AEW UK REIT plc: NAV Update and Dividend Declaration (1099815)

July 23 2020 - 2:00AM

UK Regulatory

AEW UK REIT plc (AEWU)

AEW UK REIT plc: NAV Update and Dividend Declaration

23-Jul-2020 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

23 July 2020

AEW UK REIT Plc (the "Company")

NAV Update and Dividend Declaration

AEW UK REIT plc (LSE: AEWU) (the "Company"), which, as at 23 July 2020,

directly owns a diversified portfolio of 34 regional UK commercial property

assets, announces its unaudited Net Asset Value ("NAV") and interim dividend

for the three month period ended 30 June 2020.

Highlights

· The Company today announces an interim dividend of 2.00 pence per share

for the three months ended 30 June 2020, in line with the targeted annual

dividend of 8.00 pence per share.

· EPRA earnings per share ("EPRA EPS") for the quarter of 1.81 pence (31

March 2020: 2.12 pence).

· NAV of GBP148.24 million or 93.37 pence per share as at 30 June 2020 (31

March 2020: GBP147.86 million or 93.13 pence per share).

· NAV total return of 2.40% for the quarter (31 March 2020: -2.17%).

· During the quarter, the Company disposed of 2 Geddington Road, Corby,

for gross proceeds of GBP18.80 million, 25% ahead of prior valuation. The

property was purchased for GBP12.40 million in February 2018.

· EPRA occupancy 95.70% (31 March 2020: 96.32%). During the quarter, the

Company completed a lease renewal with the Secretary of State for Housing,

Communities and Local Government at Sandford House, Solihull for term of

15 years at a rent of GBP662,785 per annum. The property's valuation

increased by 37% over the quarter.

· For the rental quarter commencing on 24 June, 84% of rent has been

collected or is expected to be received under monthly payment plans prior

to quarter end. A further 6% of income is expected to be received under

agreed, longer term payment plans with an additional 4% still under

negotiation.

· The Company remains conservatively geared with a gross loan to value

ratio of 30.03% (31 March 2020: 27.21%). The Company had a cash balance of

GBP28.09 million and net loan to value ratio of 13.65% as at 30 June 2020.

Post quarter-end, the Company repaid GBP12.00 million of the facility,

reducing the gross loan to value to 23.03%.

Alex Short and Laura Elkin, Portfolio Managers, AEW UK REIT, commented:

"We are very pleased to be able to announce today an increase in NAV for the

quarter providing a NAV total return of 2.4%. We are also confirming an

interim dividend of 2 pence per share for the quarter, in line with the

annual dividend target of 8 pence per share. This success is a result of two

main factors, firstly, the unceasing hard work carried out by our asset

management team whose proactive approach is such a key piece of the AEWU

strategy. Asset Management gains have resulted in two significantly NAV

accretive wins for the Company during the period at our asset in Solihull

and our former asset in Corby. Both of these transactions are examples of

the Investment Manager's major business plans reaching fruition and it has

been very encouraging to see our assets demonstrating such resilience in the

current market. The second factor here is the defensive nature of the

portfolio assets which has always been a focus for us when selecting stock

for AEWU. This, combined with the portfolio's majority weighting in the

industrial sector, we believe will continue to provide a robust base for

investors' capital.

Another major Management focus in recent weeks has been to take steps to

ensure that the Company has the ability to retain its conservative outlook

towards its borrowings across a range of market conditions, including the

current. We have therefore taken a number of steps during the period

including amending the facility to allow unrestricted rights of repayment

and draw down which will allow AEWU to bring its borrowing below its long

term target of 25% in the short term whilst not prejudicing its ability to

access borrowing over the long term. Another action taken has been to obtain

a waiver of interest cover covenant tests until 2021 with the lender

pledging further support past this date if needed. These changes were

enacted despite banking covenants having been passed with significant

headroom at their most recent test date in April and without increase in

cost of debt. We would like to thank our lender RBS International for their

support to the Company.

A highlight of the Company's announcement today is confirmation of the

Company's dividend of 2p per share for the quarter to 30 June 2020. We are

very pleased to be able to announce this as it shows the continuation of the

Company's track record, now in excess of 4 years, in paying dividends at

this level. Our outstanding performance in achieving the sale of Corby

during May at a level 25% ahead of valuation, has created a significant

profit in cash reserves that we can call on at this time. Going forward, we

would hope to see normalisation in our rent collection that will continue to

support the dividend at this level over the long term.

The aforementioned sale of Corby leaves the Company holding a significant

cash balance which we believe is advantageous in current market conditions

as it increases Management optionality. We have held regular discussions

with Directors over recent weeks to assess potential uses of this capital.

We also believe that the investment market will continue to yield attractive

purchasing opportunities over coming weeks and months and we are currently

analysing a number of opportunities within our pipeline."

The like-for-like valuation decrease for the quarter of GBP2.81 million

(1.61%) by sector is broken down as follows:

Sector Valuation 30 June Valuation movement for the

2020 quarter

GBP million % GBP million %

Industrial 89.61 52.2 (1.59) (1.75)

Office 46.25 27.0 1.35 3.01

Retail 22.48 13.1 (0.92) (3.91)

Other 13.15 7.7 (1.65) (11.15)

Total 171.49 100.0 (2.81) (1.61)

Net Asset Value

47.8% of the Company's portfolio valuation as at 30 June 2020, which

includes all of its assets that do not sit within the industrial sector, is

subject to material uncertainty following the Standing Independent Valuer's

determination of material valuation uncertainty as per VPS 3 and VPGA 10 of

the RICS Red Book Global, due to the unprecedented set of circumstances

surrounding the COVID-19 Global Pandemic. Consequently, less certainty and a

higher degree of caution should be attached to the NAV. The industrial

sector was removed from this clause a short time prior to the valuation

date. This set of circumstances is not unique to the Company and is being

reported by all major UK Commercial RICS registered property valuers at this

time.

The Company's unaudited NAV as at 30 June 2020 was GBP148.24 million, or 93.37

pence per share. This reflects an increase of 0.26% compared with the NAV

per share as at 31 March 2020. The Company's NAV total return, which

includes the interim dividend for the period from 1 January 2020 to 31 March

2020 of 2.00 pence per share, was 2.40% for the three-month period ended 30

June 2020. As at 30 June 2020, the Company owned investment properties with

a fair value of GBP171.49 million.

Pence per share GBP million

NAV at 1 April 2020 93.13 147.86

Gain on disposal of investment 2.31 3.67

property

Capital expenditure (0.03) (0.05)

Valuation change in property (1.84) (2.92)

portfolio

Valuation change in derivatives (0.01) (0.01)

Income earned for the period 2.71 4.31

Expenses and net finance costs for (0.90) (1.44)

the period

Interim dividend paid (2.00) (3.18)

NAV at 30 June 2020 93.37 148.24

The NAV attributable to the ordinary shares has been calculated under

International Financial Reporting Standards. It incorporates the independent

portfolio valuation as at 30 June 2020, which is subject to material

uncertainty and income for the period, but does not include a provision for

the interim dividend for the three month period to 30 June 2020.

Dividend

Dividend declaration

The Company today announces an interim dividend of 2.00 pence per share for

the period from 1 April 2020 to 30 June 2020. The dividend payment will be

made on 28 August 2020 to shareholders on the register as at 31 July 2020.

The ex-dividend date will be 30 July 2020.

The dividend of 2.00 pence per share will be designated 2.00 pence per share

as an interim property income distribution ("PID").

The EPRA EPS for the three-month period to 30 June 2020 was 1.81 pence (31

March 2020: 2.12 pence).

Dividend outlook

It remains the Company's intention to continue to pay future dividends in

line with its dividend policy, however the outlook remains unclear given the

current COVID-19 situation. In determining future dividend payments, regard

will be had to the circumstances prevailing at the relevant time, as well as

the Company's requirement, as a UK REIT, to distribute at least 90% of its

distributable income annually, which will remain a key consideration.

Financing

Equity and share buy-back

The Company's share capital consists of 158,774,746 Ordinary Shares and

there was no movement during the quarter.

The Board announces that it has approved a share buy-back programme

utilising cash available for this purpose. Liberum Capital Limited has been

appointed in connection with the buy-back programme and can use its

discretion to buy-back shares within set parameters.

Shareholders should be aware that a purchase of shares by the Company on any

trading day may represent a significant proportion of the daily trading

volume in the shares and could exceed 25 per cent of the average daily

trading volume of the preceding 20 business days.

Debt

The Company had borrowings of GBP51.50 million as at 30 June 2020, producing a

gross loan to value of 30.03% and a net loan to value of 13.65%.

During the quarter, the Company amended its loan facility to allow the

flexibility to make repayments and re-draw these amounts, akin to a

revolving credit facility, without incurring additional fees or increasing

the loan margin. On 20 July 2020, the Company repaid GBP12.00 million of the

facility, reducing the gross loan to value to 23.03%.

Whilst the Company passed its banking covenant tests with significant

headroom in April, in order to be prudent in the current market environment,

the Company, during the quarter, obtained consent from its lender, RBS

International, to waive the interest cover tests within its loan agreement

for July and October with the next proposed test date being January 2021.

The lender also conveyed a willingness to review the position again in

December based on circumstances then prevailing. The Company is not required

to place funds on account or to comply with additional terms in order to

qualify for the waiver and, during the period of the waiver, the Company

intends to maintain its usual interest payments on the loan.

The loan continues to attract interest at LIBOR + 1.4% and as a result is

currently benefitting from the reduction in LIBOR rates. The Company's all

in interest rate as at 30 June 2020 was 2.05%.

To mitigate the risk of interest rates rising, the Company has interest rate

caps effective for the remaining term of the loan. During the quarter, the

Company, replaced it existing interest rate caps covering the period from

October 2020 to October 2023, which capped the interest rate at 2.0% on a

notional value of GBP49.51 million, with new caps covering the same period

capping the interest rate at 1.0% on a notional value of GBP51.50 million. The

Company paid a premium of GBP62,968.

Rent Collection

The Investment Manager maintains close contact with all tenants, which has

been particularly relevant over recent months where rent collection across

the real estate sector has proved more challenging than usual. As at the

date of this announcement, the Company had collected the following rental

payments for the rental quarter commencing 24 June 2020, expressed as a

percentage of the quarter's total rental income:

Current Position As at 23 July 2020

Received 66%

Monthly Payments Expected Prior to Quarter 17%

End

84%

Agreed on longer term payment plans 6%

Under Negotiation - pending the agreement 4%

of potential asset management transactions

93%

Outstanding 7%

Total 100%

In respect of the quarter commencing on the 25 March 2020, the Company

reports that 86% of rents have now been collected with a further 8% of

payments expected to be received over coming periods by way of agreed

payment plans which, once received, will total 94%.

It should be noted that this is an evolving picture with further payments

being received each day.

Asset Management Update

During the quarter the Company completed the following asset management

transactions:

Bank Hey Street, Blackpool - During May 2020, the Company signed a

reversionary lease with existing tenant JD Wetherspoon. This documents the

removal of the tenant's break option in 2025 and provides an additional 10

year lease term taking the earliest expiry from 2025 to 2050. The annual

rent payable by the tenant has reduced from GBP96,750 to GBP90,000 but the lease

now provides five yearly fixed increases reflecting 1% per annum.

2 Geddington Road, Corby - On 22 May 2020, the Company disposed of its

largest asset at 2 Geddington Road, Corby, for gross proceeds of GBP18.80

million, 25% ahead of valuation level immediately prior and 52% ahead of its

acquisition price in 2018. The asset had been delivering an income stream to

the Company of 10% per annum.

Sandford House, Solihull - During June 2020, the Company completed a 15 year

renewal lease with its existing tenant, the Secretary of State for Housing,

Communities and Local Government. The agreement documents the increase of

rental income from the property by 30% as well as providing for five yearly

open market rent reviews and a tenant break option at year 10. The tenant

intends to carry out a full refurbishment of the property over coming weeks

requiring no capital payment by the Company either by way of refurbishment

cost or capital incentive to the tenant. In addition, no rent free incentive

has been granted to the tenant. Throughout its hold period the Company has

so far received a net income yield from the asset in excess of 9% per annum

against its purchase price of GBP5.4 million.

Bessemer Road, Basingstoke - Post period end, the Company has completed a 5

year lease renewal at its 58,000 sq ft industrial premises in Basingstoke.

The lease has been granted with no rent free incentive given to the tenant

and secures a rental income to the Company 6% ahead of independent valuer's

estimated levels. The tenant has the benefit of a break option in year 3.

Enquiries

AEW UK

Alex Short alex.short@eu.aew.com

+44(0) 20 7016 4848

Laura Elkin Laura.elkin@eu.aew.com

+44(0) 20 7016 4869

Nicki Gladstone nicki.gladstone-ext@eu.aew.com

+44(0) 7711 401 021

Company Secretary

Link Company Matters Limited aewu.cosec@linkgroup.co.uk

+44(0) 1392 477 500

TB Cardew AEW@tbcardew.com

Ed Orlebar +44 (0) 7738 724 630

Lucas Bramwell +44 (0) 7939 694 437

Liberum Capital

Gillian Martin/Owen Matthews +44 (0) 20 3100 2000

Notes to Editors

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total return to

shareholders by investing predominantly in smaller commercial properties

(typically less than GBP15 million), on shorter occupational leases in strong

commercial locations across the United Kingdom. The Company was listed on

the Official List of the UK Listing Authority and admitted to trading on the

Main Market of the London Stock Exchange on 12 May 2015, raising GBP100.5m.

Since IPO it has raised a further GBP58m.

The Company is currently invested in office, retail, industrial and leisure

assets, with a focus on active asset management, repositioning the

properties and improving the quality of the income stream.

AEWU is currently paying an annualised dividend of 8p per share.

www.aewukreit.com [1] [2]

About AEW UK Investment Management LLP

AEW UK Investment Management LLP employs a well-resourced team comprising 26

individuals covering investment, asset management, operations and strategy.

It is part of AEW Group, one of the world's largest real estate managers,

with &euro71.2bn of assets under management as at 31 March 2020. AEW Group

comprises AEW SA and AEW Capital Management L.P., a U.S. registered

investment manager and their respective subsidiaries. In Europe, as at 31

March 2020, AEW Group managed &euro33.5bn of real estate assets on behalf of

a number of funds and separate accounts with over 420 staff located in 9

offices. The Investment Manager is a 50:50 joint venture between the

principals of the Investment Manager and AEW. In May 2019, AEW UK Investment

Management LLP was awarded Property Manager of the Year at the Pensions and

Investment Provider Awards.

www.aewuk.co.uk [3]

LEI: 21380073LDXHV2LP5K50

ISIN: GB00BWD24154

Category Code: MSCM

TIDM: AEWU

LEI Code: 21380073LDXHV2LP5K50

OAM Categories: 3.1. Additional regulated information required to be

disclosed under the laws of a Member State

Sequence No.: 77425

EQS News ID: 1099815

End of Announcement EQS News Service

1: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=c9b6404682d7efd026577394ecbedab5&application_id=1099815&site_id=vwd&application_name=news

2: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=9220892e63355ca6947a3a3423a3bac8&application_id=1099815&site_id=vwd&application_name=news

3: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=c3ab986d9b746ee23c3523d74649f8db&application_id=1099815&site_id=vwd&application_name=news

(END) Dow Jones Newswires

July 23, 2020 02:00 ET (06:00 GMT)

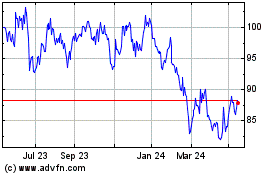

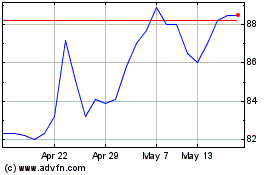

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jul 2023 to Jul 2024