TIDMBIRD

RNS Number : 7693D

Blackbird PLC

07 March 2022

7 March 2022

Blackbird plc

("Blackbird" or the "Company")

Audited full year results for the year ended 31 December

2021

Blackbird plc (AIM: BIRD, OTCQX: BBRDF), the technology

licensor, developer and seller of the multi award-winning

cloud-native video editing platform, Blackbird , announces its

audited full year results for the year ended 31 December 2021.

Ian McDonough, CEO of Blackbird, commented:

"I am thrilled to firstly report record revenues for the fourth

consecutive year of GBP2.07 million, up 32% on the previous year

and also to be able to explain how 2021 has laid the groundwork for

the transformation of Blackbird in the long term. 2021 has been

transformational in multiple ways for the Company with more

high-profile customer wins, our first technology licensing deal,

the launch of the 'Powered by Blackbird' brand for technology

licensing, followed by a successful GBP8.0 million fundraise in

December to develop 'Powered by Blackbird' products based on our

core IP and launch them into new markets."

"Blackbird published two strategic white papers in the year. The

first one was on sustainability highlighting the impact of the

media industry on the environment and how using cloud native

solutions, such as Blackbird, can dramatically reduce carbon

emissions. The second one was on Total Cost of Ownership showing

that although Blackbird takes up to a 10x share of wallet compared

to traditional editing software it is still up to 35% cheaper than

other cloud-based workflows. As sustainability rapidly grows in

importance on the agenda of Companies within the media industry,

Blackbird's credentials of lowering carbon emissions by up to 91%

compared to other cloud-based workflows, coupled with the Company's

cost benefits will provide a compelling reason to purchase. These

white papers have significantly raised the Company's profile in the

media industry and led to a raft of awards which we are very proud

to receive. We will continue to promote these initiatives during

2022."

"We start 2022 in a very strong position financially, with a

strong balance sheet and an order book 93% higher than at the start

of last year. Strategically we have plans in place to develop

market opportunities outside of media and entertainment and I very

much look forward to working with the Blackbird team to deliver

further success."

Operational highlights (post period end)

-- Achieved AWS Technology Partner status and completed

Foundational Technical Review to accelerate AWS engagement

o stepping stone to launching Blackbird in a Public Cloud which

will open up the Company's addressable market

-- Univision 'land and expand' deal secured

-- Won 2021 NAB Show Product of the Year Award

-- GBP2,025k* revenue secured for 2022, at end of February 2022,

which is up 81% year on year (2021 comparative at end of February

2021: GBP1,117k)

-- Contracted but unrecognised revenue of GBP3,436k* at end of

February 2022. Of this, GBP1,416k is to be recognised in 2022, a

further GBP824k in 2023, with the remainder in 2024 and beyond

*Unaudited and subject to exchange rate fluctuations

Operational highlights (during the year under review)

-- Raised GBP8.0 million (before expenses) from existing and new

investors to enter new markets with our 'Powered by Blackbird'

intellectual property

-- First technology licensing deal with a global broadcast

company who have licensed Blackbird's core video technology for a

5-year period:

o first proof point of the value of the patented technology

suite outside the core Blackbird platform; and

o a commercially attractive new route to market that opens up

markets inside and outside professional video production

-- High profile infrastructure deals signed with:

o CBS Sports Digital, our first US major, a division of

ViacomCBS;

o FIFA, multi-year deal signed;

o Univision, multi-year deal, the leading Spanish-language media

and content company in the United States to drive large-scale video

production efficiencies across its streaming and digital media

operations;

o Cheddar News annual deal for ultra-efficient, flexible and

sustainable video production;

o BT annual deal for ultra-fast and sustainable cloud native

video editing and publishing;

o Athletes Unlimited, a fast-growing network of next generation

US sports leagues covering softball, volleyball and lacrosse;

o ODK Media for flexible and efficient cloud video production

for their new OnDemandLatino service; and

o e-learning companies Typsy and Boclips

-- New and growing OEM Partnerships:

o deal with EVS to deploy for two major international sporting

events endorsing the OEM go to market strategy and that Blackbird

is a trusted partner for the world's most valuable content;

o expansion of deal with TownNews to 80 local U.S. TV station

reaffirming the Company's OEM and 'land and expand' strategy;

o Contracted with Eurovision Sport to drive cloud native video

production workflow efficiencies for its members in a multi-year

deal;

o new international sports league with TATA Communications which

is under strict non-disclosure terms; and

o new OEM partnership with LiveU who partnered with Blackbird to

deliver live clipping from the German elections for RTL and other

German public service broadcasters

-- Strategic white papers released by the Company on:

o Total Cost of Ownership ("TCO"): showing Blackbird's cloud

native solution delivering up to 35% lower TCO than cloud adapted

on premise video editing; and

o Sustainability: highlighting Blackbird's cloud native workflow

generates up to 91% less carbon than on premise video editing

workflows

-- Developmental and technology advancements:

o development of robust multifunctional APIs making Blackbird

more interoperable with third party products;

o modularisation of the software suite to enable 'Powered by

Blackbird' tech licensing;

o acceleration of Public Cloud integrations; and

o multiple new end user features such as blur and highlights

effects

-- Blackbird's shares begin trading on OTCQX Best platform in

July, which will lead to enhanced investor benefits, including

easier trading access for investors located in the US, and greater

liquidity due to a broader geographic pool of potential

investors

-- Awarded London Stock Exchange's Green Economy Mark,

recognition of the Company's sustainable, low-carbon solutions

-- Blackbird was included in an Industry wide proof of concept

led by BT Sport, BBC Sport, Sky Sports and NBC Universal to

demonstrate how cloud tools can reduce carbon emissions. The

results were published in January showing a 70% reduction in

technical infrastructure - other partners included Amazon Web

Services and Microsoft

-- Industry accolades including:

o 'Best Tech Company 2021' - SportsPro OTT Awards ; and

o Inaugural IABM 'Environmental Sustainability Company of the

Year 2021'

Financial highlights

-- Share placing raising GBP7.5 million (net of expenses) to

facilitate 'Powered by Blackbird' opportunities in new markets. The

placing was at 28 pence per share, double the price of the previous

placing in December 2019

-- Record revenues of GBP2,066k for the 12 months to 31 December

2021, up 32% year-on-year (12 months to 31 December 2020:

GBP1,567k)

-- North American revenues of GBP1,256k up 30% year-on-year (12

months to 31 December 2020: GBP968k)

-- Contracted but unrecognised revenue of GBP3,732k up 93%

year-on-year (as at 31 December 2020: GBP1,931k). GBP1,810k of this

balance is to be recognised in 2022 (as at 31 December 2020:

GBP1,058k to be recognised in 2021), GBP731k in 2023, GBP601k in

2024 and the remainder in 2025 and 2026

-- Operating costs, excluding LTIP provision, increased to

GBP3,107k (12 months to 31 December 2020: GBP2,721k) predominantly

due to i) increased staff costs - mainly due from the impact of a

full year of 2020 staff hires and strengthening the team this year

in R&D and product development and ii) product development

costs

-- EBITDA pre LTIP provision improved by GBP124k compared to

2020 as the increase in revenues outweighed the rise in operating

costs

-- LTIP provision of GBP358k (2020: GBP98k) booked in the year

based on a year-end share price of 30.75pence. In 2022, with

amongst other items a sell-off in global technology stocks and the

escalating crisis in Ukraine, the Company's share price has fallen.

The share price could rise or fall further prior to the LTIP payout

resulting in a material difference between the 31 December 2021

LTIP provision and the actual LTIP payout

-- EBITDA loss increased GBP259k year on year to GBP1,554k due

to an increase in the LTIP provision driven by the increase in

share price in 2021 and an additional year of the LTIP period

-- Net loss after tax GBP2,135k (12 months to 31 December 2020: net loss after tax GBP1,881k)

-- Net cash outflow, ignoring proceeds from share issues and

transfers into short-term deposits, reduced to GBP1,468k (12 months

to 31 December 2020: GBP1,579k)

-- At 31 December 2021 the Company had cash and short-term

deposits of GBP12,839k (2020: GBP6,546k) and no debt

Enquiries:

Blackbird plc Tel: +44 (0)20 8879

7245

Ian McDonough, Chief Executive Officer

Stephen White, Chief Operating and Financial

Officer

Allenby Capital Limited (Nominated Adviser Tel: +44 (0)20 3328

and Broker) 5656

Nick Naylor / Piers Shimwell (Corporate

Finance)

Amrit Nahal (Equity Sales)

About Blackbird plc

Blackbird plc operates in the fast-growing SaaS and cloud video

market. It has created Blackbird(R), the world's most advanced

suite of cloud-native computing applications for video, all

underpinned by its lightning-fast codec. Blackbird plc's patented

technology allows for frame accurate navigation, playback, viewing

and editing in the cloud. Blackbird(R) enables multiple

applications, which are used by rights holders, broadcasters,

sports and news video specialists, esports, live events and content

owners, post-production houses, other mass market digital video

channels and corporations.

Since it is cloud-native, Blackbird(R) removes the need for

costly, high-end workstations and can be used from almost anywhere

on almost any device. It also allows full visibility on

multi-location digital content, improves time to market for live

content such as video clips and highlights for digital

distribution, and ultimately results in much more effective

monetisation.

Blackbird plc is a licensor of its core video technology under

its 'Powered by Blackbird' licensing model. Enabling video

companies to accelerate their path to true cloud business models,

licensees benefit from power and carbon reductions, cost and time

savings, less hardware and bandwidth requirements and easy

scalability.

Chairman's statement

For many people, 2021 continued to be an extension of the

lifestyle and the workplace adjustments that we all had made in

2020. Working remotely via the use of innovative cloud-based

technology continues to be the norm. As a pioneer of cloud native

video technology, Blackbird continues to be the most efficient

platform available for our customers and their employees to work

collaboratively and remotely on any connected device.

2021 was also a year of increased and widening recognition for

Blackbird, winning three major media technology awards including

SportsPro's 'Technology Company of the Year'. Similarly, as ESG

continues to be a major factor in all business activities, the

important role that Blackbird plays in the potential to

significantly reduce the carbon footprint of our customers is also

being increasingly recognised. Sustainability is one of the key

differentiators for the Blackbird platform, reducing carbon

emissions by up to 91% relative to other nonlinear editors (NLE's)

of some of our major competitors, according to the independent

environmental research company Green Element.

The increased levels of awareness for our platform have allowed

us to continue the sales momentum that we achieved in 2020. As well

as year-on-year revenue growth of 32%, we also grew our contracted

but unrecognised revenue by 93% to GBP3,732k. As we onboarded yet

more meaningful global brands to our platform, our OEM strategy of

partnering with key major players where we access our partners'

sales channels as a route to market, resulted in new distribution

partnerships and a number of key infrastructure deals, which will

allow us to significantly broaden our market reach.

Our results for the year continue to show strong growth

underpinned by our increased market presence and strategic

partnerships. The Company recognised revenues of GBP2,066k (2020:

GBP1,567k). We continued to grow our North American business to

GBP1,256k (2020: GBP968k) and it now comprises 61% of our revenues.

Our revenue mix remained strong with OEM revenue accounting for 45%

in the year, 48% coming from infrastructure deals and 7% from

development work on our first 'Powered by Blackbird' deal.

Strategy

In 2021 we passed a key inflection point for our business via

the licensing of packaged modules to a global broadcast company of

the core underlying technology upon which our own editor is built.

Not only is this a significant deal, but it paves the way for

multiple market sectors to incorporate our technology into their

technology with a range of compelling benefits including superior

performance, flexibility, sustainability and reduced operating

costs. This B2B 'Powered by Blackbird' approach is a major

milestone to the unlocking of the true potential of our unique

patented technology and significantly grow our total addressable

market.

Outside of the NLE professional video editor market, the

patented Blackbird technology has many significant potential

applications around the creation, publishing and distribution of

content. By the end of 2021 the Board of Directors agreed to seek

additional funding in order to resource a wider exploitation of our

technology. To this end we successfully raised GBP8.0 million

(before costs) via a market placement, for the sole purpose of

funding the development and exploitation of our technology in new

areas whilst not compromising our core market focus today.

Regarding our core market of professional media and

entertainment video editing, the Blackbird platform continues to be

optimised for use on scalable public cloud infrastructure. This is

to support its availability as a more tightly integrated part of

our OEM partner systems and makes possible our 'Powered by

Blackbird' expansion. Similarly, we are ensuring that Blackbird can

be integrated with wider third- party functionality through

developing our APIs.

As we go forward, we remain committed to maintaining the

superiority of our video codec, and other unique components of our

platform, to extend our applicable markets. We will broaden our

strategic focus and build upon our unique points of difference. We

will continue to create meaningful IP that has strong commercial

potential and will test it in the market as appropriate.

In a year that has been very difficult for many individuals and

for many businesses, Blackbird has continued to evolve and grow.

The Board believes that the Company continues to be well positioned

to exploit its technological advantages and continue to grow in the

large, dynamic cloud video market.

Income statement and statement of financial position

In the year ended 31 December 2021, the Company recorded

revenues of GBP2,066k (2020: GBP1,567k), which represented an

increase of 32% year-on-year. Revenues in Sports and News, our core

target sectors, both increased by 28% year on year. Additionally,

the Company recognised GBP137k revenue in the year from its first

technology licensing deal. Branded 'Powered by Blackbird' this will

open up a new route to market.

Operating costs, excluding LTIP provision, during the year to 31

December 2021 were GBP3,107k compared to GBP2,721k in the

corresponding period in 2020 as we strengthened the team in

R&D, Product and Sales and saw a full year impact of 2020

hires.

The Company has identified certain metrics such as i) EBITDA pre

LTIP provision and ii) cash burn excluding proceeds from share

issues and transfers into short-term deposits, which whilst they

are non-GAAP metrics, assist in the understanding of business

performance. These alternative performance measurements may not be

directly comparable with other companies' measures and are not

intended to be a substitute for any International Accounting

Standards performance measures. The Company believes that EBITDA

pre LTIP provision is the best measure to reflect core operational

performance and that cash burn, excluding proceeds from share

issues and transfers into short-term deposits, provides the best

measure of the cash being utilised by the business until it can be

self-generating.

The EBITDA pre LTIP provision improved to a loss of GBP1,197k

(2020: loss of GBP1,318k). The net loss for the year was GBP2,135k

compared to a net loss of GBP1,881k in 2020 due to a better EBITDA

pre LTIP provision offset by a higher LTIP provision of GBP358k

(2020: GBP98k) and higher amortization and share option charges.

The LTIP provision calculated at 31 December 2021 was based on a

30.75 pence share price. In 2022, with amongst other items a

sell-off in global technology stocks and the escalating crisis in

Ukraine, the Company's share price has fallen. The share price

could rise or fall further prior to the LTIP payout resulting in a

material difference between the 31 December 2021 LTIP provision and

the actual LTIP payout.

After the December placing, the Company ended the year with a

strong balance sheet including GBP12,839k of cash and short-term

deposits (31 December 2020: GBP6,546k). During the year the Company

reduced its cash burn, excluding proceeds from share issues and

transfers into short-term deposits, to GBP1,468k from GBP1,579k in

2020, a result of increased revenue partially offset by higher

operating costs.

Current trading and outlook

As noted earlier, we start the current year in a strong

financial position, with a strong balance sheet and contracted but

unrecognised revenue of GBP3,732k as at 31 December 2021 (as at 31

December 2020: GBP1,931k). GBP1,811k of this balance relates to

revenue to be recognised in 2022 which is up 71% compared to 2020

comparative of GBP1,058k. As a result, we are well positioned for

strong growth this year.

Looking forward, our 'Powered by Blackbird' strategy has the

potential to significantly increase our addressable markets and, as

the use of video penetrates most sectors, content creators, media

publishers and broadcasters will continue to look for more

effective solutions. The benefits of these solutions will include

improved remote collaboration and helping companies to reduce their

carbon footprint, 'Powered by Blackbird' enables our partners to

license our technology and incorporate it within their own

solutions making Blackbird well positioned for meaningful

growth.

With the proceeds of our recent fundraise, we will seek to apply

our technology to other commercially attractive sectors where we

have a compelling advantage and proven capability. We may address

these sectors using different routes to market, including by going

to market directly or through partnership arrangements. The Board

remains committed to realising the full potential of our remarkable

technology and will continue to test and refine the best ways in

which to achieve this.

Finally, the Blackbird brand continued to grow in awareness and

reputation over the last year and the Board would like to thank Ian

and his team for the significant progress that has been made during

a very challenging time.

Andrew Bentley

Chairman

Chief Executive Officer's statement

Where 2020 was a year of disruption for our industry, 2021 was a

year where the expected return to a predictable normal never quite

happened. Media and Entertainment had to be prepared for the

unexpected and to an extended period of uncertainty and disrupted

work patterns. From a Blackbird perspective our preparation paid

off and this provided significant opportunities, as you would

expect. The accelerated shift to sustainable and efficient remote

production has seen Blackbird's profile rise prolifically in the

industry. We finished the year having been awarded three

prestigious industry accolades including 'Tech Company of the Year'

by SportsPro.

This year was transformational because of our first technology

licensing deal and subsequent 'Powered by Blackbird' brand launch.

Since I joined the Company, proving the value of our technology

outside of our core product has been a key goal. This opportunity

can result in significant value creation, which is why many of the

team, including myself, are significant investors in the business.

This year was the year we have that first official proof point. In

addition, it came via a Global Broadcast Company of high repute

targeting a global product rollout in 2022. The deal itself is made

up of several parts including a development fee, and an annual

minimum guarantee underpinning a revenue share of sales. It is

already double the size of any of the Company's previous contracts

at EUR2million over the 5-year term and one we expect to grow well

beyond the minimum guaranteed fees. I can happily report that the

contract execution is, at time of writing, progressing well and the

partner in question has expressed their happiness with the service

we are providing. We are both looking forward to a successful

high-profile rollout of the product starting towards the end of the

first half of 2022.

Outside of the technology licensing the key focus is scaling

Blackbird through OEM partnerships. Good progress was made in these

areas as can be seen by adding EVS, where we were involved in the

largest and most important international sporting games of 2021 and

also thus far of 2022. Unfortunately, confidentiality prevents us

naming these events. LiveU and Eurovision were also onboarded this

year as new OEM partners both bringing high profile paying

customers to add to our roster. LiveU brought Blackbird into its

deal in Germany for the national and local elections where we were

used to cut from live by RTL and other German public service

broadcasters. This was our first entry into that territory and one

where we can expect further growth. Eurovision, the production arm

of the European Broadcast Union (EBU) which has over 100

broadcasters as members has started using Blackbird on several

different international sports disciplines including cycling and

athletics. We also significantly grew existing OEM account TownNews

which from a single figure base in 2018 now has 80 stations using

Blackbird. Our relationship with TATA Communications while strong

and collaborative continues to find its feet and although it grew

this year with a significant new international sports competition

added, it was at a slower pace than we expected. There is appetite

on both sides to drive much further growth and we are working

together find a more streamlined approach in 2022.

In terms of direct infrastructure deals, Blackbird's reputation

of delivering world beating speed and efficiency into live news and

sports rooms ramped up with new deals with some major European and

US clients. Prize amongst these is our first US Studio deal with

CBS Sports where Blackbird is used on all European soccer

production. In addition, we have been deployed into Univision too

where the platform is used in live sports and news and where, post

year end, we have just seen an expansion. The trailblazing US news

network Cheddar News have also started to use Blackbird on a

nationwide basis with both field reporters and studio-based

journalists. Elsewhere we were deployed with Athletes Unlimited in

minority US growth sports such as softball and lacrosse. Our deal

with ODK showcases how Blackbird's infrastructure enables our most

international of workflows with a Korean company, using a

Vietnamese production team to prepare Latin American content for

delivery to a US audience. In the UK too we have expanded with BT

TV which is driving efficiencies in both sports and general

entertainment distribution. Just before the end of the year we also

signed a deal with FIFA, where deployment will take place in early

2022. We have also seen successes in both replacing traditional

non-linear editors, complimenting their usage through using

Blackbird in new workflows and also supplementing capability in

organisations such as A+E Networks. This was highlighted by the A+E

Networks operational team in a joint webinar showing that Blackbird

sits across multiple departments.

The financial and strategic benefits of launching our technology

licensor brand 'Powered by Blackbird' globally with the Global

Broadcast Company include that we have accelerated the

modularization of our platform for tech licensing ahead of public

cloud assimilation. In addition, we made excellent progress in the

public cloud initiative and in December we were awarded the

Foundation Technical Review by Amazon Web Services (AWS). This is a

significant milestone in the integration of our platform into the

largest of the public clouds. Public cloud integration will be a

key focus in 2022.

Elsewhere on the platform the integrations with EVS for the

international games and CBS were made possible by rapid advancement

of our API suite which are becoming both more robust and

multifunctional each month. Being a seamless part of a complex

media supply chain, as our Blackbird platform now is, means the

development of several high specification gateways which are now

operational.

Similarly, to become established in the media and entertainment

space you need to have the trust of customers. Certainly, being on

public cloud is a fast track to that in terms of convincing

management of blue chip companies of reliability and security.

Another is having SOC2 Type 2 status which is the gold standard of

US cyber and data security for the media industry. Blackbird

achieved SOC2 Type 1 and then SOC2 Type 2 statuses in 2021 and

maintained the SOC2 Type 2 accreditation this year. This has taken

some time and effort on the team's behalf, and it means contracts

that previously took months can now be completed in a much shorter

time.

The profile of Blackbird is also on a steep upward trajectory.

In 2021 we published two white papers. The first was a

groundbreaking piece on the carbon efficiency of the Blackbird

technology and product. The carbon footprint of video production

had for many years gone under the radar screen and was

underreported. We worked with an independent environmental agency,

Green Element, to be the first in our sector to put out

independently verified data points about the savings we make, which

garnered a huge amount of media coverage for the Company.

Especially when the data points are as compelling as a saving of up

to 91% carbon. I was personally interviewed on Sky News and

Blackbird was featured in over 40 different articles, features and

industry panels throughout the year talking about it. Our work

encouraged one of the key bodies in our industry, the International

Association of Broadcast Manufacturers (IABM) to launch an

'Environmental Sustainability' Award which we duly won in December.

This work also led the London Stock Exchange to award the company

its prestigious Green Economy Mark which just 5% of listed UK

businesses have received.

Within the year other accolades included the NAB Show 'Product

of the Year' and the top prize at the SportPro OTT Awards 'Best

Tech Company 2021'.

Sometimes it's easy to forget we only rebranded the software and

renamed the Company in 2018 and 2019. This year we released 28

press releases, hosted ten webinars with partners, conducted 25

interviews and were on twelve industry panels. It's safe to say

that if the industry hadn't heard of Blackbird pre-Covid, they have

now.

As a final act of 2021 we undertook a successful placing at 28p,

double the share price of the last placing in December 2019,

raising GBP8.0 million before costs. These funds will be used to

explore new markets for Blackbird outside of the professional media

and entertainment video editing market. This was presented to

shareholders at an Investor Meet Company meeting in December, a

recording of which can be found on our website and is discussed in

our Strategy section of the Annual Report.

We look forward to an incredibly exciting 2022 with a world

respected technology platform, an enviable client list, a sky-high

industry profile, a highly professional team and a very healthy

bank balance. We eagerly anticipate seeing Blackbird fully

integrated into the public cloud, the rollout of our first

technology licensing deal and the further adoption of our efficient

and sustainable solution on a global basis.

Ian McDonough

Chief Executive Officer

Income statement and statement of comprehensive income for the

year ended 31 December 2021

2021 2020

GBP GBP

CONTINUING OPERATIONS

Revenue 2,066,271 1,567,109

Cost of Sales (155,691) (163,338)

====================================================== ============ =====================

GROSS PROFIT 1,910,580 1,403,771

Other income - -

Operating costs excluding LTIP

provision (3,107,283) (2,721,465)

====================================================== ============ =====================

EARNINGS BEFORE INTEREST, TAXATION, DEPRECIATION,

AMORTISATION AND LTIP PROVISION (EBITDA

Pre LTIP) (1,196,703) (1,317,694)

LTIP provision (357,712) (98,227)

EARNINGS BEFORE INTEREST, TAXATION, DEPRECIATION,

AMORTISATION AND EMPLOYEE SHARE OPTION

COSTS (EBITDA) (1,554,415) (1,415,921)

Depreciation (117,199) (108,681)

Amortisation (337,078) (275,935)

Employee share option costs (176,583) (138,933)

------------ ---------------------

(630,860) (523,549)

OPERATING LOSS (2,185,275) (1,939,470)

Net Finance income 18,382 33,451

====================================================== ============ =====================

LOSS BEFORE INCOME TAX (2,166,893) (1,906,019)

Income tax 32,167 25,415

LOSS FOR THE YEAR (2,134,726) (1,880,604)

Other comprehensive income - -

TOTAL COMPREHENSIVE LOSS FOR THE YEAR (2,134,726) (1,880,604)

Earnings per share expressed in pence per

share

Basic - continuing and total operations (0.63p) (0.56p)

Statements of financial position as at 31 December 2021

2021 2020

GBP GBP

ASSETS

NON-CURRENT ASSETS

Intangible assets 1,195,736 1,105,657

Property, plant and

equipment 256,655 308,565

-------------------------------------- ------------- -------------

1,452,391 1,414,222

CURRENT ASSETS

Trade and other receivables 395,315 292,834

Stock 895 15,728

Current tax assets 32,167 25,415

Short-term investments 4,169,186 1,617,820

Cash and bank balances 8,670,274 4,928,021

-------------------------------------- ------------- -------------

13,267,837 6,879,818

---------------------------------- ------------- -------------

TOTAL ASSETS 14,720,228 8,294,040

====================================== ============= =============

EQUITY AND LIABILITES

CAPITAL AND RESERVES

Issued share capital 2,940,524 2,696,433

Share premium 34,034,228 26,516,613

Capital contribution

reserve 125,000 125,000

Retained earnings (24,156,905) (22,198,762)

-------------------------------------- ------------- -------------

TOTAL EQUITY 12,942,847 7,139,284

NON-CURRENT LIABILITIES

Lease and other payables 131,908 324,044

131,908 324,044

CURRENT LIABILITIES

Trade and other payables 1,645,473 830,712

-------------------------------------- ------------- -------------

TOTAL LIABILITIES 1,777,381 1,154,756

-------------------------------------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 14,720,228 8,294,040

====================================== ============= =============

Statement of changes in equity for the year ended 31 December

2021

Issued Retained Share premium Capital Total equity

share capital earnings contribution

reserve

GBP GBP GBP GBP GBP

Balance at 1 January

2020 2,681,913 (20,457,091) 26,371,502 125,000 8,721,324

Changes in equity

Issue of share capital 14,520 - 145,111 - 159,631

Share based payment - 138,933 - - 138,933

Total comprehensive

loss

for the year - (1,880,604) - - (1,880,604)

======================= =============== ============= ============== ============== =============

Balance at 31 December

2020 2,696,433 (22,198,762) 26,516,613 125,000 7,139,284

Changes in equity

Issue of share capital 244,091 - 7,517,615 - 7,761,706

Share based payment - 176,583 - - 176,583

Total comprehensive

loss

for the year - (2,134,726) - - (2,134,726)

======================= =============== ============= ============== ============== ===============

Balance at 31 December

2021 2,940,524 (24,156,905) 34,034,228 125,000 12,942,847

S ta tement of cash flows for the year ended 31 December

2021

2021 2020

Notes GBP GBP

Cash flows from operating

activities

Cash used in operations A (901,066) (1,089,946)

Interest paid on lease

liabilities (11,979) (16,059)

Tax received 25,415 32,424

------------------------------------------ ------------ ------------

Net cash from operating

activities (887,630) (1,073,581)

------------------------------------------ ------------ ------------

Cash flows from investing

activities

Payments for intangible

fixed assets (443,657) (425,848)

Payments for property,

plant and equipment (65,288) (26,203)

Transfer into short-term

investments (2,551,366) (1,617,820)

Interest received 25,393 43,172

------------------------------------------ ------------ ------------

Net cash from investing

activities (3,034,918) (2,026,699)

------------------------------------------ ------------ ------------

Cash flows from financing

activities

Share issues (net of

expenses) 7,761,706 159,631

Payment of lease liabilities (96,905) (96,821)

Net cash from financing

activities 7,664,801 62,810

------------------------------------------ ------------ ------------

Increase/(Decrease)

in cash and cash equivalents 3,742,253 (3,037,470)

Cash and cash equivalents

at beginning of year 4,928,021 7,965,491

------------------------------------------ ------------ ------------

Cash and cash equivalents

at end of year 8,670,274 4,928,021

========================================== ============ ============

A. Reconciliation of loss before income tax to cash used in operations

2021 2020

GBP GBP

Loss before income tax (2,166,893) (1,906,019)

Depreciation 117,199 108,681

Amortisation charges 337,078 275,935

Employee share option costs 176,583 138,933

Finance income (18,382) (33,451)

------------------------------------------ ------------ --------------------

Earnings before interest,

taxation, depreciation and

amortisation (1,554,415) (1,415,921)

------------------------------------------ ------------ --------------------

Movements in working capital:

(Increase)/ Decrease in trade

and other receivables (62,234) 202,145

Increase in trade and other

payables 715,583 123,830

------------------------------------------ ------------ --------------------

Cash used in operations (901,066) (1,089,946)

========================================== ============ ====================

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR USUKRUWUORAR

(END) Dow Jones Newswires

March 07, 2022 02:00 ET (07:00 GMT)

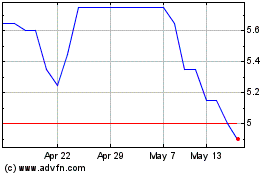

Blackbird (LSE:BIRD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Blackbird (LSE:BIRD)

Historical Stock Chart

From Jul 2023 to Jul 2024