UPDATE: Vivendi 1Q Meets Company Expectations, Keeps Outlook

April 29 2010 - 11:07AM

Dow Jones News

French entertainment and telecommunications company Vivendi SA

(VIV.FR) said Thursday that its performance in the first quarter of

2010 was in line with expectations, and forecast a modest increase

in profits for the full year.

Vivendi chief executive Jean-Bernard Levy told shareholders at

the annual meeting here that Vivendi expects slight growth in

adjusted earnings before interest and tax, its preferred profit

measure, for 2010. Levy didn't disclose financial details for the

first quarter.

This latest full-year outlook was more precise than the forecast

for "further growth" this year that the company made in March.

Adjusted EBIT excludes certain charges relating to acquisitions

and mergers.

In 2009, the Paris-based owner of Universal Music Group, the

world's biggest music company, posted a 3.6% rise in adjusted

EBIT.

Vivendi reports full first quarter results May 11.

Supervisory board chairman Jean-Rene Fourtou said Vivendi will

continue to pay a "high dividend" that will exceed its peers; its

payout for 2009 is EUR1.4 a share.

Vivendi also owns pay-TV operator Canal Plus Group and has

majority stakes in telecom operators SFR and Maroc telecom

(IAM.CL).

Many of investors' questions Thursday centered on a shareholder

class action suit the company is fighting in the U.S., after a jury

there in February found Vivendi liable for misstatements about its

financial health in 2001 and 2002. Vivendi is appealing the

verdict.

Fourtou said the suit could end up costing Vivendi EUR800

million in legal costs and expected damages, for which it has

already set aside EUR550 million. He said the company has spent

about EUR200 million in legal costs since 2002 and could spend a

further EUR50 million.

The Paris court of appeals Wednesday rejected Vivendi's motion

to exclude French shareholders from a class of plaintiffs in the

class action suit, which if accepted would have lowered any

eventual damages.

Fourtou Thursday conceded that then-chief executive Jean-Marie

Messier and others had made grievous strategic and management

mistakes but insisted that no laws were broken.

Meanwhile, current CEO Levy said that it is in Vivendi's

strategic interest to buy the remaining 20% it doesn't already own

of French broadcaster Canal Plus France, which is being put up for

sale by French media group Lagardere SCA (MMB.FR), but only at the

right price.

Analysts say the two groups are at odds over a valuation of the

stake, which Lagardere wants to dispose of because it doesn't fit

in with its core media business. It is exercising an option to sell

the stock under a shareholder pact with Vivendi, which has right of

first refusal over the shares.

Under the terms of that agreement, Lagardere can sell its take

in an initial public offering to third parties if the two can't

agree on a deal. But Levy stressed the partners have only just

begun negotiating over the stock and have years to complete a deal

at an acceptable price.

-By A.H. Mooradian, Dow Jones Newswires; 33 1 4017 1738;

jethro.mullen@dowjones.com

(Jethro Mullen and Ruth Bender in Paris contributed to this

report)

Order free Annual Report for Vivendi Universal SA

Visit http://djnweurope.ar.wilink.com/?ticker=FR0000127771 or

call +44 (0)208 391 6028

Order free Annual Report for Vivendi Universal SA

Visit http://djnweurope.ar.wilink.com/?ticker=FR0000127771 or

call +44 (0)208 391 6028

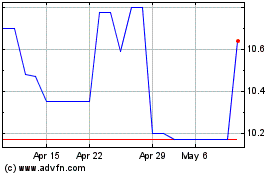

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Jul 2024 to Aug 2024

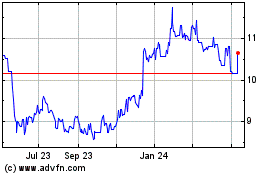

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Aug 2023 to Aug 2024