2nd UPDATE: UK Insurers Face More Regulations With Proposals

March 18 2009 - 11:32AM

Dow Jones News

U.K. insurance companies and their overseas operations could in

future be subject to coordinated international regulation if

recommendations are implemented from a report published Wednesday

by Financial Services Authority Chairman Adair Turner.

"Prudential oversight of financial institutions should ideally

be coordinated in integrated regulators (covering banks, investment

banks and insurance companies) reducing the dangers of

inconsistency and arbitrage between different authorities within

one country," Turner said. This proposition would also affect banks

and investment banks as operations in these three industries

sometimes overlap.

For example, the report noted that troubled U.S. insurer

American International Group (AIG) was deeply involved in the

credit-default swap market, "taking trading risk similar to that

facing investment banks, but was subject to an insurance regime

rather than a bank trading regime."

The near-collapse of AIG is often cited as one reason why

investors fear the crisis among banks could lead to a similar

funding crisis among insurers.

The report noted that, currently, the supervision of banks and

other financial services firms "is entirely in the hands of

national supervisory and regulatory authorities" and that the level

of supervision "varies by country."

It said any future global agreement on regulatory priorities

should include the principle that "offshore centers must be brought

within the ambit of internationally agreed financial regulation,

whether relating to banking, insurance or any other financial

sector."

Stephen Haddrill, the Director General of the Association of

British Insurers, said the review "is an important contribution

which could be a significant step towards improving

regulation."

Haddrill said Turner's recommendation for a European regulatory

authority "is a welcome acknowledgment of our arguments that we

need more effective cross-border supervision."

He said a "supervisor of supervisors" will benefit U.K.

insurers, who form the largest insurance sector in Europe.

"However, we believe the FSA should go further and support such

a body having the powers to settle disputes between regulators over

cross-border companies," Haddrill said.

The Confederation of British Industry was cautious over the

report.

"The CBI supports measures to improve the coordination of

European regulators, but does not support the need for a single

regulator. Lord Turner has come up with some interesting ideas in

this area, which the CBI will study with care," said CBI Deputy

Director General John Cridland.

Some U.K. insurers contacted by Dow Jones Newswires declined to

comment immediately, saying they would first need to study the

Turner report.

-By Vladimir Guevarra, Dow Jones Newswires, +44 (0) 20 7842

9486, vladimir.guevarra@dowjones.com

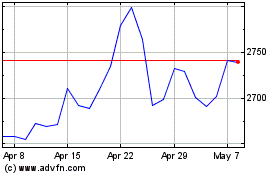

Admiral (LSE:ADM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Admiral (LSE:ADM)

Historical Stock Chart

From Jul 2023 to Jul 2024