TIDMBOOM

RNS Number : 2227Y

Boomerang Plus PLC

28 February 2012

28 February 2012

Boomerang Plus plc

('Boomerang', 'the Company' or 'the Group')

Interim Results

Boomerang Plus plc (AIM: BOOM.L), a profitable media investment

group, announces its interim results for the six months to 30

November 2011.

These interim results illustrate the successful transformation

of Boomerang into a higher-margin multi-genre, multi-platform media

group with increasingly diversified revenue streams.

FINANCIAL HIGHLIGHTS

-- Revenue of GBP15.99m (2011: GBP16.29m).

-- Gross profit up 14.1% to GBP2.83m (2011: GBP2.48m).

-- Gross margin up 16.5% to 17.7% (2011: 15.2%)

-- Adjusted EBITDA**up 10.6% to GBP1.36m (2011: GBP1.23m).

-- Adjusted operating profit* up 8% to GBP0.95m (2010: GBP0.88m).

-- Profit before tax of GBP0.71m (2011: GBP0.79m).

-- Adjusted basic EPS* up 15.5% to 7.44p (2011: 6.44p).

-- Cash and cash equivalents up 8% to GBP4.06m (2011: GBP3.76m).

OPERATIONAL HIGHLIGHTS

-- Acquisition of Oxford Scientific Films in June 2011.

-- Acquisition of Harlequin Talent Agency, through a joint

venture with Bryn Terfel, in July 2011.

-- Continued organic growth of Advertiser Funded Programming ("AFP").

-- Creation of Gorilla facilities group through merger of Mwnci

and Boomerang's in-house facilities.

-- Gorilla's acquisition and expansion of Bait Studio Limited, a graphics and VFX company.

OUTLOOK

-- Continuing growth in our Factual and AFP businesses.

-- Strong balance sheet to support future growth with net assets of GBP10m.

-- Current trading remains in line with Board's expectations

Huw Eurig Davies, Chief Executive Officer of Boomerang Plus,

commented:

"The acquisition of Oxford Scientific Films has accelerated

strong growth in our Network and AFP businesses as we continue to

diversify the Group's customer base and widen its intellectual

product base. This will continue to offset the impact of reduced

funding for S4C and provide us with future revenue growth and

opportunities to increase our gross profit margins. The Group will

also continue to look for further acquisitions that can add value

for shareholders in a fast-changing media marketplace."

* adjusted for professional fees in relation to corporate

transactions (2011 - GBP0.11m, 2010 - 0.01m), reorganisation costs

(2011 - GBP0.06m, 2010 - GBPnil), and amortisation of intangible

assets arising on business acquisitions (2011 - GBP0.01m, 2010 -

GBP0.01m).

**adjusted operating profit as defined above before depreciation

(2011 - GBP0.39m, 2010 - GBP0.34m) and other amortisation (2011 -

GBP0.02m, 2010 - GBP0.01m).

Contacts:

Boomerang Plus plc Tel : 029 2067 1500

Huw Eurig Davies, Chief Executive

Officer

Mark Fenwick, Finance Director

finnCap Limited Tel: 020 7600 1658

Geoff Nash/Charlotte Stranner

Simon Starr/Victoria Bates (broking)

Walbrook PR Ltd Tel: +44 (0)20 7933 8780

Paul Cornelius paul.cornelius@walbrookpr.com

About Boomerang Plus plc (www.boomerang.co.uk)

Boomerang Plus plc has strategic investments in a number of

complementary media businesses including production companies

Alfresco, Apollo, Boomerang, Bulb, Fflic, Indus and Oxford

Scientific Films; facilities companies Gorilla and Zoom;

multi-media publisher Boom Extreme Publishing; talent companies

Halequin and Boom Talent; event company Big Freeze Limited, and

education and corporate production business Media4.

Boomerang Plus's strategy is to continue to acquire, invest in

and develop media companies that complement the Group's existing

businesses, whilst also achieving strong organic growth.

Business Review

Financial Review

As highlighted in our 2011 preliminary results statement

released in September, the Group has had a strong first half of the

year. Headline revenues have been resilient during the period at

GBP16m (2011 - GBP16.3m), with the reductions arising from S4C's

reduced funding being largely offset by increases in organic

Network and AFP programming as well as the first full six month

contribution by Oxford Scientific Films acquired in June 2011.

The Group's key performance indicators are gross profit,

adjusted earnings before interest, tax, depreciation and

amortisation ("adjusted EBITDA**") and adjusted operating

profit.

Gross profit increased by 14.1% to GBP2.83m (2011 - GBP2.48m)

due to the accelerating contribution from our higher gross margin

Network and AFP programming businesses. Gross profit margin also

expanded 16.5% during the period to 17.7% (2011 - 15.2%), despite

continued downward pressure on overall programme budgets.

Adjusted EBITDA** increased by 10.6% to GBP1.36 million (2011 -

GBP1.23 million).

During the year the Group continued the restructuring and

relocation of its businesses, including relocating Oxford

Scientific Films to new premises in Warwick Street, London and the

merger of Mwnci and Boomerang's in-house facilities to create

Gorilla, the Group's post production and facilities business.

Following the implementation of IFRS 3 - Business Combinations,

professional fees in respect of acquisitions have been expensed in

the current period.

The above factors contributed to an increase in adjusted

operating profits* of 8% to GBP0.95 million (2011 - GBP0.88

million).

The Group's substantial capital expenditure programme of recent

years is now past its peak and capital expenditure reduced to

GBP0.32 million (2010 - GBP0.82 million) in the period to 30

November 2011. Finance lease repayments during the period were

GBP0.30 million (2010 - GBP0.29 million). The acquisition of Oxford

Scientific Films resulted in a net cash inflow of GBP0.18m and was

by means of the purchase of assets and certain liabilities

including GBP0.30 million in respect of a substantial back

catalogue. Therefore, cash and cash equivalents increased 8% to

GBP4.06 million as of 30 November 2011 (2010 - GBP3.76

million).

At 30 November 2011 the Group had net assets of GBP10 million

(2010 - GBP9.53 million). The Group has considerable headroom

within its current bank facilities together with long-term

relationships with its key customers. Due to the nature of the

Group's business, management has good visibility over its pipeline

of productions for the foreseeable future, which is fully funded by

its customers. The Group's forecasts and projections show that the

Group should be able to operate within the level of its current

facility.

* adjusted for professional fees in relation to corporate

transactions (2011 - GBP0.11m, 2010 - 0.01m), reorganisation costs

(2011 - GBP0.06m, 2010 - GBPnil), and amortisation of intangible

assets arising on business acquisitions (2011 - GBP0.01m, 2010 -

GBP0.01m).

**adjusted operating profit as defined above before depreciation

(2011 - GBP0.39m, 2010 - GBP0.34m) and other amortisation (2011 -

GBP0.02m, 2010 - GBP0.01m).

Operations

The Group continued to produce a strong, multi-genre portfolio

of multi-platform content for our broadcast and corporate customers

during the period.

Organic Network commissions during the period included the third

series of "Road to London 2012: That Paralympic Show", a

multi-platform magazine series covering the run up to the London

2012 Paralympic Games, and we are currently in production of series

4. We are currently in production of "Tales of Friendship with

Winnie the Pooh" a 72 x 5 minutes order for Disney Junior EMEA,

which coincides with a book of the same name. Other Disney work

included interstitial productions for Disney 365 on Cars 2 and Epic

Mickey.

AFP commissions during the period included a series of BT

Documentary films featuring their sponsored Paralympic athletes

including Oscar Pistorius; a high volume digital marketing campaign

for Bacardi Brands Global for a new Rum called Bacardi Oakheart; a

third year producing Relentless Freeze, Europe's biggest Snow and

Music Festival held annually in Battersea Power Station; major live

OB surfing events for Quiksilver including World Tour events

Quiksilver Pro France and Roxy Pro Biarritz; and a third season of

Nissan/Sony Playstation GT Academy, the virtual-to-reality motor

racing competition, once again hosted by F1 luminaries Eddie Jordan

and Johnny Herbert and filmed across Australia, New Zealand, Europe

and the UK, including for the first time a series for the USA

market.

Complementing this organic success the newly acquired Oxford

Scientific Films ("OSF") added to the existing Indus Fims creates a

substantial and growing Factual division. Indus has been very busy

during the period with exciting new commissions for the BBC and

paid development for Channel 4. They are about to deliver a

six-part series for BBC2 exploring the challenges facing the UK

fishing industry and are filming an observational series about how

London feeds itself, also for BBC2. Indus has also recently opened

an office in Bristol with new Executive Producer Lucy Carter on

board.

OSF delivered its first 3D production, Meerkats 3D to Sky and

National Geographic. The film aired in November 2011 in the UK and

is about to be released theatrically into museums worldwide. A

second 3D natural history film is in development with the same

partners. The second season of Fatal Attractions aired to strong

ratings on Animal Planet in the US and an uplift order for a

further 6 episodes has been received. Rory McGrath's Pub Dig, a new

4 part series blending history with archaeology and comedy went

into production for History UK and Channel 5. OSF received its

first orders from BBC1 for a broadcast pilot for a new medical

series called How to Beat.... featuring Harley Street doctors Dr

Jack Kreindler and Professor Greg Whyte; and a high end science

series. OSF is currently in pre-production on a high end

archaeology special for Channel 4 and Terra Mater; and a pilot for

a new series for Animal Planet US.

Boomerang has also produced a range of multi-genre programming

for the local Welsh Broadcasters, S4C and BBC Wales, during the

period. These include the "Stwnsh" and "Cyw" children's services;

drama series "Teulu"; factual entertainment series "Cariad@Iaith",

"Gwlad Beirdd", "Llais i Gymru", "Wales on Wheels", "Only Boys

Aloud 2" and "3Lle"; entertainmment series "Seren Rhos" and

"Noson"; factual series "Arts Review of the Year" and "Iris Prze";

music series "Bandit" and "Nodyn"; youth series "Gofod"; the Royal

Welsh show and sports series "Ras i Lundain" amongst others.

Post-production and facilities

On 5 September 2011, the Group announced that its

post-production subsidiary, Mwnci, had rebranded as Gorilla and

expanded to incorporate all of the Group's in-house facilities.

Gorilla will now be providing studios, dubbing, grading, graphics

and outside broadcast facilities to programme makers and producers

in addition to increasing its established range of editing

services. Gorilla will be one of the biggest facilities companies

outside London and the largest in Wales.

Gorilla acquired Bait Studio Limited during the period and is

investing further to create a substantial graphics and VFX

business.

Talent management

The joint investment into Harlequin Agency Limited, through a

50% joint venture with Bryn Terfel, will lead to a significant

increase in scale of our talent business and we have transferred

the trade of our existing Boom Talent to Harlequin in order to

maximise cost synergies and growth opportunities.

Segmental Information

As the majority of the Group's facilities will no longer be

fully integrated in the future, the Group anticipates making

segmental disclosures in its account for the year ended 31 May

2012.

Outlook

The acquisition of Oxford Scientific Films together with organic

growth in Network and AFP productions have all contributed to

diversifying the Group's customer base and widening its

intellectual product base. This will continue to drive further

growth in an increasingly global market and provide us with

opportunities to increase our gross profit margins.

The Group's pipeline of productions for the 2012 calendar year

remains in line with the Board's expectations and shows further

diversification of our customer base. This will both mitigate the

impact of S4C's reduced programming budgets following the

Government's Comprehensive Spending Review and deliver long

term-term benefits to the Group. We will continue to drive organic

growth and look for further acquisitions that can add value for

shareholders in the rapidly-changing media marketplace.

Huw Eurig Davies Mark Fenwick

Chief Executive Officer Finance Director

28 February 2012 28 February 2012

Condensed Consolidated Income Statement

Six months ended 30 November 2011 (unaudited)

Six months Six months

ended 30 ended 30 Year ended

November November 31 May

Note 2011 2010 2011

GBP'000 GBP'000 GBP'000

Revenue 15,984 16,295 26,933

Cost of sales (13,150) (13,811) (22,380)

Gross profit 2,834 2,484 4,553

Administrative expenses

Other administrative expenses (1,908) (1,631) (3,428)

Professional fees in relation

to corporate transactions (107) (10) (17)

Reorganisation costs (61) - -

Amortisation of intangibles arising

on business acquisitions (10) (10) (20)

Total administrative expenses (2,086) (1,651) (3,465)

Other operating income 31 37 76

Loss on disposal of fixed assets (8) - -

Share of results of joint ventures

and associates - (12) (30)

Operating profit 771 858 1,134

Investment income - 3 4

Finance costs (58) (73) (118)

Profit before tax 713 788 1,020

Tax on profit on ordinary activities 2 (228) (234) (469)

Profit for the period 485 554 551

Attributable to:

Equity holders of parent company 482 554 551

Minority interests 3 - -

485 554 551

Earnings per share 3

Basic 5.44p 6.21p 6.18p

Diluted 5.38p 6.13p 6.10p

Adjusted - basic 7.44p 6.44p 6.60p

Adjusted - diluted 7.36p 6.35p 6.51p

All activities derive from continuing operations.

The Group has no material items of comprehensive income in the

current or prior period other than the profit for the period and as

such has not presented a separate condensed consolidated statement

of comprehensive income.

Condensed Consolidated Balance Sheet

As at 30 November 2011 (unaudited)

30 30 31

November November May

2011 2010 2011

GBP'000 GBP'000 GBP'000

NON-CURRENT ASSETS

Goodwill 2,822 3,039 2,822

Other intangible assets 2,701 2,430 2,442

Property, plant and equipment 3,443 3,401 3,606

Investments 443 360 342

9,409 9,230 9,212

CURRENT ASSETS

Inventories 9 - 6

Trade and other receivables 3,255 3,461 4,064

Current tax assets - 219 -

Cash and cash equivalents 4,062 3,761 2,588

7,326 7,441 6,658

TOTAL ASSETS 16,735 16,671 15,870

CURRENT LIABILITIES

Trade and other payables 4,260 4,256 3,926

Current tax liabilities 457 374 232

Interest-bearing loans and borrowings 787 735 581

Deferred consideration 195 109 192

5,699 5,474 4,931

NON-CURRENT LIABILITIES

Interest-bearing loans and borrowings 319 634 634

Other payables 61 76 84

Deferred tax liabilities 204 219 264

Deferred consideration 433 734 426

1,017 1,663 1,408

TOTAL LIABILITIES 6,716 7,137 6,339

NET ASSETS 10,019 9,534 9,531

Condensed Consolidated Balance Sheet

As at 30 November 2011 (unaudited)

30 30 31

November November May

2011 2010 2011

GBP'000 GBP'000 GBP'000

EQUITY

Share capital 89 89 89

Share premium account 3,934 3,934 3,934

Merger reserve 1,217 1,217 1,217

Retained earnings 4,776 4,294 4,291

Equity attributable to equity holders

of the parent 10,016 9,534 9,531

Minority interests 3 - -

10,019 9,534 9,531

These condensed consolidated interim statements were approved by

the Board of Directors on 28 February 2012.

Signed on behalf of the Board of Directors

H E Davies M W Fenwick

Director Director

Condensed Consolidated Cash Flow Statement

Six months ended 30 November 2011 (unaudited)

Six months

ended 30 Six months Year ended 31 May

November ended 30 2011

Note 2011 November

2010

NET CASH INFLOW FROM OPERATING ACTIVITIES 4 1,724 1,473 833

INVESTING ACTIVITIES

Interest received - 3 4

Purchase of property, plant and equipment (101) (393) (531)

Acquisition of subsidiaries - net cash inflow arising on

acquisition 179 - -

Acquisition of subsidiaries - deferred consideration payments - (211) (229)

Acquisition of joint ventures and associates (101) - (1)

Acquisition of intangible fixed assets (2) - (49)

Proceeds on disposal of property, plant and equipment 84 7 10

NET CASH USED IN INVESTING ACTIVITIES 59 (594) (796)

FINANCING ACTIVITIES

Repayments of obligations under finance leases (309) (288) (659)

Grants received - 100 140

NET CASH USED IN FINANCING ACTIVITIES (309) (188) (519)

NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS 1,474 691 (482)

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 2,588 3,070 3,070

CASH AND CASH EQUIVALENTS AT END OF PERIOD 4,062 3,761 2,588

Condensed Consolidated Statement of Changes in Equity

Six months ended 30 November 2011 (unaudited)

Share

Share premium Merger Retained

capital account reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 June

2010 89 3,934 1,217 3,744 8,984

Profit for the financial

period - - - 554 554

Foreign exchange - - - (4) (4)

Balance at 30 November

2010 89 3,934 1,217 4,294 9,534

Loss for the financial

period - - - (3) (3)

Balance at 31 May

2011 89 3,934 1,217 4,291 9,531

Profit for the financial

period - - - 482 482

Foreign exchange - - - 3 3

Balance at 30 November

2011 89 3,934 1,217 4,776 10,016

The Group has taken advantage of section 612 of the Companies

Act 2006 and so the excess over the nominal value of shares issued

other than for cash has been allocated to the merger reserve.

1. BASIS OF PREPARATION AND ACCOUNTING

The interim financial information does not constitute statutory

accounts for the purpose of section 434 of the Companies Act 2006.

The figures for the year ended 31 May 2011 have been extracted from

the Group's audited accounts for that year. Those accounts have

been reported on by the Group's auditors and delivered to the

Registrar of Companies. The report of the auditors was (i)

unqualified, (ii) did not include a reference to any matters to

which the auditors drew attention by way of emphasis without

qualifying their report, and (iii) did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

The interim financial information for the six months ended 30

November 2011 and 30 November 2010 has not been audited or reviewed

by the auditors. The interim results have been prepared using the

same accounting policies and estimation techniques that are

expected to apply at the year-end and is consistent with the

accounting policies disclosed in the Group's annual report for the

year ended 31 May 2011.

2. tax

Taxation for the six-month period is charged at the best

estimate of the average annual effective income tax rate expected

for the full year, applied to the pre-tax income of the six-month

period.

31

30 November 30 November May

2011 2010 2011

GBP'000 GBP'000 GBP'000

UK taxation at standard rate 291 275 437

Deferred taxation (63) (41) 32

228 234 469

3. earnings per share

31

30 November 30 November May

2011 2010 2011

Earnings GBP'000 GBP'000 GBP'000

Profit for the period 485 554 551

Professional fees in relation to unsuccessful

corporate transactions 107 10 17

Reorganisation costs 61 - -

Amortisation of intangibles arising on

business acquisitions 10 10 20

Adjusted profit 663 574 588

Number of shares No. No. No.

Weighted average number of ordinary shares 8,914,731 8,914,731 8,914,731

Dilutive weighted average number of shares 9,011,143 9,036,676 9,031,436

Earnings per ordinary share - basic 5.44p 6.21p 6.18p

Earnings per ordinary share - diluted 5.38p 6.13p 6.10p

Adjusted earnings per share - basic 7.44p 6.44p 6.60p

Adjusted earnings per share - diluted 7.36p 6.35p 6.51p

4. notes to the condensed consolidated cash flow statement

31

30 November 30 November May

2011 2010 2011

GBP'000 GBP'000 GBP'000

Profit from operations 771 858 1,134

Adjustment for:

Amortisation of intangible fixed assets 32 29 57

Depreciation of property, plant and equipment 392 339 721

Loss on property, plant and equipment

disposals 8 - 15

Government grants (25) (33) (66)

Results of joint ventures and associates - 12 30

Minority interests (3) - -

Foreign exchange 10 (9) (13)

Operating cash flows before movement in

working capital 1,185 1,196 1,878

Decrease in receivables 396 724 312

Increase/(decrease) in payables 255 (397) (974)

(Increase)/decrease in inventory (3) 9 3

Cash generated from operations 1,833 1,532 1,219

Income taxes received/(paid) (62) 14 (288)

Interest paid (47) (73) (98)

Net cash inflow from operating activities 1,724 1,473 833

5. AVAILABILITY OF INTERIM RESULTS

A copy of the interim report will be available for members of

the public by application to the Company's Registered Office or on

the Company's website at www.boomerang.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BRGDDUSDBGDR

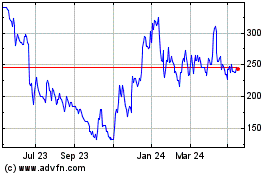

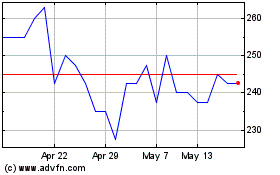

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jul 2023 to Jul 2024