Vivendi, William Ackman SPAC Confirm Talks on Sale of 10% UMG Stake

June 04 2021 - 3:26AM

Dow Jones News

By Olivia Bugault

Vivendi SE said Friday that it is in talks with Pershing Square

Tontine Holdings Ltd. regarding the sale of a 10% stake in

subsidiary Universal Music Group that would value the world's

largest music business at 35 billion euros ($42.44 billion).

The French media conglomerate said the sale of the stake to

hedge-fund billionaire William Ackman's special-purpose acquisition

company would happen prior to the distribution of 60% of UMG shares

to investors and the listing of the label by the end of the

year.

In a separate statement on Friday, Pershing Square Tontine

Holdings also confirmed the discussions to acquire the stake for

roughly $4 billion and said it will distribute the UMG shares to

its shareholders later in the year. The company will remain a

"publicly traded company with $1.5 billion of cash after the

distribution of UMG shares, and to seek new business combination

partner," it said.

The potential deal was reported late Thursday by The Wall Street

Journal, citing people familiar with the matter.

"In addition, the Pershing Square funds and their affiliates

have indicated that they may acquire additional economic exposure

to UMG by acquiring Vivendi securities and/or by acquiring UMG

securities following the distribution of UMG shares by Vivendi,"

Vivendi said.

Write to Olivia Bugault at olivia.bugault@wsj.com

(END) Dow Jones Newswires

June 04, 2021 03:17 ET (07:17 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

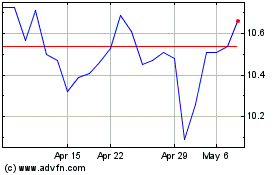

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Nov 2024 to Dec 2024

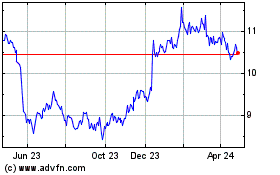

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Dec 2023 to Dec 2024