CORRECTION: The Mint Leasing, Inc., (MLES) Announces Closing of Share Exchange Agreement

September 24 2014 - 7:54PM

Business Wire

This press release corrects and replaces in its entirety,

various inaccurate information regarding the press release entitled

“The Mint Leasing, Inc., (MLES) Announces Merger With Sunset

Brands, Inc. dba Sunset Capital Assets (SSBN)”, released by The

Mint Leasing, Inc. on September 24, 2014, regarding the closing of

its transaction with Sunset Brands, Inc. dba Sunset Capital Assets,

including, but not limited to, the type of transaction; the

relationship of the parties; certain financial information

contained therein; various quotes attributed to the principals of

the parties; various projections contained in such release; the

status of the parties following the closing; and the future plans

of the parties contained therein. The corrected release is provided

below and the entirety of the information contained in the prior

release should be disregarded. We apologize for any confusion this

mistake may have created.

The Mint Leasing, Inc. (“Company or Mint”), a Nevada

corporation, trading on the Over the Counter (OTC) markets

“Bulletin Board” as MLES, announced today that the Company has

completed a share exchange (“the exchange”), pursuant to which it

exchanged 42.3% of its post-transaction common stock with Sunset

Brands, Inc. dba Sunset Capital Assets, a Nevada corporation,

trading on the Over the Counter (OTC) markets “Pink Sheets” as SSBN

(“Sunset”) in consideration for 100% of the voting securities and

99% of the non-voting securities of Investment Capital Fund Group,

LLC Series 20 (“ICFG”). Mint is based in Houston, Texas and owns

and operates an auto finance company specializing in both financing

and leasing automobiles.

Sunset is a diversified financial services firm focusing on

acquisition and investment in insured banks, mortgage companies,

real estate, title insurance, insurance, auto financing, commercial

financing, investment banking, and management consulting service

primarily in the Southeast United States.

Prior to the exchange, Mint had total assets of approximately

$18 million as of June 30, 2014, and projected annual revenues of

approximately $8.2 million for fiscal 2014. Pursuant to the

exchange, Sunset transferred ownership (as described above) of a

special purpose entity which owns sapphire gem assets recently

valued to have a retail replacement value in excess of $108

million. Sunset received 62,678,872 shares of common stock from

Mint in consideration for the ownership interests of ICFG acquired

in the exchange. Mint believes that the assets acquired will add to

the Company’s balance sheet asset value with the goal of enabling

the Company to leverage such additional assets to obtain funding

that will allow Mint to originate and service new subprime auto

receivables.

It is also anticipated that Mint and Sunset will enter into

further agreements whereby Mint will become the lead entity for

Sunset’s entrance into the auto finance space in the future.

This Press Release includes forward-looking statements. In

particular, the words "believes," "hopes," "expects," "intends,"

"plans," "anticipates," "may," and similar conditional expressions

are intended to identify forward-looking statements. Any statements

made in this news release other than those of historical fact,

about an action, event or development, are forward-looking

statements. Such statements are based upon assumptions that in the

future may prove not to have been accurate and are subject to

significant risks and uncertainties. Although the Company

believes that the expectations reflected in the forward-looking

statements are reasonable, it can give no assurance that its

forward-looking statements will prove to be correct. Such

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the Company.

Factors that could cause results to differ include but are not

limited to, successful performance of internal plans, product or

services development and acceptance, the impact of competitive

services and pricing, or general economic risks and uncertainties,

and other risks disclosed in the Company’s periodic filings with

the U.S. Securities and Exchange Commission (including Form’s 10-K

and 10-Q). Investors are cautioned that any forward-looking

statements are not guarantees of future performance and actual

results or developments may differ materially from those projected.

The forward-looking statements in this press release are made as of

the date hereof. The Company takes no obligation to update or

correct (i) its own forward-looking statements, except as required

by law, or (ii) those prepared by third parties that are not paid

for by the Company. The Company’s SEC filings are available

at http://www.sec.gov.

MLESJerry Parish, CEO, 713-665-2000

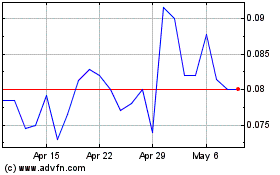

WEED (QB) (USOTC:BUDZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

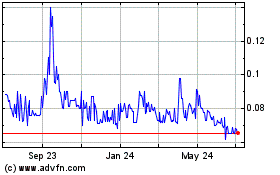

WEED (QB) (USOTC:BUDZ)

Historical Stock Chart

From Jul 2023 to Jul 2024