TIDMBHMG TIDMBHMU

BH Macro Limited

Interim Report and Unaudited Financial Statements 2022

LEI: 549300ZOFF0Z2CM87C29

(Classified Regulated Information, under DTR 6 Annex 1 section 1.2)

The Company has today, in accordance with DTR 6.3.5, released its Interim

Report and Unaudited Financial Statements for the period ended 30 June 2022.

The Report will shortly be available from the Company's website:

www.bhmacro.com.

Chair's Statement

I am delighted to present my second interim statement to shareholders.

Over the first half of the year to 30 June 2022 your Company's share price has

increased significantly, despite (or indeed, perhaps, because of) the very

difficult background for investment markets. Over the first half of 2022, the

Net Asset Value ("NAV") per Sterling share in the Company increased by 15.53%

and the NAV per US Dollar share increased by 14.11%. The share price total

return on a Sterling share was 16.58% over the period and on a US Dollar share

was 11.22%. The Company's performance is directly related to the performance of

Brevan Howard Master Fund Limited (the "Master Fund") into which the Company

invests substantially all its assets.

The components of return for your share price are firstly the change in the NAV

of the relevant Company share class driven largely by the change in the

underlying share class of the Master Fund; secondly the change in the premium

(or discount) of the Company's shares to the NAV of the relevant share class;

and thirdly, to a much smaller extent, any accretion to NAV of the relevant

share class from the Company's transactions in the relevant share class (i.e.

buying back shares at a discount or as in the current period issuing shares at

a premium).

I am pleased to report that during this period the main elements of return were

as follows:

Sterling share price total return of:

Change in premium: Increase by 0.98% (30 June 2022: premium of 10.02%; 31

December 2021: premium of 9.04%)

Increase in the Sterling share class NAV per share: 15.53%

US Dollar share price total return of:

Change in premium: Decrease of 2.85% (30 June 2022: premium of 9.45%; 31

December 2021: premium of 12.29%)

Increase in US Dollar share class NAV per share: 14.11%

During the period under review the Company issued 3,353,495 Sterling shares in

the following tranches. No US Dollar shares were issued other than inter-class

share conversions.

Date Number of shares Price per share (pence) Premium per share

14/01/2022 921,862 3,670 6.04%

16/03/2022 268,379 3,770 5.93%

19/05/2022 1,521,441 4,270 10.19%

26/05/2022 59,631 4,300 9.89%

16/06/2022 582,182 4,455 10.16%

Last year was dominated by the combination between the Company and BH Global

Limited and I am delighted that the first half of this year has seen an

excellent return for shareholders despite the significant increases in fees

which took place last year. Whilst to a certain extent these have been defrayed

by the issuance of new shares at a premium, it is gratifying that your

confidence in the Manager, and the new arrangements, have been so well

rewarded. Moreover, the shares, whilst generating very good absolute returns,

have also provided even better returns when compared to most other investable

asset classes.

In last year's interim statement, I commented on the uncertain outlook as

follows: "Against this background the investment strategy of the Company should

provide diversification to other asset classes and the shares remain one of the

few ways for the individual investor to acquire access to a long established

macro-economic hedge fund". The value of that diversification has been amply

demonstrated in this period under review. It is important for shareholders to

bear in mind the long-term value of this strategy in their broader portfolio.

Unfortunately, when looking at the outlook for markets from here, I find that

there is little that I can say to shareholders on a positive note. Geopolitical

tensions remain at a very high level. The outcome of the invasion of Ukraine

remains uncertain. The zero-COVID policy in China appears to be continuing to

create severe supply chain disruption. Inflationary pressures remain strong

across the globe though certain component data will start to decline on a

year-on-year basis. Interest rates seem set to rise even further with

significant consequences for the UK and European economies and will only

exacerbate the tensions within the EU. There has been very significant

tightening of money supply as Central Banks move from Quantitative Easing

("QE") to Quantitative Tightening ("QT") and a huge wealth effect from the

evaporation of over $2 trillion of cryptocurrency in a very short space of

time. Energy prices have risen sharply in the past 12 months, caused by

increased demand as countries eased COVID lockdown restrictions; international

travel returning to levels similar to 2019; supply chain slowdowns; and the

supply of oil and natural gas tightening due to sanctions imposed on Russia

over the invasion of Ukraine.

I feel compelled therefore to reiterate what I said last year that the

investment strategy of the Company should continue to provide diversifying

returns against what remains a very difficult background. Your Board continues

to monitor your Company's Manager closely and believes that it is well placed

to manage your money in these difficult times.

Richard Horlick

Chair

9 September 2022

Board Members

The Directors of the Company, as at the date of signing, all of whom are

non-executive, are listed below:

Richard Horlick (Chair), age 63

Richard Horlick is UK resident. He is currently the non-executive chairman of

CCLA Investment Management which manages assets for over 38,000 charities and

church and local authority funds. He has served on a number of closed end fund

boards most recently VH Global Sustainable Energy Opportunities plc since

January 2021. He was a partner and non-executive chairman of Pensato Capital

LLP until its successful sale to RWC Partners in 2017. He has had a long and

distinguished career in investment management graduating from Cambridge

University in 1980 with an MA in Modern History. After 3 years in the corporate

finance department of Samuel Montagu he joined Newton Investment Management in

January 1984, where he became a Director and portfolio manager. In 1994, he

joined Fidelity International as President of their institutional business

outside the US and in 2001 became President and CEO of Fidelity Management

Trust Company in Boston which was the Trust Bank for the US Fidelity Mutual

fund range and responsible for their defined benefit pension business. In 2003,

he joined Schroders Plc as a main board Director and head of investment

worldwide. In January 2006, he established Spencer House Capital Management

with Lord Jacob Rothschild. In addition, he has been a business angel investing

in a wide range of private companies. He became a limited partner in CBE

Capital Limited, a property development group. Mr. Horlick was appointed to the

Board in May 2019 and was appointed Chair in February 2021.

Julia Chapman, age 56

Julia Chapman is a Jersey resident and a solicitor qualified in England & Wales

and in Jersey with over 30 years' experience in the investment fund and capital

markets sector. After working at Simmons & Simmons in London, she moved to

Jersey and became a partner of Mourant du Feu & Jeune (now Mourant) in 1999.

She was then appointed general counsel to Mourant International Finance

Administration (the firm's fund administration division). Following its

acquisition by State Street in April 2010, Julia was appointed European Senior

Counsel for State Street's alternative investment business. In July 2012,

Julia left State Street to focus on the independent provision of directorship

and governance services to a small number of investment fund vehicles. Mrs.

Chapman was appointed to the Board in October 2021.

Bronwyn Curtis, age 74

Bronwyn Curtis is a UK resident and Senior Executive with 30 years leadership

in finance, commodities, consulting and the media. She is currently chair of

JPMorgan Asia Growth and Income Plc but will step down from the company in

February 2023. She is also a non-executive Director of Pershing Square Holdings

Ltd, the Scottish American Investment Company Plc, Twentyfour Income Fund Ltd

and the UK Office of Budget Responsibility. Her executive roles included Head

of Global Research at HSBC Plc, Managing Editor and Head of European Broadcast

at Bloomberg LP, Chief Economist of Nomura International, and Global Head of

Foreign Exchange and Fixed Income Strategy at Deutsche Bank. She has also

worked as a consultant for the World Bank and UNCTAD. Her other current

appointments include trustee of the Centre for Economic and Policy Research,

the Australia-UK Chamber of Commerce and The Times shadow MPC. She is a

graduate of the London School of Economics and La Trobe University in Australia

where she received a Doctor of Letters in 2017. Bronwyn was awarded an OBE in

2008 for her services to business economics. Mrs. Curtis was appointed to the

Board in January 2020.

John Le Poidevin, age 52

John Le Poidevin is Guernsey resident and has over 30 years' business

experience. Mr. Le Poidevin is a graduate of Exeter University and Harvard

Business School, a Fellow of the Institute of Chartered Accountants in England

and Wales and a former partner of BDO LLP in London where, as Head of Consumer

Markets, he developed an extensive breadth of experience and knowledge of

listed businesses in the UK and overseas. He is an experienced non-executive

who sits on several Plc boards and chairs a number of Audit Committees. He

therefore brings a wealth of relevant experience in terms of corporate

governance, audit, risk management and financial reporting. Mr. Le Poidevin was

appointed to the Board in June 2016.

Claire Whittet, age 67

Claire Whittet is Guernsey resident and has over 40 years' experience in the

financial services industry. After obtaining a MA (Hons) in Geography from the

University of Edinburgh, Mrs. Whittet joined the Bank of Scotland for 19 years

and undertook a wide variety of roles. She moved to Guernsey in 1996 and was

Global Head of Private Client Credit for Bank of Bermuda before joining

Rothschild & Co Bank International Limited in 2003, initially as Director of

Lending and latterly as Managing Director and Co-Head until May 2016 when she

became a non-executive Director. She is an ACIB member of the Chartered

Institute of Bankers in Scotland, a Chartered Banker, a member of the Chartered

Insurance Institute and holds an IoD Director's Diploma in Company Direction.

She is an experienced non-executive director of a number of listed investment

and private equity funds one of which she chairs and a number of which she is

Senior Independent Director. Mrs. Whittet was appointed to the Board in June

2014.

Disclosure of Directorships in Public Companies Listed on Recognised Stock

Exchanges

The following summarises the Directors' directorships in other public

companies:

Exchange

Richard Horlick

VH Global Sustainable Energy London

Opportunities Plc

Julia Chapman

GCP Infrastructure Investments Limited London

Henderson Far East Income Limited London

Bronwyn Curtis

JPMorgan Asia Growth and Income Plc London

Pershing Square Holdings Limited London and Euronext Amsterdam

Scottish American Investment Company Plc London

TwentyFour Income Fund Limited London

John Le Poidevin

International Public Partnerships London

Limited

Super Group (SGHC) Limited New York

TwentyFour Income Fund Limited London

Claire Whittet

Eurocastle Investment Limited Euronext Amsterdam

Riverstone Energy Limited London

Third Point Investors Limited London

TwentyFour Select Monthly Income Fund London

Limited

Directors' Report

30 June 2022

The Directors submit their Interim Report together with the Company's Unaudited

Statement of Assets and Liabilities, Unaudited Statement of Operations,

Unaudited Statement of Changes in Net Assets, Unaudited Statement of Cash Flows

and the related notes for the period ended 30 June 2022. The Directors' Report

together with the Interim Unaudited Financial Statements and their related

notes (the "Financial Statements") give a true and fair view of the financial

position of the Company. They have been prepared properly, in accordance with

United States Generally Accepted Accounting Principles ("US GAAP") and are in

agreement with the accounting records.

The Company

BH Macro Limited is a limited liability closed-ended investment company which

was incorporated in Guernsey on 17 January 2007 and then admitted to the

Official List of the London Stock Exchange ("LSE") later that year.

Currently, ordinary shares are issued in Sterling and US Dollars.

Investment Objective and Policy

The Company is organised as a feeder fund that invests all of its assets (net

of short-term working capital requirements) directly in the Master Fund, a

hedge fund in the form of a Cayman Islands open-ended investment company, which

has as its investment objective the generation of consistent long-term

appreciation through active leveraged trading and investment on a global basis.

The Master Fund is managed by Brevan Howard Capital Management LP, the

Company's Manager.

The Master Fund has flexibility to invest in a wide range of instruments

including, but not limited to, debt securities and obligations (which may be

below investment grade), bank loans, listed and unlisted equities, other

collective investment schemes, currencies, commodities, digital assets,

futures, options, warrants, swaps and other derivative instruments. The

underlying philosophy is to construct strategies, often contingent in nature,

with superior risk/return profiles, whose outcome will often be crystallised by

an expected event occurring within a pre- determined period of time.

The Master Fund employs a combination of investment strategies that focus

primarily on economic change and monetary policy and market inefficiencies.

The Company may employ leverage for the purposes of financing share purchases

or buy backs, satisfying working capital requirements or financing further

investment into the Master Fund, subject to an aggregate borrowing limit of 20%

of the Company's NAV, calculated as at the time of borrowing. Borrowing by the

Company is in addition to leverage at the Master Fund level, which has no limit

on its own leverage.

Results and Dividends

The results for the period are set out in the Unaudited Statement of

Operations. The Directors do not recommend the payment of a dividend.

Share Capital

On 14 January 2022, the Company issued 921,862 Sterling Shares at a price of

3,670 pence per share.

On 16 March 2022, the Company issued 268,379 Sterling Shares at a price of

3,770 pence per share.

At an Extraordinary General Meeting ("EGM"), held on 5 May 2022, Shareholders

approved a Special Resolution allowing the directors to issue up to 2,707,396

Sterling Shares, being 10% of the Sterling shares in issue as at the date of

the EGM.

On 19 May 2022, the Company issued 1,521,441 Sterling Shares at a price of

4,270 pence per share.

On 26 May 2022, the Company issued 59,631 Sterling Shares at a price of 4,300

pence per share.

On 16 June 2022, the Company issued 582,182 Sterling Shares at a price of 4,455

pence per share.

The number of shares in issue at period end is disclosed in note 5 of the

Interim Unaudited Financial Statements.

Going Concern

The Directors, having considered the Principal and Emerging Risks and

Uncertainties to which the Company is exposed and on the assumption that these

are managed or mitigated as noted, are not aware of any material uncertainties

which may cast significant doubt upon the Company's ability to continue as a

going concern and, accordingly, consider that it is appropriate that the

Company continues to adopt the going concern basis of accounting for these

Interim Unaudited Financial Statements.

The Board continues to monitor the ongoing impact of various geo-political

events, including the recovery from the pandemic, the risk of inflation and

Russia's invasion of Ukraine. The Board has concluded that the biggest threat

to the Company in relation to these geo-political concerns remains the failure

of a key service provider to maintain business continuity and resiliency. The

Board has assessed the measures in place by key service providers to maintain

business continuity and so far has not identified any significant issues that

affect the Company. The financial position of the Company has not been

negatively impacted by these geo-political events either. For these reasons,

the Board is confident that these events have not impacted the going concern

assessment of the Company.

The Board

The Board of Directors has overall responsibility for safeguarding the

Company's assets, for the determination of the investment policy of the

Company, for reviewing the performance of the service providers and for the

Company's activities. The Directors, all of whom are non-executive, are listed

in the Board Members section.

The Articles provide that, unless otherwise determined by ordinary resolution,

the number of Directors shall not be less than two. The Company's policy on

Directors' Remuneration, together with details of the remuneration of each

Director who served during the period, is detailed in the Directors'

Remuneration Report.

The Board meets at least four times a year and between these formal meetings,

there is regular contact with the Manager and the Administrator. The Directors

are kept fully informed of investment and financial controls, and other matters

that are relevant to the business of the Company are brought to the attention

of the Directors. The Directors also have access to the Administrator and,

where necessary in the furtherance of their duties, to independent professional

advice at the expense of the Company.

For each Director, the tables below set out the number of Board and Audit

Committee meetings they were entitled to attend during the period ended 30 June

2022 and the number of such meetings attended by each Director.

Scheduled Board Meetings Held Attended

Richard Horlick 2 2

Julia Chapman 2 2

Bronwyn Curtis 2 2

John Le Poidevin 2 2

Claire Whittet 2 2

Audit Committee Meetings Held Attended

John Le Poidevin 2 2

Julia Chapman 2 2

Bronwyn Curtis 2 2

Claire Whittet 2 2

Remuneration and Nomination Committee Held Attended

Meetings

Richard Horlick 1 1

Julia Chapman 1 1

Bronwyn Curtis 1 1

John Le Poidevin 1 1

Claire Whittet 1 1

In addition to these scheduled meetings, six ad-hoc committee meetings were

held during the period ended 30 June 2022, which were attended by those

Directors available at the time.

The Board has reviewed the composition, structure and diversity of the Board,

succession planning, the independence of the Directors and whether each of the

Directors has sufficient time available to discharge their duties effectively.

The Board confirms that it believes that it has an appropriate mix of skills

and backgrounds, that all of the Directors are considered to be independent in

accordance with the provisions of the Association of Investment Companies (the

"AIC") Code and that all Directors have the time available to discharge their

duties effectively.

The Chair's and Directors' tenures are limited to nine years, which is

consistent with the principles listed in the UK Corporate Governance Code.

Notwithstanding that some of the Directors sit on the boards of a number of

other listed investment companies, the Board notes that each appointment is

non-executive and that listed investment companies generally have a lower level

of complexity and time commitment than trading companies. Furthermore, the

Board notes that attendance of all Board and Committee meetings during the

period is high and that each Director has always shown the time commitment

necessary to discharge fully and effectively their duties as a Director.

Directors' Interests

The Directors had the following interests in the Company, held either directly

or beneficially:

Sterling Shares

30.06.22 31.12.21 30.06.21

Richard Horlick 20,000 20,000 Nil

Julia Chapman 626 626 N/A

Bronwyn Curtis 1,000 1,000 Nil

John Le Poidevin 5,482 5,482 3,222

Claire Whittet* 1,500 1,500 Nil

US Dollar Shares

30.06.22 31.12.21 30.06.21

Richard Horlick Nil Nil Nil

Julia Chapman Nil Nil N/A

Bronwyn Curtis Nil Nil Nil

John Le Poidevin Nil Nil Nil

Claire Whittet Nil Nil Nil

* All units are held through a Retirement Annuity Trust Scheme,

jointly owned by Mrs Whittet and her husband.

Directors' Indemnity

Directors' and Officers' liability insurance cover is in place in respect of

the Directors.

The Directors entered into indemnity agreements with the Company which provide,

subject to the provisions of the Companies (Guernsey) Law, 2008, for an

indemnity for Directors in respect of costs which they may incur relating to

the defence of proceedings brought against them arising out of their positions

as Directors, in which they are acquitted, or judgement is given in their

favour by the Court. The agreement does not provide for any indemnification for

liability which attaches to the Directors in connection with any negligence,

unfavourable judgements and breach of duty or trust in relation to the Company.

Corporate Governance

To comply with the UK Listing Regime, the Company must comply with the

requirements of the UK Corporate Governance Code. The Company is also required

to comply with the Code of Corporate Governance issued by the Guernsey

Financial Services Commission.

The Company is a member of the AIC and by complying with the AIC Code is deemed

to comply with both the UK Corporate Governance Code and the Guernsey Code of

Corporate Governance.

To ensure ongoing compliance with the principles and the recommendations of the

AIC Code, the Board receives and reviews a report from the Secretary, at each

quarterly meeting, identifying whether the Company is in compliance and

recommending any changes that are necessary.

The Company has complied with the requirements of the AIC Code and the relevant

provisions of the UK Corporate Governance Code, except as set out below.

The UK Corporate Governance Code includes provisions relating to:

· the role of the chief executive;

· executive directors' remuneration;

· the need for an internal audit function; and

· whistle-blowing policy.

For the reasons explained in the UK Corporate Governance Code, the Board

considers these provisions are not relevant to the position of the Company as

it is an externally managed investment company with a Board formed exclusively

of non-executive Directors. The Company has therefore not reported further in

respect of these provisions. The Company does not have employees, hence no

whistle-blowing policy is necessary. However, the Directors have satisfied

themselves that the Company's service providers have appropriate

whistle-blowing policies and procedures and seek regular confirmation from the

service providers that nothing has arisen under those policies and procedures

which should be brought to the attention of the Board.

The Company has adopted a policy that the composition of the Board of Directors

is at all times such that (i) a majority of the Directors are independent of

the Manager and any company in the same group as the Manager (the "Manager's

Group"); (ii) the Chair of the Board of Directors is free from any conflicts of

interest and is independent of the Manager's Group; and (iii) no more than one

director, partner, employee or professional adviser to the Manager's Group may

be a Director of the Company at any one time.

The Company has adopted a Code of Directors' dealings in securities.

The Company's risk appetite and risk exposure and the effectiveness of its risk

management and internal control systems are reviewed by the Audit Committee and

by the Board at their meetings. The Board believes that the Company has

adequate and effective systems in place to identify, mitigate and manage the

risks to which it is exposed.

In view of its non-executive and independent nature, the Board had previously

considered that it was not necessary for there to be a Nomination Committee, or

a Remuneration Committee as anticipated by the AIC Code. A Remuneration and

Nomination Committee was established on 17 June 2022. The Board has included a

separate Directors' Remuneration Report in these Interim Unaudited Financial

Statements.

For new appointments to the Board, a specialist independent recruitment firm is

engaged as and when appropriate, nominations are sought from the Directors and

from other relevant parties and candidates are then interviewed by the

Directors. The current Board has a breadth of experience relevant to the

Company, and the Directors believe that any changes to the Board's composition

can be managed without undue disruption. An induction programme is provided for

newly-appointed Directors.

In line with the AIC Code, Section 21.3 of the Company's Articles requires all

Directors to retire at each Annual General Meeting. At the Annual General

Meeting of the Company on 24 September 2021, Shareholders re-elected all the

then incumbent Directors of the Company, except for Julia Chapman, who was

appointed on 1 October 2021.

The Board, through the Remuneration and Nomination Committee, regularly

reviews its composition and believes that the current appointments provide an

appropriate range of skill, experience and diversity.

The Board, Audit Committee, Management Engagement Committee and Remuneration

and Nomination Committee undertake an evaluation of their own performance and

that of individual Directors on an annual basis. In order to review their

effectiveness, the Board and its Committees carry out a process of formal

self-appraisal. The Board and Committees consider how they function as a whole

and also review the individual performance of their members. This process is

conducted by the respective Chair reviewing the Directors' performance,

contribution and commitment to the Company.

Claire Whittet has been Senior Independent Director since 20 June 2019 and

takes the lead in evaluating the performance of the Chair.

Board Performance

The performance of the Board and that of each individual Director is scheduled

for external evaluation every three years.

The most recent external evaluation of the Board's performance was completed in

March 2022 and is scheduled to take place every three years. The last such

evaluation confirmed that the Board works in a collegiate, harmonious and

effective manner and made a number of recommendations for the medium-term

structure of the Board, which the Board intends to adopt.

The Board carries out an annual internal evaluation of its performance in years

when an external evaluation is not taking place. There were no matters of note

in the last annual internal evaluation.

The Board needs to ensure that the Financial Statements, taken as a whole, are

fair, balanced and understandable and provide the information necessary for

Shareholders to assess the Company's performance, business model and strategy.

In seeking to achieve this, the Directors have set out the Company's investment

objective and policy and have explained how the Board and its delegated

Committees operate and how the Directors review the risk environment within

which the Company operates and set appropriate risk controls. Furthermore,

throughout the Interim Report, the Board has sought to provide further

information to enable Shareholders to better understand the Company's business

and financial performance.

Policy to Combat Fraud, Bribery and Corruption

The Board has adopted a formal policy to combat fraud, bribery and corruption.

The policy applies to the Company and to each of its Directors. Further, the

policy is shared with each of the Company's service providers.

In respect of the UK Criminal Finances Act 2017 which introduced a new

Corporate Criminal Offence of 'failing to take reasonable steps to prevent the

facilitation of tax evasion', the Board confirms that it is committed to

preventing the facilitation of tax evasion and takes all reasonable steps to do

so.

Social and Environmental Issues

The Board also keeps under review developments involving other social and

environmental issues, such as Modern Slavery, and will report on those to the

extent they are considered relevant to the Company's operations. Further

explanation is detailed under 'Climate Change and ESG Risks'.

Ongoing Charges

The ongoing charges represent the Company's management fee and all other

operating expenses, excluding finance costs, performance fees, share issue or

buyback costs and non-recurring legal and professional fees, expressed as a

percentage of the average of the daily net assets during the period.

Ongoing charges for the six-month period ended 30 June 2022, year ended 31

December 2021 and six-month period ended 30 June 2021 have been prepared in

accordance with the AIC's recommended methodology.

The following table presents the Ongoing Charges for each share class.

30.06.22

Sterling US Dollar

Shares Shares

Company - Ongoing Charges 1.69% 1.81%

Master Fund - Ongoing Charges 0.33% 0.34%

Performance fees 3.17% 3.24%

Ongoing Charges plus performance fees 5.19% 5.39%

31.12.21

Sterling US Dollar

Shares Shares

Company - Ongoing Charges 1.34% 1.11%

Master Fund - Ongoing Charges 0.45% 0.45%

Performance fees 0.64% 0.69%

Ongoing Charges plus performance fees 2.43% 2.25%

30.06.21

Sterling US Dollar

Shares Shares

Company - Ongoing Charges 0.56% 0.55%

Master Fund - Ongoing Charges 0.69% 0.69%

Performance fees 0.30% 0.32%

Ongoing Charges plus performance fees 1.55% 1.56%

The Master Fund's Ongoing Charges represent the portion of the Master Fund's

operating expenses which have been allocated to the Company. The Company

invests substantially all of its investable assets in ordinary Sterling and US

Dollar denominated Class B shares issued by the Master Fund. These shares are

not subject to management fees and performance fees within the Master Fund. The

Master Fund's operating expenses include an operational services fee payable to

the Manager of 1/12 of 0.5% per month of the NAV.

Audit Committee

The Company's Audit Committee conducts formal meetings at least three times a

year for the purpose, amongst others, of considering the appointment,

independence, effectiveness of the audit and remuneration of the auditors and

to review and recommend the annual statutory accounts and interim report to the

Board of Directors. It is chaired by John Le Poidevin and comprises Bronwyn

Curtis, Claire Whittet and Julia Chapman. The Terms of Reference of the Audit

Committee are available from the Administrator.

Management Engagement Committee

The Board has established a Management Engagement Committee with formal duties

and responsibilities. The Management Engagement Committee meets formally at

least once a year and comprises all members of the Board. It was chaired by

Claire Whittet until 17 June 2022, when Julia Chapman was appointed Chair.

The function of the Management Engagement Committee is to ensure that the

Company's Management Agreement is competitive and reasonable for the

Shareholders, along with the Company's agreements with all other third-party

service providers (other than the Independent Auditors). The Management

Engagement Committee also monitors the performance of all service providers on

an annual basis and writes to each service provider regarding their Business

Continuity Plans. To date, all services have proved to be robust and there has

been no disruption to the Company. The Terms of Reference of the Management

Engagement Committee are available from the Administrator.

The details of the Manager's fees and notice period are set out in note 4 to

the Interim Unaudited Financial Statements.

The Board continuously monitors the performance of the Manager and a review of

the Manager is conducted by the Management Engagement Committee annually.

The Manager has wide experience in managing and administering investment

companies and has access to extensive investment management resources.

At its meeting on 3 September 2021, the Management Engagement Committee

concluded that the continued appointment of the Manager, Administrator, UK and

Guernsey Legal Advisers, Registrar and Corporate Broker on the terms agreed was

in the interests of the Company's Shareholders as a whole. At the date of this

report, the Board continues to be of the same opinion.

Remuneration and Nomination Committee

The Board established a Remuneration and Nomination Committee on 17 June 2022

with formal duties and responsibilities. The Remuneration and Nomination

Committee meets formally at least once a year, is chaired by Bronwyn Curtis and

comprises all members of the Board.

The function of the Remuneration and Nomination Committee is to:

· regularly review the structure, size and composition of the Board and

make recommendations to the Board with regard to any changes that are deemed

necessary;

· Identify, from a variety of sources, candidates to fill Board vacancies

as and when they arise with a continued focus on Board diversity;

· assess and articulate the time needed to fulfil the role of Chair and of

a non-executive director, and undertake an annual performance evaluation to

ensure that all the members of the Board have devoted sufficient time to their

duties, and also to review their contribution to the work of the Board and the

breadth of experience of the Board as a whole; and

· annually review the levels of remuneration of the Chair of the Board, the

Chair of the Audit & Risk Committee and other committees and other

non-executive directors having regard to the maximum aggregate remuneration

that may be paid under the Company's Articles of Incorporation.

Internal Controls

Responsibility for the establishment and maintenance of an appropriate system

of internal control rests with the Board and to achieve this, a process has

been established which seeks to:

· Review the risks faced by the Company and the controls in place to

address those risks;

· Identify and report changes in the risk environment;

· Identify and report changes in the operational controls;

· Identify and report on the effectiveness of controls and errors arising;

and

· Ensure no override of controls by its service providers, the Manager and

Administrator.

A report is tabled and discussed at each Audit Committee meeting, and reviewed

once a year by the Board, setting out the Company's risk exposure and the

effectiveness of its risk management and internal control systems. The Board

believes that the Company has adequate and effective systems in place to

identify, mitigate and manage the risks to which it is exposed.

In order to recognise any new risks that could impact the Company and ensure

that appropriate controls are in place to manage those risks, the Audit

Committee undertakes a regular review of the Company's Risk Matrix. This review

took place on two occasions during the period.

The Board has delegated the management of the Company, the administration,

corporate secretarial and registrar functions including the independent

calculation of the Company's NAV and the production of the Annual Report and

Financial Statements, which are independently audited. Whilst the Board

delegates these functions, it remains responsible for the functions it

delegates and for the systems of internal control. Formal contractual

agreements have been put in place between the Company and the providers of

these services. On an ongoing basis, Board reports are provided at each

quarterly Board meeting from the Manager, Administrator and Company Secretary

and Registrar. A representative from the Manager is asked to attend these

meetings.

In common with most investment companies, the Company does not have an internal

audit function. All of the Company's management functions are delegated to the

Manager, Administrator and Company Secretary and Registrar which have their own

internal audit and risk assessment functions.

Further reports are received from the Administrator in respect of compliance,

LSE continuing obligations and other matters. The reports were reviewed by the

Board. No material adverse findings were identified in these reports.

Packaged Retail and Insurance Based Investment Products ("PRIIPs")

From 1 January 2021, the Company became subject to the UK version of Regulation

(EU) No 1286/2014 on key information documents for PRIIPs, which is part of UK

law by virtue of the European Union (Withdrawal) Act 2018, as amended and

supplemented from time to time, including by the Packaged Retail and

Insurance-based Investment Products (EU Exit) Regulations 2019, (the "UK PRIIPs

Laws"), which superseded the EU regulation that previously applied to the

Company. In accordance with the requirements of the UK PRIIPs Laws, the Manager

published the latest standardised three-page Key Information Document ("KID")

on the Company on 28 April 2022. The KID is available on the Company's website

https://www.bhmacro.com/regulatory-disclosures/ and will be updated at least

every 12 months.

The Company is not responsible for the information contained in the KID. The

process for calculating the risks, cost and potential returns is prescribed by

regulation. The figures in the KID may not reflect the expected returns for the

Company and anticipated returns cannot be guaranteed.

Principal Risks and Uncertainties

The Board is responsible for the Company's system of internal controls and for

reviewing its effectiveness. The Board is satisfied that by using the Company's

risk matrix in establishing the Company's system of internal controls, while

monitoring the Company's investment objective and policy, the Board has carried

out a robust assessment of the principal and emerging risks and uncertainties

facing the Company. The principal and emerging risks and uncertainties which

have been identified and the steps which are taken by the Board to mitigate

them are as follows:

· Investment Risks: The Company is exposed to the risk that its portfolio

fails to perform in line with the Company's objectives if it is inappropriately

invested or markets move adversely. The Board reviews reports from the Manager,

which has total discretion over portfolio allocation, at each quarterly Board

meeting, paying particular attention to this allocation and to the performance

and volatility of underlying investments;

· Operational Risks: The Company is exposed to the risks arising from any

failure of systems and controls in the operations of the Manager or the

Administrator, or from the unavailability of either the Administrator or

Manager for whatever reason. The Board receives reports annually from the

Manager and Administrator on their respective internal controls;

· Accounting, Legal and Regulatory Risks: The Company is exposed to risk

if it fails to comply with the regulations of the UK Listing Authority or if it

fails to maintain accurate accounting records. The Administrator provides the

Board with regular reports on changes in regulations and accounting

requirements;

· Financial Risks: The financial risks faced by the Company include

market, credit and liquidity risk. These risks and the controls in place to

mitigate them are reviewed at each quarterly Board meeting;

· Coronavirus Risk: Despite the impact of Coronavirus (COVID-19)

pandemic, the recovery therefrom and the subsequent impact on businesses, the

Board continues to believe that this is not a major business risk for the

Company. The Company uses a number of service providers for its day-to-day

operations. These providers have established and regularly tested Business

Resiliency Policies in place, to cover various possible scenarios whereby staff

cannot turn up for work at the designated office and conduct business as usual

(such as work from home facilities and/or different regions covering work for

other regions);

· Geopolitical Risk: Russia's ongoing invasion of Ukraine, along with

consequential supply-side inflation, has led to greater economic uncertainty,

variability and volatility. Whilst the Master Fund has no material direct

exposure to Russia, Ukraine or Belarus. the Board has also made enquiries of

key service providers in respect of any impact from Russia's invasion of

Ukraine and the related instability in world markets and has been assured that

none of the service providers have operations in the region or are in any way

impacted in terms of their ability to continue to supply their services to the

Company; and

· Climate Change and ESG Risks: The Company has no employees and does not

own any physical assets and is therefore not directly exposed to climate change

risk. The Manager monitors developments in this area and industry best

practice on behalf of the Board where appropriate and also regularly assesses

the trading activity of the underlying Master Fund and sub-funds to ascertain

whether environmental, social and governance ("ESG") factors are appropriate or

applicable to such funds. The Board has also made enquiries of key service

providers in respect of their assessment of how climate change and ESG risk

impacts their own operations and has been assured that this has no impact on

their ability to continue to supply their services to the Company.

Board Diversity

When appointing new directors and reviewing the Board composition, the Board

considers, amongst other factors, diversity, balance of skills, knowledge,

gender and experience. The Board however does not consider it appropriate to

establish targets or quotas in this regard. As at the date of this report, the

Board comprised three female and two male non-executive directors. The Company

has no employees.

International Tax Reporting

For purposes of the US Foreign Account Tax Compliance Act, the Company

registered with the US Internal Revenue Services ("IRS") as a Guernsey

reporting Foreign Financial Institution ("FFI"), received a Global Intermediary

Identification Number (5QHZVI.99999.SL.831), and can be found on the IRS FFI

list.

The Common Reporting Standard ("CRS") is a global standard for the automatic

exchange of financial account information developed by the Organisation for

Economic Co-operation and Development ("OECD"), which was adopted by Guernsey

and came into effect on 1 January 2016. The CRS replaced the intergovernmental

agreement between the UK and Guernsey to improve international tax compliance

that had previously applied in respect of 2014 and 2015. The Company made its

latest report for CRS to the Director of Income Tax on 28 June 2022.

Relations with Shareholders

The Board welcomes Shareholders' views and places great importance on

communication with the Company's Shareholders. The Board receives regular

reports on the views of Shareholders and the Chair and other Directors are

available to meet Shareholders, with a number of such meetings taking place

during the period. The Company provides weekly unaudited estimates of NAV,

month end unaudited estimates and unaudited final NAVs. The Company also

provides a monthly newsletter. These are published via RNS and are also

available on the Company's website. Risk reports of the Master Fund are also

available on the Company's website.

The Manager maintains regular dialogue with institutional Shareholders, the

feedback from which is reported to the Board. Shareholders who wish to

communicate with the Board should contact the Administrator in the first

instance.

Having reviewed the Financial Conduct Authority's restrictions on the retail

distribution of non-mainstream pooled investments, the Company, after taking

legal advice, announced on 15 January 2014 that it is outside the scope of

those restrictions, so that its shares can continue to be recommended by UK

authorised persons to ordinary retail investors.

Following the publication of the updated AIC Code in February 2019, when 20

per-cent or more of Shareholder votes have been cast against a Board

recommendation for a resolution, the Company should explain, when announcing

voting results, what actions it intends to take to consult Shareholders in

order to understand the reasons behind the result. An update on the views

received from shareholders and actions taken should be published no later than

six months after the shareholder meeting. The Board should then provide a final

summary in the Annual Report and, if applicable, in the explanatory notes to

resolutions at the next shareholder meeting, on what impact the feedback has

had on the decisions the Board has taken and any actions or resolutions now

proposed. During the period, no resolution recommended by the Board received

more than 20% of votes against it.

Significant Shareholders

As at 30 June 2022, the following Shareholders had significant shareholdings in

the Company:

% holding

Total Shares Held in class

Significant Shareholders

Sterling Shares

Ferlim Nominees Limited 5,124,539 17.49%

Rathbone Nominees Limited 2,957,852 10.09%

Smith & Williamson Nominees Limited 2,334,735 7.97%

Cheviot Capital (Nominees) Limited 1,972,538 6.73%

Pershing Nominees Limited 1,428,611 4.88%

Lion Nominees Limited 1,196,798 4.08%

Vestra Nominees Limited 1,091,095 3.72%

HSBC Global Custody Nominee (UK) Limited 1,057,421 3.61%

% holding

Total Shares Held in class

Significant Shareholders

US Dollar Shares

Hero Nominees Limited 494,029 19.12%

Vidacos Nominees Limited 476,674 18.45%

Euroclear Nominees 367,205 14.21%

Luna Nominees Limited 171,447 6.64%

Securities Services Nominees Limited 107,172 4.15%

Rathbone Nominees Limited 97,790 3.78%

Ferlim Nominees Limited 95,703 3.70%

Vestra Nominees Limited 89,589 3.47%

Smith & Williamson Nominees Limited 87,256 3.38%

Signed on behalf of the Board by:

Richard Horlick

Chair

John Le Poidevin

Director

9 September 2022

Statement of Directors' Responsibility in Respect of the Interim Report and

Unaudited Financial Statements

We confirm to the best of our knowledge that:

. these Interim Unaudited Financial Statements have been prepared in

accordance with United States Generally Accepted Accounting Principles and give

a true and fair view of the assets, liabilities, financial position and profit

or loss; and

. these Interim Unaudited Financial Statements include information detailed

in the Chair's Statement, the Directors' Report, the Manager's Report and the

Notes to the Interim Unaudited Financial Statements, which provides a fair

review of the information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being an

indication of important events that have occurred during the first six months

of the financial year and their impact on these Interim Unaudited Financial

Statements and a description of the principal risks and uncertainties for the

remaining six months of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being

related-party transactions that have taken place in the first six months of the

current financial year and that have materially affected the financial position

or performance of the Company during that period and any changes in the

related-party transactions described in the last Annual Audited Financial

Statements that could materially affect the financial position or performance

of the Company.

The Directors are responsible for the maintenance and integrity of the

corporate and financial information included on the Company's website and for

the preparation and dissemination of financial statements. Legislation in

Guernsey governing the preparation and dissemination of the financial

statements may differ from legislation in other jurisdictions.

Signed on behalf of the Board by:

Richard Horlick

Chair

John Le Poidevin

Director

9 September 2022

Directors' Remuneration Report

30 June 2022

Introduction

An ordinary resolution for the approval of the Directors' Remuneration Report

was passed by the Shareholders at the Annual General Meeting held on 24

September 2021.

Remuneration policy

A Remuneration and Nomination Committee was established on 17 June 2022. Prior

to this, the Board as a whole considered matters relating to the Directors'

remuneration. No advice or services were provided by any external person in

respect of its consideration of the Directors' remuneration.

The Company's policy is that the fees payable to the Directors should reflect

the time spent by the Directors on the Company's affairs and the

responsibilities borne by the Directors and be sufficient to attract, retain

and motivate Directors of a quality required to run the Company successfully.

The Chair of the Board is paid a higher fee in recognition of his additional

responsibilities, as are the Chairs of the various Board committees and the

Senior Independent Director. The policy is to review fee rates periodically,

although such a review will not necessarily result in any changes to the rates,

and account is taken of fees paid to Directors of comparable companies.

There are no long-term incentive schemes provided by the Company and no

performance fees are paid to Directors.

No Director has a service contract with the Company but each of the Directors

is appointed by a letter of appointment which sets out the main terms of their

appointment. The Directors were appointed to the Board for an initial term of

three years and Section 21.3 of the Company's Articles requires, as does the

AIC Code, that all of the Directors retire at each Annual General Meeting. At

the Annual General Meeting of the Company on 24 September 2021, Shareholders

re-elected all the Directors. Director appointments can also be terminated in

accordance with the Articles. Should Shareholders vote against a Director

standing for re-election, the Director affected will not be entitled to any

compensation. There are no set notice periods and a Director may resign by

notice in writing to the Board at any time.

Directors are remunerated in the form of fees, payable quarterly in arrears, to

the Director personally.

No other remuneration or compensation was paid or payable by the Company during

the period to any of the Directors apart from the reimbursement of allowable

expenses.

Directors' fees

Until 30 June 2022, The Company's Articles limited the fees payable to

Directors in aggregate to £400,000 per annum. The annual Directors' fees were:

£70,000 for Richard Horlick, the Chair; £55,000 for John Le Poidevin, the Chair

of the Audit Committee; £50,000 for Claire Whittet, as Chair of the Management

Engagement Committee and the Senior Independent Director and £45,000 for all

other Directors.

From 1 July 2022, the annual aggregate limit was increased to £800,000 per

annum. The annual Directors' fees were changed to being £90,000 for Richard

Horlick, the Chair; £65,000 for John Le Poidevin, the Chair of the Audit

Committee; £55,000 for Julia Chapman, as Chair of the Management Engagement

Committee; £55,000 for Bronwyn Curtis, as Chair of the Remuneration and

Nomination Committee; £55,000 for Claire Whittet, as Senior Independent

Director and £50,000 for all other Directors.

The fees payable by the Company in respect of each of the Directors who served

during the period ended 30 June 2022, the year ended 31 December 2021 and the

period ended 30 June 2021, were as follows:

Period Year Period

ended ended ended

30.06.22 31.12.21 30.06.21

£ £ £

Richard Horlick* 35,000 *66,678 *31,678

Colin Maltby** N/A **8,822 **8,822

Julia Chapman*** 22,500 ***11,250 N/A

Bronwyn Curtis 22,500 45,000 22,500

John Le Poidevin 27,500 55,000 27,500

Claire Whittet 25,000 50,000 25,000

Total 132,500 236,750 115,500

* On 15 February 2021, Richard Horlick was appointed Chair at a fee of

£70,000 p.a. Prior to that date, he served as a Director at a fee of £45,000

p.a.

** Colin Maltby retired as Chair and Director on 15 February 2021 and

was paid a fee of £70,000 p.a. until that date.

*** Julia Chapman was appointed to the Board on 1 October 2021 at a fee of

£45,000 p.a.

Signed on behalf of the Board by:

Richard Horlick

Chair

John Le Poidevin

Director

9 September 2022

Manager's Report

Brevan Howard Capital Management LP ("BHCM" or the "Manager") is the manager of

BH Macro Limited (the "Company") and of Brevan Howard Master Fund Limited (the

"Master Fund"). The Company invests all of its assets (net of short-term

working capital) in the ordinary shares of the Master Fund.

Performance Review

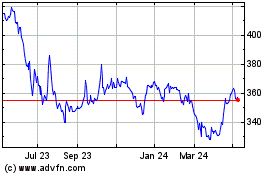

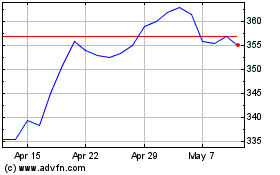

The NAV per share of the GBP shares of the Company appreciated 15.53% during

the first half of 2022, while the NAV per share of the USD shares appreciated

by 14.11%.

The month-by-month NAV performance of each currency class of the Company since

it commenced operations in 2007 is set out below.

GBP Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD

2007 - - 0.11 0.83 0.17 2.28 2.55 3.26 5.92 0.04 3.08 0.89 20.67

2008 10.18 6.85 (2.61) (2.33) 0.95 2.91 1.33 1.21 (2.99) 2.84 4.23 (0.67) 23.25

2009 5.19 2.86 1.18 0.05 3.03 (0.90) 1.36 0.66 1.55 1.02 0.40 0.40 18.00

2010 (0.23) (1.54) 0.06 1.45 0.36 1.39 (1.96) 1.23 1.42 (0.35) (0.30) (0.45) 1.03

2011 0.66 0.52 0.78 0.51 0.59 (0.56) 2.22 6.24 0.39 (0.73) 1.71 (0.46) 12.34

2012 0.90 0.27 (0.37) (0.41) (1.80) (2.19) 2.38 1.01 1.95 (0.35) 0.94 1.66 3.94

2013 1.03 2.43 0.40 3.42 (0.08) (2.95) (0.80) (1.51) 0.06 (0.55) 1.36 0.41 3.09

2014 (1.35) (1.10) (0.34) (0.91) (0.18) (0.09) 0.82 0.04 4.29 (1.70) 0.96 (0.04) 0.26

2015 3.26 (0.58) 0.38 (1.20) 0.97 (0.93) 0.37 (0.74) (0.63) (0.49) 2.27 (3.39) (0.86)

2016 0.60 0.70 (1.78) (0.82) (0.30) 3.31 (0.99) (0.10) (0.68) 0.80 5.05 0.05 5.79

2017 (1.54) 1.86 (2.95) 0.59 (0.68) (1.48) 1.47 0.09 (0.79) (0.96) 0.09 (0.06) (4.35)

2018 2.36 (0.51) (1.68) 1.01 8.19 (0.66) 0.82 0.79 0.04 1.17 0.26 0.31 12.43

2019 0.52 (0.88) 2.43 (0.60) 3.53 3.82 (0.78) 1.00 (1.94) 0.47 (1.22) 1.52 7.98

2020 (1.42) 5.49 18.31 0.19 (0.85) (0.53) 1.74 0.94 (1.16) (0.02) 0.75 3.04 28.09

2021 1.20 0.32 0.81 0.15 0.25 (1.50) (0.49) 0.87 0.40 0.27 0.00 0.47 2.76

2022 0.94 1.79 5.39 3.86 1.66 1.05 15.53

USD Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD

2007 - - 0.10 0.90 0.15 2.29 2.56 3.11 5.92 0.03 2.96 0.75 20.27

2008 9.89 6.70 (2.79) (2.48) 0.77 2.75 1.13 0.75 (3.13) 2.76 3.75 (0.68) 20.32

2009 5.06 2.78 1.17 0.13 3.14 (0.86) 1.36 0.71 1.55 1.07 0.37 0.37 18.04

2010 (0.27) (1.50) 0.04 1.45 0.32 1.38 (2.01) 1.21 1.50 (0.33) (0.33) (0.49) 0.91

2011 0.65 0.53 0.75 0.49 0.55 (0.58) 2.19 6.18 0.40 (0.76) 1.68 (0.47) 12.04

2012 0.90 0.25 (0.40) (0.43) (1.77) (2.23) 2.36 1.02 1.99 (0.36) 0.92 1.66 3.86

2013 1.01 2.32 0.34 3.45 (0.10) (3.05) (0.83) (1.55) 0.03 (0.55) 1.35 0.40 2.70

2014 (1.36) (1.10) (0.40) (0.81) (0.08) (0.06) 0.85 0.01 3.96 (1.73) 1.00 (0.05) 0.11

2015 3.14 (0.60) 0.36 (1.28) 0.93 (1.01) 0.32 (0.78) (0.64) (0.59) 2.36 (3.48) (1.42)

2016 0.71 0.73 (1.77) (0.82) (0.28) 3.61 (0.99) (0.17) (0.37) 0.77 5.02 0.19 6.63

2017 (1.47) 1.91 (2.84) 3.84 (0.60) (1.39) 1.54 0.19 (0.78) (0.84) 0.20 0.11 (0.30)

2018 2.54 (0.38) (1.54) 1.07 8.41 (0.57) 0.91 0.90 0.14 1.32 0.38 0.47 14.16

2019 0.67 (0.70) 2.45 (0.49) 3.55 3.97 (0.66) 1.12 (1.89) 0.65 (1.17) 1.68 9.38

2020 (1.25) 5.39 18.40 0.34 (0.82) (0.54) 1.84 0.97 (1.11) (0.01) 0.76 3.15 28.89

2021 1.21 0.31 0.85 0.16 0.26 (1.47) (0.47) 0.86 0.31 0.14 (0.09) 0.59 2.67

2022 0.74 1.77 5.27 3.80 1.09 0.76 14.11

Source: Master Fund NAV data is provided by the administrator of the Master

Fund, State Street Fund Services (Ireland) Limited. The Company's NAV and NAV

per Share data is provided by the Company's administrator, Northern Trust

International Fund Administration Services (Guernsey) Limited.

The Company's NAV per Share % Monthly Change is calculated by BHCM.

The Company's NAV data is unaudited and net of all investment management and

performance fees and all other fees and expenses payable by the Company. In

addition, the Company's investment in the Master Fund is subject to an

operational services fee.

NAV performance is provided for information purposes only. Shares in the

Company do not necessarily trade at a price equal to the prevailing NAV per

Share.

Data as at 30 June 2022.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

Quarterly and Annual contribution (%) to the performance of the Company's USD

Shares (net of fees and expenses) by asset class

Rates FX Commodities Credit Equity Digital TOTAL

Assets

Q1 2022 7.28 1.30 0.72 0.09 (1.05) (0.39) 7.93

Q2 2022 6.91 (0.37) (0.22) (0.43) 0.41 (0.51) 5.73

YTD 14.70 0.92 0.50 (0.35) (0.64) (0.90) 14.11

2022

Data as at 30 June 2022.

Quarterly and YTD figures are calculated by BHCM as at 30 June 2022, based on

performance data for each period provided by the Company's administrator,

Northern Trust. Figures rounded to two decimal places.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

Methodology and Definition of Contribution to Performance:

Attribution by asset class is produced at the instrument level, with

adjustments made based on risk estimates.

The above asset classes are categorised as follows:

"Rates": interest rates markets

"FX": FX forwards and options

"Commodities": commodity futures and options on commodities including mining

indices

"Credit": corporate and asset-backed indices, bonds and CDS

"Equity": equity markets including indices and other derivatives

"Digital Assets": crypto-currencies including derivatives

Performance and Economic Outlook Commentary

Headline and core inflation rose to 40-year highs in the US in the first half

of the year. Overall GDP growth has been subpar because of a combination of

factors. Inventories and international trade pulled down real GDP in the first

quarter. Real consumption spending slowed in the second quarter because

inflation ran so hot and residential investment fell as the housing sector

cooled. It's possible that both quarters eventually report declines in real

GDP, which would meet the casual definition of recession. However, with real

GDI growing and the labour market continuing to power ahead, there is no

widespread decline in economic activity which is required to meet the technical

definition of a recession. Indeed, the labour market has never been tighter

according to a number of metrics. The unemployment rate is low, the broadest

measure of labour-market slack (U-6) declined to a record low in June, and job

openings are near record highs. After having fallen behind the curve, the

Federal Reserve ("Fed") has moved quickly to tighten financial conditions,

delivering an initial 25 basis point hike in March and accelerating the removal

of accommodation in May and June with 50 bps and 75 bps rate hikes,

respectively. In response to the Fed's "expeditious" pace of rate hikes,

mortgage rates rose, equities fell, and the US dollar appreciated.

Over the course of H1 the Master Fund profited broadly from these events,

making gains from the move higher in US and global interest rates as well as

inflation and volatility markets. Additional gains came from commodity trading

as well as from a wide range of idiosyncratic emerging market interest rate and

FX positioning, while credit, equity and digital asset trading strategies

detracted modestly.

Going into the second half of the year, the Fed will likely continue raising

rates into restrictive territory. Investors will be asking whether the economy

slows enough to reduce inflationary pressures. The global picture shared a

number of themes with the US. Inflation is very high in most developed market

economies and virtually all Emerging Market economies. Even Japan is beginning

to see signs of inflationary pressures as the Bank of Japan maintains

hyper-accommodative and perhaps unsustainable monetary policy easing. China

suffered from COVID-pandemic-related shutdowns that brought economic activity

to a standstill. Although China deployed a number of fiscal measures to promote

growth there's no plan to end its dynamic zero-COVID policy. Europe faces the

most profound economic challenges that point to stagflation in the second half

of the year as Putin uses energy as a strategic weapon. Inflation is too high,

growth is at risk, and policy rates are too low among the European central

banks. The European Central Bank ("ECB") is in an especially parlous position.

Inflation is at a record-high for the Euro era, policy rates are still

negative, and the planned pace of rate hikes is relatively leisurely.

The biggest threat to financial stability may be a renewal of worries about the

sustainability of sovereign debt in heavily-indebted peripheral countries.

Indeed, political risks in Italy may flare up again and prove to be a catalyst

for market stress. Taken as a whole, the global macro environment is

complicated, challenging and changing at a fast pace.

Brevan Howard wishes to thank shareholders once again for their continued

support.

Brevan Howard Capital Management LP,

acting by its sole general partner,

Brevan Howard Capital Management Limited.

9 September 2022

Independent Review Report to BH Macro Limited

Conclusion

We have been engaged by BH Macro Limited (the "Company") to review the

financial statements in the half-yearly financial report for the six months

ended 30 June 2022 of the Company, which comprises the unaudited statement of

assets and liabilities, the unaudited statement of operations, the unaudited

statement of changes in net assets, the unaudited statement of cash flows and

the related explanatory notes.

Based on our review, nothing has come to our attention that causes us to

believe that the financial statements in the half-yearly financial report for

the period ended 30 June 2022 do not give a true and fair view of the financial

position of the Company as at 30 June 2022 and of its financial performance and

its cash flows for the six month period then ended, in accordance with U.S

generally accepted accounting principles and the Disclosure Guidance and

Transparency Rules ("the DTR") of the UK's Financial Conduct Authority ("the UK

FCA").

Scope of review

We conducted our review in accordance with International Standard on Review

Engagements (UK) 2410 Review of Interim Financial Information Performed by the

Independent Auditor of the Entity ("ISRE (UK) 2410") issued by the Financial

Reporting Council for use in the UK. A review of interim financial information

consists of making enquiries, primarily of persons responsible for financial

and accounting matters, and applying analytical and other review procedures.

We read the other information contained in the half-yearly financial report and

consider whether it contains any apparent misstatements or material

inconsistencies with the information in the financial statements.

A review is substantially less in scope than an audit conducted in accordance

with International Standards on Auditing (UK) and consequently does not enable

us to obtain assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not express an audit

opinion.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than those performed

in an audit as described in the Scope of review section of this report, nothing

has come to our attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors have

identified material uncertainties relating to going concern that are not

appropriately disclosed.

This conclusion is based on the review procedures performed in accordance with

ISRE (UK) 2410. however future events or conditions may cause the Company to

cease to continue as a going concern, and the above conclusions are not a

guarantee that the Company will continue in operation.

Director's responsibilities

The half-yearly financial report is the responsibility of, and has been

approved by, the directors. The directors are responsible for preparing the

interim financial report in accordance with the DTR of the UK FCA.

The financial statements included in this interim report have been prepared in

accordance with U.S generally accepted accounting principles.

In preparing the half-yearly financial report, the directors are responsible

for assessing the Company's ability to continue as a going concern, disclosing,

as applicable, matters related to going concern and using the going concern

basis of accounting unless liquidation is imminent.

Our responsibility

Our responsibility is to express to the Company a conclusion on the financial

statements in the half-yearly financial report based on our review. Our

conclusion, including our conclusions relating to going concern, are based on

procedures that are less extensive than audit procedures, as described in the

scope of review paragraph of this report.

The purpose of our review work and to whom we owe our responsibilities

This report is made solely to the Company in accordance with the terms of our

engagement letter to assist the Company in meeting the requirements of the DTR

of the UK FCA. Our review has been undertaken so that we might state to the

Company those matters we are required to state to it in this report and for no

other purpose. To the fullest extent permitted by law, we do not accept or

assume responsibility to anyone other than the Company for our review work, for

this report, or for the conclusions we have reached.

Simon Guilbert

For and on behalf of KPMG Channel Islands Limited

Chartered Accountants

Guernsey

9 September 2022

Unaudited Statement of Assets and Liabilities

As at 30 June 2022

30.06.22 31.12.21 30.06.21

(Unaudited) (Audited) (Unaudited)

US$'000 US$'000 US$'000

Assets

Investment in the Master Fund (note 3) 1,523,101 1,288,417 709,628

Master Fund redemption proceeds receivable - 600 68,211

Master Fund subscription paid in advance 32,180 - -

Prepaid expenses 333 294 112

Cash and bank balances denominated in 4,820 15,884 2,657

Sterling

Cash and bank balances denominated in US 334 546 441

Dollars

Combination costs receivable - 1,749 -

Total assets 1,560,768 1,307,490 781,049

Liabilities

Performance fees payable (note 4) 43,130 6,205 2,344

Management fees payable (note 4) 2,020 3,252 640

Repurchases in respect of the tender offer - - 65,215

payable

Legal and professional fees payable - - 1,467

Accrued expenses and other liabilities 227 254 166

Administration fees payable (note 4) 58 51 32

Total liabilities 45,435 9,762 69,864

1,515,333 1,297,728 711,185

Net assets

Number of shares in issue (note 5)

Sterling shares 29,300,836 25,864,663 13,750,456

US Dollar shares 2,583,898 2,689,547 1,968,239

Net asset value per share (notes 7 and 9)

Sterling shares £39.63 £34.30 £33.78

US Dollar shares US$40.76 US$35.71 US$35.24

See accompanying Notes to the Interim Unaudited Financial Statements.

Signed on behalf of the Board by:

Richard Horlick

Chair

John Le Poidevin

Director

9 September 2022

Unaudited Statement of Operations

For the period ended 30 June 2022

01.01.22 01.01.21 01.01.21

30.06.22 31.12.21 30.06.21

(Unaudited) (Audited) (Unaudited)

US$'000 US$'000 US$'000

Net investment loss allocated

from the Master Fund

Interest income 7,473 4,830 1,628

Dividend and other income

(net of withholding tax:

30 June 2022: $59,896; 31 December 2021: 333 443 189

US$41,739; 30 June 2021: US$24,654)

Expenses (13,094) (9,738) (6,179)

Net investment loss allocated (5,288) (4,465) (4,362)

from the Master Fund

Company income

Bank interest income 3 - -

Foreign exchange gains - - 7,305

(note 3)

Total Company income 3 - 7,305

Company expenses

Performance fees (note 45,802 6,286 2,350

4)

Management fees (note 11,427 10,921 1,273

4)

Legal and professional - - 1,471

fees

Other expenses 389 1,465 644

Directors' fees 172 326 161

Administration fees 113 156 63

(note 4)

Foreign exchange 144,433 13,044 -

losses (note 3)

Total Company expenses 202,336 32,198 5,962

Net investment loss (207,621) (36,663) (3,019)

Net realised and unrealised gain on investments

allocated from the Master Fund

Net realised gain on 46,061 46,982 25,643

investments

Net unrealised gain/(loss) 203,762 1,691 (7,393)

on investments

Net realised and 249,823 48,673 18,250

unrealised gain on

investments allocated

from the Master Fund

Net increase in net assets 42,202 12,010 15,231

resulting from operations

See accompanying Notes to the Interim Unaudited Financial Statements

Unaudited Statement of Changes in Net Assets

For the period ended 30 June 2022

01.01.22 01.01.21 01.01.21

30.06.22 31.12.21 30.06.21

(Unaudited) (Audited) (Unaudited)

US$'000 US$'000 US$'000

Net increase in net assets resulting from

operations

Net investment loss (207,621) (36,663) (3,019)

Net realised gain on investments allocated 46,061 46,982 25,643

from the Master Fund

Net unrealised gain/(loss) on investments 203,762 1,691 (7,393)

allocated from the Master Fund

42,202 12,010 15,231

Share capital transactions

Proceeds on issue of shares from treasury

(note 5)

Sterling shares - 129,006 -

US Dollar shares - 3,216 -

Issue of new shares from the Combination with

BH Global Limited (in Voluntary Winding Up)

Sterling shares - 339,914 -

US Dollar shares - 25,733 -

Issue of new shares

Sterling shares 175,403 91,896 -

US Dollar shares - - -

Tender offer

Sterling shares - (60,902) (60,901)

US Dollar shares - (4,314) (4,314)

Total share capital transactions 175,403 524,549 (65,215)

Net increase/(decrease) in net assets 217,605 536,559 (49,984)

Net assets at the beginning of the period/ 1,297,728 761,169 761,169

year

Net assets at the end of the period/year 1,515,333 1,297,728 711,185

See accompanying Notes to the Interim Unaudited Financial Statements.

Unaudited Statement of Cash Flows

For the period ended 30 June 2022

01.01.22 01.01.21 01.01.21

30.06.22 31.12.21 30.06.21

(Unaudited) (Audited) (Unaudited)

US$'000 US$'000 US$'000

Cash flows from

operating activities

Net increase in net assets resulting from 42,202 12,010 15,231

operations

Adjustments to reconcile net increase in net

assets resulting from operations to net cash

provided by operating activities:

Net investment loss allocated 5,288 4,465 4,362

from the Master Fund

Net realised gain on investments (46,061) (46,982) (25,643)

allocated from the Master Fund

Net unrealised (gain)/loss on investments (203,762) (1,691) 7,393

allocated from the Master Fund

Purchase of investment in the Master Fund1 (142,989) (145,200) -

Proceeds from sale of 7,261 113,482 44,546

investment in the Master Fund

Increase in Master Fund (32,180) - -

subscription paid in advance

Foreign exchange losses 144,433 13,044 (7,305)

/(gains)

Increase in prepaid (39) (258) (76)

expenses

Increase/(decrease) in 36,925 (34,263) (38,124)

performance fees payable

(Decrease)/increase in (1,232) 2,830 218

management fees payable

(Decrease)/increase in accrued (27) 152 64

expenses and other liabilities

Decrease/(increase) in 1,749 (1,749) -

combination fees receivable

Increase in legal and - - 1,467

professional fees payable

Increase/(decrease) in 7 (12) (31)

administration fees payable

Net cash (used in)/generated from (188,425) (84,172) 2,102

operating activities

Cash flows from

financing activities

Purchase of own shares - (65,216) -

into treasury

Proceeds from share 175,403 160,179 -

issue1,2

Net cash generated from 175,403 94,963 -

financing activities

Change in cash (13,022) 10,791 2,102

Cash, beginning of the 16,430 961 961

period/year

Effect of exchange rate 1,746 4,678 35

fluctuations

Cash, end of the period 5,154 16,430 3,098

/year

Cash, end of the period

/year

Cash and bank balances 4,820 15,884 2,657

denominated in Sterling3

Cash and bank balances 334 546 441

denominated in US Dollars

5,154 16,430 3,098

Supplemental disclosure of non-cash financing

activities

1. Supplemental disclosure of non-cash financing

activities: In the year ended 31 December 2021,

non-cash amounts of US$429.6 million in relation

to the Combination with BH Global Limited (in

Voluntary Winding Up) have been excluded from the

Statement of Cash Flows.

2. The balance from the year ended 31 December

2021 contains proceeds from both the Combination

with BH Global Limited (in Voluntary Winding Up)

and subsequent block listings.

3. Cash and bank balances in 3,969 11,726 1,923

Sterling (GBP'000)

See accompanying Notes to the Interim Unaudited Financial Statements