UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the quarterly period ended October 31, 2011

or

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from _________ to __________

Commission file number: 333-127915

VITAL PRODUCTS, INC.

(Exact name of registrant as specified in its charter)

Delaware 98-0464272

---------------------- --------------

(State or other jurisdiction of (IRS Employer

incorporation or organization) Identification No.)

|

245 DRUMLIN CIRCLE, CONCORD ONTARIO, CANADA L4K 3E4

(Address of principal executive offices)

(905) 482-0200

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last

report)

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T

(Section 232.405 of this chapter) during the preceding 12 months (or such

shorter period that the registrant was required to submit and post such

files). Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, or a smaller reporting company.

See the definitions of "large accelerated filer," "accelerated filer" and

"small reporting company" in Rule 12b-2 of the Exchange Act.

Large Accelerated filer [ ] Accelerated filer [ ]

Non-Accelerated filer [ ] Smaller reporting company [X]

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

As of December 15, 2011, the Issuer had 296,456,555 shares of common stock

issued and outstanding, par value $0.0001 per share.

2

VITAL PRODUCTS, INC

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTER ENDED OCTOBER 31, 2011

TABLE OF CONTENTS

Page

PART I - FINANCIAL INFORMATION

Item 1 - Consolidated Financial Statements..................................F1

Consolidated Balance Sheets as of October 31, 2011 (unaudited) and

July 31, 2011 (audited)..................................................F1

Consolidated Statements of Operations and Comprehensive Loss for

the three months ended October 31, 2011 and 2010 (unaudited)..............F2

Consolidated Statements of Cash Flows for the three months ended

October 31, 2011 and 2010 (unaudited)....................................F3

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS.............................F4 , F9

Item 2 - Management's Discussion and Analysis of Financial Condition and

Results of Operations........................................................4

Item 3 - Quantitative and Qualitative Disclosures About Market Risk..........9

Item 4T - Controls and Procedures............................................9

PART II - OTHER INFORMATION

Item 1 - Legal Proceedings..................................................10

Item 1A - Risk Factors......................................................10

Item 2 - Unregistered Sales of Equity Securities and Use of Proceeds........10

Item 3 - Defaults Upon Senior Securities....................................10

Item 4 - Submission of Matters to a Vote of Security Holders................11

Item 5 - Other Information..................................................11

Item 6 - Exhibits...........................................................11

|

3

PART I - FINANCIAL INFORMATION

ITEM 1. CONSOLIDATED FINANCIAL STATEMENTS

Vital Products Inc.

CONSOLIDATED BALANCE SHEETS

October 31,2011 July 31,2011

(Unaudited) (Audited)

_______________ ____________

ASSETS

Current assets

Cash $ 5,577 $ 3,869

Accounts receivable 5,421 9,989

Inventory 8,085 4,572

Due from related party 2,351 2,453

_______________ ____________

Total current assets 21,434 20,833

_______________ ____________

Total assets $ 21,434 $ 20,833

=============== ============

LIABILITIES AND STOCKHOLDERS DEFICIT

Current liabilities

Accounts payable and accrued liabilities $ 60,768 $ 69,904

Accounts payable and accrued liabilities

- related party 173,773 173,224

Advances 40,500 -

Convertible notes payable, net of unamortized

debt discount of $53,310 and $68,394 at

Oct. 31, 2011 and July 31, 2011,respectively 329,088 298,026

Advances from related parties 147,613 174,909

_______________ ____________

Total current liabilities 751,742 716,063

_______________ ____________

Total liabilities 751,742 716,063

_______________ ____________

Stockholders deficit

Preferred Stock; $0.01 par value; authorized

undesignated 900,000 shares, no shares issued

and outstanding

Series A Convertible Preferred Stock; $0.01

par value;100,000 shares authorized, 40,000

and 40,000 issued and outstanding, respectively 400 400

Common stock; $0.0001 par value;

1,000,000,000 shares authorized and

296,456,655 and 296,456,655 issued and

outstanding, respectively 29,646 29,646

Additional paid-in-capital 3,626,866 3,626,866

Accumulated other comprehensive income 60,811 32,853

Accumulated deficit (4,448,031) (4,384,945)

_______________ ____________

Total stockholders deficit (730,308) (695,180)

_______________ ____________

Total liabilities and stockholders deficit $ 21,434 $ 20,883

=============== ============

|

See Accompanying Notes to Consolidated Financial Statements.

F1

Vital Products Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

For the three For the three

months ended months ended

October 31, 2011 October 31, 2010

_______________ _______________

Sales $ 4,634 $ 401,194

Cost of sales 2,754 328,833

_______________ _______________

Gross profit 1,880 72,361

_______________ _______________

Operating expenses

Selling, general and

administrative 22,130 126,051

Consulting - 14,527

Total expenses 22,130 140,578

_______________ _______________

Net operating loss (20,250) (68,217)

_______________ _______________

Other income (loss)

Financing costs (35,456) (49,905)

Gain on settlement of debt 4,800 -

Gain (loss) on currency

exchange rate (12,180) 2,351

Net loss for the period (63,086) (115,771)

_______________ _______________

Net loss attributed to

non-controlling interest - (16,896)

Net loss attributable to

Vital Products Inc. (63,086) (98,875)

Other comprehensive

income (loss)

Foreign currency

translation adjustment 27,958 (3,252)

_______________ ______________

Comprehensive loss $ (35,128) $ (102,127)

================ ==============

Net loss attributable to

Vital Products Inc. per

common share, basic $ 0.00 $ (0.01)

=============== ==============

Weighted average number

of common shares

outstanding - basic 296,456,555 7,886,654

=============== ==============

|

See Accompanying Notes to Consolidated Financial Statements.

F2

Vital Products Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

For the three For the three

months ended months ended

October 31, 2011 October 31, 2010

_______________ ______________

Cash flows from operating activities

Net loss attributable

to Vital Products Inc. $ (63,086) $ (98,875)

Adjustments to reconcile net

loss to cash used in operating

activities

Non-controlling interest - (16,896)

Accretion of debt discount

and interest expense 35,456 47,849

Loss on currency exchange 12,180 (2,351)

Gain on settlement of debt (4,800) -

Change in operating assets

and liabilities

Accounts receivable 4,110 (59,543)

Inventory (3,662) (10,725)

Prepaid expenses 2,433

Accounts payable and

accrued liabilities 1,446 122,735

_______________ ______________

Net cash used in operating activities (18,356) (15,373)

_______________ ______________

Cash flow from financing activities

Advance on bank overdraft - 21,662

Payment on revolving

demand credit facility - (34,037)

Advances 40,500

Advances from related parties - 14,097

Payments on related

party advances (20,000)

Proceeds from convertible

notes payable - 12,000

Net cash provided by

financing activities 20,500 13,722

_______________ ______________

Foreign currency translation effect (436) 1,256

_______________ ______________

Net change in cash 1,708 (395)

Cash, beginning of the period 3,869 395

_______________ ______________

Cash, end of the period $ 5,577 $ -

=============== ==============

Supplemental disclosure of non-cash investing

and financing activities

Issuance of common stock for

conversion of promissory note $ - $ 1,921

=============== ==============

Beneficial conversion feature $ - $ 29,546

=============== ==============

|

See Accompanying Notes to Consolidated Financial Statements.

F3

VITAL PRODUCTS, INC.

Notes to Consolidated Financial Statements

October 31, 2011 and 2010

(Unaudited)

NOTE 1 - NATURE OF OPERATIONS AND BASIS FOR PRESENTATION

The accompanying unaudited interim consolidated financial statements of Vital

Products, Inc. have been prepared without audit pursuant to the rules and

regulations of the Securities and Exchange Commission requirements for interim

financial statements. Therefore, they do not include all of the information and

footnotes required by accounting principles generally accepted in the United

States for complete financial statements. The interim consolidated financial

statements should be read in conjunction with the annual consolidated financial

statements for the year ended July 31, 2011 of Vital Products, Inc.

The interim consolidated financial statements present the balance sheets,

statements of operations and comprehensive loss and cash flows of Vital

Products, Inc. The financial statements have been prepared in accordance with

accounting principles generally accepted in the United States.

The interim financial information is unaudited. In the opinion of management,

all adjustments necessary to present fairly the financial position as of

October 31, 2011 and the results of operations and cash

flows presented herein have been included in the interim consolidated financial

statements. All such adjustments are of a normal and recurring nature. Interim

results are not necessarily indicative of results of operations for the full

year.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

Liquidity and Going Concern

During the three months ended October 31, 2011 and 2010, the Company incurred

losses of $63,086 and $98,875, respectively, and cash used in operations

was $3,031 and $15,373, respectively. The Company financed its operations

through loans payable, advances from related parties and vendors' credit.

Management believes that the current cash balances at October 31, 2011 and net

cash proceeds from operations will not be sufficient to meet the Company's cash

requirements for the next twelve months.

Accordingly, these financial statements have been prepared on a going concern

basis and do not include any adjustments to the measurement and classification

of the recorded asset amounts and classification of liabilities that might be

necessary should the Company be unable to continue as a going concern. The

Company has experienced losses in the period and has negative working capital.

The Company's ability to realize its assets and discharge its liabilities in

the normal course of business is dependent upon continued support. The Company

is currently attempting to obtain additional financing from its existing

shareholders and other strategic investors to continue its operations. However,

the Company may not obtain sufficient additional funds from these sources.

F4

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES (continued)

These conditions cause substantial doubt about the Company's ability to

continue as a going concern. A failure to continue as a going concern would

require that stated amounts of assets and liabilities be reflected on a

liquidation basis that could differ from the going concern basis. The

consolidated financial statements do not include any adjustments relating to

the recoverability and classification of recorded assets, or the amounts of

and classification of liabilities that might be necessary in the event the

company cannot continue in existence.

ACCOUNTING PRINCIPLES

The Company's accounting and reporting policies conform to generally accepted

accounting principles in the United States. The consolidated financial

statements are reported in United States dollars.

CONSOLIDATION

The consolidated financial statements include the accounts of the Company and

its variable interest entity ('VIE') in which the Company is the primary

beneficiary. Effective August 1, 2009, the Company adopted the accounting

standards for non-controlling interests and reclassified the equity

attributable to its non-controlling interests as a component of equity in

the accompanying consolidated balance sheets. All significant intercompany

balances and transactions have been eliminated in consolidation. See Note 3.

Management's determination of the appropriate accounting method with respect

to the Company's variable interests is based on accounting standards for

VIEs issued by the Financial Accounting Standards Board ('FASB'). The

Company consolidates any VIEs in which it is the primary beneficiary and

discloses significant variable interests in VIEs of which it is not the

primary beneficiary, if any.

USE OF ESTIMATES

The preparation of consolidated financial statements in conformity with

United States generally accepted accounting principles requires management

to make estimates and assumptions that affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities at the

date of the consolidated financial statements and the reported amounts of

revenues and expenses during the year. Actual results could differ from

those estimates. Significant estimates include amounts for impairment of

equipment, share based compensation, inventory obsolescence and allowance

for doubtful accounts.

FOREIGN CURRENCY TRANSLATION

The Company determined the functional currency to be the Canadian dollar

and, accordingly, our financial information is translated into U.S. dollars

using exchange rates in effect at period-end. The income statement is

translated at the average year-to-date exchange rate. Adjustments resulting

from translation of foreign exchange are included as a component of other

comprehensive income within stockholders' deficit.

F5

VALUATION OF LONG-LIVED ASSETS

We assess the recoverability of long-lived assets whenever events or changes

in business circumstances indicate that the carrying value may not be

recoverable. An impairment loss is recognized when the sum of the expected

undiscounted net cash flows over the remaining useful life is less than the

carrying amount of the assets.

REVENUE RECOGNITION

The Company recognizes revenue in accordance with FASB ASC Subtopic 605,

Revenue Recognition. Under FASB ASC Subtopic 605, revenue is recognized

at the point of passage to the customer of title and risk of loss, there is

persuasive evidence of an arrangement, the sales price is determinable, and

collection of the resulting receivable is reasonably assured. The Company

generally recognizes revenue at the time of delivery of goods. Sales are

reflected net of sales taxes, discounts and returns.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES (continued)

CASH AND CASH EQUIVALENTS

Cash equivalents consist of highly liquid investments with maturities of

three months or less when purchased. Cash and cash equivalents are on deposit

with financial institutions without any restrictions.

ALLOWANCE FOR DOUBTFUL ACCOUNTS

The Company records an allowance for doubtful accounts as a best estimate of

the amount of probable credit losses in its accounts receivable. Each month,

the Company reviews this allowance and considers factors such as customer

credit, past transaction history with the customer and changes in customer

payment terms when determining whether the collection of a receivable is

reasonably assured. Past due balances over 90 days and over a specified

amount are reviewed individually for collectability. Receivables are charged

off against the allowance for doubtful accounts when it becomes probable

that a receivable will not be recovered.

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company's financial instruments comprise cash, accounts receivable,

accounts payable and accrued liabilities, notes payable to The Cellular

Connection Ltd. and L. Burke, and advances from related party. The carrying

value of Company's short-term instruments approximates fair value, unless

otherwise noted, due to the short-term maturity of these instruments. In

management's opinion, the fair value of notes payable is approximate to

carrying value as the interest rates and other features of these instruments

approximate those obtainable for similar instruments in the current market.

Unless otherwise noted, it is management's opinion that the Company is not

exposed to significant interest, currency or credit risks in respect of

these financial instruments.

F6

INVENTORY

Inventory comprises finished goods held for sale and is stated at lower of

cost or market value. Cost is determined by the average cost method. The

Company estimates the realizable value of inventory based on assumptions

about forecasted demand, market conditions and obsolescence. If the

estimated realizable value is less than cost, the inventory value is reduced

to its estimated realizable value. If estimates regarding demand and market

conditions are inaccurate or unexpected changes in technology affect demand,

the Company could be exposed to losses in excess of amounts recorded.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES (continued)

STOCK-BASED COMPENSATION

The Company follows FASB ASC Subtopic 718, Stock Compensation, for accounting

for stock-based compensation. The guidance requires that new, modified and

unvested share-based payment transactions with employees, such as grants of

stock options and restricted stock, be recognized in the consolidated financial

statements based on their fair value at the grant date and recognized as

compensation expense over their vesting periods. The Company also follows

the guidance for equity instruments issued to consultants.

BASIC LOSS PER SHARE

FASB ASC Subtopic 260, Earnings Per Share, provides for the calculation of

'Basic' and 'Diluted' earnings per share. Basic earnings per share is computed

by dividing net loss available to common shareholders by the weighted average

number of common shares outstanding for the period. All potentially dilutive

securities have been excluded from the computations since they would be

antidilutive. However, these dilutive securities could potentially dilute

earnings per share in the future.

F7

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES (continued)

COMPREHENSIVE INCOME

The Company has adopted FASB ASC Subtopic 220, Comprehensive Income, which

establishes standards for reporting and display of comprehensive income, its

components and accumulated balances. Comprehensive income is defined to

include all changes in equity except those resulting from investments by

owners or distributions to owners. Among other disclosures, FASB ASC Subtopic

220 requires that all items that are required to be recognized under the

current accounting standards as a component of comprehensive income be

reported in a financial statement that is displayed with the same prominence

as other financial statements. Comprehensive income is displayed in the

statement of stockholders' deficit and in the balance sheet as a component

of stockholders' deficit.

RECENT ACCOUNTING PRONOUNCEMENTS

There have been no recent accounting pronouncements or changes in accounting

pronouncements that impacted the second quarter of fiscal 2011, or which are

expected to impact future periods, that were not already adopted and disclosed

in prior periods.

3. VARIABLE INTEREST ENTITY

Following is a description of our financial interests in a variable interest

entity that we consider significant, those for which we have determined that

we are the primary beneficiary of the entity and, therefore, have consolidated

the entity into our financial statements.

Den Packaging Corporation - For the three month period October 31, 2010 our

consolidated statement of operations and comprehensive loss recognizes sales

of $392,022, cost of sales of $310,852 and selling, general and administrative

expenses of $98,066 related to our interest in Den Packaging Corporation for

the period from August 1, 2010 to October 31, 2010.

The License Agreement was terminated by Den Packaging and the Company

determined that it lost control of Den Packaging effective May 1, 2011. As

such, the Company derecognized all of the assets and liabilities of

Den Packaging from its consolidated financial statements at their carrying

values.

F8

NOTE 4 - NOTES PAYABLE TO THE CELLULAR CONNECTION LTD. AND LARRY BURKE

Original October 31, July 31

Date of Issuance Maturity Date 2011 2011

---------------- ------------- -------- ---------

Promissory Note 3 June 12, 2009 June 11, 2012 $ 31,680 $ 31,680

Promissory Note 4 November 18, 2009 November 17, 2011 30,000 30,000

Promissory Note 5 March 26, 2010 March 25, 2012 12,000 12,000

Promissory Note 6 June 29, 2010 June 28, 2012 12,000 12,000

Promissory Note 7 May 27, 2010 May 26, 2012 44,400 44,400

Promissory Note 8 September 28, 2010 September 27, 2012 14,400 12,000

Promissory Note 9 November 29, 2010 November 28, 2011 49,000 49,000

Promissory Note 10 December 10, 2010 December 9, 2011 10,000 10,000

Promissory Note 11 February 25, 2011 February 24, 2012 5,200 5,200

Promissory Note 12 April 7, 2011 April 6, 2012 32,000 32,000

Interest 39,293 25,844

Accretion 49,115 33,902

--------- --------

$ 329,088 $ 298,026

========= =========

|

As of October 31, 2011 and July 31, 2010 notes payable are recorded net of

unamortized debt discount of $53,310 and $68,394, respectively.

On September 28, 2011, Promissory Note 8 renewed for an additional year under

the terms outlined in the original Note. The modification of the Note upon

renewal has been accounted for as debt extinguishment and the issuance of a new

debt instrument. Accordingly, in connection with extinguishment of the

original debt, the Company recognized a $4,800 gain.

Each of the notes bears interest at 20% per annum and allow for the lender to

secure a portion of the Company assets up to 200% of the face value of the

note and mature one year from the day of their respective issuance. Unless

otherwise indicated, the holder has the right to convert the Notes plus accrued

interest into shares of the Company's common stock at any time prior to the

Maturity Date. The number of common stock to be issued will be determined using

a conversion price based on 75% of the average of the lowest closing bid price

during the fifteen trading days immediately prior to conversion.

NOTE 5 - ADVANCES

Advances are non-interest bearing, unsecured and have no-specific terms of

repayment.

NOTE 6 - RELATED PARTY BALANCES AND TRANSACTIONS

For the three months ended October 31, 2011 and 2010, the Company had rent

expense totaling $9,030 and $8,666, respectively and as of October 31, 2011

and July 31, 2011 advances of $41,861 and $64,598, respectively, and

outstanding payables totaling $173,773 and $173,224, respectively, with a

vendor to which the Company's Chief Executive Officer has a majority ownership

interest. The balances are non-interest bearing, unsecured and have no

specified terms of repayment.

As of October 31, 2011 and July 31, 2011 advances of $105,752 and $110,312,

respectively, with Den Packaging Corporation in which the Company's Chief

Executive Officer has a majority ownership interest. The balances are

non-interest bearing,unsecured and have no specified terms of repayment.

F9

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report on Form 10-Q contains 'forward-looking statements' that involve

risks and uncertainties. You should not place undue reliance on these

forward-looking statements. Our actual results could differ materially from

those anticipated in the forward-looking statements for many reasons, including

the risks described in our Form 10-K filed November 14, 2011, for the year

ended July 31, 2011, and other filings we make with the Securities and Exchange

Commission. Although we believe the expectations reflected in the

forward-looking statements are reasonable, they relate only to events as of

the date on which the statements are made. We do not intend to update any of

the forward-looking statements after the date of this report to conform these

statements to actual results or to changes in our expectations, except as

required by law.

The following discussion and analysis of financial condition and results of

operations is based upon, and should be read in conjunction with our audited

financial statements and related notes thereto included elsewhere in this

report, and in our Form 10-K filed November 14, 2011, for the year ended

July 31, 2011.

OVERVIEW

Vital Products, Inc. (the 'Company') was incorporated in the State of Delaware

on May 27, 2005. On July 5, 2005, the Company purchased the Childcare Division

of Metro One Development, Inc., (formerly On The Go Healthcare, Inc.) which

manufactured and distributed infant care products.

There were no material assets or revenues that relate to the discontinued

Childcare Division.

In August 2008, we changed our business plan and began the process of

developing a new line of business as a distributor of industrial packaging

products. On September 17, 2008, we entered into a Letter of Intent to

purchase Montreal-based Den Packaging Corporation. The transaction proposed in

the Letter of Intent did not close. On February 27, 2010, we entered into a

License Agreement with Den Packaging Corporation as noted below.

On October 7, 2008, we entered into a consulting agreement with DLW Partners

of Toronto, an industrial packaging consulting firm specializing in market

analysis, market and product strategies and the development of product line

extensions. We believed that DLW would work closely with us to develop new

products for existing markets and establish product line extensions to further

our market share. Most importantly DLW has experience in the development of

environmentally friendly products and we expect that DLW will further our

initiative to develop environmentally acceptable products. As we have not had

a product commercialized by DLW we let the agreement expire on

July 31, 2010.

On October 21, 2008, we entered into a sales and marketing agreement with Eco

Tech Development LLC of Nevada, a product research and development company

specializing in eco-friendly industrial packaging applications, whereby we

would market certain proprietary and patent-pending technologies that have

recently been developed by Eco Tech, beginning with the marketing of a new

bio-based foam packaging product. As we have not had a product commercialized

we let the agreement expire on July 31, 2010.

4

On January 13, 2009, we announced that we had commenced production of

Biofill(TM), our bio-based foam in place packaging product, and on

January 26, 2009, we received our first purchase order.

On February 19, 2009, we entered into an agreement to market a new paper

packaging system. While we believe paper packaging has been a staple in the

industrial packaging market for many years, our new system produces a craft

paper product that simulates a moldable nest. We believe this product is

priced competitively with other paper products and gives us the advantage of

performance and range of use. Although our new line of business continues

to develop, we believe that these purchase orders validate our product and

reflect the industrial packaging industry's trend towards environmentally

friendly product lines. As of July 31, 2010, we have limited production of

the new paper packaging product.

On February 27, 2010, we entered into a License Agreement with Den Packaging

Corporation, in which our Chief Executive Officer has a majority ownership

interest. Under the terms of the Agreement, we had the right to market the

products of Den Packaging as well as the right of use of the facilities of

Den Packaging including but not limited to the sales and distribution

facilities. We purchased all of the inventory on hand as of March 1, 2010 and

agreed to pay a fee of 5% of all sales generated plus a management fee of

5% based on the total monies paid for employee salaries, benefits and

commissions. Total fees earned by Den Packaging Corporation as a result of

the License Agreement for the three months ended October 31, 2011 and 2010 is

$0 and $25,461, respectively. The Company is responsible for all expenses

that relate to sales generated under the License Agreement. The duration of

the agreement was for a period of twelve months commencing on March 1, 2010

and thereafter on a month-by-month basis unless sooner terminated by Den

Packaging as provided for in the agreement. Den Packaging may at any time in

its sole discretion, with sixty days prior notice, terminate the agreement

and revoke the license granted for any reason whatsoever and upon such

termination we would immediately stop the use of the facilities as described.

The Company had determined that Den Packaging is a Variable Interest Entity

and that Vital Products, Inc. was the primary beneficiary. As such, Den

Packaging Corporation was consolidated into the Company's financial

statements.

The License Agreement was terminated by Den Packaging and the Company

determined that it lost control of Den Packaging effective May 1, 2011. As

such, the Company derecognized all of the assets and liabilities of

Den Packaging from its consolidated financial statements at their carrying

values.

5

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of consolidated financial statements and related disclosures

in conformity with accounting principles generally accepted in the United

States requires management to make estimates and assumptions that affect the

amounts reported in the consolidated financial statements and accompanying

notes. Estimates are used for, but not limited to, the accounting for the

allowance for doubtful accounts, inventories, impairment of long-term

assets, income taxes and loss contingencies. Management bases its estimates

on historical experience and on various other assumptions that are believed

to be reasonable under the circumstances. Actual results could differ from

these estimates under different assumptions or conditions.

We believe the following critical accounting policies, among others, may be

impacted significantly by judgment, assumptions and estimates used in the

preparation of the consolidated financial statements.

FOREIGN CURRENCY TRANSLATION

We consider the functional currency to be the local currency being Canadian

dollars and, accordingly, our financial information is translated into U.S.

dollars using exchange rates in effect at year-end for assets and liabilities

and average exchange rates during each reporting period for the results of

operations. Adjustments resulting from translation of foreign exchange are

included as a component of other comprehensive income (loss) within

stockholders' deficit. Significantly all of our operations are located in

Canada. Operational foreign exchange gains or losses from transacting in

foreign currencies are recognized through the statement of operations.

REVENUE RECOGNITION

The Company recognizes revenue in accordance with Securities and Exchange

Commission Staff Accounting Bulletin No. 101, 'Revenue Recognition in Financial

Statements' ('SAB 101') as modified by Securities and Exchange Commission Staff

Accounting Bulletin No. 104. Under SAB 101,which was primarily codified into

Topic 605 Revenue Recognition SEC Staff Accounting Bulletin Topic 13 in the

Accounting Standards Codification, revenue is recognized at the point

of passage to the customer of title and risk of loss, there is persuasive

evidence of an arrangement, the sales price is determinable, and collection of

the resulting receivable is reasonably assured. The Company generally

recognizes revenue at the time of delivery of goods. Sales are reflected net of

discounts and returns.

COMPREHENSIVE INCOME

The Company has adopted Topic 220, Comprehensive Income, which

establishes standards for reporting and display of comprehensive income,

its components and accumulated balances. Comprehensive income is defined

to include all changes in equity except those resulting from investments by

owners or distributions to owners. Among other disclosures, ASC 220

requires that all items that are required to be recognized under the current

accounting standards as a component of comprehensive income be reported in a

financial statement that is displayed with the same prominence as other

consolidated financial statements. Comprehensive income is displayed in the

statement of stockholders' deficit and in the balance sheet as a component of

stockholders' deficit.

6

EFFECT OF NEW ACCOUNTING PRONOUNCEMENTS

There have been no recent accounting pronouncements or changes in accounting

pronouncements that impacted the first quarter of fiscal 2012, or which are

expected to impact future periods, that were not already adopted and disclosed

in prior periods.

RESULTS OF OPERATIONS

COMPARISON OF RESULTS FOR THE THREE MONTHS ENDED OCTOBER 31, 2011 AND 2010

REVENUES:

We had revenues of $4,634 for the three months ended October 31, 2011, as

compared to revenues of $401,194 for the three months ended October 31, 2010.

The decrease in revenues was primarily the result of termination of the License

Agreement with Den Packaging Corporation on May 1, 2011. The Company determined

that it lost control of Den Packaging effective May 1, 2011. As such, the

Company derecognized the assets and liabilities of Den Packaging from its

consolidated financial statements at their carrying values.

COST OF SALES:

Our cost of sales for the three months ended October 31, 2011 was $2,754,

compared to $328,833 for the three months ended October 31, 2010. The decrease

in cost of sales was directly related to decrease in sales associated with the

termination of the License Agreement with Den Packaging Corporation on

May 1, 2011.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES:

Our selling, general and administrative and consulting costs were $22,130 for

the three months ended October 31, 2011, compared to $140,578 for the three

months ended October 31, 2010. The decrease in selling, general and

administrative expenses was primarily the result of the termination of the

License Agreement with Den Packaging Corporation.

NET LOSS:

Our net loss for the three months ended October 31, 2011 was $63,086, compared

to a net loss of $98,875 for the three months ended October 31, 2010. The

decrease of the net loss compared to the prior period was primarily

attributable to the termination of the License Agreement with Den Packaging

Corporation.

TOTAL ASSETS:

Our total assets as of October 31, 2011 were $21,434, a decrease of $551,

as compared to the fiscal year ended July 31, 2011 which was $20,883. Our

total liabilities as of October 31, 2011 were $751,741, an increase of

$35,678, as compared to $716,063 as of July 31, 2011. The increase in our

total liabilities compared to July 31, 2011 was primarily the result of the

increased advances from loans, related parties and vendors.

7

LIQUIDITY AND CAPITAL RESOURCES

As of October 31, 2011, we had total current assets of $21,434 and total

current liabilities of $751,742, resulting in a working capital deficit of

$730,308. At the end of the quarterly period ending October 31, 2011, we had

cash of $5,577. Our cash flow used in operating activities for the three months

ended October 31, 2011 is $3,031. Our current cash balance and cash flow

from operating activities will not be sufficient to fund our operations. Our

cash flow from financing activities for the three months ended October 31, 2011

was $5,000. We believe we will need to raise capital of approximately

$300,000 to $350,000 through either debt or equity instruments to fund our

operations for the next 12 months. However, we may not be successful in

raising the necessary capital to fund our operations. In addition to the

amounts needed to fund our operations, we will need to generate an additional

$500,000 to cover our current liabilities for the next 12 months.

As of October 31, 2011, we have $329,088 of convertible notes payable due to

The Cellular Connection Ltd. and Larry Burke payable on demand. The initial

$240,680 advanced from The Cellular Connection, Ltd. and Larry Burke is the

aggregate amount due under ten convertible secured promissory notes with an

aggregate face amount of $286,416. We issued these notes to The Cellular

Connection Ltd. and Larry Burke during 2011, 2010 and 2009. The aggregate face

amount includes one year of interest totaling $45,736 and actual loan amount

totaling $240,680.

The convertible secured promissory notes accrue interest at a rate of

20% per year and have maturity dates as disclosed in Note 4 of the

consolidated financial statements for the period ended October 31, 2011.

The outstanding face amount of the convertible secured promissory notes

increase by 20% in 2011, by an additional 20% in 2012 and again on each

one year anniversary after 2012 until the notes have been paid in full.

The notes entitle the holder to convert the note, plus accrued interest,

any time prior to the maturity date, at 75% of the average of the lowest

closing bid price during the fifteen trading days immediately preceding

the conversion date.

Pursuant to the terms of the convertible secured promissory notes, The Cellular

Connection Ltd. may elect to secure a portion of our assets not to exceed 200%

of the face amount of the notes, including, but not limited to, accounts

receivable, cash, marketable securities, equipment, or inventory.

Until we are able to generate positive cash flows from operations in an amount

sufficient to cover our current liabilities and debt obligations as they become

due, if ever, we will remain reliant on borrowing funds or selling equity. We

intend to raise funds through the issuance of debt or equity. Raising funds in

this manner typically requires much time and effort to find accredited

investors, and the terms of such an investment must be negotiated for each

investment made. There is a risk that such additional financing may not be

available, or may not be available on acceptable terms, and the inability to

obtain additional financing or generate sufficient cash from operations could

require us to reduce or eliminate expenditures for capital equipment,

production, design or marketing of our products, or otherwise curtail or

discontinue our operations, which could have a material adverse effect on our

business, financial condition and results of operations. We may not be able

to raise sufficient funds to meet our obligations. If we do not raise

sufficient funds, our operations will be curtailed or will cease entirely and

you may lose all of your investment.

8

Further, to the extent that we raise capital through the sale of equity or

convertible debt securities, the issuance of such securities may result in

dilution to our existing stockholders. If we raise additional funds through

issuance of debt securities, these securities may have rights, preferences

and privileges senior to holders our of common stock and the terms of such

debt could impose restrictions on our operations. Regardless of whether our

cash assets prove to be adequate to meet our operational needs, we may seek

to compensate our service providers with stock in lieu of cash, which may also

result in dilution to existing stockholders.

OFF-BALANCE SHEET ARRANGEMENTS

As of October 31, 2011, we have no off-balance sheet arrangements that have or

are reasonably likely to have a current or future material effect on our

financial condition, changes in financial condition, revenues or expenses,

results of operations, liquidity, capital expenditures or capital resources.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a Smaller Reporting Company, as defined by Rule 12b-2 of the Exchange Act

and in Item 10(f)(1) of Regulation S-K, we are electing scaled disclosure

reporting obligations and therefore are not required to provide the

information requested by this Item.

ITEM 4T. CONTROLS AND PROCEDURES

DISCLOSURE CONTROLS AND PROCEDURES

Our management evaluated, with the participation of our Chief Executive Officer

and our Chief Financial Officer, the effectiveness of our disclosure controls

and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Securities

Exchange Act of 1934, as amended, as of the end of the period covered by this

quarterly report on Form 10-Q. Based on this evaluation, our Chief Executive

Officer and our Chief Financial Officer have concluded that our disclosure

controls and procedures are not effective to ensure that information we are

required to disclose in reports that we file or submit under the Securities

Exchange Act of 1934 (i) is recorded, processed, summarized and reported within

the time periods specified in Securities and Exchange Commission rules and

forms, and (ii) is accumulated and communicated to our management, including

our Chief Executive Officer and our Chief Financial Officer, as appropriate

to allow timely decisions regarding required disclosure. Our disclosure

controls and procedures are designed to provide reasonable assurance that

such information is accumulated and communicated to our management. Our

disclosure controls and procedures include components of our internal control

over financial reporting. Management's assessment of the effectiveness of our

internal control over financial reporting is expressed at the level of

reasonable assurance that the control system, no matter how well designed

and operated, can provide only reasonable, but not absolute, assurance that

the control system's objectives will be met.

CHANGES IN INTERNAL CONTROLS OVER FINANCIAL REPORTING

There were no changes in our internal control over financial reporting that

occurred during the quarter ended October 31, 2011 that have materially

affected, or are reasonably likely to materially affect, our internal control

over financial reporting.

9

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

We may be involved from time to time in ordinary litigation, negotiation and

settlement matters that will not have a material effect on our operations or

finances. We are not aware of any pending or threatened litigation against

our Company or our officers and directors in their capacity as such that could

have a material impact on our operations or finances.

ITEM 1A. RISK FACTORS

WE NEED EXTERNAL FUNDING TO SUSTAIN AND GROW OUR BUSINESS AND IF WE CANNOT

FIND THIS FUNDING ON ACCEPTABLE TERMS, WE MAY NOT BE ABLE TO IMPLEMENT OUR

BUSINESS PLANS AND THEREFORE MAY HAVE TO CEASE OUR OPERATIONS

We may not be able to generate sufficient revenues from our existing

operations to fund our capital requirements. At the end of the quarterly

period ending October 31, 2011, we had a cash balance of $5,577. We will

require additional funds to enable us to operate profitably and grow our

business. We believe we will need $300,000 to $350,000 to run our business

for the next twelve months. In addition to the amounts needed to fund our

operations, we will need to generate an additional $500,000 to cover our

current liabilities for the next 12 months.

The financing we need may not be available on terms acceptable to us or

at all. We currently have no bank borrowings and we may not be able to

arrange any debt financing. Additionally, we may not be able to successfully

consummate offerings of stock or other securities in order to meet our

future capital requirements. If we cannot raise additional capital through

issuing stock or creating debt, we may not be able to sustain or grow our

business which may cause our revenues and stock price to decline.

WE HAVE ISSUED CONVERTIBLE SECURED PROMISSORY NOTES THAT ARE FULLY SECURED BY

OUR ASSETS AND IF WE ARE UNABLE TO PAY THE NOTES ON THE MATURITY DATES WE MAY

HAVE TO CEASE OPERATIONS

We have outstanding ten convertible secured promissory notes to The Cellular

Connection Ltd. and Larry Burke that bear interest at 20% per annum and have

maturity dates beginning on October 31, 2011. As of October 31, 2011 we had

$329,088 due under the note issuances to The Cellular Connection and Larry

Burke and we may not be able to make payments under the notes when due. The

holders of the notes also have the right to convert the notes plus accrued

interest into shares of our common stock at any time prior to the maturity

dates. If the holders elect to convert the notes this will further dilute

the equity interests of existing shareholders.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

During the quarter ended October 31, 2011, we did not sell any unregistered

securities.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

During the quarter ended October 31, 2011, we did not have any defaults upon

senior securities.

10

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

During the quarter ended October 31, 2011, we did not submit any matters to a

vote of security holders.

ITEM 5. OTHER INFORMATION

Not applicable.

ITEM 6. EXHIBITS

Exhibit Number Description of Exhibit

3.1 Certificate of Incorporation (included as exhibit 3.1 to the Form SB-2

filed August 29, 2005 and incorporated herein by reference).

3.2 By-laws (included as exhibit 3.2 to the Form SB-2 filed August 29, 2005

and incorporated herein by reference).

4.1 Form of Stock Certificate (included as exhibit 4.1 to the Form SB-2

filed October 26, 2006 and incorporated herein by reference).

4.2 Certificate of Designation of Preferences, Rights and Limitations of

Series A Convertible Preferred Stock, dated April 20, 2009 (included as

exhibit 4.1 to the Form 8-K filed April 24, 2009 and incorporated herein

by reference).

10.1 Asset Sale Agreement between the Company and On The Go Healthcare, Inc.

dated July 5, 2005 (included as exhibit 10.3 to the Form SB-2 filed

August 29, 2005 and incorporated herein by reference).

10.2 Secured Promissory Note between the Company and On The Go Healthcare,

Inc. dated February 23, 2006 (included as exhibit 10.2 to the Form SB-2

filed February 24, 2006 and incorporated herein by reference).

10.3 Secured Promissory Note between the Company and On The Go Healthcare,

Inc. dated February 23, 2006 (included as exhibit 10.3 to the Form SB-2

filed February 24, 2006 and incorporated herein by reference).

10.4 Secured Promissory Note between the Company and The Cellular Connection

Ltd. dated January 20, 2009 (included as exhibit 10.5 to the Form

10-Q filed March 20, 2009 and incorporated herein by reference).

10.5 Convertible Promissory Note between the Company and Metro One

Development, Inc. dated June 18, 2009 (included as exhibit 10.5 to the

Form 10-Q filed June 19, 2009 and incorporated herein by reference).

10.6 Secured Promissory Note between the Company and The Cellular Connection

Ltd. dated April 30, 2009 (included as exhibit 10.6 to the Form 10-Q

filed June 19, 2009 and incorporated herein by reference).

31.1 Certification of Chief Executive Officer pursuant to Section 302 of

the Sarbanes-Oxley Act of 2002 (filed herewith).

31.1 Certification of Chief Financial Officer pursuant to Section 302 of

the Sarbanes-Oxley Act of 2002 (filed herewith).

32.1 Certification of Officers pursuant to 18 U.S.C. Section 1350, as adopted

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (filed

herewith).

|

11

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused

this report to be signed on its behalf by the undersigned thereunto

duly authorized.

Date: December 8, 2011 Vital Products, Inc.

By:/s/ Michael Levine

--------------------------

Michael Levine

Principal Executive Officer

and Principal Accounting Officer

and Director

|

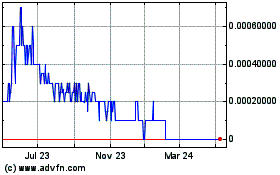

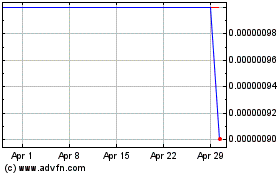

XCPCNL Business Services (CE) (USOTC:XCPL)

Historical Stock Chart

From Jun 2024 to Jul 2024

XCPCNL Business Services (CE) (USOTC:XCPL)

Historical Stock Chart

From Jul 2023 to Jul 2024