TIDMONE

RNS Number : 1996B

One Delta PLC

28 March 2013

28 March 2013

One Delta plc

("One Delta" or the "Company")

Audited financial statements for the fourteen months ended 30

November 2012

Chairman's Statement

Restructure & Change of Director

As shareholders will be aware, the Company was admitted to

trading (following the completion of a reverse takeover) in January

2012. At the time of that transaction, One Delta Limited was an

early stage company with the majority of its business relationships

based on products that had yet to come to market. It was felt that

One Delta Limited was capable of offering exciting growth

opportunities because of these relationships and the Board had

hoped that they would come to fruition during the period under

review.

Unfortunately, One Delta Limited has faced considerable

challenges in achieving the revenue that the Board and shareholders

had hoped for since admission. New product launches, focused

primarily in the Construction Sector and Public Sector, in the

current economic environment have been very difficult and the team

have been further frustrated by longer sales cycles than expected.

In addition, the lack of one of the larger contracts that the team

had spent considerable time pursuing has undermined the Company's

ability to deliver growth. Ultimately, although the business has

moved from R&D to revenue, the size and pace of the development

has been well behind where the Board expected it to be at this

stage.

The results for the 14 months to 30 November 2012 show revenue

of GBP33,318 and a loss for the period of GBP780,602 excluding the

exceptional item of GBP1,135,755 being the impairment of goodwill.

At the period end the group had cash resources of GBP149,750.

Given the delay in commercialisation and the impact on

resources, it has been necessary for the Board to review the

structure and the business of the group.

Following discussions within the Board, we have concluded that

the best course of action would be to restructure the group to

maintain an ongoing interest in One Delta Limited while reducing

shareholders' exposure to any losses. As such, this will also allow

the Board to assess any other opportunities for the Company.

Accordingly, the Company has entered into a conditional share

purchase agreement to dispose of 47.5% of One Delta Limited to Phil

Dale, Richard Ludford and I. In consideration for the interest in

One Delta Limited we will transfer back to the Company our holding

of 15,000,005 ordinary shares in itself. These shares include

shares subscribed for and those received as consideration. These

shares will be held in treasury and it is intended that they will

be cancelled in due course.

In addition, upon completion of the transaction, the Company

will enter into a management agreement with One Delta Limited, Phil

Dale, Richard Ludford and I, which will govern how One Delta

Limited will be run following the transaction.

Completion of the proposed transaction is subject to certain

conditions including shareholder approval at an Extraordinary

General Meeting of the Company.

Following completion of the transaction but prior to

cancellation of the shares, the Company will have 31,574,356

ordinary shares in issue but only 16,574,351 voting rights.

One Delta Plc. will also maintain a keen interest in the success

of the trading business.

These changes are a positive step forward and ensure that One

Delta Plc. has the maximum flexibility and the trading business can

remain as a significant part of the business.

As a result of these changes, I have decided to stand down as

Chairman and resign from the Board, so I can focus my efforts on

the trading business, which I believe will be a major source of

future value for One Delta plc.

Related party transaction

Under the AIM Rules, the sale of part of One Delta Limited to

Phil Dale, Richard Ludford and I, is classified as a related party

transaction for the purposes of Rule 13 of the AIM Rules.

The Independent Directors, being Roger King and Roger Maddock,

having consulted with the Company's Nominated Adviser, Sanlam

Securities UK, consider the terms of the transaction to be fair and

reasonable insofar as the Company's shareholders are concerned. In

advising the Independent Directors, Sanlam Securities UK has taken

into account the commercial judgment of the Independent

Directors.

Sean Reel

Chairman

28 March 2013

Enquiries:

One Delta plc

Sean Reel, Executive Chairman Tel: +44 (0) 845

Roger King, Executive Director 0945 623

Tel: +44 (0)1534

511 750

Sanlam Securities UK Limited (Nominated Adviser

and Broker)

Simon Clements/Virginia Bull Tel: +44 (0)20 7628

2200

Consolidated Statement of Comprehensive Income

Company

Group Fourteen Group and

Fourteen months Company

months ended ended Year ended

30 November 30 November 30 September

2012 2012 2011

Note GBP GBP GBP

Sales income 33,318 - 380

Cost of sales (39,773) - -

-------------- -------------- ---------------

Gross loss (6,455) - 380

Other income 478 - 15,795

Rental expenses 4 (11,054) - (70)

Investment management fee 4 - - (88,288)

Other administrative expenses (753,571) (530,868) (201,362)

Finance income - - 2,290

Impairment of goodwill / investment

in subsidiary 4 (1,135,755) (1,360,000) -

Amortisation of intangible asset 4 (10,000) - -

-------------- -------------- ---------------

Net loss before taxation (1,916,357) (1,890,868) (271,255)

Taxation - - -

Provision for winding down expenses - - 265,524

-------------- -------------- ---------------

Net loss for the year from continuing

operations (1,916,357) (1,890,868) (5,731)

-------------- -------------- ---------------

Basic earnings per share (pence) 2 (7.3) (7.2) (0.2)

-------------- ---------------

Diluted earnings per share (pence) 2 (7.3) (7.2) (0.2)

-------------- ---------------

Notes

(a) The Group and Company had no recognised gains or losses

other than those disclosed in the Consolidated Statement of

Comprehensive Income.

(b) The loss per share is calculated on the weighted average

number of Participating Shares in issue during the year.

Consolidated Statement of Financial Position

30 November 30 September

2012 2011

Notes GBP GBP

Non-current assets

Goodwill 9 300,000 -

Intangible asset 9 40,000 -

------------ -------------

340,000 -

Current assets

Inventory 16,818 -

Other receivables 6 15,708 3,375

Cash and cash equivalents 149,750 310,096

------------ -------------

182,276 313,471

Liabilities - amounts falling due

within one year

Other payables 7 (54,199) (47,079)

Net current assets 128,077 266,392

Total net assets 468,077 266,392

------------ -------------

Equity

Stated capital 5,326,952 3,208,910

Capital reserve (706,395) (706,395)

Issue costs reserve (679,868) (679,868)

Revenue reserve (3,472,612) (1,556,255)

Total shareholders' funds (all equity) 468,077 266,392

------------ -------------

Company Statement of Financial Position

30 November 30 September

2012 2011

Notes GBP GBP

Non-current assets

Investment in subsidiaries 8 340,000 -

------------ -------------

340,000 -

Current assets

Intercompany loan 60,000 -

Other receivables 6 3,200 3,375

Cash and cash equivalents 125,733 310,096

------------ -------------

188,933 313,471

Liabilities - amounts falling due

within one year

Other payables 7 (35,367) (47,079)

Net current assets 153,566 266,392

------------ -------------

Total net assets 493,566 266,392

------------ -------------

Equity

Stated capital 5,326,952 3,208,910

Capital reserve (706,395) (706,395)

Issue costs reserve (679,868) (679,868)

Revenue reserve (3,447,123) (1,556,255)

------------ -------------

Total shareholders' funds (all equity) 493,566 266,392

------------ -------------

Statement of Cash Flows

Group Company Group and

Fourteen Fourteen Company

months ended months ended Year ended

30 November 30 November 30 September

2012 2012 2011

Notes GBP GBP GBP

Net cash outflow from operating

activities 10 (579,667) (329,913) (292,466)

Cash flow from investing activities

Cash from acquisition of subsidiary 107,832 - -

Interest income received - - 2,529

Deposit recovered - - 1,099,997

-------------- -------------- --------------

Net cash inflow from investing

activities 107,832 - 1,102,526

-------------- -------------- --------------

(Decrease) / increase in cash

before financing (471,835) (329,913) 810,060

-------------- -------------- --------------

Cash flow from financing activities

Shares issued 223,750 208,750 150,000

Loan payments received / (issued) 87,739 (63,200) -

Redemption of shares - - (1,434,735)

-------------- -------------- --------------

Net cash inflow / (outflow)

from financing activities 311,489 145,550 (1,284,735)

-------------- -------------- --------------

Net decrease in cash and cash

equivalents (160,346) (184,363) (474,675)

--------------

Cash and cash equivalents at

the start of the period 310,096 310,096 784,771

--------------

Cash and cash equivalents at

the end of the period 149,750 125,733 310,096

-------------- -------------- --------------

Statement of changes in equity

Stated Capital Issue costs Revenue

Group Capital reserve reserve reserve Total

GBP GBP GBP GBP GBP

For the fourteen months ended

30 November 2012

At 1 October 2011 3,208,910 (706,395) (679,868) (1,556,255) 266,392

Loss for the period - - - (1,916,357) (1,916,357)

Issue of fee shares 209,292 - - - 209,292

Issue of consolidation shares 1,700,000 - - - 1,700,000

Issue of participation shares 208,750 - - - 208,750

------------ ---------- ------------ ------------ ------------

At 30 November 2012 5,326,952 (706,395) (679,868) (3,472,612) 468,077

------------ ---------- ------------ ------------ ------------

For the year ended 30 September

2011

At 1 October 2010 4,493,645 (706,395) (679,868) (1,550,524) 1,556,858

Redemption of shares (1,434,735) - - - (1,434,735)

Issue of participation shares 150,000 - - - 150,000

Loss for the year - - - (5,731) (5,731)

------------ ---------- ------------ ------------ ------------

At 30 September 2011 3,208,910 (706,395) (679,868) (1,556,255) 266,392

------------ ---------- ------------ ------------ ------------

Stated Capital Issue costs Revenue

Company Capital reserve reserve reserve Total

GBP GBP GBP GBP GBP

For the fourteen months ended

30 November 2012

At 1 October 2011 3,208,910 (706,395) (679,868) (1,556,255) 266,392

Loss for the period - - - (1,890,868) (1,890,868)

Issue of fee shares 209,292 - - - 209,292

Issue of consolidation shares 1,700,000 - - - 1,700,000

Issue of participation shares 208,750 - - - 208,750

------------ ---------- ------------ ------------ ------------

At 30 November 2012 5,326,952 (706,395) (679,868) (3,447,123) 493,566

------------ ---------- ------------ ------------ ------------

For the year ended 30 September

2011

At 1 October 2010 4,493,645 (706,395) (679,868) (1,550,524) 1,556,858

Redemption of shares (1,434,735) - - - (1,434,735)

Issue of participation shares 150,000 - - - 150,000

Loss for the year - - - (5,731) (5,731)

------------ ---------- ------------ ------------ ------------

At 30 September 2011 3,208,910 (706,395) (679,868) (1,556,255) 266,392

------------ ---------- ------------ ------------ ------------

Notes

(a) The capital reserve arose from recognised losses on property development and holding.

(b) The issue costs reserve arose from expenses incurred on a share issue in 2006.

Notes to the financial statements

1. Basis of preparation

The financial information set out above does not constitute the

Company's statutory accounts for the 14 months ended 30 November

2012 and the year ended 30 September 2011, but is derived from

those accounts. Statutory accounts for 2011 have been delivered to

the Registrar of Companies and those for 2012 will be delivered

following completion of those accounts and the Company's Annual

General Meeting. The Auditors have reported on the accounts for the

14 months ended 30 November 201; their report was unqualified.

The financial statements have been prepared for a 14 month

period to align with new group accounting arrangements after the

acquisition of One Delta Limited. Users of these financial

statements should be aware that, because of this, amounts shown in

the Consolidated Statement of Comprehensive Income will not be

entirely comparable.

The consolidated financial statements have been prepared under

the historical cost convention, as modified to include the

revaluation of quoted investments and investment properties and in

accordance with applicable Accounting Standards as adopted by the

European Union. Applicable Accounting Standards for these purposes

are International Financial Reporting Standards ("IFRS"), as

adopted by the European Union.

Following the group restructuring carried out after the year end

and a review of the business plan and related commitments, the

Directors have concluded that the Group has adequate financial

resources to continue in operational existence for the foreseeable

future and therefore continue to adopt the going concern basis in

preparing the accounts.

2. Loss per share

Basic earnings per share amounts are calculated by dividing the

net loss for the period attributable to ordinary equity holders of

the Company by the weighted average number of participating

ordinary shares outstanding during the year.

Diluted earnings per share are not applicable to the Company,

since there is only one participating class of share issued by the

Company.

The following reflects the income and share data used in the

basic earnings per share computation:

Group fourteen Company fourteen Group and

months months ended Company year

ended 30 30 November ended 30 September

November 2012 2012 2011

Loss attributable to ordinary

shareholders GBP(1,916,357) GBP(1,890,868) GBP(5,731)

Weighted average of shares

in issue 26,366,056 26,366,056 2,869,107

Basic and diluted loss per

share (7.3)p (7.2)p (0.2)p

3. Operating segment

The subsidiary company, One Delta Limited, is currently in the

early stages of developing its technology and hence only has one

operating and geographical segment.

4. Other operating expenses

The profit for the period is stated after charging the

following:

Group

Fourteen Company Fourteen Group and

months months ended company

ended 30 30 November Year ended

November 2012 30 September

2012 2011

GBP GBP GBP

Impairment of goodwill / investment

in subsidiary 1,135,755 1,360,000 -

Amortisation of intangible assets 10,000 - -

Director loans written off 80,509 - -

Wages and salaries 69,945 - -

Research and development 16,386 - -

Auditors' fees - for audit services 20,300 17,900 12,700

Other amounts due to auditors 3,600 3,600 -

Directors' remuneration 62,616 62,616 40,333

Cost of inventories sold 39,773 - -

Rental expenses 11,054 - 70

Provision for winding down expenses - - (265,524)

Acquisition costs 227,129 227,129 -

5. Taxation

Profits arising in the company for the 2012 Year of Assessment

will be subject to Jersey Income Tax at the rate of NIL per cent

(2011: NIL per cent).

30 November 30 September

2012 2011

Reconciliation of taxable profit

Net loss on ordinary activities before finance

costs and taxation

(1,916,357) (271,255)

Adjustment for disallowable income and expenses 1,916,357 271,255

------------ -------------

Taxable profit - -

------------ -------------

6. Other receivables

Group Company

30 November 30 September 30 November 30 September

2012 2011 2012 2011

GBP GBP GBP GBP

Accounts receivable 15,708 - 3,200 -

Prepayments - 3,375 - 3,375

------------ -------------

15,708 3,375 3,200 3,375

------------ ------------- ------------ -------------

7. Other payables

Group Company

30 November 30 September 30 November 30 September

2012 2011 2012 2011

GBP GBP GBP GBP

Accruals 37,320 30,200 18,488 30,200

Tax 16,879 16,879 16,879 16,879

------------ -------------

54,199 47,079 35,367 47,079

------------ ------------- ------------ -------------

8. Investment in subsidiaries

The Company has the following investments in subsidiaries:

Country of Class of

Incorporation shares held %

England and

One Delta Limited Wales Ordinary 100%

England and

Fusion Delta Limited Wales Ordinary 100%

On 23 December 2011 the Company acquired the entire shareholding

of One Delta Limited. The consideration of GBP1,700,000 was met by

the issue of 21,250,002 shares in One Delta plc. to the previous

shareholders of One Delta Limited. The value of 8 pence per share

was a combination of the value attributed to Cholet Investments

plc. and the price at which investors were prepared to subscribe

the additional GBP275,750 on the reverse take-over.

Of the issue of these shares, 89% were defined as Locked-in and

therefore specified shareholders were unable to dispose of any

shares until 12 months after the date of admission to trading on

the AIM.

One Delta Limited is incorporated in the United Kingdom and is

100% owned by One Delta plc. The results of One Delta Limited are

included within these financial statements.

One Delta Limited GBP GBP

Cost 1,700,000

Cash 107,832

Accounts receivable 116,567

Intangible asset 50,000

Accounts payable (15,218)

Other payable (11,736)

Inventory 16,800

---------

264,245

----------

Goodwill 1,435,755

----------

In the interim financial statements, goodwill was shown at a

value of GBP1,468,981. Since then, the directors have re-assessed

the cost of One Delta Limited to include Intellectual Property at

GBP50,000, to be amortised over 5 years, and have impaired the

value of goodwill to GBP300,000 (see note 9). Goodwill will be

reviewed for impairment on an annual basis. The accounts receivable

amount included director loans totaling GBP80,509 which were

written off during the period.

The reason for the business combination is in order for the

trading company to enhance its marketing ability and thereby

attract more sales through its relationship with the plc. The

goodwill was attributed to the chance of acquiring a number of

significant contracts.

The statement of comprehensive income includes turnover of

GBP33,318 and loss of GBP239,734 of the subsidiary since

acquisition. Had the subsidiary been acquired at the start of the

reporting period, turnover and profit would not have been

significantly different to that reported.

9. Intangible assets

Included in the financial statements is Intellectual Property

which the directors have valued at GBP50,000.

One Delta Limited has developed a portfolio of products that can

be produced from waste plastic. No similar products have been sold

therefore the valuation is based on known costs of GBP30,248 plus

some unaccounted costs.

Total

other

Patents Development intangible

Goodwill and and other assets

trade-marks costs

Cost GBP GBP GBP GBP

Balance at 1 October 2010

and 30 September 2011 - - - -

Balance at 1 October 2011 - - - -

Acquisitions through business

combinations 1,435,755 7,020 42,980 50,000

Balance at 30 November 2012 1,435,755 50,000

----------- ------------

Amortisation and impairment

Balance at 1 October 2010

and 30 September 2011 - -

Balance at 1 October 2011 - -

Amortisation and impairment

for the year 1,135,755 (10,000)

Balance at 30 November 2012 1,135,755 (10,000)

----------- ------------

Net book value

Balance at 1 October 2010

and 30 September 2011 - -

Balance at 1 October 2011 - -

Balance at 30 November 2012 300,000 40,000

----------- ------------

It has been estimated that the intangible asset has a useful

life of 5 years and is therefore being amortised on a straight line

basis at GBP10,000 per year with the carrying value at 30 November

2012 being GBP40,000.

It is clear that One Delta Limited has faced considerable

challenges in achieving the revenue that the Board and Shareholders

had hoped for in 2012. Launching new products, focused primarily in

the Construction Sector and Public Sector with current economic

activity being severely constrained has been very difficult.

This was further frustrated by unusually long sales cycles and

the lack of the Olympic contracts that the team had spent

considerable time pursuing.

The amortisation and impairment charges are shown separately in

the Consolidated Statement of Comprehensive Income.

There is only one cash generating unit thus the figures above

represent the total amortisation and impairment deductions for the

Company. The recoverable amount is forecast to be GBP329,573 and

has been calculated with reference to its value in use. The

directors consider 12% to be appropriate for One Delta Limited on

the basis of the anticipated risk and return.

Management forecasts are based on a 5 year period with sales

expected to increase at 30% per annum until the trading year

2015/16 and at 50% per annum thereafter. Costs of sales are

expected to remain at a constant percentage of sales whilst other

costs are expected to increase at between 10% and 20% over the same

5 year period. Management have assumed that any future price rises

in cost of sales will be negated by the ability to purchase with

volume discounts.

The growth rates used in the value in use calculation reflect

the rates currently experienced in the construction sector.

10. Cash outflow from operating activities

Fourteen

months ended Year ended

30 November 30 September

2012 2011

GBP GBP

Rental income received - 2,268

Deposit interest received - 2,529

Sales income 33,548 -

Other income 478 15,787

Investment management fees paid - (88,288)

Purchase of stock (15) -

Rental expenses (10,445) (70)

Other expenses (603,233) (224,692)

Net cash outflow from operating activities (579,667) (292,466)

-------------- ---------------

11. Related party transactions

The compensation of key management personnel, including the

directors, is as follows:

2012 2011

GBP GBP

Director fees 1,616 40,333

Share based payments 61,000 -

Roger King and Roger Maddock hold 25,640 shares and 998,556

shares respectively and are directors of the Company. Roger King

and Roger Maddock agreed that from 31 March 2011 all fees due under

their service contracts would become payable following, and

conditional upon, a reverse takeover being undertaken by the

Company and in consideration for such waiver of fees, that if fees

should become payable, they would be paid at double their usual

rate. At 30 September 2011 Roger King was due GBP10,000 and Roger

Maddock was due GBP5,000. These fees were satisfied in the

introduction of share capital on 23 December 2011.

Roger King and Donald Reid are directors of Anglo Saxon Trust

Limited, who act as administrator to the Company. Fees paid to this

company during the period amounted to GBP46,200 (2011:GBP41,614).

Balances due to Anglo Saxon Trust Limited at the period end

amounted to GBP2,093 (2011:GBPnil).

During the period, the following balances due from the directors

of the parent company and the subsidiary were written off:

GBP

Sean Reel 17,073

Phil Dale 63,436

12. Post balance sheet event

Given the delay in commercialisation and the impact on

resources, it has been necessary for the Board to review the

structure and the business of the group.

Following discussions within the Board, it was concluded that

the best course of action would be to restructure the group to

maintain an ongoing interest in One Delta Limited while reducing

shareholders' exposure to any losses. As such, this will also allow

the Board to assess any other opportunities for the Company. A full

explanation of this restructuring is noted in the Chairman's

Statement.

13. Copies of the report and accounts

Copies of the Report and Accounts will be posted to shareholders

shortly and will be available from the Company's registered office

at PO Box 264, JP Morgan House, Grenville Street, St. Helier,

Jersey JE4 8TQ and on its website www.onedeltaplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BLGDXSBDBGXI

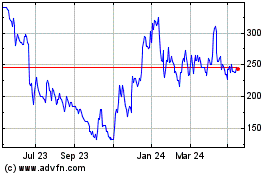

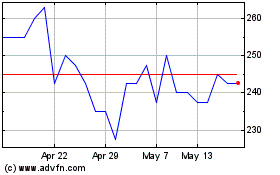

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jul 2023 to Jul 2024