TIDMACC

RNS Number : 5132D

Access Intelligence PLC

22 June 2023

22 June 2023

ACCESS INTELLIGENCE PLC

("Access Intelligence", the "Company" or the "Group")

TRADING UPDATE

Access Intelligence Plc (AIM: ACC), the technology innovator

delivering Software-as-a-Service ("SaaS") solutions for the global

marketing and communications industries, is pleased to announce an

update on trading for the six months ended 31 May 2023.

The Group has made progress against its strategic objectives,

most importantly delivering its first six month period of Annual

Recurring Revenue ("ARR") growth in the APAC region since the

acquisition of Isentia, alongside continued ARR growth in the EMEA

& NA market:

-- The Group expects to report ARR growth of GBP1.4m in the

period(1) , demonstrating a significant increase in momentum in ARR

growth across the Group when compared to ARR growth of GBP0.5m in

H1 2022(1) . Each individual region contributed to the ARR growth

during the first half.

ARR FY22 H1 23 Change in ARR

EMEA & North America (Constant GBP29.4m GBP30.5m +GBP1.1m

Currency)

--------- --------- --------------

EMEA & North America (Reported) GBP29.4m GBP30.5m +GBP1.1m

--------- --------- --------------

APAC (Constant Currency) GBP29.0m GBP29.3m +GBP0.3m

--------- --------- --------------

APAC (Reported) GBP30.6m GBP29.3m -GBP1.3m

--------- --------- --------------

Group (Constant Currency) GBP58.4m GBP59.8m +GBP1.4m

--------- --------- --------------

Group (Reported) GBP60.0m GBP59.8m -GBP0.2m

--------- --------- --------------

-- The Board anticipates total revenue for the period to be not

less than GBP31.3m, compared to GBP32.7m in H1 2022(1) with 95% of

the Group revenue being recurring (H1 2022: 93%).

-- Adjusted EBITDA is anticipated to be not less than GBP2.0m

for the period, a year-on-year increase of GBP1.7m(1) .

-- As a result of the actions taken over the last two years to

optimise the business for profitable growth and free cash flow

generation, the Board anticipates the delivery of higher adjusted

EBITDA and cash generation in the second half in line with full

year expectations.

Continued growth in EMEA & North America

In EMEA and North America the Group has continued to grow,

delivering an increase in ARR of GBP1.1m(1) in the period, similar

to the first half of the prior year. The business continues to

build a good pipeline in the region, including a number of

significant strategic opportunities. Whilst these more strategic

opportunities have a longer sales cycle than the majority of the

Group's pipeline, they represent some of the most interesting use

cases for Access Intelligence's technology and insights offerings.

They also reflect the longer-term market opportunity for Access

Intelligence to increase average order values by signing up a

greater proportion of new business sales from larger, more

technical contracts using a wider range of the Group's product

offering.

EMEA & North America revenue has increased by GBP1.0m

compared to the prior year comparative period due to ongoing ARR

growth in the region. Regional adjusted EBITDA has also improved

due to the year-on-year revenue growth alongside cost optimisation

initiatives.

New client wins in EMEA include: the British Fashion Council,

Carnival, the Delegation of the European Union to the United

Kingdom, Dentsu, the English Football League, HM Land Registry, The

Insolvency Service, Iris Worldwide, Matalan, Mayborn Group, The

National Lottery Heritage Fund, The National Trust, the Office of

the Children's Commissioner, Ofgem, Penguin Random House, Punch

Taverns, Sayara International, Student Loans Company, and Tate

& Lyle.

As previously announced, a significant contract worth GBP0.5m

per annum has been won in North America with a customer seeking to

use the Company's technology to obtain greater insights into its

local and global communications strategy. Other important wins in

North America include Basis Technologies, Havas, Legendary, McCann,

and a partnership with Reddit to deliver strategic research to be

presented at Cannes 2023 Festival of Creativity this week.

First ARR growth delivered in APAC

In APAC there has been positive momentum with the region

delivering ARR growth of GBP0.3m(1) in the period, ahead of the

full release of the Group's next generation platform into the

market expected in the next few months. In the first half of the

prior year, ARR had declined by GBP0.7m(1) . The first six months

of the current financial year are the first period of ARR growth

delivered in APAC since the acquisition of Isentia in September

2021 and reflect the stabilisation of the business in the region as

it has been integrated into the wider Group. There has been strong

engagement with customers and there remains a considerable

opportunity to continue to combine Isentia's established media

monitoring and insights services in the region alongside Access

Intelligence's audience intelligence offering.

Overall, APAC revenue has declined by GBP2.3m compared to the

prior year comparative period due to the combined effect of the

reduction in ARR in FY22 being reflected in revenue in the period

and a reduction in non-recurring campaign revenue. Non-recurring

revenue comprises 8% of total APAC revenue (H1 2022: 10%) and has

been lower in FY23 due to customers running fewer one-off campaigns

given wider macro-economic conditions. Adjusted EBITDA in the

region has increased year on year however as a result of synergies

and other cost optimisation initiatives delivered.

The Group has won a number of new clients (including client win

backs) in the region during the first half, including: CBRE, the

Department of Employment & Workplace Relations, the Department

of Fire and Emergency Services, the Department of Health and Aged

Care, FIFA, Mecca Brands, Merlin Entertainments, Mercedes, New

Zealand Rugby, Senate of the Philippines, Tesla, Uluru Dialogues

and University of Canberra.

Optimisation of the Group's operations

The Group's cash balance at the period end was GBP2.7m with the

Board focussed on delivering positive cash flow in the second half

through improved profitability and working capital enhancement due

to a change in the Group's invoicing profile. Management

continuously seeks to optimise the Group's operational structure to

provide a stable and profitable platform from which to grow in all

serviced global regions. This has been supported by the Group

delivering substantial synergies as part of the integration of

Isentia into the Group alongside other cost reduction

initiatives.

The board looks forward to updating shareholders further with

interim results in July.

Christopher Satterthwaite, Non-Executive Chairman of Access

Intelligence, commented:

"As anticipated, the first half of the year has seen Access

Intelligence deliver a significant increase in ARR growth(1) ,

coming from all global regions and with the first period of ARR

growth in APAC since the acquisition of Isentia.

With the Group's next generation platform being released into

the APAC market during Q3 2023, there is a considerable opportunity

for the Group to accelerate growth as both existing and potential

customers in the region are able to benefit from Access

Intelligence's market leading technology. In EMEA and North

America, growth has continued with a focus on signing up new

customers to take a wider range of the Group's product offering at

higher average order values.

The Board remains focussed on the delivery of improved

profitability and cash generation with a number of cost

optimisation initiatives delivered to date and with further focus

on this during the remainder of the financial year.

Overall, the Board remains confident in the outlook for the

Group in the second half of the year and beyond."

(1.) On a constant currency basis

For further information:

Access Intelligence Plc 020 3426 4024

Joanna Arnold (CEO)

Mark Fautley (CFO)

finnCap Limited (Nominated Adviser and Broker) 020 7220 0500

Corporate Finance:

Marc Milmo / Fergus Sullivan

Corporate Broking:

Alice Lane / Sunila de Silva

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSEMFUFEDSEEM

(END) Dow Jones Newswires

June 22, 2023 02:00 ET (06:00 GMT)

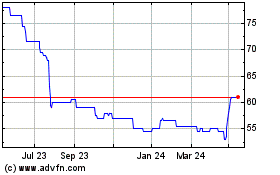

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Jan 2025 to Feb 2025

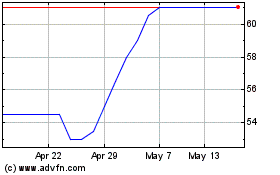

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Feb 2024 to Feb 2025