Trading Statement

April 29 2002 - 6:00AM

UK Regulatory

RNS Number:2096V

Swallowfield PLC

29 April 2002

Swallowfield plc Trading and Investment Update

During the 16 weeks to 20th April, sales for the group as a whole have been

broadly in line with our expectations.

Sales in the cosmetics business were 27% below the levels of a year ago in part

reflecting a weak market sector and greater seasonality. We do not expect a

significant improvement before the year-end on 30th June although there are

tentative signs that the market may be improving and orders for gift packs for

Christmas 2002 delivery are above last year's levels.

As expected, sales in the Aerosols business have been broadly level with the

same period last year. However, the order book has picked up strongly and in

unit volume terms now stands at record levels. Unit volume based order intake

in the first 16 weeks of the calendar year is 51% ahead of last year's levels

and enquiry levels are strong across the board in this business.

In order to continue the growth plans on the Wellington Site, the company is

investing £2m in a new factory extension and laboratory facility over the next

12 months. The investment will be financed from existing facilities provided by

the Group's main Bankers, Royal Bank of Scotland plc.

Tony Wardell, Group Managing Director commented, "this investment is necessary

to provide the additional infrastructure capacity required to meet the site's

five-year growth plans. At the same time the new building will provide

additional office and laboratory space and will enable us to continue our

commitment to innovation and new product development."

This information is provided by RNS

The company news service from the London Stock Exchange

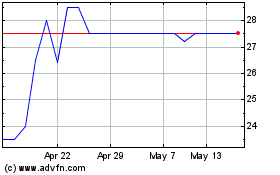

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Nov 2023 to Nov 2024