TIDMSWL

RNS Number : 8135R

Swallowfield PLC

05 March 2019

Swallowfield plc

("Swallowfield" or the "Group")

Interim results

Swallowfield plc, a market leader in the development,

formulation, and supply of personal care and beauty products,

including its own portfolio of brands, announces its interim

results for the 28 weeks ended 12 January 2019

Financial highlights

-- Group revenue increased by 3.7% to GBP41.4m. Brands sales

grew 1.3% to GBP12.5m, against a strong comparative H1 FY18. Strong

volume recovery from Manufacturing sales with growth of 8.8%.

-- Strong margin in Brands has continued despite a challenging external environment.

-- Manufacturing margin in H1 has been significantly impacted by

the continuing high level of material cost inflation and a weaker

product mix. This will be mitigated by secured price increases in

H2 (as previously announced) and a more positive product mix.

-- Underlying operating profit reduced to GBP1.6m, with a strong

recovery anticipated in H2, driven by the above actions and cost

base optimisation in our Manufacturing business.

-- Significant reduction in net debt to GBP6.8m from year end GBP11.8m due to working capital normalisation.

-- Interim dividend increased by 7.5% to 2.15 pence.

GBPm unless otherwise stated 2019 2018

-------------------------------------- ----------------- ---------

Reported results (1)

----------------- ---------

Revenue GBP41.4m GBP39.9m

----------------- ---------

Underlying operating profit (1) GBP1.63m GBP3.40m

----------------- ---------

Adjusted basic earnings per share

(1) 7.9p 13.7p

----------------- ---------

Statutory results

----------------- ---------

Revenue GBP41.4m GBP40.0m

----------------- ---------

Operating profit before exceptional GBP1.43m GBP2.99m

items

----------------- ---------

Basic earnings per share 3.1p 13.1p

----------------- ---------

Total dividend per share 2.15p 2.0p

----------------- ---------

Net debt GBP6.8m GBP7.0m

----------------- ---------

(1) Underlying operating profit is calculated before LTIP,

amortisation of acquisition related intangibles, exceptional items

and net borrowing costs. Adjusted earnings per share is calculated

using operating profit before exceptional items and amortisation of

acquisition related intangibles.

Operational highlights

-- Strong innovation and new product development (NPD) momentum

has continued in Brands with new launches and re-stages across 3

'Drive' brands and 3 'Build' brands.

-- Focus on international and e-commerce distribution expansion

in Brands, supported by further investment in organisational

capability.

-- Manufacturing delivering significant year on year growth,

fuelled by volume performance of new contracts, with further new

business in the prestige sector secured for the second half.

-- Actions taken to streamline Manufacturing portfolio and

optimise cost base, with strategic review to be concluded in

H2.

Brendan Hynes, Non-executive Chairman, commented: "This first

half year has been impacted by significant material cost inflation,

as previously signalled in the Manufacturing segment of our

business. Our Brands business continues to perform well against

very strong comparatives. Actions have been taken to improve the

margin performance of our Manufacturing business in the second half

of the year and beyond. Swallowfield therefore remains well

positioned to regain its positive growth momentum."

Tim Perman, Chief Executive, commented: "During my first eight

months as CEO of Swallowfield plc, my focus has been working

towards a consistently profitable Manufacturing business whilst

continuing to invest in the development of our Brands business,

which has continued to underpin the Group's profit margins. The

prevailing market conditions require a clear strategic focus for

the Group and with our strategy to accelerate Brands growth and to

simplify Manufacturing we are confident in delivering further

profitable growth."

For further information please contact:

Swallowfield plc

-------------------------- ---------------

Tim Perman Chief Executive Officer 01823 662 241

-------------------------- ---------------

Matthew Gazzard Group Finance Director 01823 662 241

-------------------------- ---------------

Shaun Dobson / Jen Boorer N+1 Singer 0207 496 3000

-------------------------- ---------------

Josh Royston / Sam Modlin Alma PR 07780 901979

-------------------------- ---------------

Note: This announcement contains information that was previously

inside information for the purposes of Article 7 of regulation

596/2014 (MAR).

Business review

Group revenue growth in the period was 3.7% at GBP41.4m (2018:

GBP39.9m). This was driven by 8.8% growth in our Manufacturing

business and a modest level of growth in our Brands business.

At the start of the period the Group saw strong momentum in

Brands with positive Christmas gifting sales. However, the pace of

growth across the brand portfolio has since slowed due to lower UK

consumer confidence and pressures within the retail environment.

This has resulted in softening demand and retailer reductions in

category space and promotional activity which has impacted our

business. We have made good progress in growing International sales

which underpins our belief that there is a significant opportunity

for sustained international growth in Brands, a key strategic

objective for the Group. Continued focus on supply chain efficiency

and an improved sales mix has resulted in a continued strong gross

margin, despite retail pressures.

Sales in our Manufacturing business recovered strongly during

the period, reflecting robust volume demand from existing and new

customers. The Manufacturing business continues to win new volumes

and will see a good level of revenues for the balance of the year.

The well signalled impact of continuing high input costs and lower

margin mix resulted in lower gross margins for the period,

particularly when compared to the prior year period which included

the remaining contribution from a higher margin contract. As

previously indicated, gross margins will significantly improve in

H2 due to agreed price increases, and positive mix from new

contract wins. In addition, the focus on cost base optimisation

which will equate to annualised cost savings of GBP1.0m, will also

contribute to a strong profit recovery in H2.

Overheads increased in line with sales in our Manufacturing

business and increased slightly as a percentage of sales in our

Brands business as a result of investment in organisational

capability. However, it was predominantly the effect of the lower

gross margins generated in our Manufacturing business that resulted

in the Group making an underlying operating profit of GBP1.63m,

down significantly versus the comparable period (2018: GBP3.40m).

The high margin Brands division continues to represent the majority

of operating profit.

The overall effective rate of Group taxation for the period was

19.0% (2018: 19.0%) of pre-tax profits. The current year tax charge

reflects standard UK and the Czech Republic rates of taxation.

This resulted in adjusted earnings per share of 7.9p (2018:

13.7p).

Strategic Report

The prevailing market conditions require a clear strategic focus

for the Group.

Our strategy is based on five key value drivers:

-- Portfolio of international, national and exclusive Brands

-- Distribution expansion of Brands business

-- Simplified, profitable Manufacturing business

-- Category know-how: NPD, technical, formulation & regulatory expertise

-- Performance culture: commercial acumen, speed, responsiveness, flexibility.

Our Brands business develops and markets a portfolio of personal

care and beauty brands that are distributed across major retailers

in the UK and internationally. The strategic priority for Brands is

to accelerate sales and profit growth, organically and via earnings

accretive acquisitions.

Our Manufacturing business formulates and manufactures personal

care and beauty products for a customer base that includes many of

the world's leading beauty brands. The strategic priority for

Manufacturing is to streamline and simplify the business and

actions are already underway in this regard.

The following summarises the progress made in each part of the

business in this period.

Brands

-- New product development executed at pace

-- Positive Christmas gift sales

-- 3 'Drive' brands and 3 'Build' brands restaged with new graphics

-- Ecommerce development with increased focus on e-tailers

-- Positive progress with the development of new international strategy

-- Investment in organisational capability to strengthen team

Manufacturing

-- 3 significant new contracts fully embedded with increased volumes

-- New margin accretive wins in prestige sector

-- Price increases secured to mitigate cost price inflation (H2

impact); on track to deliver a more profitable performance from

Manufacturing.

-- Utilising all 3 European sites to maximise increasing customer demand

-- Continuing to focus on R&D and innovation in areas of

core capability particularly aerosols and hot pours

-- Actions to rationalise certain areas of the cost base taken

in the period; strategic work underway with full review of

structural footprint nearing completion

Net debt and cash flow

Net debt significantly decreased from a year-end position of

GBP11.8m to GBP6.8m (2018: GBP7.0m). The key component to the

reduction in debt has been the collection of year end debtors and

the partial unwinding of material and component inventory which had

strategically been bought ahead to secure supply.

Finance costs of GBP0.22m (2018: cost GBP0.18m) comprised

interest expense of GBP0.15m (2018: GBP0.1m) plus a pension scheme

notional finance charge of GBP0.07m (2018: charge GBP0.08m).

Finance income is the receipt of GBP0.39m (2018: nil) dividend

income from our investment holding in SCCTC.

Capital expenditure was GBP0.6m, in line with depreciation. We

expect capital expenditure to remain ahead of depreciation for the

full financial year as we continue to invest in key strategic

development projects and in further line efficiency programs.

Defined benefit pension scheme

The defined benefit pension scheme underwent its last triennial

valuation as of 5 April 2017. The deficit on a statutory funding

basis was GBP2.6m and the Group has entered into a deficit recovery

plan and schedule of contributions of GBP0.2m per annum.

For accounting purposes at 12 January 2019, the Group recognised

under IAS19 'employee benefits', a deficit of GBP6.6m (June 2018:

GBP4.5m). The Accounting Standards require the discount rate to be

based on yields on high quality (usually AA-rated) corporate bonds

of appropriate currency, taking into account the term of the

relevant pension scheme's liabilities. Corporate bond indices are

used as a proxy to determine the discount rate. At the reporting

date, the yields on bonds of all types were slightly higher than

they were at 30 June 2018. This has resulted in marginally higher

discount rates being adopted for accounting purposes compared to

last year, which has been coupled with a small increase in

expectations of long term inflation, the combined effect leaving

the fair value of the scheme liabilities increased, with a weak

investment return performance decreasing the value of the schemes

assets. This has translated into an increase in liability under the

IAS19 methodology.

Dividends

The Board is pleased to announce that it has approved an interim

dividend of 2.15 pence per share (2018: 2.0 pence). This dividend

will be paid on 24 May 2019 to shareholders on the register on 3

May 2019.

The Directors' intention is to have a progressive dividend

policy that aligns future dividend payments to the underlying

earnings and cash flow of the business, taking in to account the

gearing and the operational requirements of the business.

Outlook

There is clearly a considerable level of uncertainty in the

current business environment and we expect consumer demand to

remain subdued. We are confident that the strategic focus of the

Group will enable us to deliver the best outcome for all

stakeholders.

We expect the current pace of innovation and new product

development to continue in Brands, accompanied by an enhanced focus

on distribution in both the UK and internationally, which will help

to mitigate the slowdown in retail demand in this business.

In our Manufacturing business, we expect a significant second

half recovery given the visibility of the order book and as we

benefit from the positive impact of pricing initiatives, product

mix and cost base optimisation already implemented. We will also be

finalising our strategic work, commenced in the period, to

streamline the portfolio of activities in this segment of our

business.

We are a market leader in our field with a strong and growing

portfolio of owned brands, and whilst we are seeing the impact of

the challenges faced in the wider environment, we are confident in

a materially improved performance in the second half and believe

results will be broadly in line with market expectations for the

full year demonstrating profitable growth.

Group Statement of Comprehensive Income

28 weeks 28 weeks ended 12 months

ended ended

12 Jan 2019 6 Jan 2018 30 June 2018

(unaudited) (unaudited) (audited)

Continuing operations Notes GBP'000 GBP'000 GBP'000

Revenue 2 41,441 39,962 73,945

Cost of sales (34,239) (32,012) (60,253)

--------------------------------- ------ ------------ --------------- -------------

Gross profit 7,202 7,950 13,692

Commercial and administrative

costs (5,773) (4,953) (8,716)

--------------------------------- ------ ------------ --------------- -------------

Operating profit before

exceptional items 1,429 2,997 4,976

Exceptional items 3 (869) (25) (279)

--------------------------------- ------ ------------ --------------- -------------

Operating profit 560 2,972 4,697

Finance income 386 - 191

Finance costs 4 (218) (175) (364)

Profit before taxation 728 2,797 4,524

Taxation (138) (532) (891)

--------------------------------- ------ ------------ --------------- -------------

Profit after taxation 590 2,265 3,633

Other comprehensive (loss)

/ income for the period:

Re-measurement of defined

benefit liability (1,617) 407 1,403

Items that will be reclassified

subsequently to profit

or loss

Exchange differences on

translating foreign operations (50) 54 30

Gain on available for sale

financial assets 529 158 156

Other comprehensive (loss)

/ income for the period (1,138) 619 1,589

--------------------------------- ------ ------------ --------------- -------------

Total comprehensive (loss)

/ income for the period (548) 2,884 5,222

================================= ====== ============ =============== =============

Profit attributable to:

--------------------------------- ------ ------------ --------------- -------------

Equity shareholders 537 2,205 3,542

--------------------------------- ------ ------------ --------------- -------------

Non-controlling interests 53 60 91

Total comprehensive (loss)

/ income attributable to:

--------------------------------- ------ ------------ --------------- -------------

Equity shareholders (601) 2,824 5,131

--------------------------------- ------ ------------ --------------- -------------

Non-controlling interests 53 60 91

Earnings per share

- basic 5 3.1p 13.1p 20.9p

- diluted 5 3.0p 12.7p 20.3p

Dividend

Paid in period (GBP'000) 720 590 933

Paid in period (pence per

share) 4.2p 3.5p 5.5p

Proposed (GBP'000) 368 337 720

Proposed (pence per share) 6 2.15p 2.0p 4.2p

Group Statement of Changes in Equity

Share Share Revaluation Exchange Pension Retained Non-controlling Total

Capital Premium of Reserve re-measurement Earnings interest Equity

investment reserve

reserve

Group GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- --------- ------------ --------- --------------- --------- ---------------- ---------

Balance as at

June 2018 857 11,987 1,247 (112) (2,491) 15,455 79 27,022

----------------- -------- --------- ------------ --------- --------------- --------- ---------------- ---------

Dividends - - - - - (720) - (720)

Non-controlling

interest - - - - - - 53 53

Share based

payments - - - - - 143 - 143

Transactions

with owners - - - - - (577) 53 (524)

----------------- -------- --------- ------------ --------- --------------- --------- ---------------- ---------

Profit for the

period - - - - - 537 - 537

Other

comprehensive

income:

Re-measurement

of defined

benefit

liability - - - - (1,617) - - (1,617)

Exchange

difference

on translating

foreign

operations - - - (50) - - - (50)

Gain on

available

for sale

financial

assets - - 529 - - - - 529

Total

comprehensive

income for the

year - - 529 (50) (1,617) 537 - (601)

----------------- -------- --------- ------------ --------- --------------- --------- ---------------- ---------

Balance as at

12 January 2019 857 11,987 1,776 (162) (4,108) 15,415 132 25,897

----------------- -------- --------- ------------ --------- --------------- --------- ---------------- ---------

Balance as at

June 2017 as

restated 844 11,744 1,091 (142) (3,894) 12,749 18 22,410

---------------------- ------ --------- -------- -------- ---------- --------- ----- ---------

Dividends - - - - - (590) - (590)

---------------------- ------ --------- -------- -------- ---------- --------- ----- ---------

Non-controlling

interest - - - - - - 60 60

Share based payments - - - - - 47 - 47

Transactions

with owners - - - - - (543) 60 (483)

---------------------- ------ --------- -------- -------- ---------- --------- ----- ---------

Profit for the

period - - - - - 2,205 - 2,205

Other comprehensive

income:

Re-measurement

of defined benefit

liability - - - - 407 - - 407

Exchange difference

on translating

foreign operations - - - 54 - - - 54

Gain on available

for sale financial

assets - - 158 - - - - 158

Total comprehensive

income for the

year - - 158 54 407 2,205 - 2,824

---------------------- ------ --------- -------- -------- ---------- --------- ----- ---------

Balance as at

6 January 2018 844 11,744 1,249 (88) (3,487) 14,411 78 24,751

---------------------- ------ --------- -------- -------- ---------- --------- ----- ---------

Balance as at June

2017 as restated 844 11,744 1,091 (142) (3,894) 12,749 18 22,410

------------------------- ------- ---------- ------ ------ -------- ------- ----- -------

Dividends - - - - - (933) (30) (963)

Issue of new shares 13 243 - - - - - 256

Non-controlling

interest - - - - - - 91 91

Share based payments - - - - - 97 - 97

Transactions with

owners 13 243 - - - (863) 61 (519)

------------------------- ------- ---------- ------ ------ -------- ------- ----- -------

Profit for the year - - - - - 3,542 - 3,542

Other comprehensive

income:

Re-measurement of

defined benefit

liability - - - - 1,403 - - 1,403

Exchange difference

on translating foreign

operations - - - 30 - - - 30

Gain on available

for sale financial

assets - - 156 - - - - 156

Total comprehensive

income for the year - - 156 30 1,403 3,542 - 5,131

------------------------- ------- ---------- ------ ------ -------- ------- ----- -------

Balance as at June

2018 857 11,987 1,247 (112) (2,491) 15,455 79 27,022

------------------------- ------- ---------- ------ ------ -------- ------- ----- -------

Group Statement of Financial Position

As at As at As at

12 Jan 2019 6 Jan 2018 30 June 2018

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

restated

ASSETS

Non-current assets

Property, plant and equipment 11,257 11,491 11,438

Intangible assets 12,575 9,387 12,707

Deferred tax assets 1,138 666 803

Investments 1,920 1,442 1,391

------------------------------- ------ ------------ ------------ -------------

Total non-current assets 26,890 22,986 26,339

------------------------------- ------ ------------ ------------ -------------

Current assets

Inventories 15,150 13,537 13,825

Trade and other receivables 14,792 17,325 19,283

Cash and cash equivalents 1,747 425 934

Current tax receivable 508 70 109

------------------------------- ------ ------------ ------------ -------------

Total current assets 32,197 31,357 34,151

------------------------------- ------ ------------ ------------ -------------

Total assets 59,087 54,343 60,490

------------------------------- ------ ------------ ------------ -------------

LIABILITIES

Current liabilities

Trade and other payables 21,409 21,521 23,709

Interest-bearing loans

and borrowings 1,140 541 1,127

Current tax payable 994 552 503

------------------------------- ------ ------------ ------------ -------------

Total current liabilities 23,543 22,614 25,339

------------------------------- ------ ------------ ------------ -------------

Non-current liabilities

Interest-bearing loans

and borrowings 2,623 1,242 3,230

Post-retirement benefit

obligations 8 6,614 5,665 4,489

Deferred tax liabilities 410 71 410

Total non-current liabilities 9,647 6,978 8,129

------------------------------- ------ ------------ ------------ -------------

Total liabilities 33,190 29,592 33,468

------------------------------- ------ ------------ ------------ -------------

Net assets 25,897 24,751 27,022

------------------------------- ------ ------------ ------------ -------------

EQUITY

Share capital 857 844 857

Share premium 11,987 11,744 11,987

Revaluation of investment

reserve 1,777 1,249 1,247

Exchange reserve (163) (88) (112)

Re-measurement of defined

benefit liability (4,108) (3,487) (2,491)

Retained earnings 15,415 14,411 15,455

------------------------------- ------ ------------ ------------ -------------

Total equity 25,765 24,673 26,943

------------------------------- ------ ------------ ------------ -------------

Non-controlling interest 132 78 79

------------------------------- ------ ------------ ------------ -------------

Total equity 25,897 24,751 27,022

------------------------------- ------ ------------ ------------ -------------

Group Cash Flow Statement

28 weeks 28 weeks 12 months

ended ended ended

12 Jan 2019 6 Jan 2018 30 June 2018

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Profit before taxation 728 2,797 4,524

Depreciation 667 651 1,283

Amortisation 154 122 583

Finance income (386) - (191)

Finance cost 218 175 364

(Increase) in inventories (1,325) (2,107) (2,395)

Decrease / (increase) in trade

and other receivables 3,757 (540) (2,648)

Increase in trade payables 808 211 1,298

Increase / (decrease) in other

payables 1,912 (521) (354)

(Decrease) in share-based

payments provision (158) (48) (1,666)

Contributions to defined benefit

plan (175) (54) (108)

Cash generated from operations 6,200 686 690

-------------------------------------- ------------ ------------ ----------------------

Finance expense paid (153) (97) (209)

Taxation paid (202) (321) (762)

-------------------------------------- ------------ ------------ ----------------------

Net cash flow from operating

activities 5,845 268 (281)

-------------------------------------- ------------ ------------ ----------------------

Cash flow from investing activities

Dividend income received 386 - 191

Purchase of property, plant

and equipment (639) (1,067) (1,631)

Purchase of intangibles (23) (18) (3,850)

Purchase of subsidiary - (1,925) (1,850)

Sale of property, plant and 154 - -

equipment

Net cash flow from investing

activities (122) (3,010) (7,140)

-------------------------------------- ------------ ------------ ----------------------

Cash flow from financing activities

(Repayment) / proceeds of

invoice discounting facility (3,596) 10 2,741

Proceeds from new loan - - 3,000

Issue of new share capital - - 256

Repayment of loans (594) (310) (736)

Dividends paid (720) (590) (963)

-------------------------------------- ------------ ------------ ----------------------

Net cash flow from financing

activities (4,910) (890) 4,298

-------------------------------------- ------------ ------------ ----------------------

Net increase / (decrease)

in cash and cash equivalents 813 (3,632) (3,123)

Cash and cash equivalents

at beginning of period 934 4,057 4,057

-------------------------------------- ------------ ------------ ----------------------

Cash and cash equivalents

at end of period 1,747 425 934

-------------------------------------- ------------ ------------ ----------------------

Notes to the Accounts

Note 1 Basis of preparation

The Group has prepared its interim results for the 28-week

period ended 12 January 2019 in accordance with the recognition and

measurement principles of International Financial Reporting

Standards (IFRS) as adopted by the European Union and also in

accordance with the recognition and measurement principles of IFRS

issued by the International Accounting Standards Board.

The Directors have considered trading and cash flow forecasts

prepared for the Group, and based on these, and the confirmed

banking facilities, are satisfied that the Group will continue to

be able to meet its liabilities as they fall due for at least one

year from the date of approval of the Interim Report. On this

basis, they consider it appropriate to adopt the going concern

basis in the preparation of these accounts.

As permitted, this interim report has been prepared in

accordance with the AIM rules and not in accordance with IAS34

'Interim Financial Reporting'.

These interim financial statements do not constitute full

statutory accounts within the meaning of section 434 of the

Companies Act 2006 and are unaudited. The unaudited interim

financial statements were approved by the Board of Directors on 27

February 2019.

The consolidated financial statements are prepared under the

historical cost convention as modified to include the revaluation

of certain non-current assets. The accounting policies used in the

interim financial statements are consistent with IFRS and those

which will be adopted in the preparation of the Group's Annual

Report and Financial Statements for the year ended June 2019.

The statutory accounts for the year ended June 2018, which were

prepared under IFRS, have been filed with the Registrar of

Companies. These statutory accounts carried an unqualified Auditors

Report and did not contain a statement under Section 498(2) or

498(3) of the Companies Act 2006.

Note 2 Segmental analysis

The Group is a market leader in the development, formulation,

and supply of personal care and beauty products.

The reportable segments of the Group are aggregated as

follows:

-- Brands - we leverage our skilled resources to develop and

market a growing portfolio of Swallowfield owned and managed

brands. These include organically developed Bagsy, MR. and Tru,

plus the acquisitions of The Real Shaving Company (in 2015), the

portfolio of brands included in The Brand Architekts acquisition

(in 2016) and the latest acquisition 'Fish'.

-- Manufacturing - the development, formulation and production

of quality products for many of the world's leading personal care

and beauty brands.

-- Eliminations and Central Costs - other Group-wide activities

and expenses, including defined benefit pension costs (closed

defined benefit scheme), LTIP expenses, amortisation of

acquisition-related intangibles, interest, taxation and

eliminations of intersegment items, are presented within

'Eliminations and central costs'.

This is the basis on which the Group presents its operating

results to the Board of Directors, which is considered to be the

CODM for the purposes of IFRS 8.

a) Principal measures of profit and loss - Income Statement segmental information:

28 weeks ended 12 January 2019 28 weeks ended 6 January 2018

Brands Manufacturing Eliminations Total Brands Manufacturing Eliminations Total

and Central and Central

Costs Costs

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

UK revenue 10,055 19,915 - 29,970 10,111 17,734 - 27,845

International

revenue 2,360 9,111 - 11,471 2,186 9,931 - 12,117

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

Revenue - External 12,415 29,026 - 41,441 12,297 27,665 - 39,962

Revenue - Internal 36 2,214 (2,250) - - 1,037 (1,037) -

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

Total revenue 12,451 31,240 (2,250) 41,441 12,297 28,702 (1,037) 39,962

--------------------- -------- ------------- -------- -------------

Underlying

operating

profit/(loss) 2,580 230 (1,180) 1,630 2,575 1,918 (1,089) 3,404

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

Charge for

share based

payments - - (67) (67) - - (307) (307)

Amortisation

of

acquisition-related

intangibles - - (133) (133) - - (100) (100)

Exceptional

costs - - (869) (869) - - (25) (25)

Net borrowing

income / (costs) - - 168 168 - - (175) (175)

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

Profit/(loss)

before taxation 2,580 230 (2,082) 728 2,575 1,918 (1,696) 2,797

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

Tax charge - - (138) (138) - - (532) (532)

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

Profit/(loss)

for the period 2,580 230 (2,220) 590 2,575 1,918 (2,228) 2,265

--------------------- -------- -------------- ------------- -------- -------- -------------- ------------- --------

The segmental Income Statement disclosures are measured in

accordance with the Group's accounting policies as set out in note

1.

Inter segment revenue earned by Manufacturing from sales to

Brands is determined on normal commercial trading terms as if

Brands were any other third party customer.

All defined benefit pension costs and LTIP expenses are

recognised for internal reporting to the CODM as part of Group-wide

activities and are included within 'Eliminations and central costs'

above. Other costs, such as Group insurance and auditors'

remuneration which are incurred on a Group-wide basis are recharged

by the head office to segments on a reasonable and consistent basis

for all periods presented and are included within segment results

above.

b) Other Income Statement segmental information

The following additional items are included in the measures of

profit and loss reported to the CODM and are included within (a)

above:

28 weeks ended 12 January 2019 Brands Manufacturing Eliminations Total

and Central

Costs

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- -------- -------------- ------------- --------

Depreciation 6 661 - 667

Amortisation - 21 133 154

c) Principal measures of assets and liabilities

The Groups assets and liabilities are managed centrally by the

CODM and consequently there is no reconciliation between the

Group's assets per the statement of financial position and the

segment assets.

d) Additional entity-wide disclosures

The distribution of the Group's external revenue by destination

is shown below:

Geographical segments 28 weeks ended 28 weeks ended 12 months

ended

12 Jan 2019 6 Jan 2018 30 June 2018

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

--------------- --------------- -------------

UK 29,970 27,845 51,284

Other European Union countries 7,956 9,156 16,891

Rest of the World 3,515 2,961 5,770

--------------- --------------- -------------

41,441 39,962 73,945

--------------- --------------- -------------

In the 28 weeks ended 12 January 2019, the Group had two

customers that exceeded 10% of total revenues, being 13.3% and

10.3% respectively. In the 28 weeks ended 6 January 2018, the Group

had two customers that exceeded 10% of total revenues, being 12.7%

and 10.4% respectively.

Note 3 Exceptional items

There was an exceptional items charge for the period ended 12

January 2019 of GBP0.9m. A structured redundancy program was

executed during the first half of the financial year in our

manufacturing business with related costs of GBP0.6m. A provision

of GBP0.3m has been made in respect to the GMP equalisation on the

Group's DB Pension scheme.

The prior year exceptional items charge represents the

applicable proportion of the consolidated loss for the Sterling

Shave Club Ltd. This investment was written off in the full year to

30 June 2018.

Note 4 Finance costs 28 weeks ended 28 weeks ended 12 months

ended

12 Jan 2019 6 Jan 2018 30 June 2018

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

--------------- --------------- -------------

Finance costs

Bank loans and overdrafts 153 97 212

Notional pension scheme costs 65 78 152

--------------- --------------- -------------

218 175 364

--------------- --------------- -------------

Note 5 Earnings per share 28 weeks ended 28 weeks ended 12 months

ended

12 Jan 2019 6 Jan 2018 30 June 2018

(unaudited) (unaudited) (audited)

--------------- --------------- -------------

Basic and diluted

Profit for the period (GBP'000) 537 2,205 3,542

Basic weighted average number

of

ordinary shares in issue during

the period 17,135,542 16,865,401 16,934,762

Diluted number of shares 17,659,183 17,413,330 17,454,505

Basic earnings per share 3.1p 13.1p 20.9p

--------------------------------- --------------- --------------- -------------

Diluted earnings per share 3.0p 12.7p 20.3p

--------------------------------- --------------- --------------- -------------

Basic earnings per share has been calculated by dividing the

profit for each financial period by the weighted average number of

ordinary shares in issue in the period. There is a difference at 6

January 2018 between the basic net earnings per share and the

diluted net earnings per share due to the LTIP share options

awarded to June 2017, to give a total of 547,929 share options. The

difference at 12 January 2019 includes the net LTIP share options

awarded to June 2018, to give a total of 523,641 share options that

could be issued.

Adjusted earnings per share

Profit for the period (GBP'000) 537 2,205 3,542

Add back: Exceptional items 869 25 279

Add back: Amortisation of Acquisition

Related Intangibles 133 100 197

Notional tax charge on above

items (190) (24) (90)

--------------------------------------- ----------------------- ------------------------- -----------

Adjusted profit before exceptional

items 1,349 2,306 3,928

--------------------------------------- ----------------------- ------------------------- -----------

Basic weighted average number

of

ordinary shares in issue during

the period 17,135,542 16,865,401 16,934,762

Diluted number of shares 17,659,183 17,413,330 17,454,505

--------------------------------------- ----------------------- ------------------------- -----------

Adjusted basic earnings per

share 7.9p 13.7p 23.2p

--------------------------------------- ----------------------- ------------------------- -----------

Adjusted diluted earnings per

share 7.6p 13.2p 22.2p

--------------------------------------- ----------------------- ------------------------- -----------

Adjusted earnings per share has been calculated by dividing the

adjusted profit (after allowing for the notional tax charge on

exceptional items) by the weighted average number of shares in

issue in the period. There is a difference at 6 January 2018

between the basic net earnings per share and the diluted net

earnings per share due to the LTIP share options awarded to June

2017, to give a total of 547,929 share options. The difference at

12 January 2019 includes the net LTIP share options awarded to June

2018, to give a total of 523,641 share options that could be

issued.

Note 6 Dividends

The Directors have declared an interim dividend payment of 2.15p

per share (2018: Interim: 2.0p; Final: 4.2p).

Note 7 Reconciliation of cash and cash equivalents to movement

in net debt

28 weeks ended 28 weeks ended 12 months

ended

12 Jan 2019 6 Jan 2018 30 June 2018

(unaudited) (unaudited) (audited)

GBP000's GBP000's GBP000's

--------------- --------------- -------------

Increase / (decrease) in cash

and cash equivalents in the

period 813 (3,632) (3,123)

Net cash outflow / (inflow)

from decrease / (increase) in

borrowings 4,190 300 (5,005)

----------------------------------- --------------- --------------- -------------

Change in net debt resulting

from cash flows 5,003 (3,332) (8,128)

Net debt at the beginning of

the period (11,769) (3,641) (3,641)

----------------------------------- --------------- --------------- -------------

Net debt at the end of the period (6,766) (6,973) (11,769)

----------------------------------- --------------- --------------- -------------

Note 8 IAS 19 'Employee Benefits'

Expected future cash flows to and from the Scheme:

The Scheme is subject to the scheme funding requirements

outlined in UK legislation. The last scheme funding valuation of

the Scheme was as at 5 April 2017 and revealed a funding deficit of

GBP2.6m. The liabilities of the Scheme are based on the current

value of expected benefit payment cash flows to members of the

Scheme over the next 60 to 80 years. The average duration of the

liabilities is approximately 20 years.

In accordance with the schedule of contributions dated 4

September 2018, the Company is expected to pay contributions to the

Scheme to make good any shortfalls in funding and has agreed to pay

GBP0.2m per annum. Contributions will subsequently increase from

FY24 to a sufficient level to eliminate the deficit over the

established 10 year recovery period. The magnitude of such payments

will be reviewed following the next scheme funding valuation as at

April 2020.

In addition, the Company has agreed to meet the cost of

administrative expenses and Pension Protection Fund insurance

premiums for the Scheme.

Payments made by the Company to the Scheme and in respect of

Scheme liabilities were:

28 weeks ended 28 weeks ended 12 months ended

12 January 2019 6 January 2018 30 June 2018

GBP000's GBP000's GBP000's

----------------- ---------------- ----------------

Company pension contributions - - -

Deficit recovery payments 175 54 108

Scheme administrative

expenses 92 51 171

Pension Protection Fund

premium 108 222 222

------------------------------- ----------------- ---------------- ----------------

Total 375 327 501

------------------------------- ----------------- ---------------- ----------------

The amounts expensed in the Group Statement of Comprehensive

Income were:

28 weeks ended 28 weeks ended 12 months ended

12 January 2019 6 January 2018 30 June 2018

GBP000's GBP000's GBP000's

----------------- ---------------- ----------------

In Operating profit:

Company pension contributions - - -

Scheme administrative

expenses 96 88 171

Pension Protection Fund

premium 58 119 222

GMP Equalisation 288 - -

----------------- ---------------- ----------------

442 207 393

In Finance costs:

Unwinding of notional

discount factor 65 78 155

------------------------------- ----------------- ---------------- ----------------

Total 507 285 548

------------------------------- ----------------- ---------------- ----------------

IAS 19 requires a separate valuation of the Scheme on a

different basis to the funding valuation referred to above.

The effects of the application of IAS19 on the statement of

financial position at 12 January 2019 are:

12 January

2019

GBP000's

-----------

Increase in net pension and other benefit

obligations (2,125)

Reduction in deferred tax 361

Reduction in equity 1,764

--------------------------------------------- -----------

The Accounting Standards require the discount rate to be based

on yields on high quality (usually AA-rated) corporate bonds of

appropriate currency, taking into account the term of the relevant

pension scheme's liabilities. Corporate bond indices are often used

as a proxy to determine the discount rate. At the reporting date,

the yields on bonds of all types were higher than they were at June

2018. This has resulted in marginally higher discount rates being

adopted for accounting purposes compared to last year, which has

been coupled with a small increase in expectations of long term

inflation, the combined effect leaving the fair value of the scheme

liabilities increased, with a weak investment return performance

decreasing the value of the schemes assets. This has translated

into an increase in liability under the IAS19 methodology.

The key assumptions used were:

As at 12 January As at 6 January As at 30 June

2019 2018 2018

----------------- ---------------- --------------

Discount Rate 3.05% 2.60% 2.80%

Rate of inflation (RPI) 3.20% 3.10% 3.00%

Rate of inflation (CPI) 2.10% 2.10% 2.00%

The amounts recognised in the Group statement of financial

position were:

As at 12 January As at 6 January As at 30 June

2019 2018 2018

GBP000's GBP000's GBP000's

----------------- ---------------- --------------

Present value of funded

obligations (29,065) (29,471) (27,502)

Fair value of scheme assets 22,451 23,806 23,013

----------------------------- ----------------- ---------------- --------------

(Deficit) (6,614) (5,665) (4,489)

----------------------------- ----------------- ---------------- --------------

Note 9 Announcement of results

The Interim Report will be sent to shareholders and is available

to members of the public at the Company's Registered Office at

Swallowfield House, Station Road, Wellington, Somerset, TA21 8NL

and on the Company's website.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR CKQDPDBKBONK

(END) Dow Jones Newswires

March 05, 2019 02:01 ET (07:01 GMT)

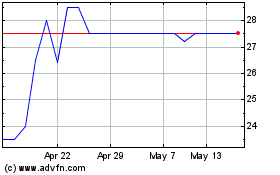

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Nov 2023 to Nov 2024