RNS Number:7847A

Swallowfield PLC

05 September 2002

Swallowfield plc

Preliminary announcement of final results for the 18 months ended 30 June 2002

Chairman's Statementwallowfield formulates, manufactures and packages fine,

tories and cosmetics across the whole specets for own label and brand name

I am pleased to present the Company's first report and accounts since changing

the year-end to 30 June. For statutory purposes these have been drawn up for the

18 months to 30 June 2002, and the comparative figures for the previous period

are those for the 12 months to 31 December 2000. These results therefore include

the typically weak January to June trading period for both 2001 and 2002.

However, to enable proper comparisons to be made, the last five years' results

have been restated to years ending 30 June, using previously reported interim

accounts. This restatement is shown in Note 1, and comparisons made in this

review are with reference to these restated results.

Results

During the year to 30 June 2002 profit after tax increased by 20.6% compared

with the prior year to #1.7m. Over the same period, and on the same basis,

earnings per share increased to 15.0p from 12.4p.

The cosmetics division reported an operating loss in the year to 30 June 2002 of

#0.1m, on sales of #11.5m. This is lower than the loss of #0.2m reported in the

previous year. The business became much more seasonal in nature and made a loss

of #0.7m in the last six months of the year. Lower sales, a worse product mix

and price pressures contributed to this loss. We still believe this business

contributes to the Group's capabilities and customer base, but continue to look

for ways to improve its core profitability.

The aerosols division made an operating profit of #2.7m during the year to 30

June 2002, an increase of 12.9% over the previous year on a 10.1% increase in

turnover. We continue to leverage our core strengths in this business to broaden

our product capabilities.

As anticipated, the Group's business has become more seasonal, justifying our

decision to change the year-end which will also provide greater clarity to the

results. As a consequence the new June year-end will typically result in higher

debt levels than a December year-end.

Gearing stood at 42% at the end of June compared to 46% at the same time last

year. Net debt levels have increased from the low levels reported at December

2001 mainly due to the seasonality impact noted above and the increased working

capital necessary to meet our growing business volumes.

The results for the last four months have been adversely affected by rising

insurance costs. Despite the insurance industry acknowledging our superior and

improving risk management, our insurance costs have increased #0.25m a year from

March 2002.

Strategic Update

We have continued to progress the strategy developed two years ago, and during

the past year, have briefed all employees on its rationale and intent.

During the last 18 months, we have invested #3.1m in plant and equipment and

laboratory facilities. This investment, facilitated by good cash management, has

been focused on increasing capacity, improving manufacturing efficiencies and

enhancement of our product capabilities. Our strategy for the business requires

organic growth and we have now started construction of a factory extension at

our site in Wellington. This extension will provide much needed room for

expansion, for both production and office accommodation and allow us to continue

to significantly improve our new product development facilities on this site.

We continue to look for opportunities to enhance our business through

acquisition or partnership, although as yet we have seen no suitable targets

which match our perception of value for money.

Changes to Accounting Standards

A number of new accounting standards have been implemented during the year, and

these are more fully described in the financial review section of the report and

accounts. We have adopted the transitional rules for implementing the

controversial new pensions accounting standard FRS17. The defined benefit

pension scheme operated on behalf of our Wellington site had an apparent

liability of #1.1m net of deferred tax at 30 June 2002 on an FRS17 basis, due

mainly to asset values on that date and use of a discount rate which does not

reflect an equity premium. However, the scheme underwent a triennial valuation

as at 6 April 2002. The results of this valuation indicate that the fund has a

slight surplus on an ongoing funding basis and importantly, was 119.6% funded on

the Government's minimum funding rate basis.

Looking Forward

Our positive outlook for the next six months remains. Whilst this is dependent

on seasonal sales, orders for the Autumn/Winter gift season exceed last year's

levels. At the end of June, the unit volume order book in the Aerosols business

was significantly higher than last year. Despite a weak sales performance in the

first six months of this calendar year, production in the cosmetics business has

picked up strongly and we remain hopeful that this will be reflected in sales in

the final quarter of this calendar year. The size of the current order books has

put us at full operating capacity in the short-term. This inevitably puts a

strain on the existing infrastructure and management is striving to ensure that

any effect on customer service levels is minimised.

Dividends

Your Board is proposing a final dividend of 2.0p against 1.7p declared at the

same time last year. This brings the total for the last 12 months to 4.8p

against 4.2p in the previous 12 month period and continues the progressive

dividend policy that we have followed over the last two years, whilst

recognising that our strategy requires reinvestment in the business to achieve

organic growth. The dividend will be paid on 30 October 2002 to shareholders on

the register on 11 October 2002.

Chairman

J S Espey

Group Profit and Loss Account

for the 18 months ended 30 June 2002

18 months 12 months

ended ended

30 June 31 Dec

2002 2000

#'000 #'000

Turnover 62,458 39,576

Cost of sales (50,155) (30,780)

Gross profit 12,303 8,796

Net operating expenses (9,168) (6,095)

Operating profit 3,135 2,701

Fundamental restructuring credit - 74

Profit on ordinary activities before interest and taxation 3,135 2,775

Interest receivable 148 48

Interest payable (589) (473)

Profit on ordinary activities before taxation 2,694 2,350

Tax on profit on ordinary activities (749) (527)

Profit attributable to shareholders 1,945 1,823

Dividends (732) (450)

Transferred to reserves 1,213 1,373

Earnings per share

- basic 17.3p 16.2p

- basic excluding fundamental

restructuring credit 17.3p 15.0p

- diluted 17.2p 16.2p

Group Statement of Total Recognised Gains and Losses

for the 18 months ended 30 June 2002

18 months 12 months

ended ended

30 June 31 Dec

2002 2000

#'000 #'000

Profit for the financial period 1,945 1,823

Translation gain on overseas investment 6 -

Total recognised gains and (losses) relating to the year 1,951 1,823

Prior year adjustment (556) -

Total recognised gains and (losses) since the last annual report 1,395 1,823

Group and Company Balance Sheets

as at 30 June 2002

Group Company

30 June 31 Dec 30 June 31 Dec

2002 2000 2002 2000

#'000 #'000 #'000 #'000

(restated) (restated)

Fixed assets

Tangible assets 11,142 10,194 - -

Investments - - 6,072 6,072

Current assets

Stocks 8,626 5,899 - -

Debtors 8,488 6,176 7,790 7,539

Cash at bank and in hand 1,306 2,419 18 46

18,420 14,494 7,808 7,585

Creditors: amounts falling due within one year (11,993) (9,127) (3,880) (4,249)

Net current assets 6,427 5,367 3,928 3,336

Total assets less current liabilities 17,569 15,561 10,000 9,408

Creditors: amounts falling due after more than one year (5,187) (4,452) (4,500) (3,925)

Provisions for liabilities and charges (770) (716) - (12)

11,612 10,393 5,500 5,471

Capital and reserves

Called up share capital 563 563 563 563

Share premium 3,796 3,796 3,796 3,796

Revaluation reserve 152 173 - -

Capital reserve - - 467 467

Profit and loss account 7,101 5,861 674 645

Equity shareholders' funds 11,612 10,393 5,500 5,471

Group Statement of Cash Flows

for the 18 months ended 30 June 2002

18 months 12 months

ended ended

30 June 31 Dec

2002 2000

#'000 #'000

Net cash inflow from operating activities 3,670 3,242

Returns on investments and servicing of finance

Interest received 148 48

Interest paid (512) (402)

Interest element of finance lease rentals (77) (71)

(441) (425)

Corporation tax paid (823) (678)

Capital expenditure

Purchase of tangible fixed assets (2,463) (868)

Sale of tangible fixed assets 77 1,007

(2,386) 139

Equity dividends paid (788) (394)

Net cash (outflow)/inflow before financing (768) 1,884

Financing

New loans 6,000 5,665

Repayment of loans (5,863) (5,895)

Capital element of finance lease rentals (482) (338)

(345) (568)

(Decrease)/increase in cash (1,113) 1,316

Reconciliation of Net Cash Flow to Movement in Net Debt

18 months 12 months

ended ended

30 June 31 Dec

2002 2000

#'000 #'000

(Decrease)/increase in cash (1,113) 1,316

Cash outflow from changes in debt and lease financing 345 568

Change in net debt resulting from cash flows (768) 1,884

New finance leases (723) (44)

Movement in net debt in the year (1,491) 1,840

Net debt at 1 January (3,386) (5,226)

Net debt at 30 June/31 December (4,877) (3,386)

Notes

1 Restated five year summary

The following unaudited and restated five year summary has been produced to

allow improved comparisons to be made between the current results and those of

prior years.

Notes Unaudited Unaudited Unaudited Unaudited Unaudited

Financial Financial Financial Financial Financial

Year Year Year Year Year

2002 2001 2000 1999 1998

#'000 #'000 #'000 #'000 #'000

First day of financial (a) 17 June 2001 18 June 2000 20 June 1999 21 June 1998 15 June 1997

year

Last day of the (a) 30 June 2002 16 June 2001 17 June 2000 19 June 1999 20 June 1998

financial year

Number of weeks in (b)

financial year 54 52 52 52 53

Profit and Loss Account

Turnover 44,404 40,425 37,600 39,731 52,797

Adjustment to 52 week (b)

basis (1,088)

Adjusted turnover 43,316 40,425 37,600 39,731 52,797

Operating profit 2,628 2,177 2,205 917 3,231

Fundamental - 20 54 (3,302) -

restructuring

Interest (296) (354) (454) (503) (462)

Profit/(loss) before 2,332 1,843 1,805 (2,888) 2,769

taxation

Taxation (645) (444) (501) (325) (864)

Profit attributable to

shareholders 1,687 1,399 1,304 (3,213) 1,905

Dividends (541) (472) (394) (113) (778)

Retained earnings 1,146 927 910 (3,326) 1,127

Balance Sheet

Fixed assets 11,142 10,228 10,516 11,972 12,278

Net current assets 6,427 6,610 5,146 (421) 3,855

Total assets less

current liabilities 17,569 16,838 15,662 11,551 16,133

Long-term creditors:

Loans and lease finance (5,187) (5,669) (5,243) (1,211) (3,726)

Deferred tax (770) (716) (720) (667) (623)

Provision for - - (146) (950) -

liabilities

Equity 11,612 10,453 9,553 8,723 11,784

Net debt 4,877 4,777 5,825 6,285 7,731

Segmental Analysis

Aerosol products:

Turnover 31,783 28,880 25,041 21,671 29,606

Operating profit 2,710 2,400 2,470 1,734 3,247

Cosmetic products:

Turnover 11,533 11,545 12,559 18,060 23,191

Operating profit (82) (223) (265) (817) (16)

Statistics

Weighted average number

of shares in issue 11,256,416 11,256,416 11,256,416 11,256,416 11,248,021

Undiluted earnings per

share 15.0p 12.4p 11.6p (28.5)p 16.9p

Earnings per share

excluding fundamental 15.0p 11.7p 11.1p (0.8)p 16.9p

restructuring

Gearing 42% 46% 61% 72% 66%

Dividends per share 4.8p 4.2p 3.5p 1.0p 6.9p

Notes to five year summary

(a) The restated five year summary is based on previously reported interim and

full year reports as adjusted for the restrospective implementation of FRS19,

Deferred Tax. The results for each financial year comprise the interim results

for the first half of the calendar year in which the financial year ends,

together with the second half of the previous calendar year. The balance sheet

and net debt numbers are those reported at the last day of the financial year.

(b) Except for turnover, where the relevant adjustment has been shown above, no

material changes would be required to the profit and loss account to adjust the

financial year 2002 numbers to a 52 week basis.

2 Turnover and Segmental Analysis

18 months ended 30 June 2002 12 months ended 31 December 2000

Turnover Profit before Net Turnover Profit before Net

Class of tax assets tax assets

business #'000 #'000 #'000 #'000 #'000 #'000

Aerosol products 45,615 3,430 11,004 27,637 2,698 9,203

Cosmetic 16,843 (295) 6,667 11,939 3 5,898

products

62,458 17,671 39,576 15,101

Operating 3,135 2,701

profit

Fundamental

restructuring - 74

Net interest

payable (441) (425)

Profit before 2,694 2,350

tax

Unallocated net

liabilities (6,059) (4,708)

Group net 11,612 10,393

assets

Geographic segment

By destination:

UK 47,546 32,258

Continental Europe 10,766 6,426

North America 1,223 252

Far East 2,336 583

Other 587 57

62,458 39,576

Unallocated net liabilities comprise bank loans, finance leases, taxation,

proposed dividend and certain other holding company assets.

3 Earnings per Share

18 months 12 months

ended ended

30 June 31 Dec

2002 2000

(a) Basic

Profit on ordinary activities after taxation #1,945,000 #1,823,000

Weighted average number of ordinary shares in issue during the year 11,256,416 11,256,416

Earnings per share 17.3p 16.2p

(b) Basic excluding fundamental restructuring credit

Profit on ordinary activities after taxation #1,945,000 #1,823,000

Less:

Fundamental restructuring credit - #(74,000)

Tax credit on fundamental restructuring expenditure - #(60,000)

#1,945,000 #1,689,000

Weighted average number of ordinary shares during the year 11,256,416 11,256,416

Earnings per share 17.3p 15.0p

(c) Diluted

Profit on ordinary activities after taxation #1,945,000 #1,823,000

Basic weighted average number of ordinary shares in issue during the year 11,256,416 11,256,416

Dilutive potential ordinary shares:

executive share options 26,838 29,586

11,283,254 11,286,002

Earnings per share 17.2p 16.2p

4 Statutory Accounts

The financial information does not constitute statutory accounts as defined in

section 240 of the Companies Act 1985, but has been extracted from the

statutory accounts for the 18 months ended 30 June 2002, on which an unqualified

audit report has been issued and which will be delivered to the Registrar

following their adoption at the Extraordinary General Meeting. The statutory

accounts for the financial year ended 31 December 2000 have been delivered to

the Registrar of Companies with an unqualified audit report thereon. The

restated five year summary in Note 1 above which has been produced to allow

comparisons to be made between the current results and those of prior years, is

unaudited.

5 Extraordinary General Meeting

The Extraordinary General Meeting will be held on Thursday 10 October 2002 at

the Castle Hotel, Taunton, Somerset at 12.00 noon

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAFNLEEDAEAE

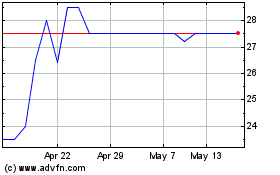

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Aug 2024 to Sep 2024

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Sep 2023 to Sep 2024