue return per ordinary share (pence)4 40.68 43.59 -6.7

--------------- --------------- ---------------

Dividends per ordinary share (pence)

- 1st interim 5.50 4.50 +22.2

- 2nd interim 5.50 5.50 -

- 3rd interim 5.50 5.50 -

- Final 23.50 27.00 -13.0

--------------- --------------- ---------------

Total dividends paid and payable 40.00 42.50 -5.9

========= ========= =========

1 The change in net assets reflects portfolio movements, share

reissues and dividends paid during the year.

2 MSCI ACWI Metals & Mining 30% Buffer 10/40 Index (net total

return). With effect from 31 December 2019, the Reference Index changed to the

MSCI ACWI Metals & Mining 30% Buffer 10/40 Index (net total return). Prior to

31 December 2019, the Reference Index was the EMIX Global Mining Index (net

total return). The performance returns of the Reference Index since inception

have been blended to reflect this change.

3 Alternative Performance Measures, see Glossary in the Annual

Report and Financial Statements.

4 Further details are given in the Glossary in the Annual Report

and Financial Statements.

CHAIRMAN'S STATEMENT

HIGHLIGHTS

* NAV per share +17.7%1 (with dividends reinvested)

* Share price +26.0%1 (with dividends reinvested)

* Total dividends of 40.00p per share

PERFORMANCE

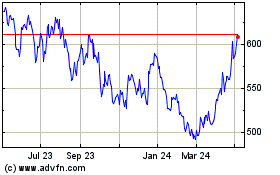

I am pleased to report that your Company has reported another year of excellent

performance. Over the twelve months to 31 December 2022, the Company's net

asset value per share (NAV) returned +17.7%1 and the share price +26.0%1. In

comparison, over the same period, the Company's reference index, the MSCI ACWI

Metals & Mining 30% Buffer 10/40 Index (net total return), returned +11.5%, the

FTSE All-Share Index returned +0.3% and the UK Consumer Price Index (CPI)

increased by 9.2%.

OVERVIEW

As the Company's financial year began, the mining sector held up better than

broader equity markets, which recorded their worst month since March 2020, when

more widespread public health measures were introduced following the outbreak

of the COVID-19 pandemic. Supply constraints, coupled with increasing demand as

post-COVID-19 economic activity restarted, caused inflation to rise sharply and

the geopolitical events of early 2022, with Russia's unprovoked invasion of

Ukraine, exacerbated an already challenging market environment. For much of the

previous decade, markets have been characterised by low inflation and very low

interest rates, but the resulting rise in energy and food prices pushed

inflation in the UK to a 41-year high in October 2022. This, when added to

higher interest rates, had a pronounced impact on equity markets and caused a

deep fall in households' real disposable incomes.

Given the aforementioned headwinds, it is extremely impressive that the mining

sector delivered such strong gains in absolute terms and when compared with the

wider market. It is also important to remember that China, the world's largest

consumer of mined commodities, remained in varying stages of lockdowns for most

of the year. Miners should be applauded for being responsible in capital

allocation and balance sheet discipline during the prevailing market

environment. Whilst this practice is encouraging, companies will be compelled

to invest in growth in the medium to long term. The sector was also aided by

supply constraints across a number of commodities which kept prices higher and

the continued growth in demand for mined commodities for the transition to net

zero carbon emissions. Encouragingly, the Company's mining holdings

outperformed during the year, including the contribution from our unquoted

investments.

1 Alternative Performance Measures. All percentages calculated in sterling

terms with dividends reinvested. Further details of the calculation of

performance with dividends reinvested are given in the Glossary in the Annual

Report and Financial Statements.

REVENUE RETURN AND DIVIDS

This year was the second best year in the Company's history for income and only

marginally short of last year's record. Collectively, the balance sheets of

mining companies have never been stronger, reflecting tight financial

discipline and strength in commodity prices. By prioritising financial

stability and investor returns over growth, the mining sector has enabled

investors to continue to share in the fundamentals benefiting the underlying

companies.

The Company's revenue return per share for the year amounted to 40.68p compared

with 43.59p for the previous year, representing a slight decrease of 6.7%.

During the year, three quarterly interim dividends of 5.50p per share were paid

on 30 June 2022, 30 September 2022 and 22 December 2022. The Board is proposing

a final dividend payment of 23.50p per share for the year ended 31 December

2022. This, together with the quarterly interim dividends, makes a total of

40.00p per share (2021: 42.50p per share) representing a small decrease of 5.9%

on payments made in the previous financial year. As in past years, all

dividends are fully covered by income. In accordance with the Board's stated

policy, the total dividends represent substantially all of the year's available

income.

Subject to approval at the Annual General Meeting, the final dividend will be

paid on 26 April 2023 to shareholders on the Company's register on 10 March

2023, the ex-dividend date being 9 March 2023. It remains the Board's intention

to seek to distribute substantially all of the Company's available income along

similar lines in the future.

GEARING

The Company operates a flexible gearing policy which takes into account

prevailing market conditions. It is not intended that gearing will exceed 25%

of the net assets of the Group. Gearing at 31 December 2022 was 9.6%. Average

gearing over the year to 31 December 2022 was 11.2%.

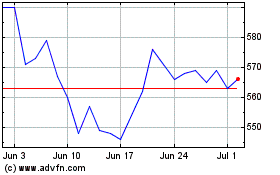

MANAGEMENT OF SHARE RATING

The Board recognises the importance to investors that the market price of the

Company's shares should not trade at a significant premium or discount to the

underlying NAV. Accordingly, in normal market conditions, the Board may use the

Company's share buyback, sale of shares from treasury and share issuance powers

to ensure that the share price is broadly in line with the NAV, if it is deemed

to be in shareholders' interests.

I am pleased to report that during the year the Company reissued 5,071,920

ordinary shares from treasury for a net consideration of £34,902,000, at an

average price of 688.14p per share and an average 1.3% premium to NAV. Since

the year end up to 2 March 2023, a further 150,000 shares have been reissued

from treasury at an average premium over NAV of 1.5%, at an average price of

717.50p for a total consideration of £1,086,000. As at 28 February March 2023

the discount stood at 0.2%.

Resolutions to renew the authorities to issue and buy back shares will be put

to shareholders at the forthcoming Annual General Meeting.

BOARD COMPOSITION

Russell Edey has informed the Board of his intention to retire as a Director of

the Company following the Annual General Meeting in April 2023 and,

accordingly, will not be seeking re-election. Russell joined the Board in May

2014 and has acted as Chairman of the Audit Committee and Management Engagement

Committee and Senior Independent Director since May 2020. The Board would like

to express its strong appreciation for Russell's wise counsel and invaluable

contribution to the Company.

The Board has commenced a search to identify a new Director and a further

announcement will be made in due course. Following Mr Edey's retirement, Mr

Venkatakrishnan will be appointed as Chairman of the Audit Committee. Ms Lewis

will become Chair of the Management Engagement Committee and Ms Mosely will

become the Company's Senior Independent Director.

ANNUAL GENERAL MEETING

The Company's Annual General Meeting (AGM) will be held at the offices of

BlackRock at 12 Throgmorton Avenue, London EC2N 2DL on Tuesday, 18 April 2023

at 11.30 a.m. Details of the business of the meeting are set out in the Notice

of Meeting in the Annual Report and Financial Statements.

Shareholders who intend to attend the AGM should ensure that they have read and

understood the venue requirements for entry to the AGM. These requirements,

along with further arrangements for the AGM, can be found in the Directors'

Report in the Annual Report and Financial Statements. In the absence of any

reimposition of COVID-19 restrictions, the Board very much looks forward to

meeting with shareholders at the AGM.

OUTLOOK

The impact of the COVID-19 pandemic has receded, but the recovery of the global

economy has been hindered by geopolitical tensions and rising interest rates.

Since recognising the urgent need for policy tightening to combat inflationary

pressures on the back of soaring prices, the US Federal Reserve has raised

interest rates at the fastest pace in more than three decades, with most other

major developed central banks following suit. High inflation has sparked

cost-of-living crises and slowing global growth and, although central banks are

forecast to slow the rate of interest rate increases, the possibility of

recession for developed markets looms.

Whilst the macro environment in developed market economies continues to present

near-term headwinds for commodity markets, the structural backdrop with low

inventories, limited investment in new production and a more rapid recovery in

China than expected, are supportive tailwinds. The energy transition will

require enormous scale of investment by mining companies over the coming

decades. Mining companies are in an excellent financial position, with high

levels of free cash flow and solid balance sheets and these factors combined

with the above potential tailwinds could be a major factor in how 2023 shapes

up for the sector.

Against this backdrop, our Investment Manager remains cautiously optimistic for

the mining sector. The Board is also confident that the Company remains

well-placed to benefit from the transition to net zero carbon emissions which

will continue to create investment opportunities in those companies that

service the associated supply chains.

DAVID CHEYNE

Chairman

2 March 2023

INVESTMENT MANAGER'S REPORT

PORTFOLIO PERFORMANCE

We are pleased to report another strong year of absolute returns for the

Company in 2022. The year also marked a record in terms of another all-time

high in NAV and share price total returns as, since the Initial Public Offering

(IPO) of the Company in 1993 at 100p per share, the shares have delivered a NAV

total return of 1412.5% and a share price total return of 1535.8% against a

reference index total return of 979.6%. In addition, the year was also

significant for income after the record-breaking numbers in 2021. Despite not

quite matching last year's record, the total was well in excess of expectations

with all parts of the strategy contributing. Also, like last year, the

performance was split into distinct periods with excellent gains made during

the first four months, followed by falls during the summer before a decent

rally in the final quarter. This volatility allowed us to take advantage of

opportunities by adjusting holdings, as well as selling volatility out to the

market using options. It is also important to remember that the Company

delivered these gains against a broader market backdrop of strongly negative

returns across not just equities but also fixed income making the relative

return very valuable to investors.

COMMODITY PRICE MOVES

31 December % Change in % Change average

2022 2022

prices 2022 vs

2021

Commodity

Gold US$/oz 1,815.6 -0.4% +0.1%

Silver US$/oz 23.75 2.1% -13.3%

Platinum US$/oz 1,065 11.1% -11.8%

Palladium US$/oz 1,788 -9.4% -12.1%

Copper US$/lb 3.79 -14.1% -5.2%

Nickel US$/lb 13.56 +43.3% +42.1%

Aluminium US$/lb 1.07 -16.3% +9.3%

Zinc US$/lb 1.36 -16.3% +16.0%

Lead US$/lb 1.06 -0.1% -2.1%

Tin US$/lb 11.23 -37.1% -3.3%

Baltic Freight Rate 1,515 -31.7% -33.7%

West Texas Intermediate Oil (Cushing) US$/ 80.2 +6.7% +39.5%

barrel

Iron Ore fines 62% US$/t 118 -3.7% -24.5%

Thermal Coal US$/t 145.16 +18.5% +110.6%

Metallurgical Coal US$/t 279.45 -24.5% +63.4%

Lithium US$/lb 191.5 +101.6% +274.0%

========= ========= =========

Sources: Datastream and Bloomberg, December 2022.

Looking at the year more broadly, it was driven by a shifting macro backdrop

and a sharp uptick in geopolitical tensions. The former saw interest rates rise

across the world causing equities to derate on the back of both a higher cost

of capital but also fears of recessionary impacts to profit margins. These

issues were further compounded by the invasion of Ukraine by Russia which

triggered a range of consequences from spikes in oil prices, huge volatility in

European power costs and shortages of natural resources from oil/gas/metals/

fertilizers etc. China was also impacted by their zero COVID-19 policy which

badly damaged their economic growth. Given all of the above it is even more

remarkable that the mining sector not only managed to navigate its way through

this unscathed, but also posted such a strong year of gains and dividends.

Credit must go to the executive teams who have stayed the course of disciplined

capital allocation and strong balance sheets, as without this the sector would

surely have come unstuck given the huge macro challenges.

It would be remiss not to highlight the contribution from the investments in

illiquid assets during 2022. During the year two companies, Ivanhoe Electric

and Bravo Mining, completed successful IPOs at big premiums to the entry prices

paid by the Company. This happened despite the difficult conditions in

financial markets and is testament to the quality of the opportunities each

company has exposure to. In addition, Jetti Resources completed a successful

capital raise at a substantial premium to their last round and with more trial

projects moving into commercial discussion the outlook remains encouraging.

There is more detail on the illiquid portfolio later in this report.

For the year as a whole, the NAV of the Company was up by 17.7% with income

reinvested and the share price total return was 26.0%. This compares to the

FTSE 100 rising 4.7%, the Consumer Price Index up by 9.2% and the reference

index (MSCI ACWI Metals & Mining 30% Buffer 10/40 Index net total return) up by

11.5% (all percentages calculated in sterling terms with dividends reinvested).

PRESSURE BUILDING

2022 was a complicated year for the mining sector in many ways. If one had

known beforehand about the big macro headwinds such as slower growth in China,

rising rates and recessionary conditions across the developed world, most

people would have expected mining shares to have delivered negative returns for

the year. Therefore, to see the leading sectoral gains in financial markets for

the year coming from natural resources shares, with energy leading the way on

the back of supply disruption following Russia's invasion of Ukraine, makes it

easy to understand why generalist investors missed the opportunity. It is also

easy to understand their reticence to buy after such a long period of

outperformance.

It is our belief that the trends of prior years, such as capital discipline and

strong balance sheets, have built strong foundations for the sector and it is

these factors that drove the outperformance in 2022. For example, if mining

companies had gone into the year with large capital spending plans and high

levels of debt, share prices would have fallen as sharply as in similar periods

from the past. The work that has been done to entrench capital discipline,

combined with keeping stronger balance sheets, in our view saved the day in

2022.

Another output of the improved capital allocation decisions has been a lower

level of reinvestment into production. This has allowed free cash flow to grow,

but, more importantly, it has meant limited new supply growth across the

industry. Given that the world economy now needs commodities to build the

projects for the energy transition, the absence of new supply has left

commodity markets extremely tight. In fact, at the end of 2022, inventories at

London Metal Exchange warehouses were at 25-year lows. Available inventories

for aluminium, copper, nickel and zinc decreased by over two-thirds during the

year. The low levels of stockpiles reflect a tension that has kept traders and

consumers gripped as demand weakened (due to China economic slowdown and

recessionary fears in developed markets), but constrained supplies kept prices

at levels higher than expected.

It is our expectation that the supply constraints are unlikely to ease during

the next few years due to the scarcity of "shovel ready" projects and high

permitting barriers. This has left companies focused on growth needing to

revisit mergers and acquisitions (M&A), as producing assets valued in the

equity markets often trade below the cost of building new capacity. In

Australia, BHP managed to agree terms to buy OZ Minerals after many months of

discussions. The deal looks set to complete in 2023 and the Company has

benefited materially from this deal due to having a large holding in OZ

Minerals. It is hard to see other deals happening due to the small number of

listed copper producers and fears of resource nationalism that continue to add

risk to moving capital into more remote regions e.g. the threat of closing

First Quantum's new Cobre de Panama mine.

Outside of sector specific issues, the geo-political tensions caused by

Russia's invasion of Ukraine further tightened markets due to the sanctions

imposed by other countries. This disrupted commodity supply chains at a time

when markets were already tight, further supporting prices at a time when

economic weakness would normally have seen them fall. As the year developed,

prices did cool during the summer, only to recover in Q4 2022 as China started

to ease COVID-19 restrictions. It will be interesting to see the impact that

post COVID-19 Chinese demand has on metals markets.

ESG ISSUES AND THE SOCIAL LICENSE TO OPERATE

Information on the way in which the Company seeks to manage risks related to

ESG (Environmental, Social and Governance) and the social license to operate is

covered in further detail in the Strategic Report within the Annual Report and

Financial Statements. The Investment Manager also seeks to understand the ESG

risks and opportunities facing companies and industries in the portfolio. As an

extractive industry, the mining sector naturally faces a number of ESG

challenges given its dependence on water, carbon emissions and geographical

location of assets. However, we consider that the sector can provide critical

infrastructure, taxes and employment to local communities, as well as materials

essential to technological development, enabling the carbon transition through

the production of the metals required for the technology underpinning that

transition.

The Investment Manager considers ESG insights and data, including

sustainability risks, within the total set of information in its research

process and makes a determination as to the materiality of such information as

part of the investment process used to build and manage the portfolio. Further

information on the Investment Manager's approach to ESG integration is set out

in the AIFMD Fund Disclosures in respect of the Company, available on the

Company's website. ESG insights are not the sole consideration when making

investment decisions but, in most cases, the Company will not invest in

companies which have high ESG risks (risks that affect a company's financial

position or operating performance) and which have no plans to address existing

deficiencies.

* The Investment Manager is also engaging with the executives of

portfolio companies in which the Company invests to understand how their

current business plans are compatible with achieving a net zero carbon

emissions economy by 2050.

* There will be cases where a serious event has occurred and, in that

case, the Investment Manager will assess whether the relevant portfolio

company is taking appropriate action to resolve matters before deciding

what to do.

* There will be companies which have derated (the downward adjustment

of multiples) as a result of an adverse ESG event or due to generally poor

ESG practices where there may consequently be opportunities to invest at a

discounted price. However, the Company will only invest in these

value-based opportunities if the portfolio managers are satisfied that

there is real evidence that the relevant company's culture has changed and

that better operating practices have been put in place.

* Given the activities that mining companies undertake, negative ESG

events can occur. However, there were very few company-specific events in

2022. This meant that ongoing engagement focused mainly on the Company's

holdings approach to the energy transition and how they plan to not only

benefit from the opportunities but also how they are going to decarbonise

their own operations.

During the year the main areas of focus in relation to ESG risks and issues

remained on Rio Tinto and Vale. By way of an update, at Rio Tinto work is

ongoing with historical owners, including the establishment of the Juukan Gorge

Legacy Foundation, which will support major cultural and social projects. At

Vale, the company has continued its journey to raise its ESG profile following

the tragic tailings related events from the last decade. Further changes have

also been made to the Vale board and its operating structure. The company was

also upgraded by Fitch on the back of the work they have done to improve their

ESG track record.

PRICE WEAKNESS BUT STRONG MARGINS

2022 saw prices generally down for the year as a whole, as well as lower

average prices versus the prior year. However, it is important not just to look

at the moves in isolation. For example, the average price of copper in 2022 was

down 5.2% compared with 2021 but the actual level of US$4.2/lb was the second

highest average price ever, leaving companies enjoying healthy margins. The

opposite is true for nickel where the prices were up year-on-year but the

average price was not as high as it had been in the past, but still at

extremely profitable levels for producers.

In precious metals, gold was the standout as the average price was flat for the

year compared to silver, platinum and palladium which were all lower. However,

gold companies seem to have suffered more from cost inflation as they did not

go into the inflationary environment with levels of profitability as high as

their industrial peers.

The standout commodity for the year was lithium, as the price soared driven by

demand exceeding estimates as electric vehicle (EV) adoption rates increased

across the world. In fact, the whole battery material suite looks set to see

strong demand as the transition away from the combustion engine gathers pace.

DO NOT FORGET THE INCOME

In 2021 the Company received record levels of income as the underlying

investments paid surplus cash back to their investors. Despite fearing that

this would be a peak and 2022 might be less favourable for investors, we are

delighted to report that once again companies honoured their commitments and

continued with a strategy of distributions. The chart in the Annual Report and

Financial Statements compares the payments received in 2021 and 2022 versus the

average payments received by the Company in prior years. It is clear just how

much higher these last two years have been and it is testament to the hard work

done during earlier years that has left the companies in a position to deliver

this.

It is also important to note how the portfolio investments have generally moved

to a more shareholder friendly strategy. In 2021 82% of the Company's assets

were exposed to companies paying dividends versus only 68% in 2013. Part of

this change has been due to changes in the portfolio, but by far the majority

has come from more and more companies moving to dividend paying mode as project

capital expenditure and debt repayment needs declined. In summary, the

combination of more companies paying dividends, combined with diversification

into royalties, should build in some resilience to general economic risks.

THE ENERGY TRANSITION

As alluded to earlier, the energy transition continues to gather pace. EVs are

taking market share away from combustion engine vehicles at levels well in

excess of expectations. The roll out of renewable power projects and related

infrastructure is happening far quicker than planned. This has in part been

driven by a desire by European countries to diversify away from Russian

supplied fossil fuels and the fact that with fossil fuel prices so high

renewable power is substantially more cost effective, not to mention helping

countries/companies to meet their net zero commitments.

Despite the positive news from 2022, it is clear that we remain very close to

the start of the energy transition cycle given the enormous scale of investment

that is going to be needed over the coming decades. Looking at the data for

renewable power, it is increasingly obvious how much more resource intensive it

is (see charts in the Annual Report and Financial Statements). On top of this

there will also be commodity demand from battery storage needs and the buildout

of the hydrogen economy.

It is also essential for mining companies to embrace the need to decarbonise

their own operations as future demand is likely to seek out supply from

companies that do not just meet quality but also have green credentials. This

move from "Brown to Green" presents a range of investment opportunities for the

Company both in trying to reduce the heavy discount rates applied to carbon

intensive production techniques, as well as new technologies that could solve

some of the more damaging historical processes.

BASE METALS

It was a volatile year for base metals with prices starting the year well on

strong western world demand and risks around supply amplified with the invasion

of Ukraine. However, as we approached the middle of the year, the macro-outlook

began to deteriorate with COVID-19 lockdowns in China, further weakness in the

Chinese property market and interest rate increases to tame inflation which led

to concerns around global growth, particularly in Europe as energy prices

became an increasing toll on consumer and economic activity. This resulted in

peak to trough declines of 30% to 40% across the base metal complex, which

combined with supply challenges, cost inflation and royalty increases created a

difficult environment for the producers. Given this, share prices fared far

better than might have been expected, a reflection of the balance sheet

strength of the producers and improving outlook for demand.

Encouragingly, as we approached the year end, several measures announced by the

Chinese government to support the economy, including relaxation of its zero

COVID-19 policies, buoyed sentiment with prices rallying from their Q3 lows.

Interestingly, when we look at the overall price performance for the year as

shown in the table in the Annual Report and Financial Statements, while the

majority of base metal prices finished the year lower, with the exception of

nickel, the average price received in 2022 was higher than the prior year,

supporting earnings for the producers. As we look forward into 2023 and the

potential impact of China re-opening, not only do we expect to see a

year-on-year pick-up in underlying demand, but also a re-stocking of

commodities such as copper and aluminium assuming China reverts back to its

pre-COVID-19 levels of inventory cover. Given the tightness in physical markets

and low level of base metal inventories today, this creates upside risk to

commodity prices over the next two years if Chinese growth stabilises and the

slowdown in the US economy is not protracted.

The copper price started the year strongly reaching US$4.85/lb in early March,

to subsequently trade between US$3.25/lb to US$3.70/lb for much of the second

half before rallying to US$3.79/lb at the end of the year as China looked to

stabilise its economy. Whilst the absolute copper price is high versus history,

the cumulative impact of cost inflation over the last five years has seen a

step change in the operating cost base of the industry with several mines

operating at cash breakeven levels during the low copper prices of Q3.

Copper is a clear beneficiary of the energy transition with more than 65% of

copper used for applications that deliver electricity, whilst at the same time

the industry is facing mine supply challenges resulting in a material deficit

in the market longer term. This is driven by a lack of new greenfield copper

projects, as well as deteriorating performance at existing assets, particularly

in Chile. The expectation was for 2022 to deliver a step-up in copper supply

with new projects such as QB2 (Teck Resources) and Qualleveco (Anglo American)

due to come online. However, as we approached the year end, a swathe of

production cuts has delayed growth until 2023/2024, leaving the physical market

tight with a lack of inventory becoming an increasing issue for industrial

users. Given the significant copper supply gap estimated longer term (3.5Mt gap

estimated by Macquarie Bank by 2030), we continue to believe that copper prices

need to remain above incentive prices to induce new supply into the market

which is an attractive position for existing low-cost producers.

As at the end of December 2022, the Company had 22.0% of the portfolio exposed

to copper producing companies which modestly detracted from performance for the

year. The Company's second largest copper exposure Freeport-McMoRan (4.0% of

the portfolio) continued to deliver operationally at Grasberg, as well as

executing on their US$3 billion buyback which they announced in late 2021.

Among our other copper producers, Ivanhoe Mines (1.8% of the portfolio) have

continued to surpass the market's expectation on the ramp-up of Kamoa-Kakula,

underpinning our confidence in the management team's ability to deliver value

from their other assets including the Western Forelands in the future. Among

our mid-cap holdings in the portfolio, there was exceptional performance from

Ivanhoe Electric which held an IPO during the year delivering close to a 100%

return from our pre-IPO investment, as well as Jetti Resources which raised

US$100 million at a substantially higher level than our entry price. Both are

discussed in detail in the unquoted section of the report. The portfolio has

also benefited from M&A activity during the year following BHP's cash offer for

OZ Minerals (1.2% of the portfolio) that was recommended by the OZ Minerals

Limited board in December 2022. Strategically the transaction brings

significant benefits to BHP given the proximity of OZ Minerals' assets to BHP's

Olympic Dam operation in South Australia and supports the build-out of an

Australian based copper basin for BHP in the years ahead. OZ Minerals have been

an exceptionally strong performer over a number of years where the Company

benefited from the re-rating of the company as they delivered operationally,

and they were also the operator of the OZ Minerals Brazil Royalty when they

acquired Avanco Resources in 2018.

The aluminium price finished the year down by 16%, facing similar global growth

headwinds as the copper market. In the first half of the year there were fears

that Russian exports of primary aluminium might be impacted by sanctions which

supported prices. However, whilst certain companies have chosen not to purchase

Russian material, there have been no sanctions imposed directly on Russian

aluminium exports and these tonnes have still entered the market. With power a

major cost component for aluminium smelters, higher energy costs have resulted

in 1.2mtpa of capacity curtailed in Europe. At an aluminium price of US$2,500/

tonne, WoodMac estimates that 30% of smelters are loss making on a full cost

basis, which provides a level of downside protection to the price. However,

increasing aluminium exports from China this year has largely capped the price.

As China's domestic demand improves into 2023, we would expect exports to

moderate, which in turn should support prices. The Company has exposure to two

aluminium producers Alcoa (1.2% of the portfolio) and Norsk Hydro (2.1% of the

portfolio) both of which have access to renewable, low cost energy for the

majority of their production, leaving them well positioned in the current

environment of high energy costs and longer term as the market places a greater

cost on carbon.

Nickel prices have been very volatile this year where a short squeeze

temporarily drove prices above US$100,000 a tonne before the LME suspended the

market and cancelled some trades in March. Similar to aluminium, Russia is also

a significant producer of nickel, but we are yet to see any supply disruptions.

Overall, the nickel price finished the year up by 43% with the market becoming

increasingly aware of the longer-term deficit building for high grade nickel

used in batteries. In Q4 2022, the Company made an investment in Lifezone which

announced a business combination with a Special Purpose Acquisition Company

(SPAC) GoGreen Investments which is listed on the New York Stock Exchange.

Lifezone has a controlling shareholding in Kabanga, the largest and

highest-grade undeveloped nickel project globally, located in Tanzania. The

project has significant backing from BHP the world's largest mining company

which has invested US$100 million into the asset at a see-through valuation of

US$627 million to acquire 14.3% of the project, with the option to acquire a

51% interest once the feasibility study is completed by the end of 2023.

BULK COMMODITIES AND STEEL

It was a challenging year for the iron ore market with average prices 24.5%

lower year-on-year, with demand undermined by China's zero COVID-19 policy and

ongoing weakness in China's key steel intensive property sector. Whilst the

market enjoyed a post Beijing Winter Olympics restock in first quarter seeing

prices hold a healthy range between US$120-140/tonne during the first half of

the year, they subsequently averaged below US$100/tonne during the second half

of the year bottoming at US$80/tonne in the third quarter as Chinese steel

margins turned negative and uncertainty around China's COVID-19 policy saw

further de-stocking by customers.

China's shift in COVID-19 policy and further support announced for the property

sector at the end of the year, has seen prices rally back above US$100/tonne as

the market looks to price in the impact of China re-opening. As we look into

2023, we expect to see a recovery in construction activity, which combined with

first quarter seasonality in the iron ore market with both Brazilian and

Australian tonnes exposed to weather events, it provides a constructive

backdrop for the price during the first half of the year. Among the 'big 4'

producers there is modest (1%) growth in supply this year which will be second

half weighted and we continue to see the producers being disciplined around

volumes which should be supportive of the price over the medium term. During

the course of the year, we had the opportunity to visit BHP's and Rio Tinto's

key iron ore assets in the Pilbara Region of Western Australia which enabled us

to learn more about the world class size and grade of these assets, their

approach to ESG and the focus on decarbonising their operations.

The Company's exposure to iron ore is in the diversified majors BHP, Vale and

Rio Tinto, which have performed well this year returning 30%, 35% and 19%

respectively. In addition, the Company has exposure to two pure play high grade

iron ore producers Champion Iron and Labrador Royalty Company which have

returned 41% and -6% respectively, as well as Mineral Resources which is

looking to grow its iron ore business alongside its lithium, mining service and

gas business which finished the year up by 45%.

Coal markets have been one of the most interesting commodity markets over the

last couple of years with record prices achieved for both metallurgical and

thermal coal during 2022. Thermal coal markets have benefited from tightness in

global energy markets particularly in Europe due to the ban of Russian coal

imports, limited supply growth due to ESG pressures and higher than normal

levels of rainfall in Australia which accounts for 60% of seaborne supply. With

levels of gas storage in Europe above average levels at the end of 2022, we

have seen European gas prices decline which poses a risk to thermal coal

prices. However, given the tightness in the market for high grade Australian

thermal coal, prices have held at a record level of US$400/tonne at the end of

2022. As we look into 2023, we continue to see a tight market for thermal coal

given much of Europe's coal and inventory build was sourced from Russia, but

with supply from Australia expected to recover in 2023 after record rain

impacts in 2022, a moderation in thermal coal prices from record levels is

likely.

The Company's thermal coal exposure is via our 7.7% position in Glencore, which

is using elevated thermal coal prices to deleverage the business and remains

focused on decreasing its coal exposure overtime. Glencore has indicated that

they intend to return excess cashflow above their net debt target of US$10

billion. This implies a 15% capital return yield for 2022 which is industry

leading and will result in a circa 10% decline in their share capital

outstanding. The Company has no exposure to pure play thermal coal producers.

The seaborne metallurgical coal price reached a new all-time high during the

first half of the year at circa US$500/tonne, supported by Russian supply

concerns (5% of global supply), tightness in the thermal coal market, as well

as the flooding in Australia which impacted supply. However, as we moved into

the second half of the year, prices moderated as weaker steel demand in Europe

began to bite with the metallurgical coal price finishing the year at US$295/

tonne (Premium Hard Coking Coal, FOB). During the course of the year, we saw a

number of production downgrades announced including Anglo American reducing

volume guidance for its Grosvenor mine in Queensland and Teck Resources

reducing guidance at Elkview due to operational issues. This, combined with

limited investment into new supply and seasonal weather events, leaves the

coking coal market susceptible to upside spikes in prices which has been a

consistent feature of this market in recent years. The Company's exposure to

metallurgical coal remains in the two leading producers of BHP and Teck

Resources which have been able to generate very strong levels of free cash flow

from their coking coal businesses to support returns to shareholders. (All data

reported in pounds sterling terms.)

PRECIOUS METALS

The last three years have seen a largely rangebound price environment for

precious metals, with the average annual gold price between 2020 to 2022 within

1.7% of each other in US dollar terms. This is a remarkable level of stability

for a commodity, with the gold price driven by two opposing forces over the

last year. On the positive side we have seen rising inflation, elevated

geopolitical and market risk, while on the other hand the impact of interest

rate hikes to combat inflation which has seen real rates for Government bonds

flip from negative to positive over the course of the year. As we approached

the year end, we saw the gold price rally and breakthrough US$1800/oz on the

back of China's reopening news, the knock-on impact from a weaker US dollar and

the potential for the Federal Reserve (the Fed) to slow the pace of interest

rate hikes as inflation started to moderate.

With positive real interest rates in the US and most global economies, the

appeal for non-yielding gold in the short term is limited. The performance of

gold over the next 12 months is likely to be driven by the Fed's ability to

tame inflation and whether they can effectively bring down inflation to their

targeted level, or whether inflation remains at a structurally higher level

than in the past which should raise inflation expectations supportive of the

gold price.

An encouraging feature of the gold equity market over recent years has been the

increased focus on shareholder returns, free cash flow and dividends. However,

results in 2022 have shown margin compression due to rising labour, energy and

other input costs. Whilst the portfolio has continued to hold a lower

allocation (13.0%) to gold companies versus a similar time last year (16.4%) we

have maintained our strategy of focusing on high quality producers which have

an attractive operating margin and solid production profile and resource base.

This includes the Company's exposure to the royalty companies Franco Nevada

(2.6% of the portfolio) and Wheaton Precious Metals (2.3% of the portfolio)

which outperformed the gold equities during the year given their stronger

margins and lack of exposure to cost inflation. In addition, the Company's

exposure to Endeavour Mining (0.6% of the portfolio) and Northern Star

Resources (1.2% of the portfolio), both mid-cap growth focused gold companies,

added to performance as the benefit of volume growth helped offset some of the

cost inflation in the sector.

Demand for the Platinum Group Metals (PGMs) continues to be impacted by the

weakness in global auto production and the share gains from electric vehicles

(over internal combustion engines) which do not use PGMs. While Russia is a

major producer of PGMs, accounting for 40% of global palladium production,

there has been minimal impact to Russian PGM supply. During 2022 there was

mixed performance from the PGMs with the platinum price (+11%) outperforming

the palladium price (-9%).

We continue to remain positive on the medium-term outlook for the PGMs and

believe the PGM basket will remain high relative to history given limited new

supply and increasing PGM loadings for auto catalysts to meet rising emissions

standards. The Company has reduced its exposure to pure play PGM producers

during the year which represented 2.0% of the portfolio at the year end. In

addition, the Company has exposure to PGMs via its holding in Anglo American

(5.2% the portfolio) which owns 79% of Anglo American Platinum. The standout

performer among our PGM exposure during the year was our investment in Bravo

Metals, a PGM exploration company focused on the Luanga project in Brazil which

they acquired from Vale. As outlined in the unquoted section of the report, the

company's IPO during the year resulted in a 170% uplift from our pre-IPO

investment made in early 2022 and finished the year above its IPO price with

early results from its drilling campaign confirming and, in a number of

instances, exceeding the historical drilling results from Vale showing

previously unidentified rhodium and nickel sulphide mineralisation in the assay

results.

ENERGY TRANSITION METALS

Growth in battery electric vehicles (BEVs) continued in 2022, creating

significant demand for the materials that enable that transition. Demand for

pure battery electric vehicles grew 40% in 2022 to 267,000 units (16% of all

new car registrations in 2022), with demand for plug-in hybrids also growing.

This growth has been mainly driven by China, with Europe and the US lagging. We

expect this structural growth to continue and accelerate particularly in the

US, driven by increased model launches, strengthening consumer preference due

to technological advantage and government policy. Of particular note in 2022,

was the announcement of the US Inflation Reduction Act. As well as other

climate change related measures, this policy supports EV demand through

significant subsidies of up to US$7,500 per car. This is expected to support US

BEV demand in 2023. The Company has exposure to the raw materials that go into

EV batteries and the e-motor.

Lithium is a critical component of an EV battery and demand for lithium has

been strong this year with the market firmly in deficit and benchmark Chinese

prices reaching all-time highs in November, finishing 2022 up by 101.6%. The

Company added to its lithium holdings in late 2021, establishing a position in

SQM and Sigma Lithium both of which have performed well in this environment

returning 78% and 207% respectively (GBP returns). We also added a new position

in relative underperformer Albemarle in June and Mineral Resources in October,

as they too stand to benefit from the continued tight demand supply situation

in lithium, as well as their own volume growth. The Company has a 2.1% position

across its lithium holdings.

A critical component of the electric car is also the e-motor, which most

commonly uses a Praseodymium-Neodymium (NdPr) magnet, an alloy of two rare

earth elements (REE). REE are commonly mined and processed in China and have

been deemed of strategic importance by both Europe and the US. The Company has

exposure to REEs through Lynas, a REE miner and processor crucially based in

Malaysia and Australia. In 2022 Lynas equity fell by 19.1%, but the company

announced in June that they had won a contract from the US Department of

Defence to deliver a US rare earth separation facility, underscoring the

strategic growth opportunity.

EV battery raw materials include cobalt, where LME prices fell by 26.3% as

supply increased faster than demand; the market is moving to lower cobalt

intensity cathode materials with higher nickel or lithium iron phosphate

chemistry (LFP). Supply growth is set to continue with cobalt being a

by-product of many of the Indonesian nickel projects announced and currently

ramping. In addition, 2023 may be impacted by the release of 10,000 tonnes of

stockpiled cobalt from the Tenke mine in the Democratic Republic of the Congo

(DRC) which has been unable to export in the second half of 2022 due to a

government dispute. Glencore's Mutanda mine in the DRC ramped-up production in

2022, supporting circa 50% growth in cobalt production in the first nine months

of the year. Glencore, in which the Company has a 7.7% position, saw its share

price rise by 47.3% during 2022. Glencore is a globally significant cobalt

producer which produced 22% of mine production in 2020 and this is set to

increase with Mutanda's ramp-up.

ROYALTY AND UNQUOTED INVESTMENTS

Over the last year the Company has been busy growing the unquoted part of the

portfolio and we are delighted to report that this has delivered great

performance through a combination of IPOs, financing valuation uplifts and

strong income generation. As mentioned in previous reports, the focus of the

unquoted investments is to seek to generate both capital growth and income to

deliver the superior total return goal for the portfolio. Ongoing income from

the royalty investments has continued with the OZ Minerals Brazil Royalty

starting to benefit from the ramp-up of the Pedra Branca mine, whilst the Vale

Debentures enjoyed a better period of production despite lower iron ore prices

year-on-year.

Key highlights in the unquoted equity sleeve include Ivanhoe Electric which

completed its IPO in June despite the difficult market conditions. This

resulted in an increase in the value of the holding of over 100% in less than

10 months since the position was acquired. Elsewhere Bravo Mining completed its

IPO in July at a valuation 170% higher than the price paid for the shares in

May 2022. Both positions finished the year at a price higher than IPO and will

no longer be reported in the unquoted section of the portfolio as they are now

fully tradeable securities. Jetti Resources completed its Series D financing,

raising US$100 million at a substantial valuation uplift to our investment made

at the beginning of 2022. OZ Minerals received a takeover offer from BHP which

has been recommended by the OZ Minerals board and is expected to complete in Q2

of 2023 which will see BHP become the operator of the mines linked to our

royalty.

As at the end of 2022, the unquoted and illiquid investments in the portfolio

amounted to 6.6% of the portfolio and consist of the OZ Minerals Brazil

Royalty, the Vale Debentures, Jetti Resources and MCC Mining. These, and any

future investments, will be managed in line with the guidelines set by the

Board as outlined to shareholders in the Strategic Report.

We continue to actively look for opportunities to grow royalty exposure given

it is a key differentiator of the Company and an effective mechanism to lock-in

long-term income which further diversifies the Company's revenues.

OZ MINERALS BRAZIL ROYALTY CONTRACT

In July 2014 the Company signed a binding royalty agreement with Avanco

Minerals. The Company invested US$12 million in return for a Net Smelter Return

(net revenue after deductions for freight, smelter and refining charges)

royalty payments comprising 2% on copper, 25% on gold and 2% on all other

metals produced from mines built on Avanco's Antas North and Pedra Branca

licences. In addition, there is a flat 2% royalty over all metals produced from

any other discoveries within Avanco's licence area as at the time of the

agreement.

In 2018 Avanco was successfully acquired by OZ Minerals, an Australian based

copper and gold producer for A$418 million, with the royalty now assumed by OZ

Minerals. Since our initial US$12 million investment was made, we have received

US$22.1 million in royalty payments, with the royalty achieving full payback on

the initial investment in 3½ years. As at the end of December 2022, the royalty

was valued at £21.2 million (1.5% NAV) which equates to a 297.1% return on the

initial US$12 million invested.

In 2021 OZ Minerals achieved a significant milestone and commenced mining of

Pedra Branca ore. This year we have seen the ramp-up progress ahead of plan

with Pedra Branca on track to achieve its 2022 guidance of 10-12kt copper and

8-10koz gold, with the company targeting production beyond this level in 2023.

We continue to remain optimistic on the longer-term optionality provided by the

royalty via the development of Pedra Branca West, as well as greenfield

exploration over the licence area.

In August 2022, OZ Minerals received an initial indicative proposal from BHP to

acquire the company in an all-cash deal at A$25 per share. This offer was

rejected by the OZ Minerals board with BHP submitting a revised offer of

A$28.25 per share which was unanimously recommended in November 2022. The deal

remains subject to approval by OZ Minerals shareholders with the deal expected

to close in Q2 2023. This will see BHP operate the Brazilian assets and assume

the royalty, consistent with the mechanism used when OZ Minerals acquired

Avanco in 2018. We believe that BHP's strong operating focus, balance sheet

strength and ESG credentials leaves the Brazilian operations in a very strong

set of hands.

VALE DEBENTURES

At the beginning of 2019, the Company completed a significant transaction to

increase its holding in Vale Debentures. The Debentures consist of a 1.8% net

revenue royalty over Vale's Northern System and Southeastern System iron ore

assets in Brazil, as well as a 1.25% royalty over the Sossego copper mine. We

consider that the iron ore assets are world class given their grade, cost

position, infrastructure and resource life which is well in excess of 50 years.

As at the end of December 2022 the Company's exposure to the Vale Debentures

was 2.6%.

Dividend payments are expected to grow once royalty payments commence on the

Southeastern System in 2024 and volumes from S11D and Serra Norte improve into

2023 where project ramp-ups have been challenged in 2022 by licencing

requirements. In December, Vale reduced its longer-term iron ore production

profile in light of licencing challenges and also a greater focus on high grade

material. This now sees Vale target modest volume growth from the Northern

System out to 2026, but the improvement in grade, to the extent achieved, will

aid received pricing that the royalty will benefit from.

Despite the decline in iron ore prices during 2022, the Debentures continue to

offer an attractive yield of circa 10% based on the 1H-22 annualised dividend.

This is an attractive yield for a royalty investment, with this value

opportunity recognised by other listed royalty producers, Franco Nevada and

Sandstorm royalties, which have both acquired stakes in the Debentures since

the sell-down occurred in 2021.

Whilst the Vale Debentures are a royalty, they are also a listed security on

the Brazilian National Debentures System. As we have highlighted in previous

reports, shareholders should be aware that historically there has been a low

level of liquidity in the Debentures and price volatility is to be expected.

However, we expect this progressively to improve following the sell down in

April 2021.

IVANHOE ELECTRIC

In early August 2021 the Company made a US$20 million investment (equivalent to

1.3% of NAV) into Ivanhoe Electric, an exploration and mining business focused

on identifying and developing "electric metals" (copper, nickel, gold and

silver) required for the energy transition. The exploration portfolio is

focused in the US where they have developed a proprietary exploration

technology that has the ability to identify mineral resources at greater depths

than existing methods. The team is led by Robert Friedland who has a successful

track-record of identifying and developing world class mineral deposits such as

Voisey's Bay, Oyu Tolgoi and Kamoa-Kukula.

In June 2022 Ivanhoe Electric (2.4% of the portfolio) successfully completed an

IPO at US$11.75 per share. The Company's investment consisted of common shares

of Ivanhoe Electric, as well as convertible notes which convert at a discount

to the IPO price into Ivanhoe Electric shares with a total return of 91% on our

initial investment. During the course of 2022, the company has been focused on

exploration drilling at their Santa Cruz asset in Arizona which is the

third-largest undeveloped copper deposit in the US. An updated Santa Cruz

resource estimate and Preliminary Economic Analysis report is due to be

released in the first half of 2023 and we expect to see significant growth in

the size of the resource, based on recent drilling success at the existing

Santa Cruz deposit, as well as new discoveries at East Ridge and Texaco. 2023

is set to be an exciting year for Ivanhoe Electric with the company potentially

offering significant strategic benefit as a future low carbon producer of

copper in the US.

JETTI RESOURCES

In early 2022 the Company made an investment into mining technology company

Jetti Resources which has developed a new catalyst that appears to improve

copper recovery from primary copper sulphides (specifically copper contained in

chalcopyrite, which is often uneconomic) under conventional leach conditions.

Jetti is currently trialling their technology at 35 mines where they will look

to integrate their catalyst into existing heap leach SX-EW mines to improve

recoveries at a low capital cost. The technology has been demonstrated to work

at scale at the Pinto Valley copper mine, with further trials at different

copper assets planned for this year. If Jetti's technology is proven to work at

scale we see material valuation upside, with Jetti sharing in the economics of

additional copper volumes recovered through the application of their catalyst.

During the second half of 2022 we are pleased to report that Jetti completed

its Series D financing to raise US$100 million at a substantially higher

valuation than when our investment was made at the beginning of 2022. This sees

the company fully financed to execute on their expected growth plans in the

years ahead. As at the end of December, Jetti represented 2.1% of the

portfolio.

MCC MINING

MCC Mining (0.4% of the portfolio) operates as a mineral exploration company

focused on exploring for copper in Columbia. The company has several large

porphyry targets which we believe could have significant potential.

Shareholders include other mid to large cap copper miners, which is another

indication of the strategic value of the company. The valuation of the company

is based on the US$170.7 million equity value implied by the April 2022 equity

raise. The money raised will fund a drilling campaign which commenced in Q4

2022 at their Comita project, a joint venture with Rio Tinto, with drilling on

two other projects (Urrao and Pantanos) expected to commence in mid-2023.

Importantly, MCC's three projects are located in the Forestry Reserve in

Colombia which allows for exploration drilling in the forestry reserve based on

new regulations introduced in Colombia in early 2022.

BRAVO MINING

Bravo Mining (0.9% of NAV) is a Brazil-based mineral exploration and

development company focused on advancing the Luanga platinum group metals/gold/

nickel project in the world-class Carajas Mineral Province of Brazil. Due to

our belief in the asset's potential, the Company participated in a pre-IPO

round in April 2022, at a $39 million valuation. The proceeds of the raise were

used to fund drilling and survey work. Since the pre-IPO round the company has

decided to IPO, which completed in July at C$1.75/share. This represents a 170%

return since the Company's investment.

During the course of 2022, Bravo has been focused on drilling the historical

resource at Luanga which has confirmed and, in a number of cases, exceeded the

expectations of the original resource. With less than half of the phase 1

drilling analysed and a similar sized drill program scheduled for 2023, we

expect to see substantial growth in Luanga's resource where recent results show

rhodium and potential for nickel sulphide which was previously unknown. Bravo

is still in the early days of its journey and highlights the potential value

unlock available by backing quality management in attractive geological areas.

DERIVATIVES ACTIVITY

The Company from time to time enters into derivatives contracts, mostly

involving the sale of "puts" and "calls". These are taken to revenue and are

subject to strict Board guidelines which limit their magnitude to an aggregate

10% of the portfolio. In 2022 income generated from options was £7.3 million in

line with contributions from prior periods. During the year opportunities

presented themselves in the first few months and once again during the autumn

and into winter when volatility was priced at elevated levels. At the end of

the period the Company had 2.6% of the net assets exposed to derivatives and

the average exposure to derivatives during the period was less than 5%.

GEARING

At 31 December 2022, the Company had £125.0 million of net debt, with a gearing

level of 9.6%. The debt is held principally in US dollar rolling short-term

loans and managed against the value of the debt securities and the high

yielding royalty positions in the Company. During the year the Company sought

to maximise the use of gearing against the equity holdings rather than debt

securities. This was driven by the risk adjusted relative value available in

shares where dividend yields were mostly in excess of the coupons being paid on

the bonds. Since the companies in the portfolio also have strong balance

sheets, it was opportune to gear up the equity portfolio of the Company since

we were not adding debt to holdings that were already heavily leveraged

themselves.

Shareholders should note that the total gearing available to the Company has

increased during the year due to the rise in assets but remains within the

percentage limits set by the Board. On the back of this, facilities were

refreshed with our lenders and stand at £200 million for loans and £30 million

for the overdraft. The current average cost of debt for the Company remains low

at 2.82% and is linked to SONIA following the demise of LIBOR.

OUTLOOK

At the macro level it seems likely that the peak in the pace of interest rate

increases is behind us and, if anything, the economic background should become

more supportive for economic activity during the year assuming inflation

pressures start to fade. On the geo-political front, it is very hard to gauge

what will happen, but even if there is an end to conflict it will be many years

before sanctions are lifted and commodity trade routes reopen meaning that

ongoing disruption to supply will last longer than the conflict.

With the energy transition well under way and the Chinese economy emerging from

its self-imposed COVID-19 related disruption, the outlook for commodities

demand is strong. At the same time supply remains constrained by a range of

issues from permitting, elevated capital expenditure, delays due to ESG factors

and a scarcity of projects. It is these factors that fuel our ongoing positive

outlook for commodity prices and the fact that they are not yet priced into

valuations means there are plenty of opportunities within the mining equity

market.

At the company levels, despite all of the uncertainties at the start of the new

year, the mining sector goes forward on a strong footing as corporate balance

sheets remain some of the strongest of any equity sector. In addition, profit

margins continue at very healthy levels even after adjusting for the cost

inflation seen during the last year. However, it is worth pointing out that

free cash might easily be impacted by capital expenditure and decarbonisation

projects as the sector transitions to producing "greener" commodities needed

for the energy transition. The priority to allocate cash flow into these areas

means that there could be less available for dividends and as such the Company

might see a lower level of distributions. In the results announced to date in

2023, dividends from some of our portfolio companies have decreased.

EVY HAMBRO AND OLIVIA MARKHAM

BLACKROCK INVESTMENT MANAGEMENT (UK) LIMITED

2 March 2023

TEN LARGEST INVESTMENTS

1 + BHP (2021: 2nd)

Diversified mining group

Market value: £135,048,000

Share of investments: 9.5% (2021: 7.7%)

The world's largest diversified mining group by market capitalisation. The

group is an important global player in a number of commodities including iron

ore, copper, thermal and metallurgical coal, manganese, nickel, silver and

diamonds.

2 - Vale1,2 (2021: 1st)

Diversified mining group

Market value: £130,476,000

Share of investments: 9.1% (2021: 8.5%)

One of the largest mining groups in the world, with operations in 30 countries.

Vale is the world's largest producer of iron ore and iron ore pellets and the

world's largest producer of nickel. The group also produces manganese ore,

ferroalloys, metallurgical and thermal coal, copper, platinum group metals,

gold, silver and cobalt.

3 = Glencore (2021: 3rd)

Diversified mining group

Market value: £109,508,000

Share of investments: 7.7% (2021: 7.7%)

One of the world's largest globally diversified natural resources groups. The

group's operations include approximately 150 mining and metallurgical sites and

oil production assets. Glencore's mined commodity exposure includes copper,

cobalt, nickel, zinc, lead, ferroalloys, aluminium, thermal coal, iron ore,

gold and silver.

4 = Anglo American3 (2021: 4th)

Diversified mining group

Market value: £73,942,000

Share of investments: 5.2% (2021: 7.5%)

A global mining group. The group's mining portfolio includes bulk commodities

including iron ore, manganese, metallurgical coal, base metals including copper

and nickel and precious metals and minerals including platinum and diamonds.

Anglo American has mining operations globally, with significant assets in

Africa and South America.

5 + Rio Tinto (2021: 7th)

Diversified mining group

Market value: £63,652,000

Share of investments: 4.5% (2021: 4.2%)

One of the world's leading mining groups. The group's primary product is iron

ore, but it also produces aluminium, copper, diamonds, gold, industrial

minerals and energy products.

6 + First Quantum Minerals1 (2021: 10th)

Copper producer

Market value: £58,504,000

Share of investments: 4.1% (2021: 2.9%)

A Canadian-based mining and metals group with principal activities that include

mineral exploration, development and mining. Its main product is copper.

7 - ArcelorMittal1 (2021: 6th)

Steel producer

Market value: £57,127,000

Share of investments: 4.0% (2021: 5.2%)

A multinational steel manufacturing group, with a focus on producing safe

sustainable steel. The group has operations across the globe and is the largest

steel manufacturer in North America, South America and Europe.

8 - Freeport-McMoRan3 (2021: 5th)

Copper producer

Market value: £56,549,000

Share of investments: 4.0% (2021: 6.2%)

A global mining group which operates large, long-lived, geographically diverse

assets with significant proven and probable reserves of copper, gold and

molybdenum.

9 - Teck Resources (2021: 8th)

Diversified mining group

Market value: £51,395,000

Share of investments: 3.6% (2021: 3.6%)

A diversified mining group headquartered in Canada. The company is engaged in

mining and mineral development with operations and projects in Canada, the US,

Chile and Peru. The group has exposure to copper, zinc, metallurgical coal and

energy.

10 + Franco Nevada (2021: 14th)

Gold royalty

Market value: £37,460,000

Share of investments: 2.6% (2021: 2.2%)

A leading gold-focused royalty and streaming group with the largest and most

diversified portfolio of cash-flow producing assets. Its business model

provides investors with gold price and exploration optionality while limiting

exposure to cost inflation.

1 Includes fixed income securities.

2 Includes investments held at Directors' valuation.

3 Includes options.

All percentages reflect the value of the holding as a percentage of total

investments. For this purpose, where more than one class of securities is held,

these have been aggregated.

Together, the ten largest investments represented 54.3% of total investments of

the Company's portfolio as at 31 December 2022 (ten largest investments as at

31 December 2021: 57.0%).

INVESTMENTS AS AT 31 DECEMBER 2022

Main Market

geographical value % of

exposure £'000 investments

Diversified

BHP Global 135,048 9.5

Vale Global 93,137 } 9.1

Vale Debentures*#^ Global 37,339

Glencore Global 109,508 7.7

Anglo American Global 74,626 } 5.2

Anglo American Call Option 20/01/23 GBP£31.40 Global (684)

Rio Tinto Global 63,652 4.5

Teck Resources Global 51,395 3.6

Trident Global 5,793 0.4

--------------- ---------------

569,814 40.0

========= =========

Copper

First Quantum Minerals* Global 58,504 4.1

Freeport-McMoRan Global 56,848 } 4.0

Freeport-McMoRan Put Option 20/01/23 US$37 Global (299)

OZ Minerals Brazil Royalty# Latin 21,199 } 2.7

America

OZ Minerals Australasia 17,320

Ivanhoe Electric United 23,753 } 2.4

States

I-Pulse* United 10,727

States

Jetti Resources# Global 29,873 2.1

Ivanhoe Mines Other Africa 25,364 1.8

Sociedad Minera Cerro Verde Latin 17,171 1.2

America

Develop Global Australasia 15,316 1.1

Solaris Resources Latin 8,889 0.6

America

Ero Copper Latin 6,316 0.4

America

Antofagasta Latin 6,291 0.4

America

MCC Mining# Latin 5,819 0.4

America

Aurubis Global 5,139 0.4

Lundin Mining Global 3,490 0.2

Hudbay Global 2,371 0.2

SolGold Latin 346 -

America

--------------- ---------------

314,437 22.0

========= =========

Gold

Franco Nevada Global 37,460 2.6

Barrick Gold Global 32,994 2.3

Wheaton Precious Metals Global 32,472 2.3

Newmont Corporation Global 27,014 1.9

Newcrest Mining Australasia 19,719 1.4

Northern Star Resources Australasia 17,160 1.2

Endeavour Mining Other Africa 9,119 0.6

Agnico Eagle Mines Canada 6,594 0.5

Polymetal International United 2,306 0.2

Kingdom

Polyus Russia - -

--------------- ---------------

184,838 13.0

========= =========

Steel

ArcelorMittal* Global 57,127 4.0

Nucor United 28,520 } 2.0

States

Nucor Call Option 20/01/23 US$136 United (244)

States

Steel Dynamics United 22,285 1.6

States

Stelco Holdings Canada 7,457 0.5

--------------- ---------------

115,145 8.1

========= =========

Industrial Minerals

Sigma Lithium Latin 15,728 1.1

America

Albemarle Global 13,936 1.0

Mineral Resources Australasia 13,721 1.0

Sociedad Quimica y Minera ADR Latin 13,506 1.0

America

Iluka Resources Australasia 11,973 0.8

Lynas Rare Earths Australasia 10,191 0.7

Chalice Mining Australasia 7,602 0.5

Sheffield Resources Australasia 5,945 0.4

--------------- ---------------

92,602 6.5

========= =========

Aluminium

Norsk Hydro Global 30,036 2.1

Alcoa Global 16,798 1.2

--------------- ---------------

46,834 3.3

========= =========

Iron Ore

Labrador Iron Canada 24,172 1.7

Champion Iron Canada 14,546 1.0

Deterra Royalties Australasia 5,202 0.4

Equatorial Resources Other Africa 313 -

--------------- ---------------

44,233 3.1

========= =========

Platinum Group Metals

Bravo Mining Latin 11,287 0.9

America

Northam Platinum Global 6,050 0.4

Impala Platinum South Africa 6,011 0.4

Sibanye Stillwater South Africa 3,768 0.3

--------------- ---------------

27,656 2.0

========= =========

Nickel

Nickel Mines Indonesia 10,806 0.8

Bindura Nickel Global 60 -

Lifezone SPAC PIPE Commitment# Global - -

--------------- ---------------

10,866 0.8

========= =========

Mining Services

Epiroc Global 6,184 0.4

--------------- ---------------

6,184 0.4

========= =========

Uranium

Cameco Canada 5,363 0.4

--------------- ---------------

5,363 0.4

========= =========

Other

Woodside Energy Group Australasia 3,638 0.3

--------------- ---------------

3,638 0.3

========= =========

Zinc

Titan Mining United 2,007 0.1

States

--------------- ---------------

2,007 0.1

========= =========

Comprising: 1,423,617 100.0

========= =========

- Investments 1,424,844 100.1

- Options (1,227) (0.1)

--------------- ---------------

1,423,617 100.0

========= =========

* Includes fixed income securities.

# Includes investments held at Directors' valuation.

Mining royalty contract.

^ The investment in the Vale Debentures is illiquid and has been valued

using secondary market pricing information provided by the Brazilian Financial

and Capital Markets Association (ANBIMA).

All investments are in equity shares unless otherwise stated.

The total number of investments as at 31 December 2022 (including options

classified as liabilities on the balance sheet) was 68 (31 December 2021: 56).

As at 31 December 2022 the Company did not hold any equity interests in

companies comprising more than 3% of a company's share capital.

PORTFOLIO ANALYSIS AS AT 31 DECEMBER 2022

Commodity Exposure1

2022 portfolio 2021# portfolio 2022 Reference

Index*

Diversified 39.5% 39.4%

40.0%

Copper 22.0% 21.5% 9.3%

Gold 13.0% 16.4% 20.6%

Steel 8.1% 7.7% 16.5%

Industrial 6.5% 4.1% 2.4%

Minerals

Aluminium 3.3% 3.3% 3.8%

Iron Ore 3.1% 2.8% 3.9%

Platinum Group 2.0% 3.1% 2.6%

Metals

Nickel 0.8% 1.4% 0.1%

Mining Services 0.4% 0.0% 0.1%

Uranium 0.4% 0.0% 0.0%

Other& 0.3% 0.0% 0.9%

Zinc 0.1% 0.2% 0.4%

1 Based on index classifications.

# Represents exposure at 31 December 2021.

* MSCI ACWI Metals & Mining 30% Buffer 10/40 Index (net total return).

& Represents a very small exposure.

Geographic Exposure1

2022

Global 69.2%

Australasia 9.0%

Latin America 7.5%

Other2 7.1%

Canada 4.1%

Other Africa (ex South 2.4%

Africa)

South Africa 0.7%

2021

Global 69.9%

Latin America 8.0%

Other3 7.4%

Australasia 6.3%

South Africa 3.1%

Other Africa (ex South 3.1%

Africa)

Canada 2.2%

1 Based on the principal commodity exposure and place of operation of each

investment.

2 Consists of Indonesia, Russia, United Kingdom and United States.